TIDMCCZ

RNS Number : 9824W

Castillo Copper Limited

29 April 2021

29 April 2021

CASTILLO COPPER LIMITED

("Castillo" or the "Company")

March 2021 Quarterly Report

Castillo Copper Limited (LSE and ASX: CCZ), a base metal

explorer primarily focused on copper across Australia and Zambia,

is pleased to announce its quarterly report for the period 1

January to 31 March 2021.

During the period, the focus was primarily on developing the Big

One Deposit within the Mt Oxide Project in the Mt Isa copper-belt,

north-west Queensland, Australia. An overview of key events

follows:

HIGHLIGHTS

Mt Oxide Project - Big One Deposit and Arya Prospect:

-- Assays confirm major copper discovery at the high-grade Big

One Deposit, as two 40-44m wide intercepts from surface, with up to

16.65% Cu , significantly extended known mineralisation

-- The best apparent intercepts comprise:

o 303RC: 40m @ 1.64% from surface including 11m @ 4.40% from

24m, 5m @ 7.34% from 28m & 1m @ 16.65% from 29m

o 301RC: 44m @ 1.19% Cu from surface including 14m @ 3.55% from

27m, 3m @ 10.88% from 37m & 1m @ 12.6% from 37m

-- Subsequent to quarter end, the compelling case for the Arya

Prospect, which has an interpreted 130m thick potential massive

sulphide target (circa 1,500m by 450m and 426m deep), was outlined

post reviewing legacy BHP and MIM data

BHA Project:

-- Divestment strategies being considered for prime Broken Hill

asset, which is prospective for IOCG and BHT mineralisation

DEVELOPMENT WORK

Castillo has four properties comprising the Mt Oxide Project in

Mt Isa's copper-belt, four assets across Zambia's copper-belt, the

historic Cangai Copper Mine and a large footprint near Broken

Hill's world class silver-zinc-lead deposit in NSW.

Mt Oxide Project

On 11 January 2021, Castillo released assays, which comprised

final laboratory reporting for the 200 (complete) and 300 (partial)

series, including two 40-44m wide intercepts from surface, with up

to 16.65% Cu :

-- 303RC: 40m @ 1.64% from surface including 11m @ 4.40% from

24m, 5m @ 7.34% from 28m & 1m @ 16.65% from 29m

-- 301RC: 44m @ 1.19% Cu from surface including 14m @ 3.55% from

27m, 3m @ 10.88% from 37m & 1m @ 12.6% from 37m

These were excellent assays results, as they make the geological

case more compelling by clearly confirming there is potential for a

high-grade, shallow copper system to be apparent at the Big One

Deposit. Notably, the latest assays significantly extend known

mineralisation and build on high-grade historical intercepts which

produced stellar intercepts from supergene copper mineralisation up

to 28.4% Cu .

On 19 January 2021, Castillo announced the appointment of two

key service providers to facilitate accelerating developing the new

copper discovery at the Big One Deposit, detailed as follows:

-- ROM Resources has been appointed to utilise legacy and

current data to progress the modelling of an inaugural JORC

compliant inferred resource; and,

-- GeoDiscovery Group, has been mandated to undertake an

extensive geophysical survey with two core goals:

1) Potentially extend known mineralisation through the

identification of massive sulphide bedrock conductors along the

1,200m strike extent; and

2) Deliver fresh geophysical insights into several known yet

under-explored nearby anomalies, particularly previously mapped

gossanous outcrops north-east of the recent drilling campaign.

On 10 February 2021, Castillo's geology consultant, ROM

Resources, uncovered comprehensive historical assays from a

drilling campaign undertaken by previously listed Forsayth Minerals

Exploration NL (FME). Combining these findings from FME, with the

final assay results from Castillo's 2020 campaign, clearly extended

the known mineralisation at the Big One Deposit.

The best intercepts include the standout B0017 with up to 9.4%

Cu:

-- BO017: 34m @ 1.51% Cu from surface including 21m @ 2.25% Cu

from surface, 12m @ 3.44% Cu from 3m, 6m @ 4.79% Cu from 3m and 1m

@ 9.4% from 9m

-- BO015: 18m @ 0.86% Cu fm 11m including 6m @ 1.85% Cu from

20m, 3m @ 2.98% Cu from 20m and 1m @ 8% from 20m

Note: Due to the lack of QA/QC and a positional accuracy of

+/-10-20m, FME's drill-holes are regarded as historical

"Exploration Results" and whilst providing support to the existing

information cannot form the basis alone of any resource

estimate.

On 3 March 2021, Castillo stated that due to the prevailing

solid outlook for the global copper market, the Board decided to

re-shape its strategic intent for the Big One Deposit to capitalise

on this prevailing opportunity. In addition, the Board noted it is

cognisant of the improving fundamentals for the global cobalt

market, as the recent drilling campaign verified there is ore grade

cobalt mineralisation also apparent at the Big One Deposit.

