ECR MINERALS PLC: PLACING OF SHARES, ACCELERATION AND EXPANSION OF DRILLING CAMPAIGN

April 09 2021 - 1:11AM

UK Regulatory

TIDMECR

ECR MINERALS plc

("ECR Minerals", "ECR" or the "Company")

PLACING OF SHARES

ACCELERATION AND EXPANSION OF DRILLING CAMPAIGN

ECR Minerals plc (LON: ECR), the gold exploration and

development company focussed on Australia, is pleased to announce

the placing ("Placing") of 90,909,091 new ordinary shares of 0.001p

(the "Placing Shares") at a Placing price of 2.2p per share to

raise gross proceeds of GBP2,000,000.

The net proceeds of the Placing, which is conditional on

admission of the Placing Shares to trading on AIM ("Admission"),

will be used to ramp-up drilling and exploration activities on

ECR's 100%-owned gold exploration projects in Victoria, Australia

and for working capital purposes. The Placing was arranged by the

Company's joint-broker Novum Securities.

Drilling with the Company's own diamond drill rig is continuing

in the HR3 area of the Bailieston gold project in Victoria. Five

drill holes have been completed, and a sixth hole is in progress.

ECR expects to be in a position to report assay results from

initial holes later this month. Visible gold has been noted in the

hole first drilled at the Byron prospect (see announcement dated 12

February 2021).

Placees will receive one warrant ("Warrant") for every two

Placing Shares and accordingly, subject to the Placing completing,

45,454,545 Warrants will be issued by the Company. Each Warrant

permits the holder to subscribe for one new ordinary share in ECR

Minerals plc at a price of 3.75p for a period of 24 months from the

date of Admission. If all the Warrants were to be exercised, this

would generate proceeds of approximately GBP1.7 million for the

Company, although there can be no guarantee that this would

occur.

Craig Brown, Chief Executive Officer, commented:

"We are delighted by the tremendous show of support for ECR from

investors in the placing announced today. We believe this reflects

both the high degree of market interest in Victorian gold projects

generally, and ECR's success in assembling a highly prospective

portfolio of projects and establishing an in-house drilling

capability which is being put to full use.

The net proceeds of the placing announced today will take the

Company's cash position to in excess of GBP5.8 million and, in

addition to funding a modest expansion of our operational

capabilities at our Bendigo HQ in Central Victoria, will enable ECR

to drive hard towards its twin targets of establishing a maiden

JORC compliant gold resource at the Bailieston project and

completing further drilling at the Creswick project. The funds

raised will also provide ECR with the financial flexibility to

consider potential new opportunities as they arise. We are now

fully funded for these programmes and don't envisage requiring

additional equity financing for quite some time."

ADMISSION OF NEW SHARES AND TOTAL VOTING RIGHTS

Admission of the Placing Shares to trading on AIM is expected to

occur on or around 30 April 2021. Following admission, ECR's issued

ordinary share capital will comprise 985,528,390 ordinary shares of

0.001p. This number will represent the total voting rights in the

Company, and, following admission of the Placing Shares, may be

used by shareholders as the denominator for the calculation by

which they can determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the Financial Conduct Authority's Disclosure and Transparency

Rules. The new shares will rank pari passu in all respects with the

ordinary shares of the Company currently traded on AIM.

MARKET ABUSE REGULATION

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 (MAR) (as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018). Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0)20 7929 1010

David Tang, Non-Executive Chairman

Craig Brown, Director & CEO

Email:

info@ecrminerals.com

Website: www.ecrminerals.com

WH Ireland Ltd Tel: +44 (0)207 220 1666

Nominated Adviser

Katy Mitchell and James Sinclair-Ford

Tel: +44 (0)20 7399 9425

Novum Securities Limited

Broker

Jon Belliss

SI Capital Ltd Tel: +44 (0)1483 413500

Broker

Nick Emerson

ABOUT ECR MINERALS PLC

ECR is a mineral exploration and development company. ECR's

wholly owned Australian subsidiary Mercator Gold Australia Pty Ltd

has 100% ownership of the Bailieston and Creswick gold projects in

central Victoria, Australia. ECR is currently drilling high

priority targets on the Bailieston gold project using the Company's

own diamond drill rig. ECR has an experienced exploration team with

significant local knowledge in the Victoria Goldfields.

Following the sale of the Avoca, Moormbool and Timor gold

projects in Victoria, Australia to Fosterville South Exploration

Ltd (TSX-V: FSX), ECR has the right to receive up to A$2 million in

payments subject to future resource estimation or production at

those projects.

ECR has earned a 25% interest in the Danglay gold project, an

advanced exploration project located in a prolific gold and copper

mining district in the north of the Philippines, and holds a

royalty on the SLM gold project in La Rioja Province,

Argentina.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210408006001/en/

CONTACT:

ECR Minerals plc

SOURCE: ECR Minerals plc

Copyright Business Wire 2021

(END) Dow Jones Newswires

April 09, 2021 02:11 ET (06:11 GMT)

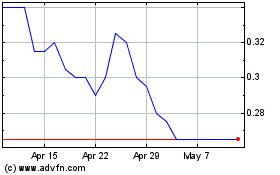

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Mar 2024 to Apr 2024

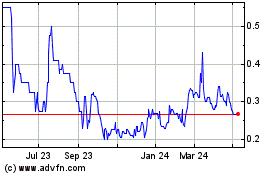

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Apr 2023 to Apr 2024