TIDMCTEC

RNS Number : 9851W

ConvaTec Group PLC

29 April 2021

LEI: 213800LS272L4FIDOH92

29 April 2021

ConvaTec Group Plc

Trading update for the three months ended 31 March 2021

Strong Q1 performance - guidance unchanged

Key Points:

-- Q1 Group reported revenue of $500 million was 8.7% higher

year on year; up 6.7%(1) on an organic basis or 5.4%(2) in constant

currency.

o Strong organic growth in Advanced Wound Care and Infusion

Care, modest growth in Ostomy Care and Continence Care and

continued strength in Critical Care.

-- Good progress with our FISBE (Focus, Innovate, Simplify,

Build, Execute) strategy as we pivot to sustainable and profitable

growth:

o Acquired Cure Medical LLC in March for an upfront

consideration of $85m to strengthen Continence Care.

o Continued to build our sales and marketing capabilities.

o Execution is improving with particularly strong growth in the

Global Emerging Markets.

-- 2021 full year outlook is unchanged given continuing macro uncertainties:

o Organic revenue growth between 3-4.5%

o Constant currency(2) adjusted EBIT margin of 18-19.5%.

Currency headwind is currently c.80bps.

Karim Bitar, Chief Executive Officer, commented:

"We have made a good start to the year, continuing to deliver

for our customers and patients. In addition, we effectively

executed on our strategy, notably with the acquisition of Cure

Medical which strengthens our position as a leading developer and

manufacturer of continence care products in the large and growing

US market place."

"We are making good progress and remain focused on executing on

the significant number of strategic initiatives underway as we

continue on our journey to pivot to sustainable and profitable

growth. Despite the near term uncertainties, I remain confident in

ConvaTec's growth prospects."

Q1 2021 Q1 2020 Reported Constant currency Organic

Revenue Summary Reported Reported growth % growth(1) growth(2)

$'m $'m % %

----------------------- ---------- ---------- ---------- ------------------ -----------

Advanced Wound Care 143 132 8.8 3.8 9.4

Ostomy Care 136 127 6.7 3.0 3.0

Continence & Critical

Care 128 119 7.4 5.6 4.5

Infusion Care 93 82 13.9 11.7 11.7

----------------------- ---------- ---------- ---------- ------------------ -----------

Total revenue 500 460 8.7 5.4 6.7

----------------------- ---------- ---------- ---------- ------------------ -----------

Advanced Wound Care r evenue of $143 million increased 8.8% on a

reported basis and 3.8% in constant currency. The business

experienced a 5.0% currency tailwind given the proportion of

non-dollar sales and the relative movements in FX. Adjusting for

the disposal of the US Skincare products, which contributed $6.8m

of revenue in Q1'20, organic growth was 9.4%. We saw particularly

strong growth in Global Emerging Markets as we strengthen our

commercial execution across Asia and Latin America. There was

strong growth in Europe helped by some beneficial phasing and

enhanced by a relatively soft Q1 2020 comparative. In North America

we experienced some continued softness, in part a function of the

ongoing COVID-19 pandemic coupled with a tougher comparative given

the inventory building we saw in Q1 2020.

Ostomy Care revenue of $136 million increased 6.7% on a reported

basis and 3.0% on constant currency and organic bases. We achieved

strong growth in Global Emerging Markets. There was modest growth

in North America, with favorable phasing and growth in HSG Ostomy

helping to offset the relatively strong comparatives. These

positive performances were partially offset by a decline in Europe

given continued rationalisation and the inventory build-up we saw

in Q1 2020.

Continence & Critical Care revenue of $128 million increased

7.4% on a reported basis and 5.6% in constant currency. After

adjusting for the Cure Medical acquisition, which contributed $1.3

million of incremental revenue during the period, revenues rose

4.5% on an organic basis. Despite lower new patient starts across

the segment in 2020, Continence Care achieved moderate growth.

Demand for Critical Care products remained strong, up 7.5% in

constant currency during the quarter, although the performance

turned negative during the period as expected given strong COVID-19

related sales in 2020.

Infusion Care revenue of $93 million increased 13.9% on a

reported basis or 11.7% on constant currency and organic bases.

This was primarily driven by continued strong demand from diabetes

customers for our innovative infusion sets supported by growth in

non-diabetes, albeit off a small base. In April Medtronic announced

the launch, in selected European markets, of our new and

proprietary extended wear infusion set.

Strategic Transformation

We have continued to make progress implementing our FISBE

strategy, most notably with the acquisition of Cure Medical

LLC.

On 15(th) March we acquired the business (on a cash free/debt

free basis) for $85 million(3) . B ased in California the business

develops, manufactures and distributes intermittent catheters.

