Virgin Money UK PLC 2020 LTIP Financial Targets Update (5416X)

May 05 2021 - 1:05AM

UK Regulatory

TIDMVMUK TIDM91XR

RNS Number : 5416X

Virgin Money UK PLC

05 May 2021

Virgin Money UK PLC

(Company)

LEI: 213800ZK9VGCYYR6O495

5 May 2021

2020 Long-term Incentive Plan Financial Targets Update

At the time of publication of the Directors' Remuneration Report

alongside the Virgin Money UK PLC 2020 Annual Report &

Accounts, the material uncertainty in economic backdrop meant it

was not possible to set quantitative 3-year targets. The VMUK PLC

Remuneration Committee was therefore not in a position to propose

the specific targets that underpin the financial elements of the

2020 Long-term Incentive Award (LTIP) but committed to updating

shareholders on its approach and key metrics within six months.

Following that commitment, and after careful consideration in

consultation with major shareholders, the Committee is pleased to

provide an update on the performance measures and weightings that

will apply. These remain broadly aligned with the measures and

weightings applicable to the FY2019 LTIP Award and central to the

delivery of the Group's long-term strategy. The measures,

weightings and targets for the 2020 LTIP (with performance assessed

at the end of FY2023) will be as follows.

Strategic Measures Weighting Threshold Target Max

Pillars

------------------------

Pioneering Relationship Deposit

Growth Growth(1) 10.00% 4 5.5 7

------------------------- ---------- -------------- ---------- --------

Super Straightforward

Efficiency CIR(2) 10.00% 53 50 47

----------------------- ------------------------- ---------- -------------- ---------- --------

Operating Cost Outcome

(GBPm)(2) 10.00% 810 780 750

------------------------- ---------- -------------- ---------- --------

Disciplined

and sustainable ROTE(3) 25.00% 6.0 8.0 10.0

----------------------- ------------------------- ---------- -------------- ---------- --------

Risk Scorecard 20% Remuneration Committee

assessment against qualitative

and quantitative measures(4)

----------------------- ------------------------- ---------- ------------------------------------

Delighting ESG Scorecard 15.00% Remuneration Committee

Customers assessment against qualitative

and Colleagues and quantitative measures(5)

----------------------- ---------- ------------------------------------

CMA Ranking 10.00% Top 5 Top 3 Top 2

------------------------- ---------- -------------- ---------- --------

Total 100%

---------- -------------- ---------- --------

(1) Compound Annual Growth Rate (CAGR) 2020 - 2023

(2) CIR and operating costs are on an underlying basis.

(3) RoTE calculated on a statutory basis.

(4) Performance will be assessed by the Committee based on

several qualitative and quantitative inputs such as feedback from

the Chair of the Board of the Risk Committee and achievement of the

long-term objectives of the organisation. Specific focus will be on

customer complaints, credit risk policy compliance, operational

risk losses and cost of risk.

(5) Performance will be assessed by the Committee based on

several qualitative and quantitative measures such as operational

carbon emissions, senior leadership diversity and colleague

engagement. Our aim is to develop a more sophisticated set of

metrics over time.

The LTIPs are based on a broad framework of financial and

non-financial targets to ensure a balanced range of considerations.

The targets have been established based (where practical) on market

consensus, at the time of proposal, in the absence of formal

company targets for 2023.

The Remuneration Committee remains cognisant of the uncertain

market conditions under which these awards are made and retains

discretion in ensuring that the final outcome reflects the

performance of the Group and considers all relevant factors. This

includes taking any steps necessary to mitigate excessive windfall

gains. Given the level of uncertainty in the economy over the short

to medium term the Committee will make this assessment at the time

of vesting, at which point the Committee will describe the factors

considered and what discretion (if any) that was applied.

Announcement authorised for release by Lorna McMillan, Group

Company Secretary.

For further information, please contact:

Investors and Analysts

Richard Smith 0 7483 399303

-------------------------------------

Interim Head of Investor Relations richard.smith@virginmoneyukplc.com

-------------------------------------

Company Secretary

-------------------------------------

Lorna McMillan 07834 585 436

-------------------------------------

Group Company Secretary lorna.mcmillan@ virginmoneyukplc.com

-------------------------------------

Media Relations

-------------------------------------

Press Office 0800 066 5998

-------------------------------------

press.office@ virginmoneyukplc.com

-------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSMESLEFSEEI

(END) Dow Jones Newswires

May 05, 2021 02:05 ET (06:05 GMT)

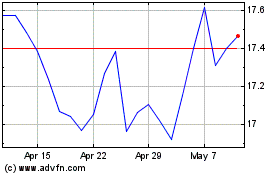

Ve Bionic Etf (LSE:CYBG)

Historical Stock Chart

From Mar 2024 to Apr 2024

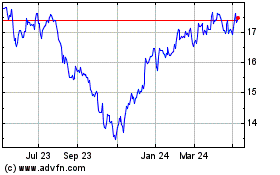

Ve Bionic Etf (LSE:CYBG)

Historical Stock Chart

From Apr 2023 to Apr 2024