TIDMCMH

RNS Number : 6750V

Chamberlin PLC

16 April 2021

AIM: CMH

16 April 2021

CHAMBERLIN plc

("Chamberlin", the "Company" or the "Group")

FINAL RESULTS

for the year ended 31 March 2020

Chamberlin plc (AIM: CMH.L) has today published the Company's

Report and Accounts for the year ended 31 March 2020 ("FY2020

Accounts"). The Company has also published the Company's interim

results for the six months to 30 September 2020 ("FY2021 Interim

Results"). Upon publication of the FY2020 Accounts and the FY2021

Interim Results, the Company anticipates that suspension of trading

in the Company's ordinary shares on AIM will be lifted with effect

from 8.00am today.

The FY2020 Accounts, including Notice of the Company's AGM, are

available on the Group's website, www.chamberlin.co.uk and will be

posted to Shareholders on 19 April 2021. The AGM, which will be

held as a closed meeting given the restrictions in relation to

COVID-19, will be held on 8 June 2021 at Chuckery Road, Walsall,

West Midlands, WS1 2DU.

Highlights

Financial

-- Revenue in the year to 31 March 2020 of GBP26.1m (2019:

GBP33.0m) reflecting challenging automotive sector over the

year

-- Underlying operating loss before tax* of GBP1.1m (2019:

GBP1.0m) despite the 21% reduction in revenue

-- Non-underlying items in the year of GBP0.9m (2019: GBP3.4m)

included GBP0.8m relating to the realignment of the cost base of

the Group

-- Net debt at 31 March 2020 decreased by GBP0.8m to GBP4.6m (2019: GBP5.4m)

Post balance Sheet Events

-- The publication of the FY2020 Accounts was delayed due, in

part, to the impact of COVID 19 on the business and the audit

process. In addition, the Company announced the loss of a major

contact in December 2020 which has impacted on the Company's future

prospects.

-- Due to the inability to finalise the FY2020 Accounts, the

Company had been unable to publish the FY2021 Interim Results.

-- Trading in the Company's ordinary shares on AIM has been suspended since 4 January 2021

-- The Company announced a GBP3.5m share placing and

subscription on 26 March 2021 which has enabled the Company to

proceed with finalising the FY2020 Accounts. The Company is now

well positioned to take advantage of future growth

opportunities.

* Underlying figures are stated before non-underlying costs

(restructuring costs, hedge ineffectiveness, impairment, GMP

equalization, onerous leases and share based payment costs)

together with the associated tax impact.

Chairman, Keith Butler-Wheelhouse, commented:

"Management are confident that sales at Chamberlin will

stabilise in the first half of the 2021/22 financial year and will

then grow from the post BorgWarner low, with the growth gathering

pace in the second half. The Board expects growth from all business

units and a return to profitability and cash generation post our

restructuring."

Enquiries

Chamberlin plc T: 01922 707100

Kevin Nolan, Chief Executive

Neil Davies, Finance Director

Cenkos Securities plc T: 020 7397 8900

(Nominated Adviser and Broker)

Russell Cook, Katy Birkin

Peterhouse Capital Limited T: 020 7469 0930

(Joint Broker)

Heena Karani

Duncan Vasey

Chairman's Statement

The year under review was a difficult period for Chamberlin.

Revenue was 21% below the prior year, with a loss before tax of

GBP2.3m, including GBP0.8m of restructuring costs. However,

downsizing, cost reductions and careful cash management allowed the

company to operate effectively.

The Board and Staff

In July 2019, Keith Jackson retired from the Board after 14

years, having joined as a Non-Executive Director in 2005. Keith

continues in his role as Trustee Chairman of the Chamberlin and

Hill Staff Pension and Life Assurance Scheme. David Flowerday has

replaced Keith as Chair of the Audit Committee. On behalf of the

Board, we would like to place on record our thanks to Keith for his

many years of service to Chamberlin. He has made a significant

contribution and we wish him well in the future. Subsequent to the

year end the Board was strengthened by the appointment of Trevor

Brown in March 2021. There have been no other changes to the

Board.

As part of the overall restructuring mentioned above, there has

been a consolidation of many positions - including senior roles -

in order to reduce costs. On behalf of the Board, I would like to

give our thanks to all our employees during what has been a

difficult and challenging period.

Subsequent events

COVID-19 hit us very hard in April 2020 and to a lesser degree

in the months since. In December 2020 our principal customer

BorgWarner gave notice of the early termination of all existing

contracts, dealing a body blow to the Company.

This required Chamberlin to seek additional finance in order to

remain solvent and pursue substantial further restructuring. A

share issue was successfully undertaken in March 2021 generating

GBP3.5m before costs.

The publication of these accounts was delayed first by Covid,

then by the loss of the BorgWarner contract and finally by the

share issue.

Outlook

This outlook statement was first prepared in November 2020,

prior to events concerning BorgWarner. As penned in November the

outlook was uncertain, principally due to COVID 19.

As rewritten in April 2021 the market outlook is more positive,

with all businesses enjoying sales levels above those of the prior

year in recent months, excluding the effect of BorgWarner. Whilst

the COVID 19 outlook in the UK is much brighter, things remain

uncertain, particularly in Continental Europe where many of our

customers are based.

