TIDMDEMG

RNS Number : 5050Z

Deltex Medical Group PLC

21 September 2020

21 September 2020

Deltex Medical Group plc ("Deltex Medical" or the "Group")

Interim results to 30 June, 2020

Deltex Medical Group plc (AIM: DEMG), the global leader in

oesophageal Doppler monitoring, today announces its unaudited

interim results to 30 June 2020.

HIGHLIGHTS

COVID-19

-- Deltex Medical's TrueVue system is primarily used by

clinicians to guide clinical practice during elective surgery;

however, elective surgery in our key markets was effectively halted

by the COVID-19 ("CV-19") pandemic earlier this year

-- in the UK, TrueVue Doppler is also used in intensive care

units ("ICUs") for very sick patients. Use of TrueVue Doppler

increased at the height of the pandemic during March and April, but

dropped back sharply as admission to ICUs for CV-19 patients

reduced

-- there are preliminary signs that elective surgery is now

beginning to increase as pressure to reduce waiting lists starts to

grow, particularly overseas

Financial

-- revenues: GBP1.2 million (2019: GBP2.0 million)

-- 33% reduction in like-for-like revenues: GBP1.2 million

(2019: GBP1.8 million)

-- 25% reduction in overhead costs to GBP1.3 million (2019:

GBP1.7 million)

-- adjusted EBITDA: GBP(0.2) million (2019: GBP0.2 million)

-- loss for the period: GBP(0.6) million (2019: GBP(0.3)

million)

-- cash at hand - 30 June 2020: GBP0.6 million (30 June 2019:

GBP0.6 million)

Business

-- the reduction in revenues linked to the cessation of elective

surgical procedures in our key markets has been partially offset by

the treatment of CV-19 patients in ICUs

-- careful stewardship of cash resources, including use of

Government furlough scheme and successful application to the US

Government's Paycheck Protection Program

-- good progress being made on new product development,

including securing further grant funding

-- focus now on positioning the business for progress in

2021

Nigel Keen, Chairman of Deltex Medical, said:

"The first half was challenging, but our much lower cost base

and careful stewardship of cash means that the business is well

placed for future opportunities."

"Although it was pleasing to see the Group's TrueVue Doppler

being used to treat a number of acutely sick COVID-19 NHS patients

in March and April, the decline in elective surgery in our key

markets adversely affected the business significantly."

"We are confident that as the number of elective surgical

procedures starts to climb, in part due to increasing pressure to

reduce waiting lists, so the financial performance of the Group

will improve."

For further information, please contact:

Deltex Medical Group plc 01243 774 837

Nigel Keen, Chairman investorinfo@Deltexmedical.com

Andy Mears, Chief Executive

David Moorhouse, Group Finance Director

Arden Partners plc 020 7614 5900

Ciaran Walsh info@arden-partners.com

Dan Gee-Summons

Joint Broker

Turner Pope Investments (TPI) Ltd 0203 657 0050

Andy Thacker info@turnerpope.com

Zoe Alexander

This announcement contains Inside Information as defined under

the Market Abuse Regulation (EU) No. 596/2014.

Notes for Editors

Deltex Medical manufactures and markets haemodynamic monitoring

technologies which are primarily used in critical care and general

surgical procedures. Deltex Medical's proprietary oesophageal

Doppler monitoring ("ODM") (TrueVue Doppler) measures blood flow

velocity in the central circulation in real time. Minimally

invasive, easy to set-up and quick to focus, the technology

generates a low-frequency ultrasound signal which is highly

sensitive to changes in blood flow and measures such changes in

'real time'. Deltex Medical is the only company in the enhanced

haemodynamic space to have built a robust and credible evidence

base demonstrating both the clinical and economic benefits of its

core technology: TrueVue Doppler. This technology has been proven

in a wide range of clinical trials to reduce complications suffered

by patients after surgery and consequently can save hospitals

money.

Deltex Medical's TrueVue System on the CardioQ-ODM+ monitor

platform now provides clinicians with two further advanced

haemodynamic monitoring technologies. TrueVue Impedance is an

entirely non-invasive monitoring technology which transmits low

magnitude, high frequency electrical signals through the thorax and

measures the changes to this signal when the heart pumps blood.

TrueVue PressureWave uses the peripheral blood pressure signal

analysis to give doctors information on changes in the circulation

and is particularly suited to monitoring lower risk or

haemodynamically stable patients.

