TIDMCSFS

RNS Number : 0926B

Cornerstone FS PLC

08 June 2021

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain .

8 June 2021

Cornerstone FS plc

("Cornerstone", the "Company" or the "Group")

Final Results

Notice of AGM and Publication of Annual Report

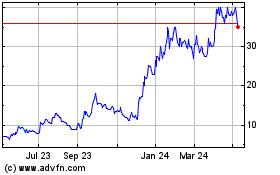

Cornerstone FS plc (AIM: CSFS), the cloud-based provider of

international payment, currency risk management and electronic

account services to SMEs, announces its final results for the year

ended 31 December 2020. In addition, the Company gives notices of

its annual general meeting ("AGM") and publication of its annual

report and accounts, both of which are now available to download

from the Company's website at

https://investors.cornerstonefs.com/document-centre/ .

Highlights*

-- Transformational acquisitions to position Cornerstone as a

fintech business focused on providing foreign currency

management:

o FXPress Payment Services Ltd ("FXPress"), a provider of

advanced payment systems as platform-as-a-service to SMEs

o Avila House Limited ("Avila House"), a licensed small e-money

institution

-- Revenue of GBP1.7m (2019: GBP1.2m)

-- Transacted payments worth over GBP462m (2019: GBP336m)

-- Onboarded 328 new clients (2019: 181)

-- Total number of clients increased to 732 (2019: 530)

-- Post period, Cornerstone was admitted to trading on AIM and

raised gross proceeds of GBP2.7m through the placing of ordinary

shares and convertible loan note facilities

* While the consolidated financial information has been issued

in the name of Cornerstone FS plc, the legal parent, it represents

in substance the continuation of the financial information of the

legal subsidiary, FXPress. As such, the prior-period comparatives

represent the results of FXPress only and are for a nine-month

period commensurate with FXPress' last accounting reference period.

See 'Basis of Consolidation' in the notes to the financial

statements for further information.

Julian Wheatland, Chief Executive Officer of Cornerstone,

said:

"It is a great pleasure to present Cornerstone's first annual

results as a public company following our IPO in April 2021. Amid a

year of global upheaval, 2020 was a milestone period for us;

establishing Cornerstone's foundations, making two key acquisitions

and culminating, post period, in our admission to AIM. While, along

with the rest of the industry, our trading volumes were impacted by

COVID-19, we successfully navigated the transition to home working

with no disruption to our operations or service provision.

"We have come to the market to build a significant business in

the provision of technology-enabled international payment services,

foreign exchange and currency risk management. While we are still

at the beginning of our journey, with our strong team and highly

scalable platform, we believe we are well-placed to take advantage

of the meaningful organic and acquisition opportunities that will

enable us to achieve this. We look forward to reporting on our

progress."

Enquiries

+44 (0)203 971

Cornerstone FS plc 4865

Julian Wheatland, Chief Executive

Officer

Judy Happe, Chief Financial Officer

+44 (0)203 368

SPARK Advisory Partners Limited (Nomad) 3550

Mark Brady, Neil Baldwin

Peterhouse Capital Limited (Joint +44 (0)207 469

Broker) 0930

Heena Karani, Lucy Williams

+44 (0)203 700

Pello Capital Limited (Joint Broker) 2500

Dan Gee, Mark Treharne

+44 (0)207 618

Luther Pendragon (Financial PR) 9100

Harry Chathli, Claire Norbury, Joe

Quinlan

Operational Review

The year to 31 December 2020 was transformational for

Cornerstone. It undertook two acquisitions to establish what

Cornerstone is today: a fintech business that makes managing

currency simple for international small- and medium-sized

businesses ("SMEs"). Whilst, along with the rest of the industry,

trading volumes were impacted by COVID-19, the Group successfully

navigated the disruption caused by the pandemic and progressed the

delivery of its strategy. This culminated with Cornerstone's

successful IPO, which occurred, post period, in April 2021 and

raised GBP2.7m. The IPO is a key element in the Group's strategy to

grow the business through acquisition as well as continuing

development of its own highly scalable, cloud-based software

platform.

Transformational Acquisitions

Cornerstone completed the acquisition of FXPress, a provider of

advanced payment systems as platform-as-a-service to SMEs, in

September 2020, which became the Group's main operating entity.

Alongside this, the Group disposed of the legacy Cornerstone

consumer business and adopted the name 'Cornerstone FS plc' (having

previously been 'Cornerstone Brands'). This marked the foundational

step towards the Group's goal of building a significant business in

the provision of international payment services for SMEs.

In October 2020, the Group acquired Avila House, a licensed

small e-money institution. This expanded the Group's product and

service capability to provide clients with access to multi-currency

accounts with individual IBAN numbers where they can deposit and

retain funds for future use. By bringing together the e-money

assets of Avila House and the technology of FXPress, the Group

signalled its intention to establish a portfolio of products and

services to optimise the foreign exchange payments process for

SMEs.

Performance

Ahead of the COVID-19 outbreak, FXPress, was delivering strong

growth, with revenue for the first half of 2020 being 28% ahead of

the same period of 2019. However, the public lockdowns and

associated reduction in economic activity led to a contraction in

trading volumes. As a result, for the full year, the Group

delivered slight growth on a pro rata basis, with revenue of

GBP1.7m for the 12 months ended 31 December 2020 compared with

GBP1.2m for the nine months ended 31 December 2019.

The majority of this revenue continued to be generated by

clients the Group serves on a white label basis, with revenue

generated through its introducer network (which is primarily white

label partners but also introducer brokers) being GBP1.4m and

accounting for 88% (2019 period: GBP1.0m and 84%). Clients that the

Group serves directly generated GBP0.2m for both 2020 and the prior

nine-month period, accounting for 12% and 16% respectively.

By client type, corporate accounts generated GBP1.5m in 2020

(2019 period: GBP1.1m), accounting for 92% (2019 period: 91%) of

total revenue. High net worth individuals ("HNWIs") generated

GBP0.1m for both 2020 and the earlier period, accounting for 8% and

9% of total revenue respectively. As at 31 December 2020, the Group

had 732 active clients, compared with 530 a year earlier, and

during the year onboarded 328 new clients (2019: 181).

Spot trades accounted for 94% of transactions (2019 period: 95%)

and 87% of revenue (2019 period: 90%), and forward currency

contracts accounted for 6% of transactions (2019 period: 5%) and

13% of revenue (2019 period: 10%). The difference between the

volume of transactions and proportion of revenue reflects the

higher levels of commission charged on forward transactions.

During 2020, FXPress conducted transactions between 59 different

currency pairs (2019 period: 43), with 88% of transactions being

between various combinations of Sterling, Euros and US Dollars

(2019 period: 89%).

In total, payments worth over GBP462m were transacted through

the FXPress platform in 2020 compared with approximately GBP336m

for the nine months ended 31 December 2019.

Product Enhancement

As part of the Group's continued and ongoing programme of

investment and development of its cloud-based technology platform,

several enhancements were implemented during the year. In addition

to integration with new banking and payment partners, the Group

introduced new platform features including:

-- virtual IBANs to allow each client to have their own account

in their name with a unique IBAN;

-- integration with Xero, a popular accounting platform, to

allow seamless organisation of payment runs; and

-- the launch of payment tracking, to allow clients to see the

progress of their payments en route to the payee.

COVID-19

As noted, COVID-19 and the associated economic slowdown resulted

in a reduction in trading volumes compared with the start of the

year. However, Cornerstone successfully navigated the transition

from office to home working for its employees, in line with

government guidance, and implemented a number of cost saving

measures. The Group's operations continued effectively with no

disruption to service provision. This was achieved thanks to the

cloud-based nature of its platform as well as the commitment of

Cornerstone's employees.

