TIDMCORA

RNS Number : 6464A

Cora Gold Limited

03 June 2021

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

03 June 2021

Cora Gold Limited ('Cora' or 'the Company')

Fundraising - excess demand from Subscribers

Cora Gold Limited, the West African focused gold exploration

company, is pleased to announce that it has conditionally raised

GBP3,132,937.50 million (before expenses) through a subscription of

40,425,000 new ordinary shares of no par value in the Company

('Ordinary Shares') at a price of 7.75 pence per Ordinary Share

(the 'Subscription Shares') (the 'Fundraising'). The funds raised

will principally be used for further drilling, related exploration

activities and ongoing study work focussed on growing resources at

the Company's flagship Sanankoro Gold Project in southern Mali.

Excess demand from subscribers to the Fundraising means that Cora

has now fully allotted the maximum number of shares authorised by

its shareholders at the 2020 Annual General Meeting.

Binding commitments to subscribe (the 'Subscription') for a

total of 40,425,000 Subscription Shares have been received from

Brookstone Business Inc ('Brookstone'; the Company's largest

shareholder), Lord Farmer (a substantial shareholder), Key Ventures

Holding Ltd ('Key Ventures'; a substantial shareholder), certain

directors of the Company and other subscribers. Details of their

participation and consequent interest in the Company's issued share

capital is described below.

The Fundraising is conditional on admission of the Subscription

Shares to trading on AIM ('Admission').

Bert Monro, Chief Executive Officer of Cora, commented, "I am

very pleased with the strong support we have received in this

fundraise from many of our existing shareholders. Following the

receipt of all subscription funds the Company will have total cash

of approximately GBP4.6 million (US$6.5 million). Drilling is

ongoing at Sanankoro and it has been pleasing to see such strong

results coming out of the programme to date. We look forward to

releasing further drill results over the coming months before a

targeted resource update in H2 2021. Certain aspects of the

Definitive Feasibility Study have already kicked off with more to

commence in the coming months. We look forward to keeping all

shareholders updated with our progress at this exciting time for

the Company."

Details of the Subscription

Use of proceeds

It is intended that the proceeds of the Fundraising will

principally be used for further drilling, related exploration

activities and ongoing study work focussed on growing resources at

the Company's flagship Sanankoro Gold Project in southern Mali.

Additionally, the proceeds of the Fundraising will be used to

continue exploration of the Company's other permits and for general

working capital purposes.

Admission and Total Voting Rights

The Company has conditionally raised approximately GBP3.1

million, before expenses, through the proposed issue of 40,425,000

Subscription Shares to certain existing shareholders and new

investors.

As noted above, the Fundraising is subject to Admission.

Application will be made for the Subscription Shares to be admitted

to trading on AIM and it is expected that Admission will become

effective and dealing in the Subscription Shares will commence on

or around 09 June 2021. The Subscription Shares will rank pari

passu with the existing Ordinary Shares.

Following Admission, the share capital of the Company will be

comprised of 245,807,159 Ordinary Shares. The above figure of

245,807,159 may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in Cora under the FCA's Disclosure and

Transparency Rules.

Related party transaction

The Subscription by each of Brookstone, Lord Farmer, Key

Ventures, Edward Bowie, Andrew Chubb, Robert ('Bert') Monro and

Paul Quirk constitutes related party transactions pursuant to Rule

13 of the AIM Rules. Having consulted with the Company's nominated

adviser, David Pelham, a Non-Executive Director of the Company,

considers that the terms of the transaction are fair and reasonable

insofar as its shareholders are concerned.

The following directors of the Company or their connected

parties have given a binding commitment to subscribe for the

following numbers of shares in the Fundraising:

-- Edward Bowie (independent Non-Executive Director and Chairman

of the board) - 64,000 Subscription Shares;

-- Andrew Chubb (independent Non-Executive Director) - 129,000 Subscription Shares;

-- Robert Monro (Chief Executive Officer and a Director) - 182,000 Subscription Shares; and

-- Paul Quirk (Non-Executive Director) - 1,820,000 Subscription

Shares, being through Key Ventures which is wholly owned and

controlled by First Island Trust Company Limited as Trustee of The

Sunnega Trust, a discretionary trust with a broad class of

potential beneficiaries. Paul Quirk is a potential beneficiary of

The Sunnega Trust.

