TIDMDXRX

RNS Number : 5982N

Diaceutics PLC

26 September 2023

Diaceutics PLC - Half Year Results

Diaceutics reports 32% growth in revenue and reaffirms full year

outlook

66% growth in recurring revenues to GBP4.6 million, representing

47% of revenues in H1 2023

Order book growth of 43% to GBP24.1 million providing good

forward visibility

Four enterprise-wide engagements secured by end H1 2023

Core DXRX platform adoption by large pharma customers driving

business momentum

Daily alerts launched for DXRX Signal enabling pharma clients to

identify patients previously not receiving the most appropriate

treatment due to lack of timely data

Diaceutics becoming the primary commercialisation partner for

pharma launching precision medicines, with 21 of the top 30 global

pharma companies as Diaceutics' customers

First of its kind virtual lab conference was successfully held

in July 2023 - labs on the DXRX platform grows to 900

Strong balance sheet with cash of GBP17.9 million - fully funded

to execute significant growth plans

Peter Keeling stepping down as CEO - will remain with the

Company to advance corporate development

Ryan Keeling appointed as CEO Designate

Belfast and London, 26 September 2023 - Diaceutics PLC (AIM:

DXRX) , a leading technology and solutions provider to the

pharmaceutical industry, today announces continued strong

performance and growth across its business and its unaudited half

year results for the six months ended 30 June 2023.

H1 2023 Financial Highlights:

H1 2023 H1 2022 Change

Revenue GBP9.9m GBP7.5m +32%

-------- -------- ---------

Platform based revenue 83% 76% +7 ppts

-------- -------- ---------

Recurring revenue percentage of

overall revenue 47% 37% +10 ppts

-------- -------- ---------

Gross Profit GBP8.7m GBP6.3m +38%

-------- -------- ---------

Gross Profit Margin 88% 84% +4 ppts

-------- -------- ---------

EBITDA -GBP0.2m GBP0.3m -GBP0.5m

-------- -------- ---------

Loss before tax -GBP2.0m -GBP1.1m -GBP0.9m

-------- -------- ---------

Cash inflow from operations GBP0.7m GBP3.3m -GBP2.6m

-------- -------- ---------

Net cash GBP17.9m GBP20.4m -GBP2.5m

-------- -------- ---------

Order book* GBP24.1m GBP10.2m +GBP13.9m

-------- -------- ---------

-- Revenue for the six months to 30 June 2023 increased 32%

to GBP9.9 million (H1 2022: GBP7.5 million), 25% on a constant

currency basis

-- Recurring revenue grew 6 6 % to GBP 4.6 million and represents

47% of revenues in the period (H1 2022: GBP 2.8 million

and 37% of revenue in the period)

-- 43% increase in order book* at 30 June 2023 to GBP24.1 million,

up from GBP16.9 million at December 2022, with GBP6.8 million

of the order book expected to be realised in H2 2023

-- Recurring revenue now represents 94% or GBP22.7 million

of the order book

-- EBITDA loss of -GBP0.2 million in line with accelerated

investment strategy announced in January 2023

-- Cash at 30 June 2023 was GBP17.9 million (31 December 2022:

GBP19.8 million), reflecting the acceleration in platform

and data investment

H1 2023 Operational Highlights :

-- Diaceutics worked with 50 therapies in H1 2023, up 22%,

across 37 customers (H1 2022: 41 therapies across 34 customers)

-- Four enterprise-wide engagements secured by 30 June 2023

with a total contract value of $20.1 million to deliver

insight data solutions for up to three years across 25 pharma

therapies. An enterprise-wide engagement is characterised

by a customer deploying the DXRX platform across three or

more of the precision medicines in their portfolio

-- DXRX Signal product enhanced and now providing daily alerts.

This ground-breaking innovation will provide Diaceutics'

customers with even more timely data to identify patients

who would benefit from their therapies and improve their

commercial success. For patients, it means their chances

of receiving the optimal therapy within the window of effectiveness

is significantly improved

-- DXRX Signal has identified over 46,000 potential US patients

so far in 2023 for its pharma customers

-- Data tokenisation, which involves the joining of testing

and treatment data integral to new products being launched,

completed and on track to be launched in H2 2023 - this

will deliver enhanced patient insights and value to customers

-- First of its kind virtual lab conference was successfully

held in July 2023, targeted at US labs and physicians, driving

better platform network engagement and recruitment with

over 1,000 labs and physicians in attendance. A European

conference event is set to be launched in H1 2024

-- 49 labs added to the DXRX platform, taking the total to

900 across 44 countries, increasing DXRX global platform

reach with further recruitment expected from the virtual

lab events in H2 2023

-- Experienced Non-Executive Director, Graham Paterson, joins

the Board as a Non-Executive Director and Audit and Remuneration

Committees' chair on 1 October 2023

Peter Keeling, CEO of Diaceutics commented:

"As our pharma customers continue to evolve their investment to

precision medicines, we are extremely well positioned to deliver

the data insights and lab network they need to find patients in

need of appropriate therapies. We are pleased to report that the

strong momentum we enjoyed in 2022 has continued into 2023 and

delivered a very positive first half performance, with recurring

revenue and order book growth, continued expansion of our lab

network and therapy brand growth in line with our strategic

roadmap. Pharma companies are increasingly recognising the

importance of utilising our data technology and lab network to

significantly improve their commercial success.

"Most encouraging is the positive feedback we continue to

receive from our clients as they increasingly use the DXRX platform

to support the digital commercialisation of therapies delivered to

patients in need worldwide. We remain confident in our proven

growth strategy and ability to perform and deliver future growth as

we continue to hit our key milestones for the DXRX platform

expansion and introduce new products to profile and target suitable

patients."

Planned CEO Transition

The Company this morning announced separately details of its

planned CEO transition. Having co-founded the Company and spent 18

years as its CEO, Peter Keeling has informed the Board of his

intention to step back as CEO of Diaceutics on 1 January 2024. He

will continue to serve on the Board as an Executive Director, to

support the CEO transition. Thereafter, Peter's primary focus will

be to accelerate the corporate development of Diaceutics. This will

further strengthen Diaceutics leadership position as the primary

partner for pharmaceutical companies as they seek to commercialise

the new generation of precision therapeutics across a range of

disease areas over the coming months and years.

Peter Keeling co- founded Diaceutics in 2005 and has led the

growth of the Company from a niche consulting service provider to a

high margin, high growth diagnostic commercialisation platform. The

Company now serves 21 of the top 30 global pharma companies, with

161 people across Europe and North America and a network of 900

laboratories worldwide. Peter also led the Company's public listing

in 2019.

Ryan Keeling, current Chief Innovation Officer, has today been

appointed CEO Designate and will become CEO on 1 January 2024. Ryan

joined Diaceutics in 2006 and became a member of the Board on IPO

in 2019. His current responsibilities as Chief Innovation Officer

will be split between the Chief Commercial Officer and Chief Data

Officer during the transition period.

Ryan is an expert in the commercialisation of diagnostics and

associated technology, with over 17 years' experience in the field.