Brexit

The Group's sales have not been directly impacted by the UK's

withdrawal from the European Union. While, like the rest of the UK

financial services industry, the Group is currently unable to

market its services into the EU from the UK, it is not prevented

from doing business in the region. The Group has relatively few

European clients and they have continued to trade with the Group.

The Group is also currently considering options to be able to

resume marketing its services in the EU.

Financial Review

While the consolidated financial information has been issued in

the name of Cornerstone FS plc, the legal parent, it represents in

substance the continuation of the financial information of the

legal subsidiary, FXPress. As such, the prior-period comparatives

represent the results of FXPress only and are for the nine-month

period ended 31 December commensurate with FXPress' last accounting

reference period. The results of Cornerstone have been added to the

Group financials from 9 September 2020. The results of Avila House

are consolidated within FXPress for the period following the

acquisition on 19 October 2020. See 'Basis of Consolidation' in the

notes to the financial statements for further information.

The Group's revenue for the 12 months to 31 December 2020 was

GBP1.7m compared with GBP1.2m for the nine months to 31 December

2019, representing slight growth on a pro rata basis. This reflects

a strong first half of the year being largely offset by a weaker

second half due to the impact of the COVID-19 pandemic. Revenue was

generated almost entirely from the provision of foreign exchange

and payments services in the form of spot and forward trades,

accounting for 87% and 13% of revenue respectively (nine-month

period ended 31 December 2019: 90% and 10%).

As noted above, the slight increase in total revenue was due to

growth in the Group's core revenue streams, namely: sales generated

from its introducer network (for revenue by origin), which

primarily comprises revenue originating via white label partners

and also introducer brokers, and sales from corporate clients for

revenue by client type.

Gross margin for 2020 was 29.8% (2019 period: 43.4%) with the

reduction due to both the increasing proportion of revenue derived

through the Group's introducer network and that revenue being more

greatly weighted towards network partners who receive higher rates

of commission.

Total administrative expenses were GBP2.7m in 2020 compared with

GBP0.6m for the nine-month period ended 31 December 2019. This

includes:

-- GBP0.8m in costs related to the acquisitions of FXPress and

Avila House and to the IPO (2019 period: GBPnil), which completed

post year end;

-- GBP0.4m in share-based payment charges (2019 period: GBPnil),

including a GBP0.2m charge related to the reverse acquisition of

FXPress; and

-- staff and consultant costs of GBP0.9m compared with GBP0.3m

in the nine-month period ended 31 December 2019 as the Group

prepared itself for growth and its IPO.

The Group recognised a loss before tax of GBP2.2m for 2020

compared with GBP0.08m for the earlier period, which primarily

reflects the greater administrative expenses, but also the lower

gross margin. Loss per ordinary share on a basic and diluted basis

was 14.99 pence (2019 period: 0.73 pence), primarily due to the

greater loss, but also due to the larger share capital in 2020 (see

note 14 to the financial statements).

As at 31 December 2020, the Group had cash and cash equivalents

of GBP0.2m (31 December 2019: GBP0.08m). This followed a pre-IPO

fund raise during the year amounting to GBP1.0m, of which GBP0.8m

was received in cash and GBP0.2m arose through the issue of new

ordinary shares to settle service fee payments. During the year,

the Group also continued to invest in the development of its

technology platform, which accounted for GBP0.2m of the increase in

intangible assets to GBP0.3m (31 December 2019: GBP0.01m).

Post period, the Group's balance sheet was strengthened with the

raising of gross proceeds of GBP2.2m via a placing of new ordinary

shares. The Group also has access to GBP0.45m in convertible loan

note facilities.

Strategy Execution and Outlook

In 2020, Cornerstone took the initial steps in executing on its

growth strategy. The FXPress platform and business was brought

together with the Avila House e-wallet services under the

Cornerstone umbrella. The Group invested in sales automation

technology as part of its plan to increase its sales efforts and it

made a strategic hire with the appointment of a highly experienced

Chief Product Officer. The Group achieved a fundamental milestone,

post period, with the completion of its IPO on AIM, which lays the

foundations for the pursuit of further acquisitions.

Post year end, trading volumes have increased and the Group has

continued to expand its customer base. This year, 179 new customer

accounts have been opened, increasing the Group's total number of

customers to over 810, which gives a strong base on which to

build.

While Cornerstone is still at the beginning of its journey, with

a strong team and highly scalable platform, the Board believes that

the Group is well-placed to take advantage of the meaningful

opportunities to build a significant business offering

technology-enabled international payment services.

Notice of AGM and Publication of Annual Report

The Company gives notice that its AGM will be held at 11.00am

BST on Wednesday 30 June 2021 at 1 Poultry, London, EC2R 8EJ.

In view of the ongoing COVID-19 situation and the uncertainty

regarding restrictions on travel and public gatherings, the

directors have decided that shareholders (or any other guest,

including a proxy of a shareholder that is not the Chairman of the

AGM) will not be permitted to attend the AGM in person. The Company

will arrange for a minimum quorum of two shareholders necessary to

conduct the business of the AGM to be present at the meeting,

either in person or by electronic means.

The Board remains committed to shareholder engagement and

participation, and therefore shareholders will be able to access

the meeting via teleconference link. Please note that this

teleconference link will allow shareholders to listen to the

business of the AGM only - it will not be possible to use this

facility to vote or ask questions. There will not be any

presentations given by the directors at the AGM. Shareholders are

invited to submit questions in writing in advance of the AGM, which

will be responded to orally at the meeting.

Further information on registering to access the AGM via

teleconference and on submitting questions, along with details of

the resolutions to be proposed at the meeting, can be found in the

Notice of AGM that has been posted to shareholders and is available

on the Documents page of the Investor section of the Company's

website here: https://investors.cornerstonefs.com/document-centre/

.

In addition, the Company has today published its annual report

and accounts for the year ended 31 December 2020, which is

available on the Documents page of the Investor section of its

website here: https://investors.cornerstonefs.com/document-centre/

.

Group Statement of Comprehensive Income

For the year ended 31 December 2020

Year 9-month

ended period ended

31 December 31 December

2020 2019

Notes GBP GBP

REVENUE 1 1,664,237 1,240,938

Cost of sales (1,167,929) (702,000)

GROSS PROFIT 496,308 538,938

ADMINISTRATIVE EXPENSES 2

Share-based compensation 14 (358,443) -

Further adjustments to underlying profit

from operations (see below) (793,577) -

Other administrative expenses (1,499,589) (620,117)

TOTAL ADMINISTRATIVE EXPENSES (2,651,609) (620,117)

Underlying loss from operations (1,003,281) (81,179)

Stated after the add back of:

- share-based compensation on reverse

acquisition 14 211,281 -

- other share-based compensation 14 147,162 -

- transaction costs 793,577 -

------------------------------------------- ----- ------------ -------------

LOSS from operations 2 (2,155,301) (81,179)

Finance and other income 3 603 -

Finance costs 3 - (370)

LOSS BEFORE TAX (2,154,698) (81,549)

Income tax expense 6 - -

________ ________

LOSS FOR THE YEAR (2,154,698) (81,549)

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (2,154,698) (81,549)

Loss per ordinary share - basic

& diluted (pence) 7 (14.99) (0.73)

_______ _______

All amounts are derived from continuing operations.

The Notes to the Financial Statements form an integral part of

these financial statements.

