TIDMCORD

RNS Number : 3323X

Cordiant Digital Infrastructure Ltd

04 May 2021

LEI: 213800T8RBBWZQ7FTF84

This announcement has been determined to contain inside

information for the purposes of the UK version of the market abuse

regulation (EU) No.596/2014.

Cordiant Digital Infrastructure Limited

Capital Deployment and Enhanced Dividend Guidance

4 May 2021

The Board of Cordiant Digital Infrastructure Limited (the

"Company") is pleased to announce the deployment or commitment of

substantially all of the net proceeds from its Initial Public

Offering ("IPO") into digital infrastructure platforms in the Czech

Republic and Norway, as well as an acceleration of the growth in

targeted dividends.

Key Highlights

-- Substantial deployment in less than 3 months. Having

completed the IPO in February, the Company has now either committed

or reached agreement to deploy substantially all of the net

proceeds of the IPO into two attractive and complementary

transactions. The resulting portfolio of assets will include 660

TV, radio and telecommunications towers, 3,000 microwave

connections, a network of 4 ,850km of optical fibre and 6 edge data

centres.

-- Diversification. The investment provides exposure to a

diversified array of underlying digital infrastructure assets

(mobile telecom and broadcast towers, fibre and edge data centres)

through platforms with strong competitive positions, long-term

contracts and attractive growth opportunities. The acquired

platforms produced in aggregate estimated EBITDA of circa GBP 40.5

million over the 12 months ended 31 December 2020.([1])

-- Advanced pipeline. The Company's pipeline of further,

well-advanced and complementary transaction opportunities (across

the U.S., Canada, Scandinavia and other European markets) has grown

considerably since the IPO.

-- Substantial increase in dividend guidance. A dividend per

share of no less than 3 pence per share is now targeted for the

current financial year, an increase from 1 pence per share.

Deployment of IPO Proceeds

The Company has completed the acquisition of České

Radiokomunikace (" CRA") and entered into a legally binding letter

of intent (subject to confirmatory technical due diligence and

final transaction documentation) to acquire a Norwegian fibre

network and certain land for data centre development for a combined

total consideration of GBP 451 million, comprising GBP 318 million

of equity and the assumption of an amount equal to GBP 133 million

of debt. The acquisitions of CRA and the Norwegian assets provide

the Company with a base of stable, cash generative assets with

long-term contracts in operational areas the Cordiant Capital team

understands well. Moreover, each of the new platforms accords

attractive opportunities for further, accretive capital

investment.

Following the completion of the Norwegian acquisition, the

Company will have uninvested proceeds from the IPO of approximately

GBP 43.4 million.

The Company's pipeline of attractive, advanced opportunities in

North America, Scandinavia and other parts of Europe has increased

in size and evolved in a positive direction since the IPO. The

Company's strategic approach and long-term investment thesis has

been well received in the market; the Company consequently enjoys

an available pool of high-quality opportunities in the various

sub-sectors of digital infrastructure (both internally sourced

transactions and those introduced through market

counterparties).

CRA

CRA is a leading independent digital infrastructure platform in

the Czech Republic; it also holds the national broadcast license.

It is a highly successful digital infrastructure platform with

contracted, long term, growing revenues in a strong and dynamic

Central European country demonstrating rapid convergence with the

economies of the European Union's historic core. The assets include

a portfolio of digital broadcast towers that would be challenging

to replace or replicate, a nationwide network of mobile towers, an

optical backbone network, and a portfolio of strategically located

data centres. The Czech Republic has a number of unique attributes

supporting the long-term potential of the CRA business, including

historically robust demand for broadcast entertainment in the Czech

Republic to a population distributed in a manner well-suited to

CRA's network.

Growth opportunities for CRA exist in supporting the mobile

operators with infrastructure as well as in expanding the size and

reach of the data centre platforms. There is significant potential

to expand CRA's early, successful, network offerings in the

"Internet of Things". The network already offers smart metering for

water, electricity and gas for companies including E.ON and

RWE.

The Company looks forward to working with CRA's experienced and

accomplished management team.

Fibre Optic Network Acquisition - Norway

The Company has entered into a binding letter of intent to

acquire an extensive fibre-optic network linking regions of Norway

to Scandinavia and the population densities of the core of Europe

beyond. Customers include telecommunications operators, industrial

concerns and utilities who have signed long-term contracts and for

whom the fibre connectivity is of critical importance.