He is the architect of the Company's data capabilities and DXRX

platform, leading the development and commercialisation of the

Group's technology, including its proprietary data lake. During his

tenure with Diaceutics, Ryan has underpinned the Company's growth,

holding the key roles of Chief Commercial Officer, Chief Operating

Officer and most recently, Chief Innovation Officer where he has

led the Group's product innovation, with a near term focus on the

development of DXRX.

Outlook

We observed the pharmaceutical industry spending cautiously

during H1 2023, predominately attributed to general uncertainties

around macroeconomic and political pressures, particularly

reorganisations and drug pricing policies. Despite this, Diaceutics

has seen continued strong demand from new customers and renewals of

its insight and engagement solutions leading to order book growth

and increases in recurring revenues.

The market opportunity available to Diaceutics is significant,

larger than ever and continues to grow at pace as global pharma

accelerates the shift to precision medicine to improve patient

access, capture lost revenue and increase profitability. The

successes of 2023 to date and the significant momentum achieved

across the period serve to validate the Group's growth strategy,

with trading in line with management expectations. The Board is

confident that Diaceutics can continue to execute its growth

strategy and seize the market opportunity as we become the primary

commercialisation partner for pharma companies launching precision

medicines, and today reaffirms its full year outlook.

Analyst Presentation

A webinar presentation for analysts will be held at 10.00 am on

Tuesday, 26 September 2023 via the London Stock Exchange's

SparkLive platform. Those wishing to attend can register using the

following link:

https://www.lsegissuerservices.com/spark/Diaceutics/events/3e138a9b-2f9d-4adf-b5e0-790cb1f39b49

Investor Presentation

Peter Keeling (CEO ), Nick Roberts (CFO) and Ryan Keeling (CEO

Designate) will also provide a live presentation relating to the

Company's results via the Investor Meet Company platform on Tuesday

26 September 2023 at 4.30 pm. The presentation is open to all

existing and potential shareholders and registration can be

completed via the following link:

https://www.investormeetcompany.com/diaceutics-plc/register-investor

* Order book is the value of future contracted revenue not yet

recognised

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR"), and is disclosed in accordance with the Company's

obligations under Article 17 of MAR. The person responsible for

making this announcement on behalf of the Company is Nick Roberts,

Chief Financial Officer.

Enquiries:

Diaceutics PLC Tel: +44 (0)28 9040

6500

Peter Keeling, Chief Executive Officer investorrelations@diaceutics.com

Ryan Keeling, Chief Executive Officer Designate

Nick Roberts, Chief Financial Officer

Stifel Nicolaus Europe Limited (Nomad & Broker) Tel: +44 (0)20 7710

7600

Ben Maddison

Nick Harland

Kate Hanshaw

Alma PR Tel: +44(0)20 3405

0205

Caroline Forde diaceutics@almapr.co.uk

Matthew Young

Kinvara Verdon

About Diaceutics

At Diaceutics we believe that every patient should get the

opportunity to receive the right test and the right therapy to

positively impact their disease outcome.

We provide the world's leading pharma and biotech companies with

an end-to-end commercialisation solution for precision medicines

through data analytics, scientific and advisory services enabled by

our platform DXRX - The Diagnostics Network (R).

Strategic and Operational Review

Business and Strategic Overview

We have continued to build on the momentum from 2022 with

encouraging financial and operational progress in the six months to

30 June 2023. The successes in the period have underpinned a strong

financial performance which includes revenue growth of 32% to

GBP9.9m, improved visibility of revenues with 47% now recurring and

significant order book growth of 43% to GBP24.1 million, providing

excellent forward visibility; these all support our sustainable

growth as we continue to deliver against our strategic roadmap.

Growth during the period has been driven by a number of factors

including the increased adoption of our DXRX platform by large

pharma customers. A key pillar of the platform is our extensive lab

network. In the six months to 30 June 2023, we have added 49 labs

to the platform network, taking the total to 900, and we also

launched the first of two virtual lab conferences in July 2023.

These virtual events deliver specialist thought leadership content

to labs and physicians, driving better platform network engagement

and recruitment, and allowing us to continue to leverage the

platform network as a key differentiator and growth

accelerator.

We remain committed to investing in the expansion of our unique

assets and key value drivers: our partner network, data repository,

and platform product offering. During H1 2023 we have made good

progress against our accelerated investment strategy; we have

expanded the partner network, enhanced the value of the data

repository and successfully launched a number of new capabilities

on the DXRX platform. We continue to ensure that the customer is at

the centre of everything we do and that we are ideally positioned

to capitalise on the increasing precision medicine market and grow

Diaceutics' presence within our customers' commercialisation

strategy budgets.

The Group's therapy brand engagement remains consistently strong

with Diaceutics working with 50 therapies in H1 2023 (up 22%)

across 37 customers (H1 2022: 41 brands across 34 customers).

Customer centricity is fundamental to our growth strategy, and

we are embedding our customer centricity framework across the

organisation. The investment in this strategy includes developing

processes to capture the voice of our customers and having d

edicated customer account teams to promote integrated

cross-functional working. These enable continuous customer focused

improvements and seamless delivery of our solutions. We have been

delighted with the feedback we have had to date from our customers

as a result of this framework, with exceptionally strong engagement

and feedback.

Overall, we are pleased with the progress made against the

strategic milestones set out in our accelerated investment strategy

at the beginning of 2023 and this progress is summarised in the

milestone tracker below:

Accelerated investment strategy - milestones set for Progress and impact in 2023

2023

Secure best-in-class organic revenue growth of between Revenue growth of 32% with underlying constant currency

20-25%. growth of 25% (H1 2022: 25% with CCY

growth of 18%).

----------------------------------------------------------

Transition of business onto the DXRX platform and 83% of revenue derived from the DXRX platform (H1 2022:

increase the value of multi-year recurring 76%).

revenue contacts. Recurring revenue grew 66% to GBP4.6 million and

represents 47% of revenues in the period

(H1 2022: GBP2.8 million and 37% of revenue in the

period).

Order book increased 43% to GBP24. 1 million (H1 2022:

GBP10.2 million).

----------------------------------------------------------

Secure additional enterprise-wide* engagements. Secured 4 enterprise-wide engagements across 25

therapies (as at 31 December 2022: 2 engagements

across 8 therapies).

----------------------------------------------------------

Enrich data and product offerings DXRX Signal product enhanced in H1 2023 and launched in

Invest in platform scale and capability. H2 2023 providing daily alerts.

Tokenisation and joining of testing and treatment data

completed and on track to be launched

in H2 2023.

----------------------------------------------------------

Accelerate growth and engagement of the laboratory We expanded our lab network to include 900 laboratories

network and platform-based community. across 44 countries (as at 31 December

2022: 851 across 38 countries).

Launched first virtual lab conference in July 2023

targeted at US labs and physicians with

1,018 participants.

----------------------------------------------------------

Expand the number of therapy brands generating revenue We worked with 50 brands during the period with an

and the average revenue per brand. average revenue per brand of GBP198,000

(H1 2022: 41 brands at an average of GBP184,000 per

brand) - 8% increase in revenue per brand.

----------------------------------------------------------

Transform our customer experience and service. Added 4 Vice Presidents, enhancing strength and depth of

senior management, bolstering industry

expertise and facilitating a sharper emphasis on

operational success.