Group and Company Statement of Financial Position

As at 31 December 2020

Group Group Company Company

31 December 31

31 December 31 December 2020 July

2020 2019 2020

Notes GBP GBP GBP GBP

assets

NON-CURRENT ASSETS

Intangible assets 8 320,972 6,076 226,278 -

Tangible assets 9 8,464 1,050 - -

Investments 10 - - 6,147,773 100

_______ _______ _______ _______

329,436 7,126 6,374,051 100

CURRENT ASSETS

Trade and other receivables 12 570,159 355,370 238,810 95,000

Cash and cash equivalents 183,675 78,265 96,394 -

_______ _______ _______ _______

753,834 433,635 335,204 95,000

_______ _______ _______ _______

total assets 1,083,270 440,761 6,709,225 95,100

_______ _______ _______ _______

equity and liabilities

equity

Share capital 14 165,887 91,559 165,887 286

Share premium 951,422 1,543,988 951,422 8,186,967

Share-based payment reserve 54,215 - 54,215 -

Merger relief reserve 5,557,645 - 5,557,645 -

Reverse acquisition reserve (3,140,631) - - -

Retained earnings (3,724,461) (1,569,763) (1,083,751) (8,092,153)

_______ _______ _______ _______

TOTAL EQUITY (135,923) 65,784 5,645,418 95,100

_______ _______ _______ _______

CURRENT LIABILITIES

Trade and other payables 13 1,219,193 374,977 1,063,837 -

_______ _______ _______ _______

TOTAL EQUITY AND LIABILITIES 1,083,270 440,761 6,709,255 95,100

_______ _______ _______ _______

A separate profit and loss account for the parent company is

omitted from the Group financial statements by virtue of section

408 of the Companies Act 2006. The Company loss for the five-month

period ended 31 December 2020 was GBP1,173,655 (seven-month period

ended 31 July 2020: profit of GBP63,418).

The financial statements were approved by the Board of Directors

and authorised for issue on 7 June 2021 and are signed on its

behalf by:

Julian Wheatland

Chief Executive Officer

Group Statement of Changes in Equity

For the year ended 31 December 2020

Share-based Reverse

Share Share payment Merger relief acquisition Retained

capital premium reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

April 2019 82,496 1,146,676 - - - (1,488,214) (259,042)

Issue of

shares 9,063 397,312 - - - - 406,375

Loss and total

comprehensive

income

for the year - - - - - (81,549) (81,549)

_______ _______ _______ _______ _______ _______ _______

Balance at 31

December 2019 91,559 1,543,988 - - - (1,569,763) 65,784

Parent company

reflected on

reverse

acquisition 5,197 - - - - - 5,197

Issue of

FXPress

Payment

Services

Ltd shares

prior to

acquisition 12,037 565,426 - - - - 577,463

Share-based

payments for

FXPress

Payment

Services Ltd

shares prior

to

acquisition - - 92,947 - - - 92,947

Costs of

raising

equity in

FXPress

Payment

Services Ltd - (50,000) - - (50,000)

Reverse

acquisition

adjustment (103,596) (2,059,414) (92,947) - 2,557,142 - 301,185

Issue of

shares 20,562 1,007,557 - - - - 1,028,119

Issue of

consideration

shares 140,128 - - 5,557,645 (5,697,773) - -

Costs of

raising

equity - (56,135) - - - - (56,135)

Share-based

payments

(note 14) - - 54,215 - - - 54,215

Loss and total

comprehensive

income

for the year - - - - - (2,154,698) (2,154,698)

_______ _______ _______ _______ _______ _______ _______

Balance at 31

December 2020 165,887 951,422 54,215 5,557,645 (3,140,631) (3,724,461) (135,923)

_______ _______ _______ _______ _______ _______ _______

Company Statement of Changes in Equity

For the five months ended 31 December 2020

Share-based Merger

Share payment relief Retained

Capital Share premium reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP

Balance at 1 January

2020 286 8,186,967 - - (8,155,571) 31,682

Profit and total comprehensive

income for the period - - - - 63,418 63,418

Balance at 31 July

2020 286 8,186,967 - - (8,092,153) 95,100

Bonus issues 4,911 (4,911) - - - -

Capital reduction - (8,182,057) - - 8,182,057 -

Issue of consideration

shares 140,128 - - 5,557,645 5,697,773

Issue of other shares 20,562 1,007,558 - - - 1,028,120

Costs of raising equity - (56,135) - - - (56,135)

Share-based payments - - 54,215 - - 54,215

Loss and total comprehensive

income for the period - - - - (1,173,655) (1,173,655)

_______ _______ _______ _______ _______ _______

Balance at 31 December

2020 165,887 951,422 54,215 5,557,645 (1,083,751) 5,645,418

_______ _______ _______ _______ _______ _______

Group and Company Cash Flow Statement

For the year ended 31 December 2020

Group Group Company Company

Year ended 9-month 5-month 7-month

31 December period period period

2020 ended ended ended

31 December 31 December 31 July

2019 2020 2020

GBP GBP GBP GBP

Notes

Loss before tax (2,154,698) (81,549) (1,173,655) 63,418

Adjustments to

reconcile profit

before tax to cash

generated

from operating

activities:

Finance income 3 (603) - (603) -

Finance costs 3 - 370 - -

Share-based

compensation 14 358,443 - 54,215 -

Depreciation and

amortisation 8,9 22,270 3,656 16,638 26,541

(Increase)/decrease

in accrued

income, trade and

other receivables (83,297) (120,731) (370,302) 800,188

Increase/(decrease)

in trade

and other payables 1,000,240 96,290 1,069,655 (1,315,279)

_______ _______ _________ _______

Cash used in

operations (857,645) (101,964) (404,052) (425,132)

Income tax paid - - - -

_______ _______ _________ _______

Cash used in

operating

activities (857,645) (101,964) (404,052) (425,132)

Investing activities

Acquisition of

property, plant

and equipment 9 (9,144) - - -

Acquisition of

intangible

assets 8 (335,436) - (242,916) -

_______ _______ _________ _______

Cash used in

investment

activities (344,580) - (242,916) -

Financing activities

Shares issued (net

of costs) 14 1,212,032 406,375 647,759 -

Repayment of - (381,300) - -

shareholder loans

Loans received 95,000 - 95,000 -

Interest and similar

income 603 - 603 -

Interest and similar - (370) -

charges

_______ _______ __________ _______

Cash generated from

financing

activities 1,307,635 24,705 743,362 -

Increase/(decrease)

in cash

and cash

equivalents 105,410 (77,259) 96,394 (425,132)

Opening cash and

cash equivalents 78,265 155,524 - 425,132

_______ _______ ________ _______

Closing cash and

cash equivalents 183,675 78,265 96,394 -

===================== ===================== ===================== =====================

Notes to the Financial Statements

For the year ended 31 December 2020

BAsis of preparation

Cornerstone FS plc is a public limited company, incorporated and

domiciled in England. T he Company was admitted to AIM, London

Stock Exchange's market for small and medium size growth companies,

on 6 April 2021 . The registered office of the Company is The Old

Rectory, Addington, Buckingham, England, MK18 2JR, and its

principal business address is 1 Poultry, London, EC2R 8EJ. The main

activities are set out in the Strategic Report on pages 2-14 of the

annual report and accounts.

These financial statements have been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union ("IFRS") for the year ended 31 December 2020 and the

comparative 9-month period to 31 December 2019, and with those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS. The financial statements have been prepared in

sterling, which is the Group's presentation currency and the

functional currency of each Group entity. They have been prepared

using the historical cost convention except for the measurement of

certain financial instruments.

The parent company accounts have also been prepared in

accordance with IFRS and using the historical cost convention. The

accounting policies set out below have been applied consistently to

the parent company where applicable.

