TIDMDGOC

RNS Number : 2671X

Diversified Gas & Oil PLC

30 April 2021

The issuer advises that the following release replaces the

Acquisition Announcement and Trading Update released at 7.01am BST

on 30(th) April 2021.

The first bullet for 'Financed with borrowings on the Revolving

Credit Facility' under Acquisition Highlights has been corrected to

state Pro forma consolidated Net Debt/Adjusted EBITDA unchanged at

2.3x rather than 2.4x in the earlier version.

Nothing else has been amended. The full corrected version is

below.

30 April 2021

Diversified Gas & Oil PLC

("Diversified" or the "Company")

Conditional Acquisition in New Regional Focus Area and Trading

Update

Diversified Gas & Oil PLC (LSE: DGOC) announces the $135

million (gross) conditional acquisition of certain Cotton Valley

upstream assets and related facilities primarily in the state of

Louisiana ("the Assets") from Indigo Minerals LLC ("Indigo"), (the

"Acquisition") and the following operations and trading update for

the quarter ended 31 March 2021.

The Acquisition represents the first for the Company in its

newly identified "Central" Regional Focus Area ("RFA") where it

expects to replicate its proven business model on an expanded

opportunity set:

-- Acquisition Highlights

-- Purchase price of $135MM (gross; estimated $115MM net

purchase price after customary purchase price adjustments)

2.9x multiple on $40MM of Adjusted EBITDA (Hedged)(a) before

anticipated synergies

13% accretive to the Company's 2020 Adjusted EBITDA(b)

PV10 $175MM as of 1 March 2021 effective date and based on 16

April 2021 NYMEX strip price

Proved-Developed-Producing ("PDP") reserves of 50 MMBoe (305

Bcfe)

Current production of 16 MBoepd (95 MMcfepd) includes 780 net

operated wells

Benefits from Gulf Coast pricing driving higher realisations

Retaining key field employees to streamline integration and

Smarter Asset Management

-- Strategic entry into prolific, gas-producing Cotton Valley/Haynesville area

Provides a robust opportunity set for further acquisitions

Compatible with roll-up strategy leveraging scale and geographic

density to drive efficiencies

-- Financed with borrowings on the Revolving Credit Facility

Pro forma consolidated Net Debt / Adjusted EBITDA unchanged at

2.3x(c)

Transaction effective date of 1 March 2021 with an anticipated

closing in late May 2021

-- Central Regional Focus Area Highlights

-- Includes producing areas within Louisiana, Texas, Oklahoma and Arkansas

-- Offers significant opportunity to grow scale through

complementary bolt-on and/or larger opportunities

-- Enhances ability to optimise capital allocation across

multiple regions as dictated by the prevailing M&A environment

or other economic or operational factors

-- Similar size geographical footprint to Diversified's existing Appalachia region

-- Similar asset characteristics to Appalachia

-- Industry supportive regulatory environments

-- Substantial existing infrastructure complements a low-operating cost structure

Q1'21 Operations and Financial Highlights

-- Average net daily production of 102 MBoepd (612 MMcfepd)

73% Conventional (75 MBoepd; 448 MMcfepd)

27% Unconventional (27 MBoepd; 164 MMcfepd)

-- Adjusted average net daily production ("Adjusted Production")

of 105 MBoepd, 3% higher for identifiable, temporary and primarily

winter-weather related downtime

-- 72% Conventional (76 MBoepd; 454 MMcfepd)

-- 28% Unconventional (29 MBoepd; 174 MMcfepd)

-- Q1'21 Adjusted EBITDA of $78MM (hedged) contributing to Cash Margin of 52%(d)

-- Total unit cash expense(e) of $7.86/Boe ($7.66/Boe on Adjusted Production ("Adjusted"))

-- Base LOE of $2.63/Boe ($2.57/Boe, Adjusted)

-- Total operating expenses of $6.13/Boe ($5.98/Boe, Adjusted)

-- Total recurring administrative expense of $1.73/Boe ($1.68/Boe, Adjusted)

-- Net Debt / Adjusted EBITDA(f) of 2.3x and available liquidity of $204MM(g)

-- Q1'21 dividend of 4.00c/share, payable on 24 September 2021

(ex-dividend date of 2 September 2021)

Commenting on these accomplishments, CEO Rusty Hutson, Jr.

said:

"Over the past four years as a listed company, I shared my

vision for expanding the Diversified mission with its emphasis on

cash flow and tangible shareholder returns into other producing

regions across the country. Our commitment to acquiring

cash-generative assets and retaining the talented men and women who

operate those assets establishes a highly transferable business

model. Our strategic expansion into a new producing region turns

vision to reality and marks a key milestone in our development. The

expansion also provides significant runway for us to replicate our

success in Appalachia: reducing unit expenses, improving margins

and optimising production.