Group goal

Haemodynamic management is now becoming widely accepted as a

vital part of the anaesthesia protocols for surgical patients, as

well as treating ventilated intensive care patients, including

ventilated COVID-19 patients. Consequently, the Group's focus is on

maximising value from the opportunities presented, as enhanced

haemodynamic management is adopted into routine clinical practice

around the world. The Group aims to provide clinicians with a

single platform - a 'haemodynamic workstation' - which offers them

a range of technologies from simple to sophisticated to be deployed

according to the patient's clinical condition as well as the skill

and expertise of the user. Doing this will enable the Group to

partner with healthcare providers to support modern haemodynamic

management across the whole hospital.

The Group is currently in the implementation phase of achieving

this goal in a number of territories worldwide, operating directly

in the UK and the USA, and via agreements with approximately 40

distributors overseas

Chairman's statement

Financial results

The adverse impact of COVID-19 ("CV-19") on the business is

reflected in the results of the first half.

The Group saw significantly increased sales into UK intensive

care units ("ICUs") in March and April, as intensivists started to

use Deltex Medical's equipment to improve the treatment of CV-19

patients, particularly to help avoid acute kidney injuries. In 2019

we negotiated the termination of a third-party distribution

agreement, which included revenues of GBP0.2 million in the first

half of 2019, accordingly the like-for-like H1 2019 revenues were

GBP1.8 million, meaning that the H1 2020 revenues of GBP1.2 million

declined by 33% on a like-for-like basis. On a statutory basis the

loss of revenues from elective surgical procedures in the first

half resulted in total Group revenues declining by 42% to GBP1.2

million (2019: GBP2.0 million).

When the scale of the impact of the CV-19 pandemic became clear,

especially the adverse impact globally on elective surgery volumes,

management took rapid and robust action. This included aggressively

cutting discretionary expenditure from March and furloughing the

majority of the Group's UK employees from May. These proactive

steps resulted in a 25% reduction in costs in the first half to

GBP1.3 million (2019: GBP1.7 million).

Adjusted EBITDA for the period was a loss of GBP0.2 million

(2019: positive GBP0.2 million).

During the period the Group was awarded an Innovation Continuity

Grant by Innovate UK worth approximately GBP0.2 million to help the

funding of its new product development programme which last year

received an Innovate UK Smart award. The cash associated with this

grant was received in July 2020. Deltex Medical continues to work

closely with Innovate UK to explore additional funding sources for

its new product development programme.

The Group also successfully applied for a cash grant of US$0.2

million under the US Government's Paycheck Protection Program,

which was received in July 2020.

There continues to be careful stewardship of the Group's cash

resources with cash at hand at 30 June, 2020 of GBP0.6 million

(2019: GBP0.6 million).

Commercial activities

Deltex Medical's TrueVue Doppler haemodynamic monitoring

technology was originally developed for use in ICUs where it

provides extremely accurate data to help guide therapy for very

sick patients whose haemodynamic status is changing rapidly. More

recently, other technologies have entered the market to provide

more indicative data on the haemodynamic status of ICU patients who

are relatively stable.

For patients in the Operating theatre ("OR"), whose haemodynamic

status is intrinsically unstable, the Group's TrueVue Doppler

technology has become the standard of care supported by a

significant number of positive clinical trial results published in

scientific journals. Since the use of TrueVue Doppler in the OR is

a higher margin business than its use in the ICU, and the OR also

typically represents a larger addressable market, Deltex Medical

has focussed its sales and marketing activities on promoting the

use of its TrueVue Doppler technology in the OR setting.

When the CV-19 pandemic struck, clinicians saw that patients

admitted into ICU were often critically haemodynamically unstable.

This prompted intensivists who were familiar with the benefits of

Deltex Medical's technology to start to use the TrueVue Doppler

system to treat this cohort of very sick ICU patients. Accordingly,

in March and April we saw usage rates significantly increase in UK

ICUs.

In parallel, we saw elective surgery being stopped by healthcare

systems in our key markets as hospitals focused on treating the

large numbers of extremely sick CV-19 patients being admitted into

ICUs. This decline in elective surgical procedures resulted in a

very significant reduction in orders for TrueVue Doppler probes

from the Group's established customer base.

Since May, as lockdown brought the pandemic under control, the

number of CV-19 patients in UK and US ICUs has reduced

substantially, with many ICUs being nearly completely empty.

Elective surgical procedures are, however, only just beginning to

restart and often initially at a much lower level, as hospitals

reshape their services to be able to withstand the possibility of a

second wave of CV-19 patients whilst at the same time putting in

place measures which will allow an increase in normal clinical

interventions.