Monetary amounts in these financial statements are rounded to

the nearest pound.

The preparation of the financial statements requires management

to make estimates and assumptions that affect the reported amounts

of revenues, expenses, assets and liabilities, and the disclosure

of contingent liabilities at the date of the financial statements.

If in the future such estimates and assumptions, which are based on

management's best judgement at the date of the financial

statements, deviate from the actual circumstances, the original

estimates and assumptions will be modified as appropriate in the

year in which the circumstances change.

NEW STANDARDS AND INTERPRETATIONS

As of the date of approval of these financial statements, the

following Standards and Interpretations which have not been applied

in these financial statements were in issue but not yet

effective:

-- IFRS 17 Insurance Contracts (effective p/c on or after 1 January 2021).

-- Amendments to IAS 1, presentation of financial statements on

classification of liabilities (effective p/c on or after 1 January

2022).

Some of these standards and amendments have not yet been

endorsed by the EU which may cause their effective dates to

change.

The Directors anticipate that the adoption of these Standards

and Interpretations in future periods will have no material impact

on the financial statements of the Group. The Group does not intend

to apply any of these pronouncements early.

IMPACT OF NEW INTERNATIONAL REPORTING STANDARDS, AMMENTS AND

INTERPRETATIONS

The following Standards and Interpretations have been considered

and applied in these financial statements:

-- IFRIC 23 Uncertainty over Income Tax Positions

-- Amendments to IFRS 9 Prepayment Features with Negative Compensation

-- Amendments to IAS 28 Long-term interests in Associates and Joint Ventures

-- IFRS 16 Leases

There has been no material impact on the financial statements as

a result of adopting these Standards and Interpretations.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiary undertakings. Entities

are accounted for as subsidiary undertakings when the Group is

exposed to or has rights to variable returns through its

involvement with the entity and it has the ability to affect those

returns through its power over the entity.

Details of subsidiary undertakings and % shareholding:

FXPress Payment Services Ltd - 100% owned by the Company

Avila House Limited - 100% owned by FXPress Payment Services Ltd

CS Commercial Limited - 100% owned by the Company

Cornerstone EBT Trustee Limited - 100% owned by the Company

All subsidiary undertakings have an accounting reference date

ended 31 December.

Although the consolidated financial information has been issued

in the name of Cornerstone FS plc ("Cornerstone"), the legal

parent, it represents in substance continuation of the financial

information of the primary legal subsidiary, FXPress Payment

Services Ltd.

The assets and liabilities of the primary legal subsidiary are

recognised and measured in the consolidated financial statements at

the pre-combination carrying amounts and not re-stated at fair

value.

The retained earnings and reserves balances recognised in the

consolidated financial statements reflect the retained earnings and

other reserves of the primary legal subsidiary immediately before

the business combination and the results of the period from 1

January 2020 to the date of the business combination are those of

the primary legal subsidiary only.

As FXPress Payment Services Ltd reversed into Cornerstone when

Cornerstone did not have an existing trade, the transaction cannot

be considered a business combination, as at the time of the reverse

takeover, Cornerstone did not meet the definition of a business,

under IFRS 3 "Business Combinations". As the transaction is capital

in nature and completed through the issue of shares, it falls

within the scope of IFRS 2 'Share-based payments'. Any difference

in the fair value of shares deemed to be issued by the legal

subsidiary (FXPress Payment Services Ltd) and the fair value of net

identifiable assets in the legal parent (Cornerstone FS plc) forms

part of the deemed cost of acquisition.

GOING CONCERN

During the year ended 31 December 2020, the Group made a loss of

GBP2,154,698, which has resulted in the balance sheet showing a net

liabilities position of GBP135,923. Post year-end, the Group's

balance sheet was strengthened with the raising of gross proceeds

of GBP2.2m via a placing of new ordinary shares following the

Company's admission to AIM. The Group also has access to GBP450,000

in convertible loan note facilities.

The Directors have prepared a cash flow forecast covering a

period extending 24 months from 31 December 2020. The Directors

have taken into account the placing proceeds mentioned above, the

historical growth and the inherent risks and uncertainties facing

the Group's business, and have derived forecast assumptions that

are their best estimate of the future development of Group's

business. The Directors have also run various scenario planning

forecasts alongside their best-estimate forecast assumptions, which

all indicate sufficient cash resources to continue to finance the

Group's working capital requirements over the forecast period.

The Directors are mindful of COVID-19 and the impact that this

has had on operations is discussed further in note 20. The Board

have reviewed forecasts in light of this and do not consider there

to be any material uncertainties pertaining to the Group's ability

to discharge its liabilities as they arise.

For these reasons, the Directors continue to adopt the going

concern basis of accounting in preparing the Group's financial

statements.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

revenue

The Group applies IFRS 15 Revenue from Contracts with Customers

for the recognition of revenue. IFRS 15 established a comprehensive

framework for determining whether, how much and when revenue is

recognised. It affects the timing and recognition of revenue items,

but not generally the overall amount recognised.

The performance obligations of the Group's revenue streams are

satisfied on the transaction date or by the provision of the

service for the period described in the contract. Revenue is not

recognised where there is evidence to suggest that customers do not

have the ability or intention to pay. The Group does not have any

contracts with customers where the performance obligations have not

been fully satisfied.

The Group derives revenue from the provision of foreign exchange

and payment services. When a contract with a client is entered

into, it immediately enters into a separate matched contract with

its institutional counterparty.

Spot and forward revenue is recognised when a binding contract

is entered into by a client and the rate is fixed and determined.

Revenue represents the difference between the rate offered to

clients and the rate received from its institutional

counterparties.

INVESTMENTS

Investments in subsidiary undertakings are accounted for at cost

less impairment.

FINANCIAL INSTRUMENTS

Financial assets and financial liabilities are recognised on the

Group Statement of Financial Position when the Group has become a

party to the contractual provisions of the instrument.

Derivative financial instruments

Derivative financial assets and liabilities are carried as

assets when their fair value is positive and as liabilities when

their fair value is negative. Changes in the fair value of

derivatives are included in the income statement. The Group's

derivative financial assets and liabilities at fair value through

profit or loss comprise solely of forward foreign exchange

contracts.

Trade, loan and other receivables

Trade and loan receivables are initially measured at their

transaction price. Trade and loan receivables are held to collect

the contractual cash flows which are solely payments of principal

and interest. Therefore, these receivables are subsequently

measured at amortised cost using the effective interest rate

method. The Directors have considered the impact of discounting

trade and loan receivables whose settlement may be deferred for

lengthy periods and concluded that the impact would not be

material.

An impairment loss is recognised for the expected credit losses

on trade and loan receivables when there is an increased

probability that the counterparty will be unable to settle an

instrument's contractual cash flows on the contractual due dates, a

reduction in the amounts expected to be recovered, or both.

Impairment losses and any subsequent reversals of impairment

losses are adjusted against the carrying amount of the receivable

and are recognised in profit or loss.

Trade payables

Trade payables are initially recognised at fair value and

subsequently at amortised cost using the effective interest

method.

Equity instruments

Equity instruments issued by the Group are recorded at the

proceeds received, net of direct issue costs.

Financial liabilities

Financial liabilities are classified according to the substance

of the contractual arrangements entered into. An instrument will be

classified as a financial liability when there is a contractual

obligation to deliver cash or another financial asset to another

enterprise.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand, deposits held

at call with banks and other short-term highly liquid investments

with original maturities of three months or less.

For the purposes of the Cash Flow Statement, cash and cash

equivalents consist of cash and cash equivalents as defined above,

net of any outstanding bank overdraft which is integral to the

Group's cash management.

