Chesnara PLC Director/PDMR Shareholding and Total Voting Rights (3566Z)

May 21 2021 - 1:00AM

UK Regulatory

TIDMCSN

RNS Number : 3566Z

Chesnara PLC

21 May 2021

CHESNARA plc

("Chesnara" or "the Company")

21 May 2021

LEI Number: 213800VFRMBRTSZ3SJ06

NOTIFICATION OF PDMR DEALING AND TOTAL VOTING RIGHTS

Chesnara plc (the 'Company') today announces that the following

PDMR has exercised options over ordinary shares as a result of the

vesting of the awards made under the 2014 Chesnara Long Term and

Short Term incentive schemes. Of these, 31,795 shares were sold to

cover liability to tax and national insurance contributions arising

on vesting, with the balance being retained.

Further, in conformity with 5.6.1 of the Disclosure Guidance and

Transparency Rules, the Company notifies the market that, as at the

date of this announcement, its issued share capital consisted of

150,145,602 ordinary 5p shares and, with no shares in Treasury,

this too was the number of voting rights.

This figure of 150,145,602 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company under the FCA's Disclosure Guidance and

Transparency Rules.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name David Rimmington

2 Reason for the notification

a) Position/status Chief Finance Officer

b) Initial notification Initial notification

/Amendment

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

a) Name Chesnara plc

b) LEI 213800VFRMBRTSZ3SJ06

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been conducted

a) Description of Chesnara plc Ordinary shares of 5 pence each (Shares)

the financial ID Code: (GB00B00FPT80)

instrument, type

of instrument

and identification

code

b) Nature of the 1. Exercise of options over 14,449 shares following

transaction vesting of the conditional awards under the 2014

Long Term Incentive scheme.

2. Exercise of options over 53,347 shares following

vesting of the conditional awards under the 2014

Short Term Incentive scheme.

3. 31,795 shares sold to cover tax and social security

obligations

c) Price(s) and volume(s) 1. Price(s): nil. Volume: 14,449.

2. Price(s): nil. Volume: 53,347.

3. Price(s): 273.1174p. Volume: 31,795.

d) Aggregated information N/A

e) Date of the transaction 1. 20 May 2021

2. 20 May 2021

3. 20 May 2021

f) Place of the transaction 1. XOFF

2. XOFF

3. London Stock Exchange (XLON)

The above notification is made in accordance with the

requirements of the EU Market Abuse Regulation.

For further information, please contact:

Roddy Watt

Director, Capital Markets

FWD

Forward thinking communications

T - 020 7280 0651

E - roddy.watt@fwdconsulting.co.uk

Notes to Editors

Chesnara is a life and pensions company listed on the London

Stock Exchange. It administers over one million policies and

operates as Countrywide Assured in the UK, as The Waard Group and

Scildon in the Netherlands, and as Movestic in Sweden.

Following a three pillar strategy, Chesnara's primary

responsibility is the efficient administration of its customers'

life and savings policies, ensuring good customer outcomes and

providing a secure and compliant environment to protect

policyholder interests. It also adds value by writing profitable

new business in Sweden and the Netherlands and by undertaking

value-adding acquisitions of either companies or portfolios.

Consistent delivery of the Company strategy has enabled Chesnara

to increase its dividend for 16 years in succession.

Further details are available on the Company's website (

www.chesnara.co.uk ).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHDKKBQABKDFPB

(END) Dow Jones Newswires

May 21, 2021 02:00 ET (06:00 GMT)

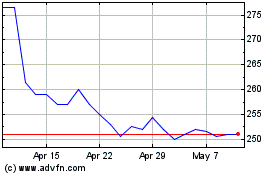

Chesnara (LSE:CSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

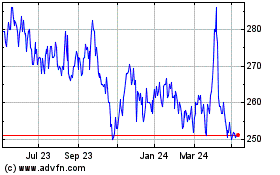

Chesnara (LSE:CSN)

Historical Stock Chart

From Apr 2023 to Apr 2024