TIDMCREO

RNS Number : 8011A

Creo Medical Group PLC

04 June 2021

Creo Medical Group plc

("Creo" the "Group" or the "Company")

Final results for the 12 months ended 31 December 2020

A Transformational Year: Significant growth and continued

regulatory progress

Creo Medical Group plc (AIM: CREO), a medical device company

focused on the emerging field of surgical endoscopy, announces its

audited final results for the 12 months ended 31 December 2020

.

The Board is pleased to be able to report that, despite the

COVID-19 pandemic, the year ended 31 December 2020 was a strong

period for Creo marked by significant internal development and

expansion, along with the continued development of the Company's

suite of devices to complement the Company's CROMA Advanced Energy

Platform ("CROMA") and Speedboat device for use in Gastrointestinal

("GI") therapeutic endoscopy.

Operational Highlights:

-- Albyn Medical and Boucart Medical acquired providing a direct

sales presence in key European markets and strengthening Creo's

commercial team

-- An increased ESG focus with a strong COVID-19 response

-- Appointment of David Woods as Chief Commercial Officer in

August 2020, brought a wealth of knowledge and experience to the

business

-- Recruitment of a direct sales team in the USA and APAC

-- 10-fold increase in the commercial, marketing and distribution resource

-- Direct presence across five European countries, four regions

of the USA and a centralised hub in Asia

-- CE marking an additional five devices

-- US Food and Drug Administration ('FDA') 510(k) clearance achieved for:

o SlypSeal;

o MicroBlate Fine; and

o MicroBlate Flex (post period end)

-- The first clinical use of MicroBlate Fine in a successful pancreatic tumour ablation

-- Strengthened IP portfolio, with 247 granted patents and 763 pending applications

Financial Highlights :

-- Total sales in the period were GBP9.4m (2019: GBP0.01m)

-- Cash and cash equivalents of GBP45.1m at 31 December 2020 (31 December 2019: GBP81.0m)

-- Operating loss of GBP23.5m (2019: GBP18.9m) including GBP0.7m

share based payments, in line with management expectations and

reflects increased R&D and commercial activities

-- Net cash outflow from operating activities of GBP16.3m (2019: GBP11.9m)

Craig Gulliford, Chief Executive Officer, commented:

"It has been a transformational year and we have made impressive

progress against our build, buy and partner strategy. Perhaps the

most satisfying achievement for the whole team has been the first

clinical use of MicroBlate Fine to successfully treat a number of

patients with pancreatic tumours in early December 2020, with no

adverse events reported to date.

"Though the evolution of Creo since IPO has been exceptional our

mission remains the same: to improve patient outcomes and this is

evidence that we are doing that.

"Having started the year with only one CE marked device, we have

successfully cleared five additional advanced energy devices

through the CE mark process and gained FDA 501(k) clearance for

three devices. Furthermore, we have completed two transformational

acquisitions which are delivering meaningful revenue to the

business and we have exceeded our objectives in expanding our sales

team globally.

"We are extremely well positioned to be the next generation

solution in minimally invasive surgery and, whilst our current

focus is on GI therapeutic endoscopy, looking forward we see

significant further opportunities in other surgical

disciplines/specialities and then beyond into diagnostics."

Creo Medical Group plc

Richard Rees (CFO) +44 (0)1291 606005

Cenkos Securities plc +44 (0)20 7397 8900

Stephen Keys / Camilla Hume (NOMAD)

Michael Johnson / Russell Kerr (Sales)

Walbrook PR Ltd +44 (0)20 7933 8780 or creo@walbrookpr.com

Paul McManus / Lianne Cawthorne +44 (0)7980 541 893 / +44 (0) 7515

909 238

About Creo Medical

Creo Medical, founded in 2003, is a medical device company

focused on the development and commercialisation of minimally

invasive surgical devices, bringing advanced energy to endoscopy.

The Company's mission is to improve patient outcomes by applying

microwave and RF energy to surgical endoscopy. Creo has developed

CROMA, an electrosurgical Advanced Energy Platform that delivers

bipolar radiofrequency for precise localised cutting and microwave

for controlled coagulation. This technology provides clinicians

with flexible, accurate and controlled surgical solutions.

