TIDMECO

RNS Number : 2705Q

Eco (Atlantic) Oil and Gas Ltd.

25 February 2021

25 February 2021

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Unaudited Results for the three and nine months ended 31

December 2020

Corporate and Operational Update

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company with licences in proven oil

province in Guyana and the highly prospective basins in Namibia, is

pleased to announce its results for the three and nine months ended

31 December 2020, alongside a corporate and operational update.

Results Highlights:

Financials

-- As at 31 December 2020, the Company had cash and cash

equivalents of US$16,350,090 with no debt.

-- Eco remains fully funded for its share (15% WI net) of its

planned two exploration wells at the Orinduik Block offshore

Guyana.

-- As at 31 December 2020, the Company had total assets of

US$17.7 million and a net equity position of $17.4 million.

-- The Company has decreased its total non-exploration expenses,

including general and administration expense and compensation costs

incurred during the nine months ended 31 December 2020 (H1 2021),

when compared to the nine months ended 31 December 2019, by over 5

0 %.

Operations

Eco Atlantic Oil & Gas

-- Multiple light sweet oil drilling prospects on the Orinduik

block are currently being reviewed by the Company and its licence

partners (the "JV Partners"), with high-graded candidates being

considered for the next drilling programme. The intention is to

provide further definition to the upper and lower Cretaceous

interpretation and target selection for drilling.

-- The Company, together with its strategic alliance partner

Africa Oil Corp., continues to evaluate additional asset

opportunities in both West Africa and South America.

-- On 30 November 2020, the Company successfully negotiated the

reissuance of its four licenses in Namibia's Walvis Basin for 10

years, which received final Government confirmation on 5 February

2021.

Solear Ltd. (formerly Eco Atlantic Renewables post period

end)

-- On January 26, 2021, the Company announced the formation of a

new joint venture company with Nepcoe Capital Partners Ltd, to

source, acquire and develop an exclusive pipeline of potential high

yield solar projects. At the time of launch, the new entity was to

be called Eco Atlantic Renewables, however, in order to further

reflect the standalone nature of the business the company has been

re-named Solear Ltd ("Solear").

-- Eco agreed to provide a secured loan of up to US$6 million

(the "Loan") to Solear, as a result of which the Company holds a

70% shareholding in Solear, with Nepcoe holding the remaining 30%.

The Loan, which carries a 2% annual interest, is expected to be

repayable from the proceeds of either a public or private

financing, through operating cash flow, and/or a project

monetization event.

-- In January 2021, Solear completed its first acquisition of a

fully contracted, permitted, and build ready project in Greece,

known as the Kozani Project.

-- Solear is continuing to build its exclusive portfolio in

Spain, Italy, and Greece and is targeting a further financing event

in the form of a private finance and/or IPO later this year.

Outlook:

Guyana

-- Guyana continues to be one of the most prolific exploration

regions in the world, with over nine billion barrels of oil

discovered in the last five years. Eco and its JV Partners have

already delivered two substantial oil discoveries on the Orinduik

Block and the licence continues to offer significant upside

potential. With the increase in oil prices the JV partners will

revisit the Jethro discovery commercialisation potential.

-- As previously reported, Eco is fully funded for further

drilling on the block and, with its JV Partners, is assessing all

opportunities available to drill at least two exploration wells

into the light oil cretaceous targets as soon as practical. The

Company is fully aligned with its JV partners on careful target

selection based on the reprocessed 3D and the block and nearby oil

discoveries for the next drilling campaign and Eco expects to be

able to update the market on further drilling plans in due

course.

The Orinduik JV partners are Eco Atlantic (15% working interest

("WI")), Tullow Guyana B.V. ("Tullow") (Operator, 60% WI) and Total

E&P Guyana B.V. ("Total") (25% WI) in partnership with Qatar

Petroleum.

Namibia

-- The Company's successful negotiation of the reissuance of its

four licences in the Walvis Basin, Offshore Namibia, lead to the

expansion of its acreage position. As announced on 30 November

2020, the Company's updated licences in Namibia cover approximately

28,593 km(2) , with over 2.362 BBOE of prospective P50

resources.

-- Eco has a strategically significant acreage position

in-country and is progressing its various work programmes across

its four blocks offshore Namibia. The Company has witnessed

considerable interest from multiple international oil companies in

Namibia.

