TIDMEMH

RNS Number : 3629C

European Metals Holdings Limited

18 June 2021

For immediate release

18 June 2021

EUROPEAN METALS HOLDINGS LIMITED

EMH ADS TO TRADE IN THE U.S.

HIGHLIGHTS

-- EMH expands presence in the U.S. with Deutsche Bank appointed

as the depositary bank for EMH's American Depositary Shares

(ADS)

-- EMH and Deutsche Bank establishing a sponsored Level 1 ADS

program with each ADS representing 20 ordinary EMH shares

-- ADSs expected to commence trading on the OTC Market as a

member of the Nasdaq International Designation during July 2021

under the ticker symbol "EMHYY"

-- Extensive marketing campaign to begin to new U.S. investors,

further build relationships with U.S. banks, green energy funds and

institutional investors and brokers

-- Prague Listing to be postponed at suggestion of Prague Stock Exchange

European Metals Holdings Limited (ASX & AIM: EMH, NASDAQ:

ERPNF) ("EMH", "European Metals" or the "Company") is pleased to

advise it has appointed one of the world's leading depositary

banks, Deutsche Bank, as the depositary bank for the issue of its

American Depositary Shares ("ADS").

European Metals will work with Deutsche Bank to create a

sponsored Level 1 ADS program with each ADS issued under the

program representing 20 ordinary shares of the Company. It is

intended that EMH's ADS will commence trading on the OTC Market as

a member of the Nasdaq International Designation under the ticker

symbol "EMHYY" during July 2021 which is expected to attract

institutional and fund investors who are restricted from trading in

non US stocks.

The Nasdaq International Designation and Level 1 ADS program in

the United States will enable new and existing U.S. investors to

trade EMH's ADS electronically 'commission free' on most retail

trading platforms such as Charles Schwab, E-Trade, TD Ameritrade in

U.S. dollars and during normal U.S. trading hours. European Metals'

Certificates of Depositary Interest ("CDIs"), representing ordinary

shares and ordinary shares in the Company, will continue to trade

on the ASX and AIM, a market of the London Stock Exchange,

respectively, under the symbol "EMH" as will the shares with the

tickers ERPNF and EMHLF currently trading in the USA.

With the establishment of the Level 1 ADS program, the Company

will now begin an extensive marketing campaign to new investors

throughout the United States and will continue to build

relationships with U.S. banks, green energy funds and institutional

investors and brokers that have experience and knowledge of the

lithium and "clean-technology" sectors.

EMH Executive Chairman Keith Coughlan said: "Launching an ADS

program in the United States signals a key milestone as we drive

development forward at our Cinovec Project and boost visibility

among U.S. investors. We will begin an extensive U.S. marketing

campaign with the ADSs and Nasdaq International Designation to

enable investors to trade the ADS electronically 'commission free'

on most retail trading platforms such as Charles Schwab, E-Trade,

TD Ameritrade in U.S. dollars, during U.S. trading hours."

"I have been very pleased with the initial feedback from our US

marketing efforts and this listing is consistent with our strategy

to expand our presence in the biggest capital markets globally. Our

focus will be to attract US and Global green energy funds and

institutional investors who recognise the significance of the

Cinovec Project, its ESG principles and potentially low carbon

footprint. We continue to be highly encouraged by the results of

our Definitive Feasibility Study and look forward to updating the

market on project development plan."

ABOUT NASDAQ INTERNATIONAL DESIGNATION

Launched in December 2015, the Nasdaq International Designation

program is designed for non-U.S.-based companies that have level 1

American Depositary Shares that trade in the over-the-counter (OTC)

market.

The program offers a unique partnership with Nasdaq that

provides member companies with Nasdaq's robust visibility offering

which allows for greater access to US investors, and can

potentially increase liquidity. The Nasdaq International

Designation is home to a diverse range of companies in innovative

industries across the globe.

The total market capitalisation of the Nasdaq International

Designation program member Companies exceeds $150 billion and

program members hail from Australia, Japan, Germany, Brazil,

Canada, the U.K. and the Netherlands. As participants in a

comprehensive program, companies receive a full service offering

that includes investor relations tools and services, as well as

access to Nasdaq's visibility assets to enhance communication with

the investment community. In the past year, members of the program

were invited to the Nasdaq MarketSite with the opportunity to

amplify their brand activities through different channels.

ABOUT NASDAQ

Nasdaq is a leading global provider of trading, clearing,

exchange technology, listing, information and public company

services. Through its diverse portfolio of solutions, Nasdaq

enables customers to plan, optimize and execute their business

vision with confidence, using proven technologies that provide

transparency and insight for navigating today's global capital

markets.

