TIDMCHF

RNS Number : 0579Z

Chesterfield Resources PLC

19 May 2021

Chesterfield Resources Plc / EPIC: CHF / Market: LSE / Sector:

Mining

19 May 2021

Chesterfield to acquire substantial copper project in Canada

Chesterfield Resources is pleased to announce that it is to

acquire a belt scale copper exploration project, called Adeline, in

the highly-rated Labrador region of eastern Canada. The project is

close to the regional service hub of Goose Bay, and in range of

major road and rail infrastructure to the coast. The vendor, Altius

Minerals Corporation (together with its affiliates "Altius") TSX:

ALS, will become a strategic partner and help manage the

project.

-- Chesterfield to acquire 100% of a globally significant copper

exploration project, covering an entire geological basin nearly

40km long, that hosts over 200 known copper occurrences.

-- Previous prospecting and drilling on the site has encountered

high-grade copper-silver mineralisation. Potential for world class

discoveries.

-- Labrador ranked as one of the top ten mining destinations in

the world by the Fraser Institute, and is host to several major

mines.

-- Acquisition is via an all-share deal. The vendor, Altius,

will be issued 10% of Chesterfield's stock as payment for the

project, with an option to purchase a further 10% via a three-year

warrant exercisable at 20p. Altius is also entitled to a 1.6% gross

sales royalty. Low project expenditure obligations for

Chesterfield.

-- Altius will become a strategic shareholder and will help

design and manage initial exploration operations in Labrador on

behalf of Chesterfield.

-- Chesterfield will be hosting a Webinar to present the project

to investors, to be held at 4.30 pm on 20 May. All are welcome,

details below.

Said Martin French, Executive Chairman, "The Adeline project is

an outstanding acquisition for Chesterfield. It is highly unusual

to secure and be able to explore an entire copper belt in a

top-tier jurisdiction. The project has the potential for a

world-class discovery.

We have taken a strategic decision to greatly increase our

global footprint of high quality copper exploration assets. Our

objective is to be positioned as a leading copper exploration and

resource development company to help supply the surging global

demand for electrification.

Expansion into Canada is a natural fit for Chesterfield. The

company was co-founded by a Canadian and retains a core group of

Canadian shareholders. Our Director of Exploration, Dr Neil

O'Brien, is a Canadian and is based near Toronto. The acquisition

complements well our copper exploration project in Cyprus. Flight

time between London and St John's, Newfoundland is similar to

Cyprus, and like Cyprus, Labrador is an excellent mining location,

with good regulation, legal codes and infrastructure."

In recent months we have significantly bolstered the team at

Chesterfield in anticipation of expansion. Initial expenditure

obligations at Adeline are easily manageable within our current

cash reserves. We are also very pleased to welcome Altius as a

strategic partner. Altius is a highly regarded and successful

mining group in Canada and expert in Labrador, being head quartered

in St John's. Altius is helping us design and manage the initial

phase of exploration, of which there will be more news soon."

Said Neil O'Brien, Director of Exploration "Adeline is an

excellent entry point to a mid-stage exploration project covering

an entire sediment-hosted copper belt. Previous work has clearly

demonstrated its potential for important new copper discoveries

with significant silver credits. There are distinct similarities to

many of the world's great sediment-hosted copper deposits and belts

including very rich copper ore mineralogy, efficient metal traps

needed to form economic copper-silver deposits, and km-scale strike

extents of prospective geology with 100's of copper showings that

allow for multiple camp-scale discoveries.

A rich exploration and research database exists that, coupled

with heads-up field investigations, can be leveraged towards rapid,

smart drill target development in a very cost-effective manner.

Consequent important new copper-silver resources can be confidently

developed within a top tier mining jurisdiction. Labrador has a

track record for supporting new mine and resource sector

development projects in partnership with a local indigenous First

Nation that is already actively supporting, as well as

participating in, other exploration and mining ventures in

Labrador.

Investor Webinar invitation

Chesterfield will be hosting a Webinar, open to all, to present

and explain the project. Executive Chairman Martin French will

provide background to the deal, while senior geologists Dr Neil

O'Brien and Dave Cliff will present the project itself, with time

for questions afterwards.

