TIDMELLA

RNS Number : 7630W

Ecclesiastical Insurance Office PLC

21 August 2020

2020 INTERIM RESULTS

Ecclesiastical Insurance Office plc 20 August 2020

Ecclesiastical Insurance Office plc ("Ecclesiastical"), the

specialist financial services group, today announces its 2020

interim results. A copy of the 2020 interim results will be

available on the Company's website at www.ecclesiastical.com

Group overview

-- During March the Group announced that it had made a record

GBP32m donation to charity for the previous calendar year, almost

double our original expectations. Since then the Group has

continued to support charities and communities during the pandemic.

Notably in the first half of the year the GBP1m Movement for Good

awards were launched again and GBP500,000 distributed; the Group

has also responded to coronavirus response appeals initiated by the

National Emergencies Trust, Disasters Emergencies Committee and

Association of British Insurers with donations totalling

GBP200,000.

-- The Group has now donated over GBP97m to charity since 2016

and is just short of its enhanced target of giving more than

GBP100m by September 2021. This giving has enabled the Group and

its parent charity, Allchurches Trust, to accelerate its giving to

churches and charities most in need.

-- Following a strong year in 2019, in the first half of 2020 we

report a loss before tax of GBP59.7m (H1 2019: profit before tax

GBP42.8m) due to COVID-19's impact on financial markets, including

an investment loss of GBP48.9m.

-- Gross written premium (GWP) up 9% to GBP202m (H1 2019:

GBP185m), supported by strong retention and rate increases in

hardening markets.

-- Underwriting loss of GBP1.3m (H1 2019: profit GBP9.5m),

giving a Group COR* of 101.1% (H1 2019: 91.4%). This includes

GBP14m for the provision of COVID-19 related claims where there is

confirmed cover. Excluding these, the Group's COR is 89.5%.

-- We have prioritised the health and wellbeing of our people,

successfully adapting to new ways of working and providing a

seamless service to our customers.

-- Continued external recognition of the Group as a trusted and

specialist financial services organisation. This included being

named as the UK's best and most trusted insurer for the 11th time

by independent ratings agency Fairer Finance, and our Canada team

was once again awarded Top Employer for Young People.

*The Group uses APMs to help explain performance. More

information on APMs is included in note 15.

Mark Hews, Group Chief Executive Officer of Ecclesiastical,

said:

"The first half of 2020 was uniquely challenging due to the

significant impact of COVID-19. However, we remain true to our core

purpose and have continued to give to church, charities and

communities most in need.

"Whilst our headline loss before tax is disappointing, in the

main it has been driven by unrealised fair value losses on our

investment portfolio. These are investments that are being held for

the long term and on which we have already seen some recovery. We

expect this to continue over the months and years ahead, and we

continue to take a long-term view and look beyond the current

pandemic.

"Our underlying performance is resilient and we are starting to

see activity returning to normal levels. We are proud of the way

that our colleagues rose to the challenge and continued to serve

our customers throughout this difficult period while themselves

adapting to new ways of working.

"We recognise and understand that the coronavirus pandemic has

created a worrying and uncertain time for many customers and

businesses and we recognise the challenges they have faced. As an

ethical insurer, we are driven by a desire to help our customers in

their moment of need and we have continued to pay claims where

cover was offered, quickly and fairly. We have also offered

enhanced cover, free of charge, to many of our customers alongside

a range of additional support measures.

"We also recognise that some customers have been disappointed

that their policy has not provided business interruption cover

during the pandemic, in common with much of the market. As a

result, we were pleased to participate, alongside seven other

leading insurers, in the Financial Conduct Authority's Test Case.

We hope that this will provide maximum clarity for all concerned in

the shortest amount of time. We expect to hear the outcome, which

may be subject to appeal, later in the year.

"Recognising the impact COVID-19 has had on communities, we've

continued our programme of giving during this difficult time.

Following the GBP32m record grant we announced in March, we

launched our GBP1m Movement for Good awards for the second year and

distributed GBP500,000. We also responded to coronavirus response

appeals initiated by the National Emergencies Trust, Disasters

Emergencies Committee and Association of British Insurers by

donating GBP200,000.

"We also continue to invest in the future of our business. Our

new head office building was completed at the end of June and fit

out work is now underway. We are expecting to move into the new

building during the first quarter of next year. We are also

continuing to invest in new systems to improve our efficiency and

improve the customer experience.

"While it has been a difficult period, we delivered a resilient

set of results in the first half of 2020 from our operating

businesses. We maintained steady progress in our underlying

underwriting performance, despite the impact of adverse weather

events in Australia and Canada, and gross written premium (GWP) was

up 9% to GBP202m, supported by strong retention and rate increases.

However the overall underwriting result was impacted as we reserved

GBP14m for COVID-19 related claims where there is confirmed cover.

Ecclesiastical, itself, has a comprehensive programme of

reinsurance to mitigate any further claim development that may be

incurred over the months ahead.

"The adverse market conditions in the first half affected our

investment returns, with a loss of GBP48.9m, primarily on equity

holdings. Although they have stabilised over recent months, there

is still a level of uncertainty in markets. As we look ahead, we

remain confident about our long-term value investment philosophy,

and are relatively defensively positioned and well diversified

across a broad range of asset classes.

"Our investment management business EdenTree is recognised for

its responsible and sustainable approach and has benefited as we

have seen investor confidence starting to return. EdenTree was

pleased to report net new external money of GBP57.8m in exceptional

market conditions.

"Our broking and advisory businesses contributed GBP1.4m profit

in the first half of the year despite the difficult trading

conditions. Positively, June income levels had returned to 2019

levels.

"Despite the challenging environment, we remain in a strong

capital position with S&P recently affirming its credit rating

of "A-" and with "stable" outlook. As we head into the second half

of the year we recognise the challenges in the economic environment

but are energised by the clarity of our charitable purpose and are

optimistic about the opportunities ahead.

"On behalf of all our charitable beneficiaries, I would like to

thank all those who continue to support the Group's work, enabling

it to give to so many worthy causes at a time when the need has

never been higher. Together, we are supporting charities,

communities and improving lives."

Key Financial Performance Data

H1 2020 H1 2019

Gross written premiums GBP202.5m GBP185.0m

Group underwriting (loss)/profit* (GBP1.3m) GBP9.5m

Group combined operating ratio* 101.1% 91.4%

Investment (losses)/return (GBP48.9m) GBP42.0m

(Loss)/profit before tax (GBP59.7m) GBP42.8m

30 June 31 Dec 2019

2020

Net asset value GBP539m GBP608m

Solvency II capital cover (solo) 206% 216%

*The Group uses APMs to help explain performance. More

information on APMs is included in note 15.