Added 10 employees (inc. VPs) to take the total to 161

at 30 June 2023 and reorganised customer

experience and service staff into 9 core customer

centric account teams, creating a more efficient

and effective structure to support our strategy.

----------------------------------------------------------

* An enterprise-wide engagement is characterised by a customer

deploying the DXRX platform across three or more of the precision

medicines in their portfolio

Three Unique Assets: Investing in our Value Drivers

We have made good progress against our accelerated investment

strategy. Seven of eight core insight and engagement platform

solutions now available on the DXRX platform, of which, four are

available as recurring revenue contracts. As we continue to execute

against our roadmap, we expect to continue converting our solutions

to our recurring revenue contract model and innovating in our

product offering, ensuring that they are platform based, and target

our customer needs increase recurring revenues. Ultimately, we

anticipate 70% of our revenue will be platform-based and recurring

by 2025, with peak adoption expected to reach around 80% by

2028.

We are pleased to report that strong progress has been made

across the Group's unique asset value drivers detailed below.

DXRX Partner Network

Labs that are better equipped and well-informed have the

capacity to significantly impact the diagnostic and treatment

journey for patients. Leveraging our extensive partner lab network,

we offer various multi-year lab engagement modules to our

pharmaceutical and biotech clients, with the goal of enhancing

patient diagnostic and treatment experiences.

The number of labs on the DXRX platform has continued to

increase with 49 joining in the past six months, bringing the total

to 900 across 44 countries, increasing the DXRX global platform

reach and enhancing our data supply chain and disease coverage.

Diaceutics continues to position itself as a thought leader in

the space and we were pleased to host a first of its kind virtual

lab conference in July 2023. Targeted at delivering specialist

content to US labs and physicians, this event was aimed at driving

better platform network engagement and recruitment, which was

successfully achieved with over 1,000 labs and physicians attending

on the day and that number continues to grow as further labs access

the archived conference recordings. Following the success of the

conference, we are pleased to build on this with the launch of a

European equivalent in H1 2024 and will report on the accelerated

engagement and recruitment of labs as a result of these events at

the end of the year.

DXRX Data

The Group's unrivalled depth of data continues to consolidate

its competitive advantage and serves as a key driver of new client

and therapy brand acquisition. During the period, new testing and

treatment patient records were added, further widening the Group's

competitive moat as it establishes itself as the primary

commercialisation partner for pharma and biotech companies

launching precision medicine.

As the number of patient records on the platform continues to

increase, so too does the requirement for automation and the

application of machine learning and AI within our systems. In order

to enhance patient insights and the value we can deliver to

customers; we have completed the tokenisation of our entire dataset

and are on track to launch tokenised data products in H2 2023. The

tokenisation of our testing data allows us to join it with other

data sets, such as treatment data, which considerably enhances the

patient insights and value to customers. We have also embedded

natural language processing technology into our platform data

capabilities which helps us to accelerate the processing and enrich

the quality of the insights derived from the vast amount of data

received on a daily basis.

DXRX Platform Products

In line with our strategic investment strategy, we have

continued to develop and expand our product offering in the DXRX

platform. These developments allow Diaceutics to further embed

within our customers' commercialisation efforts and take full

advantage of the current opportunity to expand our portion of the

customer budget.

Enhancements made to the DXRX Signal product have continued to

resonate well with clients and our recently launched daily signal

capability now provides customers with even more timely data to

identify patients who would benefit from therapies and improve

their commercial success.

Available only through the Diaceutics' platform, DXRX Signal

utilises our partner network data to identify physicians with a

patient who has tested positive for a specific biomarker of

interest, which may be eligible for therapy. This signal is

seamlessly integrated within a customers' operations within as

little as 48 hours of the positive test result. From this, they are

able to target that physician with a well-informed engagement

before a treatment decision has been made so that they can offer a

more effective drug or therapy sooner; a key goal for all involved

in precision medicine.

For patients, it means their chances of receiving the optimal

therapy within the window of effectiveness is significantly

improved. So far in 2023, DXRX Signal has identified over 46,000

potential US patients that may not have otherwise been recognised

as suitable candidates for treatment with personalised medicines.

The updated version of Signal is very important to Diaceutics and

its customers, as having early access to the diagnostic data will

mean that patients not only get the most appropriate treatment, but

also will potentially start on that treatment earlier. In H1 2023

six of seven DXRX Signal customer contracts renewed for another 12

months (an 86% renewal rate, albeit on low volumes). The one

customer contract non-renewal was for a single therapy brand and as

a result of the customer ceasing commercialisation spend on that

asset. DXRX Signal now supports in excess of 30 therapy brands.

Capitalising on a Growing Market Opportunity

The global precision medicine market continues to grow at pace

and is estimated to increase at 11.5% CAGR to $175.6bn by 2030

(Precedence Research: Precision Medicine Market Size, Share, Report

2022 to 2030). Through strategic investment and developments in our

network, data, products and people, Diaceutics is better placed

than ever to grow alongside the market as a whole and capitalise on

this significant opportunity.

Precision medicines currently represent 51% of oncology medicine

annual sales. However, pharma is losing over 50% of potential

patients due to suboptimal diagnosis practices, meaning that

patients do not receive the most effective medicines. The reality

of this was evidenced in the jointly published November 2022

Diaceutics Practice Gaps study in the peer reviewed JCO Precision

Oncology, which found that 64% of non-small cell lung cancer

patients in the US in 2019 did not receive access to the medicines

most suitable to them, and therefore did not benefit from

personalised medicine treatment.

This hurdle in the diagnostic process is both harmful for

patients not receiving the most suitable diagnosis and treatments

for their illness, and for pharma who are currently seeing up to an

estimated $5bn of lost precision medicine oncology sales over the

lifecycle of a therapy. Diaceutics' unique network, data and

product assets are ideally positioned to meet both of these needs

and ensure that patients receive the right treatment at the right

time.

We are well positioned to capitalise on this growing marketing

opportunity as the pharma industry becomes increasingly aware of

the need to understand the diagnostic infrastructure and the

communication between lab and physician and physician and

prescribing. This is hugely valuable for us, and we continue to

develop innovative commercialisation solutions for pharma and

biotech.

We have evidenced that pharma is willing to spend in excess of

$6 million over the therapy lifetime addressing these opportunities

and are confident that ultimately this should be US$10-15 million

per brand to maximise the addressable patient treatment

population.

Diaceutics has already established itself as a trusted partner

to pharma, and to date we have identified over 46,000 potential

patient candidates who are not yet being offered precision

medicines and bridging this gap for both patients and pharma.

We have made good progress towards capitalising on this

opportunity, working across 50 therapies in H1 2023 with 37

customers, up 22% on H1 2022 and increasing the value of

addressable lifetime therapy brand spend secured with 33 brands

with lifetime brand spend over $1 million. As we continue to

consolidate our position as a trusted partner to pharma and execute

against our strategic investment program, we are confident in

further capitalising on the significant opportunity available to us

within the market.

Our Team

Diaceutics' commitment to its people is at the centre of what we

do, in our drive to ensure that every patient receives the right

test at the right time, and in how we work to achieve that goal.

Our successes to date would not be possible without the hard work

and dedication of our team for which we sincerely grateful.

