EJF Investments Ltd Recent Investment Announcement (8312I)

December 16 2020 - 1:00AM

UK Regulatory

TIDMEJFI TIDMEJFZ

RNS Number : 8312I

EJF Investments Ltd

16 December 2020

FOR IMMEDIATE RELEASE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN THE

REPUBLIC OF IRELAND), AUSTRALIA, CANADA, SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DO SO

16 December 2020

EJF Investments Ltd

Recent Investment Announcement

The Board of EJF Investments Ltd (together with its

subsidiaries, "EJFI" or the "Company") is pleased to announce that

the Company invested approximately GBP6.7 million(1) in the

preferred shares (the "Investment") issued by TruPS Financials Note

Securitization 2020-2 ("TFINS 2020-2") on 15 December 2020.

The underlying collateral of TFINS 2020-2 mainly consists of

trust preferred securities, subordinated debt, senior notes and

surplus notes issued by 26 U.S. banks and 10 insurance companies

with an aggregate par value of approximately US$177.245 million.

The Investment represents the Company's tenth risk retention

investment in a securitisation sponsored by EJF Capital LLC ("EJF")

and represents the continuation of the Company's focus on equity

tranches of collateralised debt obligations backed primarily by US

small and medium banks and insurance companies.

Approximately 40% of the collateral is indexed to three-month

LIBOR, while the balance of the collateral is fixed rate. The

weighted average spread of the floating assets is approximately

3.58%. Approximately 14% of the underlying securities have a fixed

interest rate with a weighted average coupon of approximately 7.0%.

The remaining 46% of the underlying securities have a

fixed-to-float interest rate. TFINS 2020-2 has a final maturity

date in 2041 and is callable after October 2022 at the option of

the majority preferred shareholders, with mandatory auction calls

commencing after October 2028. Anticipated return scenarios

estimate that the Investment will generate a gross return in the

high single digits over the estimated life of the Investment.

EJF CDO Manager LLC ("CDO Manager") will serve as the collateral

manager for TFINS 2020-2 and will receive a 30-basis points p.a.

fee in addition to earning an incentive management fee equal to 20%

of profits over a 10% hurdle, subject to certain exceptions. The

Company will also benefit from the economics generated by the CDO

Manager through the Company's 49% ownership interest in the CDO

Manager.

(1) As converted using a GBP/USD foreign exchange rate of

1.3448

ENQUIRIES

For the Investment Manager

EJF Investments Manager LLC

Peter Stage / Hammad Khan / Matthew Gill

pstage@ejfcap.com / hkhan@ejfcap.com / mgill@ejfcap.com

+44 203 752 6775 / +44 203 752 6771 / +44 203 752 6774

For the Company Secretary and Administrator

BNP Paribas Securities Services S.C.A

jersey.bp2s.ejf.cosec@bnpparibas.com

+44 1534 709 181 / +44 1534 813 996

For the Broker

Numis Securities Limited

David Luck

d.luck@numis.com

+44 20 7260 1301

About EJF Investments Ltd

EJFI is a registered closed-ended limited liability company

incorporated in Jersey under the Companies (Jersey) Law 1991, as

amended, on 20 October 2016 with registered number 122353. The

Company is regulated by the Jersey Financial Services Commission

(the "JFSC"). The JFSC is protected by both the Collective

Investment Funds (Jersey) Law 1988 and the Financial Services

(Jersey) Law 1998, as amended, against liability arising from the

discharge of its functions under such laws.

The JFSC has not reviewed or approved this announcement.

LEI: 549300XZYEQCLA1ZAT25

Investor information & warnings

The latest available information on the Company can be accessed

via its website at www.ejfi.com.

This communication has been issued by, and is the sole

responsibility of, the Company and is for information purposes

only. It is not, and is not intended to be an invitation,

inducement, offer or solicitation to deal in the shares of the

Company. The price and value of shares in the Company and the

income from them may go down as well as up and investors may not

get back the full amount invested on disposal of shares in the

Company. An investment in the Company should be considered only as

part of a balanced portfolio of which it should not form a

disproportionate part. Prospective investors are advised to seek

expert legal, financial, tax and other professional advice before

making any investment decision.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKAKFLSEFEA

(END) Dow Jones Newswires

December 16, 2020 02:00 ET (07:00 GMT)

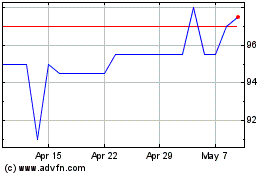

Ejf Investments (LSE:EJFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ejf Investments (LSE:EJFI)

Historical Stock Chart

From Apr 2023 to Apr 2024