TIDMCGO

RNS Number : 0866U

Contango Holdings PLC

31 March 2021

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural

Resources

31 March 2021

Contango Holdings Plc

('Contango' or the 'Company')

Interim Results

Contango Holdings Plc, the London listed natural resource

development company, announces its results for the six-month period

ended 30 November 2020.

CHAIRMAN'S STATEMENT

The period under review bore witness to the most significant

advances in Contango's development since incorporation as the

Company shifted from being an investment company to an operational

natural resource development company with two high quality assets -

both with near term production potential.

As shareholders will be aware, Contango completed the

long-awaited acquisition of the Lubu Coal Project in Zimbabwe

('Lubu') during the period. The completion of this acquisition, and

the Company's subsequent readmission to trading on standard segment

of the official list and the LSE on 18 June 2020, were the

catalysts for a period of rapid growth and corporate development as

Contango simultaneously advanced Lubu towards commercial production

and expanded its portfolio of resource interests.

Lubu exhibited the most important characteristics of a

favourable investment as defined by the Contango board, namely it

is a low capex and low opex project with potential for near term

production. Lubu benefits from de-risked development with total

historical spend in excess $20 million and over 100 holes and

12,000m of drilling completed and total resource in excess of 1

billion tonnes of coal - which Contango was fortunate enough to

acquire for an implied value of GBP6.4 million.

COVID-19 restrictions internationally have frustratingly delayed

scheduled site visits by prospective off-take partners from a

number of countries, however, the team in Zimbabwe have ensured

that Lubu is ready to commence commercial production following the

finalisation of formal off-take negotiations. A key development in

this process was announced post period end in March 2021, with the

confirmation that Contango is in discussions with the Zimbabwean

subsidiary of a major Chinese industrial company and one the

world's largest stainless-steel producers.

This potential offtake partner, which already has a sizeable

footprint in Zimbabwe, is in the process of constructing a number

of coke batteries in the Hwange region of Zimbabwe where Lubu is

located, with the aim of being ready for production by the end of

April 2021. The synergies between Lubu and the potential offtake

partner are clear, and the Contango team are enthusiastic about an

upcoming site visit by the offtake partner, planned for

mid-April.

Contango delivered a further landmark development towards the

end of the period with the acquisition of the Garalo Gold Project

in Mali ('Garalo'). Garalo, which was acquired for $1 million, is

an advanced discovery and had, at that point, a non-independent

resource of 320,000 ounces of gold at an average grade of 1.5g/t

across three dominant structural trends. The Company's original

objective at Garalo was to establish a small operation targeting

initial production of circa 10,000oz of gold per annum through an

oxide plant.

Work conducted post period end has re-shaped our strategy at

Garalo, and based on the NI 43-101 Independent Technical Report

delivered in March 2021, we now understand that Garalo is capable

of a much larger operation. This report confirms and expands on the

information received in December 2020, and highlights the potential

for up to 2Moz, a 525% increase on the original non-independent

resource of 320k that was envisaged on acquisition. This is clearly

a tremendous result for Contango shareholders, and we believe there

is still room for improvement over and above the 2Moz threshold as,

in addition to G1 and G3 targets (the basis for 2Moz), numerous

other clusters of anomalous zones with potential for gold discovery

have been identified.

This information, together with the acquisition of the

contiguous 100km(2) Ntiela Gold Project in March 2021, has prompted

the re-evaluation of our longer-term plans at Garalo with a view to

establishing a larger processing hub in this region, capable of

supporting multiple open pit operations. Our current focus remains

on delivering cashflow within an expedited timeframe and the team

in Mali are currently planning an accelerated development schedule

targeting first gold in Q4 2021 in conjunction with expansion

drilling.

Financial Review

Funding

During the period the Company was funded through cash raised

from the IPO and a further GBP1.8m (before expenses) was raised

through an oversubscribed placing of 36,000,000 new ordinary shares

of GBP0.01 each at a price of 5 pence per placing share in October

2020 in conjunction with the acquisition of the Garalo Gold

Project.

Revenue

The Company generated no revenue during the year as it was

focussing on assets that will ultimately generate revenue for the

Company.

Expenditure

The Company has low ongoing overheads and devoted its cash

resources to transaction costs and the development of Lubu and

Garalo towards commercial production.

However, during the period the company incurred significant

one-off costs related to the readmission in June 2020 of GBP417,642

as disclosed in note 3. These included legal, accountancy and other

professional services costs. Also, the Company incurred a

GBP100,000 non-cash charge by way of a share based bonus paid to

the original directors of Contango prior to readmission in lieu of

their efforts to conclude the transaction.

