TIDMECEL

RNS Number : 3229T

Eurocell plc

24 November 2021

24 November 2021

EUROCELL PLC

("Eurocell" or the "Group")

Trading Update - Continued Growth, Outlook Confirmed

Eurocell plc, the market leading, vertically integrated UK

manufacturer, recycler and distributor of innovative window, door

and roofline PVC products, provides the following update for the

ten months to 31 October 2021.

Summary

The positive sales trends from H1 have continued into the second

half of the year, supported by good underlying demand in our

markets. We are taking effective action to mitigate ongoing cost

inflation and supply chain pressures. As a result, we remain on

track to deliver profit before tax for the full year in line with

market expectations(1) .

Trading Performance

Group sales for the four months to 31 October were up 18%

compared to 2019 and 5% compared to 2020, with the latter

reflecting a very strong second half last year. For the ten months

to 31 October 2021, sales were up 21% compared to 2019 and 38%

compared to 2020. Divisional growth rates were as follows:

Sales growth 4 months YTD 4 months YTD

to 31 to 31 to 31 to 31

Oct 2021 Oct 2021 Oct 2021 Oct 2021

----------

vs 2019 vs 2020

----------------------

Total Group 18% 21% 5% 38%

Profiles Division 19% 19% 14% 48%

Building Plastics Division 18% 23% -1% 32%

---------- ---------- ----------

Whilst demand in the repair, maintenance and improvement (RMI)

market has moderated from the unprecedented levels experienced in

H2 2020 and H1 2021, this sector remains strong. Furthermore, we

believe we are also continuing to take market share. Group sales

growth for the ten months to 31 October of 21% compared to 2019

includes:

-- Profiles up 19% - good contributions from trade fabricators,

who are substantially focused on the RMI market, and another very

strong performance from Vista doors. New build has enjoyed improved

sales in the second half, with the house builders now focused on

achieving year end completion targets

-- Building Plastics up 23% - good performance across our full

range of own-manufactured products and traded goods, including more

than 50% growth in outdoor living products, supported by a

consistently strong order book. We opened 8 new branches in the

first ten months, with a further 4 new sites to follow by the end

of the year. 4 of this year's new branches are the new larger

format

We have continued to secure most of the raw materials we

require, and we are mitigating raw material cost inflation with

selling price increases, and primarily for resin, a surcharge

adjusted monthly in response to price changes.

Higher resin costs are also partially offset by our

market-leading recycling plants, which as well as keeping up with

increased demand, continue to improve the proportion of recycled

material used in our primary extrusion operations. So far this

year, these plants have supplied 27% of our raw material

consumption (year ending 31 December 2020: 25%), driving

significant cost and carbon savings compared to the use of virgin

material.

FTSE Green Economy Mark(2)

We are pleased to report that Eurocell has received the London

Stock Exchange's (LSE) Green Economy Mark, which is awarded to

companies that derive more than 50% of revenues from environmental

solutions, and reflects contributions to the global green economy.

In our case, the LSE also recognised that our PVC profiles can be

recycled up to 10 times and have a life span of around 100 years.

The fact that we operate recycling plants and use recycled material

in our products was also a significant factor.

New Warehouse and Manufacturing Capacity Expansion

Fit-out of our new state-of-the-art warehouse is now complete.

As well as being central to increasing capacity, the facility is

key to delivering further improvements in operational efficiencies

as the new plant, systems and processes become embedded. We were

delighted that, earlier this month, the facility won the Warehouse

Initiative Prize at the National Supply Chain Excellence Awards.

The award recognises the innovative storage and picking solutions

implemented, alongside improved safety and sustainability

criteria.

The manufacturing capacity expansion planned for this year,

including 5 new extrusion lines, together with the associated

mixing plant upgrade and tooling, is now substantially complete. As

previously reported, we plan to add a further 5 lines in 2022.

These investments increase extrusion capacity by more than 15%,

thereby enabling future sales and market share growth.

Notice of Results

We expect to publish our results for the year ending 31 December

2021 on 18 March 2022.

Notes

(1) Eurocell calculated analyst consensus profit before tax forecast for 2021 of GBP26.5 million.

(2) This classification, first introduced in 2019, was created

to highlight companies and investment funds listed on all segments

of London Stock Exchange's Main Market and AIM that are driving the

global green economy. To qualify for the Green Economy Mark,

companies and funds must generate 50% or more of their total annual

revenues from products and services that contribute to the global

green economy.

The underlying methodology incorporates the Green Revenues data

model developed by FTSE Russell. It provides a detailed taxonomy of

environmental goods, products and services, and is designed to

recognise both 'pure-play' green technology companies, as well as

those across all industries that make significant contributions to

the transition to a sustainable, low carbon economy.

Enquiries:

Mark Kelly, Chief Executive +44 (0) 1773 842

Officer 105

Michael Scott, Chief Financial +44 (0) 1773 842

Officer 140

+44 (0) 777 624

Ben Foster (Teneo) 0806

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBJBFTMTBTBLB

(END) Dow Jones Newswires

November 24, 2021 01:59 ET (06:59 GMT)

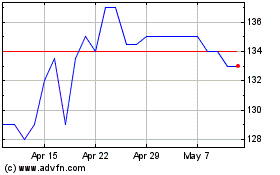

Eurocell (LSE:ECEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eurocell (LSE:ECEL)

Historical Stock Chart

From Apr 2023 to Apr 2024