The Company's strategy is to bring its CROMA Advanced Energy

Platform powered by its full spectrum Kamaptive Technology to

market, enabling a suite of medical devices which the Company has

designed, initially for the emerging field of GI therapeutic

endoscopy, an area with high unmet needs. The CROMA Advanced Energy

Platform will be developed further for bronchoscopy and laparoscopy

procedures. The Company believes its technology can impact the

landscape of surgery and endoscopy by providing a safer, less

invasive and more cost-efficient option of treatment. An overview

of the Creo Medical device technology portfolio can be seen

here:

https://www.rns-pdf.londonstockexchange.com/rns/8918P_1-2020-6-14.pdf

For more information about Creo Medical please see our website,

www.creomedical.com

Chairman's statement

As for many businesses, families and individuals across the

globe, 2020 was an extraordinary year for Creo. The Board is full

of admiration for how effectively our senior management team and

staff rose to the challenges presented by COVID-19 and navigated

the Company through the year, achieving significant regulatory and

commercial progress.

While the excitement around the clinical results being achieved

remains high in each of our key markets, as expected, the various

lockdowns and other national and international restrictions

impacted the ability for Creo's products to be commercially

adopted. The senior management team wisely refocused resources to

build an international commercial platform and, in parallel with

our R&D and engineering teams, continued to develop our

technology and intellectual property faster and further than

planned. Consequently, we achieved better than expected progress in

developing new products, filing intellectual property and have

secured regulatory clearances in Europe and the USA.

In July, we announced the transformational acquisition of Albyn

Medical, the first and largest of the two acquisitions executed

during the period. Completing cross-border acquisitions of

businesses based in Europe against the headwinds of both COVID-19

and Brexit presented a set of challenges to which the Executive

Directors and wider team rose admirably to. In November, we also

acquired Boucart Medical to further strengthen Albyn's European

platform. We welcome both the Albyn and Boucart teams into the

Group and thank them for their hard work and flexibility in

integrating the businesses so quickly. Albyn exceeded our

expectations in its first five months as part of the Group and, as

announced in the trading update on 19 May 2021, the Directors are

very positive about its ongoing contribution to the enlarged

business.

Management and staff

In 2020, Creo's executive team and staff have continued to

evolve and expand and this positions us very favourably for the

years ahead. David Woods was appointed Chief Commercial Officer in

August and has quickly recruited an experienced international team

to support him in the US and APAC. David was, of course, already

part of the Creo family, having served as a Non-Executive Director

of the Group since the IPO. He now takes on a vital executive role

in building out our global commercial platform and we are very

pleased to welcome him and his new colleagues onto the executive

team.

Central to the seamless integration into Creo of Albyn has been

the addition of its CEO Luis Collantes to the Group's senior

management team. Supported by his team, Luis has made an immediate

and positive contribution to Creo so we are similarly delighted to

welcome them into the Group.

Last year we reported that our staff had trebled since the IPO

and with two acquisitions, by the end of 2020, the Group employed

217 staff based in eight countries; this represents a roughly

eightfold increase in our overall headcount since our admission to

AIM in 2016. The Creo team now includes first class talent from a

wide range of nationalities, technical skill sets and professional

backgrounds. The Board would like to express its thanks and

admiration for all they have achieved during this year and the

energy, good humour and resourcefulness with which they have

addressed the added challenges presented by the pandemic.

Shareholders

Creo has a supportive shareholder base of which we are highly

appreciative. With their support, and having completed our equity

raise in December 2019, we entered 2020 with a strong balance

sheet. This gave us a solid platform on which to grow during what

proved, for everyone, a turbulent year. We continue to maintain

frequent communications with our shareholders and remain very

grateful for their enthusiasm, support and understanding.

ESG

This year, in line with evolving best practice, our annual

report will for the first time include an ESG report, which we hope

shareholders will find informative especially around the shared

response to the pandemic. Creo has always recognised its wider

responsibilities and has prioritised those communities it serves,

most obviously our patients and their families, the clinicians that

treat and care for them, but also our staff and their families and

the local communities in which we employ them.

Outlook

Against the backdrop of the pandemic we made impressive progress

in 2020 targeting internal development and expansion to provide

strong foundations upon which to build in the future. We have a

solid book of clinicians waiting to be trained and are strongly

placed to support healthcare systems clearing patient screening and

treatment backlogs built up through the pandemic. This, combined

with the commercial progress we expect to make with our expanded

core portfolio as restrictions on hospital access ease, give us

confidence for 2021 and beyond and so we remain excited by what the

future holds for Creo and its shareholders.