As the creator of the world's first electronic stock market,

Nasdaq has technology that powers more than 89 marketplaces in 50

countries, and 1 in 10 of the world's securities transactions.

Nasdaq is home to 3,800 total listings with a market value of $11.0

trillion.

ABOUT DEUTSCHE BANK

As one of the world's leading depositary banks, Deutsche Bank's

depositary receipt business is dedicated to providing excellent

service for companies with American or global depositary receipt

programs. Deutsche Bank has a wealth of experience in establishing

and maintaining depositary receipt programs, with specialists in

Hong Kong, London, Moscow, Mumbai, New York and Sydney providing

local knowledge and expertise across different time zones.

Their dedicated client management team offers clients a single

point of contact for all program related issues. Deutsche Bank's

depositary receipts team is part of a group of over 1,100

professionals who specialise in providing trust, paying agency and

administrative solutions to corporates, financial institutions and

government agencies worldwide.

UPDATE ON PRAGUE LISTING

The Company has been informed by the Prague Stock Exchange that,

as a result of the Company being a pre-revenue company, at this

stage of EMH's development they did not consider it appropriate for

EMH to list on the Prague Stock exchange. The Prague Stock Exchange

indicated that they were open to further discussion about the

listing of EMH shares on the Prague Stock Exchange but that

reflecting relevant regulatory, legal and technical aspects on

their side, it was their suggestion to postpone the listing process

until the later stages of the Cínovec Project development.

For the avoidance of doubt, European Metals' Certificates of

Depositary Interest ("CDIs"), representing ordinary shares and

ordinary shares in the Company, will continue to trade on the ASX

and AIM, a market of the London Stock Exchange, respectively, under

the symbol "EMH".

WEBSITE

A copy of this announcement is available from the Company's

website at www.europeanmet.com.

ENQUIRIES:

European Metals Holdings Limited

Keith Coughlan, Executive Chairman Tel: +61 (0) 419 996 333

Email: keith@europeanmet.com

Kiran Morzaria, Non-Executive Director Tel: +44 (0) 20 7440 0647

Dennis Wilkins, Company Secretary Tel: +61 (0) 417 945 049

Email: dennis@europeanmet.com

WH Ireland Ltd (Nomad & Joint Broker)

James Joyce/James Sinclair-Ford Tel: +44 (0) 20 7220 1666

(Corporate Finance)

Harry Ansell/Jasper Berry (Broking

Shard Capital (Joint Broker) Tel: +44 (0) 20 7186 9950

Damon Heath

Erik Woolgar

Blytheweigh (Financial PR) Tel: +44 (0) 20 7138 3222

Tim Blythe

Megan Ray

Chapter 1 Advisors (Financial PR

- Aus) Tel: +61 (0) 433 112 936

David Tasker

The information contained within this announcement is considered

to be inside information, for the purposes of Article 7 of EU

Regulation 596/2014, prior to its release. The person who

authorised for the release of this announcement on behalf of the

Company was Keith Coughlan, Executive Chairman .

BACKGROUND INFORMATION ON CINOVEC

PROJECT OVERVIEW

Cinovec Lithium/Tin Project

Geomet s.r.o. controls the mineral exploration licenses awarded

by the Czech State over the Cinovec Lithium/Tin Project. Geomet

s.r.o. is owned 49% by European Metals and 51% by CEZ a.s. through

its wholly owned subsidiary, SDAS. Cinovec hosts a globally

significant hard rock lithium deposit with a total Indicated

Mineral Resource of 372.4Mt at 0.45% Li2O and 0.04% Sn and an

Inferred Mineral Resource of 323.5Mt at 0.39% Li2O and 0.04% Sn

containing a combined 7.22 million tonnes Lithium Carbonate

Equivalent and 263kt of tin reported 28 November 2017 (Further

Increase in Indicated Resource at Cinovec South). An initial

Probable Ore Reserve of 34.5Mt at 0.65% Li2O and 0.09% Sn reported

4 July 2017 (Cinovec Maiden Ore Reserve - Further Information) has

been declared to cover the first 20 years mining at an output of

22,500tpa of lithium carbonate reported 11 July 2018 (Cinovec

Production Modelled to Increase to 22,500tpa of Lithium

Carbonate).

This makes Cinovec the largest hard rock lithium deposit in

Europe, the fourth largest non-brine deposit in the world and a

globally significant tin resource.

The deposit has previously had over 400,000 tonnes of ore mined

as a trial sub-level open stope underground mining operation.

