TIDMCGH

RNS Number : 5103W

Chaarat Gold Holdings Ltd

26 April 2021

26 April 2021

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

Q1 2021 Operational Update

Chaarat (AIM:CGH), the AIM-quoted gold mining Company with an

operating mine in Armenia and assets at various stages of

development in the Kyrgyz Republic, announces its production and

operational results for the quarter ended 31 March 2021 (the

"Quarter", "Q1" or the "Period") for its Kapan Mine ("Kapan"), in

Armenia and a general corporate update.

Chaarat Gold will host an investor and analyst presentation

tomorrow, 27 April 2021, at 9:00 am BST. Participants can access

the presentation by registering here:

https://us02web.zoom.us/webinar/register/WN_mD9-07tESLOLPtZzQT2BKQ

Q1 2021 Highlights

Kapan

-- Production of 16,174 gold equivalent ounces(1) ("oz") vs 13,353 oz in Q1 2020 (+21%)

-- Third party ore treated was 34kt for Q1 2021 vs 0kt for Q1 2020

-- All-in-sustaining cost ("AISC"(2) ) of USD1,024 /oz vs USD1,074 /oz in Q1 2020 (-4.7%)

-- Preliminary unaudited standalone EBITDA contribution of

USD6.9 million vs USD2 million in Q1 2020 (+245%)

Tulkubash & Kyzyltash

-- Strong support and appreciation for investment and community

support received from new government and head of investment agency

in Kyrgyz Republic

-- Updated bankable feasibility study ("BFS") expected to be released in May 2021

-- Project financing on track for closing in H1 2021

-- Tulkubash and Kyzyltash drilling programmes to commence in May 2021

Corporate Finance

-- Funding package of USD52.2 million closed in February 2020

reducing the net debt position from USD64.5 million as at 31

December 2020 to USD12 million (-82%).

Kapan Polymetallic Mine - Q1 Highlights and Outlook

-- As previously disclosed, one fatality occurred in early

March. Initial investigations by Chaarat, the mining contractor and

relevant authorities have concluded and identified that the

drilling contractor's employee walked over a blocked ore pass

against basic general safety practices and behavioural safety

principles. Actions are ongoing to continue to reinforce a mature

safety culture that will prevent such incidents occurring in the

future.

-- Because of that incident, one lost time injury in Q1 and the

recordable injury case rate (per one million hours worked) is 0.78

compared to 0.39 in Q1 2020 and 0.0 in Q4 2020.

-- COVID 19 measures remain in place throughout the Company's

operations. Incident rates in country dropped during Q1 but are now

starting to increase again. There has been no impact to our

operations to date where strict adherence to COVID 19 protocols has

continued.

-- Production of 16,174 oz represents a 21% increase on Q1 2020

(13,353 oz) as a result of increased third-party ore treatment, and

improved mine grade.

-- Third party ore treated was 34kt for Q1 2021 vs 0kt for Q1

2020, approximately 10kt above the target for the Period.

-- Q1 2021 production consisted of:

o 8,893 ounces of gold;

o 160,945 ounces of silver;

o 605 tonnes of copper; and

o 1,527 tonnes of zinc;

-- All-in-sustaining cost ("AISC" (2) ) of USD1,024 /oz also

improved compared to Q1 2020 (USD1,074 /oz, -4.7%) due to further

efficiency gains realised in the milling circuit.

-- Realised gold price for the quarter of USD1,762 /oz versus

USD1,565 /oz in Q1 2020 (+12.6%) in line with the average gold

price for Q1 2021. Continuing strong price environment, especially

with realised copper prices of USD8,590/t vs USD5,283 in Q1 2020

(+63 % vs Q1 2020) above budgeted prices.

-- Contained gold equivalent ("AuEq") in own ore was 12,382 oz

in Q1 2021 vs 13,353 in Q1 2020 (-7%). Tonnes were down year over

year by 16.3%, but grade improved 13.6% due to mining changes to

reduce dilution.

o Total tonnes mined of 149kt vs 178kt in Q1 2020 (-16.3%).

Mining rates were lower due to reduced development activity in Q4

2020 as a result of the conflict between Armenia and Azerbaijan.

This led to a follow-on impact of reduced mining tonnes in Q1 2021.

