TIDMCLIG

RNS Number : 6149A

City of London Investment Group PLC

02 June 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS NOT FOR

RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY

OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA,

JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR INTO ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OR BREACH

OF ANY APPLICABLE LAW.

2 June 2021

For immediate release

City of London Investment Group PLC ("CLIG")

Publication of circular

Further to the announcement by the Company on 6 April 2021, the

Company announces that it will today post to shareholders a

circular to convene a general meeting of the shareholders of the

Company (the "General Meeting") to be held at the Company's

registered office at 77 Gracechurch Street, London EC3V 0AS at

12.30 p.m. on 29 June 2021. The purpose of the General Meeting is

for shareholders to vote on a resolution to approve the

appropriation of distributable reserves in respect of certain

historic dividends and the entry into a shareholders' deed of

release and a directors' deed of release each as described further

in the circular.

Due to mandatory measures imposed by the UK Government as a

result of the spread of the COVID-19 virus in the United Kingdom,

the General Meeting will be convened with the minimum quorum of

shareholders present in order to conduct the business of the

meeting, which is in accordance with the latest guidance published

by the Department for Business, Energy & Industrial Strategy

and the Financial Reporting Council. Shareholders are therefore

requested to appoint the Chairman of the General Meeting as his or

her proxy as any other person so appointed will not be permitted to

attend the General Meeting. Further details are set out in the

circular.

The circular is also available on the website of the Company at

www.clig.com. The circular includes a letter from the senior

independent director, which is reproduced in the Appendix without

material adjustment or amendment.

For further information please contact:

City of London Investment Group Tel: 001-610-380-0435

PLC

Tom Griffith, CEO

Beaumont Cornish Limited (Sponsor) Tel: +44 (0) 207 628 3396

Roland Cornish, Michael Cornish

Zeus Capital Limited (Financial Tel: +44 (0) 20 3829 5000

Adviser and Broker)

Martin Green, Pippa Hamnett

Beaumont Cornish Limited ("Beaumont Cornish" or the "Sponsor"),

is authorised and regulated in the United Kingdom by the FCA, is

acting exclusively for the Company and no one else in connection

with the arrangements described in this Announcement and will not

regard any other person (whether or not a recipient of this

Announcement) as a client in relation to the arrangements described

in this Announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to its

clients or for providing advice in relation to the arrangements

referred to in this Announcement.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Appendix 1

Letter from the Senior Independent Director, as set out in the

Circular

The Circular includes a letter from the Senior Independent

Director, which is reproduced in full below without material

adjustment or amendment. Terms used below have the same meaning

given to them as defined in the Part IV of the Circular.

"Introduction

The Board has become aware of a technical issue in respect of

the payment of certain historic dividends paid by the Company in

each of the financial years ended 31 May 2007 to, and including, 30

June 2019 (with the exception of the financial year ended 30 June

2018). The distributions affected by this issue are set out in

paragraph 1 of Part II of this Circular (the "Relevant

Distributions").

Accordingly, I, Peter Roth, as the Company's Senior Independent

Director, am writing to you today to explain the proposals to

address this issue and the action you are being asked to take, as

the Chairman of the Board, Barry Aling, along with a number of our

fellow Directors, are considered related parties under the Listing

Rules in connection with the proposals described in this

Circular.

This technical issue in respect of the Relevant Distributions is

of an historic nature and there is no change to the financial

outlook of the Company as a consequence. The Proposals described in

this Circular do not affect the Company's existing distributable

reserves nor its capacity to pay shareholder dividends going

forward in accordance with the Company's dividend policy.

Background

The Companies Act provides that a public company may only pay a

dividend out of its distributable reserves as shown in the last

accounts circulated to members or, if used, interim accounts filed

at Companies House. The requirement for the relevant accounts to

have been filed applies even if the company in question has

sufficient distributable profits and reserves at the relevant time

in its financial records.

Whilst the Group has at all times had sufficient distributable

reserves on a consolidated basis to cover the Relevant

Distributions, those reserves had not always been distributed

upward to the Company itself from its operating subsidiaries at the

time of declaration of each Relevant Distribution and were not

recorded, and therefore available, in the Company's own accounts.