Bringing together Cure Medical and ConvaTec's Continence Care

business allows us to better serve continence customers in the US,

which accounts for the largest demand for such products in the

world. The two portfolios are complementary; together we will offer

a more comprehensive range of continence products and services for

patients and our partners to better serve their broad range of

needs. Had ConvaTec owned Cure Medical for the whole of 2020 it

would have contributed an incremental c.$32 million of revenue.

Outlook

Given the continuing macro uncertainties at this early point in

the year and relatively tougher comparatives in the second half,

our guidance remains unchanged with organic(1) revenue growth of

3-4.5% and a constant currency(2) adjusted EBIT margin of

18-19.5%.

Footnotes

(1) Organic growth is calculated by applying the applicable

prior period average exchange rates to the Group's actual

performance in the respective period and excluding M&A

activities.

(2) Constant currency growth is calculated by applying the

applicable prior period average exchange rates to the Group's

actual performance in the respective period.

(3) Subject to over-performance over the course of 2021 through

to 2023 there is a potential earn out of up to $10 million payable

no later than 20 April 2023.

Foreign exchange rates

Q1 2021 Average Q1 2020 Average

--------- ---------------- ----------------

USD/GBP 1.38 1.28

USD/EUR 1.21 1.10

Investor and analyst audio webcast

There will be an audio webcast hosted by Frank Schulkes, CFO for

investors and analysts at 8am BST, details of which can be found

below and on the ConvaTec website,

www.convatecgroup.com/investors/reports.

Dial-in details:

United Kingdom - 020 3936 2999

United States - 1 646 664 1960

All other locations - +44 203 936 2999

Access code - 641140

Enquiries:

Analysts and Investors

Kate Postans, Vice President, Investor Relations +44 (0)7826 447

807

ir@convatec.com

Media

Buchanan: Charles Ryland / Chris Lane / Hannah Ratcliff

+44 (0)207 466 5000

About ConvaTec

ConvaTec is a global medical products and technologies company

focused on therapies for the management of chronic conditions, with

leading market positions in advanced wound care, ostomy care,

continence and critical care, and infusion care. Our vision, which

encompasses our purpose, is: Pioneering trusted medical solutions

to improve the lives we touch. Our products provide a range of

clinical and economic benefits including infection prevention,

protection of at-risk skin, improved patient outcomes and reduced

total cost of care. To learn more about ConvaTec, please visit

www.convatecgroup.com

Forward Looking Statements

This document includes statements that are, or may be deemed to

be, "forward-looking statements". These forward-looking statements

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control. "Forward-looking statements" are

sometimes identified by the use of forward-looking terminology,

including the terms "believes", "estimates", "aims", "anticipates",

"expects", "intends", "plans", "predicts", "may", "will", "could",

"shall", "risk", "targets", "forecasts", "should", "guidance",

"continues", "assumes" or "positioned" or, in each case, their

negative or other variations or comparable terminology. These

forward-looking statements include all matters that are not

historical facts. They appear in a number of places and include,

but are not limited to, statements regarding the Group's

intentions, beliefs or current expectations concerning, amongst

other things, results of operations, financial condition,

liquidity, prospects, growth, strategies and dividend policy of the

Group and the industry in which it operates.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. These

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. As such, no assurance

can be given that such future results, including guidance provided

by the Group, will be achieved; actual events or results may differ

materially as a result of risks and uncertainties facing the Group.

Such risks and uncertainties could cause actual results to vary

materially from the future results indicated, expressed, or implied

in such forward-looking statements. Forward-looking statements are

not guarantees of future performance and the actual results of

operations, financial condition and liquidity, and the development

of the industry in which the Group operates, may differ materially

from those made in or suggested by the forward-looking statements

set out in this document. Past performance of the Group cannot be

relied on as a guide to future performance. Forward-looking

statements speak only as at the date of this document and the Group

and its directors, officers, employees, agents, affiliates and

advisers expressly disclaim any obligations or undertaking to

release any update of, or revisions to, any forward-looking

statements in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIGDSIUDDGBI

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

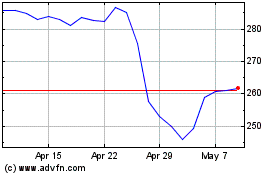

Convatec (LSE:CTEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

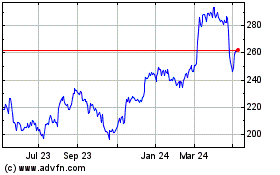

Convatec (LSE:CTEC)

Historical Stock Chart

From Apr 2023 to Apr 2024