TIDMEML

RNS Number : 5392A

Emmerson PLC

26 September 2022

Emmerson PLC / Ticker: EML / Index: AIM / Sector: Mining

26 September 2022

Emmerson PLC ("Emmerson" or the "Company")

Interim Results for the six months ended 30 June 2022

Emmerson, which is developing the world class Khemisset Potash

Project in Morocco ("Khemisset" or the "Project"), is pleased to

announce its interim results for the six-month period ended 30 June

2022.

Highlights

-- Strong progress at Khemisset in basic engineering and

drilling campaigns, positioning the Company to proceed rapidly

towards the construction of the mine in 2023 after financial

close

-- Enhancements made to the Project to reduce further its

environmental impact, including sourcing of waste water for

processing, and the selection of dry tailings storage

-- Potash prices remain high due to tight supply and growing

demand - food security becoming a major global issue

-- Further support for the Project from strategic investors,

with US$40 million financing commitment extended for a further 12

months, and a new subscription of US$6.0 million at 6.0 pence per

share (see separate announcement)

-- Emmerson now funded for remaining technical and other

workstreams to deliver Khemisset through to construction decision

and financial close, currently expected to be during H2 2023

-- Positive discussions around environmental approvals as

Emmerson continues to work with the relevant authorities to receive

full approval.

Chief Executive Graham Clarke said: "I am pleased to report that

we have made strong progress in 2022 to date towards completing the

basic engineering and technical workstreams as part of finalising

the design of the Khemisset project. We are now well placed to move

rapidly towards concluding the financing for the construction of

the mine, once the final environmental approvals are received.

Although these approvals have been taking longer than we had

originally anticipated, the Moroccan authorities have assured us of

their support for the Project, which all parties recognise has a

significant role to play in the context of the global crisis around

food security, of which potash supply is a key element.

"Today we announce the extension of our US$40 million financing

commitment with Global Sustainable Minerals Pte Ltd and Gold Quay

Capital Pte Ltd, together with a US$6 million placing for new

equity. These agreements demonstrate the ongoing support of our

strategic investors and leave us funded for our remaining technical

workstreams up to financial close. Once we receive the final

environmental approvals, we expect financial close to take around

six months if all goes well, and construction to commence soon

thereafter. Subject to progress in the coming months on the

environmental permit, we would hope to be able to commence

construction in the second half of 2023. "

Financing

The Company announces today that it has received further support

from its strategic investors Global Sustainable Minerals Pte Ltd

("GSM") and Gold Quay Capital Pte Ltd ("GQC") (together the

"Strategic Investors") in the form of an extension to its existing

Convertible Loan Notes agreement, and a new US$6.0 million

subscription for new shares at a price of 6.0 pence per share by

GSM. Further details of this important and positive development,

and the opportunity for existing shareholders to participate

alongside the GSM subscription are covered in separate

announcements published immediately following this

announcement.

Discussions have continued regarding the financing package for

the construction project at Khemisset. A range of international and

Moroccan banks have expressed interest in participating in the debt

funding, while there has also been considerable interest in the

equity portion, which is corner-stoned by the Strategic Investors'

renewed commitment for up to US$64 million, comprising US$12

million of equity subscriptions to date (including US$6 million

announced today), up to US$40 million of convertible notes, and

potential additional funding of US$12 million from warrant

exercises.

The combination of strong economics, solid jurisdiction, an

experienced management team and a compelling investment case for

potash have attracted significant attention from a variety of

investors, in spite of some challenging market conditions.

Khemisset

Emmerson is committed to making Khemisset the first potash

producer in Africa. Achieving this will enhance Morocco's status as

a fertiliser hub supporting food security for Africa and the rest

of the world and will confirm the country's growing reputation as

an attractive destination for foreign investment. Emmerson's

management is committed to working proactively with Morocco to

ensure that the development of the Project aligns with the

Kingdom's economic strategy through a mutually beneficial

relationship that maximises local and national benefits. It will

continue to engage closely with a wide range of Moroccan

stakeholders to ensure the optimum route to production is

achieved.