INTANGIBLE aSSETS

An intangible asset, which is an identifiable non-monetary asset

without physical substance, is recognised to the extent that it is

probable that the expected future economic benefits attributable to

the asset will flow to the Group and that its cost can be measured

reliably. The asset is deemed to be identifiable when it is

separable or when it arises from contractual or other legal

rights.

Amortisation is charged on a straight-line basis through the

profit or loss within administrative expenses. The rates

applicable, which represent the Directors' best estimate of the

useful economic life, are as follows:

Internally developed software - 3 years

Software costs - 3 years

Other intangible assets - 3 years (no charge in the first period

of ownership)

property, plant and equipment

All property, plant and equipment is initially recorded at cost

and is subsequently measured at cost less accumulated depreciation

and any recognised impairment loss.

Depreciation, which is charged through the profit or loss within

administrative expenses, is provided at rates calculated to write

off the cost less residual value of each asset over its expected

useful life, as follows:

Computer equipment - 25% straight line

The gain or loss arising on the disposal or retirement of an

asset is determined as the difference between the sales proceeds

and the carrying amount of the asset and is recognised in profit or

loss.

PROVISIONS

Provisions are recognised when the Group has a present

obligation as a result of a past event which it is probable will

result in an outflow of economic benefits that can be reliably

estimated.

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares are shown in share

premium as a deduction from the proceeds.

SHARE-BASED COMPENSATION

Where share options are awarded to employees, the fair value of

the options at the date of grant is charged to the income statement

over the vesting period. Non-market vesting conditions are taken

into account by adjusting the number of equity instruments expected

to vest at each balance sheet date so that, ultimately, the

cumulative amount recognised over the vesting period is based on

the number of options that eventually vest. Market vesting

conditions are factored into the fair value of the options

granted.

As long as all other vesting conditions are satisfied, a charge

is made irrespective of whether the market vesting conditions are

satisfied. The cumulative expense is not adjusted for failure to

achieve a market vesting condition.

Where the terms and conditions of options are modified before

they vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the income statement over the remaining vesting period. Where

equity instruments are granted to persons other than employees, the

income statement is charged with fair value of goods and services

received.

Cancelled or settled options are accounted for as an

acceleration of vesting and the amount that would have been

recognised over the remaining vesting period is recognised

immediately.

The proceeds received net of any attributable transaction costs

are credited to share capital (nominal value) and share premium

when the options are exercised.

Fair value is measured by use of the Black-Scholes pricing model

which is considered by management to be the most appropriate method

of valuation.

employee benefits

The Group operates a defined contribution pension scheme. The

pension costs charged in the financial statements represent the

contribution payable by the Group during the year.

The costs of short-term employee benefits are recognised as a

liability and an expense in the period the related service is

rendered at the undiscounted amount of the benefits expected to be

paid in exchange for that service.

TAXATION

Current income tax assets and liabilities are measured at the

amount expected to be recovered from or paid to the taxation

authorities. The tax rates and tax laws used to compute the amount

are those that are enacted or substantively enacted at the

reporting date. Current income tax relating to items recognised

directly in equity or other comprehensive income is recognised in

equity and not in the consolidated statement of comprehensive

income.

Deferred income tax is provided on all temporary differences at

the reporting date arising between the tax bases of assets and

liabilities and their carrying amounts for financial reporting

purposes. Deferred tax assets and liabilities are offset when the

Group has a legally enforceable right to offset current tax assets

and liabilities and the deferred tax assets and liabilities relate

to taxes levied by the same tax authority.

Deferred tax assets have not been recognised in respect of the

Group's tax losses carried forward.

Research and Development tax credits are not recognised as

receivables until the claims have been submitted and agreed by

HMRC.

CRITIAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Group makes estimates and assumptions concerning the future.

The resulting accounting judgements will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year are discussed below.

IMPAIRMENT

At each accounting reference date, the Group reviews the

carrying amounts of its intangibles, property, plant and equipment

to determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any).

Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs. An

intangible asset with an indefinite useful life is tested for

impairment annually and whenever there is an indication that the

asset may be impaired.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in profit or loss,

unless the relevant asset is carried in at a revalued amount, in

which case the reversal of the impairment loss is treated as a

revaluation increase.

SHARE-BASED COMPENSATION

The fair value of share-based awards is measured using the

Black-Scholes model which inherently makes use of significant

estimates and assumptions concerning the future applied by the

Directors. Such estimates and judgements include the expected life

of the options and the number of employees that will achieve the

vesting conditions. Further details of the share option scheme are

given in note 14 .

ALTERNATIVE PERFORMANCE MEASURES

The Group uses the alternative performance measure of underlying

profit/(loss) from operations. This measure is not defined under

IFRS, nor is it a measure of financial performance under IFRS.

This measure is sometimes used by investors to evaluate a

company's operational performance with a long-term view towards

adding shareholder value. This measure should not be considered an

alternative, but instead supplementary, to profit/(loss) from

operations and any other measure of performance derived in

accordance with IFRS.

Alternative performance measures do not have generally accepted

principles for governing calculations and may vary from company to

company. As such, the underlying profit/(loss) from operations

quoted within the Group Statement of Comprehensive Income should

not be used as a basis for comparison of the Group's performance

with other companies.

UNDERLYING PROFIT/(LOSS) FROM OPERATIONS

The Group uses underlying profit/(loss) from operations, defined

as profit/(loss) from operations, adding back share-based

compensation and transaction costs associated with the Group's AIM

listing and acquisitions strategy.

The underlying loss from operations is reconciled back to the

loss from operations within the Group Statement of Comprehensive

Income.

1 revenue and SEGMENTAL REPORTING

All of the Group's revenue arises from activities within the UK.

Management considers there to be only one operating segment within

the business based on the way the business is organised and the way

results are reported internally.

Revenue is as follows:

Group Group

9-month

Year ended period ended

31 December 31 December

2020 2019

GBP GBP

_______ _______

Total revenue 1,664,237 1,240,938

_______ _______

Group Group

9-month period

Year ended ended 31

31 December December

2020 2019

2 LOSS FROM OPERATIONS GBP GBP

Loss from operations is stated after charging:

Share-based compensation on reverse acquisition 211,281 -

Other share-based compensation 147,162 -

Transaction costs 793,577 -

Expensed software development costs 42,333 43,000

Depreciation of property, plant and equipment 1,730 729

Amortisation of intangible assets 20,540 2,926

Short-term (2018 IAS 17 operating) lease rentals 70,697 69,992

_______ _______

Amounts payable to the Group's auditor in respect of both audit

and non-audit services:

Year ended 31 9-month period

December 2020 ended 31 December

2019

GBP GBP

Audit Services

* Statutory audit 15,000 -

Other Services

The auditing of accounts of associates

of the Company pursuant to legislation:

* Audit of subsidiaries and its associates 16,500 8,000

------------------------- -------------------------

31,500 8,000

========================= =========================

Group Group

9-month period

Year ended ended 31

31 December December

3 INTEREST AND SIMILAR ITEMS 2020 2019

GBP GBP

i. Total finance and other income 603 -

_______ _______

ii. Total finance costs - 370

_______ _______

4

Employees

The average monthly numbers of employees in the Group (including

the Directors) during the year was made up as follows (the Company

has no employees other than the Directors):

Year

ended 9-month period

31 ended 31

December December

2020 2019

Number Number

Directors - -

Employees 9 6

_______ _______

9 6

_______ _______

9-month period

Year ended ended 31

31 December December

Employment costs 2020 2019

GBP GBP

Wages and salaries 618,522 135,557

Social security costs 68,455 13,899

Pension costs 5,930 4,073

Share-based compensation 26,787 -

_______ _______

719,694 153,529

_______ _______

remuneration of key management personnel

The remuneration of the Directors, who are the key management

personnel of the Group, is set out below in aggregate. Further

information about the remuneration of the individual directors

is provided in the Directors' Remuneration Report on pages 24-26

of the annual report and accounts.