The starting point is to firm up plans to apply for a new mining

lease, ahead of Castillo's geology consultant releasing an

inaugural JORC compliant resource. The arguments in favour of

taking this assertive stance are compelling, as the Big One Deposit

already has several high-quality fundamental strengths,

including:

-- A known high-grade shallow copper system that was mined in

1997 - producing 4,400t of supergene ore, averaging 3.5% Cu - via

several open pits;

-- Recent and historical drilling campaigns that have produced

exceptional high-grade intercepts.

New South Wales Projects

-- BHA Project

On 19 January 2021, following a strategic review, Castillo's

Board decided it was an opportune time to capitalise on the

prevailing base and precious metal upcycle to fast-track creating

additional shareholder value. Noting a significant resurgence of

interest in groups with footprints around Broken Hill, notably ASX

listed Cobalt Blue (ASX: COB), the Board decided to consider

divestment opportunities including a possible spin-off of its

sizeable Broken Hill asset into a new vehicle which could be listed

in either London or Australia.

-- Cangai Copper Mine

No material work was undertaken on Cangai Copper Mine during the

quarter.

-- Zambia Projects

No material work was undertaken on the Zambia Projects during

the quarter.

POST QUARTER EVENT

On 7 April 2021, Castillo confirmed that improving weather

conditions should enable a resumption of exploratory work at the

core Mt Oxide Project. In addition, further forensic work has

uncovered eleven targets and more details on the Arya Prospect's

geological potential.

On 13 April 2021, Castillo outlined further compelling insights

into the Arya Prospect, arising from reviewing historical reports

undertaken by BHP and MIM that bolster the exploration potential

ahead of a resumption in the drilling campaign. In addition,

another deep bedrock conductor has been identified at the newly

named Sansa Prospect, immediately west of the Arya Prospect.

However, further interpretation work is required to formulate the

dimensions and determine the prospectivity for copper

mineralisation.

PAYMENTS TO, OR TO AN ASSOCIATE OF, A RELATED PARTY OF THE

ENTITY DURING QUARTER DURING THE QUARTER

$83,000 was paid to related parties of the Company relating to

executive director salary and non-executive director fees.

SUMMARY OF THE EXPLORATION EXPITURE INCURRED DURING THE

QUARTER

Consulting fees Rates and mines departments fees

NSW $85,000 $18,000

QLD $454,000 -

Zambia $15,000 -

---------------- ---------------------------------

$554,000 $18,000

In addition to this release, a PDF version of this report with

supplementary information can be found on the Company's website:

https://www.castillocopper.com/asx-announcements/

For further information, please contact:

Castillo Copper Limited +61 8 6558 0886

Simon Paull (Australia), Managing Director

Gerrard Hall (UK), Director

-------------------

SI Capital Limited (Financial Adviser and

Corporate Broker) +44 (0)1483 413500

-------------------

Nick Emerson

-------------------

Luther Pendragon (Financial PR) +44 (0)20 7618 9100

-------------------

Harry Chathli, Alexis Gore, Joe Quinlan

-------------------

About Castillo Copper

Castillo Copper Limited is an Australian-based explorer

primarily focused on copper across Australia and Zambia. The group

is embarking on a strategic transformation to morph into a mid-tier

copper group underpinned by its core projects:

-- The Mt Oxide project in the Mt Isa copper-belt district,

north-west Queensland, which delivers significant exploration

upside through having several high-grade targets and a sizeable

untested anomaly within its boundaries in a copper-rich region.

-- Four high-quality prospective assets across Zambia ' s

copper-belt which is the second largest copper producer in

Africa.

-- A large tenure footprint proximal to Broken Hill's

world-class deposit that is prospective for

zinc-silver-lead-copper-gold.

-- Cangai Copper Mine in northern New South Wales, which is one

of Australia ' s highest grading historic copper mines.

The group is listed on the LSE and ASX under the ticker

"CCZ."

Competent Person Statement

The information in this report that relates to Exploration

Results for "Big One Deposit" is based on information compiled or

reviewed by Mr Mark Biggs. Mr Biggs is both a shareholder and

director of ROM Resources, a company which is a shareholder of

Castillo Copper Limited. ROM Resources provides ad hoc geological

consultancy services to Castillo Copper Limited. Mr Biggs is a

member of the Australian Institute of Mining and Metallurgy (member

#107188) and has sufficient experience of relevance to the styles

of mineralisation and types of deposits under consideration, and to

the activities undertaken, to qualify as a Competent Person as

defined in the 2012 Edition of the Joint Ore Reserves Committee

(JORC) Australasian Code for Reporting of Exploration Results, and

Mineral Resources. Mr Biggs holds an AusIMM Online Course

Certificate in 2012 JORC Code Reporting. Mr Biggs also consents to

the inclusion in this report of the matters based on information in

the form and context in which it appears.