Technical Workstreams

The Emmerson team in Morocco continues to progress towards

achieving construction readiness at Khemisset. The work undertaken

during the period, in partnership with Moroccan partners Reminex

Engineering on the general infrastructure, and Barr Engineering on

the process plant, has ensured that the Company is well positioned

to move quickly to the next stage once the final permits and

financing are in place.

Recent geotechnical work has driven the adjustment of the mine

site location, with decline alignment drilling conducted during the

period demonstrating better than anticipated ore conditions at the

end of the decline. Information gathered from boreholes and

Electrical Resistance Tomography ("ERT") surveys has led to the

selection of a more suitable area for construction of the site and

the decline, as well as reducing the use of private land.

Additional deep drill holes, supplemented by directional

drilling and four further ERT surveys, were completed in order to

provide further insights into the lithography around the declines,

and will assist in finalising the precise siting of key

infrastructure to take advantage of the most competent ground

conditions. One of the holes was extended to provide detailed data

to feed into the design of the Deep Well Injection ("DWI") which

will help minimise surface tailings. The 8km of ERT surveys have

covered the tailings storage facility area and the Mining

Infrastructure Area, for best understanding of rock competence for

foundations.

As previously reported, the Company has determined that a dry

tailings system will now be employed at Khemisset. The key

advantages of the dry tailings system are the environmental

benefits of reduced footprint, reduced water consumption and also

reduced risk in the event of any extreme weather events, a key

environmental benefit.

Workstreams relating to the process plant have also progressed

well, with process flow diagrams, piping and instrumentation

diagrams, and function specifications now completed. Infrastructure

and service investigations are now well advanced, and an improved

solution for process plant water supply has been identified whereby

water will be taken either partially or fully from the Khemisset

Waste Water Treatment Plant, with the ultimate goal of requiring no

fresh water for the process. This is a scientifically robust and

environmentally friendly approach that both reduces risks of water

supply to the Project, and further reduces environmental impacts

with a shorter pipeline required.

Potash market

During the first half of 2022 the significant rise in the price

of potash, especially in the large growth market of Brazil, became

more broad-based, with prices reaching US$1,000/t in many markets

around the world. These prices reflect the tightening of supply

following many years of underinvestment in mining, a situation

brought sharply into focus by the war in Ukraine, with sanctions

imposed on both Russia and Belarus (which together account for

nearly 40% of global potash production).

Although prices have settled back slightly in recent weeks at

lower levels, at approximately US$800/t they remain considerably

higher than the assumptions included at the time of the Khemisset

Feasibility Study in 2020, which estimated a project net present

value of US$1.4 billion. While supply issues related to the Ukraine

crisis are likely to remain for the foreseeable future, the

longer-term drivers of potash demand, in particular population

growth and pressure on land usage in the context of climate change,

are expected to sustain high prices for some time.

Permitting Update

As shareholders will be aware, the Company's Environmental and

Social Impact Assessment ("ESIA") is awaiting final approval.

Emmerson is committed to meeting the highest environmental

standards in Morocco and this will remain a core principle at the

heart of its work throughout the construction phase and during the

subsequent life of the mine. The Company has addressed all the ESIA

issues raised by the relevant Moroccan authorities. It has enhanced

and upgraded various aspects of its proposed development plan, far

surpassing the minimum requirements of the ESIA and working to

International Finance Corporation Performance Standards, including,

as stated above, in its water sourcing and tailings management

strategies.

Corporate

Emmerson has continued to make significant strides towards

securing the funding need to bring Khemisset into construction and

has strengthened its internal and advisory teams with a view to

finalising these steps. In February 2022, Emmerson announced the

appointed of Jim Wynn as CFO, and Liberum Capital as a joint

broker, and Matt Wilmott was recruited as Technical Services

Manager.