Chief Executive's Review

I am proud of the progress we have made in delivering against

our strategy during 2020. COVID-19 caused a huge upheaval in our

industry, demanding that clinical resource be reassigned to assist

on the front line. At the start of the pandemic I asked the Creo

team to "focus on what you can achieve, and not on what you can't

achieve". I believe that they did just that and, in so doing,

enabled Creo to take great strides forward so I thank each and

every colleague for playing their part in our achievements during

the year.

Having started the year with only one CE marked device, we have

successfully cleared five additional advanced energy devices

through the CE mark process and gained FDA 501(k) clearance for

three devices. Furthermore, we have completed two transformational

acquisitions which are delivering meaningful revenue to the

business and we have exceeded our objectives in expanding our sales

team globally.

Like all businesses we have been impacted by COVID-19, but we

are resourceful and have used the period to adapt and grow. We

rapidly adjusted our day-to-day operations to ensure employee

safety, supporting our community by being able to source

ventilators for NHS hospitals, donating bikes for medical staff and

acquiring 3D printers to allow Creo employees to manufacture PPE

from home, in local schools and in small businesses. We have

included further details on our COVID-19 response within our annual

report.

We have organically grown our commercial team in 2020. David

Woods, previously a Non-Executive Director of Creo and former

President and CEO of PENTAX Americas, joined Creo full-time as

Chief Commercial Officer. Since joining the executive team David

has built an experienced team in the US and APAC providing the

Company with greater access to these important markets. This

additional strength, together with the acquisitions of Albyn

Medical and Boucart Medical, have resulted in a tenfold increase in

Creo's commercial, marketing and distribution resource so,

importantly, we now have an established commercial and distribution

platform to accelerate our growth.

Building momentum

We have made strong progress against our build, buy and partner

strategy.

Build

We have significantly strengthened our product portfolio during

the year having CE marked five new devices across

our four technology platforms: Speedboat, SlypSeal, SpydrBlade

and MicroBlate. Despite the disruption caused by COVID-19, we were

also pleased to receive FDA 510(k) clearance for SlypSeal Flex and

MicroBlate Fine. After the year end, MicroBlate Flex was our fourth

product to receive FDA 510(k) clearance.

We have continued to receive commercial orders for Speedboat

Inject from the UK, US, South Africa and Australia where the

initial focus is on establishing clinical education centres.

Perhaps even more satisfying for the whole team, was the first

clinical use of MicroBlate Fine to successfully treat a number of

patients with pancreatic tumours in early December 2020, with no

adverse events reported to date.

Buy

The acquisition of Albyn Medical in July 2020 brought breadth

and depth to Creo within Europe, accelerating our commercial

progress there. Albyn is a European specialist in the supply and

manufacture of Gastroenterology, Urology and Endoscopy products to

healthcare providers in Spain, France, Germany and the UK. With a

well established sales and marketing team, this acquisition gives

us an enhanced commercial and distribution platform, providing a

direct route to market for our products. Albyn's product range is

highly complementary to Creo's and also brings with it the

opportunity to broaden into the pulmonary and urology markets. We

were delighted to welcome Luis Collantes, CEO of Albyn Medical, to

Creo's senior management team and the enlarged Group is already

benefitting from his significant experience and market

expertise.

In November 2020, we further enhanced our European commercial

platform and direct European coverage through the acquisition of

Boucart Medical, the largest independent supplier of

gastrointestinal (GI) endoscopy consumables in Belgium and

Luxembourg.

Partner

As we look forward to 2021, we are focused on delivering

clinical outcomes for all our current devices. In addition, we see

further opportunities to exploit the potential of Kamaptive, the

advanced energy technology that powers our devices, in the adjacent

fields of laparoscopic and robotic assisted surgery. We intend to

address these markets through building partnerships and, where

appropriate, licensing our Kamaptive Technology for use with third

party solutions.

The journey to commercialisation

The delivery of our first significant revenues marked a further

milestone on our journey to commercialisation. Whilst the GBP9

million of revenue generated in 2020 was largely from our recent

acquisitions, the expansion of our global commercial team and

imminent product launches, puts us in a strong position to build on

this and enhance the value of the businesses that we have

acquired.

People

In addition to Dave Woods and Luis Collantes joining our senior

management team, we welcomed a further 95 new employees into the

Creo family through the Albyn and Boucart acquisitions. Combined

with the organic growth in our engineering talent, the Company

exited the year with 217 employees. Maintaining and nurturing our

culture across this fast-growing organisation has been a priority,

along with the careful integration of the newly acquired

businesses.