APPIX 1: INTEREST IN MINING TENEMENTS HELD

JACKADERRY (CANGAI)

New England Orogen in NSW

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EL8635 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8625 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8601 100% 100% -

------------------------------ ---------------------------- --------------------------

BROKEN HILL

located within a 20km radius of Broken Hill, NSW

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EL8599 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8572 100% 100% -

------------------------------ ---------------------------- --------------------------

EL 8434 0% 100% 100%

------------------------------ ---------------------------- --------------------------

EL 8435 0% 100% 100%

------------------------------ ---------------------------- --------------------------

MT OXIDE

Mt Isa region, northwest Queensland

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EPM 26513 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26525 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26574 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26462 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 27440 - 100% -

------------------------------ ---------------------------- --------------------------

Zambia

Project Tenement ID Ownership at start of Ownership at end of Change during the Quarter

Quarter Quarter

-------------- ---------------------------- --------------------------- --------------------------

Lumwana North 23914-HQ-SEL - 100% 100%

-------------- ---------------------------- --------------------------- --------------------------

Lumwana North 23913-HQ-SEL - 100% 100%

-------------- ---------------------------- --------------------------- --------------------------

Mkushi 24659-HQ-LEL - 100% 100%

-------------- ---------------------------- --------------------------- --------------------------

Luanshya 22448-HQ-LEL - 0%* 0%*

-------------- ---------------------------- --------------------------- --------------------------

Luanshya 25195-HQ-LEL - 55% 55%*

-------------- ---------------------------- --------------------------- --------------------------

Luanshya 25273-HQ-LEL - 55%^ 55%^*

-------------- ---------------------------- --------------------------- --------------------------

Mwansa 25261-HQ-LEL - 100%^ 100%^

-------------- ---------------------------- --------------------------- --------------------------

*CCZ can earn up to 80% by meeting previously disclosed

milestones

^ Indicates the tenement is still under application

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Consolidated statement of cash Current quarter Year to date

flows (9 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers

1.2 Payments for

(a) exploration & evaluation

(b) development

(c) production

(d) staff costs

(e) administration and corporate

costs (423) (1,200)

1.3 Dividends received (see note

3)

1.4 Interest received

1.5 Interest and other costs of

finance paid

1.6 Income taxes paid

1.7 Government grants and tax

incentives

1.8 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

1.9 operating activities (423) (1,200)

----------------- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities

(b) tenements (233)

(c) property, plant and equipment

(d) exploration & evaluation (572) (1,357)

(e) investments

(f) other non-current assets (214)

2.2 Proceeds from the disposal

of:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) investments

(e) other non-current assets

2.3 Cash flows from loans to other

entities

2.4 Dividends received (see note

3)

2.5 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

2.6 investing activities (572) (1,804)

----------------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) 2,246

3.2 Proceeds from issue of convertible

debt securities

Proceeds from exercise of

3.3 options 240 310

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities (323)

3.5 Proceeds from borrowings

3.6 Repayment of borrowings

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities 240 2,233

----------------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 3,115 3,130

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (423) (1,200)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (572) (1,804)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) 240 2,233

Effect of movement in exchange

4.5 rates on cash held 40 41

---------------- -------------

Cash and cash equivalents

4.6 at end of period 2,400 2,400

----------------- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 2,400 3,115

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 2,400 3,115

----------------- ------------------------------------------------ ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 53(1)

----------------

6.2 Aggregate amount of payments to related 30(2)

parties and their associates included in

item 2

----------------

(1) Comprises director's fees for the quarter.

(2) Comprises consulting fees paid to the Managing Director.

7. Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity. Add notes as necessary

for an understanding of the

sources of finance available

to the entity.

7.1 Loan facilities

------------------- ----------------

7.2 Credit standby arrangements

------------------- ----------------

7.3 Other (please specify)

------------------- ----------------

7.4 Total financing facilities

------------------- ----------------

7.5 Unused financing facilities available at

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ----------------------------------------------------------------------------------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (423)

8.2 (Payments for exploration & evaluation classified (572)

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item (995)

8.2)

8.4 Cash and cash equivalents at quarter end 2,400

(item 4.6)

8.5 Unused finance facilities available at quarter

end (item 7.5)

-------

8.6 Total available funding (item 8.4 + item 2,400

8.5)

-------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 2.4

-------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

--------------------------------------------------------------------

Answer: N/A

--------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

--------------------------------------------------------------------

Answer: N/A

--------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

--------------------------------------------------------------------

Answer: N/A

--------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of questions

8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- --------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 29 April 2021

Authorised: By the Board

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIGDSXGDDGBI

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

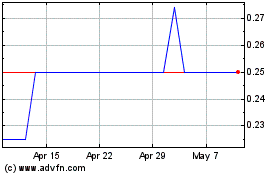

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From Apr 2023 to Apr 2024