The substantial further restructuring mentioned above will

reduce the overhead structure and the direct workforce to that

needed for the reduced turnover caused by the BorgWarner contract

termination.

The Company continues to explore additional opportunities for

all business units, including non- traditional products and

e-commerce.

Management are confident that sales at Chamberlin will stabilise

in the first half of the 2021/22 financial year and will then grow

from the post BorgWarner low, with the growth gathering pace in the

second half. The Board expects growth from all business units and a

return to profitability and cash generation post our

restructuring.

Keith Butler-Wheelhouse

Chairman

Chief Executive's Review

Early in this financial year, Chamberlin's revenues suffered a

reduction with several factors hitting hard in the first half:-

-- A reduction in European car production adversely affected

both the Walsall foundry and machining facility

-- The troubles at British Steel impacted our Scunthorpe heavy castings foundry

-- Our emergency lighting business found many construction

projects were delayed by uncertainties in the UK economy associated

with Brexit.

Most importantly, and particularly for our dominant turbocharger

market, the continuing lack of clarity over future tariffs on trade

with the EU frustrated securing contracts on new models needed to

replace contracts on older vehicles reaching the end of their

production run.

This all reflected in first half revenues of GBP12.8m, a

reduction of 26% compared with the previous year. This necessitated

a substantial reduction in the cost base, which occurred during the

first half, with the number of employees reducing in line with

sales. The first half experienced a pre-tax loss of GBP1.8m which

included GBP0.7m of restructuring costs.

The restructuring programme was designed to right-size the cost

base to the expected future demand, with the latter buoyed in the

second half by the successful negotiation of several new

non-automotive contracts, and the potential to be further improved

by additional automotive work now the future trading regime with

the EU has been clarified.

In the second half, the increase in revenue from the new

non-automotive contracts helped to out-weigh the continuing effect

of automotive contracts winding down. Overall, second-half revenues

were 4% above those in the first half. The lower cost base enabled

the second-half pre-tax loss to be reduced to GBP0.5m, including a

further GBP0.1m restructuring costs and a small initial COVID-19

effect in March 2020. Excluding both, profit before tax for the

second half was essentially break-even.

Looking at the year, revenues at GBP26.1m were 21% below the

prior year, with a loss before tax of GBP2.3m, including GBP0.8m

restructuring costs. The lower activity enabled working capital to

be reduced, capital spend was constrained to the diminished

business opportunity and, despite the loss for the year, net debt

decreased from GBP5.4m to GBP4.6m.

Kevin Nolan

Chief Executive

Finance Review

Overview

Revenue reduced by 21% during the year to GBP26.1m (2019:

GBP33.0m) as trading conditions in our automotive market were

challenging. Gross profit margin decreased to 9.6% from 11.4% in

2019.

Underlying operating loss before tax only increased slightly to

GBP1.1m (2019: GBP1.0m) despite the 21% reduction in revenue.

Financing costs were 38% lower than 2019 at GBP0.3m (2019:

GBP0.5m) as a result of a reduction in net debt and a reduced

finance cost of pensions on a lower deficit.

Underlying loss before tax of GBP1.4m (2019: GBP1.5m loss) was

5% lower than 2019 due primarily to the lower financing costs.

The statutory loss before tax of GBP2.3m (2019: loss of GBP5.0m)

was 53% lower than 2019 as an asset impairment charge of GBP3.0m

taken in 2019 was not repeated.

Non-underlying items

Non-underlying items in the year of GBP0.9m (2019: GBP3.4m)

included GBP0.8m relating to the realignment of the cost base of

the Group and GBP0.1m of foreign currency related hedge

ineffectiveness resulting from Covid-19 induced revenue

reductions.

Tax

The effective rate of taxation on a statutory basis was 2%

compared to the mainstream corporation tax rate of 19%, primarily

as a result of not recognising deferred tax on trading losses due

to the inherent uncertainty surrounding future profitability.

Diluted loss per share

Underlying diluted loss per share from continuing operations of

18.7p (2019: 19.5p loss) was 4% lower than 2019, with total diluted

loss per share of 30.1p (2019: earnings of 18.2p).

Cash generation and financing

Operating cash inflow from continuing operations was GBP1.5m

(2019: outflow of GBP3.4m). This included a contractually agreed

advance payment from a customer of GBP1.5m and GBP0.4m of

corporation tax refunds received during the year offset by

restructuring costs of GBP0.7m.

Cash spent on property, plant and equipment and capitalised

software and development costs in the year was GBP0.4m (2019:

GBP1.2m).

Interest paid of GBP0.3m (2019: GBP0.4m) was lower than 2019 due

to lower average net debt in 2020.

Lease payments of GBP1.1m (2019: GBP0.8m) primarily relate to

assets at the Group's machining facility.

Net debt

Net debt at 31 March 2020 decreased by GBP0.8m to GBP4.6m (2019:

GBP5.4m). The Group debt facility has two elements: a GBP6.0m

invoice discounting facility limited to 90% of outstanding invoice

value and finance leases of GBP3.1m. The invoice discounting

facility has the following covenant at year-end, which was complied

with:

- Without prior written consent of HSBC, no dividends are

payable in the year ended 31 March 2020, and in subsequent years,

prior written consent of HSBC is required for the payment of any

dividends in excess of 50% of net profit after tax.

