TIDMCNC

RNS Number : 0558V

Concurrent Technologies PLC

12 April 2021

This announcement contains inside information

12 April 2021

Concurrent Technologies Plc

Results for the year ended 31 December 2020

Concurrent Technologies Plc (AIM: CNC), a world leading

specialist in the design and manufacture of high-end embedded

computer boards for critical applications , announces r esults for

the year to 31 December 2020.

Financial Highlights

-- Revenue for the year increased 9% to GBP21.1m (2019: GBP19.4m)

-- Gross profit increased 12% to GBP11.4m (2019: GBP10.2m)

-- Gross margin increased to 53.7% (2019: 52.7%)

-- EBITDA steady at GBP5.0m (2019: GBP5.1m)

-- Adjusted Profit before tax of GBP2.8m (2019: 3.1m after

adjusting for other, non-recurring income of GBP1.0m)

-- Profit before Tax of GBP2.8m (2019: GBP4.1m - including

other, non-recurring income of GBP1.0m)

-- Profit after Tax of GBP2.7m (2019: GBP4.0m)

-- Adjusted EPS for 2020 was 3.75 (2019: 4.38 after removing the

non-recurring income of GBP1m and the associated tax impact)

-- Dividend increased to 2.55 pence per share for the year (2019: 2.50 pence)

-- Cash in the business increased to GBP11.8m (2019: GBP10.5m)

Operational Highlights

-- Production and the design and development functions have

remained open and, for the most part, fully operational throughout

the COVID-19 pandemic. The Group has not participated in any

government aid scheme such as the Coronavirus Business Interruption

Loan Scheme (CBILS) or VAT payment deferral and no employees have

been furloughed during the pandemic.

-- Exports remain strong and contribute 91% of Group revenue

-- Cessation of R&D facility in India almost completed and

functions transferred to UK. Costs of cessation were GBP0.7m which

have been recognised in the 2020 accounts.

-- Spending on R&D increased to GBP3.89m in 2020 (2019:

GBP3.51m), of which GBP1.88m was capitalised (2019: GBP2.26m).

The Group's previous Chairman, Michael Collins, retired from the

Board in September 2020 after 31 years' service to the Group.

Mike's knowledge and experience helped to guide the Group from

start-up to PLC. Mark Cubitt was appointed as the Group's new

Chairman at the AGM, having previously joined the Board as a

Non-Executive Director in March 2020. Mark is a Chartered

Accountant and is a member of the Association of Corporate

Treasurers. He has extensive multinational experience gained over

the last 33 years, including 23 years in the listed PLC

environment.

Mark Cubitt, Chairman of Concurrent Technologies Plc,

commented:

" During 2020, the Group introduced several new high-performance

embedded computer boards and accessory modules. These included

products based on the 9th generation embedded Intel(R) Xeon(R)

processor for use in AMC, CompactPCI(R) and OpenVPX(TM)

architectures.

As part of the Group's long-term continuous improvement

strategy, and to mitigate an identified risk to the business during

2020, a further investment of GBP155,000 was made within

manufacturing to introduce a new circuit board processing line.

The Board is taking a cautious approach to revenue growth in the

coming year because of the continuing uncertainty caused by the

COVID-19 outbreak and the delays seen to some programmes

potentially moving revenue from 2021 to 2022. However, the Group's

proven ability to adapt to the challenges brought about by the

pandemic, the overhead savings from closure of the Indian design

office, its ability to provide a well-supported, UK designed and

manufactured product, and the current record order book, which has

seen a substantial increase during the first quarter of 2021, gives

the Board confidence in the Group's continuing solid

performance."

Annual General Meeting

Due to the COVID-19 crisis and social distancing requirements

the date and arrangements for the AGM will be announced

separately.

Enquiries:

Concurrent Technologies Plc

Jane Annear, Managing Director/CEO +44 (0)1206 752626

Newgate (Financial PR)

Bob Huxford +44 (0)20 7653 9848

Isabelle Smurfit +44 (0)20 7653 3411

Cenkos Securities Plc (NOMAD)

Neil McDonald +44 (0)131 220 9771

Peter Lynch +44 (0)131 220 9772

Extracts from the Strategic Report

Review of Operations

The Group generated record Revenue for the year of GBP21.14m

(2019: GBP19.38m). This converted into Gross Profit of GBP11.36m

(2020: GBP10.21m) while the gross margin improved to 53.7% (2019:

52.7%).