"Our new regional focus area covers a multi-state area in a

similar size footprint to Appalachia, and meets our expansion

criteria in terms of asset quality, infrastructure, market

dynamics, opportunity set and supportive regulatory environment.

This first strategic acquisition outside of Appalachia also

reflects our continued commitment to a consistent asset profile and

valuation while affording us expanded value-accretive roll-up

opportunities in this new region that will enable us to quickly

build scale and drive efficiencies. Our financial and operational

strengths continue to uniquely position Diversified to capitalise

on current market conditions as the PDP buyer of choice.

"I'd also like to commend our field team on their continued

commitment and diligence through the first quarter and its harsh

winter climate. Despite the challenging environment, our team

continued to deliver strong financial performance through the

quarter with continued strong Cash Margins. As detailed in our

recently released second Sustainability Report, we also made

significant progress enhancing our sustainability practices as we

seek to optimise the stewardship of our assets in line with the

global energy transition. I'm proud of what we've already

accomplished, and look forward to working with our team of

dedicated professionals to further build on this success as we

responsibly enlarge the Diversified footprint."

New Regional Focus Area and Acquisition of Assets from

Indigo

The Company's strategy of acquiring producing assets supported

by their existing operational personnel is naturally and highly

transferable to other producing regions across the United States.

Retaining the assembled workforce with its collective understanding

of the acquired assets while eliminating the expense, complexity

and risk associated with drilling. as well as corporate and related

management costs, aligns with the Company's Smarter Asset

Management programme and commitment to low operating costs.

Diversified has actively been evaluating a variety of regions as

its first step outside of Appalachia to identify the optimal area

to replicate its success in Appalachia through systematically

adding scale and driving operational efficiencies with additional

accretive acquisitions. Today's announced Acquisition represents

the Company's strategic entry into a new RFA that includes

producing areas within Louisiana, Texas, Oklahoma and Arkansas. In

addition to a large opportunity set, the RFA benefits from an

industry-friendly regulatory environment and mature infrastructure,

which complement Diversified's low-cost operating profile.

The Company has signed a purchase and sale agreement with Indigo

to acquire 780 net operated wells producing 16 MBoepd (95 MMcfepd)

located within the Cotton Valley/Haynesville producing area of

northwest Louisiana and east Texas. The Acquisition will add 50

MMBoe (305 Bcfe) in PDP reserves, with a PV10 of $175MM using a

full NYMEX strip as of 16 April 2021. DGO expects to close the

transaction in the latter half of May 2021 following its customary

diligence, reviews and approvals, with an effective date of 1 March

2021.

Consistent with Diversified's acquisition strategy, the long

life and low-decline nature of the Assets' annualised $40MM of

Adjusted EBITDA(a) ("Cash Flow") enhances the Company's free cash

flow generation and strong Cash Margins with access to the

favourable Gulf Coast pricing market and historical Cash Margins of

50%. The estimated net purchase price of $115MM represents just a

2.9x multiple of Adjusted EBITDA(a) and a PV20 value of the

acquired PDP reserves before any anticipated synergies.

Accordingly, the Acquisition both supports Diversified's current

dividend distribution and complements its existing operations.

The Company will retain 25 field personnel currently servicing

the wells to ensure operational continuity and smooth integration

into its Smarter Asset Management programme. Replicating its

success in Appalachia, DGO will continue to optimise the operations

and cost structure as it acquires additional assets in the RFA.

The Company expects to initially fully fund the Acquisition from

existing liquidity on its Revolving Credit Facility as it evaluates

its options for long-term financing including additional

asset-backed securitisations, term loans or similar financing

options. Pro forma Net Debt/Adjusted EBITDA(c) after the

Acquisition will approximate 2.3x, in line with the Company's

current leverage position.

The Company continues to evaluate other acquisition

opportunities, both in and out of the Appalachian Basin, with a

keen focus on opportunities that align with the parameters of its

participation agreement with Oaktree, including a purchase price

threshold of greater than $250MM.

The Company will host a conference call later today to discuss

the Acquisition, with call details as follows:

Date: 30 April 2021

Time: 2:00 pm BST / 08:00 am CDT

US (toll-free) +1 877-407-5976

UK (toll-free) +44 (0)800 756 3429

Web Audio www.dgoc.com/news-events/events

Operations and Financial Update

Production Update

Diversified's average net production for the quarter was 102

MBoepd (612 MMcfepd), consistent with average net production during

4Q'20. Adjusted for identifiable and temporary downtime, primarily

related to the harsh winter weather, net production would have been

3% higher at 105 MBoepd (628 MMcfepd). Importantly, the Company's

conventional production also remained consistent with 4Q'20 at 75

MBoepd or 76 MBoepd, Adjusted.