-- The Company continues to monitor upcoming drilling activity

in the region, which could potentially see up to five exploration

wells drilled on behalf of ExxonMobil, Total, Maurel & Prom,

Shell and ReconAfrica in the next 12 months.

Corporate

-- Throughout the ongoing COVID-19 pandemic, Eco has prioritised

the welfare of its staff and partners.

-- The Company continues to keep a strict control over costs

throughout the business, which continues to generate material

savings and has ensured that Eco remains well capitalised with a

strong balance sheet.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"We have made significant progress in recent months across a

number of aspects of the business. We have demonstrated our

commitment to our core business strategy of achieving near-term

exploration success in Guyana and Namibia, through maturing and

upgrading the drilling targets' inventory in Guyana and the

successful reissuance of our licences in Namibia, as well as adding

a highly relevant and attractive asset to our portfolio through the

formation of Solear Ltd., a majority held renewable energy

company.

" Successfully renegotiating our four licences offshore Namibia,

which we see as being an increasingly active exploration

jurisdiction, was an important milestone for the Company and gives

us a considerable footprint in country from which we will seek

create significant shareholder value.

"In Guyana, we continue to work with our partners in the

Orinduik block to finalise drilling selection, and look forward to

recommencing drilling activity in the coming months. We remain very

confident in Guyana's prospectivity as a hydrocarbon basin and the

upside potential it offers. The recent increase in oil prices makes

our existing discoveries in Guyana and drilling prospects inventory

ever more attractive.

"Our recent strategic investment into Solear Ltd. demonstrates

our drive and determination to use our cash reserves wisely

alongside high impact exploration drilling. We are very excited

about both the near-term opportunities that Solear brings, as well

as the long-term benefits that come with broadening our asset

portfolio. Solear has a highly attractive pipeline of low cost,

high yield solar PV projects, that have the potential to generate

high IRR returns for our shareholders. As ever, we look forward to

keeping the market updated on our progress over the coming

months."

The Company's unaudited financial results for three months and

nine months ended 31 December 2020, together with Management's

Discussion and Analysis as at 31 December 2020, are available to

download on the Company's website at www.ecooilandgas.com and on

Sedar at www.sedar.com .

The following are the Company's Balance Sheet, Income

Statements, Cash Flow Statement and selected notes from the annual

Financial Statements. All amounts are in US Dollars, unless

otherwise stated.

Balance Sheet

December March 31, April 1,

31,

---------------------------

2020 2020 2019

--------------------------- --------------------- ------------------------- -----------------------------------

Assets Unaudited Audited Audited

--------------------- ------------------------- -----------------------------------

Current assets

Cash and cash equivalents 16,350,090 18,667,016 18,750,453

Short-term investments 52,663 52,737 56,098

Government receivable 39,283 19,276 24,821

Amounts owing by license

partners,

net 89,805 45,596 -

Accounts receivable and

prepaid

expenses 73,215 46,262 60,678

--------------------------- --------------------- ------------------------- -----------------------------------

16,605,056 18,830,887 18,892,050

Petroleum and natural

gas licenses 1,117,171 1,117,171 1,117,171

--------------------------- --------------------- ------------------------- -----------------------------------

Total Assets 17,722,227 19,948,058 20,009,221

--------------------------- --------------------- ------------------------- -----------------------------------

Liabilities

Current liabilities

Accounts payable and

accrued

liabilities 158,784 350,242 317,548

Advances from and amounts

owing

to license partners, net 98,947 - 845,524

---------------------------

Total Liabilities 257,731 350,242 1,163,072

Long term liabilities

Equity

Share capital 59,099,725 59,099,725 37,509,183

Restricted Share

Units reserve 267,669 267,669 83,597

Warrants 53,026 53,026 39,570

Stock options 2,631,101 2,542,824 2,387,837

Foreign currency

translation

reserve (1,200,457) (1,117,859) -

Accumulated

deficit (43,386,568) (41,247,569) (21,174,038)

--------------------------- --------------------- ------------------------- -----------------------------------

Total Equity 17,464,496 19,597,816 18,846,149

--------------------------- --------------------- ------------------------- -----------------------------------

Total Liabilities and

Equity 17,722,227 19,948,058 20,009,221

--------------------------- --------------------- ------------------------- -----------------------------------