Liquidity, cash and cash equivalents

As of 30 November 2020, the Company held GBP1,145,301 (2019:

GBP10,430).

Outlook

Contango's model of focussing on near term production through

low capex and low opex projects is expected to bear fruit for

shareholders during 2021. The demand for coking coal in Southern

Africa remains buoyant and the conversations that we have had over

recent months, and perhaps more importantly, in recent weeks in

relation to the aforementioned potential offtake partner looking to

be ready to commence production from its coke batteries by the end

of April, are particularly promising.

Separate to the aforementioned potential sizeable offtake, the

Company entered into two Letters of Intention ('LOI') during the

period. Upon conversion of these LOIs for 32,000 tonnes per month

of coking coal into formal offtake contracts, the Board believe

that this could be translated to earnings of circa $1m per month.

Coupled with an initial phase of production from Garalo in Q4 2021,

at an initial level of 30,000oz per annum, the Board believes that

an additional EBIT figure of in excess of $1m per month is

realistic. This would clearly be a significant result for Contango

shareholders and testament to the value of the Board's strategy of

prioritising assets with the potential for rapid returns.

I would like to thank our shareholders, and the Contango team

here, in Zimbabwe and Mali, for their support during the rest of

2021 as we look to deliver on our strategic objectives and move

into commercial production in Zimbabwe and Mali.

Roy Pitchford

31 March 2021

CEO REPORT

Contango's primary objectives during the year were to advance

the Lubu Coal Project in Zimbabwe and the Garalo Gold Project in

Mali towards production. Post period end, in March 2021, the

Company acquired the Ntiela Gold Project, which is contiguous to

Garalo.

Lubu Coal Project ('Lubu')

Contango has a 70% interest in Lubu, with the remaining 30% held

by supportive local partners.

Previous owners have expended more than $20m on Lubu, which has

enabled a sizeable resource in excess of 1.3 billion tonnes to be

identified under NI 43-101 standard. Contango will initially focus

on producing metallurgical coal from Block B2, where extensive work

has also been undertaken to define the specific properties of the

coal, which in turn has enabled offtake conversations to commence.

The coal seams within Block B2 are from surface down to a maximum

depth of 47m, ensuring operating costs are kept at very attractive

levels. Contango is focussed on achieving the production of

metallurgical coal products and sales to international industrial

consumers in the Southern Africa region.

The Board has focussed on developing markets for its semi soft

coking coal and 28MJ/kg CV coal which is known to be in demand by

industrial users in the Southern Africa region. The Company may

develop a relatively material operation without recourse to the

full-scale mining given that the terms of the Special Grant area

does not stipulate a maximum threshold of production under the

trial mining licence and bulk licence.

As announced in March 2021, the Company has elected to cease

mining operations at Lubu and discussions with a potential partner

relating to a long-term offtake have progressed, which is expected

to be in April 2021. This will ensure any potential development is

optimised and the Company's resources are deployed

appropriately.

The discussions relate to a potential long-term offtake for

coking coal with the Zimbabwean subsidiary of a major Chinese

industrial company and one the world's largest stainless-steel

producers. The potential offtake partner has a sizeable footprint

in Zimbabwe and is planning to construct a US$1bn carbon steel

plant in the country, with capacity of 2 million tonnes of steel

per annum. In addition, the Potential Offtake Partner is currently

in the process of constructing a number of coke batteries in the

Hwange region of Zimbabwe with the aim of being ready for

production by the end of April 2021.

The Company intends to open a trial pit and a bulk sample will

be sent to the potential offtake partner so that it can conduct a

burn test. Further updates will be provided following the site

visit which is scheduled in mid-April 2021.

Garalo Gold Project and Ntiela Gold Project in Mali ('Garalo'

and 'Ntiela')

In October 2020 Contango acquired Garalo, an advanced gold

discovery with a non-independent resource of 320,000oz gold. Garalo

is located in the Sikasso region of southern Mali, 200km south-east

of the capital Bamako and close to the Guinea border. Garalo

consists of an exploration licence for gold and associated minerals

covering a surface area of 62.50 km(2) which is valid for two years

and is renewable for another term of two years.

The permit is surrounded by a number of multi-million ounce gold

deposits and the region is home to some of the world's leading gold

miners, including IAMGOLD, Barrick, B2 Gold, Endeavour Mining and

Hummingbird Resources, which has helped to establish Mali as the

third largest gold producer in Africa.