We continue to invest in our team to ensure we remain both an

attractive, and enjoyable, place to work for current and future

employees. In H1 2023, we have added four Vice Presidents to

enhance the strength and depth of the senior management team,

bolster our industry expertise, and in turn facilitate our

business' emphasis on operational success. Our customer centric

growth strategy led to us reorganising our customer experience and

service staff into 9 core customer account teams and we continue to

add people and skills in key roles to facilitate the company's

growth and scale plans for 2024 and beyond, adding six new

employees in H1 2023.

From 1 October 2023, experienced Non-Executive Director, Graham

Paterson, will be appointed to the Board of Diaceutics as a

Non-Executive Director. Graham brings extensive leadership and

board experience to Diaceutics and we look forward to working with

him as we progress on the next stage of our growth journey. At the

same time, Charles Hindson will be stepping down from his position

as a Non-Executive Director at Diaceutics. The Board thanks Charles

for his hard work, dedication and much valued counsel during the

past four years and wishes him all the best in his future

endeavours.

In addition, we have today announced that CEO, Peter Keeling,

has informed the Board of his intention to step back from his role

as CEO of Diaceutics on 1 January 2024. Peter will continue to

serve on the Board as an Executive Director, to support the CEO

transition. Thereafter, Peter's primary focus will be to accelerate

the corporate development of Diaceutics. This will further

strengthen Diaceutics leadership position as the primary partner

for pharmaceutical companies as they seek to commercialise the new

generation of precision therapeutics across a range of disease

areas over the coming months and years.

We are delighted that Ryan Keeling, current Chief Innovation

Officer, has today been appointed CEO Designate and will become CEO

on 1 January 2024. Ryan joined Diaceutics in 2006 and became a

member of the Board on IPO in 2019. Ryan is the architect of the

Company's data capabilities and DXRX platform, leading the

development and commercialisation of the Group's technology,

including its proprietary data lake. During his tenure with

Diaceutics, Ryan has held the key roles of Chief Commercial

Officer, Chief Operating Officer and most recently, Chief

Innovation Officer, where he has led the Group's DXRX product

innovation.

Financial Review

We are pleased to report that despite the challenging

macroeconomic trading conditions impacting all sectors, Diaceutics

has delivered a strong financial performance in the first six

months of 2023, the fifth consecutive period of growth for the

Group. With strong cash reserves of GBP17.9 million at 30 June

2023, the Company enters the second half of the year reaffirming

its full year outlook as it continues to pursue its accelerated

investment strategy and drive to become the primary precision

medicine commercialisation partner to the global pharma and biotech

industries.

Revenue Growth and Order Book Visibility

Our comprehensive suite of data driven insight and engagement

solutions, designed to serve the precision medicine

commercialisation requirements of pharma and biotech companies,

have continued to experience strong organic growth in H1 2023.

Revenue for the period grew 32% to GBP9.9 million (H1 2022: GBP7.5

million), a 25% increase on a constant currency basis. The strong

revenue growth continues to be maintained whilst transitioning a

significant proportion of customer products and contracts to

recurring revenue, which saw GBP4.6 million ( 47%) of recurring

revenues in the period, up 66% from GBP2.8 million and 37% in H1

2022 .

Revenue growth has been especially strong within the

platform-based insight and engagement solutions, growing 44% to GBP

8.2 million. Platform based solutions now represent 83 % of all

revenues (up from 76% for the comparative period), a transition

which has been achieved in just two and a half years since the

platform launch and tracking roughly a year ahead of management's

expectations. Advisory service revenues were GBP1.7 million in the

year, down slightly on the comparative period (H1 2022: GBP1.8

million).

During H1 2023, we observed a slowing in pharmaceutical industry

spending, predominately discretionary spend, which was attributed

to general uncertainties around macroeconomic and politics

pressures, particularly drug pricing policies. These pressures

materialised as lower spending across the shorter-term strategic

consultancy services, impacting our advisory service business, but

demand remained strong for forward contracted platform-based

insight and engagement solutions which are more embedded into

pharma go-to-market commercialisation critical pathways.

The Total Contract Value (TCV) secured by way of sales in the

period was GBP16.9 million and was slightly ahead of the value of

contracts secured in the comparative period (H1 2022: GBP16.5

million). The quality of TCV was aided by the Company's continued

progress towards securing enterprise-wide engagements, which is

characterised by a customer deploying the DXRX platform across

three or more of the precision medicines in their portfolio.

The success in securing enterprise-wide engagements has

continued to build future visibility through a multi-year recurring

revenue order book. By 30 June 2023 the Company had secured f our

enterprise-wide engagements with a TCV of $20.1 million and

delivering insight data solutions for up to three years across 25

pharma therapies. The order book at 30 June 2023 grew to GBP24.1

million, representing 43% growth in the period (GBP16.9 million at

31 December 2022), with around GBP6.8 million expected to be

realised as revenue in H2 2023 and giving the business around 70%

visibility of the full year consensus revenue number at the

mid-year point. Recurring revenue now represents 94% or GBP22.7

million of the future order book.

The Group's customer base is heavily weighted towards blue chip

pharma companies, with 83% of revenue generated by customers based

in the USA (H1 2022: 72%). The Group worked with a total of 37

customers during the H1 2023 (H1 2022: 34) across 50 therapies (H1

2022: 41). Diaceutics has increased its average revenue per brand

for the first six months of 2023 to GBP198,000, up from GBP184,000

in H1 2022, and continues to increase the value of addressable

lifetime therapy brand spend secured with 33 therapy brands with

lifetime spend over $1 million (26 therapy brands as at 31 December

2022).

The Group continues to expect a higher weighting of revenue, and

therefore profitability, in the second half of the financial year.

In 2022 the revenue weighting first vs. second half of the year was

38:62 compared to 43:57 in 2021. This weighting has historically

been driven by pharma customers' propensity to spend more of its

allocated annual budget in the second half of the year,

particularly quarter four, as it reaches the end of its own budget

and financial years. Although we see this second half revenue

weighting reducing in future years as a result of the Company's

shift to recurring revenue contracts, the strong growth rates

experienced by the Company and lower level of spend observed by

pharma in H1 2023 means that this second half revenue weighting

trend is expected again for the 2023 full year.

Gross Profit and Margins

The gross profit for the first six months of 2023 increased 38%

to GBP8.7 million (H1 2022: GBP6.3 million). The gross margin for

H1 2023 was 88%, up four percentage points from the gross margin in

H1 2022 of 84%. The increase in margin was primarily the result of

sales mix with a higher concentration of revenue generated from

platform-based solutions and a reduction in lower marg in

pass-through costs associated with some engagement solution

deliverables.

EBITDA and Loss Before Tax Performance

In line with expectations, the Company generated an EBITDA loss

of GBP0.2 million, lower than the comparative period profit of

GBP0.3 million. The EBITDA loss reflects the impact of the

Company's planned accelerated investment strategy which

predominately materialised as increased headcount and people

related costs in H1 2023 (headcount up to 161 vs. 138 in H1 2022)

as well as a higher proportion of platform development costs

expensed during the period and foreign exchange losses from

strengthening GBP.

