Contango Holdings PLC Lubu Coking Coal Update (5953Y)

May 14 2021 - 1:00AM

UK Regulatory

TIDMCGO

RNS Number : 5953Y

Contango Holdings PLC

14 May 2021

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural

Resources

14 May 2021

Contango Holdings Plc

('Contango' or the 'Company')

Lubu Coking Coal Update

Contango Holdings Plc, the London listed natural resource

development company, is pleased to announce an update following the

announcement of 26 March 2021 regarding the Company's discussions

relating to a potential long-term offtake for coking coal produced

at Contango's Lubu Coking Coal Project (the "Project") with the

Zimbabwean subsidiary of a major Chinese industrial company and one

of the world's largest stainless-steel producers (the "Potential

Offtake Partner"). As previously reported the Potential Offtake

Partner has a sizeable footprint in Zimbabwe, with plans to

construct a US$1bn carbon steel plant in the country and is

currently in the process of constructing several coke batteries in

the Hwange region of Zimbabwe.

Contango is pleased to advise a productive site visit recently

took place at Lubu with senior members of the Potential Offtake

Partner in attendance. Since the site visit discussions have

continued to make good progress, with an agreement now reached

between Contango and the Potential Offtake Partner on the next

steps to advance the Project.

Contango will now focus on extracting bulk samples of the high

value coking and metallurgical coals found in the 1A Lower and MSU

seams. Although close to surface, this will be treated as an

underground operation, like those previously mined around Hwange

Colliery, enabling the Company to focus specifically on the high

value product of particular interest to the Potential Offtake

Partner for its newly built coke batteries, expected to be

commissioned later this month.

Given the increasing likelihood of a positive outcome with the

Potential Offtake Partner, Contango will shortly approve the

appointment of a mining engineer, who will be charged with

identifying the best areas for underground mining, specifically

looking at fresh coal characteristics and strength importance,

needed to determine mine depth cut-off. In addition, liaising with

Contango's technical team, the engineer will also help select the

best excavation position for a 4m x 4m shaft, from which the bulk

sample will be taken.

Completion of the shaft and collection of the approximate 150

tonnes bulk sample is expected to take approximately 45 days. The

bulk samples will then be transferred to Hwange, where it will be

washed by the Potential Offtake Partner's plant before being run

through its laboratory and coke batteries at the Potential Offtake

Partner's cost.

Given the work already undertaken by Contango and the Potential

Offtake Partner, the Company believes there will be a good level of

confidence in the positive results of this testwork, which will

enable the two parties to finalise the long-term formal offtake

agreement. Moreover, this targeted underground approach is expected

to be funded from existing cash resources, having minimised the

upfront capital expenditure by Contango prior to finalising an

offtake agreement, with the Potential Offtake Partner also bearing

some of the testwork costs.

Carl Esprey, Chief Executive Officer of Contango Holdings, said:

"Discussions with the Potential Offtake Partner continue to

progress well, and I am pleased we have now reached a clear path to

enable formal offtake agreements to be entered into. Our potential

partner is one of the largest companies in Zimbabwe and its parent

company is one of the largest steel producers in the world. The

synergies between us are evident and I have every belief that upon

completion of this brief and low-cost test work we will be able to

enter a mutual and highly beneficial arrangement.

"I look forward to updating the market on our progress at Lubu

in due course and also expect to provide an update on our Mali gold

operations before the end of the month."

**ENDS**

For further information, please visit

www.contango-holdings-plc.co.uk or contact:

Contango Holdings plc E: info@contango-holdings-plc.co.uk

Chief Executive Officer

Carl Esprey

Brandon Hill Capital Limited T: +44 (0)20 3463 5000

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd T: +44 (0)20 7236 1177

Financial PR & Investor Relations

Susie Geliher / Cosima Akerman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFDFIDEFSELI

(END) Dow Jones Newswires

May 14, 2021 02:00 ET (06:00 GMT)

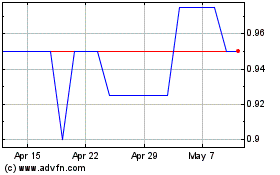

Contango (LSE:CGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Contango (LSE:CGO)

Historical Stock Chart

From Apr 2023 to Apr 2024