Against the backdrop of an uncertain world, the commitment and

dedication of all our staff has been impressive. I would like to

thank them all for the resilience and pragmatism they have shown in

tackling the challenges COVID-19 has presented.

COVID-19 Reflection

It would be remiss of me to not take a moment to reflect on

COVID-19 and the impact it has had on all of us. Creo started 2020

with a strong balance sheet having closed a funding round at the

end of December 2019 and looking forward to the challenges that lay

ahead. Little did any of us realise that we would be facing a

global pandemic on a scale not seen for over a century.

In line with UK Government guidance, in March 2020 I instructed

the Creo team to work from home where possible and to stay safe.

The resilience that we have built into the Creo team proved

invaluable, with everyone pulling their weight and more, to ensure

that the business could respond appropriately to the Pandemic

whilst continuing to deliver against Creo's goals and

objectives.

Our 2020 Report and Accounts sets out examples of how Creo

played its part in the COVID-19 response, not just within Creo but

with the wider community. I am extremely proud of the response that

we have been able to coordinate.

Whilst we have had cases of COVID-19 within the team, we have

been lucky to have no fatalities. This being said, I am aware that

within our network of friends, family and business associates there

are those who have suffered; our thoughts remain with them.

Looking forward

2020 has been a transformational year for the Company. The

reduction in elective surgery and redeployment of medical staff in

response to COVID-19 has inevitably delayed Creo's short-term

commercialisation activities. However, the significant backlog in

surgery and procedures that have resulted as a consequence of the

pandemic will require faster, more efficient healthcare solutions

and the solutions available through Creo's technology and devices

have never been more relevant than now.

The steps we have taken this year to gain regulatory clearances

for our devices and build our global commercial and distribution

platform means we are ready for the next phase of our growth and to

play our part in improving timeframes and outcomes for patients. In

2021 we will expect to see a wider adoption of our devices and to

begin developing broader commercial opportunities for our Kamaptive

Technology.

Though the evolution of Creo since IPO has been exceptional our

mission remains the same: to improve patient outcomes. We are

extremely well positioned to be the next generation solution in

minimally invasive surgery and, whilst our current focus is on GI

therapeutic endoscopy, looking forward we see significant further

opportunities in other surgical disciplines/specialities and then

beyond into diagnostics.

Craig Gulliford

Chief Executive Officer

Financial Review

I am pleased to announce Creo's audited results for the year

ended 31 December 2020. The adversity faced by the business from

COVID-19 has, in part, been mitigated through the strength of the

balance sheet following the 2019 fund raise. Applying this funding

in line with the objectives set out in 2019 to acquire Albyn

Medical and Boucart Medical brings immediate revenue and positive

cash flow to the Group, strengthens the business and confirms Creo

as a platform for future growth.

Revenue and other income

Despite Covid-19 disrupting sales channels limiting access to

clinical training and travel, the Group has made significant

progress in establishing a longer-term sales channel through new

products as well as development of our commercial footprint via

acquisitions and organic growth. We secured distribution contracts

in the APAC region, developed our sales team in the US, headed by

David Woods, and acquired Albyn Medical to provide additional

cashflow, access to and sales expertise throughout Europe and

further enhanced our European presence with the acquisition of

Boucart Medical.

Revenues billed in the period in relation to Speedboat and CROMA

totalled GBP0.1m of which GBP39k has been recognised as revenue

with the balance accounted for below the line in administrative

expenses. Since the acquisition of Albyn Medical SL, the Albyn

Group of the business generated Albyn GBP9.4m of revenue in the

five-month period since 24 July 2020. Other operating income of

GBP0.05m in the 12-month period to 31 December 2020 (2019: GBP0.1m)

relates to research grants.

Operating loss

The operating loss for the period increased to GBP23.5m (2019:

GBP18.9m) reflecting the increased operating expenses in relation

to clinical and development activities together with further

investment in headcount and business infrastructure to support the

business and enable it to continue to develop and commercialise its

technology. This continued investment in the business will support

anticipated growth and development in the coming periods.

The underlying operating loss (also referred to as adjusted

EBITDA) for the period was GBP18.0m (2019: GBP14.0m).

Whilst EBITDA is not a statutory measure, the Board believes it

is helpful to investors to include as an additional metric to help

provide a meaningful understanding of the financial information as

this measure provides an approximation of the ongoing cash

requirements of the business as it continues to pursue its future

development and begins to commercialise its approved products. The

adjusted EBITDA position excludes share-based payment expenses

which are non-cash and incorporates the recovery of research and

development expenditure which the Group is able to benefit from

through R&D Tax credit schemes.