However, early in the Quarter, development mining reverted to

historical levels and therefore mining levels are expected to be in

line with historical results from Q2 2021 onwards.

o Grade improved to 3.25g/t AuEq vs 2.94g/t AuEq in the same

period last year (+10.5%). Changes were made to reduce dilution

using the existing mining fleet, but new mining methods were also

introduced to optimise mining of narrow high-grade areas which

would be less valuable if mined using conventional mechanised

methods.

o Mill throughout increased year over year by 3% primary due to

increase in treatment of Third party-ore.

o AuEq recoveries were flat at 79.8% in Q1 2021 compared with Q1

2020 (79.6%).

-- Underground development of 5,755 metres achieved in the

quarter, compared to 5,623 metres in Q1 2020 (+2.3%). This was

achieved through additional work by the drilling contractors who

compensated for the mining staff temporarily involved in the

previously mentioned conflict.

-- CAPEX spent was USD1 million, 30% lower than expected given

some delivery delays of spare parts and replacement equipment,

mainly a surface loader.

-- Unaudited Q1 2021 Kapan standalone EBITDA contribution of

USD6.9 million vs USD2.0 million in Q1 2020 (+245%).

Outlook for Kapan

-- COVID 19 vaccination programs are expected to commence in Q2

as COVAX supplied vaccines are delivered which will hopefully ease

the increasing rates seen in the beginning of Q2.

-- Chaarat remains on track to deliver on its AuEq 57koz

guidance for the year, as previously set out in its FY 2020

Production, Operational and Financial Update on 21 January

2021.

-- Third-party ore supply is expected to remain stable for the remainder of 2021.

-- East Flank drilling campaign is planned to commence in May

2021 with an updated resource statement expected by end of

year.

-- An update to the current resource and reserve statement is

underway with completion and release of the new Life of Mine

targeted for Q4 2021.

-- Financial performance in H1 2021 is expected to be improved

vs H1 2020 as a result of higher-grade areas, constant third-party

ore supply, further improved milling performance and increased

commodity prices.

(1) Gold equivalent ounces for 2020 recalculated on 2021 budget

prices with Au at $1,700/oz and gold ratios of 68 for silver, 7,287

for copper and 21,862 for zinc. In last years' Q1 2020 operations

update, 2020 oz were based on gold ratios of 83 for silver, 7,778

for copper and 20,968 for zinc leading to a lower AuEq number

reported in that previous year.

(2) AISC on a gold oz produced basis exclude smelter TC/RC

charges, others which add c. USD$ 133/oz. Sustaining capex of c.

USD 8 million p.a. is included in the AISC, of which capex of USD1

million was spent in Q1 2021.

Tulkubash and Kyzyltash Project Update

Chaarat Executive Chairman, Martin Andersson, held meetings with

the new government and investment agency of the Kyrgyz Republic in

March 2021 receiving strong support and positive feedback for the

development of Tulkubash and Kyzyltash and appreciation for the

investments and community support to date.

Project preparation work for Tulkubash has progressed as

expected, with mobilisation after the winter period planned for

May. Full stage construction activities to commence once project

financing is completed.

The 2021 exploration program is planned to commence soon.

Resource drilling is planned for areas with potential close to the

current planned pit areas and existing reserves. Further drilling

is targeted for previously drilled areas with good results just to

the north east of the current reserve to identify mine life

extension opportunities. The plan consists of approximately 5,000m

of drilling and a further 4,000m of trenching.

The updated BFS for the Tulkubash project is being peer reviewed

and the Company expects it to be published in May 2021 along with a

revised Mineral Resource estimate and Ore Reserve.

Additional drilling is also planned on the Kyzyltash deposit

this season to collect core in preparation for the metallurgical

test programme later this year. This core will be used to develop

understanding of the metallurgical processing options for the

deposit. The result of this program would be available early

2022.

Project Financing

Chaarat is on track to secure a debt facility that, together

with an equity contribution from the Company, will fully fund the

USD110 million required for the construction of Tulkubash and

enable the asset to be brought into production during H1 2021. It

is envisioned that the debt facility will comprise standard project

finance conditions, including the requirement for the Company to

contribute equity to the financing of the project. As previously

announced, the Company will utilise a substantial portion of the

funds raised in February 2021 to meet the equity contribution

required for the project.

