D4T4 Solutions PLC Share Buyback Programme (5573T)

March 26 2021 - 2:00AM

UK Regulatory

TIDMD4T4

RNS Number : 5573T

D4T4 Solutions PLC

26 March 2021

D4t4 Solutions Plc

Share Buyback Programme

D4t4 Solutions Plc (AIM: D4T4), the AIM-listed data solutions

provider, announces that the Board of Directors have approved a

share buyback programme of ordinary shares of 2 pence each in the

capital of the Company ("Ordinary Shares") for an aggregate value

of up to GBP200,000 (the "Buyback Programme").

The Company has entered into non-discretionary instructions with

finnCap to conduct the Buyback Programme on its behalf and to make

trading decisions under the Buyback Programme independently of the

Company. The Buyback Programme commences from today and ends no

later than upon the announcement of the Company's results for the

financial year ending 31 March 2021, or when the maximum purchase

of Ordinary Shares level has been reached, if earlier.

The Buyback Programme is in accordance with the terms of the

Company's authority to make market purchases of its own Ordinary

Shares granted to it by shareholders on 6 August 2020 (the

"Authority"), including that the maximum price paid per Ordinary

Share is to be no more than 105 per cent. of the average middle

market closing price of an Ordinary Share for the five business

days preceding the date of any Buy-back. The Company has instructed

finnCap that the maximum price at which any Ordinary Share may be

bought back at must be the lower of either (i) 285 pence or (ii) as

stipulated by the pricing restrictions set out within its

Authority.

The Company intends to hold all Ordinary Shares so purchased in

treasury for the purpose of satisfying future obligations in

relation to its employees' or other share schemes.

Due to the limited liquidity in the issued Ordinary Shares, a

buy-back of Ordinary Shares pursuant to the Authority on any given

trading day is likely to represent a significant proportion of the

daily trading volume in the Ordinary Shares on AIM and is likely to

exceed 25 per cent. of the average daily trading volume and,

accordingly, the Company will not benefit from the exemption

contained in Article 5(1) of Regulation (EU) No. 596/2014.

The Company will make further announcements in due course

following any share repurchases.

Enquiries

D4t4 Solutions Plc +44 (0) 1932 893333

Peter Kear, Chief Executive Officer moreinfo@d4t4solutions.com

finnCap (Nominated Adviser & Joint Broker)

Julian Blunt / Emily Watts / Edward Whiley, Corporate Finance

Alice Lane, ECM +44 (0) 20 7220 0500

Canaccord Genuity (Joint Broker)

Simon Bridges / Andrew Potts +44 (0) 20 7523 8000

Instinctif Partners +44 (0) 20 7457 2020

Kay Larsen / Rozi Morris / Hannah Campbell D4t4Solutions@instinctif.com

About D4t4 Solutions plc

D4t4 Solutions plc (www.d4t4solutions.com) provides data

solutions through its Celebrus suite of products and services,

which is comprised of two distinct complementary offerings - its

proprietary Customer Data Platform (CDP) and Customer Data

Management (CDM) solution. The Celebrus family of products offer

data capture, data migration, data synchronization, data management

and data monitoring.

Celebrus CDP is an enterprise software product which captures

customer behaviour in real time across digital channels to enable a

range of applications including customer analytics, personalised

marketing, risk, fraud detection and compliance.

Celebrus CDM is an integrated platform that automates the

ingestion, integration, transformation, and delivery of customer

data from streaming, persisted or historical sources, whether as an

appliance on-premises or in the cloud, to deliver real-time,

unified, and trusted multidimensional views of customer data for

personalisation, risk, fraud, analytics, and recommendation

applications.

The Group has offices in the UK, USA and India with employees

across the UK, US, Europe and India. D4t4's blue chip global

customers are largely within the financial services, retail and

consumer sectors.

Celebrus is fully compliant with all major data privacy

regulations and the Group is accredited to ISO27001: Information

Security Management.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSUVABRABUOUAR

(END) Dow Jones Newswires

March 26, 2021 03:00 ET (07:00 GMT)

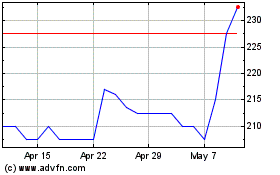

Celebrus Technologies (LSE:CLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celebrus Technologies (LSE:CLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024