The registration link is on the home page of our website:

https://www.chesterfieldresourcesplc.com

The Adeline exploration project

The Adeline copper-silver project is located within the western

half of the Central Mineral Belt, a 260 km long, metal-rich

geological terrane located in Central Labrador, eastern Canada. The

property is comprised of five contiguous mineral licenses totalling

129.3 km2, covering the full extent of the Seal Lake basin, a

nearly 40 km long by 10 km wide geological structure which contains

some 250 copper prospects. The project is similar in scale to the

renowned Chambisi basin on the Zambian Copperbelt and shares key

geological attributes with the giant sediment-hosted copper-silver

deposits at Udokan, Russia (1.4Bt @ 1.05%Cu, 10 g/t Ag) and the

Keweenawan Copperbelt, Michigan (historic production of 7.3Mt

copper) as well as copper deposits across the Zambian Copperbelt.

The Adeline property is close to the regional service hub of Goose

Bay, and within range of major road and rail infrastructure to the

coast, some of which was built specifically for mining projects

including the large iron ore mines of Labrador.

The successful track record of sediment-hosted copper belts

At the Adeline project, the numerous copper showings located

across the entire extent of the regional Seal Lake basin belong to

one very large sediment-hosted copper mineral system, and is one of

a number of similar belts globally. These include the world class

copper deposits of the Central African Copperbelt in the Democratic

Republic of Congo and Zambia, the Kupferscheifer of central Europe,

the Keweenawan Copperbelt of Michigan, US and the Udokan

copper-silver deposit in eastern Russia. These sediment-hosted

copper belts have been successfully developed into significant,

very long-life mining camps that have each seen mine production of

several millions of tonnes of contained copper and other valuable

metals including cobalt and silver. It is important to recognize

that whilst sediment-hosted copper deposits commonly form as fairly

narrow beds of typically a few meters they can have kilometres of

regional extent both along strike and down-dip. However, these

copper beds can become locally much thicker and so these zones

become the target for exploration.

Geologically, the Adeline copper prospects have particular

similarities with those of the Keweenawan Copperbelt, as they

contain high copper tenor sulphide mineralization comprised of

chalcocite-bornite with substantial silver content hosted by grey

bed type shales and native copper within underlying basalts. They

also share a similar Late Proterozoic ("Grenvillian") age of copper

mineralization, again the same as the copper deposits at Keweenawan

as well as those hosted in the older host rocks of the Zambian

Copperbelt. It is thought that these particular, large

sediment-hosted copper belts may have all formed at the same time,

around a billion years ago, in response to the formation of a

former supercontinent.

Plenty of evidence of high-grade copper at Adeline, yet there

has been drilling on the belt

There have been a number of field exploration programmes and

government mapping surveys across the Adeline project area covering

the Seal Lake basin over previous decades, resulting in a robust

knowledge base and many defined targets to work from. Trenching and

channel sampling, for example, has established the presence of

high-grade copper beds, such as 7.11% Cu, 90.8 g/t Ag across 1.5m

and 2.5% Cu, 94.3 g/t Ag over 4.5m, but also laterally continuous

copper beds with resource grades and thicknesses, such as 1.35% Cu,

49.8 g/t Ag across an average 4.2m thickness over an exposed strike

length of 60m. However, where sulphide mineralization becomes

massive the grades are extremely high, commonly 10-30% Cu due to

the high copper tenor of chalcocite-bornite, the principal copper

sulphides.

Yet despite the encouraging field work there has been relatively

little drill testing, largely due to the lack of road access. Only

7,317m has been drilled since 1951 with much of this as shallow

prospect drilling. However, this shallow historic drilling has

returned some good resource grades and thicknesses, including 7.9m

@ 1.76% Cu, 56.2ppm Ag, that need following up.

While many of these copper-silver intercepts are open along

strike and down-dip, the vast majority of the over 200 copper

prospects at Adeline have still only been explored by local mapping

and rock sampling and their extents remain unknown. There is

clearly considerable opportunity for further exploration work, and

especially carefully targeted drilling. The regional exploration

database includes results of extensive, high-quality geological,

geochemical and geophysical surveys. Using advanced techniques,

these databases can now be quickly combined and analysed to

generate high priority target areas for field follow up prior to

drill target definition.

An initial field season is already being planned to investigate

prospects and more specific field-based targeting methods based

upon a re-evaluation and re-modeling of the regional exploration

datasets with the latest visualization software tools and with

expert consultants who have decades of experience in this belt.

This is expected to generate a significant pipeline of quality

drill targets to test for significant extents of high-grade

copper-silver mineralized grey beds. Drilling can be done

throughout much of the year including during the winter if needed

when rigs can set up on frozen lakes.

Labrador as a mining region

Newfoundland & Labrador was ranked the eighth most

attractive mining investment destination in the world by the

influential Fraser Institute Survey of Mining Companies (2020),

which ranked jurisdictions on criteria such as regulation, legal

and tax environments, environmental protection issues, community

issues, infrastructure, trade barriers, political stability,

security, labour and the quality of geological databases.