On Admission certain substantial shareholders of the Company

will hold the following numbers of Ordinary Shares:

-- Brookstone will be the registered holder of 71,260,025

Ordinary Shares, representing approximately 28.99 per cent. of the

issued share capital of the Company on Admission. Brookstone is

wholly owned and controlled by First Island Trust Company Limited

as Trustee of the Nodo Trust, a discretionary trust with a broad

class of potential beneficiaries. Patrick Quirk, the father of Paul

Quirk (a Non-Executive Director of the Company), is a potential

beneficiary of the Nodo Trust; and

-- Lord Farmer will be the registered holder of 35,190,536

Ordinary Shares, representing approximately 14.32 per cent. of the

issued share capital of the Company on Admission.

Relationship Agreement

On 18 March 2020 Brookstone, Key Ventures and Paul Quirk

(collectively the 'Investors') entered into a Relationship

Agreement to regulate the relationship between the Investors and

the Company on an arm's length and normal commercial basis. In the

event that Investors' aggregated shareholdings becomes less than 30

per cent. then the Relationship Agreement shall terminate. As at

the date of this news release the Investors' aggregated

shareholdings were 31.61 per cent. of the issued share capital of

the Company. On Admission the Investors' revised aggregated

shareholdings will be 34.55 per cent. of the issued share capital

of the Company.

Revised shareholdings following Admission

On Admission, the revised shareholdings of the following

directors and substantial shareholders will be:

Current shareholding Subscription Shareholding Percentage

Shares on Admission of enlarged

issued share

capital

Brookstone Business Inc 53,060,025 18,200,000 71,260,025 28.99%

--------------------- ------------- -------------- --------------

Lord Farmer 29,410,536 5,780,000 35,190,536 14.32%

--------------------- ------------- -------------- --------------

Key Ventures Holding

Ltd plus Paul Quirk

(Non-Executive Director) 11,854,689 1,820,000 13,674,689 5.56%

--------------------- ------------- -------------- --------------

Edward Bowie

(Non-Executive Director) 361,510 64,000 425,510 0.17%

--------------------- ------------- -------------- --------------

Andrew Chubb

(Non-Executive Director) 210,526 129,000 339,526 0.14%

--------------------- ------------- -------------- --------------

Robert Monro

(Director) 1,546,896 182,000 1,728,896 0.70%

--------------------- ------------- -------------- --------------

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**S**

For further information, please visit http://www.coragold.com or

contact:

Bert Monro / Norm Bailie Cora Gold Limited +44 (0) 20 3239 0010

Christopher Raggett / Charlie finnCap Ltd

Beeson (Nomad & Joint Broker) +44 (0) 20 7220 0500

------------------------- ---------------------

Turner Pope Investments

Andy Thacker / James Pope (Joint Broker) +44 (0) 20 3657 0050

------------------------- ---------------------

Susie Geliher / Isabel de St Brides Partners

Salis (Financial PR) +44 (0) 20 7236 1177

------------------------- ---------------------

Notes

Cora is a gold company focused on two world class gold regions

in Mali and Senegal in West Africa. Historical exploration has

resulted in the highly prospective Sanankoro Gold Discovery, in

addition to multiple, high potential, drill ready gold targets

within its broader portfolio. Cora's primary focus is on further

developing Sanankoro in the Yanfolila Gold Belt (southern Mali),

which Cora believes has the potential for a standalone mine

development. Sanankoro has a positive Scoping Study published on it

showing an 107% IRR and US$41.5m NPV(8) at a US$1,500 gold price.

Cora's highly experienced management team has a proven track record

in making multi-million-ounce gold discoveries, which have been

developed into operating mines.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROISSFFAEEFSESM

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

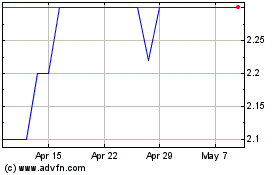

Cora Gold (LSE:CORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Apr 2023 to Apr 2024