Low Costs Drive Consistent Margins While Proactively Positioning

for Growth

Diversified's commitment to one of its daily objectives that

"Every Dollar Counts" remains strong. We proactively prepared our

business for this milestone through many of the initiatives we have

highlighted over the past several quarters including our:

-- Transition from AIM to the Premium Segment of the Main Market

and transition of our independent financial and reserve audit work

to PricewaterhouseCoopers and Netherland, Sewell & Associates,

Inc., respectively;

-- Enhanced governance with an expanded, more diverse and more independent Board;

-- Investments in a variety of ESG-related activities including

asset integrity and line loss initiatives; and

-- Investments in our people, processes and systems with an

emphasis on scalability and security including:

Cloud data architecture capable of efficiently growing with the

Company and

Technology that will provide insights to optimise both financial

and human capital allocation.

We made these enhancements and investments to our

vertically-integrated structure to establish Diversified with a

solid foundation grounded in the right leadership and expertise to

responsibly and efficiently position the Company for entry into a

new RFA. Importantly, inclusive of these investments, we once again

delivered a Cash Margin greater than 50%(d) with a total unit cash

expense of $7.86/Boe in the quarter. While our general and

administrative costs in the first quarter are higher than our

previous trend, by building scale in this RFA and Appalachia, we

expect to enjoy unit cost reductions, mirroring our past success.

While total unit cash expenses were higher in the first quarter, we

continued to reduce our Base Lease Operating Expense by 6% to just

$2.57/Boe on adjusted production.

Footnotes (for Company-specific items, refer also to the

Glossary of Terms and/or Alternative Performance Measures found in

the Company's 2020 Annual Report):

(a) Multiple based on estimated net purchase price of $115MM and Acquisition's

annualised 4Q'20 Adjusted EBITDA (hedged), where Adjusted EBITDA assumes

historical cost structure and not reflective of synergies that may be

realised following post-acquisition integration

(b) Based on the Company's 2020 reported Adjusted EBITDA of $301MM and the

Acquisition's annualised 4Q'20 Adjusted EBITDA (hedged) of $40MM

(c) Pro forma, calculated as current Net Debt/Adj EBITDA, see footnote (f),

adjusted for the impact of the Acquisition's Net Purchase Price and

Estimated Adjusted EBITDA (Hedged) as described herein

(d) Cash Margin calculated as Adjusted EBITDA (Hedged) as a percentage of

Adjusted Total Revenue (which includes natural gas, natural gas liquids

and crude oil commodity revenue, midstream revenue and other revenue)

plus settled net hedging gains (losses) as applicable

(e) Total Unit Cash Expenses represent total lease operating costs plus

recurring administrative costs. Total lease operating costs include

base lease operating expense, owned gathering and compression (midstream)

expense, third-party gathering and transportation expense, and production

taxes. Recurring administrative expenses is a non-IFRS financial measure

defined as total administrative expenses excluding non-recurring acquisition

& integration costs and non-cash equity compensation.

(f) Calculated as Net Debt at 31 March 2021 (inclusive of Acquisition down

payment) / LTM ended 31 March 2021 Adjusted EBITDA (Hedged), pro forma

for the annualised impact of previously announced Carbon, EQT and Utica

shale acquisitions

(g) As at 31 March 2021

For further information, please contact:

Diversified Gas & Oil PLC +1 205 408 0909

Teresa Odom, Vice President,

Investor Relations

www.dgoc.com

ir@dgoc.com

Buchanan +44 20 7466 5000

Financial Public Relations

Ben Romney

Chris Judd

Kelsey Traynor

James Husband

dgo@buchanan.uk.com

About Diversified Gas & Oil PLC

Diversified Gas & Oil PLC is an independent energy company

engaged in the production, marketing and transportation of

primarily natural gas related to its synergistic US onshore

upstream and midstream assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSDIFFSEFSEIL

(END) Dow Jones Newswires

April 30, 2021 07:56 ET (11:56 GMT)

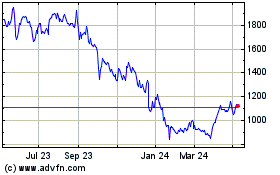

Diversified Energy (LSE:DEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

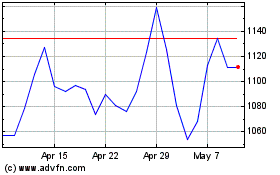

Diversified Energy (LSE:DEC)

Historical Stock Chart

From Apr 2023 to Apr 2024