Foreign exchange

It is the Group's policy to minimise risk to exchange rate

movements affecting sales and purchases by economically hedging or

netting currency exposures at the time of commitment, or when there

is a high probability of future commitment, using currency

instruments (primarily forward exchange contracts). A proportion of

forecast exposures are hedged depending on the level of confidence

and hedging is topped up following regular reviews. On this basis

up to 90% of the Group's annual exposures are likely to be hedged

at any point in time and the Group's net transactional exposure to

different currencies varies from time to time.

Approximately 63% of the Group's revenues are denominated in

Euros. During the year to 31 March 2020, the average exchange rate

used to translate into GBP Sterling was EUR1.15 (31 March 2019:

EUR1.13).

Pension

The Group has one defined benefit pension scheme. It is closed

to future accrual, with the Group operating a defined contribution

pension scheme for its current employees. The deficit for the

defined benefit pension scheme at 31 March 2020 was GBP2.0m (2019:

GBP2.6m).

The Group's defined benefit pension scheme was closed to future

accrual in 2007. During the year the latest triennial valuation, as

at 31 March 2019, was concluded and contributions were set at

GBP0.3m for 2021, GBP0.33m for 2022 and GBP0.36m for 2023. The next

triennial valuation is due as at 31 March 2022.

Administration costs of the defined benefit pension scheme were

GBP0.2m in 2020 (2019: GBP0.2m) and are shown in other operating

expenses. The Group cash contribution during the year was GBP0.3m

(2019: GBP2.7m).

Audit Opinion

The auditors have reported on the accounts for the year ended 31

March 2020 and have given a modified audit opinion drawing

attention to a material uncertainty regarding going concern. The

Board has addressed these issues through the restructuring exercise

referred to above and through GBP3.5m raised by the share issue in

March 2021. As a consequence, the Directors have an expectation

that, in the circumstances of a reasonably foreseeable downside

scenario, the Group has adequate resources to continue to operate

for the foreseeable future.

However, the rate at which new work can be secured to replace

the lost BorgWarner activity is difficult to predict resulting in

material uncertainty, as referred to in note 2 below. The Directors

continue to adopt the going concern basis, whilst recognising there

is material uncertainty relating to the above matter.

Neil Davies

Group Finance Director

Consolidated Income Statement

for the year ended 31 March 2020

Year ended 31 March 2020 Year ended 31 March 2019

-------------------------------------- ----------------------------------------

(+) Non- (+) Non-

Note Underlying underlying Total Underlying underlying Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 3 26,143 - 26,143 32,958 - 32,958

Cost of sales (23,632) - (23,632) (29,192) - (29,192)

Gross profit 2,511 - 2,511 3,766 - 3,766

Other operating

expenses 6 (3,635) (909) (4,544) (4,776) (3,448) (8,224)

----------- ------------- ---------- ----------- ------------- ------------

Operating loss (1,124) (909) (2,033) (1,010) (3,448) (4,458)

Finance costs 4 (310) - (310) (499) - (499)

----------- ------------- ---------- ----------- ------------- ------------

Loss before

tax (1,434) (909) (2,343) (1,509) (3,448) (4,957)

Tax (expense)/

credit (50) - (50) (39) 87 48

----------- ------------- ---------- ----------- ------------- ------------

Loss for the

year from continuing

operations (1,484) (909) (2,393) (1,548) (3,361) (4,909)

Discontinued

operations 7

Profit for the

year from discontinued

operations - - - - 6,435 6,435

----------- ------------- ---------- ----------- ------------- ------------

(Loss)/ profit

for the year

attributable to

equity holders

of the parent company (1,484) (909) (2,393) (1,548) 3,074 1,526

=========== ============= ========== =========== ============= ============

Underlying loss

per share from

continuing operations:

Basic 5 - - (18.7)p - - (19.5)p

Diluted 5 - - (18.7)p - - (19.5)p

Earnings per share

from discontinued

operations:

Basic 5 - - - - - 80.9p

Diluted 5 - - - - - 76.8p

Total (loss)

/earnings per

share:

Basic 5 - - (30.1)p - - 19.2p

Diluted 5 - - (30.1)p - - 18.2p

*Non-underlying items include restructuring costs, hedge

ineffectiveness, impairment, GMP equalisation, onerous leases and

share-based payment costs together with the associated tax impact.

Underlying and non-underlying figures for the year ended 31 March

2019 have been restated as detailed in Note 10.

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2020

2020 2019

Note GBP000 GBP000

(Loss) / profit for the year (2,393) 1,526

Other comprehensive income

Movements in fair value of cash flow

hedges taken to other comprehensive

income (614) 134

Ineffective portion of movement in

cash flow hedges recycled to income

statement 138 -

Deferred tax on movement in cash

flow hedges 81 (23)

--------- -------

Net other comprehensive (expense)/income

that may be recycled to profit and

loss (395) 111

--------- -------

Re-measurement losses on pension

scheme assets and liabilities 9 460 76

Deferred tax expense on re-measurement

gain on pension scheme (87) (15)