9-month period

Year ended ended 31

31 December December

2020 2019

GBP GBP

Salaries and fees 116,786 -

Share-based compensation 20,088 -

Social security costs 9,453 -

_______ _______

146,327

_______ _______

Number Number

Number of Directors to whom retirement benefits

are accruing under a defined contribution

scheme - -

9-month period

Year ended ended 31

31 December December

2020 2019

GBP GBP

The remuneration in respect of the highest

paid Director was:

Salaries and fees 85,000 -

Share-based compensation 15,452 -

Social security costs 5,580 -

_______ _______

106,032 -

_______ _______

During the year no (2019: nil) Directors exercised any (2019:

nil) share options.

5 Pension costs

The Group operates a defined contribution pension scheme. The

scheme and its assets are held by independent managers. The pension

charge represents contributions due from the Group and amounted to

GBP5,930 (2019: GBP4,070). At 31 December 2020 contributions of

GBP2,490 remained outstanding and are included within other

payables (31 December 2019: GBP543).

6 taxation

The tax on the loss on ordinary activities for the period was as

follows:

Group Group

9-month period

Year ended ended 31

31 December December

2020 2019

GBP GBP

_______ _______

Current Tax:

UK Corporation tax - -

Deferred tax - -

_______ _______

Tax on loss on ordinary activities - -

_______ _______

Group Group

9-month period

Year ended ended 31

31 December December

2020 2019

GBP GBP

Loss before taxation (2,154,698) (81,549)

_______ _______

Loss multiplied by main rate of corporation

tax in the UK of 19% (9-month ended 31 December

2019: 19%) (409,393) (15,494)

Effects of:

Expenses not deductible for tax purposes 155,158 656

Share-based payments 68,104 -

Other deductions in period (1,446) -

Tax losses carried forward 185,577 14,838

_______ _______

Current tax - -

_______ _______

As at 31 December 2020, the Group had prepared but not yet

submitted a Research and Development tax credits reclaim, the

estimated net benefit of which is approximately GBP62,000. It has

not been recognised as an asset due to its contingent nature.

As at 31 December 2020, the Group had tax losses carried forward

of GBP2,847,347 (31 December 2019: GBP1,860,098). Deferred tax has

not been recognised in respect of these tax losses. The standard

rate of corporation tax applicable to the Group for the year ended

31 December 2020 was 19.0%. The UK government has indicated that

the rate of corporation tax may be increased to 25% with effect

from 1 April 2023.

7 LOSS PER SHARE

The loss per share of 14.99p is based upon the loss of

GBP2,154,698 (2019: loss of GBP81,549) and the weighted average

number of ordinary shares in issue for the year of 14,370,030

(2019: 11,221,348).

The loss incurred by the Group means that the effect of any

outstanding warrants and options would be considered anti-dilutive

and is ignored for the purposes of the loss per share

calculation.

8 GROUP INTANGIBLE ASSETS

Internally

developed Software

software costs Other Total

GBP GBP GBP GBP

COST

At 1 January 2020 - 15,611 - 15,611

Additions 242,916 - - 242,916

Acquired through business combination - - 92,520 92,520

_______ _______ _______ _______

At 31 December 2020 242,916 15,611 92,520 351,047

AMORTISATION

At 1 January 2020 - 9,535 - 9,535

Charge for the period 16,638 3,902 - 20,540

_______ _______ _______ _______

At 31 December 2020 16,638 13,437 - 30,075

NET BOOK VALUE

At 31 December 2020 226,278 2,174 92,520 320,972

_______ _______ _______ _______

At 31 December 2019 - 6,076 - 6,076

_______ _______ _______ _______

Other intangible assets comprise regulatory licenses held at

cost and are not amortised in the first period of ownership.

Company INTANGIBLE ASSETS

Internally

developed Software

software costs Other Total

GBP GBP GBP GBP

COST

At 1 August 2020 - - - -

Additions 242,916 - - 242,916

_______ _______ _______ _______

At 31 December 2020 242,916 - - 242,916

AMORTISATION

At 1 August 2020 - - - -

Charge for the period 16,638 - - 16,638

_______ _______ _______ _______

At 31 December 2020 16,638 16,638

NET BOOK VALUE

At 31 December 2020 226,278 - - 226,278

_______ _______ _______ _______

At 31 July 2020 - - - -

_______ _______ _______ _______

9 GROUP property, plant and equipment

Computer Equipment

GBP

COST

At 1 January 2020 6,531

Additions 9,144

At 31 December 2020

15,675

-------------

DEPRECIATION

At 1 January 2020 5,481

Charge for the period 1,730

At 31 December 2020

7,211

-------------

NET BOOK VALUE

At 31 December 2020 8,464

-------------

At 31 December 2019 1,050

-------------

10 investments

Investments

in

Subsidiaries

GBP

Cost or Valuation

At 1 August 2020 100

Additions 6,147,773

Disposals (100)

At 31 December 2020

6,147,773

------------

Net Book value

At 31 December 2020 6,147,773

------------

At 31 July 2020 100

------------

The Company's investment as at 31 December 2020 represents the

initial investment in FXPress Payment Services Ltd on 9 September

2020 and a further GBP450,000 invested on 31 December 2020.

On 9 September 2020, the Company acquired the entire issued

share capital of FXPress Payment Services Ltd ("legal subsidiary")

for a consideration of GBP5,697,773, satisfied by the issue of

1,401,275,638 shares.

Prior to the acquisition, on 7 July 2020, the legacy business

and trade of Cornerstone (formerly Cornerstone Brands, a consumer

product business) together with its trade, assets and liabilities,

was hived down to a newly incorporated wholly-owned subsidiary,

CSTT Limited ("CSTT"). Cornerstone's investment in CSTT, stated at

cost, was GBP100. The disposal of CSTT to the prior owners of the

legacy business was approved by shareholders at a general meeting

on 26 August 2020 and completed on 9 September 2020.

As the legal subsidiary reversed into the Company ("legal

parent"), without an existing trade, this transaction cannot be

considered a business combination, as the legal parent did not meet

the definition of a business, under IFRS 3 "Business

Combinations".

As the transaction is capital in nature and completed through

the issue of shares it falls within the scope of IFRS 2

'Share-based payments'. Any difference in the fair value of shares

deemed to be issued by the legal subsidiary and the fair value of

net identifiable assets in the legal parent will form part of the

deemed cost of acquisition.

Shares in subsidiary and associate undertakings are stated at

cost. As at 31 December 2020, Cornerstone FS plc owned the

following principal subsidiaries which are included in the

consolidated accounts:

Principal Country Registered Percentage

Subsidiary Activity of Incorporation Office of Ownership

------------------------ ------------ ----------------- ----------------- -------------

FXPress Payment Services Foreign Northern 1 Elmfield 100 per

Ltd Exchange Ireland Avenue, cent.

and Payment Warrenpoint,

Services Newry,

Co. Down,

BT34 3HQ

Avila House Limited E-money England The Old 100 per

and Payment and Wales Rectory, cent.

Services Addington,

Buckinghamshire,

MK18 2JR

CS Commercial Limited Dormant England The Old 100 per

(audit exempt) and Wales Rectory, cent.

Addington,

Buckinghamshire,

MK18 2JR

Cornerstone EBT Trustee Employee England The Old 100 per

Limited Benefit and Rectory, cent.