The Company Birima Gold Resources Consulting ('BRG Consult'), an

international mineral exploration consulting company with

significant experience in West Africa, ranging from grassroots to

mine-site exploration and mineral deposit expansion to prepare an

Independent Technical Report to NI 43-101 standards and this was

published post-period end in March 2021 (the 'Report').

The Report summarised historic and more recent technical

information on Garalo and concludes that the main structure that

controls the gold mineralisation at the Garalo G1 and G3 Targets is

a north-south-striking, shallowly-west-dipping shear zone system

forming pull-apart similar to the nearby 2.8Moz Kalana Gold

Deposit.

This new model for the gold formation at Garalo suggests that

the gold mineralisation is hosted in a system of parallel dilation

fracture networks within shear zones. These fracture networks are

under-explored and may contain a gold potential of up to 2Moz. The

Report found that Garalo has high potential to host economic gold

mineralisation, which can be delineated via Reverse Circulation

(RC), Diamond (DD) and Rotary Air Blast (RAB) drilling

programmes.

The Report also concluded that historic exploration works

completed between 2001 and 2008 were professionally managed and

procedures were consistent with generally accepted industry best

practices. Consequently, the exploration data from soil

geochemistry sampling, ground geophysical survey, trenches and

drilling were assessed to be sufficiently reliable to confidently

allow interpretation of the gold mineralisation in the Garalo

property, enabling the outline of an extensive drilling programme

over existing gold deposits and in areas with potential for new

discovery to be drawn. Exploration works performed in the Garalo

permit resulted in the discovery of the Garalo G1 and G3 gold

deposits and numerous other clusters of anomalous zones with

potential for gold discovery, some of which have offered additional

high-grade potential.

In March 2021, the Company acquired the neighbouring Ntiela

licence, which borders the western boundary of the Garalo permit.

The prospectivity of Ntiela has been established from work

programmes conducted by the previous operator which included soil

and termite mound sampling and geochemistry, regolith mapping and

extensive trenching. Existing data from soil geochemistry studies

on Ntiela also suggests a strong correlation with the data the

Company has been collecting at the G3 target on Garalo, pointing to

the potential for high-grade gold mineralisation on the Ntiela

licence. This work has been supplemented by drone surveys conducted

by Contango geologists, which supported the potential for the

extension of at least two target zones from Garalo to Ntiela.

Exploration campaigns are expected to commence in Q2 2021 in

order to better define the geological structures and resource

expansion potential at Garalo and Ntiela however the Board's

priority focus remains on near term cash flow. As reported

previously, the Contango team are accelerating the development of a

30,000oz per annum heap leach operation from the shallow oxides

given the high margins and low capex for its development. However,

given the significant findings in the Report, in due course the

Company will undertake further drilling programmes on both Garalo

and Ntiela, designed to realise and optimise the asset's full

potential, as the Company looks to establish a large standalone

gold mine with multiple open pit operations across both permit

areas.

Carl Esprey

31 March 2021

**S**

For further information, please visit

www.contango-holdings-plc.co.uk or contact:

Contango Holdings plc E: info@contango-holdings-plc.co.uk

Chief Executive Officer

Carl Esprey

Brandon Hill Capital Limited T: +44 (0)20 3463 5000

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd T: +44 (0)20 7236 1177

Financial PR & Investor Relations

Susie Geliher / Cosima Akerman

FINANCIAL STATEMENTS

Condensed Consolidated Statements of Comprehensive Income

For the six months ended 30 November 2020

Unaudited Audited

Six Months Year to

ended 31 May

30 November 2020

2020

Notes GBP GBP

Administrative fees and

other expenses 3 (1,129,659) (258,027)

-------------- ----------

Operating loss (1,129,659) (258,027)

Finance revenue - -

Finance expense - -

-------------- ----------

Loss before tax (1,129,659) (258,027)

Income tax - -

Loss for the period and

total comprehensive loss

for the period (1,129,659) (258,027)

-------------- ----------

Loss attributable to owners

of the parent company (1,108,611) (258,027)

Loss attributable to non-controlling (21,048) -

interests

-------------- ----------

(1,129,659) (258,027)

-------------- ----------

Basic and diluted loss

per Ordinary Share (pence) 4 (0.92) (0.60)