Net other comprehensive income that

will not be recycled to profit and

loss 373 61

Other comprehensive (expense) / income

for the year net of tax (22) 172

Total comprehensive (expense) / income

for the year attributable to equity

holders of the parent company (2,415) 1,698

========= =======

Consolidated Balance Sheet

at 31 March 2020

Note 31 March 31 March

2020 2019

GBP000 GBP000

Non-current assets

Property, plant and equipment 7,209 7,769

Intangible assets 341 290

Deferred tax assets 611 906

--------- ---------

8,161 8,965

Current assets

Inventories 2,589 2,702

Trade and other receivables 6,082 6,052

Cash at Bank 457 291

9,128 9,045

Total assets 17,289 18,010

========= =========

Current liabilities

Financial liabilities 8 3,028 2,683

Trade and other payables 7,481 4,600

10,509 7,283

Non-current liabilities

Financial liabilities 8 2,037 2,966

Deferred tax 39 53

Provisions 200 200

Defined benefit pension scheme

deficit 9 1,959 2,640

--------- ---------

4,235 5,859

Total liabilities 14,744 13,142

--------- ---------

Capital and reserves

Share capital 1,990 1,990

Share premium 1,269 1,269

Capital redemption reserve 109 109

Hedging reserve (299) 96

Retained earnings (524) 1,404

--------- ---------

Total equity 2,545 4,868

Total equity and liabilities 17,289 18,010

========= =========

Consolidated Cash Flow Statement

for the year ended 31 March 2020

Year ended Year ended

31 March 31 March

2020 2019

GBP000 GBP000

Operating activities

Loss for the year before tax (2,343) (4,957)

Adjustments to reconcile (loss)

for the year to net cash (outflow)/

inflow from operating activities:

Net finance costs excluding pensions 310 499

Impairment charge on property,

plant and equipment - 3,043

Hedge ineffectiveness 138 -

Depreciation of property, plant

and equipment 980 1,688

Amortisation of software 52 59

Amortisation and impairment of

development costs 25 25

Profit on disposal of property,

plant and equipment (12) -

Foreign exchange rate movement (91) -

Share based payments 59 40

One-off contribution to defined

benefit pension scheme - (2,500)

Difference between pension contributions

paid and amounts recognised in

the Consolidated Income Statement (279) 25

(Increase)/ Decrease in inventories 113 (388)

Decrease/ (Increase) in receivables (95) 419

(Decrease)/ Increase in payables 2,265 (1,332)

Corporation tax received 424 -

---------------- -------------

Cash inflow / (outflow) from continuing

operations 1,546 (3,379)

Cash inflow from discontinued operations - 491

---------------- -------------

Net cash inflow / (outflow) from

operating activities 1,546 (2,888)

---------------- -------------

Investing activities

Purchase of property, plant and

equipment (316) (1,188)

Purchase of software (30) -

Development costs (20) (22)

Disposal of property, plant and

equipment 12 -

Proceeds from sale of subsidiary - 8,520

Cash and cash equivalents disposed - (1,146)

Investing activities from discontinued

operations - (125)

Net cash (outflow) / inflow from

investing activities (354) 6,039

---------------- -------------

Financing activities

Interest paid (252) (387)

Net invoice finance inflow / (outflow) 279 (1,832)

Import loan outflow - (873)

Principal element of lease payments (1,066) (781)

Finance leases taken - 1,291

Financing activities from discontinued

operations - 207

Net cash outflow from financing

activities (1,039) (2,375)

---------------- -------------

Net increase in cash and cash equivalents 153 776

Cash and cash equivalents at the

start of the year 291 (485)

Impact of foreign exchange rate 13 -

movements

Cash and cash equivalents at the

end of the year 457 291

================ =============

Cash and cash equivalents comprise:

Cash at bank 457 291

---------------- -------------

457 291

================ =============

Consolidated statement of changes in equity

Attributable

to equity

Share Capital holders

Share premium redemption Hedging Retained of the

capital account reserve reserve earnings parent

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 April

2018 1,990 1,269 109 (15) (197) 3,156

Profit for the year - - - - 1,526 1,526

Other comprehensive

income for the year

net of tax - - - 111 61 172

--------- --------- ------------ --------- ---------- -------------

Total comprehensive

income/ (expense) - - - 111 1,587 1,698

Share-based payment - - - - 40 40

Deferred tax on

employee share options - - - - (26) (26)

--------- --------- ------------ --------- ---------- -------------

Total of transactions

with shareholders - - - - 14 14

Balance at 1 April

2019 1,990 1,269 109 96 1,404 4,868

Loss for the year - - - - (2,393) (2,393)

Other comprehensive

income for the year

net of tax - - - (395) 373 (22)

--------- --------- ------------ --------- ---------- -------------

Total comprehensive

income - - - (395) (2,020) (2,415)

Share-based payments - - - - 59 59

Deferred tax on

employee share options - - - - 33 33

--------- --------- ------------ --------- ---------- -------------

Total of transactions

with shareholders - - - - 92 92

Balance at 31 March

2020 1,990 1,269 109 (299) (524) 2,545

========= ========= ============ ========= ========== =============

Share premium account

The share premium account balance includes the proceeds that

were above the nominal value from issuance of the Company's equity

share capital.

Capital redemption reserve

The capital redemption reserve has arisen on the cancellation of

previously issued shares and represents the nominal value of those

shares cancelled.

Hedging reserve

The hedging reserve records the effective portion of the net

change in the fair value of the cash flow hedging instruments

related to hedged transactions that have not yet occurred.