(audit exempt) Scheme Wales Addington,

Trustee Buckinghamshire,

MK18 2JR

11 Avila House acquisition

On 19 October 2020 FXPress Payment Services Ltd acquired the

entire issued share capital of Avila House Limited ("Avila House"),

a company which has a small electronic money institution licence

focused on multi-currency e-wallets, for a total consideration of

GBP92,685 (satisfied by GBP60,000 in shares and GBP32,685 in cash).

The acquisition was made in line with the Group's strategy to allow

clients to leave funds on deposit, effectively providing them with

multi-currency current accounts.

The Group determined that the activities and assets acquired

represent a business as defined under IFRS 3 Business Combinations

and has accounted for the transaction accordingly.

The net assets acquired at the date of acquisition were

determined to be GBP92,520, representing the fair value of the FCA

registered small electronic money institution licence, which was

the only asset held by Avila House at the time of acquisition.

No goodwill arose as a result of the acquisition.

Since the acquisition date, Avila House has not generated any

revenue (also in line with the Group's product development roadmap)

and generated a loss of GBP3,822, which is included in the

consolidated financial statements.

12 current trade and other receivables

Group Group Company Company

31 December 31 December 31 December 31 July

2020 2019 2020 2020

GBP GBP GBP GBP

Trade receivables 8,405 7,720 - -

Prepayments and accrued income 24,623 - 9,600 -

Derivative financial assets at fair

value 299,035 281,134 - -

Other receivables 140,378 66,516 131,492 -

Amounts due from Group undertakings

and undertakings in which the Company

has a participating interest - - - 95,000

Taxes and social security 97,718 - 97,718 -

_______ _______ _______ _______

570,159 355,370 238,310 95,000

_______ _______ _______ _______

For the year ended 31 December 2020, GBPnil was recorded as a

bad debt expense (nine-month period ended 31 December 2019:

GBPnil).

As at 31 December 2020, the Group had a contingent asset in

respect of Research and Development tax credits for which a reclaim

had been prepared, but not yet submitted (31 December 2019:

GBPnil). The estimated net benefit of the claim is approximately

GBP62,000 and has not been included in current receivables due to

its contingent nature.

13 current trade and other payables

Group Group Company Company

31 December 31 December 31 December 31 July

2020 2019 2020 2020

GBP GBP GBP GBP

Trade payables 525,064 101,577 238,654 -

Derivative financial liabilities

at fair value 216,061 249,989 - -

Other tax and social security 47,273 5,458 17,411 -

Other payables and accruals 430,795 17,953 290,773 -

Amount due to Group undertakings - - 516,999 -

_______ _______ _______ _______

1,219,193 374,977 1,063,837 -

_______ _______ _______ _______

14 Share capital AND Reserves

Allotted, called up and fully paid

Ordinary

shares Share capital

No. GBP

Ordinary shares of GBP0.00001 each

as at 1 August 2020 28,597,462 286

Bonus issue of GBP0.00001 shares 9

August 2020 257,377,158 2,573

Consolidation to GBP0.0001 9 August

2020 (257,377,158) -

Issue of consideration shares of GBP0.0001

9 September 2020 1,401,275,638 140,128

Bonus issue of GBP0.0001 shares 10

September 2020 23,363,722 2,336

Issue of new shares of GBP0.0001 16

September 2020 13,438,678 1,344

Consolidation to GBP0.01 shares 2 October

2020 (1,452,008,745) -

Issue of new shares of GBP0.01 October

to December 2020 1,921,853 19,219

_______ _______

Ordinary shares of GBP0.01 each at

31 December 2020 16,588,608 165,886

_______ _______

At 31 December 2020 share subscriptions of GBP131,492,

comprising GBP2,630 share capital and GBP128,862 share premium,

remained unpaid (31 July 2020: GBPnil).

The following changes in the share capital of the Company have

taken place in the five-month period ended 31 December 2020:

-- On 26 August 2020, the Company issued 9 bonus shares for

every share in issue and subsequently consolidated such shares, in

respect of each relevant class of shares, on the basis of 10 shares

of GBP0.00001 each into 1 share of GBP0.0001 each;

-- on 9 September 2020, 1,401,275,638 new A ordinary shares of

GBP0.0001 each were issued as consideration shares to FXPress

Payment Services Ltd shareholders pursuant to the acquisition;

-- on 10 September 2020, 23,363,722 new bonus E ordinary shares of GBP0.0001 each were issued;

-- on 16 September 2020, 13,438,598 new A ordinary shares of

GBP0.0001 each were issued at a price of GBP0.005 each and 80 new A

ordinary shares of GBP0.0001 each were issued for the purposes of

ensuring there would be a whole number of shares in issue upon the

proposed consolidation on 2 October 2020;

-- on 2 October 2020, the entire issued share capital of the

Company comprising different classes of shares were re-designated

and consolidated on the basis of 100 shares of GBP0.0001 each into

1 Ordinary Share of GBP0.01 each;

-- on 3 October 2020, 1,390,018 Ordinary Shares were issued at a

price of GBP0.50 each and 211,835 Ordinary Shares were issued in

consideration for services at an equivalent price of GBP0.50 per

share;

-- on 19 October 2020, 120,000 Ordinary Shares were issued as

consideration shares to the shareholders of Avila House in

accordance with the terms of the share purchase agreement; and

-- on 1 December 2020, 200,000 Ordinary Shares were issued at a price of GBP0.50 each.

All Ordinary Shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

As at 31 December 2020, GBP131,492 of issued share capital was

unpaid (31 December 2019: GBP26,247).

The following describes the nature and purpose of each reserve

within owner's equity:

Share capital : Amount subscribed for shares at nominal

value.

Share premium : Amount subscribed for share capital in excess of

nominal value, less costs of share issue.

Share-based payment reserve : The share-based payment reserve

comprises the cumulative expense representing the extent to which

the vesting period of warrants and share options has passed and

management's best estimate of the achievement or otherwise of

non-market conditions and the number of equity instruments that

will ultimately vest.

Merger relief reserve : Effect on equity of the consideration

shares issued over their nominal value.

Reverse acquisition reserve : Effect on equity of the reverse

acquisition of FXPress Payment Services Ltd.

Retained losses : Cumulative realised profits less cumulative

realised losses and distributions made, attributable to the equity

shareholders of the Company.

Options

The Company operates an Enterprise Management Inventive ("EMI")

Scheme equity-settled share-based remuneration scheme for

employees.

Each of the option agreements under the EMI scheme provides that

the relevant options vest, as to one third of the shares comprised

in them, on each of the first three anniversaries of the date of

grant. Once vested, the options are exercisable at any time. The

options are also exercisable in the event of a change of control.

If the optionholder's employment within the Group is terminated,

other than for gross misconduct, any options vested may be

exercised within 90 days of such termination (12 months in the case

of the optionholder's death). Otherwise the options lapse five

years after the date of grant. The options also lapse, inter alia,

if the optionholder is adjudged bankrupt or proposes a voluntary

arrangement or other scheme in relation to his/her debts.

Weighted

average

Ordinary exercise

shares price

No. GBP

Outstanding as at 1 August 2020 - -

Granted during the period 1,599,480 0.50

_______ _______

Outstanding as at 31 December 2020 1,599,480 0.50

_______ _______

On 2 December 2020 Julian Wheatland was granted options over

922,677 Ordinary Shares at an exercise price of GBP0.50 per share.

The Company has also agreed to make an annual grant of additional

options to Julian Wheatland equal to 5% of any increase in the

fully diluted capital of the Company which has occurred in the 12

months immediately prior to the date of grant to be exercisable at

a price equal to the average mid-market closing price of the

Ordinary Shares over the relevant 12-month period.