The area is host to world class mines including Vale's famous

Voisey's Bay nickel-copper mine and Rio Tinto's Carol Lake iron ore

operation, as well as other natural resource sector projects

including large hydroelectric power generating projects, all under

current permitting processes and legislation. The legislative

environment is transparent, and government mineral claims

management inexpensive and efficient.

Newfoundland and Labrador is thus arguably one of the most

mining supportive jurisdictions in the world. Within legislative

and regulatory practice there are numerous examples of mining (and

exploration) activities that co-exist with natural water courses

and have been fully permitted for construction but that are also in

full compliance with operating environmental permits (including

those impacting water) and other related regulations.

Project location

The property is located in south-central Labrador, 20 minutes

away by helicopter from Goose Bay, which is a major settlement with

services and an airport, plus access to deep water. Goose Bay is

the service hub to most of Labrador and is the base of operations

for a number of exploration-related service providers including

helicopter and fixed wing support and diamond drilling companies. A

number of large lakes allow for good boat access throughout the

project area.

The paved, all-weather Trans-Labrador Highway is located

approximately 110 km to the south of the project and the 5,428 MW

Churchill Falls hydroelectric facility (the tenth largest in the

world) is located approximately 180 km to the southwest. A hydro

access road is located within approximately 60 km of the western

end of the project.

The climate at lower elevations is subarctic with normal average

temperatures at Goose Bay ranging between -12degC in January, to an

average of 20degC in July. Annual precipitation is in the order of

950 mm, distributed between the short, wet, warmer summers and

cold, snowy winters. Exploration work can be carried out for most

of each year with slightly more planning and preparation needed

during the winter months. The general prospecting and geological

mapping season is mid-June through mid-October with thaw of late

ice historically occurring around mid-June, although earlier in

recent years.

ESG considerations

All exploration work must be approved by the Department of

Industry, Energy and Technology, which adheres to world class best

practices in environmental and social considerations. All Mineral

Exploration Approval Applications are referred to various

government departments and stakeholders in the vicinity for

approval, such as Environment and Wildlife, Forestry, Fisheries,

Protected Lands Committees, Municipal Government, Indigenous

groups, before any permits are granted.

The Property falls in an area that the Labrador Innu, an

indigenous First Nations group, have asserted their traditional

rights. The Innu Nation has been in negotiations for a land claims

agreement with the federal (and indirectly provincial) government

since 1978 and these negotiations are ongoing. No final designation

of the Innu land claims area has been promulgated. The Innu Nation

has not explicitly expressed opposition to mineral exploration and

mining and in fact signed an Impact Benefits Agreement with INCO

(now Vale) and the governments of Canada and Newfoundland and

Labrador which led to the successful development of the Voisey's

Bay Mine in northeast Labrador. Many Innu people are actively

employed at that mine.

Transaction details

Chesterfield has entered into a share purchase agreement with

Altius in which Altius has agreed to sell the entire issued share

capital of a special purpose vehicle ("SPV"), which in turn owns a

100% interest in the Adeline copper project, to Chesterfield (the

"Share Purchase Agreement"). The consideration for the share

purchase will be satisfied by Chesterfield's issue to Altius of (i)

10,089,199 ordinary shares in the capital of Chesterfield (the

"Ordinary Shares") and (ii) warrants over 11,100,000 Ordinary

Shares, exercisable for three years from completion at an exercise

price of GBP0.20 per new Ordinary Share.

Under the Share Purchase Agreement, Chesterfield agrees that it

will spend C$250,000 (GBP146,185) on the Adeline copper project

within 18 months following the date of the Share Purchase Agreement

and an additional C$750,000 (GBP438,554) within a further 12

months. Altius has also applied for some additional claims on the

project periphery which it will transfer to the SPV at

Chesterfield's request at cost if granted.

Chesterfield and Altius have also entered into a relationship

agreement. The principal terms are that 1) Altius is required to

exercise its voting rights so as to ensure the independence of

Chesterfield's board; 2) Altius is required not to control or

influence the running of Chesterfield at an operational level; 3)

Altius is required not to exercise its voting rights in respect of

any resolution relating to (a) any transaction with Altius; (b) the

cancellation of Chesterfield's admission to trading on the Main

Market; or (c) any amendments to Chesterfield's articles of

association which would be inconsistent with the agreement and 4)

Altius has the right to participate in any issue of shares or other

equity securities by Chesterfield by subscribing for such number of

shares as will ensure that the total proportion of all voting

rights held by Altius is not reduced following such issue. These

rights and restrictions shall apply for so long as Altius maintains

an interest in more than 5% of Chesterfield's voting rights.