Deltex Medical has seen increased activity levels from our key

markets since August. For example:

-- in the United States, our direct sales team is beginning to

see the number of elective surgical procedures in US hospitals

increasing. It is too early to be able to assess how quickly it

will take our US hospital customers to get back to full capacity,

although we believe that the USA is currently moving faster than

the UK, notwithstanding the continuing relatively high CV-19

transmission rates;

-- in the UK, there are signs that elective surgery is beginning

to restart following the end of the summer holiday period. There is

also significant pressure from both patients and clinicians to

reduce the substantial waiting lists which developed during

lockdown for both NHS and private patients. There is a clear

recognition that it is better clinically, and less expensive, to

treat patients via elective surgical procedures as opposed to

waiting for patients' underlying health issues to deteriorate and

require emergency interventions. We have seen a UK hospital place

an order for 10 new TrueVue Monitors for its ORs following intense

use of the TrueVue Doppler technology in its ICUs during the peak

of the CV-19 pandemic. It is currently too early to estimate how

quickly elective procedures will return to normal, pre-pandemic

levels in NHS and private hospitals in the UK; and

-- through our international network of distributors, we are

seeing signs of orders returning to more normal levels of demand.

For example, in France, Deltex Medical's distributor ordered probes

in August for the first time this year and we have also seen orders

from Korea as well as some smaller European customers.

New product development

Deltex Medical's new product development programme, including

the development of the new Monitor, has continued despite the

disruption caused by engineers working from home. Good progress has

been made, including securing further grant funding for elements of

this development work.

Brexit

The Group has a number of contingency plans already in place

which can be quickly implemented to respond to the different

possible outcomes associated with Brexit and the EU-UK Withdrawal

Agreement negotiations.

Current trading and prospects

Deltex Medical's core haemodynamic monitoring business remains

focused on elective surgery. As elective surgery numbers increase

worldwide, so the Group's financial performance will improve. In

the meantime, we believe that the Group will continue to trade at a

reduced level of activity in comparison to pre-CV-19 levels, but

that this level of activity is sustainable and is expected to be

broadly cash neutral.

Although the second half is expected to be an improvement on the

first half of 2020, the ongoing elective surgery delays will result

in revenues being materially behind market expectations. The Group

does have some significant live tenders with potential

international buyers. However, the Board has taken a prudent

approach with guidance due to the limited visibility on these large

potential orders. We expect revenue levels in 2021 to recover to

previous levels seen in 2019.

On the back of the CV-19 ICU experience, the Group is now

working with key opinion leaders in the UK and the United States to

develop data to show how the protocolized use of TrueVue Doppler on

severely sick CV-19 patients can significantly improve patient

outcomes.

Since the beginning of September, a number of Deltex Medical

employees have been taken off furlough to return to work on a

part-time basis in order to help the Group satisfy increasing

demand for its TrueVue Doppler probes.

Deltex Medical's focus for the rest of this year will be to

ensure that the business is optimally positioned for 2021,

including maximising cash generation and, assisted by the Innovate

Smart award, continuing with its programme of new product

development.

Nigel Keen

Chairman

21 September, 2020

Condensed Consolidated Statement of Comprehensive Income

for the period ended 30 June 2020

Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

---------------------------------------------- ----- ----------- ----------- -------------

Note GBP'000 GBP'000 GBP'000

Revenue 4 1,157 1,993 4,256

Cost of sales (364) (487) (974)

---------------------------------------------- ----- ----------- ----------- -------------

Gross profit 793 1,506 3,282

Administrative expenses (575) (853) (1,515)

Sales and distribution expenses (542) (624) (1,220)

Research and Development, Quality and

Regulatory (185) (250) (446)

Impairment loss on trade receivables - - (11)

Exceptional costs 16 - - (137)

---------------------------------------------- ----- ----------- ----------- -------------

Total costs (1,302) (1,727) (3,329)

---------------------------------------------- ----- ----------- -----------

Operating profit / (loss) before exceptional

costs and other gain (509) (221) 90

Exceptional costs 16 - - (137)

---------------------------------------------- ----- ----------- ----------- -------------

Other gain 7 19 - 13

Operating loss (490) (221) (34)

Finance costs (88) (86) (176)

---------------------------------------------- ----- ----------- ----------- -------------

Loss before taxation (578) (307) (210)

Tax credit on loss 7 4 38 51

---------------------------------------------- ----- ----------- ----------- -------------

Loss for the period/year (574) (269) (159)