The loss before tax increased from GBP1.1 million in H1 2022 to

GBP2.0 million in H1 2023. This was a result of the increasing

operating loss (see commentary on EBITDA above) as well as an

increase in amortisation costs which rose by approximately GBP0.5

million in the period, with the increasing amortisation costs being

the result of the capitalisation of internal development costs in

prior years and increasing data purchasing costs.

The intensity of development costs being capitalised will

continue to curtail over the coming years, instead being expensed

to the income statement. Data acquisition costs will continue to

increase as additional opportunities are identified to acquire data

through our lab network and existing data supply chain and to

accelerate the depth and breadth of our data repository. Increasing

the total data acquisition spend in future years is a key strategic

goal and driver of both growth and value, and as a result, the

total level of amortisation will continue to rise as a result of

this capitalised spend.

Reconciliation of Operating Loss to EBITDA

2023 2022

GBPm's GBPm's

---------------------------- ------- -------

Operating Loss (2.2) (1.1)

Depreciation & Amortisation 2.0 1.4

------- -------

EBITDA (0.2) 0.3

Financial Strength

At 30 June 2023, the Company reported a strong net asset

position of GBP41.1 million (31 December 2022: GBP42.5

million).

Cash at 30 June 2023 was GBP17.9 million (31 December 2022:

GBP19.8 million), reflecting the acceleration in investment

announced in the January 2023 Strategy Update, and the Company has

sufficient financial resources in place to fully execute its

ambitious growth plans.

During the year, the Company continued to invest in the

development of its platform technology, with GBP1.9 million of a

total platform development spend for H1 2023, of which GBP0.8

million was capitalised in the year (H1 2022: GBP1.8 million of a

total platform development spend of which GBP1.4 million was

capitalised). As planned and set out in the accelerated investment

strategy, total platform development costs have increased on

comparative periods as the business looks to accelerate the

development of the platform products, capability and scale.

However, the proportion of development costs which are capitalised

has decreased as the platform reaches maturity. Data expenditure,

which is capitalised and amortised over the period of its use, has

increased around double over H1 2023 to GBP1.8 million compared

with GBP0.9 million in H1 2022. In line with the strategy, the

increase in spend will enhance our proprietary data repository

through expanding the geographical coverage, the frequency of the

data received and the disease coverage.

The free cash flow (Net cash inflow from operating activities

less capital expenditure less the payment of lease liabilities) for

H1 2023 was an outflow of GBP2.3 million (H1 2022: inflow GBP0.8

million). Cash received operating activities for H1 2023 was GBP0.7

million (H1 2022: GBP3.3 million), demonstrating the Company's

ability to continually generate cash from its operating activities,

and which has only reversed back to a free cash outflow in H1 2023

as a result of the enhanced investment in data and lower proportion

of capitalised platform development costs.

Based on the increasing cost of servicing debt and the low

probability of forecast utilisation the Company's Revolving Credit

Facility (RCF), the Company has not renewed the GBP4 million

facility that ended in July 2023. The Company retains strong

relationships with its primary banking partners and is satisfied

that it can arrange an RCF of equal or greater quantum if

required.

Condensed Profit and Loss Account

for the six months ended 30 June 2023

Six months Six months Year ended

to to 31 December

30 June 2023 30 June 2022* 2022

(Unaudited) (Unaudited) (audited)

Notes GBP000's GBP000's GBP000's

Revenue 2 9,924 7,528 19,504

Cost of sales (1,224) (1,221) (2,763)

------------- -------------- ------------

Gross profit 8,700 6,307 16,741

Administrative expenses (10,873) ( 7,466) (16,280)

Other operating income 3 7 96 114

------------- -------------- ------------

Operating (loss)/profit (2,166) (1,063) 575

Finance Income 253 - 111

Finance costs (42) (68) (122)

------------- -------------- ------------

(Loss)/profit before tax (1,955) (1,131) 564

Income tax credit 4 470 364 160

(Loss)/profit for the financial

period (1,485) (767) 724

============= ============== ============

All activities in the current and prior periods relate to

continuing operations.

* The Group has restated the classification of amortisation of

intangible assets for the period ending 30 June 2022 to conform

with the current year presentation. Further details of this

reclassification are detailed in note 13 to these financial

statements.

Condensed Statement of Comprehensive Income

For the the six months ended 30 June 2023

Six months Six months Year ended

to to 31 December

30 June 2023 30 June 2022 2022 (audited)

(Unaudited) (Unaudited)

GBP000's GBP000's GBP000's

(Loss)/profit for the financial

period (1,485) (767) 724

Items that may be reclassified

subsequently to profit or loss

:

Exchange differences on translation

of foreign operations (121) 639 440

Total comprehensive (loss)/profit

for the period, net of tax (1,606) (128) 1,164

============= ============= ===============

All activities in the current and prior periods relate to

continuing operations.

Earnings per share

for the six months ended 30 June 2023

Six months Six months

to to Year ended

30 June 2023 30 June 2022 31 December

Note (Unaudited) (Unaudited) 2022 (audited)

Pence Pence Pence

Basic 6 (1.76) (0.91) 0.86

Diluted 6 (1.76) (0.91) 0.84

============= ============= ===============

Condensed Balance Sheet

as at 30 June 2023

31 December

30 June 30 June

2023 2022 2022

Notes (Unaudited) (Unaudited) (Audited)

ASSETS GBP000's GBP000's GBP000's

Non-current assets

Intangible assets 7 16,070 14,189 15,222

Right of use assets 1,257 1,339 1,333

Property, plant and equipment 8 737 704 759

Deferred tax asset 96 99 46

--------------------- -------------- -------------

18,160 16,331 17,360

--------------------- -------------- -------------

Current assets

Trade and other receivables 9 9,164 7,290 9,209

Income tax receivable 917 1,519 1,846

Cash and cash equivalents 17,880 20,388 19,841

--------------------- -------------- -------------

27,961 29,197 30,896

--------------------- -------------- -------------

TOTAL ASSETS 46,121 45,528 48,256

===================== ============== =============

EQUITY AND LIABILITIES

Equity

Equity share capital 12 169 169 169

Share premium 37,126 37,125 37,126

Treasury shares (293) (255) (263)

Translation reserve 17 337 138

Profit & loss account 4,040 3,574 5,344

--------------------- ------- -------

TOTAL EQUITY 41,059 40,950 42,514

===================== ======= =======

Non-current liabilities

Leasehold liability 1,132 1,284 1,205

Provision for dilapidations 88 - 79

Deferred tax liability 341 424 706

---------------------- ------ ------

1,561 1,708 1,990

---------------------- ------ ------

Current liabilities

Trade and other payables 10 3,365 2,740 3,628

Leasehold liability 128 130 124

Income tax payable 8 - -

---------------------- ------ ------

3,501 2,870 3,752

---------------------- ------ ------

TOTAL LIABILITIES 5,062 4,578 5,742

====================== ====== ======

TOTAL EQUITY AND LIABILITIES 46,121 45,528 48,256

======= ======= =======

Condensed Statement of Changes in Equity

for the six months ended 30 June 2023

Share Treasury Profit

Equity premium shares Translation and loss Total

share capital reserve account equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 1 January 2022 168 36,864 (165) (302) 4,084 40,649

