Dekel Agri-Vision PLC July 2020 Palm Oil Production Update (5701V)

August 10 2020 - 1:00AM

UK Regulatory

TIDMDKL

RNS Number : 5701V

Dekel Agri-Vision PLC

10 August 2020

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

10 August 2020

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

July 2020 Palm Oil Production Update

Dekel Agri-Vision Plc, the West African focused agriculture

company, is pleased to provide a production and sales update for

its Ayenouan palm oil project in Côte d'Ivoire (the 'Project') for

July 2020. In line with recent trends, trading during July 2020 has

benefited from improving global crude palm oil ('CPO') prices,

which continue to recover from the COVID-19 induced lows

experienced earlier in the year. Together with high extraction

rates, this has offset lower CPO production volumes at Ayenouan. A

table providing a breakdown of production, sales and pricing levels

achieved at Ayenouan during July 2020 is set out below.

As previously announced, the Company is issuing CPO production

figures on a monthly basis to provide shareholders with increased

visibility on operations and trading during the pandemic and

associated market volatility. The Company will continue to provide

monthly data until 30 September at which point it will consider

reverting to quarterly data. In the meantime, Ayenouan continues to

operate with relatively minimal disruption from COVID-19 however,

Dekel continues to adhere to government advice and guidance in

order to help ensure the wellbeing of staff and the local

communities in which it operates in.

July 2020 Production

July 2020 July 2019 Increase/

(decrease)

FFB processed (tonnes) 7,975 9,780 -18.5 %

CPO production (tonnes) 1764 2032 -13.2 %

CPO sales (tonnes) 1819 3533 -48.5 %

Average CPO price per tonne EUR 502 EUR 480 4.5 %

PKO production (tonnes) 172 176 -2.3 %

PKO sales (tonnes) 137 197 -30.5 %

Average PKO price per tonne EUR 595 EUR 489 21.7 %

PKC production (tonnes) 406 483 -15.9 %

PKC sales (tonnes) 336 762 -55.9 %

Average PKC price per tonne EUR 59 EUR 56 5.4%

Production

-- 1,764 tonnes of CPO produced at Ayenouan in July 2020 compared to 2,032 tonnes in July 2019

o Lower production follows a reduction in fresh fruit bunches

('FFB') delivered to the mill for processing in line with the

experience of other operators in the region

-- Higher extraction rates due to higher oil content in FFB have

continued to offset lower production

o July 2020 CPO extraction rate came in at 22.3% compared to

20.2% July 2019

-- PKO production of 171.5 tonnes similar to July 2019 as a

result of higher than normal kernel extraction rates

-- Lower month on month PKC production of 406 tonnes (July 2019:

483.06 tonnes) due to lower volumes of FFB delivered to the

mill

Sales and Pricing

-- Year on year CPO sales performance comparison distorted by

3,000 tonnes of CPO which were held in storage in June 2019 and

sold in Jul/Aug 2019

-- 1,819 tonnes of CPO sold at average prices of EUR502 per

tonne in July 2020 - a 4.5% increase on the 3,533 tonnes sold at

EUR480 per tonne in July 2019

-- CPO prices expected to show material improvement in August

2020 compared to July 2020 due to jump seen in international prices

to around US$715 per tonne at the time of writing as global markets

reopen

o Typically there is a 4-5 week lag before local prices reflect

moves in international benchmarks therefore we expect to achieve a

material increase in prices in August compared to July

-- Reduction in PKO sales to 137 tonnes (July 2019: 197 tonnes)

due to timings of sales and deliveries

o Over 50% of the 950tn of PKO stock on hand at July month end

has now been sold and we expect will leave to material increases in

sales in August and September as it is collected by customers from

our tanks

Dekel Agri-Vision Executive Director Lincoln Moore said, "While

only one month's data, the recent trend of higher prices and

extraction rates offsetting lower CPO volumes has continued in July

2020. Set against the backdrop of the ongoing COVID-19 pandemic,

this is a creditable outcome, particularly as we recently announced

at the half year stage that we expect to report a more profitable

H1 financial performance compared to last year.

"With international palm oil prices recovering strongly to over

$700 per tonne at the time of writing combined with the 4-5 week

lag it takes for local prices to reflect international moves, we

are confident that the positive tailwind of higher pricing levels

will at least be maintained in August. Together with progress

continuing to be made at Tiebissou where our large-scale cashew

processing project remains on track to commence production in Q2

2021, I look forward to providing further updates as we look to

transform Dekel into a multi-project, multi-commodity agriculture

business."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website at

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr /

Dan Gee-Summons (Corporate Finance)

Simon Johnson (Corporate Broking) +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

St Brides Partners Ltd (Investor Relations)

Frank Buhagiar

Cosima Akerman

Megan Dennison +44 (0) 207 236 1177

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development

including a fully operational palm oil project in Ayenouan where

fruit produced by local smallholders is processed at the Company's

60,000tpa crude palm oil mill and a cashew processing project in

Tiebissou, which is due to commence production in Q2 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSSSESUESSESA

(END) Dow Jones Newswires

August 10, 2020 02:00 ET (06:00 GMT)

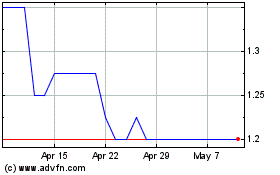

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Apr 2023 to Apr 2024