31 December 31 December

(All figures GBP) 2020 2019

------------------------------------------ ------------- -------------

Operating loss (23,484,062) (18,875,378)

Loss before Income tax (23,461,805) (18,615,381)

Total comprehensive loss for the period (20,744,241) (15,911,150)

Underlying operating loss adjustments:

Share-based payments 728,145 1,554,845

Depreciation and amortisation 1,596,419 641,725

R&D expenditure recovered via tax credit

scheme 3,146,080 2,710,239

Underlying operating loss (non-statutory

measure) (18,013,418) (13,968,569)

-------------------------------------------- ------------- -------------

*R&D expenditure includes a GBP1,839 claimed under the large

company ('RDEC') scheme in relation to monies received from

Research Grants.

Tax

The tax credits recognised in the current and previous fiscal

year relate solely to R&D tax credit claims. A deferred tax

asset has been recognised in respect of the business combination

relating to our Albyn subsidiaries. A deferred tax asset has yet to

be recognised for the losses of Creo Medical Limited due to the

uncertainty over the timing of future recoverability.

Expenses

Administrative expenses comprising R&D, operational support,

sales and marketing, and finance and administration costs totalled

GBP27.1m (2019: GBP19.0m). Adjusting for share-based payments,

depreciation, amortisation and tax income as shown in the table

above, underlying administrative expenses are GBP21.7m (2019:

GBP14.0m).

This annualised increase of GBP8.1m reflects the continued

investment made by the Group in clinical and development activities

and the move from small discrete production batches into full-scale

manufacturing. Personnel costs continue to be the largest expense

and represent approximately 60% of the Group's underlying

administrative expenses.

Loss per share

Loss per share was 13 pence (2019: 13 pence).

Dividend

No dividend has been proposed for the period to 31 December 2020

(31 December 2019: GBPnil).

Cash flow and balance sheet

Net cash used in operating activities was GBP16.3m (December

2019: GBP11.8m), driven by the continued investment in research and

development of new devices, establishing a U.S. and APAC presence.

Net cash used in investing activities was GBP21.0m (2019: GBP0.8m)

driven by the acquisition of Albyn and Boucart to bolster market

access and sales expertise.

Total assets at the end of the period increased to GBP93.5m (31

December 2019: GBP88.3m), a 5.9% increase, reflecting the increase

in assets and goodwill, as a result of the business combination,

offset by the operating cash outflow for the period. Cash and cash

equivalents at 31 December 2020 was GBP45.1m (31 December 2019:

GBP81.0m). Net assets were GBP62.8m (31 December 2019: GBP82.6m), a

25% decrease due to liabilities associated with the business

combination.

Accounting policies

The Group's financial statements have been prepared in

accordance with International Financial Reporting Standards. The

Group's accounting policies have been applied consistently

throughout the period and are described in the 2020 Report and

Accounts.

Principal risks and uncertainties

The principal risks and uncertainties facing the Group are set

out in the 2020 Report and Accounts.

Richard Rees

Chief Financial Officer

Consolidated Statement of Profit and Loss and Other

Comprehensive Income

31 December 31 December

(All figures GBP) 2020 2019

------------------------------ ------------- -------------

Revenue 9,428,880 13,473

Cost of sales (5,393,884) (8,522)

Gross Profit 4,034,996 4,951

Other operating income 49,192 126,719

Administrative expenses (27,121,353) (19,007,048)

Impairment loss on trade and

other receivables (446,897) -

Operating loss (23,484,062) (18,875,378)

Finance expenses (172,875) (51,291)

Finance income 195,132 311,288

Loss before tax (23,461,805) (18,615,381)

Taxation 3,146,080 2,704,231

Loss for the period/year (20,315,725) (15,911,150)

--------------------------------- ------------- -------------

Other comprehensive income (428,516) -

Total comprehensive loss for

the period/year (20,744,241) (15,911,150)

--------------------------------- ------------- -------------

Loss per Share

Basic and diluted (0.13) (0.13)