Interim Management Report

The environment in the first half of 2020 has been

unprecedented. COVID-19 has caused extensive worldwide economic

impacts resulting in significant Government and regulatory

responses. Notwithstanding this exceptional set of circumstances

our businesses have responded well by continuing to support our

customers, delivering robust underlying results and continuing our

giving programme.

Indeed, during March the Group announced that it had made a

record GBP32m donation to charity for the previous calendar year,

almost double our original expectations. Since then, the Group has

continued to support charities and communities during the pandemic.

Notably in the first half of the year the GBP1m Movement for Good

awards were launched again and GBP500,000 distributed to date; the

Group has also responded to coronavirus response appeals initiated

by the National Emergencies Trust, Disasters Emergencies Committee

and Association of British Insurers.

The Group has now donated over GBP97m to charity since 2016 and

is just short of its enhanced target of giving more than GBP100m by

September 2021. This giving has enabled the Group and its parent

charity, Allchurches Trust, to help people, organisations and

communities flourish despite the challenges presented by the

pandemic, and to help build resilience and encourage hope.

Following a strong year in 2019, the reported loss before tax of

GBP59.7m in the first half of the year (H1 2019: profit before tax

GBP42.8m) was principally due to GBP48.9m of investment losses

following significant market falls in March, partially offset by

moderate but steady gains towards the later part of the period. The

Group's underwriting businesses reported a small loss of GBP1.3m

(H1 2019: profit GBP9.5m) after setting aside GBP14m for COVID-19

claims where there is confirmed cover and following a number of

weather events in the period, both of which have resulted in an

increase in claims incurred. Ecclesiastical, itself, has a

comprehensive programme of reinsurance to mitigate any further

claim development that may be incurred over the months ahead.

Our strategy over the medium term continues to deliver moderate

GWP growth, by maintaining our strong underwriting discipline and

focusing on profit over growth. Gross written premiums grew by 9.5%

to GBP202.5m (H1 2019: GBP185.0m) supported by strong retention and

rate increases. We have deep specialist capabilities, which we

continue to develop through investment in technology and

innovation, and by providing appealing customer propositions and

excellent service.

Investment losses of GBP48.9m in the first half of the year were

driven by unrealised fair value losses as markets reacted to the

impact of the coronavirus in March but were unable to assess the

full impact. As markets now look beyond the immediate impact of the

coronavirus we have seen a moderation across markets and an

increase in equity valuations. Whilst the global economy is not out

of the woods yet, and we may see further stock market volatility

this year, we manage the business with a long-term view of risk and

have a strong capital position that can withstand short term

volatility. As such we will continue to take a long-term view and

look well beyond the current pandemic.

Strategic Update

Despite the many challenges the coronavirus pandemic has

presented, we have continued to make good progress on our journey

to become the most trusted and ethical specialist financial

services group. Our charitable purpose continues to define our

strategy and in the first half of the year we have continued to

invest in our business and our people under our broad range of

initiatives. Our resilience and financial strength are important

pillars that support our strategy.

In the first half of the year, the Board and management decided

to respond to changed circumstances by enhancing its strategy and

increasing its ambitions for charitable giving. Whilst being the

most trusted and ethical specialist financial services provider

continues to be central to our strategy, we have refocussed and

developed this around the following three themes. Within these

themes, we also have a number of more short-term priorities which

includes our coronavirus response.

Support and protect

Ecclesiastical will support and protect our colleagues,

customers, communities and the businesses we serve. This includes a

focus on our teams, colleagues and their well-being and creating a

supportive environment ensuring ongoing flexibility and compassion.

Also, as part of our coronavirus response, we have started a

programme of essential commercial and business activity to support

customers and our core purpose.

In these difficult times, our charitable purpose has never been

more important, and therefore we have been creating an environment

that actively encourages all of us to undertake acts of kindness

across all our communities. We're funding projects aimed at

supporting communities through the pandemic and charities facing

financial difficulties because of it. We hope our giving will help

today and, crucially, we are determined to help in the future as

charities build their work back up.

Innovate and grow

As the world changes, we are innovating to find new ways to

position the business to meet the needs of our customers and

communities. We are building new propositions, developing our risk

management and loss-prevention solutions and providing the

infrastructure to support our growth ambitions. As our general

insurance businesses deepen their understanding of our portfolio

this will also drive underwriting actions and improve

profitability.

Transform and thrive

We have continued our investment in new technology, our people

and our premises, helping our businesses to transform and thrive,

increase our efficiency and safeguard data. Some of this investment

spans a number of years, not least the on-going development of a

new strategic UK General Insurance system. Once live, this new

system will help to offer an enhanced experience to customers and

brokers and provide improved processes and capacity.

General Insurance - UK and Ireland

UK and Ireland GWP grew by 8% to GBP134m in the six months to 30

June 2020 (H1 2019: GBP124m). This is driven by particularly strong

growth in our Real Estate business together with continued growth

in our Heritage business as we demonstrate our position as a

leading insurer of heritage, listed and period properties.

The business reported an underwriting profit of GBP2.7m and a

net combined ratio of 96.7% (H1 2019: GBP9.2m profit, COR 87.8%)

after reserving GBP11.6m for COVID-19 related claims. This

represents another good performance with a greater contribution

from current year underwriting performance as expected.

The property result has been better than expected in the first

half of the year despite storm and flood weather events and the

reduced economic activity. Our liability business has continued to

perform well into 2020 with prior year claims in line with

expectations and current year claims experience similar to last

year. As anticipated, reserve releases are lower than last year as

we see a continued run-off of claims in respect of the unprofitable

business we exited in 2012 and 2013.

General Insurance - Canada

The Canadian business has continued its track record of

delivering premium growth, supported by strong retention and

reported an increase in GWP of 10.9% to GBP28.3m (H1 2019:

GBP25.5m).

Several weather events in Canada resulted in a small

underwriting profit of GBP0.1m (H1 2019: GBP0.4m) after reserving

GBP1.8m for COVID-19 related claims. Our Canadian business has

continued to see rate strengthening and underwriting discipline

drive good performance across its portfolios. The Property

portfolio was also supported by the favourable development of prior

year claims helping offset the impact of this year's weather

events.

General Insurance - Australia

Our Australian business continues to be successful in generating

new business and strengthening rate, with premium growth of 13.7%.

The business reported an underwriting loss of GBP2.1m (H1 2019:

GBP0.4m). The result was adversely impacted by GBP2.1m for the

January hail storm event in south eastern Australia and the

February East Coast Low event.

Investment Returns

Like many other businesses, Ecclesiastical is not immune to the

market disruption caused by COVID-19. This disruption caused the

Group's net investment return to report a loss of GBP48.9m (H1

2019: GBP42.0m profit) predominantly driven by unrealised fair

value losses. Despite the significant market disruption, the

long-term investment philosophy and defensively positioned and well

diversified asset classes resulted in the Group's UK fund

outperforming benchmarks.