Profit before tax was GBP2.85m (2019: GBP4.06m: 2019 included

other, non-recurring income of GBP1.0m). Earnings per share was

3.75 pence (2019: 5.51 pence) while earnings per share on normal

activities, adjusted to remove the impact of Other Income, was 3.75

pence (2019: 4.38 pence). EBITDA (measured as Operating Profit plus

Depreciation and Amortisation) for the Group in 2020 was GBP4.99m

(2019: GBP5.07m).

The Group continued its long-term commitment to R&D by

spending GBP3.89m in 2020 (2019: GBP3.51m), of which GBP1.88m was

capitalised (2019: GBP2.26m) and GBP0.69m related to closure costs

of the Indian R&D centre. In light of the slowdown in the sales

of some projects, an unusually large impairment charge of

GBP888,579 (2019: GBP483,630) was included during the year to

reflect relatively pessimistic cash generating expectations of

itemised projects.

The Group continues to have no borrowings and again paid

increased dividends during the year. Its cash balances plus short

to medium term cash deposits at the year-end were GBP11.8m (2019:

GBP10.5m).

Operational Highlights

During 2020, the Group introduced several new high-performance

embedded computer boards and accessory modules. These included

products based on the 9th generation embedded Intel(R) Xeon(R)

processor for use in AMC, CompactPCI(R) and OpenVPX(TM)

architectures. These products were introduced as part of the

Group's policy to provide existing customers with products that can

be used as upgrade paths from previous generations where additional

processing power or enhanced features are required. New customers

benefit from choosing products based on the latest technologies. As

required by many applications, these new products offer support for

enhanced security features and most are suitable for both

commercial and harsh environments. In addition, support for

additional partner software and hardware products was announced to

broaden the Group's product range. The Group's AI technology

product is currently being developed for use on a prototype

third-party end product that may come to market this year.

As part of the Group's long-term continuous improvement

strategy, and to mitigate an identified risk to the business during

2020, a further investment of GBP155,000 was made within

manufacturing to introduce a new circuit board processing line.

This line will significantly help to reduce lead times for

particular product variants.

Outlook

The new financial year of 2021 started with a healthy order book

which has seen a significant increase during the first quarter of

the year. The Group's telecoms business is now recovering and

growing after last year's second half slow down, and several

customers in the defence and telecoms sectors have placed orders

for previous generation products that have been offered under

extended manufacturing to protect and extend the lifecycle of their

projects. These orders are due for delivery in 2021 and beyond.

Several of the Group's customers have made the decision to upgrade

to its newer generation products.

The Group plans to maintain its policy of investing in R&D

to expand its current range of advanced technology products with a

particular focus on the OpenVPX(TM) bus architecture, featuring the

latest Intel processors suitable for the long lifecycle embedded

markets in which the Group operates. Support for third party

software and hardware products will be continued in order to

enhance the Group's capability to provide development systems.

These ready-to-use development systems enable customers to reduce

their product development times by focussing on their own areas of

expertise to develop specialised applications.

The Board sees opportunities to grow the business organically by

broadening the range of both hardware and software products within

its existing core markets of defence and telecommunications.

Savings made from ceasing operations in the Indian office will

largely be reinvested to increase and broaden the skills and

technical expertise within the UK team. In addition, the Board

continues to look to recruit key individuals and skill for both

succession and organic growth as well as for worldwide acquisition

opportunities which would assist the Group in introducing new

skills and technologies complementary and adjacent to its current

product ranges. This is with the aim of increasing the Group's

potential share of the total available market.

Dividend

The Board has declared a second interim dividend of 1.45 pence

per share (2019: 1.45 pence) which, when added to the first interim

dividend of 1.10 pence per share (2019: 1.05 pence), will make a

total of 2.55 pence per share for the year (2019: 2.50 pence). This

is an increase of 2.0% on dividends paid for 2019. The total cost

of this second interim dividend amounts to GBP1,063,771. As in

previous years, the Directors do not intend to recommend a final

dividend.

Annual General Meeting

Due to the COVID-19 crisis and social distancing requirements

the date and arrangements for the AGM will be announced

separately.

All trademarks, registered trademarks and trade names used in

this announcement are the property of their respective owners.