---------------------------------------------- ----- ----------- ----------- -------------

Other comprehensive (expense)/income

Items that may be reclassified to profit

or loss:

Net translation differences on overseas

subsidiaries 24 1 (8)

---------------------------------------------- ----- ----------- ----------- -------------

Other comprehensive (expense)/income

for the period/year, net of tax 24 1 (8)

---------------------------------------------- ----- ----------- ----------- -------------

Total comprehensive loss for the period/year (550) (268) (167)

---------------------------------------------- ----- ----------- ----------- -------------

Total comprehensive loss for the period/year

attributable to:

Owners of the Parent (560) (269) (169)

Non-controlling interests 10 1 2

---------------------------------------------- ----- ----------- ----------- -------------

(550) (268) (167)

---------------------------------------------- ----- ----------- ----------- -------------

Loss per share - basic and diluted 8 (0.11)p (0.05)p (0.03p)

---------------------------------------------- ----- ----------- ----------- -------------

Condensed Consolidated Balance Sheet

Unaudited Audited

30 June 30 June 31 December

2020 2019(1) 2019

Note

GBP'000 GBP'000 GBP'000

-------------------------------------- ------ --------- --------- ------------

Assets

Non-current assets

Property, plant and equipment 344 403 395

Intangible assets 2,696 2,595 2,651

Financial assets at amortised cost 159 161 157

-------------------------------------- ------ --------- --------- ------------

Total non-current assets 3,199 3,159 3,203

Current assets

Inventories 9 1,000 946 915

Trade and other receivables 655 1,051 1,062

Financial assets at amortised cost 214 214 214

Other current assets 114 104 113

Current income tax recoverable 103 100 80

Cash and cash equivalents 10 568 595 908

-------------------------------------- ------ --------- --------- ------------

Total current assets 2,654 3,010 3,292

-------------------------------------- ------ --------- --------- ------------

Total assets 5,853 6,169 6,495

Liabilities

Current liabilities

Borrowings 12 (77) (267) (188)

Trade and other payables 13 (2,185) (2,026) (2,198)

Total current liabilities (2,262) (2,293) (2,386)

-------------------------------------- ------ --------- --------- ------------

Non-current liabilities

Borrowings 12,14 (1,092) (1,052) (1,072)

Trade and other payables (300) (334) (320)

Provisions (65) (56) (62)

-------------------------------------- ------ --------- --------- ------------

Total non-current liabilities (1,457) (1,442) (1,454)

-------------------------------------- ------ --------- --------- ------------

Total liabilities (3,719) (3,735) (3,840)

-------------------------------------- ------ --------- --------- ------------

Net assets 2,134 2,434 2,655

-------------------------------------- ------ --------- --------- ------------

Equity

Share capital 15 5,249 5,123 5,249

Share premium 33,230 33,230 33,230

Capital redemption reserve 17,476 17,476 17,476

Other reserve 468 1,076 439

Translation reserve 165 150 141

Convertible loan note reserve 82 82 82

Accumulated losses (54,407) (54,563) (53,823)

-------------------------------------- ------ --------- --------- ------------

Equity attributable to owners of the

Parent 2,263 2,574 2,794

Non-controlling interests (129) (140) (139)

-------------------------------------- ------ --------- --------- ------------

Total equity 2,134 2,434 2,655

-------------------------------------- ------ --------- --------- ------------

1. Certain comparatives have been restated to be consistent with

the presentation used in the 2019 Annual Report & Accounts

(Note 17).

Condensed Consolidated Statement of Changes in Equity for the

period ended 30 June 2020 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

1 January 2020 5,249 33,230 17,476 439 82 141 (53,823) 2,794 (139) 2,655

Comprehensive

income

Loss for the

period - - - - - - (584) (584) 10 (574)

Other

comprehensive

income for the

period - - - - - 24 - 24 - 24

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 24 (584) (560) 10 (550)

Transactions

with owners

of the company

Equity-settled

share-based

payment - - - 29 - - - 29 - 29

Balance at

30 June 2020 5,249 33,230 17,476 468 82 165 (54,407) 2,263 (129) 2,134

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

period ended 30 June 2019 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at 1

January 2019,

as restated 4,927 33,230 17,476 953 82 149 (54,293) 2,524 (141) 2,383

Comprehensive

income

Loss for the

period - - - - - - (270) (270) 1 (269)

Other

comprehensive

income for the

period - - - - - 1 - 1 - 1

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 1 (270) (269) 1 (268)

