Dekel Agri-Vision PLC Acquisition of further interest in cashew project (2364O)

February 08 2021 - 1:00AM

UK Regulatory

TIDMDKL

RNS Number : 2364O

Dekel Agri-Vision PLC

08 February 2021

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

Acquisition of a further 16.7% interest in cashew project

Dekel Agri-Vision Plc, the West African focused agriculture

company, is pleased to announce it has entered into an agreement to

acquire an additional 16.7% interest in the large scale raw cashew

nut ('RCN') processing project at Tiebissou, Côte d'Ivoire (the

'Cashew Project'), which will increase its interest in the Project

to 70.7% (the 'Acquisition'). The Cashew Project is on course to

become Dekel's second producing asset in Q2 2021, alongside the

100%-owned palm oil asset at Ayenouan.

Cash and shares settlement at request of vendor to retain

exposure to upside potential

Dekel is increasing its interest in the Cashew Project via the

acquisition of a 16.7% beneficial interest in Pearlside Holdings

Ltd ('Pearlside'), the wholly owned parent of Capro CI SA, the

entity developing the Project, for a total consideration of

GBP1.062m. GBP708,000 of the consideration is to be settled in cash

with the remaining GBP354,000 to be settled via the issue of

7,080,000 new ordinary shares of EUR0.0003367 in the Company (the

'Consideration Shares') at 5p per share. The Consideration Shares,

which represent approximately 1.3% of Dekel's enlarged share

capital, are to be issued to one individual shareholder of

Pearlside and will be subject to a six month lock-in period and an

orderly market undertaking thereafter.

The settlement of the Acquisition via cash and the issue of the

Consideration Shares follows a request by the vendor for the

consideration to include an equity element in order to retain

exposure to the Cashew Project and to gain exposure to Dekel's

wider portfolio and strategy to build a multi-commodity agriculture

company. The cash element of the Consideration will be funded by

the proceeds of the Company's recent fundraise (see announcement of

29 January 2021 for further details).

Cashew Project on track to become Dekel's second producing asset

in Q2 2021

Under a phased development programme, the plant at Tiebissou

will commence production at an initial RCN processing capacity of

10,000 tonnes per annum. Within 12-24 months, production at the

plant is expected to increase by 50% to 15,000tpa at no extra

capital outlay by increasing the number of shifts of employees from

two to three per day. From this level, it is envisaged cash flows

generated by the plant will largely fund a doubling in capacity to

30,000tpa. The Directors believe the Cashew Project, which will

capitalise on a shortfall in cashew processing capacity in Côte

d'Ivoire, one of the world's largest cashew growers, will be cash

flow generative at the initial processing rate of 10,000 tonnes per

annum.

Dekel Agri-Vision Plc Executive Director Lincoln Moore said:

"With the commencement of cashew processing operations at Tiebissou

in Q2 2021 rapidly approaching, we believe this is the right time

to increase our interest in what promises to be a strong margin

project that will scale up and diversify our revenues and transform

our financial profile. It is also the right deal for both Dekel and

the vendor whose request it was to receive shares in the Company as

part payment for the Acquisition. In our view, this represents an

endorsement not only of the attractive economics of the Cashew

Project, but also of Dekel's wider portfolio and growth plans.

"Our portfolio includes the established palm oil operations at

Ayenouan, which are well placed to benefit from high global crude

palm oil prices during the current peak harvest season in Cote

d'Ivoire. Our additional growth plans include adding a third

commodity to our portfolio. At this point, as we have previously

disclosed, having three projects will provide us with a highly cash

flow generative platfom. We now believe we have a clear line of

sight towards building a multi-project, multi-commodity agriculture

company, which has the potential to generate significant returns

for investors and significant benefits for the local smallholders

with whom we work closely with. I look forward to providing further

updates on our progress."

Admission to trading on AIM

Application will be made to the London Stock Exchange for the

admission of a total of 7,080,000 new Ordinary Shares to be

admitted to trading on AIM ('Admission'). It is expected that

Admission will occur on or around 12 February 2021.

Total voting rights

Following Admission, the total issued share capital of the

Company will be 535,527,705 Ordinary Shares. The Company has no

Ordinary Shares in treasury. Therefore the total number of voting

rights in the Company is 535,527,705 and this figure should be used

by shareholders of the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr /

Dan Gee-Summons (Corporate Finance)

Simon Johnson (Corporate Broking) +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

St Brides Partners Ltd (Investor Relations)

Frank Buhagiar

Cosima Akerman

Megan Dennison +44 (0) 207 236 1177

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa crude

palm oil mill; a cashew processing project in Tiebissou, which is

due to commence production in Q2 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDZGGZGNLGMZZ

(END) Dow Jones Newswires

February 08, 2021 02:00 ET (07:00 GMT)

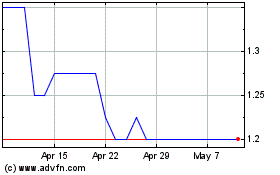

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Apr 2023 to Apr 2024