Condensed Consolidated Statements of Financial Position

For the six months ended 30 November 2020

Unaudited as

at Audited

30 November as at

Notes 2020 31 May 2020

GBP GBP

Non-current assets

Intangible assets 6 10,898,698 -

Investments 62,260 -

Property, plant and equipment 44 -

------------- -------------

Total non-current assets 10,961,002 -

Current assets

Other receivables 585,538 403,163

Cash and cash equivalents 1,145,301 10,430

Total current assets 1,730,839 413,593

Total assets 12,691,841 413,593

------------- -------------

Current liabilities

Trade and other payables 833,860 435,173

------------- -------------

Total current liabilities 833,860 435,173

Net assets/(liabilities) 11,857,981 (21,580)

------------- -------------

Equity

Share capital 5 2,396,333 429,500

Share premium 5 8,198,148 368,978

Warrant reserve 5 83,533 84,874

Merger reserve 7 3,214,558 -

Retained earnings (2,034,591) (904,932)

------------- -------------

Total equity 11,857,981 (21,580)

------------- -------------

Total equity attributable

to the owners of the

parent company 10,428,061 (21,580)

Non-controlling interests 1,429,920 -

------------- -------------

Total equity 11,857,981 (21,580)

------------- -------------

Condensed Consolidated Statements of Changes in Equity

For the six months ended 30 November 2020

Share Share Warrant Merger Retaining Total

Capital Premium Reserve Reserve Earnings Equity

GBP GBP GBP GBP GBP GBP

---------- ---------- --------- ---------- ------------ ------------

Balance as

at 31 May 2019 429,500 368,978 84,874 - (646,905) 236,447

Loss for the

year (258,027) (258,027)

---------- ---------- --------- ---------- ------------ ------------

Balance as

at 31 May 2020 429,500 368,978 84,874 (904,932) (21,580)

---------- ---------- --------- ---------- ------------ ------------

Issue of shares 1,966,833 7,829,170 9,796,003

Exercising

of warrants (1,341) (1,341)

Merger reserve

arising on

acquisition 3,214,558 3,214,558

Loss for the

six months

to 30 November

2020 (1,129,659) (1,129,659)

---------- ---------- --------- ---------- ------------ ------------

Balance as

at 30 November

2020 2,396,333 8,198,148 83,533 3,214,558 (2,034,591) 11,857,981

---------- ---------- --------- ---------- ------------ ------------

Condensed Consolidated Statements of Cash Flows

For the six months ended 30 November 2020

Unaudited Audited

Six Months Year

ended ended

30 November 31 May

Notes 2020 2020

GBP GBP

Operating activities

Loss after tax (1,129,659) (258,027)

Adjustment for:

Depreciation 67 -

Changes in working capital

(Increase)/decrease in trade

and other receivables (182,375) (371,852)

Increase in trade and other

payables 398,687 359,425

------------- ----------

(Decrease) in Net cash from

operating activities (913,280) (270,454)

------------- ----------

Investing activities

Purchase of subsidiary (6,858,391) -

Purchase of 75% share of (825,748)

mining licence -

Purchase of investment (62,260) -

------------- ----------

(Decrease) in Net cash from (7,746,399)

investing activities -

------------- ----------

Financing activities

Ordinary Shares issued (net

of issue costs) 5 9,794,662 -

------------- ----------

Net cash flows from financing 9,794,662

activities -

Increase/(decrease) in cash

and short-term deposits 1,134,983 (270,454)

Cash and short-term deposits

as at the start of the period 10,430 280,884

Effect of foreign exchange (112)

changes -

------------- ----------

Cash and short-term deposits

at the end of the period 1,145,301 10,430

------------- ----------

Notes to the Condensed Consolidated Financial Statements

For the six months ended 30 November 2020

1 General information

The Company was incorporated in England under the Laws of

England and Wales with registered number 10186111 on 18 May 2016.

All of the Company's Ordinary Shares were admitted to the London

Stock Exchange's Main Market and commenced trading on 1 November

2017. The company was re-registered as a public company under

Companies Act 2006 on 1 June 2017, by the name Contango Holdings

plc.

The Company is listed on the Standard Market of London Stock

Exchange plc.

The unaudited interim consolidated financial statements for the

six months ended 30 November 2020 were approved for issue by the

board on 31 March 2021.

The figures for the six months ended 30 November 2020 are

unaudited and do not constitute full accounts. The comparative

figures for the period ended 31 May 2020 are extracts from the

annual report and do not constitute statutory accounts.

2 Basis of Preparation and Risk Factors

The Company Financial Information has been prepared in

accordance with and comply with IFRS as adopted by the European

Union, International Financial Reporting Interpretations Committee

interpretations and the Companies Act 2006. The financial

statements have been prepared under the historical cost convention

as modified for financial assets carried at fair value.