We discount some of our liability claims reserves. The reserves

relate to liability policies, written over many decades, and

represent very long-tail risks. The movement in yields from the

year end resulted in a negative impact of GBP6.4m in the first six

months of the year.

We remain cautious about our expectations for investment returns

for the remainder of 2020, even as markets show signs of recovery

and some stability. Our approach to the management of risks

resulting from the Group's exposure to financial markets is

outlined in note 4 to our latest annual report.

Asset Management - EdenTree

Our investment management business, EdenTree, reported a small

loss of GBP0.2m (H1 2019: GBP0.1m). Fee income of GBP6.2m was

marginally down (H1 2019: GBP6.3m) reflecting the market impacts

from COVID-19. Against this background, EdenTree were pleased to

report net new money for funds not held by the Group of

GBP57.8m.

Broking and Advisory - SEIB Insurance Brokers

SEIB has performed well in the first half of the year as the

business quickly adapted to the coronavirus. Customers were

supported with changes to the cover they required, or in some

cases, cover they no longer needed. SEIB continues to deliver

stable returns to the Group and reported a half year profit before

tax of GBP1.4m (H1 2019: GBP1.4m).

Life Business

Our life insurance business, which is not currently writing new

business, reported a loss before tax of GBP0.2m at the half year

(H1 2019: GBP0.2m profit). Assets and liabilities are well matched,

though we expect small variances as the margins in the reserves

unwind.

Balance Sheet and Capital Position

Total shareholders' equity decreased by GBP68.4m to GBP539.2m in

the first six months of the year. Losses in the period were

primarily due to a loss in investment return. There were also

actuarial losses, net of tax of GBP12.3m, on retirement benefit

plans (see note 3 to these condensed financial statements for more

information).

The normal first-half dividend to preference shareholders of

GBP4.6m was paid in June 2020 (H1 2019: GBP4.6m).

Our Solvency II regulatory capital position remains above

regulatory requirements and the risk appetite set by the Group.

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Group and our

approach to managing them are outlined in our latest annual report

and in note 4 to these condensed financial statements.

Group Outlook

In common with many businesses, the first half of 2020 has been

significantly impacted by COVID-19 but has shown us just how

important our charitable purpose is. Owned by a charity,

Ecclesiastical is a commercial business with a purely charitable

purpose.

We are dedicated to doing all we can to supporting our

customers, partners, communities and employees through this period

of uncertainty caused by the coronavirus. In common with much of

the market, the vast majority of our insurance cover does not

include pandemics. However, we appreciate that the Financial

Conduct Authority (FCA) received a number of questions and concerns

from customers across the insurance industry where their business

interruption policies do not cover COVID-19 losses. As such, we

agreed to participate alongside many other leading insurers in a

'Test Case' with the FCA, which was heard by the High Court in

July, to provide clarity and certainty to customers in as short a

time frame as possible. The outcome, which may be subject to

appeal, is expected to be known later in the year. More information

can be found in note 16 to the consolidated interim financial

statements.

Ecclesiastical responded quickly and effectively to the COVID-19

challenge and is both operationally and financially resilient.

However, as we still live with coronavirus, we are under no

illusion that there will be more challenges and opportunities

ahead. The global economic downturn and fiscal responses have been

unprecedented, but as we see governments withdraw support and an

easing of protective measures, we expect economic headwinds and

some market volatility to persist.

Some continued uncertainty in the near term outlook is expected,

which will present challenges for us and our customers. However, we

remain confident in our longer-term objective of delivering

sustainable profitable growth. Ecclesiastical is a well-positioned,

diverse financial services group and has proved itself to be

operationally and financially resilient. We will continue to pursue

our long-term charitable objective and provide all the support

necessary for our customers in these uncertain times and look

forward with confidence to the future beyond the pandemic.

In closing, the Board would like to thank all those who continue

to support the Group's work, enabling it to support its customers

and give to so many worthy causes at a time when need has never

been higher. We would also like to thank all our employees; their

combined commitment during this difficult period has been nothing

short of exceptional.

Together, we are supporting charities, communities and improving

lives.

By order of the Board

Mark Hews

Group Chief Executive

20 August 2020

CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the 6 months to 30 June 2020

30.06.20 30.06.19 31.12.19

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Revenue

Gross written premiums 202,487 185,002 393,952

Outward reinsurance premiums (80,313) (71,172) (152,886)

Net change in provision for unearned premium (980) (4,351) (15,080)

Net earned premiums 121,194 109,479 225,986

------------ ------------ ----------

Fee and commission income 33,444 30,582 71,240

Other operating income 1,960 339 544

Net investment return (48,859) 42,017 74,438

Total revenue 107,739 182,417 372,208

------------ ------------ ----------

Expenses

Claims and change in insurance liabilities (139,152) (78,962) (157,808)

Reinsurance recoveries 68,104 31,512 52,800

Fees, commissions and other acquisition costs (38,826) (35,165) (72,740)

Other operating and administrative expenses (57,319) (56,705) (120,577)

Total operating expenses (167,193) (139,320) (298,325)

------------ ------------ ----------

Operating (loss)/profit (59,454) 43,097 73,883

Finance costs (258) (324) (620)

(Loss)/profit before tax (59,712) 42,773 73,263

Tax credit/(expense) 8,275 (6,309) (11,450)

------------ ------------ ----------

(Loss)/profit for the financial period from

continuing operations attributable to equity

holders of the Parent (51,437) 36,464 61,813

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 6 months to 30 June 2020

30.06.20 30.06.19 31.12.19

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit for the period (51,437) 36,464 61,813

------------ ------------ ----------

Other comprehensive expense

Items that will not be reclassified subsequently

to profit or loss:

Actuarial losses on retirement benefit plans (15,433) (1,113) (7,049)

Attributable tax 3,100 189 1,198

(12,333) (924) (5,851)

Items that may be reclassified subsequently

to profit or loss:

Gains/(losses) on currency translation differences 2,283 1,213 (1,368)

(Losses)/gains on net investment hedges (2,653) (1,643) 640

Attributable tax 367 292 (19)

(3) (138) (747)

------------ ------------ ----------

Other comprehensive expense (12,336) (1,062) (6,598)

------------ ------------ ----------

Total comprehensive (expense)/income attributable

to equity holders of the Parent (63,773) 35,402 55,215

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 6 months to 30 June 2020

Translation

Share Share Revaluation and hedging Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

2020 (Unaudited)

At 1 January 120,477 4,632 565 18,324 463,537 607,535

Loss for the period - - - - (51,437) (51,437)

Other net expense - - (14) (3) (12,319) (12,336)

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

expense - - (14) (3) (63,756) (63,773)

Dividends on preference

shares - - - - (4,591) (4,591)