Retained earnings

Retained earnings include the accumulated profits and losses

arising from the Consolidated Income Statement and certain items

from the Statement of Comprehensive Income attributable to equity

shareholders, less distributions to shareholders.

NOTES TO THE PRELIMINARY ANNOUNCEMENT

1. AUTHORISATION OF FINANCIAL STATEMENTS AND STATEMENT OF COMPLIANCE WITH IFRS

The Group and Company's financial statements of Chamberlin Plc

for the year ended 31 March 2020 were authorised for issue by the

board of directors on 15 April 2021 and the balance sheets were

signed on the Board's behalf by Kevin Nolan and Neil Davies. The

Company is a public limited company incorporated and domiciled in

England and Wales. The Company's ordinary shares are admitted to

trading on AIM, a market of the same name operated by the London

Stock Exchange. However, as disclosed in Note 11 Subsequent Events,

the Company's shares were suspended from trading on AIM with effect

from 4 January 2021.

The Group's financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 as adopted by the

European Union.

The financial information set out in this announcement does not

constitute the statutory accounts of the Group for the years to 31

March 2020 or 31 March 2019 but is derived from the 2020 Annual

Report and Accounts. The Annual Report and Accounts for 2019 have

been delivered to the Registrar of Companies and the Group Annual

Report and Accounts for 2020 will be delivered to the Registrar of

Companies in due course. The auditors, Grant Thornton UK LLP, have

reported on the accounts for the year ended 31 March 2020 and have

given a modified audit opinion drawing attention to a material

uncertainty regarding going concern.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The consolidated financial statements are presented in sterling

and all values are rounded to the nearest thousand pounds (GBP000)

except when otherwise indicated.

Basis of consolidation

The consolidated financial statements comprise the financial

statements of Chamberlin plc and its subsidiaries as at 31 March

each year. The financial statements of subsidiaries are prepared

for the same reporting year as the parent Company, using consistent

accounting policies. All inter-Company balances and transactions,

including unrealised profits arising from intra-group transactions,

have been eliminated in full. Subsidiaries are consolidated from

the date on which control is transferred to the Group and cease to

be consolidated from the date on which control is transferred out

of the Group.

Accounting policies

The preliminary announcement has been prepared on the same basis

as the financial statements for the year ended 31 March 2020. There

were no new accounting standards adopted in the year that have a

material impact on the financial statements.

Going concern

The Group's detailed budget for the year ending 31 March 2022

and extended forecast for the six months to 30 September 2022 take

into account the net proceeds of GBP3.3m raised from the Share

Placing and Subscription announced on 26 March 2021 and the

Director's view of most likely trading conditions. These forecasts

and projections indicate that existing bank facilities are expected

to remain adequate. The budget and extended forecast provides for

significant revenue growth in the second half of the year to 31

March 2022 and the 6 months to 30 September 2022, which is needed

to replace the lost BorgWarner contracts. The budget includes the

significant but necessary benefits and costs of the restructuring

that will be required to right-size the cost-base to the lower

level of revenue. As the implementation and delivery of the

restructuring benefits and costs are within the control of the

Directors, no downside sensitivities have been applied in relation

to these. The Directors have, however, applied reasonably

foreseeable downside sensitivities to the budget and forecast,

which assumes that sales growth from October 2021 onwards is only

3% above the first half average and the machine shop has no sales

output. In the detailed budget, extended forecast and sensitised

scenario, the possible receipt of compensation from BorgWarner has

been entirely discounted, as has any sales of no-longer required

machinery.

As a consequence, after making enquiries, the Directors have an

expectation that, in the circumstances of a reasonably foreseeable

downside scenario as described above, the Group and Company have

adequate resources to continue in operational existence for the

foreseeable future.

However, the rate at which new work can be secured to replace

the lost BorgWarner activity is difficult to predict resulting in

material uncertainty, which may cast significant doubt over the

ability of the Group and Company to realise its assets and

discharge its liabilities in the normal course of business and

hence continue as a going concern.

The Directors continue to adopt the going concern basis, whilst

recognising there is material uncertainty relating to the above

matter.

3. SEGMENTAL ANALYSIS

For management purposes, the Group is organised into two

operating divisions according to the nature of the products and

services. Operating segments within those divisions are combined on

the basis of their similar long-term characteristics and similar

nature of their products, services and end users as follows:

The Foundries segment is a supplier of iron castings, in raw or

machined form, to a variety of industrial customers who incorporate

the castings into their own products or carry out further machining

or assembly operations on the castings before selling them on to

their customers.

The Engineering segment supplies manufactured products to

distributors and end-users operating in hazardous area and

industrial lighting markets.

Management monitors the operating results of its divisions

separately for the purposes of making decisions about resource

allocation and performance assessment. The Chief Operating Decision

Maker is the Chief Executive.