In addition, interim accounts in respect of the Company were not

always filed, where required, with Companies House to show the

availability of sufficient distributable reserves in respect of

Relevant Distributions made by the Company. In such cases, this

constituted a breach of section 838(6) of the Companies Act which

requires a copy of the interim accounts to be delivered to

Companies House.

Therefore, regrettably, the Relevant Distributions were made

otherwise than in accordance with the Companies Act. The Board has

reviewed the Company's internal financial reporting procedures to

ensure that a similar situation does not occur in the future.

Separately, and as part of a wider review of the Company's service

providers, the Company is delighted to confirm the appointment of

Prism Cosec Limited as its corporate company secretary with effect

from 4 May 2021.

The purpose of this Circular is to convene a General Meeting to

propose the Resolution, which will, if passed, give the Board

authority for the appropriation of the distributable profits of the

Company to the payment of each of the Relevant Distributions and to

enter into the deeds of release described in Part II of this

Circular and put all potentially affected parties so far as

possible in the position in which they were always intended to be

had the Relevant Distributions been made in accordance with the

requirements of the Companies Act.

The Company has been advised that, as a consequence of the

Relevant Distributions having been made otherwise than in

accordance with the Companies Act, it may have claims against past

and present shareholders who were recipients of the Relevant

Distributions and against persons who were directors of the Company

at the time of payment of the Relevant Distributions. It is

therefore proposed that the Company enters into the Shareholders'

Deed of Release and the Directors' Deed of Release. The consequence

of the entry into these deeds by the Company is that the Company

will be unable to make any claims against:

(i) past and present shareholders of the Company who were

recipients of Relevant Distributions (the "Recipient

Shareholders"); or

(ii) all past and present directors of the Company who were

directors at the time a Relevant Distribution was made, being: (a)

the Company's current Chairman, Barry Aling; (b) certain of the

Company's current Executive Directors, namely Tom Griffith, Mark

Dwyer and Carlos Yuste; (c) certain of the Company's current

Non-Executive Directors, namely Barry Olliff, Jane Stabile and Rian

Dartnell; and (d) the following former directors of the Company,

Susannah Nicklin, Tracy Rodrigues, Lynn Ruddick, George Robb, Mark

Driver, Valerie Tannahill, Andrew Davison, David Cardale, Allan

Bufferd, Omar Ashur and Douglas Allison (the "Relevant

Directors"),

in each case in respect of the payment of the Relevant

Distributions otherwise than in accordance with the Companies

Act.

The entry by the Company into the Directors' Deed of Release

constitutes a related party transaction (as defined in the Listing

Rules) as Barry Aling, Barry Olliff, Tom Griffith, Mark Dwyer,

Carlos Yuste, Jane Stabile, Rian Dartnell and Susannah Nicklin are

considered related parties under the Listing Rules (being persons

who are, or were within the last 12 months, directors of the

Company) and each of them is a beneficiary of the deed. Therefore,

the Resolution will seek the specific approval of the Company's

shareholders for the entry into the Directors' Deed of Release as a

related party transaction, in accordance with the requirements of

the Listing Rules.

Further details and an explanation of the business of the

General Meeting and the related party transaction are set out in

Part II of this Circular.

Notice of General Meeting

A notice of General Meeting of the Company which will be held at

the Company's registered office at 77 Gracechurch Street, London

EC3V 0AS at 12.30 p.m. on 29 June 2021 can be found in Part V of

this Circular.

You are advised to read the whole of this Circular, including

the Notice, and not to rely solely on the information contained in

this letter.

Action to be taken

Due to mandatory measures imposed by the UK Government as a

result of the spread of the COVID-19 virus in the United Kingdom,

the General Meeting will be convened with the minimum quorum of

shareholders present in order to conduct the business of the

meeting, which is in accordance with the latest guidance published

by the Department for Business, Energy & Industrial Strategy

and the Financial Reporting Council. Shareholders are therefore

requested to appoint the Chairman of the General Meeting as his or

her proxy as any other person so appointed will not be permitted to

attend the General Meeting. A shareholder may appoint more than one

proxy in relation to the General Meeting provided that each proxy

is appointed to exercise the rights attached to a different share

or shares held by that shareholder.