Consolidated Statement of Financial Position

31 December 31 December

(All figures GBP) 2020 2019

------------------------------- ------------- -------------

Assets

Non-current assets

Intangible assets 10,267,868 865,241

Goodwill 18,261,605 -

Investments 500,000 -

Property, plant and equipment 3,378,425 1,295,818

Deferred tax 474,289 -

Other non-current receivables 111,780 8,400

32,993,967 2,169,459

Current assets

Inventories 6,812,252 727,158

Trade and other receivables 5,633,205 1,616,319

Tax receivable 2,973,364 2,702,198

Cash and cash equivalents 45,091,552 81,048,448

60,510,373 86,094,123

Total assets 93,504,340 88,263,582

-------------------------------- ------------- -------------

Shareholder equity

Called up share capital 157,891 150,378

Share premium 115,263,193 115,111,506

Merger reserve 13,602,735 13,602,735

Share option reserve 5,376,060 4,647,915

Foreign exchange reserve (428,516) -

Retained earnings (71,164,915) (50,849,190)

62,806,448 82,663,344

Liabilities

Non-current liabilities

Interest bearing liabilities 6,541,597 543,892

Other liabilities 2,318,909 -

8,860,506 543,892

Current liabilities

Interest bearing liabilities 4,023,119 173,193

Trade and other payables 9,960,279 4,883,153

Deferred tax liability 1,996,246 -

Non interest bearing loans 1,789,944 -

Other liabilities 4,067,798 -

21,837,386 5,056,346

Total liabilities 30,697,892 5,600,238

Total equity and liabilities 93,504,340 88,263,582

-------------------------------- ------------- -------------

Consolidated Statement of Changes in Equity

Called

up Share Foreign

share Retained Share Merger option Exchange Total

(All figures GBP) Note capital earnings premium reserve reserve Reserve equity

------------------- ------ -------- ------------- ------------ ----------- ---------- ---------- -------------

Balance at 31 December

2018 120,495 (34,938,040) 65,835,555 13,602,735 3,093,070 - 47,713,815

Total

comprehensive

income for the

period

Profit or loss - (15,911,150) - - - - (15,911,150)

Total comprehensive

income - (15,911,150) - - - - (15,911,150)

Transactions with

owners,

recorded directly

in

equity

Issue of share capital 29,883 - 49,275,951 - - - 49,305,834

Equity settled share-based

payment transactions - - - - 1,554,845 - 1,554,845

Balance at 31 December

2019 150,378 (50,849,190) 115,111,506 13,602,735 4,647,915 - 82,663,344

--------------------------- -------- ------------- ------------ ----------- ---------- ---------- -------------

Total

comprehensive

income for the

period

Profit or loss - (20,315,725) - - - (428,516) (20,744,241)

Total comprehensive

income - (20,315,725) - - - (428,516) (20,744,241)

Transactions with

owners,

recorded directly

in

equity

Issue of share capital 7,513 - 151,687 - - - 159,200

Equity settled share-based

payment transactions - - - - 728,145 - 728,145

Balance at 31 December

2020 157,891 (71,164,915) 115,263,193 13,602,735 5,376,060 (428,516) 62,806,448

--------------------------- -------- ------------- ------------ ----------- ---------- ---------- -------------

Consolidated Statement of Cash Flows

31 December 31 December

(All figures GBP) 2020 2019

-------------------------------------------------- ------------- -----------------------------------

Cash flows from operating activities

Loss for the period (20,315,725) (15,911,150)

Depreciation/amortisation charges 1,596,419 641,726

Equity settled share-based payment expenses 728,145 1,554,845

Fair value adjustment to derivatives - 27,894

Finance expenses 172,875 23,397

Finance income (195,132) (311,288)

R&D expenditure credit (1,839) (5,362)

Taxation (3,146,080) (2,704,231)

Impairment of intangible assets 140,814 -

(21,020,523) (16,684,170)

Increase in inventories 766,553 (424,686)

Decrease in trade and other receivables (394,012) (552,696)

Increase in trade and other payables 1,686,474 3,283,533

(18,961,508) (14,378,019)

Interest paid (172,875) (51,291)

Tax Paid 153,277 -

Tax received 2,702,198 2,577,026

Net cash from operating activities (16,278,908) (11,852,284)

Cash flows from investing activities

Purchase of intangible fixed assets (91,462) (633,795)

Purchase of tangible fixed assets (484,771) (484,006)

Acquisition of subsidiary net of cash acquired (20,586,496) -

Interest received 195,132 311,288

Net cash from investing activities (20,967,597) (806,513)

Cash flows from financing activities

Capital repaid in respect of loans (497,047) -

Proceeds for new loan 2,055,000 -

Capital repaid in respect of lease liabilities (391,404) (187,310)

