TIDMCORO

RNS Number : 9516Z

Coro Energy PLC

27 May 2021

This announcement contains inside information

27 May 2021

Coro Energy plc

("Coro" or the "Company")

Disposal of Italian Portfolio

Coro Energy plc, the South East Asian energy company focused on

leading the regional transition to a low carbon economy, is pleased

to announce it has entered into a conditional Sale and Purchase

Agreement ("SPA") with Dubai Energy Partners, Inc ("DEPI") to

dispose of the Company's Italian portfolio (the "Italian

Portfolio") for cash consideration of EUR300,000 (the

"Disposal").

DEPI is incorporated in the United States of America and is

focused on the acquisition of producing, and shut-in, oil and gas

fields.

Highlights

-- DEPI will acquire the Company's entire interest in the

Italian Portfolio, through the acquisition by DEPI of the entire

issued share capital of the Company's wholly owned subsidiary Coro

Europe Limited ("Coro Europe") for a cash consideration of

EUR300,000, with a deposit of EUR30,000 payable on entry of the SPA

(non-refundable except in limited circumstances)

-- The economic effective date for the Disposal is 26 May 2021,

being the date of signing the SPA. DEPI will be entitled to any

profits, and responsible for any losses, from the Italian Portfolio

from this date

-- Completion of the Disposal is conditional on, inter alia,

approval by the Italian Ministry of Economic Development, with DEPI

assuming responsibility for any operational losses for the Italian

Portfolio from signature of the SPA until completion

-- The proceeds of the Disposal will be applied towards the

Group's energy transition strategy in South East Asia

Mark Hood, Chief Executive Officer, commented:

"We are pleased to agree a sale of our non-core Italian assets

to DEPI, who are ideally placed to take the portfolio forward. The

disposal allows us to prioritise our time and resources on our low

carbon and renewable energy strategy in South East Asia, which

continues to gain momentum. We look forward to updating

shareholders in due course."

Background to, and reasons for, the Disposal

On 12 September 2019, the Company announced that the Board of

Directors had taken the decision to prioritise full divestment of

the Italian Portfolio, given the Group's strategic focus on growth

in South East Asia.

Thereafter the Company entered into an agreement to dispose of

the Italian Portfolio, the terms of which were announced by the

Company on 3 December 2019 and approved by Coro shareholders at a

General Meeting held on 20 December 2019. However, the Company

subsequently announced on 31 July 2020 that, by mutual agreement of

the parties, this proposed transaction would not be proceeding due

to doubts about the likelihood of successfully completing that

transaction ahead of the 31 October 2020 long stop date.

Since prioritising the Italian Portfolio for divestment, the

Group has continued to recognise losses relating to Italian

operations. In the year to 31 December 2020 Coro Europe incurred a

loss after tax of $2.2m on revenues of $0.8 million, with the Group

providing $0.6m of funding to the Italian Portfolio during that

year. Coro Europe net assets as at 31 December 2020 were $0.5

million.

While the Board believes that the Italian portfolio is capable

of generating profits through targeted investment to increase

production and extend asset lives, the Group's strategic focus

continues to be South East Asia. The Board believes that

incremental capital expenditure on the Group's renewable energy

projects and the Duyung PSC represent a more value accretive use of

the Group's resources and, ultimately, has a greater possibility of

generating higher returns for shareholders than allocating

additional capital to the development of the Italian Portfolio. As

a result, the Group has continued to pursue divestment of the

Italian Portfolio as a priority.

Background to DEPI

DEPI was founded in the USA and is an international oil and gas

company focused on the acquisition of undervalued producing, and

shut-in, oil and gas fields.

Details of the Disposal

The Company's wholly owned subsidiary, Coro Energy Holdings Cell

A Limited, has entered into a binding, conditional Sale and

Purchase Agreement ("SPA") with DEPI for the disposal by the Group

of the entire issued capital of Coro Europe Limited, which holds

the Group's interests and liabilities in the Italian portfolio, for

a consideration of EUR300,000 (the "Disposal"). DEPI will pay a

deposit of EUR30,000 within three (3) days of SPA signing

(non-refundable except in limited circumstances), with the balance

of the consideration of EUR270,000 due on completion of the

Disposal. The proceeds of the Disposal will be applied towards the

Group's energy transition strategy in South East Asia.

Completion of the Disposal is conditional on certain conditions

having been satisfied or waived, including:

-- Receipt of required regulatory approvals from the Italian

authorities by 26 February 2022 (the "End Date", such date being

extendable by mutual consent of the parties); and

-- There not having occurred between the date of the SPA and the

date of Completion, a breach of a warranty which constitutes a

material adverse change, defined as an event, change or condition

that causes, or could reasonably be expected to cause, a reduction

in the consolidated net assets of the Coro Europe Group and its

subsidiaries of more than EUR1,000,000, excluding certain global

events.

The economic effective date of the Disposal is 26 May 2021,

being the date the SPA was entered into. As a result, DEPI will be

entitled to any profits, and will assume responsibility for any

losses up to an aggregate limit of EUR5 million, from the Italian

Portfolio from this date until the first to occur of Completion,

the End Date, or termination of the SPA in accordance with its

terms.

The SPA may be terminated by either party in the event that the

conditions precedent, completion obligations and/or undertakings

given for that party's benefit and standing to be satisfied on or

before the date of Completion are not met or waived.

Coro Energy plc Via Vigo Communications

Mark Hood Ltd

Cenkos Securities plc (Nominated Adviser) Tel: 44 (0)20 7397 8900

Ben Jeynes

Katy Birkin

Tennyson Securities (Broker) Tel: 44 (0)20 7186 9030

Peter Krens

Ed Haig-Thomas

Vigo Consulting Ltd (IR/PR Advisor) Tel: 44 (0)20 7390 0230

Patrick d'Ancona

Chris McMahon

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISQQLFLFELZBBX

(END) Dow Jones Newswires

May 27, 2021 02:00 ET (06:00 GMT)

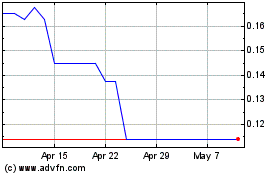

Coro Energy (LSE:CORO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coro Energy (LSE:CORO)

Historical Stock Chart

From Apr 2023 to Apr 2024