At 30 June 120,477 4,632 551 18,321 395,190 539,171

--------- -------- ------------ ------------ --------- ---------

2019 (Unaudited)

At 1 January 120,477 4,632 565 19,071 441,259 586,004

Profit for the period - - - - 36,464 36,464

Other net expense - - - (138) (924) (1,062)

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

(expense)/income - - - (138) 35,540 35,402

Dividends on preference

shares - - - - (4,591) (4,591)

At 30 June 120,477 4,632 565 18,933 472,208 616,815

--------- -------- ------------ ------------ --------- ---------

2019 (Audited)

At 1 January 120,477 4,632 565 19,071 441,259 586,004

Profit for the year - - - - 61,813 61,813

Other net expense - - - (747) (5,851) (6,598)

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

(expense)/income - - - (747) 55,962 55,215

Dividends on preference

shares - - - - (9,181) (9,181)

Gross charitable grant - - - - (30,000) (30,000)

Tax credit on charitable

grant - - - - 5,497 5,497

At 31 December 120,477 4,632 565 18,324 463,537 607,535

--------- -------- ------------ ------------ --------- ---------

The revaluation reserve represents cumulative net fair value

gains on owner-occupied property. Further details of the

translation and hedging reserve are included in note 11.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2020

30.06.20 30.06.19 31.12.19

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Assets

Goodwill and other intangible assets 46,197 33,517 38,651

Deferred acquisition costs 39,075 34,113 38,199

Deferred tax assets 2,973 1,807 2,203

Retirement benefit asset - 14,815 8,505

Property, plant and equipment 18,487 22,214 20,322

Investment property 143,331 152,046 148,146

Financial investments 779,619 851,780 857,913

Reinsurers' share of contract liabilities 210,079 156,359 159,556

Current tax recoverable 7,322 688 4,211

Other assets 226,651 169,612 178,358

Cash and cash equivalents 94,574 94,657 74,775

Total assets 1,568,308 1,531,608 1,530,839

------------ ------------ -----------

Equity

Share capital 120,477 120,477 120,477

Share premium account 4,632 4,632 4,632

Retained earnings and other reserves 414,062 491,706 482,426

Total shareholders' equity 539,171 616,815 607,535

------------ ------------ -----------

Liabilities

Insurance contract liabilities 855,630 752,525 763,977

Lease obligations 11,688 14,370 12,923

Provisions for other liabilities 7,424 7,329 4,867

Pension liabilities 7,226 - -

Retirement benefit obligations 6,166 6,102 5,998

Deferred tax liabilities 24,569 35,332 35,649

Current tax liabilities 1,005 585 123

Deferred income 24,217 20,623 22,815

Other liabilities 91,212 77,927 76,952

Total liabilities 1,029,137 914,793 923,304

------------ ------------ -----------

Total shareholders' equity and liabilities 1,568,308 1,531,608 1,530,839

------------ ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the 6 months to 30 June 2020

30.06.20 30.06.19 31.12.19

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit before tax (59,712) 42,773 73,263

Adjustments for:

Depreciation of property, plant and equipment 2,511 2,665 5,081

Loss on disposal of property, plant and equipment - 94 171

Amortisation of intangible assets 477 501 1,016

Net fair value losses/(gains) on financial

instruments and investment property 54,641 (34,542) (52,091)

Dividend and interest income (12,080) (14,263) (26,218)

Finance costs 258 324 620

Adjustment for pension funding 455 511 815

(13,450) (1,937) 2,657

Changes in operating assets and liabilities:

Net increase in insurance contract liabilities 78,161 28,790 49,537

Net increase in reinsurers' share of contract

liabilities (45,280) (15,497) (21,265)

Net (increase)/decrease in deferred acquisition

costs (152) 141 (4,553)

Net increase in other assets (44,557) (15,005) (25,272)

Net increase in operating liabilities 7,142 2,012 11,153

Net increase in other liabilities 2,562 3,224 784

Cash (used)/generated by operations (15,574) 1,728 13,041

Purchases of financial instruments and investment

property (36,735) (76,741) (156,760)

Sale of financial instruments and investment

property 76,313 64,644 148,308

Dividends received 3,940 5,396 9,605

Interest received 7,170 8,292 16,293

Tax paid (2,076) (5,189) (8,296)

Net cash from/(used by) operating activities 33,038 (1,870) 22,191

------------ ------------ ----------

Cash flows from investing activities

Purchases of property, plant and equipment (405) (3,593) (4,394)

Purchases of intangible assets (7,813) (3,823) (9,613)

Acquisition of business, net of cash acquired - - (40)

Net cash used by investing activities (8,218) (7,416) (14,047)

------------ ------------ ----------

Cash flows from financing activities

Interest paid (258) (324) (620)

Payment of principal element of lease liabilities (1,455) (1,447) (2,787)

Dividends paid to Company's shareholders (4,591) (4,591) (9,181)

Donations paid to ultimate parent undertaking - - (30,000)

Net cash used by financing activities (6,304) (6,362) (42,588)

------------ ------------ ----------

Net increase/(decrease) in cash and cash equivalents 18,516 (15,648) (34,444)

Cash and cash equivalents at the beginning

of the period 74,775 109,417 109,417

Exchange gains/(losses) on cash and cash equivalents 1,283 888 (198)

Cash and cash equivalents at the end of the

period 94,574 94,657 74,775

------------ ------------ ----------

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

1. General information and basis of preparation

Ecclesiastical Insurance Office plc (hereafter referred to as

the "Company"), a public limited company incorporated and domiciled

in England, together with its subsidiaries (collectively the

"Group") operates principally as a provider of general insurance

and in addition offers a range of financial services, with offices

in the UK & Ireland, Australia and Canada.

The annual financial statements are prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. The condensed set of financial statements

included in the 2020 interim results has been prepared in

accordance with IAS 34, Interim Financial Reporting.

The information for the year ended 31 December 2019 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor

reported on those accounts: its report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

These condensed consolidated interim financial statements were

approved by the Board on 20 August 2020 and were not reviewed by

the Group's statutory auditor and are not audited. Following an

audit tender in 2019, PricewaterhouseCoopers LLP (PwC) were

appointed as the Group's statutory auditor on 18 June 2020 and will

complete their first statutory audit for the 31 December 2020

financial year. The Group chose not to obtain interim review

services from PwC for these interim financial statements to ensure

management's complete support of the transition to new statutory

auditors and PwC's first full year statutory audit as management

and PwC operate in a remote working environment.

The Directors have assessed the going concern status of the

Group. The directors have considered the Group's plans and

forecasts, financial resources, investment portfolio and solvency

position. The directors have also assessed the Group's ability to

continue as a going concern in light of COVID-19 and the consequent

downturn in the UK's economic condition. The Group's forecasts and

projections, taking into account plausible scenarios, show that the

group will have adequate resources to continue operating over a

period of at least 12 months from the approval of the condensed

consolidated interim financial statements. Accordingly, the

Directors continue to adopt the going concern basis in preparing

the consolidated interim financial statements.