(i) By operating segment

Segmental operating

Segmental revenue profit

Year ended 2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000

Foundries 23,106 29,343 (84) (211)

Engineering 3,037 3,615 (45) 251

----------- -------------- ------------------- ------------

Segment results 26,143 32,958 (129) 40

=========== ============== =================== ============

Reconciliation of reported segmental

operating (loss) / profit

Segment operating (loss) / profit (129) 40

Shared costs (995) (1,050)

Non-underlying costs (909) (3,448)

Net finance costs (310) (499)

Loss before tax from continuing

operations (2,343) (4,957)

Segmental assets

Foundries 14,974 15,244

Engineering 1,247 1,402

------------------- ------------

16,221 16,646

------------------- ------------

Segmental liabilities

Foundries (6,880) (3,840)

Engineering (801) (794)

------------------- ------------

(7,681) (4,634)

------------------- ------------

Segmental net assets 8,540 12,012

Unallocated net liabilities (5,995) (7,144)

Total net assets 2,545 4,868

======================= ============

Unallocated net liabilities include the pension liability of

GBP1,959,000 (2019: GBP2,640,000), financial liabilities of

GBP4,608,000 (2019: GBP5,357,000) and deferred tax asset of

GBP572,000 (2019: GBP853,000).

Capital expenditure,

depreciation, amortisation

and impairment

Capital additions Foundries Engineering Total

2020 2019 2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Property, plant and

equipment 426 1,047 - 8 426 1,055

Software 97 - 1 - 98 -

Development costs - - 30 22 30 22

Depreciation, amortisation Foundries Engineering Total

and impairment

2020 2019 2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Property, plant and

equipment (965) (4,563) (15) (49) (980) (4,612)

Software (45) (52) (7) (7) (52) (59)

Development costs - - (25) (25) (25) (25)

(ii) By geographical segment

2020 2019

Revenue by location of customer: GBP000 GBP000

United Kingdom 9,008 12,203

Italy 2,051 3,743

Germany 2,602 3,124

Rest of Europe 11,863 13,024

Other countries 619 864

----------- -----------

26,143 32,958

=========== ===========

4. FINANCE COSTS

2020 2019

GBP000 GBP000

Bank overdraft and invoice finance interest

payable (164) (335)

Interest expense on lease liabilities and other

interest payable (88) (52)

Finance cost of pensions (58) (112)

------- -------

(310) (499)

======= =======

5. (LOSS)/ EARNINGS PER SHARE

The calculation of (loss)/ earnings per share is based on the

(loss)/profit attributable to shareholders and the weighted average

number of ordinary shares in issue. In calculating the diluted

(loss)/ earnings per share, adjustment has been made for the

dilutive effect of outstanding share options. Underlying (loss)/

earnings per share, which excludes non-underlying items, as

analysed below, has also been disclosed as the Directors believe

this allows a better assessment of the underlying trading

performance of the Group. Non-underlying items are detailed in note

6.

2020 2019

GBP000 GBP000

Continuing operations loss for basic earnings

per share (2,393) (4,909)

Non-underlying items 909 3,448

Taxation effect of the above - (87)

Loss for underlying loss per share (1,484) (1,548)

========= ===========

Underlying loss per share (pence) from continuing

operations:

Basic (18.7) (19.5)

Diluted (18.7) (19.5)

2020 2019

GBP000 GBP000

Discontinued operations earnings for basic

earnings per share - 6,435

Earnings for basic earnings per share (discontinued

operations) - 6,435

========= ===========

Earnings per share (pence) from discontinued

operations:

Basic - 80.9

Diluted - 76.8

Total (loss)/ earnings per share (pence):

Basic (30.1) 19.2

Diluted (30.1) 18.2

2020 2019

Number Number

'000 '000

Weighted average number of ordinary shares 7,958 7,958

Adjustment to reflect shares under options 217 424

--------- -----------

Weighted average number of ordinary shares

- fully diluted 8,175 8,382

========= ===========

There is no adjustment in the total diluted loss per share

calculation for the 217,000 (2019:424,000) shares under option as

they are required to be excluded from the weighted average number

of shares for diluted loss per share as they are anti-dilutive.

6. NON-UNDERLYING ITEMS

2020 2019

GBP000 GBP000

Group reorganisation 712 54

Hedge ineffectiveness 138 -

Asset impairment - 3,043

Onerous leases - 16

GMP equalisation - 295

Share-based payment charge 59 40

------- -------

Non-underlying operating costs 909 3,448

Taxation

- tax effect of non-underlying costs - (87)

------- -------

909 3,361

------- -------

During the year ended 31 March 2020, the Group undertook a

Group-wide restructuring programme in order to realign the cost

base to the reduced levels of revenue. Group reorganisation costs

of GBP712,000, which include redundancy and related costs, relate

to this restructuring programme.

The hedge ineffectiveness charge of GBP138,000 in 2020 arises

from a short-term reduction in highly probable Euro denominated

sales as a result of economic disruption to our customers caused by

COVID-19.

The share-based payment charge in 2020 is GBP59,000 (2019:

GBP40,000).

In 2019, the Group undertook an impairment review of two of its

sites within the Foundry Division, which identified that the prior

carrying value of its assets could not be supported by their future

value to the business, resulting in the recognition of an

impairment charge of GBP3,043,000.

Furthermore in 2019, a Guaranteed Minimum Pension (GMP)

equalisation review was undertaken, which resulted in an increase

in the pension liability of GBP295,000.

7. DISCONTINUED OPERATIONS

On 19 December 2018 the Group sold its entire interest in Exidor

Limited. As a result the results of Exidor Limited were classified

as a discontinued operation in the prior year and presented as such

in the financial statements.