On 2 December 2020 Judy Happe was granted options over 276,803

Ordinary Shares at an exercise price of GBP0.50 per share. The

Company has also agreed to make an annual grant of additional

options to Judy Happe equal to 1.5% of any increase in the fully

diluted capital of the Company which has occurred in the 12 months

immediately prior to the date of grant to be exercisable at a price

equal to the average mid-market closing price of the Ordinary

Shares over the relevant 12-month period.

On 2 December 2020 a further 400,000 options were granted to

other senior employees at an exercise price of GBP0.50 per

share.

The Black-Scholes model was used for calculating the cost of

options. The model inputs for the options issued were:

Grant date - 2 December 2020

Share price at grant date - 50 pence

Exercise price - 50 pence

Risk free rate - 0.8%

Expected volatility - 83.7% (based on reference to the Group's quoted competitors)

Contractual life - 5 years

Market performance conditions were ignored in determining the

fair value of options.

The weighted average contractual life of the options is five

years (2019: zero).

No options were exercised during the current year (2019:

nil).

Warrants

Between 15 January 2020 and 31 March 2020 FXPress Payment

Services Ltd granted 14,911,060 warrants to various advisors,

employees and directors with an average exercise price of GBP0.050

and a term of five years. Due to failure to satisfy a vesting

condition specified at the grant date, the fair value of 9,155,930

warrants issued to employees and ex-employees was assessed to be

zero.

The remaining 5,755,130 warrants were estimated to have an

average fair value of GBP0.016 per warrant at the grant date using

the Black-Scholes valuation model. The principal inputs into the

model were:

Share price at grant date - between 4.7 pence and 5.5 pence

Risk-free rate - 0.75%

Expected Volatility - 25%

Contractual life - 5 years

In connection with the reverse acquisition of the Company on 9

September 2020, the Directors of Cornerstone wrote to the holders

of the 9,155,930 outstanding FXPress Payment Services Ltd warrants,

agreeing to exchange their warrants for warrants in Cornerstone in

return for waiving all rights under their FXPress Payment Services

Ltd warrants.

As a result of the effective cancellation of the FXPress Payment

Services Ltd warrants, FXPress Payment Services Ltd recognised an

accelerated share-based payment charge of GBP92,947 for the

year-ended 31 December 2020 (9 months ended 31 December 2019:

GBPnil).

On 3 October 2020 Cornerstone granted 778,460 warrants to the

former holders of FXPress Payment Services Ltd warrants with an

average exercise price of GBP0.31 and an average term of four years

and 117 days. Between 5 October 2020 and 10 December 2020

Cornerstone granted 1,000,000 warrants with an exercise price of

GBP0.50 and a term of five years. The Cornerstone warrants were

estimated to have an average grant date fair value of GBP0.342 per

warrant using the Black-Scholes valuation model. The principal

inputs into the model were:

Share price at grant date - between 16.6 pence and 50 pence

Risk-free rate - 0.8%

Expected volatility - 83.7%

Contractual life - between 4 years & 105 days and 5 years

The Group share-based compensation charge for the year ended 31

December 2020 of GBP147,162 (9-month period ended 31 December 2019:

GBPnil) consists of GBP92,947 in relation to the accelerated

share-based payment charges in respect of the cancelled warrants in

FXPress Payment Services Ltd, GBP27,428 in respect of the

replacement warrants granted in Cornerstone and GBP26,787 in

respect of the Cornerstone options.

15 Related party transactions

Details of key management compensation are included in note 4.

Key management are considered to be the Directors of the Group.

Transactions with subsidiaries

During the year, the Company and FXPress Payment Services Ltd

entered into various transactions with each other including

software development charges, licenses fees and working capital

support. The net balance of transactions between the companies are

held on an interest free inter-Group loan which has no terms for

repayment. At the year end, the Company owed GBP516,999 (2019:

GBPnil) to FXPress Payment Services Ltd.

Other related parties:

All of the amounts below were in respect of the year ended 31

December 2020.

Fees of GBP50,000 (2019: GBPnil) in connection with fundraising

activities were due to LGEC Capital Partners LLP, of which Gareth

Edwards is a Designated Member. The amount was unpaid at the

year-end.

Corporate finance advisory fees of GBP49,323 were due to London

Bridge Capital Limited, a company of which Gareth Edwards and

Elliott Mannis are directors and Elliott Mannis is the shareholder.

GBP36,135 remained due to London Bridge Capital Limited at the

year-end (2019: GBPnil).

Terry Everson, a director of FXPress Payment Services Ltd and a

significant shareholder in Cornerstone, was paid consulting fees of

GBP24,000 via Hazelwood Financial Ltd, a company of which he is a

director and significant shareholder (9 months ended 31 December

2019: GBP54,000). As at 31 December 2020, a loan of GBP10,000 made

by the Group to Terry Everson remained unpaid (31 December 2019:

GBPnil).

William Newton, a director of FXPress Payment Services Ltd and a

significant shareholder in Cornerstone, was paid consulting fees of

GBP8,333 (9 months ended 31 December 2019: GBP21,000).

Stephen Flynn, a director of FXPress Payment Services Ltd and a

significant shareholder in Cornerstone, was paid consulting fees of

GBP68,871 via JF Technology (UK) Ltd, a company of which he is a

director and significant shareholder (9 months ended 31 December

2019: GBP21,500).

David Mason, a director of FXPress Payment Services Ltd, was

paid consulting fees of GBP85,800 (9 months ended 31 December 2019:

GBPnil).

Jason Conibear, a former director of FXPress Payment Services

Ltd, was paid consulting fees of GBP42,650 (9 months ended 31

December 2019: GBP15,000).

16 FINANCIAL INSTRUMENTS

FINANCIAL ASSETS

Group Group Company Company

31 December 31 December 31 December 31 July

2020 2019 2020 2020

GBP GBP GBP GBP

DERIVATIVE FINANCIAL ASSETS

Foreign currency forward contracts

with customers 253,077 182,117 - -

Foreign currency forward contracts

with institutional counterparty 45,958 99,017 - -

_______ _______ _______ _______

299,035 281,134 - -

Cash and cash equivalents 183,675 78,265 96,394 -

Trade receivables 8,405 7,720 - -

Other receivables 165,001 66,516 141,092 95,000

_______ _______ _______ _______

656,116 433,655 237,486 95,000

_______ _______ _______ _______

FINANCIAL LIABILITIES

Group Group Company Company

31 December 31 December 31 December 31 July

2020 2019 2020 2020

GBP GBP GBP GBP

DERIVATIVE FINANCIAL LIABILITIES

Foreign currency forward contracts

with customers 55,869 120,754 - -

Foreign currency forward contracts

with institutional counterparty 160,192 129,235 - -

_______ _______ _______ _______

216,061 249,989 - -

Trade payables 525,064 101,577 238,654 -

Other payables 430,795 17,953 807,772 -

_______ _______ _______ _______

1,171,920 369,519 1,046,426 -

_______ _______ _______ _______

All financial assets and liabilities have contractual maturity

of less than one year.

Derivative financial assets and liabilities

Derivative financial assets not designated as hedging

instruments

31 December 2020 31 December 2019

Notional Notional

Fair Value Principal Fair Value Principal

GBP GBP GBP GBP

Foreign currency forward contracts

with customers 253,077 14,686,425 182,117 4,986,924

Foreign currency forward contracts

with institutional counterparty 45,958 5,785,633 99,017 4,971,285

_______ _______ _______ _______

299,035 20,472,058 281,134 9,958,209

_______ _______ _______ _______