Condensed Consolidated Statement of Comprehensive Income for the

six months ended 30 June 2022

6 months ended 6 months 12 months ended

30 Jun 2022 ended 31 Dec 2021

30 Jun 2021

(Unaudited) (Unaudited) (Audited)

Notes US$'000 US$'000 US$'000

Administrative expenses 3 (1,244) (897) (2,349)

Share-based payment expense (53) (217) (33)

Net foreign exchange loss (81) (26) (388)

Operating loss (1,378) (1,140) (2,770)

Finance cost - (5) (7)

Loss before tax (1,378) (1,145) (2,777)

Income tax - - -

---------------------------------------------------------- ------ --------------- ------------- ----------------

Loss for the period attributable to equity owners (1,378) (1,145) (2,777)

---------------------------------------------------------- ------ --------------- ------------- ----------------

Other comprehensive income

Exchange loss on translating foreign operations (84) (169) (693)

Total comprehensive income attributable to equity owners (1,462) (1,314) (3,470)

---------------------------------------------------------- ------ --------------- ------------- ----------------

Loss per share (cents) 4 (0.15) (0.14) (0.34)

Condensed Consolidated Statement of Financial Position as at 30

June 2022

30 June 2022 30 June 2021 31 Dec 2021

(Unaudited) (Unaudited) (Audited)

Notes US$'000 US$'000 US$'000

Non-current assets

Intangible assets 5 16,489 12,032 13,555

Property, plant and equipment 39 12 41

--------------------------------------------------- ------ -------------

Total non-current assets 16,528 12,044 13,596

Current assets

Trade and other receivables 1,126 490 771

Cash and cash equivalents 4,535 6,362 10,032

--------------------------------------------------- ------ ------------- ------------- ------------

Total current assets 5,661 6,852 10,803

Total assets 22,189 18,896 24,399

--------------------------------------------------- ------ ------------- ------------- ------------

Current liabilities

Trade and other payables (1,005) (207) (1,835)

Total current liabilities (1,005) (207) (1,835)

Net assets 21,184 18,689 22,564

--------------------------------------------------- ------ ------------- ------------- ------------

Shareholders equity attributable to equity owners

Share capital 29,025 23,223 28,774

Share-based payment reserve 2,163 1,572 2,048

Reverse acquisition reserve 2,234 2,198 2,198

Retained earnings (11,867) (8,650) (10,278)

Translation reserve (371) 346 (178)

--------------------------------------------------- ------ ------------- ------------- ------------

Total equity 21,184 18,689 22,564

--------------------------------------------------- ------ ------------- ------------- ------------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2022

US$'000 Share Capital Share-based Reverse Retained Translation Total equity

payment reserve acquisition earnings reserve

reserve

Balance as at 1

January 2021 15,755 1,499 2,198 (7,508) 515 12,459

Loss for the

period - - - (1,145) - (1,145)

Other

comprehensive

loss:

Exchange loss on

translating

foreign

operations - - - - (169) (169)

------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

loss - - - (1,145) (169) (1,314)

Share option and

warrant issue - 166 - - - 166

Transfer - (3) - 3 - -

Share issue -

3rd parties 8,223 (90) - - - 8,133

Share issue

costs (755) - - - - (755)

Balance as at 30

June 2021 23,223 1,572 2,198 (8,650) 346 18,689

------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance as at 1

January 2021 15,755 1,499 2,198 (7,508) 515 12,459

Loss for the

year - - - (2,777) - (2,777)

Other

comprehensive

loss:

Exchange loss on

translating

foreign

operations - - - - (693) (693)

------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

income - - - (2,777) (693) (3,470)

Issue of share

options and

warrants 90 (104) - - - (14)

Transfer - (7) - 7 - -

Issue of shares

for cash 14,345 660 - - - 15,005

Share issue

costs (1,416) - - - - (1,416)

------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance as at 31

December 2021 28,774 2,048 2,198 (10,278) (178) 22,564

------------- ---------------- ---------------- ---------------- ---------------- ------------

Adjustment for

change in

functional

currency 1/1/22 219 65 36 (211) (109) -

Balance as at 1

January 2022 28,993 2,113 2,234 (10,489) (287) 22,564

Loss for the

period - - - (1,378) - (1,378)

Other

comprehensive

loss:

Exchange loss on

translating

foreign

operations - - - - (84) (84)

------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

loss - - - (1,378) (84) (1,462)

Issue of share

options - 53 - - - 53

Share option and

warrant

exercised 3 (3) - - - -

Issue of shares

for cash 29 - - - - 29

Balance as at 30

June 2022 29,025 2,163 2,234 (11,867) (371) 21,184

------------- ---------------- ---------------- ---------------- ---------------- ------------