Consolidated Statement of Comprehensive Income

Year to Year to

31 December 31 December

2020 2019

CONTINUING OPERATIONS GBP GBP

Revenue 21,141,294 19,384,724

Cost of sales 9,780,750 9,174,588

------------ ------------

Gross profit 11,360,544 10,210,136

Operating expenses 8,444,962 7,204,073

============ ============

Group operating profit 2,915,582 3,006,063

Finance costs (83,985) (41,808)

Finance income 16,480 96,601

Other Income - 1,000,000

------------ ------------

Profit before tax 2,848,077 4,060,856

Tax 98,167 52,857

------------ ------------

Profit for the year 2,749,910 4,007,999

============ ============

Other Comprehensive Income

Items that will be reclassified subsequently

to profit or loss:

Exchange differences on translating

foreign operations (283,681) (186,972)

Tax relating to components of other - -

comprehensive income

Other Comprehensive Income for the

year, net of tax (283,681) (186,972)

Total Comprehensive Income for the

year 2,466,229 3,821,026

============ ============

Profit for the period attributable

to:

------------ ------------

Equity holders of the parent 2,749,910 4,007,999

------------ ------------

Total Comprehensive Income attributable

to:

Equity holders of the parent 2,466,229 3,821,026

------------ ------------

Earnings per share

Basic earnings per share 3.75p 5.51p

Diluted earnings per share 3.74p 5.47p

Consolidated Balance Sheet

As at As at

31 December 31 December

2020 2019

(as restated)

GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 1,734,965 1,638,429

Intangible assets 7,205,581 7,991,119

Deferred tax assets 134,775 142,894

9,075,321 9,772,442

Current assets

Inventories 5,533,574 5,097,907

Trade and other receivables 2,356,157 2,703,960

Current tax assets 305,113 274,221

Other financial assets - -

Cash and cash equivalents 11,765,974 10,487,902

----------- -------------

19,960,818 18,563,990

Total assets 29,036,139 28,336,432

----------- -------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 1,571,830 1,453,331

Trade and other payables 704,800 838,001

Long term provisions 16,162 16,731

----------- -------------

2,292,792 2,308,063

Current liabilities

Trade and other payables 4,143,522 4,126,823

Short term provisions 16,354 16,832

Current Tax Liabilities 26,504 -

4,186,380 4,142,655

Total liabilities 6,479,172 6,451,718

----------- -------------

Net assets 22,556,967 21,884,714

=========== =============

EQUITY

Capital and reserves

Share capital 739,000 739,000

Share premium account 3,699,105 3,699,105

Capital redemption reserve 256,976 256,976

Cumulative translation reserve (121,293) 162,388

Profit and loss account 17,983,179 17,027,245

----------- -------------

Equity attributable to equity holders

of the parent 22,556,967 21,884,714

Total equity 22,556,967 21,884,714

=========== =============

Consolidated Cash Flow Statement

Year to Year to

31 December 31 December

2020 2019

GBP GBP

Cash flows from operating activities

Profit before tax for the period 2,848,077 4,060,856

Adjustments for:

Finance income (16,480) (96,601)

Finance costs 83,985 41,808

Depreciation 282,563 315,687

Amortisation 1,793,628 1,788,003

Impairment loss 888,579 483,630

Share-based payment 6,991 82,421

Exchange differences (300,569) (205,790)

Decrease/(increase) in inventories (435,667) (1,001,331)

(Increase)/decrease in trade and

other receivables 347,803 648,621

Increase/(decrease) in trade and

other payables (9,354) 1,232,237

----------- -----------

Cash generated from operations 5,489,557 7,349,541

Tax received 40,536 (21,173)

----------- -----------

Net cash generated from operating

activities 5,530,092 7,328,368

----------- -----------

Cash flows from investing activities

Interest received 16,480 96,601

Purchases of property, plant and equipment

(PPE) (385,964) (476,376)

Capitalisation of development costs

and purchases of intangible assets (1,896,659) (2,272,054)

----------- -----------

Net cash used in investing activities (2,266,143) (2,651,829)

Cash flows from financing activities

Equity dividends paid (1,864,968) (1,745,345)

Repayment of leasing liabilities (108,195) (108,426)

Interest paid (83,985) (41,808)

Sale of treasury shares 47,529 4,950

----------- -----------

Net cash used in financing activities (2,009,619) (1,890,629)