=============== ========= ========= ============ ========== =========

Loss for the period - - - - (767) (767)

Other comprehensive

loss - - - 639 - 639

Total comprehensive

loss for the period - - - 639 (767) (128)

--------------- --------- --------- ------------ ---------- ---------

Transactions with owners

recorded directly in

equity

Share based payment - - - - 257 257

Treasury shares - - (90) - - (90)

Conversion of convertible

loan notes 1 133 - - - 134

Exercise of warrants - 129 - - - 129

Total transactions with

owners 1 262 (90) - 257 430

--------------- --------- --------- ------------ ---------- ---------

At 30 June 2022 (unaudited) 169 37,126 (255) 337 3,574 40,951

=============== ========= ========= ============ ========== =========

Profit for the period - - - - 1,491 1,491

Other comprehensive

loss - - - (199) - (199)

Total comprehensive

profit for the period - - - (199) 1,491 1,292

--------------- --------- --------- ------------ ---------- ---------

Transactions with owners

recorded directly in

equity

Share based payments - - - - 279 279

Treasury Shares - - (8) - - (8)

Total transactions with

owners - - (8) - 279 271

--------------- --------- --------- ------------ ---------- ---------

At 31 December 2022

(audited) 169 37,126 (263) 138 5,344 42,514

=============== ========= ========= ============ ========== =========

Share Treasury Profit

Equity premium shares Translation and loss Total

share capital reserve account equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 1 January

2023 169 37,126 (263) 138 5,344 42,514

============== ========= ========= ============ ====================================== =========

Loss for the

period - - - - (1,485) (1,485)

Other

comprehensive

loss - - - (121) - (121)

Total

comprehensive

loss for the

period - - - (121) (1,485) (1,606)

-------------- --------- --------- ------------ -------------------------------------- ---------

Transactions

with owners

recorded

directly in

equity

Share based

payment - - - - 181 181

Treasury

shares - - (30) - - (30)

Total

transactions

with

owners - - (30) - 181 151

-------------- --------- --------- ------------ -------------------------------------- ---------

At 30 June

2023

(unaudited) 169 37,126 (293) 17 4,040 41,059

============== ========= ========= ============ ====================================== =========

Condensed Statement of Cash Flows

for the six months ended 30 June 2023

Six months Six months Year ended

to 30 June to 30 June 31 December

Notes 2023 (Unaudited) 2022 ( Unaudited) 2022 ( audited)

GBP000's GBP000's GBP000's

(Loss)/profit before tax (1,955) (1,131) 564

Adjustments to reconcile profit

before tax to net cash flows from

operating activities

Net finance (income)/costs (211) 68 11

Amortisation of intangible assets 7 1,774 1,193 2,704

Depreciation of right to use asset 78 73 157

Depreciation of property, plant

and equipment 8 81 70 147

Research and development tax credits - (75) (86)

Decrease/(increase) in trade and

other receivables 45 778 (1,594)

(Decrease)/increase in trade and

other payables (265) 293 1,266

Unrealised currency translation

gain - 193 -

Share based payments 181 257 536

------------------ ------------------- -----------------

Cash generated from operations (272) 1,719 3,705

Tax received 970 1,545 1,391

------------------ ------------------- -----------------

Net cash inflow from operating

activities 698 3,264 5,096

------------------ ------------------- -----------------

Investing activities

Purchase of intangible assets (2,885) (2,324) (4,684)

Purchase of property, plant and

equipment (61) (56) (186)

Finance interest received 253 - 111

------------------ ------------------- -----------------

Net cash outflow from investing

activities (2,693) (2,380) (4,759)

------------------ ------------------- -----------------

Financing activities

Borrowing costs (13) (35) (59)

Leasehold repayments (98) (49) (163)

Purchase of treasury shares 12 (30) (90) (98)

Issue of shares on exercise of

a warrant 12 - 129 129

------------------ ------------------- -----------------

Net cash outflow from financing

activities (141) (45) (191)

------------------ ------------------- -----------------

Net (decrease)/increase in cash

and cash equivalents (2,136) 839 146

Net foreign exchange movements 175 (126) 20

Opening cash and cash equivalents 19,841 19,675 19,675

------------------ ------------------- -----------------

Closing cash and cash equivalents 17,880 20,388 19,841

================== =================== =================

Notes to the Condensed Financial Statements

for the six months ended to 30 June 2023

1. Summary of significant accounting policies

Basis of preparation

The condensed financial statements have been prepared in

accordance with the recognition and measurement requirements of UK

adopted International Accounting Standard 34, 'Interim Financial

Reporting'.

The condensed financial statements should be read in conjunction

with the Group's last annual consolidated financial statements as

at and for the year ended 31 December 2022. Selected explanatory

notes are included to explain events and transactions that are

significant to an understanding of the changes in the Group's

financial position and performance since the last annual financial

statements.

The condensed financial statements have been prepared under the

historical cost convention, except for the fair value of certain

financial instruments which are further detailed in note 11.

The same accounting policies, presentation and methods of

computation have been followed in these condensed financial

statements as were applied in the preparation of the Group's

financial statements for the year ended 31 December 2022.

These condensed financial statements do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2022 were

approved by the Board of Directors and have been delivered to the

Registrar of Companies. The audit report on those accounts was

unqualified, did not draw attention to any matters by way of

emphasis and did not contain any statement under section 498(2) or

(3) of the Companies Act 2006.

There have been no significant related party transactions in the

period which have materially affected the financial position or

performance of the Company, or changes to related party

transactions in the period which were disclosed in the prior annual

report.

Critical accounting judgements and key sources of estimation

uncertainty

In preparing these condensed financial statements, management

has made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements and are summarised below.

Sources of estimation uncertainty

Source of Description

estimation

uncertainty

Useful economic The assessment of UEL of data purchases and platform

life (UEL) require estimation over the period in which these

of intangible assets will be utilised and is based on information

assets on the estimated technical obsolescence of such assets

and latest information on commercial and technical

use. The platform has been assessed to have a UEL

of 10 years, platform algorithms s ix years and data

four years.

-------------------------------------------------------------

Impairment The assessment of the recoverable amount of property

of assets plant and equipment, intangible assets and right-of-use

assets is made in accordance with IAS 36 Impairment

of Assets. The Group performs an annual review in

respect of indicators of impairment, and if any such

indication exists, the Group is required to estimate

the recoverable amount of the asset. Following this

assessment, no impairment indicators were present

at 31 December 2022. The Group's policy is to test

non-financial assets for impairment annually, or

if events or changes in circumstances indicate that

the carrying amount of these assets may not be recoverable.

The Group has considered whether there have been

any indicators of impairment during the six-month

period to 30 June 2023 which would require an impairment

review to be performed. Based upon this review, the

Group has concluded that there are no such indicators

of impairment as 30 June 2023.

-------------------------------------------------------------

Discount Application of IFRS 16 requires the Group to make

rate significant estimates in assessing the rate used

to discount the lease payments in order to calculate

the lease liability. The incremental borrowing rate

depends on the term, currency and start date of the

lease and is determined based on a series of inputs

including the Group commercial borrowing rate.