2. Accounting policies

The same accounting policies and methods of computation are

followed in the consolidated interim financial statements as

applied in the Group's latest audited annual financial

statements.

The following standards were in issue but not yet effective and

have not been applied to these condensed financial statements.

IFRS 17, Insurance Contracts, was issued in May 2017 and is

effective for periods beginning on or after 1 January 2023. The

standard establishes revised principles for the recognition,

measurement, presentation and disclosure of insurance contracts.

The Group's long-term business is expected to be the most affected

by the new standard. The Group expects to be able to use the

simplified premium allocation approach to the majority of its

general business insurance contracts, which applies mainly to

short-duration contracts.

IFRS 9, Financial Instruments, which provides a new model for

the classification and measurement of financial instruments, is

effective for periods beginning on or after 1 January 2018. The

Group has taken the option available to insurers to defer the

application of IFRS 9 until the implementation of IFRS 17, which is

now on or after 1 January 2023.

Other standards in issue but not yet effective are not expected

to materially impact the Group.

3. Critical accounting estimates and judgements

In preparing these interim financial statements and applying the

Group's accounting policies, the directors have made judgements and

estimates based on their best knowledge of current circumstances

and expectation of future events. The judgements made in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the 31 December

2019 consolidated financial statements. In 2020, the COVID-19

global pandemic has had a significant impact on market conditions

and the business. Estimates and their underlying assumptions

continue to be reviewed on an ongoing basis with revisions to

estimates being recognised prospectively. The following areas are

those where specific consideration has been made in response to

COVID-19:

- Valuation of insurance contract liabilities: the assumptions

used in the estimated ultimate cost of all claims incurred but not

settled at the year-end date have been adjusted for the potential

impact of COVID-19.

- Measurement of pension liabilities: although COVID-19 has

impacted on the key assumptions in the valuation, namely the

discount rate, the methodology used to determine key actuarial

assumptions has remained consistent with the 2019 Annual Report and

Accounts.

- Impairment of goodwill and intangible assets: key assumptions

applied in the valuation of the recoverable amount have been

adjusted to reflect the potential impact of COVID-19. No impairment

has been recognised.

- Valuation of investment properties: the emergence of COVID-19

has increased uncertainty surrounding the valuation of properties

as at the balance sheet date, leading to the valuation of

investment properties to be considered a critical accounting

estimate. The carrying value of investment properties has been

updated as at 30 June 2020 and a loss of GBP4.8m has been

recognised.

4. Risk management

The principal risks and uncertainties, together with details of

the financial risk management objectives and policies of the Group,

are disclosed in the latest annual report. COVID-19 is a new

emerging risk and one which impacts the existing principal risks

related to market and investment risk and operational risk. The

COVID-19 pandemic and corresponding concerns about the impact of

government intervention has increased market volatility and led to

a reduction in equity asset values. Also in response to COVID-19

all areas of the Group have adapted to working in a remote

environment. Whilst this presents an increased level of operational

risk, all the businesses continue to operate effectively.

5. Segment information

The Group segments its business activities on the basis of

differences in the products and services offered and, for general

insurance, the underwriting territory. Expenses relating to Group

management activities are included within 'Corporate costs'. This

reflects the management and internal Group reporting structure.

The activities of each operating segment are described

below.

- General business

United Kingdom and Ireland

The Group's principal general insurance business operation is in

the UK, where it operates under the Ecclesiastical and Ansvar brands.

The Group also operates in the Republic of Ireland, underwriting

general insurance business across the whole of Ireland.

Australia

The Group has a wholly-owned subsidiary in Australia underwriting

general insurance business under the Ansvar brand.

Canada

The Group operates a general insurance Ecclesiastical branch in

Canada.

Other insurance operations

This includes the Group's internal reinsurance function and operations

that are in run-off or not reportable due to their immateriality.

- Investment management

The Group provides investment management services both internally

and to third parties through EdenTree Investment Management Limited.

- Broking and Advisory

The Group provides insurance broking through South Essex Insurance

Brokers Limited, financial advisory services through Ecclesiastical

Financial Advisory Services Limited and risk advisory services

through Ansvar Risk Management Services Pty Limited which operates

in Australia.

- Life business

Ecclesiastical Life Limited provides long-term insurance policies

to support funeral planning products. It is closed to new business.

- Corporate costs

This includes costs associated with Group management activities.

Inter-segment and inter-territory transfers or transactions are

entered into under normal commercial terms and conditions that

would also be available to unrelated third parties.

Segment revenue

The Group uses gross written premiums as the measure for

turnover of the general and life insurance business segments.

Turnover of the non-insurance segments comprises fees and

commissions earned in relation to services provided by the Group to

third parties. Segment revenues do not include net investment

return or general business fee and commission income, which are

reported within revenue in the consolidated statement of profit or

loss.

Revenue is attributed to the geographical region in which the

customer is based. Group revenues are not materially concentrated

on any single external customer.

6 months ended 6 months ended

30.06.20 30.06.19

Gross Non- Gross Non-

written insurance written insurance

premiums services Total premiums services Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 133,735 - 133,735 123,957 - 123,957

Australia 38,263 - 38,263 33,652 - 33,652

Canada 28,255 - 28,255 25,481 - 25,481

Other insurance operations 2,225 - 2,225 1,911 - 1,911

Total 202,478 - 202,478 185,001 - 185,001

Life business 9 - 9 1 - 1

Investment management - 6,238 6,238 - 6,270 6,270

Broking and Advisory - 4,556 4,556 - 4,776 4,776

--------- ---------- --------- --------- ---------- ---------

Group revenue 202,487 10,794 213,281 185,002 11,046 196,048

--------- ---------- --------- --------- ---------- ---------

12 months ended

31.12.19

Gross Non-

written insurance

premiums services Total

GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 257,135 - 257,135

Australia 68,857 - 68,857

Canada 64,457 - 64,457

Other insurance operations 3,516 - 3,516

Total 393,965 - 393,965

Life business (13) - (13)

Investment management - 12,795 12,795

Broking and Advisory - 9,078 9,078

--------- ---------- ---------

Group revenue 393,952 21,873 415,825

--------- ---------- ---------

Segment result

General business segment results comprise the insurance

underwriting profit or loss, investment activities and other

expenses of each underwriting territory. The Group uses the

industry standard net combined operating ratio (COR) as a measure

of underwriting efficiency. The COR expresses the total of net

claims costs, commission and underwriting expenses as a percentage

of net earned premiums. Further details on the underwriting profit

or loss and COR, which are alternative performance measures that

are not defined under IFRS, are detailed in note 15.