Share issue 159,200 49,305,833

Net cash from financing activities 1,325,749 49,118,523

(Decrease)/increase in cash and cash equivalents (35,920,756) 36,459,726

Effect of exchange rates in cash held (36,140) -

Cash and cash equivalents at beginning of period 81,048,448 44,588,722

Cash and cash equivalents at end of period 45,091,552 81,048,448

--------------------------------------------------- ------------- -----------------------------------

Notes to the financial statements

1. Financial information set out in this announcement

The financial information set out above does not constitute the

Company's statutory accounts for the period ended 31 December 2020

or 31 December 2019 but is derived from those accounts. Statutory

accounts for the period ended 31 December 2019 have been delivered

to the registrar of companies, and those for the period ended 31

December 2020 will be delivered in due course. The auditor has

reported on those accounts; their reports were (i) unqualified,

(ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

2. Revenue and other operating income

Revenue from contracts with customers

Revenue is recognised when substantially all of the risk and

reward of ownership of the goods are transferred to the customer on

despatch, and thus has the ability to direct the use and obtain the

benefits from the goods. Revenue is recognised net of any sales

tax.

Collaborative arrangements

All Collaboration agreements as at 31 December 2020 have been

terminated or moved to non-collaboration agreements. s. The result

of this is that these new distribution agreements are now deemed to

be a 'customer' of the entity, as defined in IFRS 15 and all sales

made under these new distributor agreements are assessed against

the IFRS 15 criteria upon inception of the contract to determine

the appropriate accounting treatment.

Performance obligations and revenue recognition policies

Revenue is recognised in accordance with IFRS 15 at the point at

which the Groups performance obligation has been satisfied. Below

is a summary of the recognition policies for each type of sale:

Type of product/service Nature and timing of satisfaction of Revenue recognition policies

performance obligations, including

significant payments

terms

---------------------------------- ---------------------------------------- ----------------------------------------

Direct Sales of Devices/Products Customers obtain control of medical Revenue is recognised when the goods

devices or products when the goods leave the warehouse or are delivered to

either leave the warehouse the customers

or when they physically arrive at the premises (depending on shipment terms).

customer premises based on the shipment

terms.

Invoices are generated at this point

with payment required within 30-60 days

depending on

customer terms.

---------------------------------- ---------------------------------------- ----------------------------------------

Sales to Distributors Distributors obtain control of medical Revenue is recognised when the goods

devices or products when the goods leave the warehouse or are delivered to

either leave the the customers

warehouse or when they physically premises (depending on shipment terms).

arrive at the distributor premises

based on the shipment

terms.

Invoices are generated at this point

with payment required within 30-60 days

depending on

distributor terms.

---------------------------------- ---------------------------------------- ----------------------------------------

Service/Maintenance Contracts Service & maintenance contracts are for Revenue is recognised over the life of

a set period of time as specified with the contract on a straight line basis.

the customer. We consider

Our performance obligations are this matches the satisfaction of our

satisfied over the length of the performance obligations of the

contract. contract.

Customers are invoiced monthly based on

the annual value of the contract

agreed.

---------------------------------- ---------------------------------------- ----------------------------------------

Demonstration/Placement Equipment Equipment may be provided free of Where the rights to an asset are

charge to the customer provided they retained by the Group the asset is

purchase ancillary depreciated over its useful

products, or it may transfer to them if life.

they purchase a set volume.

Where the customer obtains control of

No contract is deemed to exist under the equipment the revenue is recognised

IFRS 15 in relation to theplacement of over the period

the equipment, in which the right was obtained.

due to the Group retaining the

significant element of risks and Ancillary products sold are recognised

rewards including future cashflows, at the point of sale.

a lack of commercial substance in

relation to the equipment and

recoverability of the asset

without ability to enforce compensation

for the period of use of the equipment.

Where the

Group retains control of the equipment

it is classified as fixed asset.

Where the customer obtains control the

asset will be classified as a sold

product and not

held as an asset.

---------------------------------- ---------------------------------------- ----------------------------------------

Warranty Products manufactured by the Group have Revenue is only recognised when we

a warranty period. Customers have the consider it likely that the product

right to return will not be returned.

the product if it is faulty within this

period. We calculate a warranty provision based

on historical warranty data of

comparable products.

The warranty provision is

accounted of under IAS 37 as a

provision

and an expense.

---------------------------------- ---------------------------------------- ----------------------------------------

The revenue split between the Group for 2020 was as follows:

All figures GBP

----------------------------------- --------------------------------------------

Albyn subsidiaries 9,397,104

Creo Medical Limited subsidiaries 31,776

Total 9,428,880

----------------------------------- --------------------------------------------

Segmental reporting

Operating segments are identified on the basis of internal

reporting and decision making. Creo currently has one operating

segment which is the research, development and distribution of

electrosurgical medical devices relating to the field of surgical

endoscopy.