The financial information of the company is presented in British

Pound Sterling ("GBP").

The accounting policies and methods of calculation adopted are

consistent with those of the financial statements for the year

ended 31 May 2020.

The business and operations of the Company are subject to a

number of risk factors which may be sub-divided into the following

categories:

Exploration and development risks, including but not limited

to:

-- Mineral exploration is speculative and uncertain

-- Verification of historical washability analysis

-- Independent verification of internal resource estimation at Garalo

-- Mining is inherently dangerous and subject to conditions or

events beyond the Company's control, which could have a material

adverse effect on the Company's business

-- The volume and quality of coal recovered may not conform to current expectations

-- The extend and grade of gold mineralisation at Garalo may not

conform to current expectations

Permitting and title risks, including but not limited to:

-- Licence and permits

-- The Company will be subject to a variety of risks associated

with current and any potential future joint ventures, which could

result in a material adverse effect on its future growth, results

of operations and financial position

Political risks, including but not limited to:

-- Political stability

-- Enforcement of foreign judgements

-- Potential legal proceedings or disputes may have a material

adverse effect on the Company's financial performance, cash flow

and results of operations

Financial risks, including but not limited to:

-- Foreign exchange effects

-- Valuation of intangible assets

-- The Company may not be able to obtain additional external

financing on commercially acceptable terms, or at all, to fund the

development of its projects

-- The Company will be subject to taxation in several different

jurisdictions, and adverse changes to the taxation laws of such

jurisdictions could have a material adverse effect on its

profitability

-- The Company's insurance may not cover all potential losses,

liabilities and damage related to its business and certain risks

are uninsured and uninsurable

Commodity prices, including but not limited to:

-- The price of coal may affect the economic viability of ultimate production at Lubu

-- The revenues and financial performance are dependent on the price of coal

-- The price of gold may affect the economic viability of ultimate production at Garalo

Operational risks, including but not limited to:

-- Availability of local facilities

-- Adverse seasonal weather

-- The Company's operational performance will depend on key

management and qualified operating personnel which the Company may

not be able to attract and retain in the future

-- The Company's directors may have interests that conflict with its interests

-- Risk relating to Controlling Shareholders

The Company's comments and mitigating actions against the above

risk categories are as follows:

Exploration and development risks

There can be no assurance that the Company's development

activities will be successful however significant exploratory work

has been conducted to date at Lubu and Garalo which supports the

Board's confidence that a profitable mining operation can be

developed.

Additionally, the phased development route which will be

employed at Lubu seeks to mitigate risks along the development life

cycle of the project.

Permitting and title risks

The Company complies with existing laws and regulations and

ensures that regulatory reporting and compliance in respect of each

permit is achieved. Applications for the award of a permit may be

unsuccessful. Applications for the renewal or extension of any

permit may not result in the renewal or extension taking effect

prior to the expiry of the previous permit. There can be no

assurance as to the nature of the terms of any award, renewal or

extension of any permit.

The Company regularly monitors the good standing of its

permits.

Political risks

The Company maintains an active focus on all regulatory

developments applicable to the Company, in particular in relation

to the local mining codes.

In recent years the political and security situations in

Zimbabwe and Mali have been particularly volatile.

Financial risks

The board regularly reviews expenditures on projects. This

includes updating working capital models, reviewing actual costs

against budgeted costs, and assessing potential impacts on future

funding requirements and performance targets.

Commodity prices

As projects move towards commercial mining the Company will

increasingly review changes in commodity prices so as to ensure

projects remain both technically and economically viable.

Operational risks

Continual and careful planning, both long-term and short-term,

at all stages of activity is vital so as to ensure that work

programmes and costings remain both realistic and achievable.

COVID-19 outbreak

In addition to the foregoing comments and mitigating actions

against the above risk categories the Company has implemented

various protocols in relation to the current COVID-19 outbreak.

Contango places the health and safety of its employees and

contractors as its highest priority. Accordingly, a business

continuity programme has been put in place to protect employees

whilst ensuring the safe operation of the Company.

Having spoken with, amongst others, local government, staff and

contractors, strict protocols have been implemented to reduce the

risk of transmission of COVID-19 at all the Company's

operations.

The situation in respect of COVID-19 is an evolving one and the

Board will continue to review its potential impact on its staff and

the business.