The life business segment result comprises the profit or loss on

insurance contracts (including return on assets backing liabilities

in the long-term fund), shareholder investment return and other

expenses.

All other segment results consist of the profit or loss before

tax measured in accordance with IFRS.

6 months ended Combined

30 June 2020 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 96.7% 2,680 (48,701) (108) (46,129)

Australia 115.8% (2,054) (213) (16) (2,283)

Canada 99.9% 24 2,037 (91) 1,970

Other insurance operations (1,964) - - (1,964)

---------- ------------ --------- ---------

101.1% (1,314) (46,877) (215) (48,406)

Life business (233) (3,031) - (3,264)

Investment management - - (200) (200)

Broking and Advisory - - 1,373 1,373

Corporate costs - - (9,215) (9,215)

(Loss)/profit before tax (1,547) (49,908) (8,257) (59,712)

---------- ------------ --------- ---------

6 months ended Combined

30 June 2019 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 87.8% 9,198 33,345 (158) 42,385

Australia 103.3% (354) 677 (37) 286

Canada 98.0% 434 993 (84) 1,343

Other insurance operations 186 - - 186

---------- ------------ --------- ---------

91.4% 9,464 35,015 (279) 44,200

Life business 241 4,327 - 4,568

Investment management - - (18) (18)

Broking and Advisory - - 1,425 1,425

Corporate costs - - (7,402) (7,402)

Profit/(loss) before tax 9,705 39,342 (6,274) 42,773

---------- ------------ --------- ---------

12 months ended Combined

31 December 2019 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 86.8% 20,412 59,433 (292) 79,553

Australia 114.1% (3,246) 1,815 (65) (1,496)

Canada 95.1% 2,218 1,805 (174) 3,849

Other insurance operations 634 - - 634

---------- ------------ --------- ---------

91.1% 20,018 63,053 (531) 82,540

Life business 335 6,486 - 6,821

Investment management - - (310) (310)

Broking and Advisory - - 2,062 2,062

Corporate costs - - (17,850) (17,850)

Profit/(loss) before tax 20,353 69,539 (16,629) 73,263

---------- ------------ --------- ---------

6. Tax

Income tax for the six month period is calculated at rates

representing the best estimate of the average annual effective

income tax rate expected for the full year, applied to the pre-tax

result of the six month period.

7. Preference shares

Interim dividends paid on the 8.625% Non-Cumulative Irredeemable

Preference shares amounted to GBP4.6m (H1 2019: GBP4.6m). At the

point these dividends were paid, consideration was given to the

distributable reserves and capital position.

8. Financial investments

Financial investments summarised by measurement category are as

follows:

30.06.20 30.06.19 31.12.19

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Financial investments at fair value through

profit or loss

Equity securities

- listed 238,225 280,004 289,754

- unlisted 47,544 63,107 66,304

Debt securities

- government bonds 152,142 153,602 154,244

- listed 331,195 342,256 338,001

- unlisted 270 125 270

Derivative financial instruments

- options 4,388 2,022 1,562

- forwards - - 1,499

773,764 841,116 851,634

Financial investments at fair value through

other comprehensive income

Derivative financial instruments

- forwards - - 509

Total financial investments at fair value 773,764 841,116 852,143

Loans and receivables

Cash held on deposit 5,032 9,943 4,974

Other loans 823 721 796

Total financial investments 779,619 851,780 857,913

------------ ------------ ----------

9. Financial instruments' held at fair value disclosures

IAS 34 requires that interim financial statements include

certain of the disclosures about the fair value of financial

instruments set out in IFRS 13, Fair Value Measurement and IFRS 7,

Financial Instruments Disclosures.

The fair value measurement basis used to value those financial

assets and financial liabilities held at fair value is categorised

into a fair value hierarchy as follows:

Level 1: fair values measured using quoted prices (unadjusted)

in active markets for identical assets or liabilities. This

category includes listed equities in active markets, listed debt

securities in active markets and exchange-traded derivatives.

Level 2: fair values measured using inputs other than quoted

prices included within level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices). This category includes listed debt or equity

securities in a market that is not active and derivatives that are

not exchange-traded.

Level 3: fair values measured using inputs for the asset or

liability that are not based on observable market data

(unobservable inputs). This category includes unlisted debt and

equities, including investments in venture capital, and suspended

securities. Where a look-through valuation approach is applied,

underlying net asset values are sourced from the investee,

translated into the Group's functional currency and adjusted to

reflect current market conditions.

There have been no transfers between investment categories in

the current period.

Fair value measurement

at the

end of the reporting period

based on

--------------------------------

Level 1 Level Level Total

2 3

30 June 2020 GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 237,620 205 47,944 285,769

Debt securities 482,307 898 402 483,607

Derivative securities - 4,388 - 4,388

----------- --------- -------- ---------

Total financial assets at fair value 719,927 5,491 48,346 773,764

----------- --------- -------- ---------

Financial liabilities at fair value

through profit or loss

Financial liabilities

Derivative securities - (3,327) - (3,327)

- (3,327) - (3,327)

----------- --------- -------- ---------

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative securities - (3,194) - (3,194)

Total financial liabilities at fair

value - (6,521) - (6,521)

----------- --------- -------- ---------

30 June 2019

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 279,806 197 63,108 343,111

Debt securities 494,523 1,200 260 495,983

Derivative securities - 2,022 - 2,022

----------- --------- -------- ---------

774,329 3,419 63,368 841,116

----------- --------- -------- ---------

Financial liabilities at fair value

through profit or loss

Financial liabilities

Derivative securities - (4,261) - (4,261)

- (4,261) - (4,261)

----------- --------- -------- ---------

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative securities - (2,560) - (2,560)

Total financial liabilities at fair

value - (6,821) - (6,821)

----------- --------- -------- ---------

31 December 2019

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 289,165 190 66,703 356,058

Debt securities 490,911 1,200 404 492,515

Derivative securities - 3,061 - 3,061

780,076 4,451 67,107 851,634

----------- --------- -------- ---------

Financial assets at fair value through

other comprehensive income

Financial investments

Derivative securities - 509 - 509

Total financial assets at fair value 780,076 4,960 67,107 852,143

----------- --------- -------- ---------

The derivative liabilities of the Group at the end of the prior

year were measured at fair value through profit or loss and

categorised as level 2.