Following completion, Altius will be entitled to a 1.6% gross

sales royalty on the Adeline project pursuant to a royalty

agreement between the SPV and an Altius affiliate. Altius will also

assist with the design of, and manage initial exploration

operations in Labrador of behalf of, and under the direction of

Chesterfield by virtue of a technical services agreement between

the SPV and an Altius affiliate.

The transaction is conditional upon, among other things,

approval of a Chesterfield prospectus expected in coming weeks.

Further details of the transaction will be published in the

prospectus.

About Altius

Altius Minerals Corporation is a well-regarded and successful

exploration project generator and royalty company listed on the TSX

(ALS.TO) with a market capitalisation of approximately C$710

million.

The Altius group holds royalty interests in 13 producing assets

throughout the Americas. In Canada these assets include a 4% net

sales royalty on Hudbay's 777 copper-zinc mine in Manitoba, 6

potash mines and two other mines located in western Canada, and a

royalty on the Voisey's Bay nickel-copper-cobalt mine in Labrador.

In 2020 it generated revenue of C$67 million.

Altius is headquartered in St John's, Newfoundland and so is

highly familiar with Labrador, and well connected with exploration

service providers there, as well as the local Innu First Nation

group.

About Chesterfield Resources

Chesterfield Resources is a copper-focussed exploration company

with a project in Cyprus and the proposed new Adeline copper

project in Labrador Canada, contingent, among other things, upon

the publication of a prospectus. In December 2020, Polymetal

International, the FTSE100 mining group, took a 23% strategic

investment in Chesterfield via a placing of new shares. Upon

completion of the acquisition of the project in Labrador, Altius

will similarly become a strategic partner, with a 10% holding in

the Chesterfield, and a 20p warrant over a further 10% of the

company.

The exploration team is led by two veteran industry geologists

Neil O'Brien, formally SVP Exploration & New Business

Development, Lundin Mining, and Dave Cliff, previously Head of

Exploration Europe, Rio Tinto.

In Cyprus the company holds the largest mineral exploration

licence area of any operator on the island.

Cyprus is regarded as a high-quality exploration location. It is

a member of the EU, and its legal system is based on English common

law. An opportunity exists because there has been minimal

exploration activity on the island in the last 46 years since the

invasion by Turkey in 1974 put a halt to what had been a very

active mining industry.

The current focus of exploration is in the Troodos West group of

licences belonging to the company, with around 30 defined targets

in an area measuring 10km by 10km. The objective is to discover

several VMS deposits in close proximity to each other to create a

mining project with a centralised processing unit.

While copper is the main exploration target, it is noteworthy

that gold was not historically exploited in Cyprus . Gold has been

encountered in several locations in the exploration target area and

is an important part of the exploration objective.

The company announced high grade results from its late season

2020 drilling campaign and is now engaged in an enlarged integrated

2021 geophysics, percussion and diamond drilling exploration

campaign. The company will commence its diamond drill programme in

one month.

Chesterfield Resources is committed to world-class environmental

standards in all of its operations to mine copper, which is

essential to developing clean technology projects worldwide. The

company hopes to develop

industry and opportunities for the benefit of the Republic of Cyprus and Canada.

Chesterfield has embarked on a strategy of acquisition to take

advantage of mega-trend of electrification and copper demand.

Further acquisitions are expected to significantly enlarge its

exploration footprint.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**ENDS**

For further information, please visit

www.chesterfieldresourcesplc.com or contact:

Chesterfield Resources plc:

Martin French, Executive Chairman Tel: +44(0) 7901 552277

Panmure Gordon (UK) Limited Tel: +44 (0)207 886 2500

(Joint Broker):

John Prior & Hugh Rich

Fox-Davies Capital Limited

(Broker): Tel: +44 ( 0)20 3884 8450

Daniel Fox-Davies

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAXSPFLKFEFA

(END) Dow Jones Newswires

May 19, 2021 02:00 ET (06:00 GMT)

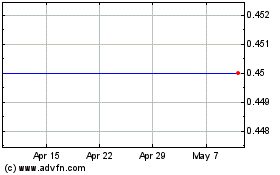

Chesterfield Resources (LSE:CHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesterfield Resources (LSE:CHF)

Historical Stock Chart

From Apr 2023 to Apr 2024