Income Statement

Three months ended Nine months ended

December 31, December 31,

------------------------------------------ -------------------------------------------

2020 2019 2020 2019

--------------------- ------------------- -------------------- ---------------------

Unaudited Unaudited

------------------------------------------ -------------------------------------------

Revenue

Interest income 6,123 80,302 41,779 309,186

--------------------- ------------------- -------------------- ---------------------

6,123 80,302 41,779 309,186

Operating expenses :

Compensation

costs 173,373 207,440 486,999 627,967

Professional

fees 80,280 117,844 200,694 353,963

Operating costs 255,477 1,097,788 1,105,892 12,466,334

General and

administrative

costs 138,472 386,275 367,742 1,139,106

Share-based

compensation 33,457 35,758 88,277 5,654,869

Foreign

exchange gain (32,561) 708,530 (68,826) 890,495

Total expenses 648,498 2,553,635 2,180,778 21,132,734

Net loss and

comprehensive

loss (642,375) (2,473,333) (2,138,999) (20,823,548)

===================== =================== ==================== =====================

Basic and diluted net

loss

per share attributable

to equity holders of

the

parent (0.00) (0.01) (0.01) (0.11)

===================== =================== ==================== =====================

Weighted average number

of ordinary shares

used

in computing basic and

diluted net loss per

share 184,697,723 184,441,830 184,697,723 182,225,982

===================== =================== ==================== =====================

Cash Flow Statement

Nine months ended

December 31,

----------------------------------------

2020 2019

------------------- -------------------

Unaudited

----------------------------------------

Cash flow from operating activities

Net loss from operations (2,138,999) (20,823,548)

Items not affecting cash:

Share-based compensation 88,277 5,654,869

Warrants issued for services -

Changes in non--cash working

capital:

Government receivable (20,007) (12,818)

Accounts payable and accrued

liabilities (130,818) (172,484)

Accounts receivable and prepaid

expenses (26,726) 11,533

Advance from and amounts owing

to license partners (135,313) (749,180)

-------------------------------------- ------------------- -------------------

(2,363,586) (16,091,628)

-------------------------------------- ------------------- -------------------

Cash flow from financing activities

Issuance of shares from Restricted -

share units

Net proceeds from Private Placement - 15,935,765

Proceeds from the exercise of

stock options - 93,559

Proceeds from the exercise of

warrants - 120,612

-------------------------------------- ------------------- -------------------

- 16,149,936

-------------------------------------- ------------------- -------------------

Increase (decrease) in cash and

cash equivalents (2,363,586) 58,308

Foreign exchange differences 46,660 721,021

Cash and cash equivalents, beginning

of period 18,667,016 18,750,453

-------------------------------------- ------------------- -------------------

Cash and cash equivalents, end

of period 16,350,090 19,529,782

-------------------------------------- ------------------- -------------------

Notes to the Financial Statements

Basis of Preparation

The condensed consolidated interim financial statements of the

Company have been prepared on a historical cost basis with the

exception of certain financial instruments that are measured at

fair value. Historical cost is generally based on the fair value of

the consideration given in exchange for assets.

Summary of Significant Accounting Policies

Critical accounting estimates

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognized

prospectively from the period in which the estimates are revised.

The following are the key estimate and assumption uncertainties

considered by management.

Change in functional currency assessment

The functional currency of the Company and its subsidiaries

represent the currency of the primary economic environment in which

each entity operates. Through to March 31, 2020, all entities were

considered to have a functional currency of Canadian Dollars. On

March 31, 2020, the Company determined the United States Dollar

("USD") to be the functional currency for Eco Guyana based on the

increased expenditures incurred in USD which is expected to

continue in the foreseeable future. On April 1, 2020, the Company

determined the USD to be the functional currency for Eco (Atlantic)

Oil and Gas Ltd, based on the increase in USD denominated spending

as of April 1, 2020. On April 1, 2020, the Company also determined

the USD to be the functional currency of Eco Guyana Oil & Gas

(Barbados) Ltd, since this entity is 100% owned by Eco Atlantic,

and is the 100% owner of Eco Guyana, both of which have functional

currencies denominated in USD. The change in estimate has been

applied on a prospective basis effective April 1, 2020.