3 Loss before taxation

Loss before income tax is Unaudited Six Audited

stated after charging: Months to Year

ended ended

30 November 2020 31 May 2020

GBP GBP

Directors' remuneration 52,800 72,000

Contango share-based bonus 100,000 -

on IPO

Relisting costs 417,642 -

Ongoing listing costs 80,661 -

Salaries 174,755 -

Consultancy fees 80,695 -

Travel 69,287 -

Office costs 85,186 -

Other 68,633 -

Fee payable to the Company's

auditor for the audit of the

company's annual accounts - 15,250

Fee payable to the Company's

auditor in respect of all

other non-audit services - 5,113

4 Loss per Ordinary Share

The calculation of the basic and diluted loss per Ordinary Share

is based on the following data:

Unaudited Audited

Six Months Year

to to

30 November 31 May

2020 2020

Earnings

Loss from continuing operations

for the period attributable

to the equity holders of the

Company (1,108,611) (258,027)

Number of Ordinary Shares

Weighted average number of

Ordinary Shares for the purpose

of basic and diluted earnings

per Ordinary Share (number) 120,346,178 42,949,987

------------- -----------

Basic and diluted loss per

Ordinary Share (pence) (0.92) (0.60)

------------- -----------

There are no potentially dilutive Ordinary Shares in issue.

5. Share capital

Number of Share Capital Share Premium Warrants Total Share

Ordinary Reserve Capital

Shares issued

and fully

paid

GBP GBP GBP GBP

--------------- -------------- -------------- --------- ------------

As at 31

May 2020 42,949,987 429,500 368,978 84,874 883,352

Share issue 128,849,961 1,288,500 5,134,170 - 6,422,670

Share issue 28,000,000 280,000 1,120,000 - 1,400,000

Share issue 3,333,330 33,333 125,000 - 158,333

Warrant

Exercise 500,000 5,000 10,000 (1,341) 13,659

Share issue 36,000,000 360,000 1,440,000 - 1,800,000

Less issue

costs

--------------- -------------- -------------- --------- ------------

At 30 Nov

2020 239,633,278 2,396,333 8,198,148 83,533 10,678,014

--------------- -------------- -------------- --------- ------------

The Ordinary Shares issued by the Company have par value of 1p

each and each Ordinary Share carries one vote on a poll vote. The

Authorised share capital of the company is GBP5,000,000 ordinary

shares at GBP0.01 per share resulting in 500,000,000 ordinary

shares.

On 18(th) June 2020 Consolidated Growth Holdings were paid for

their 70% shareholding in the Lubu project with the issue of

128,849,961 new shares in Contango Holdings. In the associated

placing 28 million new ordinary shares were issued along with

3,333,330 bonus shares for the Contango directors. This increased

the total number of shares in issue to 203,133,278.

On 5(th) August 500,000 warrants were exercised.

On 22(nd) October Contango announced that it had issued 36

million new ordinary shares in a placing. This increased the total

number of shares in issue to 239,633,278.

6. Intangible Asset

Unaudited As Audited As at

at 31 May

30 November 2020

2020

GBP GBP

Mining rights (Zimbabwe) 9,797,701 -

Mining rights (Mali) 1,100,997 -

10,898,698 -

-------------------- ----------------

The intangible asset represents the mining rights and

technical information acquired when the Company acquired

its 70% shareholding in Monaf Investments (Pty) Ltd on

18(th) June 2020; and its 75% share in the Garalo gold

licence in Mali on 22nd October 2020.

7 Merger reserve

Unaudited As Audited As at

at 31 May

30 November 2020

2020

GBP GBP

Mining rights (Zimbabwe) 2,939,310 -

Mining rights (Mali) 275,248 -

3,214,558 -

-------------------- ----------------

The merger reserve represents the minority interest's

share in mining rights and technical information acquired

when the Company acquired its 70% shareholding in Monaf

Investments (Pty) Ltd on 18(th) June 2020; and its 75%

share in the Garalo gold licence in Mali on 22nd October

2020.

8 Related Party Transactions

Further to the announcement on 22(nd) October 2020 noting the

RAB Capital RP transaction, the board does not believe it

materially affected performance as required to be disclosed in DTR

4.2.7

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EFLBXFXLXBBE

(END) Dow Jones Newswires

March 31, 2021 02:00 ET (06:00 GMT)

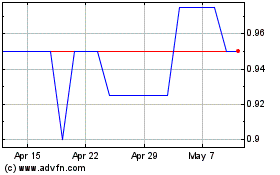

Contango (LSE:CGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Contango (LSE:CGO)

Historical Stock Chart

From Apr 2023 to Apr 2024