In June 2019 EMH completed an updated Preliminary Feasibility

Study, conducted by specialist independent consultants, which

indicated a return post tax NPV of USD1.108B and an IRR of 28.8%

and confirmed that the Cinovec Project is a potential low operating

cost, producer of battery grade lithium hydroxide or battery grade

lithium carbonate as markets demand. It confirmed the deposit is

amenable to bulk underground mining. Metallurgical test-work has

produced both battery grade lithium hydroxide and battery grade

lithium carbonate in addition to high-grade tin concentrate at

excellent recoveries. Cinovec is centrally located for European

end-users and is well serviced by infrastructure, with a sealed

road adjacent to the deposit, rail lines located 5 km north and 8

km south of the deposit and an active 22 kV transmission line

running to the historic mine. As the deposit lies in an active

mining region, it has strong community support.

The economic viability of Cinovec has been enhanced by the

recent strong increase in demand for lithium globally, and within

Europe specifically.

There are no other material changes to the original information

and all the material assumptions continue to apply to the

forecasts.

BACKGROUND INFORMATION ON CEZ

Headquartered in the Czech Republic, CEZ a.s. is an established,

integrated energy group with operations in a number of Central and

Southeastern European countries and Turkey. CEZ's core business is

the generation, distribution, trade in, and sales of electricity

and heat, trade in and sales of natural gas, and coal extraction.

CEZ Group has 33,000 employees and annual revenue of approximately

EUR 7.24 billion.

The largest shareholder of its parent company, CEZ a.s., is the

Czech Republic with a stake of approximately 70%. The shares of CEZ

a.s. are traded on the Prague and Warsaw stock exchanges and

included in the PX and WIG-CEE exchange indices. CEZ's market

capitalization is approximately EUR 10.08 billion.

As one of the leading Central European power companies, CEZ

intends to develop several projects in areas of energy storage and

battery manufacturing in the Czech Republic and in Central

Europe.

CEZ is also a market leader for E-mobility in the region and has

installed and operates a network of EV charging stations throughout

Czech Republic. The automotive industry in Czech is a significant

contributor to GDP and the number of EV's in the country is

expected to grow significantly in coming years.

CONTACT

For further information on this update or the Company generally,

please visit our website at www.europeanmet.com or see full contact

details at the end of this release.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information included in this release constitutes forward-looking

statements. Often, but not always, forward looking statements can

generally be identified by the use of forward looking words such as

"may", "will", "expect", "intend", "plan", "estimate",

"anticipate", "continue", and "guidance", or other similar words

and may include, without limitation, statements regarding plans,

strategies and objectives of management, anticipated production or

construction commencement dates and expected costs or production

outputs.

Forward looking statements inherently involve known and unknown

risks, uncertainties and other factors that may cause the company's

actual results, performance and achievements to differ materially

from any future results, performance or achievements. Relevant

factors may include, but are not limited to, changes in commodity

prices, foreign exchange fluctuations and general economic

conditions, increased costs and demand for production inputs, the

speculative nature of exploration and project development,

including the risks of obtaining necessary licences and permits and

diminishing quantities or grades of reserves, political and social

risks, changes to the regulatory framework within which the company

operates or may in the future operate, environmental conditions

including extreme weather conditions, recruitment and retention of

personnel, industrial relations issues and litigation.

Forward looking statements are based on the company and its

management's good faith assumptions relating to the financial,

market, regulatory and other relevant environments that will exist

and affect the company's business and operations in the future. The

company does not give any assurance that the assumptions on which

forward looking statements are based will prove to be correct, or

that the company's business or operations will not be affected in

any material manner by these or other factors not foreseen or

foreseeable by the company or management or beyond the company's

control.

Although the company attempts and has attempted to identify

factors that would cause actual actions, events or results to

differ materially from those disclosed in forward looking

statements, there may be other factors that could cause actual

results, performance, achievements or events not to be as

anticipated, estimated or intended, and many events are beyond the

reasonable control of the company. Accordingly, readers are

cautioned not to place undue reliance on forward looking

statements. Forward looking statements in these materials speak

only at the date of issue. Subject to any continuing obligations

under applicable law or any relevant stock exchange listing rules,

in providing this information the company does not undertake any

obligation to publicly update or revise any of the forward looking

statements or to advise of any change in events, conditions or

circumstances on which any such statement is based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUMUQUPGUAR

(END) Dow Jones Newswires

June 18, 2021 02:00 ET (06:00 GMT)

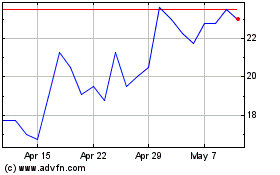

European Metals (LSE:EMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

European Metals (LSE:EMH)

Historical Stock Chart

From Apr 2023 to Apr 2024