Effective April 1, 2020, the Company also changed its

presentation currency from Canadian Dollars to USD. The change in

presentation currency is to better reflect the Company's business

activities and to improve investors' ability to compare the

Company's results to its peers. This change has been applied

retroactively as if the Company's new presentation currency has

always been the Company's presentation currency.

Events After the Reporting Period

On January 26, 2021, the Company announced the formation of a

new partnership with Nepcoe Capital Partners (Hong Kong) Ltd.

("Nepcoe"), to source, acquire and develop an exclusive pipeline of

potential high yield solar projects. To give effect to the new

venture, the Company's existing subsidiary Eco - EBVI, has been

renamed Solear Ltd. ("Solear"), in which the Company now owns 70%

and Nepcoe owns 30%. Solear completed its first acquisition of a

fully contracted, permitted, and build ready project in Greece,

known as the Kozani Project.

The Company has agreed to provide a secured loan of up to $6m

(the "Loan") to Solear. The Loan bears 2% annual interest, which

will accrue and is expected to be payable from the proceeds of

either a public or private financing, through operating cash flow,

or a project monetization event. The Board of Eco Atlantic will

assess the ability for shareholders to participate directly in the

financing of Solear when it seeks to raise the necessary funds for

capturing more project opportunities and / or the construction of

the projects within its pipeline, for which a number of options are

being actively considered.

**ENDS**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Marketing and +44(0)781 729 5070 | +1 (416)

IR 318 8272

Strand Hanson Limited (Financial & Nominated

Adviser) +44 (0) 20 7409 3494

James Harris

Rory Murphy

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Matthew Armitt

Emily Morris

Detlir Elezi

Celicourt (PR) +44 (0) 20 8434 2754

Mark Antelme

Jimmy Lea

Hannam & Partners (Research Advisor)

Neil Passmore +44 (0) 20 7905 8500

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM quoted Oil & Gas exploration

and production Company with interests in Guyana and Namibia, where

significant oil discoveries have been made.

The Group aims to deliver material value for its stakeholders

through oil exploration, appraisal and development activities in

stable emerging markets, in partnership with major oil companies,

including Tullow, Total and Azinam.

In Guyana, Eco Guyana holds a 15% Working Interest alongside

Total (25%) and Operator Tullow Oil (60%) in the 1,800 km2 Orinduik

Block in the shallow water of the prospective Suriname-Guyana

basin. The Orinduik Block is adjacent and updip to ExxonMobil

Operated Stabroek Block, on which eighteen discoveries have been

announced and over 9 Billion BOE of oil equivalent recoverable

resources are estimated. First oil production commenced in December

2019 from the deep-water Liza Field, less than three years from

FID.

Jethro-1 was the first major oil discovery on Orinduik Block.

The Jethro-1 encountered 180.5 feet (55 meters) of net high-quality

oil pay in excellent Lower Tertiary sandstone reservoirs which

further proves recoverable oil resources. Joe-1 is the second

discovery on the Orinduik Block and comprises high quality

oil-bearing sandstone reservoir with a high porosity of Upper

Tertiary age. The Joe-1 well encountered 52 feet (16 meters) of

continuous thick sandstone which further proves the presence of

recoverable oil resources.

In Namibia, the Company holds interests in four offshore

petroleum licenses totalling approximately 28,593km2 with over

2.362bboe of prospective P50 resources in the Walvis Basin. These

four licenses, Cooper, Guy, Sharon and Tamar are being developed

alongside partners Azinam and NAMCOR. Eco has been granted a

drilling permit on its Cooper Block (Operator).

Eco Atlantic is a 70% shareholder in Solear Ltd., alongside

Nepcoe Capital Partners Ltd., a renewable energy developer and

investment company, that own the remaining 30%. Solear is a private

clean energy investment company focused on low cost, high yield

solar development projects. Solear provides exposure to a large

primarily European portfolio of pre-construction opportunities

across the renewable energy value chain, from Ready-to-Build to

early-stage development.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTDDGDDSGDDGBS

(END) Dow Jones Newswires

February 25, 2021 02:00 ET (07:00 GMT)

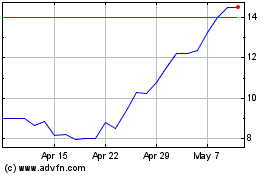

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Apr 2023 to Apr 2024