Corporate Finance Update

The Company received strong demand for a funding package in

February 2021 for a total of USD52.2 million which included issuing

USD30.0 million in equity to new institutional investors and family

offices as well as existing shareholders and conversion of debt

into equity of USD22.2 million.

The Financing led to a significant improvement in the Company's

debt position reducing it from USD70.5 million as at 31 December

2020 to USD46 million now, a reduction of 35%(3) . The net debt

position is reduced from USD64.5 million as at 31 December 2020 to

USD12 million, a reduction of 82%.

The funds received from the equity fundraise will predominantly

be contributed to the remainder of the upfront equity portion

required to fund the Tulkubash project in the Kyrgyz Republic and

fulfils one of the key criteria in order to draw on any debt

project finance facility that is arranged.

With the debt-to-equity conversion, the Labro Term Loan has been

extinguished, saving the Company USD2.1 million a year in interest

payments from 2021 to 2024.

The Kapan acquisition loan facility was reduced by another USD2

million to USD26 million at the end of Q1 2021 in accordance with

the amortisation schedule.

Chaarat continues to evaluate capital opportunities to either

refinance existing financing facilities and/or reduce its overall

cost of capital. One of the key priorities for the next months is

to evaluate options on the upcoming convertible bond in October

2021 that create most shareholder value which could include the

conversion or refinancing of this bond.

(3) Excluding lease liabilities, contract liabilities and

accrued interest on the convertible loan note.

Artem Volynets, Chief Executive Officer, commented:

"I am pleased that we can report another strong quarter with

further improvements to the mine. Especially the work on minimising

dilution and increasing efficiencies supported by the continuing

strong commodity price environment have resulted in strong first

quarter performance. I am very happy with the performance of the

Kapan team in delivering higher production this quarter by mining

higher grade areas and treating more third-party ore, offsetting a

temporary reduction in own tonnes mined.

At Tulkubash, the BFS update is almost ready for release along

with a revised mineral resource estimate and ore reserve. The teams

are ready to commence exploration works and construction works.

Project financing discussions are on track for closing in H1

2021."

Enquiries

+44 (0)20 7499

Chaarat Gold Holdings Limited 2612

Artem Volynets (CEO) info@chaarat.com

Canaccord Genuity Limited (NOMAD and + 44 (0)20 7523

Joint Broker) 8000

Henry Fitzgerald-O'Connor

James Asensio

+44 (0)20 7220

finnCap Limited (Joint Broker) 0500

Christopher Raggett

Panmure Gordon (UK) Limited (Joint +44 (0)20 7886

Broker) 2500

John Prior

Hugh Rich

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on the

FSU through organic growth and selective M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com/ .

Q1 2021 PRODUCTION & OPERATIONAL SUMMARY

Q1 2021 Q1 2020 Q1 2021 Q4 2020

Tonnes ore mined 149,102 178,144 149,102 152,091

AuEq Grade (g/t) 3.25 2.94 3.25 3.77

Tonnes ore milled 180,507 175,948 180,507 185,567

Tonnes ore milled (Third-Party

Ore) 34,025 0 34,025

AuEq Recovery Kapan (%) 79.8 79.6 79.8 79.7

Gold equivalent production

(oz) 16,174 13,353 16,174 9,023

Incl. from Third-Party

Ore 3,792 0 3,792

Gold production (oz) 8,893 6,656 8,893 5,972

Silver production (oz) 160,945 130,366 160,945 118,526

Copper production (t) 605 455 605 355

Zinc production (t) 1,527 1,886 1,527 1,656

AuEq Sales 12,775 11,161 12,775 13,186

Realised gold price

(USD/oz) 1,762 1,565 1,762 1,512

AISC (USD/oz) 1,024 1,074 1,024 1,242

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLBRGDSBUDDGBU

(END) Dow Jones Newswires

April 26, 2021 02:00 ET (06:00 GMT)

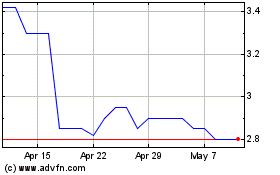

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Apr 2023 to Apr 2024