The acquisition of Albyn Medical SL and Boucart Medcial SRL in

the year was made to helps us achieve our objectives in this

segment. As the Group continues to grow we expect the internal

reporting structure to change to meet the changing goals and

objectives of the business and additional operating segments may be

identified in future reporting periods.

As there is only one reportable operating segment whole profit,

expenses, assets, liabilities and cashflows are measured and

reported on a basis consistent with the financial statements, with

no additional disclosures necessary.

Other operating income

Other operating income relates to research grants. Income is

recognised necessary to match it with the related costs in the

profit or loss on a systematic basis over the periods in which the

entity recognises expenses for the related costs for which the

grants are intended to compensate. Furthermore, income is

recognised only when there is reasonable assurance that the Company

will comply with any conditions attached to the grant and the grant

will be received. Grant income received during the year was GBP49k

(2019: GBP126k).

3. Loss before tax

The loss before income tax is stated after

charging/(crediting):

12 months 12 months

to to

31 December 31 December

(All figures GBP) 2020 2019

-------------------------------------------------- ------------ ------------

Depreciation - owned assets 581,813 369,382

Depreciation - assets on hire purchase contracts 36,235 41,545

Depreciation - right of use assets 320,751 154,429

Amortisation 657,620 76,368

Impairment of Intangible Assets 140,814 -

Research and development expenditure 10,192,891 8,146,338

--------------------------------------------------- ------------ ------------

4. Earnings per share

Earnings per share has been calculated in accordance with IAS 33

- Earnings Per Share using the loss for the period after tax,

divided by the weighted average number of shares in issue.

12 months 18 months

to to

31 December 31 December

(All figures GBP) 2020 2019

---------------------------------- ------------- -------------

(Loss)

(Loss) attributable to equity

holders of Company (basic) (20,315,725) (15,911,150)

Shares (number)

Weighted average number of

ordinary shares in issue during

the period 155,797,600 121,343,612

Earnings per share

Basic and diluted (0.13) (0.13)

------------------------------------- ------------- -------------

5. Share Capital 31 December 31 December

(All figures GBP) 2020 2019

----------------------------- ------------ ------------

Balance at start of period 150,378 120,495

Issue of share capital

Number of shares 7,512,423 29,883,373

Price per share (GBP) 0.001 0.001

Share value (GBP) 7,513 29,883

Balance at 31 December 2020 157,891 150,378

------------------------------ ------------ ------------

6. Subsequent events

MicroBlate Flex received FDA regulatory clearance in January

2021 and is the fourth device within Creo's portfolio of flexible

endoscopy devices for the gastrointestinal ('GI') market to receive

FDA regulatory clearance, alongside CE marking already received

across the range in 2020.

Post year end we have signed agreements with a number of

distributors to purchase and promote Creo products throughout

various regions. The distributor agreements signed were as

follows:

Distributor Signing Date Location

Welmore Co. Ltd. 27 January 2021 Taiwan

---------------- ------------

Hat-Med 04 March 2021 Vietnam

---------------- ------------

Suntek Medical 09 March 2021 South Korea

---------------- ------------

Medical Distributor Alliance 11 March 2021 Hong Kong

---------------- ------------

Avro Medical Sdn. Bhd. 19 April 2021 Malaysia

---------------- ------------

Hayleys Lifesciences (Pvt) Ltd 22 April 2021 Sri Lanka

---------------- ------------

Innovamedical 12 May 2021 Italy

---------------- ------------

Meditop Co Ltd 14 May 2021 Thailand

---------------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOOBRAVUNRAR

(END) Dow Jones Newswires

June 04, 2021 02:00 ET (06:00 GMT)

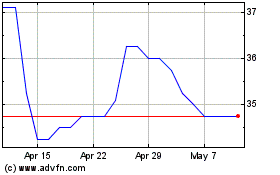

Creo Medical (LSE:CREO)

Historical Stock Chart

From Mar 2024 to Apr 2024

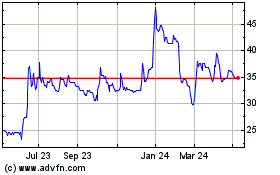

Creo Medical (LSE:CREO)

Historical Stock Chart

From Apr 2023 to Apr 2024