CLS Holdings PLC Completion of GBP61.7m long-term, sustainable loan (7856W)

April 28 2021 - 1:00AM

UK Regulatory

TIDMCLI

RNS Number : 7856W

CLS Holdings PLC

28 April 2021

Release date: 28 April 2021

Embargoed until: 07:00 am

CLS Holdings plc ("CLS")

announces the completion of a GBP61.7 million long-term,

sustainable real estate loan with Scottish Widows

CLS announces that it has completed a GBP61.7 million loan with

Scottish Widows secured on a portfolio of five UK office

properties. This loan replaces two existing loans of GBP27.4

million, which were due to expire before the end of 2021, as well

as financing three recent unencumbered acquisitions. Overall, the

transaction will result in net additional cash to CLS of GBP33.7

million, after costs.

The twelve-year loan has a loan-to-value ratio of 55% and a

fixed interest rate of 2.65%. Subject to certain conditions, CLS

will be able to remove or substitute properties as security for the

loan.

The loan, which is in line with the LMA sustainability-linked

loan principles, incorporates a 10-basis point margin reduction

dependent on the delivery of specific sustainability targets. The

loan will increase the proportion of CLS' total loans which are

green/sustainability-linked to around 20%.

Andrew Kirkman, Chief Financial Officer of CLS, commented:

"We have had a strong relationship with Lloyds Banking Group, of

which Scottish Widows is a part, for many years. This long-term

financing recognises and incentivises our sustainability

commitments while aligning them to those of Scottish Widows.

Furthermore, this loan diversifies our debt profile and the amount

meeting green financing principles."

Duncan Smith, Director of Loan Investments at Scottish Widows,

commented:

" We have worked closely with CLS to put in place this long-term

funding package to support its continued growth strategy. This

marks the first sustainability-linked Scottish Widows loan and

follows our recent announcement to halve our carbon footprint of

investments by 2030 and target net zero emissions by 2050."

Following the execution of this loan and the financings

associated with the recent completion of our five German

acquisitions as well as payment of the final dividend on 29 April

2021, CLS will have cash of over GBP150 million and a loan to value

ratio of c.39% based on 31 December 2020 portfolio valuation (31

December 2020: 33.7%) with a further GBP50 million in undrawn

facilities.

-ends-

For further information, please contact:

CLS Holdings plc

(LEI: 213800A357TKB2TD9U78)

www.clsholdings.com

Fredrik Widlund, Chief Executive Officer

Andrew Kirkman, Chief Financial Officer

+44 (0)20 7582 7766

Liberum Capital Limited

Richard Crawley

Jamie Richards

+44 (0)20 3100 2222

Panmure Gordon

Hugh Rich

+44 (0)20 7886 2733

Elm Square Advisers Limited

Jonathan Gray

+44 (0)20 7823 3695

Smithfield Consultants (Financial PR)

Alex Simmons

Rob Yates

+44 (0)20 3047 2546

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVDSVIDFIL

(END) Dow Jones Newswires

April 28, 2021 02:00 ET (06:00 GMT)

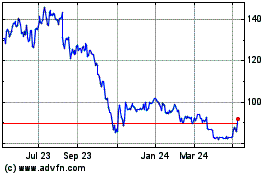

Cls (LSE:CLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

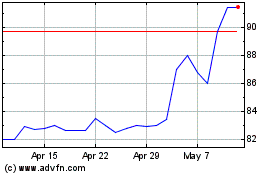

Cls (LSE:CLI)

Historical Stock Chart

From Apr 2023 to Apr 2024