-------------------------------------------------------------

Attrition In the calculation of Share Based Payments and related

rate costs charge an assessment of expected employee attrition

is used based on expected employee attrition and

where possible actual employee turnover from the

inception of the share option plan.

-------------------------------------------------------------

Critical accounting judgements

Accounting Description of critical judgement

policy

Revenue With respect to revenue recognition, where the input

method is used to determine recognition over time,

a key source of estimation will be the total budgeted

hours to completion for comparison with the actual

hours spent.

------------------------------------------------------------

Deferred In assessing the requirement to recognise a deferred

tax tax asset, management carried out a forecasting exercise

in order to assess whether the Group will have sufficient

future profits on which the deferred tax asset can

be utilised. This forecast required management's

judgment as to the future performance of the Group.

------------------------------------------------------------

Intangible The Group capitalises costs associated with the development

assets of the DXRX platform and data lake. These costs are

assessed against IAS 38 Intangible Assets to ensure

they meet the criteria for capitalisation.

------------------------------------------------------------

Going Concern

The financial performance and balance sheet position at 30 June

2023 along with a range of scenario plans to 31 December 2025 has

been considered, applying different sensitives to revenue. Across

these scenarios, including at the lower end of the range, there

remains significant headroom in the minimum cash balance over the

period to 31 December 2024 and therefore the Directors have

satisfied themselves that the Group has adequate funds in place to

continue to meet its obligations as they fall due.

2. Revenue and segmental analysis

For all periods reported the Group operated under one reporting

segment but revenue is analysed under three separate

products/service lines.

a) Revenue by major product/service line

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Insight Solutions (Data) 6,989 4,798 12,653

Engagement Solutions (Tech enabled

services) 1,251 910 2,227

Advisory Services (Professional

services) 1,684 1,820 4,624

9,924 7,528 19,504

============ ============ =============

b) Revenue by geographical area

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

North America 8 ,261 5,424 14,454

UK 195 222 561

Europe 1,115 1,348 2,696

Asia and rest of world 353 534 1,793

9 ,924 7,528 19,504

============ ============ =============

c) Revenue by timing of recognition

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Point in time 2,464 3,685 9,370

Over time and input method 7,460 3,843 10,134

9,924 7,528 19,504

============ ============ =============

The receivables, contract assets and liabilities in relation to

contracts with customers are as follows:

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Contract assets

Accrued revenue 3,370 3,109 2,582

Contract liabilities

Deferred revenue 1,283 379 411

Order book

The aggregate amount of the transaction price allocated to

product and service contracts that are partially or fully

unsatisfied as at the reporting date ('order book') are as

follows:

2023 2024 2025+ Total

GBP000's GBP000's GBP000's GBP000's

Platform based products

and services 6,300 7,816 9,510 23,626

Advisory services 453 - - 453

6,753 7,816 9,510 24,079

========= ========= ========= =========

3. Other operating income

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Government grants 7 19 28

Research and developments credits - 77 86

7 96 114

============ ============ =============

4. Income tax

Income tax expense is recognised at an amount determined by

multiplying the profit before tax for the interim reporting period

by management's best estimate of the weighted-average annual income

tax rate, adjusted for the tax effect of certain items recognised

in full in the interim period. As such, the effective tax rate in

the condensed financial statements may differ from management's

estimate of the effective tax rate for the annual financial

statements.

The Group's consolidated effective tax rate in respect of

continuing operations for the six months ended 30 June 2023 was

24.1% (six months ended 30 June 2022: 32.2%).

The difference to the corporation tax rate of 23.52% reflects UK

Research & Development credits under the SME R&D tax

regimes of GBP82,000, disallowable expenses of GBP9,000, GBP58,000

movement in deferred tax not recognised, GBP43,000 of higher rate

taxes, prior period adjustments totalling a credit of GBP35,000 and

a credit of GBP4,000 arising as a result of the impact of the

change in the future UK tax rate on the Group's deferred tax

assets.

UK corporation tax is calculated at 23.52% (2022: 19%) of the

taxable profit or loss for the period. Taxation for other

jurisdictions is calculated at the rates prevailing in the

respective jurisdictions. In the March 2021 budget, it was

announced that the UK tax rate will increase to 25% from 1 April

2023. This will have a consequential effect on the group's future

tax charge. The deferred tax asset is recognised on the basis that

the Group has forecasted sufficient profits on which the deferred

tax asset will be utilised in future periods.

Tax losses carried forward amount to GBP1,678,000 (H1 2022:

GBP1,998,000) within Diaceutics PLC, GBP266,000 in Diaceutics Inc

and GBP96,000 in Diaceutics Ireland. The Group has tax losses

carried forward arising in subsidiary undertakings. Due to the

uncertainty of the recoverability of the tax losses within these

subsidiaries, a potential deferred tax asset of GBP402,000 (H1

2022: GBP277,000) has not been recognised. All other deferred tax

assets and liabilities have otherwise been recognised as they

arise.

5. EBITDA

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Operating (loss)/profit: (2,165) (1,063) 575

Adjusted for:

Depreciation and amortisation 1,933 1,336 3,008

EBITDA (232) 273 3,583

============ ============ =============

6. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Earnings attributable to shareholders

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP000's GBP000's GBP000's

Earnings for the purposes of basic

and diluted earnings per share being

net (loss)/profit attributable to

owners of the Company (1,485) (767) 724

============ ============ =============

Number of shares

Year ended

Six months Six months 31 December

to 30 June to 30 June 2022

2023 2022 Number

Number Number

Ordinary Shares in issue at the

end of the period 84,472,431 84,472,431 84,472,431

------------ ------------- -------------

Weighted average number of shares

in issue 84,472,431 84,242,344 84,357,387

Less Treasury Shares (245,729) (133,000) (207,791)

------------ ------------- -------------

Weighted average number of shares

for basic

earnings per share 84,226,702 84,109,344 84,149,596

Effect of dilution of Convertible

Loan Notes - 503 -

Effect of dilution of share options

and warrants granted 2,646,772 1,766,949 1,939,925

Weighted average number of shares

for diluted

earnings per share 86,873,474 85,876,796 86,089,521

============ ============= =============

Earnings and diluted Earnings per share

Six months Six months

to to Year ended

30 June 30 June 31 December

2023 2022 2022

Pence Pence Pence

Basic (1.76) (0.91) 0.86

Diluted (1.76) (0.91) 0.84

========== ========== ============

7. Intangible assets

Patents Development

and trademarks Datasets expenditure Platform Software Total

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Cost

At 1 January

2022 1,144 4,849 216 9,727 562 16,498

Foreign exchange 32 163 3 222 1 421

Transfer from

Development

expenditure

to Platform - - (959) 959 - -

Additions - 853 1,387 - - 2,240

---------------- --------- ------------- ----------- ----------- ---------

At 30 June

2022 1,176 5,865 647 10,908 563 19,159

Foreign exchange 27 65 1 79 - 172

Transfer from

Development

expenditure

to Platform - - (1,442) 1,442 - -

Additions 1 1,316 972 - 155 2,444

At 31 December

2022 1,204 7,246 178 12,429 718 21,775

---------------- --------- ------------- ----------- ----------- ---------

Foreign exchange (33) (190) (8) (168) (1) (400)