Transactions

with owners

of the company

Equity-settled

share-based

payment - - - 123 - - - 123 - 123

Share options

exercised 196 - - - - - - 196 - 196

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

30 June 2019 5,123 33,230 17,476 1,076 82 150 (54,563) 2,574 (140) 2,434

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

year ended 31 December 2019 (audited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest

capital premium reserve reserve reserve reserve losses Total Total

equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at 1

January 2019,

as restated 4,927 33,230 17,476 953 82 149 (54,293) 2,524 (141) 2,383

Comprehensive

income

Loss for the

period - - - - - - (161) (161) 2 (159)

Other

comprehensive

income for the

period - - - - - (8) - (8) - (8)

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for

year - - - - - (8) (161) (169) 2 (167)

Transactions

with owners

of the Group

Equity-settled

share-based

payment - - - 117 - - - 117 - 117

Transfers - - - (631) - - 631 - - -

Share options

exercised 322 - - - - - - 322 - 322

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

31 December

2019 5,249 33,230 17,476 439 82 141 (53,823) 2,794 (139) 2,655

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Cash Flows

for the period ended 30 June 2020

Unaudited Audited

Six months Six months Year

ended ended ended 31

30 June 30 June December

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------------------------- ----------- ----------- ----------

Cash flows from operating activities

Loss before taxation (578) (307) (210)

Adjustments for:

Net finance costs 88 86 176

Depreciation of property, plant and

equipment 97 100 149

Profit on disposal of loan monitors (35) (2) (36)

Amortisation of intangible assets 40 71 84

Share-based payment expense 29 123 117

Effect of exchange rate fluctuations (1) 2 (2)

----------------------------------------------- ----------- ----------- ----------

(360) 73 278

(Increase)/decrease in inventories (85) (257) (235)

Decrease in trade and other receivables 383 479 427

Increase/(decrease) in trade and other

payables (16) 27 212

Increase in provisions 3 - 6

Net cash from/(used in) operations (75) 322 688

Interest paid (67) (69) (139)

Income taxes received - 11 60

----------------------------------------------- ----------- ----------- ----------

Net cash generated from/(used in)

operating activities (142) 264 609

Cash flows from investing activities

Purchase of property, plant and equipment (10) (12) (10)

Proceeds from the sale of loan monitors - 6 59

Capitalised development expenditure (85) (138) (250)

Net cash used in investing activities (95) (144) (201)

Cash flows from financing activities

Issue of ordinary share capital - 196 322

Outflow from decrease in invoice discounting

facility (111) (281) (356)

Repayment of obligations under finance

leases (17) (16) (33)

----------------------------------------------- ----------- ----------- ----------

Net cash (used in)/generated from

financing activities (128) (101) (67)

----------------------------------------------- ----------- ----------- ----------

Net increase in cash and cash equivalents (365) 19 341

Cash and cash equivalents at beginning

of the period 908 580 580

Exchange (loss)/gain on cash and cash

equivalents 25 (4) (13)

----------------------------------------------- ----------- ----------- ----------

Cash and cash equivalents at the end

of the period/year 568 595 908

----------------------------------------------- ----------- ----------- ----------

Notes to the condensed consolidated interim financial

statements

1. Reporting Entity

Deltex Medical Group plc is a company that is domiciled in the

United Kingdom. It is incorporated in England and Wales (Company

Number 03902895) and its registered office is at Terminus Road,

Chichester, PO19 8TX, United Kingdom. These condensed consolidated

interim financial statements (Interim Financial Statements) as at

and for the period ended 30 June 2020 comprise the Company and its

subsidiaries (together referred to as 'the Group'). The Group is

principally involved with the manufacture and sale of advanced

haemodynamic monitoring technologies.

2. Basis of accounting

These interim financial statements have been prepared in

accordance with IAS 34, 'Interim Financial Reporting', and should

be read in conjunction with the Group's last annual consolidated

financial statements as at and for the year ended 31 December 2019

(Annual Report & Accounts 2019). They do not include all the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position.

These condensed consolidated interim financial statements do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The summary of results for the year ended

31 December 2019 is an extract from the published consolidated

financial statements of the Group for that year which have been

reported on by the Group's auditors and delivered to the Registrar

of Companies. The Independent Auditors' Report on the Annual Report

& Accounts for 2019 was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

These condensed consolidated interim financial statements have

been prepared applying the accounting policies and presentation

that were applied in the preparation of the Group's published

consolidated financial statements for the year ended 31 December

2019 and are expected to be applied in the preparation of the

financial statements for the year ending 31 December 2020. The

Group has not early adopted any other standard, interpretation or

amendment that has been issued but is not yet effective.