Effects of exchange rate changes on

cash and cash equivalents 23,742 22,640

Net increase/(decrease) in cash 1,278,072 2,808,550

Cash at beginning of period 10,487,902 7,679,352

----------- -----------

Cash at the end of the period 11,765,974 10,487,902

=========== ===========

Consolidated Statement of Changes in Equity

Capital Cumulative Profit

Share Share redemption translation and loss Total

capital premium reserve reserve account Equity

GBP GBP GBP GBP GBP GBP

Balance at 1

January

2019 739,000 3,699,105 256,976 349,360 14,670,553 19,714,994

Profit for the

period - - - - 4,007,999 4,007,999

Exchange

differences

on translating

foreign

operations - - - (186,972) - (186,972)

---------------- ---------------- ---------------- ---------------- ------------------ -----------

Total

comprehensive

income for the

period - - - (186,972) 4,007,999 3,821,027

Transactions

with

owners:

Share-based

payment - - - - 82,421 82,421

Deferred tax on

share

based payment - - - - 6,667 6,667

Dividends paid - - - - (1,745,345) (1,745,345)

Purchase of

treasury

shares - - - - 4,950 4,950

---------------- ---------------- ---------------- ---------------- ------------------ -----------

Balance at 31

December

2019 739,000 3,699,105 256,976 162,388 17,027,245 21,884,714

---------------- ---------------- ---------------- ---------------- ------------------ -----------

Profit for the

period - - - - 2,749,910 2,749,910

Exchange

differences

on translating

foreign

operations - - - (283,681) - (283,681)

---------------- ---------------- ---------------- ---------------- ------------------ -----------

Total

comprehensive

income for the

period - - - (283,681) 2,749,910 2,466,229

Transactions

with

owners:

Share-based

payment - - - - 6,991 6,991

Deferred tax on

share

based payment - - - - 16,472 16,472

Dividends paid - - - - (1,864,968) (1,864,968)

Sale of

treasury

shares - - - - 47,529 47,529

---------------- ---------------- ---------------- ---------------- ------------------ -----------

Balance at 31

December

2020 739,000 3,699,105 256,976 (121,293) 17,983,179 22,556,967

================ ================ ================ ================ ================== ===========

NOTES

1. The Group financial statements consolidate those of the

Company and its subsidiaries (together referred to as the 'Group').

The financial information set out in these preliminary results has

been prepared in accordance with international accounting standards

in conformity with the requirements of the Companies Act 2006. The

accounting policies adopted in this results announcement have been

consistently applied to all the years presented. The restatement of

balance sheet items refers to lease liabilities which have been

reclassified from current to non-current liabilities. The

adjustment does not impact shareholder funds or profit previously

stated.

2. The financial information set out above does not constitute

the Group's statutory accounts for the years ended 31 December 2020

or 2019, but is derived from those accounts. Statutory accounts for

2019 have been delivered to the Registrar of Companies and those

for 2020 will be delivered following the Annual General Meeting.

The auditors have reported on those accounts; their reports were

(i) unqualified, (ii) did not contain statements under section

498(2) or (3) of the Companies Act 2006 in respect of 2019 or 2020

and (iii) did not draw attention to any matters by way of

emphasis.

3. The calculation of basic earnings per share is based on the

weighted average number of Ordinary Shares in issue during 2020 of

73,253,120 (2019: 72,724,271) after adjustment for treasury shares

on the profit after tax for 2020 of GBP 2,749,910 (2019:

GBP4,007,999). The calculation of diluted earnings per share

incorporates 311,651 Ordinary Shares (2019: 574,542) in respect of

performance related employee share options. The profit after tax is

the same as for basic earnings per share.

4. Due to the COVID-19 crisis and social distancing requirements

the date and arrangements for the AGM will be announced

separately.

Copies of the Annual Report will be sent to Shareholders and

will also be available from the Company's Registered Office: 4,

Gilberd Court, Newcomen Way, Colchester, Essex, CO4 9WN, UK, and on

the Company's website: www.gocct.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EANLEFLPFEFA

(END) Dow Jones Newswires

April 12, 2021 02:00 ET (06:00 GMT)

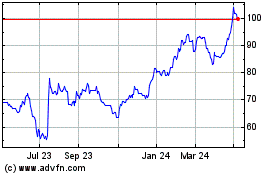

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

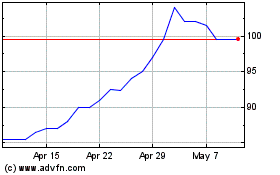

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Apr 2023 to Apr 2024