Fair value measurements in level 3 consist of financial assets,

analysed as follows:

Financial assets at fair

value

through profit or loss

-----------------------------------

Equity Debt

securities securities Total

GBP000 GBP000 GBP000

2020

At 1 January 66,703 404 66,107

Total losses recognised in profit or loss (18,759) (2) (18,761)

At 30 June 47,944 402 48,346

----------- ----------- ---------

Total losses for the period included in profit

or loss for assets held at the end of the

reporting period (18,759) (2) (18,761)

----------- ----------- ---------

2019

At 1 January 44,773 261 45,034

Total gains/(losses) recognised in profit

or loss 4,342 (1) 4,341

Purchases 13,993 - 13,993

At 30 June 63,108 260 63,368

----------- ----------- ---------

Total gains/(losses) for the period included

in profit or loss for assets held at the end

of the reporting period 4,342 (1) 4,341

----------- ----------- ---------

2019

At 1 January 44,773 261 45,034

Total gains recognised in profit or loss 7,538 143 7,681

Purchases 14,392 - 14,392

At 31 December 66,703 404 66,107

----------- ----------- ---------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 7,538 143 7,681

----------- ----------- ---------

All the above gains included in profit or loss for the period

are presented in net investment return within the statement of

profit or loss.

The valuation techniques used for instruments categorised in

Levels 2 and 3 are described below.

Listed debt and equity securities not in active market (Level

2)

These financial assets are valued using third party pricing

information that is regularly reviewed and internally calibrated

based on management's knowledge of the markets.

Non exchange-traded derivative contracts (Level 2)

The Group's derivative contracts are not traded in active

markets. Foreign currency forward contracts are valued using

observable forward exchange rates corresponding to the maturity of

the contract and the contract forward rate. Over-the-counter equity

or index options and futures are valued by reference to observable

index prices.

Unlisted equity securities (Level 3)

These financial assets are valued using observable net asset

data, adjusted for unobservable inputs including comparable

price-to-book ratios based on similar listed companies, and

management's consideration of constituents as to what exit price

might be obtainable.

The valuation is sensitive to the level of underlying net

assets, the Euro exchange rate, the price-to-book ratio chosen, an

illiquidity discount and a credit rating discount applied to the

valuation to account for the risks associated with holding the

asset. If the illiquidity discount or credit rating discount

applied changes by +/-10%, the value of unlisted equity securities

could move by +/-GBP5m (H1 2019: +/-GBP7m).

Unlisted debt (Level 3)

Unlisted debt is valued using an adjusted net asset method

whereby management uses a look-through approach to the underlying

assets supporting the loan, discounted using observable market

interest rates of similar loans with similar risk, and allowing for

unobservable future transaction costs.

The valuation is most sensitive to the level of underlying net

assets, but it is also sensitive to the interest rate used for

discounting and the projected date of disposal of the asset, with

the exit costs sensitive to an expected return on capital of any

purchaser and estimated transaction costs. Reasonably likely

changes in unobservable inputs used in the valuation would not have

a significant impact on shareholders' equity or the net result.

10. Changes in estimates

The estimation of the ultimate liability arising from claims

made under general insurance business contracts is a critical

accounting estimate. There are various sources of uncertainty as to

how much the Group will ultimately pay with respect to such

contracts. There is uncertainty as to the total number of claims

made on each class of business, the amounts that such claims will

be settled for and the timing of any payments.

During the six month period, changes to claims reserve estimates

made in prior years as a result of reserve development resulted in

a net release of GBP10.8m (H1 2019: GBP13.0m) offset by a GBP6.5m

increase (H1 2019: GBP8.5m increase) in reserves due to discount

rate movements.

The estimation of the ultimate liability arising from claims

made under life insurance business contracts is also a critical

accounting estimate. Estimates are made as to the expected number

of deaths in each future year until claims have been paid on all

policies, as well as expected future real investment returns from

assets backing life insurance contracts. During the six month

period there was a GBP4.5m increase (H1 2019: GBP2.7m increase) in

reserves due to discount rate movements.

11. Translation and hedging reserve

Translation Hedging

reserve reserve Total

GBP000 GBP000 GBP000

2020

At 1 January 13,572 4,752 18,324

Gains on currency translation differences 2,283 - 2,283

Losses on net investment hedges - (2,653) (2,653)

Attributable tax - 367 367

At 30 June 15,855 2,466 18,321

------------ -------- --------

2019

At 1 January 14,940 4,131 19,071

Gains on currency translation differences 1,213 - 1,213

Losses on net investment hedges - (1,643) (1,643)

Attributable tax - 292 292

At 30 June 16,153 2,780 18,933

------------ -------- --------

2019

At 1 January 14,940 4,131 19,071

Losses on currency translation differences (1,368) - (1,368)

Gains on net investment hedges - 640 640

Attributable tax - (19) (19)

At 31 December 13,572 4,752 18,324

------------ -------- --------

The translation reserve arises on consolidation of the Group's

foreign operations. The hedging reserve represents the cumulative

amount of gains and losses on hedging instruments in respect of net

investments in foreign operations.

12. Insurance contract liabilities and reinsurers' share of

contract liabilities

30.06.20 30.06.19 31.12.19

6 months 6 months 12 months

GBP000 GBP000 GBP000

Gross

Claims outstanding 565,121 481,747 481,669

Unearned premiums 210,916 188,624 203,096

Life business provision 79,593 82,154 79,212

Total gross insurance contract liabilities 855,630 752,525 763,977

--------- --------- ----------

Recoverable from reinsurers

Claims outstanding 135,565 92,354 89,982

Unearned premiums 74,514 64,005 69,574

Total reinsurers' share of contract liabilities 210,079 156,359 159,556

--------- --------- ----------

Net

Claims outstanding 429,556 389,393 391,687

Unearned premiums 136,402 124,619 133,522

Life business provision 79,593 82,154 79,212

Total net insurance liabilities 645,551 596,166 604,421

--------- --------- ----------

13. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Charitable grants to the ultimate parent company are disclosed

in the condensed consolidated statement of changes in equity.

There have been no material related party transactions in the

period or changes thereto since the latest annual report which

require disclosure.

14. Holding company

The ultimate holding company is Allchurches Trust Limited, a

company limited by guarantee and a registered charity incorporated

in England and Wales.

15. Reconciliation of Alternative Performance Measures

The Group uses alternative performance measures (APM) in

addition to the figures which are prepared in accordance with IFRS.

The financial measures in our key financial performance data

include the combined operating ratio (COR). This measure is

commonly used in the industries we operate in and we believe it

provides useful information and enhances the understanding of our

results.

Users of the accounts should be aware that similarly titled APM

reported by other companies may be calculated differently. For that

reason, the comparability of APM across companies might be

limited.

In line with the European Securities and Markets Authority

guidelines, we provide a reconciliation of the combined operating

ratio to its most directly reconcilable line item in the financial

statements.