These condensed consolidated interim financial statements were

approved by the Board of Directors and approved for issue on 21

September 2020.

3. Use of judgements and estimates

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense. Although these estimates are based

on the directors' best knowledge of the amount, event or actions,

it should be noted that actual results may differ from those

estimates.

The significant judgements and estimates made by the directors

in applying the Group's accounting policies and key sources of

estimation uncertainty were the same as those disclosed in Annual

Report & Accounts 2019.

4. Revenue

The Group's revenue disaggregated by primary geographical

markets is as follows:

For the six months ended 30 June 2020 (Unaudited)

Direct markets Indirect markets

Probes Monitors Third Party Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

UK 377 16 - 31 - - - 424

USA 477 16 - 12 - - - 505

France - - - - - - 7 7

Scandinavia - - - - 41 - - 41

South Korea - - - - 53 - 1 54

Peru - - - - - - - -

Other countries - - - - 96 28 2 126

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

854 32 - 43 190 28 10 1,157

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

For the six months ended 30 June 2019 (Unaudited)

Direct markets Indirect markets

Probes Monitors Third Party Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

UK 441 19 178 44 - - - 682

USA 719 - - 2 - - - 721

France - - - - 250 - 4 254

Scandinavia - - - - 42 - 1 43

South Korea - - - - 139 - 2 141

Peru - - - - - - - -

Other countries 16 - - - 102 27 7 152

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

1,176 19 178 46 533 27 14 1,993

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

For the year ended 31 December 2019 (Audited)

Direct markets Indirect markets

Probes Monitors Third Party Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

UK 902 49 293 107 - - - 1,351

USA 1,443 45 - 42 - - - 1,530

France - - - - 289 9 6 304

Scandinavia - - - - 83 - 1 84

South Korea - - - - 277 10 3 290

Peru - - - - 258 - 3 261

Other countries 29 - - - 251 148 8 436

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

2,374 94 293 149 1,158 167 21 4,256

----------------- -------- --------- ------------ -------- -------- --------- -------- --------

The Group's revenue disaggregated between the sale of goods and

the provision of services is set out below. All revenues are

recognised at a point in time.

Period ended Year ended

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------- ------------------- ------------------- -----------------------

Sale of goods 1,138 1,961 4,176

Maintenance income 19 32 80

1,157 1,993 4,256

------------------------------- ------------------- ------------------- -----------------------

The following table provides information about trade receivables

and contract liabilities from contracts with customers. There were

no contract assets at either 30 June 2020 or 1 January 2020.

30 June 1 January

2020 2020

GBP'000 GBP'000

------------------------------------------------------------ ------------------- ---------------------

Trade receivables which are in 'Trade and other

receivables' 437 1,062

Contract liabilities (72) (53)

------------------------------------------------------------ ------------------- ---------------------

The following aggregated amounts of transaction prices relate to

the performance obligations from existing contracts that are

unsatisfied or partially unsatisfied as at 30 June 2020:

2020 2021 2022 2023 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Revenue

expected

to be

recognised 33 33 1 5 72

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

5. Segment results

Performance is monitored, and the allocation of resources is

made, on the basis of results derived from the sale of probes,

monitors and third-party products for which revenues and gross

margins are regularly reported to the Group's Chief Executive

Officer who has been identified as the Chief Operating Decision

Maker (CODM). The CODM also monitors a profit measure described

internally as 'adjusted earnings before interest, tax, depreciation

and amortisation (Adjusted EBITDA). However, this measure is

reported at a Group level rather than an operating segment which is

based on the nature of the goods provided rather than the

geographical market in which they are sold.

The unaudited segment results for the six months ended 30 June

2020 were:

Third

Probes(1) Monitors party Other Unallocated Total

products

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Revenues 1,044 60 - 53 - 1,157

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted gross profit(2) 726 68 - 41 - 835

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - - - (519)

Administration costs(3) - - - - - (423)

R&D costs(3) - - - - - (53)

Quality and regulation

costs(3) - - - - - (81)

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted EBITDA(4) - - - - - (241)

-------------------------- ----------- ---------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Excluding non-cash costs namely depreciation, amortisation,

share-based payment expense, non-executive directors' fees and

accumulated absence costs

4. Earnings before interest, tax, depreciation and amortisation,

share-based payment expense and non-executive directors' fees

The unaudited segment results for the six months ended 30 June

2019 were:

Third

Probes(1) Monitors party Other Unallocated Total

products

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Revenues 1,709 46 178 60 - 1,993

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted gross profit(2) 1,416 41 83 32 - 1,572

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - - (632) (632)

Administration costs(3) - - - - (615) (615)

R&D costs(3) - - - - (62) (62)

Quality and regulation

costs(3) - - - (110) (110)

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted EBITDA(4) - - - - - 153

-------------------------- ----------- ---------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Excluding non-cash costs namely depreciation, amortisation,

share-based payment expense, non-executive directors' fees and

accumulated absence costs

4. Earnings before interest, tax, depreciation and amortisation,

share-based payment expense and non-executive directors' fees

The audited segment results for the year ended 31 December 2019

were:

Third

Probes(1) Monitors party Other Unallocated Total

products

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Revenues 3,533 260 293 170 - 4,256

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted gross profit(2) 2,881 232 127 113 - 3,353

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - - (1,304) (1,304)

Administration costs(3) - - - - (1,297) (1,297)

R&D costs(3) - - - - (139) (139)

Quality and regulation

costs(3) - - - (222) (222)

-------------------------- ----------- ---------- ---------- -------- ------------- --------

Adjusted EBITDA(4) - - - - - 391

-------------------------- ----------- ---------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Excluding non-cash costs namely depreciation, amortisation,

share-based payment expense, non-executive directors' fees and

accumulated absence costs

4. Earnings before interest, tax, depreciation and amortisation,

share-based payment expense and non-executive directors' fees

The reconciliation of the profit measure used by the Group's

CODM to the result reported in the Group's consolidated SOCI is set

out below:

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------- --------- ------------

Adjusted EBITDA (241) 153 391

Non-cash items:

Depreciation of property, plant and equipment (61) (98) (149)

Amortisation of development costs (40) (71) (84)

Non-executive directors' fees and employer's

social security costs (72) (72) (136)

Share-based payment expense (29) (123) (117)

Change in accumulated absence cost liability (66) (10) 26

Bonus accrual releases - - 22

Cash item: Other tax income 19 - 13

----------------------------------------------- --------- --------- ------------

(249) (374) (425)

----------------------------------------------- --------- --------- ------------

Operating loss (490) (221) (34)

Finance costs (88) (86) (176)

----------------------------------------------- --------- --------- ------------

Loss before tax (578) (307) (210)

Tax credit on loss 4 38 51

----------------------------------------------- --------- --------- ------------

Loss for the period/year (574) (269) (159)

----------------------------------------------- --------- --------- ------------

6. Dividends

The Directors cannot recommend the payment of a dividend (2019:

nil) for 2020.

7. Tax credit on loss

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ------------------- ------------------- -----------------------

Research and development tax credit (4) (52) (64)

Adjustment in respect of prior periods - 14 13

--------------------------------------------------- ------------------- ------------------- -----------------------

Total tax credit on loss (4) (38) (51)

--------------------------------------------------- ------------------- ------------------- -----------------------

The other gain amount for six months to 30 June 2020 of

GBP19,000 (six months to 30 June 2019: GBPnil) comprises tax income

arising from the Research and Development Expenditure Credit scheme

which is accounted for as a government grant.

8. Loss per share

Basic loss per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares issued during the year.

The loss per share calculation for six months to 30 June 2020 is

based on the loss after tax attributable to owners of the parent of

GBP584,000 and the weighted average number of shares in issue of

524,868,826.

The loss per share calculation for six months to 30 June 2019 is

based on the loss after tax attributable to owners of the parent of

GBP270,000 and the weighted average number of shares in issue of

502,437,787.

The loss per share calculation for the year ended 31 December

2019 is based on the loss after tax attributable to owners of the

parent of GBP161,000 and the weighted average number of shares in

issue of 509,679,881. While the Company is loss-making, the diluted

loss per share and the loss per share are the same.

9. Inventories

Inventories at 30 June 2020 include the following Finished

Goods: 21,398 probes and 250 monitors.

