TIDMCGO

RNS Number : 6478A

Contango Holdings PLC

03 June 2021

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural

Resources

Contango Holdings Plc ('Contango' or the 'Company')

3 June 2021

Operational & Corporate Update

Highlights:

-- Further positive exploration results in Mali from Garalo and Ntiela

-- 8,000m of additional RC drilling in Mali

-- Zero Coupon GBP1M Convertible Loan entered into at 6p

Contango Holdings Plc, the London listed natural resource

development company, is pleased to provide a summary of recent work

undertaken at the Garalo-Ntiela Gold Project Area ('the Project')

in Southern Mali. The work programme was designed to assist in the

Company's previously reported focus of fast tracking the Project

into production by the end of 2021, as well as further increasing

the understanding of the wider prospectivity of the licences.

Given the focus on early production and cash generation, most of

the exploration activities have centred on the Garalo permit, which

has demonstrated potential for a 2Moz Resource. However, work on

the more recently acquired Ntiela concession, has also continued to

yield encouraging results with the intersection of two major

structures already. A summary of operations is presented below:

Work performed

-- Detailed regolith mapping on both Garalo and Ntiela sites;

-- Interpretation of historic data across both sites, identifying multiple new gold anomalies;

-- Over 1,000 samples collected and sent to in-country laboratory;

-- Land clearance completed for new operational camp, with

buildings expected to arrive later this month

Planned work programme:

-- Aeromagnetics and airborne geophysics for the collection of

magnetic and radiometric data - expected to commence in July

2021

-- 8,000m of RC drilling to further increase the resource and understanding of the orebody

-- Core will be sent for oxide / sulphide testing to support

final design work for the initial low-cost early production

plant

-- First production remains targeted for end 2021

GBP1M Convertible Loan

The Company is pleased to advise it has received commitments for

GBP1,000,000 in a Convertible Loan. The Convertible Loan has a

fixed conversion price of 6 pence per share and conversion is

mandatory on 4 January 2022. The Convertible Loan carries zero

interest and upon conversion into shares, each subscriber will

receive one warrant for every two ordinary shares they receive,

with an exercise price of 8p and a life of 2 years.

Existing major shareholder RAB Capital, has agreed to invest

GBP200,000 in the Convertible Loan. As Philip Richards is a

director of the Company, this Subscription is deemed a related

party transaction as defined under DTR 7.3. The independent

director, Roy Pitchford (Non-Executive Chairman), considers the

terms of the Director participation in the Fundraising are fair and

reasonable insofar as the Company's shareholders are concerned.

Carl Esprey, Chief Executive Officer of Contango Holdings, said:

"Our exploration and development activities at Garalo and the newly

acquired Ntiela permit continue to deliver highly encouraging

results which point to the Project having the potential to be a

major new mine in the region. Our work in the short-term is

focussed on properly assessing the upside potential to the current

2Moz gold resource we are contemplating at Garalo and establishing

the optimum route to first production by the end of 2021. As a

result, we have made the decision to undertake a short, low-cost

drill programme to help with our understanding and

optimisation.

"To fund this expanded pre-production work programme, the

Company has sourced GBP1M, primarily from existing investors at the

current market price. The convertible is a zero-coupon instrument

and has a mandatory conversion at 6p at the end of 2021,

highlighting the belief of the subscribers in the inherent value

Contango offers. The subsequent development to first production of

Garalo is still intended to be funded via a mixture of royalties

and debt as previously outlined.

"We look forward to providing further updates over the coming

weeks as we receive results from the laboratory and begin our

aeromagnetic and airborne geophysics programme, as well as

additional drilling."

Project Background

The combined Garalo-Ntiela Project covers an area of 161.5km(2)

and is in the department of Bougouni within the Sikasso region in

southern Mali, 200km south-south-east of Bamako and close to the

Guinea border. The Project is surrounded by several

multi-million-ounce gold deposits and the region is home to some of

the world's leading gold miners, which has helped to establish Mali

as the third largest gold producer in Africa.

An NI 43-101 Independent Technical Report delivered in March

2021 highlighted the potential for the Garalo to have up to 2Moz

Resource. The Company believes that there is still room for

improvement over and above this threshold as, in addition to G1 and

G3 targets (the basis for 2Moz), numerous other clusters of

anomalous zones with potential for gold discovery have been

identified in both the Garalo and contiguous Ntiela permit area.

With this background and given the excellent infrastructure in the

vicinity, historical exploration, and the deposit's surface

location, the Company aims to establish a processing hub in the

region, capable of supporting multiple open pit operations

targeting initial production of gold in Q4 2021 in conjunction with

an exploration programme including expansion drilling.

Accordingly, as part of the exploration programme, Contango has

completed a detailed regolith mapping exercise across both permits

to gain a better understanding of the geology/structures of the

area, as well as collecting key data like anomalous structural

site, gold endowment, hydrothermal alteration, and mineralisation,

and deep mantle related fertility indicators. The Company has also

undertaken an interpretation exercise relating to historical data

which has identified multiple new gold anomalies.

To facilitate the exploration and development campaigns now

gaining momentum at Garalo-Ntiela, a camp is being constructed

capable of supporting up to 20 employees and contractors, along

with a secure storage building for drill core. Ground clearance has

now been completed at the selected site and the specialist camp

buildings are due to be shipped from South Africa to Mali in the

next 3 weeks. This camp will support a permanent presence on site

at Garalo-Ntiela as work programmes intensify ahead of first

production.

These work programmes will begin with an aeromagnetics and

airborne geophysics campaign and this will be followed by 8,000m of

RC drilling. The over-arching strategy of this work is to better

define the extents and characteristics of the orebody, considering

the significant increase in resource quantum that is now

contemplated at Garalo. As previously announced, the Company is

advancing the development of a 30,000oz per annum heap leach

operation from the shallow oxides given the high margins and low

capex for its development. Given the increased resource potential

highlighted in the NI 43-101 Independent Technical Report released

in March 2021, the proposed drilling campaign is designed to

complement this strategy and help realise and optimise the asset's

full potential, as Contango looks to establish a large standalone

gold mine with multiple open pit operations across both permit

areas.

**ENDS**

For further information, please visit

www.contango-holdings-plc.co.uk or contact:

Contango Holdings plc E: info@contango-holdings-plc.co.uk

Chief Executive Officer

Carl Esprey

Brandon Hill Capital Limited T: +44 (0)20 3463 5000

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd E: info@stbridespartners.co.uk

Financial PR & Investor Relations

Susie Geliher / Cosima Akerman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUUVKRARUNRAR

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

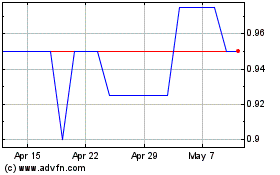

Contango (LSE:CGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Contango (LSE:CGO)

Historical Stock Chart

From Apr 2023 to Apr 2024