An analysis of the disposal calculation is

given below:

GBP000

Property, plant and equipment 1,135

Intangible assets 75

Deferred tax 70

Inventories 1,491

Trade and other receivables 1,882

Cash and cash equivalents 1,146

Trade and other payables (3,508)

-------------------

Net assets disposed 2,291

-------------------

Consideration 10,000

Working capital adjustment (98)

Debt adjustment (639)

Claim retention (350)

8,913

Disposal costs (393)

-------------------

Net cash received relating to disposal 8,520

===================

Cash proceeds 8,520

Net assets disposed (2,291)

-------------------

Profit on disposal 6,229

===================

Included in the consideration is a retention of GBP350,000

relating to a customer claim. This claim has not yet been finalised

and is still ongoing.

The results prior to 19 December 2018 for the discontinued

operations included in the consolidated income statement were:

2019

'000

Revenue 5,924

-------

Operating profit 305

Finance costs (23)

-------

Profit before tax 282

Tax (76)

Profit on disposal 6,229

Profit after tax from discontinued operations 6,435

=======

Exidor Limited contributed the following to the Group's

cashflow:

2019

'000

Operating activities 491

Investing activities (125)

Financing activities 207

-------

573

=======

8. NET DEBT

2020 2019

GBP000 GBP000

Net cash (457) (291)

Invoice finance facility 1,925 1,628

Lease liabilities 1,103 1,055

Net debt due in less than one year 2,571 2,392

Non-current liabilities

Lease liabilities 2,037 2,966

Total net debt 4,608 5,358

------- -------

Lease liabilities are secured against the specific item to which

they relate. These leases are repayable by monthly instalments for

a period of up to five years to February 2025. Interest is payable

at fixed amounts that range between 3.1% and 9.4%.

Invoice finance balances are secured against the trade

receivables of the Group and are repayable on demand. Interest is

payable at 2.3% over base rate. The maximum facility as at 31 March

2020 was GBP6,000,000 (2019: GBP7,750,000). Management have

assessed the treatment of the financing arrangements and have

determined it is appropriate to recognise trade receivables and

invoice finance liabilities separately.

9. PENSIONS ARRANGEMENTS

During the year, the Group operated funded defined benefit and

defined contribution pension schemes for the majority of its

employees, these being established under trusts with the assets

held separately from those of the Group. The pension operating cost

for the Group defined benefit scheme for 2020 was GBP199,000 (2019:

GBP124,000), with the increase being due to costs associated with

the triennial valuation, together with GBP58,000 of financing cost

(2019: GBP112,000).

The other schemes within the Group are defined contribution

schemes and the pension cost represents contributions payable. The

total cost of defined contribution schemes was GBP396,000 (2019:

GBP423,000). The notes below relate to the defined benefit

scheme.

The actuarial liabilities have been calculated using the

Projected Unit method. The major assumptions used by the actuary

were (in nominal terms):-

31 March 31 March 31 March

2020 2019 2018

Salary increases n/a n/a n/a

Pension increases (post 1997) 2.6% 3.2% 3.1%

Discount rate 2.3% 2.3% 2.5%

Inflation assumption - RPI 2.6% 3.3% 3.2%

Inflation assumption - CPI 1.7% 2.3% 2.2%

Demographic assumptions are all based on the S3PA (2019: S2PA)

mortality tables with a 1.25% annual increase. The post retirement

mortality assumptions allow for expected increases in longevity.

The current disclosures relate to assumptions based on longevity in

years following retirement as of the balance sheet date, with

future pensions relating to an employee retiring in 15 years from

the balance sheet date.

2020 2019

Years Years

Current pensioner at 65 - male 21.0 20.9

* female 23.2 23.1

Future pensioner at 65 - male 21.9 21.8

* female 24.3 24.2

The scheme was closed to future accrual with effect from 30

November 2007, after which the Company's regular contribution rate

reduced to zero (previously the rate had been 9.1% of members'

pensionable salaries).

The triennial valuation as at 31 March 2019 was completed during

the year and concluded that Company contributions would increase to

GBP300,000 for the year ended 31 March 2021, GBP330,000 for the

year ended 31 March 2022 and GBP360,000 for the year ended 31 March

2023, with the deficit reduction period reducing to 2032. The

Company has given security over the Group's land and buildings to

the pension scheme. There will be a further triennial review with

effect from 31 March 2022, which will establish future deficit

payments.

The scheme assets are stated at the market values at the

respective balance sheet dates. The assets and liabilities of the

scheme were:

2020 2019

GBP000 GBP000

Equities/ diversified growth

fund 12,534 14,286

Bonds 1,565 1,580

Insured pensioner assets 24 26

Cash 415 173

----------- -----------

Market value of assets 14,538 16,065

Actuarial value of liabilities (16,497) (18,705)

----------- -----------

Scheme deficit (1,959) (2,640)

Related deferred tax asset 333 448

----------- -----------

Net pension liability (1,626) (2,192)

----------- -----------

Net benefit expense recognised 2020 2019

in profit and loss GBP000 GBP000

Net interest cost (58) (112)

(58) (112)

--------- ---------

Re-measurement losses/ (gains) in other 2020 2019

comprehensive income GBP000 GBP000

Actuarial (gains) / losses arising from

changes in financial assumptions (593) 622

Actuarial gains arising from changes

in demographic assumptions (244) (151)

Experience adjustments (931) 91

Loss / (return) on assets (excluding

interest income) 1,308 (638)