30.06.20

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 202,478 9 - - - - 202,487

Outward reinsurance premiums (80,313) - - - - - (80,313)

Net change in provision

for unearned premiums (980) - - - - - (980)

Net earned premiums [1] 121,185 9 - - - - 121,194

---------- ------- --------- -------- --------- ---------- ----------

Fee and commission income 22,650 - - 6,238 4,556 - 33,444

Other operating income 1,960 - - - - - 1,960

Net investment return - (660) (48,595) (13) 409 - (48,859)

Total revenue 145,795 (651) (48,595) 6,225 4,965 - 107,739

---------- ------- --------- -------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (139,715) 563 - - - - (139,152)

Reinsurance recoveries 68,104 - - - - - 68,104

Fees, commissions and other

acquisition costs (38,448) - - (535) 157 - (38,826)

Other operating and administrative

expenses (37,050) (145) (1,313) (5,890) (3,706) (9,215) (57,319)

Total operating expenses (147,109) 418 (1,313) (6,425) (3,549) (9,215) (167,193)

---------- ------- --------- -------- --------- ---------- ----------

Operating (loss)/profit [2] (1,314) (233) (49,908) (200) 1,416 (9,215) (59,454)

Finance costs (215) - - - (43) - (258)

---------- ------- --------- -------- --------- ---------- ----------

(Loss)/profit before tax (1,529) (233) (49,908) (200) 1,373 (9,215) (59,712)

---------- ------- --------- -------- --------- ---------- ----------

Underwriting loss [2] (1,314)

Combined operating ratio

( = ( [1] - [2] ) / [1]

) 101.1%

The underwriting profit of the Group is defined as the operating

profit of the general insurance business.

The Group uses the industry standard net combined operating

ratio as a measure of underwriting efficiency. The COR expresses

the total of net claims costs, commission and underwriting expenses

as a percentage of net earned premiums. It is calculated as

( [1] - [2] ) / [1].

30.06.19

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 185,001 1 - - - - 185,002

Outward reinsurance premiums (71,172) - - - - - (71,172)

Net change in provision

for unearned premiums (4,351) - - - - - (4,351)

Net earned premiums [1] 109,478 1 - - - - 109,479

---------- ------- -------- -------- --------- ---------- ----------

Fee and commission income 19,537 - - 6,269 4,776 - 30,582

Other operating income 339 - - - - - 339

Net investment return - 724 40,865 8 420 - 42,017

Total revenue 129,354 725 40,865 6,277 5,196 - 182,417

---------- ------- -------- -------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (78,617) (345) - - - - (78,962)

Reinsurance recoveries 31,512 - - - - - 31,512

Fees, commissions and other

acquisition costs (34,968) - - (410) 213 - (35,165)

Other operating and administrative

expenses (37,817) (139) (1,523) (5,885) (3,939) (7,402) (56,705)

Total operating expenses (119,890) (484) (1,523) (6,295) (3,726) (7,402) (139,320)

---------- ------- -------- -------- --------- ---------- ----------

Operating profit/(loss) [2] 9,464 241 39,342 (18) 1,470 (7,402) 43,097

Finance costs (279) - - - (45) - (324)

---------- ------- -------- -------- --------- ---------- ----------

Profit/(loss) before tax 9,185 241 39,342 (18) 1,425 (7,402) 42,773

---------- ------- -------- -------- --------- ---------- ----------

Underwriting profit [2] 9,464

Combined operating ratio

( = ( [1] - [2] ) / [1]

) 91.4%

31.12.19

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 393,965 (13) - - - - 393,952

Outward reinsurance premiums (152,886) - - - - - (152,886)

Net change in provision

for unearned premiums (15,080) - - - - - (15,080)

Net earned premiums [1] 225,999 (13) - - - - 225,986

---------- ------- -------- --------- --------- ---------- ----------

Fee and commission income 49,368 - - 12,795 9,077 - 71,240

Other operating income 544 - - - - - 544

Net investment return - 989 72,596 19 834 - 74,438

Total revenue 275,911 976 72,596 12,814 9,911 - 372,208

---------- ------- -------- --------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (157,481) (327) - - - - (157,808)

Reinsurance recoveries 52,800 - - - - - 52,800

Fees, commissions and other

acquisition costs (72,383) (14) - (819) 476 - (72,740)

Other operating and administrative

expenses (78,829) (300) (3,057) (12,305) (8,236) (17,850) (120,577)

Total operating expenses (255,893) (641) (3,057) (13,124) (7,760) (17,850) (298,325)

---------- ------- -------- --------- --------- ---------- ----------

Operating profit/(loss) [2] 20,018 335 69,539 (310) 2,151 (17,850) 73,883

Finance costs (531) - - - (89) - (620)

---------- ------- -------- --------- --------- ---------- ----------

Profit/(loss) before tax 19,487 335 69,539 (310) 2,062 (17,850) 73,263

---------- ------- -------- --------- --------- ---------- ----------

Underwriting profit [2] 20,018

Combined operating ratio

( = ([1] - [2]) / [1]

) 91.1%

16. Events after the balance sheet date

Ecclesiastical is aware that the COVID-19 pandemic is causing an

unprecedented situation for many and business interruption cover is

an important issue for the whole of the insurance industry. In May

2020 the Financial Conduct Authority (FCA) announced that while the

majority of business interruption policies (BI) are focused on

property damage, there were some policies where they considered the

wording to be unclear in how they respond to COVID-19.

Ecclesiastical agreed with the FCA that some relevant policy

wordings are considered as part of an expedited Test Case and

alongside seven other insurers agreed to participate to provide

clarity and certainty to customers. The Test Case was heard by the

High Court between 20-30 July 2020. The judgement on the Test Case

is not expected before the middle of September 2020.

The FCA have stated that inclusion in the Test Case does not

imply that all or any of the policies being tested may provide

cover. The policies are representative across the industry and

enabled a better 'test' to help provide certainty and clarity to

the market. Ecclesiastical carries out thorough claims assessments

for all claims received and the vast majority of insurance cover

does not include pandemics. Consequently claims reserves are not

held in respect of insurance cover that excludes pandemics.

Ecclesiastical is well capitalised and continues to expect to

hold a capital position in excess of regulatory requirements,

regardless of the outcome of the Test Case.

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

(a) the consolidated interim financial statements have been

prepared in accordance with IAS 34, 'Interim Financial Reporting'

as adopted by the European Union;

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

The Board of Directors is as per the latest audited annual

financial statements, with the following changes:

-- Sir Stephen Lamport was appointed as a Non-Executive Director on 23 March 2020

-- The Very Revd Christine Wilson resigned as a Non-Executive Director on 18 June 2020

By order of the Board,

Mark Hews David Henderson

Group Chief Executive Chairman

20 August 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KBLFLBVLZBBB

(END) Dow Jones Newswires

August 21, 2020 02:00 ET (06:00 GMT)

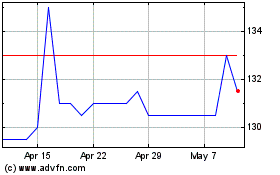

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From Apr 2023 to Apr 2024