10. Cash at bank

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------- ------------------- ------------------- -----------------------

Cash at bank 568 595 908

------------------------- ------------------- ------------------- -----------------------

11. Net cash

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------------- ------------------- -----------------------

Cash at bank 568 595 908

Less Invoice discount facility (77) (267) (188)

------------------------------------------- ------------------- ------------------- -----------------------

491 328 720

------------------------------------------- ------------------- ------------------- -----------------------

12. Borrowings

Unaudited Audited

30 June 2020 30 June 2019 31 December 2019

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Invoice

discount

facility 77 - 267 - 188 -

Convertible

loan

notes - 1,092 - 1,052 - 1,072

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

77 1,092 267 1,052 188 1,072

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

13. Trade and other payables

Unaudited Audited

30 June 2020 30 June 2019 31 December 2019

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Trade

payables 445 - 360 - 381 -

Other

payables 348 - 345 - 483 -

Social

security

and other

taxes 175 - 122 - 129 -

Lease

obligations 35 300 35 334 32 320

Contract

liabilities 72 - 150 - 53 -

Employee

short-term

liabilities 98 - 67 - 31 -

Accrued

expenses 1,012 - 947 - 1,089 -

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

2,185 300 2,026 334 2,198 320

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

14. Convertible loan note

The convertible loan note recognised in the Condensed

Consolidated Balance Sheet is calculated as:

Financial Equity

liability component Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------------------- ---------------------- -------------------

Carrying amount at 1 January 2020 1,072 82 1,154

Interest expense 64 - 64

Interest paid (44) - (44)

---------------------------------------------- ---------------------- ---------------------- -------------------

Carrying amount at 30 June 2020 1,092 82 1,174

---------------------------------------------- ---------------------- ---------------------- -------------------

The convertible loan note falls due for repayment in February

2022. The convertible loan note is, at the option of the loan note

holder, convertible at anytime into new ordinary shares of 1 penny

each at a conversion price of 4 pence per share.

15. Share capital

During the six months ended 30 June 2020, there were no share

issues or exercises of shares.

16. Exceptional items

Exceptional items comprised:

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------------------- -----------------------

Payments in lieu of notice - - 65

Compensation for loss of office - - 30

Write off of research and development

obsolete projects - - 42

---------------------------------------- ------------ ---------- -------------------------

- - 137

---------------------------------------- ------------ ---------- -------------------------

17. Seasonal fluctuations

Revenues in our Distributor markets are traditionally higher in

the second half of the financial year due to the purchasing

patterns of customers.

18. Restatement of prior period balance sheet amounts

Certain comparative balances at 30 June 2019 have been restated

to reflect presentational changes made in the preparation of the

2019 Annual Report & Accounts. The table below summarises the

changes made:

Prior period

adjustment for

As reported removal of capitalised As restated

dilapidation

GBP'000 GBP'000 GBP'000

--------------------- ------------- ------------------------ -------------

Non-current assets

Property, plant and

equipment 490 (87) 403

--------------------- ------------- ------------------------ -------------

Prior period

adjustment for

As reported discounting of As restated

dilapidation

provision

GBP'000 GBP'000 GBP'000

------------------------- ------------- ----------------- -------------

Non-current liabilities

Provisions (114) 58 (56)

------------------------- ------------- ----------------- -------------

19. Foreign exchange rates

The following are the principal foreign exchange rates used in

the preparation of the condensed consolidated interim financial

statements:

Unaudited Audited

30 June 2020 30 June 2019 31 December 2019

Average Closing Average Closing Average Closing

rate rate rate rate rate rate

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Sterling/US dollar 1.27 1.24 1.30 1.27 1.28 1.31

Sterling/Euro 1.15 1.10 1.15 1.12 1.14 1.17

Sterling/Canadian

dollar 1.72 1.68 1.73 1.66 1.70 1.71

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

20. Distribution of the announcement

Copies of this announcement are sent to shareholders on request

and will be available for collection free of charge from the

Company's registered office at Terminus Road, Chichester, PO19 8TX,

United Kingdom. This announcement is available, free of charge,

from the Company's website at www.deltexmedical.com

21. Cautionary statement

This announcement contains forward-looking statements which are

made in good faith based on the information available at the time

of its approval. It is believed that the expectations reflected in

these statements are reasonable, but they may be affected by

several risks and uncertainties that are inherent in any

forward-looking statement which could cause actual results to

differ materially from those currently anticipated. Nothing in this

document should be considered to be a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAPNEADAEEFA

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

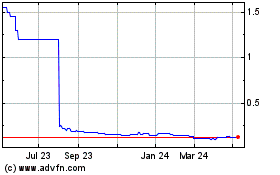

Deltex Medical (LSE:DEMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

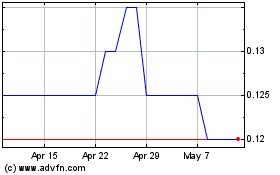

Deltex Medical (LSE:DEMG)

Historical Stock Chart

From Apr 2023 to Apr 2024