Cineworld Faces Shareholder Revolt Over Pay Policy -- Update

May 07 2021 - 8:32AM

Dow Jones News

--Proxy advisers recommend that Cineworld shareholders oppose

remuneration policy

--Legal & General Investment Management plans to escalate

vote position on concerns over pay package

--LGIM plans to vote against re-election of Cineworld's chair

and members of the remuneration committee

By Adria Calatayud

Cineworld Group PLC faces a potential shareholder revolt at its

annual general meeting due to be held on Wednesday after advisory

firms recommended shareholders reject its remuneration policy.

Proxy advisers Institutional Shareholder Services and Glass

Lewis cited concerns over potential excessive payouts to executives

and change of control provisions that would discourage potential

buyers from making an offer for the company.

ISS also recommended shareholders in Cineworld, the owner of

U.S. cinema chain Regal, reject the company's remuneration report

and the re-election of Dean Moore, chair of the board's

remuneration committee, as director.

ISS said the structure of Cineworld's long-term incentive plan

raises concerns on multiple fronts, including the amount of awards,

the lack of stretch in the performance conditions, and that they

would vest automatically on a change of control. Due to the

severity of the remuneration concerns, shareholder support isn't

considered warranted for the re-election of Mr. Moore, ISS

said.

Legal & General Group PLC's investment-management arm plans

to vote against re-election of Cineworld's chairwoman and all

members of the board's remuneration committee due to concerns over

its incentive plan.

"We have strong concerns about the structure of the long-term

incentive plan granted to the executives, and its misalignment with

the long-term interests of the company, its shareholders and other

stakeholders," Legal & General Investment Management said in a

blog post published Thursday.

"In particular, we note the impact of Covid-19 on the company's

financials and stakeholders, including furloughs for employees and

the suspension of dividends. We also take into account the current

social sensitivities around income inequality," LGIM said.

The London-based asset manager said it would vote against

resolutions to re-elect Cineworld Chairwoman Alicja Kornasiewicz as

director at the company's annual general meeting due to be held on

Wednesday. LGIM also said it would oppose the re-election of Mr.

Moore and Camela Galano, member of the remuneration committee, and

the election of Ashley Steel, member of the committee, as

director.

Cineworld declined to comment on Friday. In its AGM circular,

the company said its board believes the proposed resolutions are in

the best interests of shareholders and the company as a whole and

recommended that shareholders vote in favor of them.

LGIM said it had chosen to escalate its vote position as it was

concerned by the lack of response from the company's remuneration

committee and board despite significant opposition from

shareholders to its pay proposals.

LGIM said it already raised concerns about Cineworld's pay

package at a special shareholder meeting held in January. At that

meeting, two remuneration resolutions were approved despite

significant minority opposition.

Glass Lewis and ISS recommended that shareholders oppose

Cineworld's remuneration proposals at the January meeting.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

May 07, 2021 09:17 ET (13:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

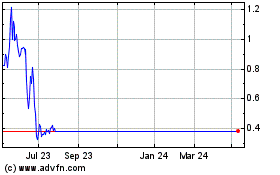

Cineworld (LSE:CINE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cineworld (LSE:CINE)

Historical Stock Chart

From Apr 2023 to Apr 2024