Shareholders can vote either:

-- by logging on to www.signalshares.com and following the instructions;

-- by requesting a hard copy Form of Proxy from the Registrar on

0371 664 0300. Calls are charged at the standard geographic rate

and will vary by provider. Calls outside the United Kingdom will be

charged at the applicable international rate. The Registrar is open

between 9.00 a.m. - 5.30 p.m. Monday to Friday, excluding public

holidays in England and Wales; or

-- in the case of CREST members, by utilising the CREST

electronic proxy appointment service in accordance with the

procedures set out in the notes to the notice of General

Meeting.

To be valid any proxy vote must be received by the Registrar by

no later than 12.30 p.m. on 25 June 2021.

Further details are given in the notes to the notice of General

Meeting set out on pages 22 to 24 of this Circular.

This letter is also being sent to those who have been nominated

to receive information rights under section 146 of the Companies

Act who do not themselves have a right to appoint a proxy or

proxies. The attention of such nominated persons is drawn to note

10 to the Notice set out on page 24 of this Circular.

Recommendation

The Board, who has been so advised by Beaumont Cornish, believes

that (i) the waiver of claims against the Relevant Directors

pursuant to the Resolution and (ii) the entry into each of the

Directors' Deed of Release and the Shareholders' Deed of Release,

are fair and reasonable so far as the shareholders of the Company

are concerned. Beaumont Cornish has taken into account the Board's

commercial assessment of the effect of the Proposals. Further, the

Board considers the Resolution is in the best interests of

shareholders as a whole. The Interested Directors who are related

parties as defined in the Listing Rules, have not taken part in the

Board's consideration of these Proposals.

Accordingly, the Board unanimously recommends that shareholders

vote in favour of the Resolution at the General Meeting, as the

Independent Directors intend to do in respect of their own

beneficial shareholdings amounting in aggregate to 16,202,898

Ordinary Shares, representing approximately 31.97 per cent. of the

Company's current issued share capital and approximately 33.34 per

cent. of the Ordinary Shares eligible to vote on the

Resolution.

The Interested Directors and Susannah Nicklin, as related

parties under the Listing Rules, being persons who are currently or

were within the last 12 months directors of the Company, and who

also hold Ordinary Shares, are precluded from voting any Ordinary

Shares in which they are interested on the Resolution and

therefore, they have each undertaken to abstain, and to take all

reasonable steps to ensure that their respective associates

abstain, from voting on the Resolution. As at 1 June 2021 (being

the latest practicable date before the publication of this

Circular), the Interested Directors and Susannah Nicklin held, in

aggregate, 2,084,151 Ordinary Shares in the capital of the Company,

representing approximately 4.11 per cent. of the Company's existing

ordinary share capital.

In accordance with current best practice and to ensure voting

accurately reflects the views of shareholders, it will be proposed

at the General Meeting that voting on the Resolution will be

conducted by poll vote rather than by a show of hands and the

relevant procedures will be explained at the General Meeting.

If the Resolution is not passed, the Company may continue to

have claims against the Relevant Directors and Recipient

Shareholders.

The Board has taken steps to ensure that, in the future, the

issues referred to in this Circular do not arise in relation to the

payment of dividends. We are grateful for shareholders'

understanding in respect of the issues set out in this

Circular.

On behalf of the Board, thank you for your continued support of

the Company.

Yours sincerely

Peter Roth

Senior Independent Director"

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURSSFFEEEFSEFM

(END) Dow Jones Newswires

June 02, 2021 08:14 ET (12:14 GMT)

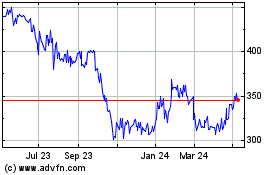

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

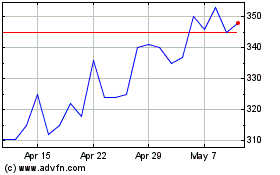

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Apr 2023 to Apr 2024