------------- ----------

Total re-measurement gain shown in other

comprehensive income (460) (76)

------------- ----------

2020 2019

GBP000 GBP000

Actual loss on plan assets (946) (976)

------------- ----------

Movement in deficit during the 2020 2019

year GBP000 GBP000

Deficit in scheme at beginning

of year (2,640) (5,080)

Past service cost - (295)

Employer contributions 279 2,771

Net interest expense (58) (112)

Actuarial gain 460 76

-------- --------

Deficit in scheme at end of

year (1,959) (2,640)

-------- --------

Movement in scheme assets 2020 2019

GBP000 GBP000

Fair value at beginning of year 16,065 13,207

Interest income on scheme assets 362 338

Return on assets (excluding

interest income) (1,308) 638

Employer contributions 279 2,771

Benefits paid (860) (889)

------------- -----------

Fair value at end of year 14,538 16,065

------------- -----------

Movement in scheme liabilities 2020 2019

GBP000 GBP000

Benefit obligation at start of year 18,705 18,287

Interest cost 420 450

Actuarial (gains)/ losses arising from

changes in financial assumptions (593) 622

Actuarial gains arising from changes

in demographic assumptions (244) (151)

Experience adjustments (931) 91

Benefits paid (860) (889)

Past service cost - 295

------------- -----------

Benefit obligation at end of year 16,497 18,705

------------- -----------

The weighted average duration of the pension scheme liabilities

are 13 years (2019: 13.5 years).

A quantitative sensitivity analysis for significant assumptions

as at 31 March 2020 is as shown below:

2020

Present value of scheme liabilities when changing GBP000

the following assumptions:

Discount rate increased by 1% p.a. 14,635

RPI and CPI increased by 1% p.a. 17,340

Mortality- members assumed to be their actual

age as opposed to one year older 17,266

The sensitivity analysis above has been determined based on a

method that extrapolates the impact on defined benefit obligations

as a result of reasonable changes in key assumptions occurring at

the end of the year.

10. RESTATEMENT OF COMPARATIVES

During the year, a change has been made to the presentation of

administration costs and interest costs associated with the

Company's defined benefit pension scheme. Previously, these costs

were shown as non-underlying items. Management is now of the view

that such costs should be reported as part of underlying results

reflecting the ongoing recurring nature of these costs. As a result

of this presentational change, the underlying results in the

comparative periods have been restated. There is no change to

statutory results as a consequence of this presentational

change.

Impact on underlying loss for As reported Reclassification As restated

the year ended 31 March 2019 GBP'000 GBP'000 GBP'000

Underlying operating loss (886) (124) (1,010)

Underlying finance costs (387) (112) (499)

Underlying loss before taxation (1,273) (236) (1,509)

Taxation (63) 24 (39)

Underlying loss from continuing

operations (1,336) (212) (1,548)

11. SUBSEQUENT EVENTS

On 16 December 2020, the Company announced that it had received

notice from its major customer, BorgWarner Turbo Systems Worldwide

Headquarters GmbH, of its intention to cancel all contracts with

effect from 22 January 2021. Following this announcement, it became

evident that the Company was not in a position to publish its 2020

Accounts by an agreed extended date of 31 December 2020 in

accordance with AIM Rules. Consequently, the Company's shares were

suspended from trading on AIM with effect from 4 January 2021.

The Board and its advisers immediately implemented measures to

reduce costs and preserve cash whilst exploring options to

strengthen the balance sheet in order to safeguard the Company's

future. After evaluating a number of alternative options with its

advisers, the Company issued a GBP200,000 unsecured convertible

loan note to Mr Trevor Brown in February 2021 to provide immediate

short-term working capital, which was converted into 3,333,333

Ordinary Shares following Shareholder approval at the General

Meeting held on 8 March 2021. On that same date, Mr Trevor Brown

was appointed to the Board of Chamberlin as a Non-Executive

Director.

The Board continued to explore further funding possibilities and

on 26 March 2021 announced that the Company had raised net proceeds

of GBP3.3 million by way of a Share Placing and Subscription. The

primary purpose of the Share Placing and Subscription was to fund

working capital and to meet the restructuring costs associated with

reducing the cost base to a level appropriate to the lower ongoing

revenue of the Group. Following the publication and filing of the

annual audited accounts for the year end 31 March 2020 and the

publication of the interim results for the six months ended 30

September 2020, the Company will immediately apply for the

suspension of trading of the Company's Ordinary Shares on AIM to be

lifted by the London Stock Exchange.

12. REPORT AND ACCOUNTS

The FY2020 accounts are available on the Group's website,

www.chamberlin.co.uk and from the Group's head office at Chuckery

Road, Walsall, West Midlands, WS1 2DU. The AGM, which will be a

closed meeting given the current restrictions in relation to

COVID-19, will be held on 8 June 2021 at Chuckery Road, Walsall,

West Midlands, WS1 2DU.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZGMDFKNGMZZ

(END) Dow Jones Newswires

April 16, 2021 02:00 ET (06:00 GMT)

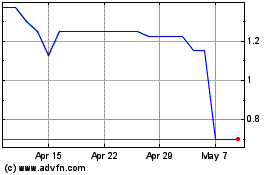

Chamberlin (LSE:CMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chamberlin (LSE:CMH)

Historical Stock Chart

From Apr 2023 to Apr 2024