Approximately half of the network's fibres have currently been

leased, offering significant potential to increase revenues with

existing and new customers (such as data centre operators). The

region offers the least expensive, most environmentally friendly

and abundant electrical power in Europe with attractive low

operating costs for data centre operators. As such, Scandinavia is

expected to attract increasing investment in data centres and

require augmented fibre optic capacity.

In addition, the Company has signed an agreement to invest in

strategically-located Norwegian land parcels with substantial power

availability. These offer significant development potential for

data centre operators, thereby providing the Company with a

potential base on which to grow a Nordic data platform.

Enhanced Dividend Guidance

The Company is pleased to announce its intention to pay a

dividend of 3 pence per share in respect of its first financial

year ending 31 March 2022. This is an increase from the 1 penny per

share targeted at IPO. A maiden dividend of 1.5 pence per share is

now targeted for payment in December 2021 with respect to the half

year to the end of September 2021 and a further dividend of 1.5

pence per share is now expected to be paid in July 2022 for the

period ending March 2022.

The Company intends to pay a progressive dividend in future

years and is targeting a further acceleration of the dividend

timetable, previously announced at the time of the IPO, which

envisioned a dividend of at least 4 pence per share in the fifth

full financial year.

Steven Marshall, Chairman Digital Infrastructure, Cordiant

Capital Inc. said:

"We are delighted to have acquired these attractive digital

infrastructure platforms. CRA is a national champion with an

unrivalled portfolio of assets in a core European country. We are

excited to be partnering with their strong management team, its

employees, and other stakeholders in order to continue building CRA

as a leading digital infrastructure platform serving the broadcast,

telecommunications and data centre markets.

"The Norwegian long-distance fibre-optic network is profitable

and ideally located to support future growth in the digital

infrastructure market in Scandinavia. We look forward to supporting

further expansion and growth of this network with the existing

management team."

Shonaid Jemmett-Page, Chairman of the Company , said:

"Our Manager has been able to swiftly deploy the substantial

majority of the IPO proceeds into compelling platform transactions,

in addition to developing an advanced pipeline of further

investment opportunities. These significant maiden investments

provide an attractive source of income and we are pleased to be

able to announce a significant acceleration in the quantum of

dividends that the Company intends to distribute."

Analyst & Investor Call at 10am

The Manager will host a conference call for analysts and

institutional investors at 10am. Please contact the Company's

Financial Communications Adviser for participation details (

CordiantDigitalInfra@Camarco.co.uk ).

Enquiries:

For further information, please contact:

Cordiant Digital Infrastructure Management

Ltd

Manager

Stephen Foss, Investor Relations +44 (0)20 7201 7546

Investec Bank plc

Corporate Broker +44 (0)20 7597 4000

Tom Skinner (Corporate Broking)

Lucy Lewis, David Yovichic, Denis Flanagan (Corporate Finance)

Dominic Waters, Will Barnett, Neil Brierley (Sales)

Camarco +44 (0)20 3757 4980

Financial Communications Adviser CordiantDigitalInfra@Camarco.co.uk

Louise Dolan

Eddie Livingstone-Learmonth

Monique Perks

Billy Clegg

Ocorian Administration (Guernsey) Limited

Company Secretary and Administrator

Ian Smith

Holly Tierney + 44 (0)1481 742742

Notes to Editors:

Cordiant Digital Infrastructure Limited primarily invests in the

core infrastructure of the digital economy - data centres,

fibreoptic networks and broadcast and telecommunication towers -

"the plumbing of the internet" - in the UK, Europe and North

America. Further details of the Company can be found on the

Company's website at www.cordiantdigitaltrust.com.

Cordiant Capital Inc., the Company's investment manager, is a

sector-focused investment manager with particular expertise and

experience in digital infrastructure. Cordiant invests in global

infrastructure and real assets, running infrastructure private

equity and infrastructure private credit strategies through limited

partnership funds and managed accounts. Cordiant's current client

base consists of global insurance companies, pension plans and

family offices.

([1]) EBITDA figure is presented on a pre-IFRS 15 & 16

basis, excluding one off items and is based on CZK-GBP and NOK-GBP

average exchange rates for the year 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUEANSDEFFFEFA

(END) Dow Jones Newswires

May 04, 2021 02:00 ET (06:00 GMT)

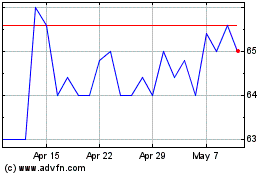

Cordiant Digital Infrast... (LSE:CORD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cordiant Digital Infrast... (LSE:CORD)

Historical Stock Chart

From Apr 2023 to Apr 2024