Transfer from

Development

expenditure

to Platform - - (923) 923 - -

Additions - 1,843 753 - 289 2,885

At 30 June

2023 1,171 8,899 - 13,184 1,006 24,260

---------------- --------- ------------- ----------- ----------- ---------

Patents Development

and trademarks Datasets expenditure Platform Software Total

Amortisation GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 1 January

2022 1,085 1,692 - 721 179 3,677

Foreign exchange 32 47 - 21 - 100

Charge for

the period 20 605 - 513 55 1,193

---------------- ---------- -------------- ----------- ----------- ---------

At 30 June

2022 1,137 2,344 - 1,255 234 4,970

Foreign exchange 27 30 - 14 1 72

Charge for

the period 21 708 - 599 183 1,511

---------------- ---------- -------------- ----------- ----------- ---------

At 31 December

2022 1,185 3,082 - 1,868 418 6,553

Foreign Exchange (34) (69) - (33) (1) (137)

Charge for

the period 14 953 650 157 1,774

---------------- ---------- -------------- ----------- ----------- ---------

At 30 June

2023 1,165 3,966 - 2,485 574 8,190

Net book

value

At 30 June

2023 6 4,933 - 10,699 432 16,070

================ ========== ============== =========== =========== =========

At 31 December

2022 19 4,164 178 10,561 300 15,222

================ ========== ============== =========== =========== =========

At 30 June

2022 39 3,521 647 9,653 329 14,189

================ ========== ============== =========== =========== =========

8. Property, plant and equipment

Leasehold Total

Office equipment improvements

GBP000's GBP000's GBP000's

Cost

At 1 July 2022 540 478 1,018

Foreign exchange translation 3 - 3

Additions 76 54 130

At 31 December 2022 619 532 1,151

--------------------------- -------------- ---------

Foreign exchange translation (2) - (2)

Disposals (11) - (11)

Additions 61 - 61

At 30 June 2023 667 532 1,199

--------------------------- -------------- ---------

Depreciation

At 1 July 2022 274 40 314

Charge for the period 52 26 78

At 31 December 2022 326 66 392

--------------------------- -------------- ---------

Foreign exchange translation (2) - (2)

Disposals (9) - (9)

Charge for the period 53 28 81

At 30 June 2023 368 94 462

--------------------------- -------------- ---------

Net book value

At 30 June 2023 299 438 737

=========================== ============== =========

At 31 December 2022 293 466 759

=========================== ============== =========

At 30 June 2022 266 438 704

=========================== ============== =========

9. Trade and other receivables

30 June 30 June 31 Dec 2022

2023 2022

GBP000's GBP000's GBP000's

Trade receivables 4,698 3,331 5,792

Accrued revenue 3,370 3,109 2,582

Other receivables 222 132 207

Prepayments 845 718 628

Derivative asset - Foreign currency -

forward contract 29 -

9,164 7,290 9,209

========= ========= ============

10. Trade and other payables

30 June 30 June 31 Dec 2022

2023 2022

GBP000's GBP000's GBP000's

Creditors : falling due within

one year

Trade payables 287 239 759

Accruals 1,325 1,629 1,996

Other tax and social security 418 337 423

Deferred revenue 1,283 379 411

Other Payables 52 - 39

Derivative liability - Foreign

currency forward contract - 156 -

3,365 2,740 3,628

========= ========= ============

11. Financial instruments

30 June 30 June 31 Dec 2022

2023 2022

GBP000's GBP000's GBP000's

Financial assets at cost

Trade receivables 4,698 3,331 5,792

Other receivables 222 132 207

Cash at bank and in hand 17,880 20,388 19,841

Financial liabilities at cost

Trade payables (287) (239) (759)

Leasehold liability (1,260) (1,414) (1,329)

Financial assets/(liabilities)

at fair value

Derivative financial instrument

- Foreign currency forward contract 29 (156) -

Derivative financial instrument - Foreign currency forward

contract

The group has entered into a number of foreign currency

derivative contracts during the period. The nominal value of the

Group's forward contracts is GBP3,200,000 (2022: GBP1,896,000)

principally to sell US Dollars.

The foreign currency forward contracts are categorised as level

2 within the fair value hierarchy.

The Group's foreign currency forward contracts are not traded in

active markets. These contracts have been fair valued using

observable forward exchange rates and interest rates corresponding

to the maturity of the contract. The effects of non-observable

inputs are not significant for foreign currency forward

contracts.

Fair value measurement on these derivatives as at the period end

are GBP29,000 (30 June 2022: -GBP156,000).

12. Share capital

30 June 30 June 31 Dec

2023 2022 2022

GBP000's GBP000's GBP000's

Allotted, called up and fully paid

84,472,431 (June 2022 and Dec 2022:

84,472,431)

Ordinary shares of GBP0.002 each 169 169 169

========= ========= =========

No warrants exercised during the period (01 January 2023 - 30

June 2023).

Warrant balance of 177,915 with an exercise price of GBP0.76

will potentially provide the Company with proceeds of

GBP135,215.

Treasury shares are shares in Diaceutics PLC that are acquired

and held by the Diaceutics Employee Share Trust for the purpose of

issuing shares under relevant employee share option plans.

13. Change in accounting policy

At the end of 2022, the Directors have voluntarily changed the

accounting policy in respect of presentation of amortisation of

Intangible assets on the face of the Group Profit and Loss account.

The Group has made a decision to disclose the amortisation of

intangible assets in administrative expenses instead of Cost of

sales.

The change was implemented to better align Diaceutics' Group

Profit and Loss account presentation with peers in the pharma tech

industry, allowing investors and analysts to benchmark the Group's

results more readily. This has resulted in the H1 2022 gross profit

and gross profit margin increasing. Operating profit and profit

before and after tax for the H1 2022 reporting period have not

changed. Accordingly, the prior year comparatives have been

restated to reflect this change in accounting policy.

The following table summarises the impact of change in

accounting policy on the Group's Profit and Loss account as at 30

June 2022 for each of the financial statement lines affected.

Please note that there is no impact on the Group Statement of

Comprehensive Income, Group Statement of Financial Position, Group

Statement of Cash Flow and as at 30 June 2022.

As reported As restated

30 June 2022 Adjustments 30 June 2022

GBP000's GBP000's GBP000's

Revenue 7,528 - 7,528

Cost of sales (2,414) 1,193 (1,221)

------------- ----------- -------------

Gross profit 5,114 1,193 6,307

Administrative expenses ( 6,273) (1,193) ( 7,466)

Other operating income 96 - 96

------------- ----------- -------------

Operating loss (1,063) - (1,063)

Finance Income - - -

Finance costs (68) - (68)

------------- ----------- -------------

Loss before tax (1,131) - (1,131)

Income tax credit 364 - 364

Loss for the financial period (767) - (767)

============= =========== =============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUWPBUPWPGA

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

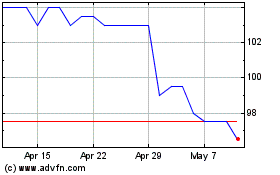

Diaceutics (LSE:DXRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diaceutics (LSE:DXRX)

Historical Stock Chart

From Feb 2024 to Feb 2025