Condensed Consolidated Statement of Cash Flows for the six month

period ended 30 June 2022

6 months ended 6 months 12 months ended

30 June 2022 ended 31 Dec 2021

30 June 2021

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Cash flows from operating activities

Loss before tax (1,378) (1,145) (2,777)

Add back: Foreign exchange 81 (324) (448)

Add back: Share-based payment 53 167 33

Add back: Depreciation 2 4 5

Changes in working capital

Increase in trade and other receivables (355) (60) (351)

(Decrease)/increase in trade and other payables (821) (473) 1,182

---------------------------------------------------- ------------------ -------------- ----------------

Net cash flows used in operating activities (2,418) (1,831) (2,356)

---------------------------------------------------- ------------------ -------------- ----------------

Cash flows from investing activities

Exploration expenditure (2,934) (766) (2,671)

Property, plant and equipment purchase - - (30)

---------------------------------------------------- ------------------ -------------- ----------------

Net cash flows used in investing activities (2,934) (766) (2,701)

---------------------------------------------------- ------------------ -------------- ----------------

Cash flows from financing activities

Proceeds from issuing shares and warrants 29 8,133 14,958

Cost of issuing shares - (755) (1,416)

Net cash flows generated from financing activities 29 7,378 13,542

---------------------------------------------------- ------------------ -------------- ----------------

(Decrease)/increase in cash and cash equivalents (5,323) 4,781 8,485

Cash and cash equivalents at beginning of period 10,032 1,563 1,563

Foreign exchange on cash and cash equivalents (174) 18 (16)

---------------------------------------------------- ------------------ -------------- ----------------

Cash and cash equivalents at end of period 4,535 6,362 10,032

---------------------------------------------------- ------------------ -------------- ----------------

Notes to the Condensed Consolidated Financial Statements for the

six months ended 30 June 2022

1. General information

Emmerson PLC (the "Company") is a company incorporated and

domiciled in the Isle of Man, whose shares were admitted to the

Standard Listing segment of the Main market of the London Stock

Exchange on 15 February 2017. On 27 April 2021, the Ordinary Shares

of the Company were admitted to trading on AIM and the listing of

the Company's ordinary shares on the Official List and their

trading on the Main Market were cancelled.

The principal activity of the Group is the exploration,

development and exploitation of a potash development project in

Morocco .

2. Basis of preparation

2.1 General

The Condensed Consolidated Financial Statements have been

prepared in accordance with UK-adopted International Accounting

Standards. The Condensed Consolidated Financial Statements for the

six months ended 30 June 2022 are unaudited and have not been

reviewed by the Group's auditor, and do not include all of the

information required for full annual financial statements.

They should be read in conjunction with the Company's annual

financial statements for the year ended 31 December 2021. The

principal accounting policies applied in the preparation of the

Condensed Consolidated Financial Statements are unchanged from

those disclosed in those statements. These policies have been

consistently applied to each of the periods presented.

The financial information of the Group is presented in US

Dollars, which is also the functional currency of the Company and

has been prepared under the historical cost convention. The

individual financial statements of each of the Company's wholly

owned subsidiaries are prepared in the currency of the primary

economic environment in which it operates (its functional

currency).

2.2 Basis of consolidation

The Consolidated Financial Statements comprise the financial

statements of the Company, Moroccan Salts Limited and Moroccan

Salts Limited's subsidiaries (the "MSL Group") following the

business combination which took place on 4 June 2018.

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtains control.

Control is achieved when the Group is exposed, or has rights, to

variable returns from its involvement with the investee and has the

ability to affect those returns through its power over the

investee.

Generally, there is a presumption that a majority of voting

rights result in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- The contractual arrangement with the other vote holders of the investee;

-- Rights arising from other contractual arrangements; and

-- The Group's voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group. They are deconsolidated from the date that control ceases.

Assets, liabilities, income and expenses of a subsidiary acquired

or disposed of during the period are included in the Group

Financial Statements from the date the Group gains control until

the date the Group ceases to control the subsidiary.

All intra-group balances, transactions, income and expenses and

profits and losses resulting from intra-group transactions that are

recognised in assets, are eliminated in full.

All the Group's companies have 31 December as their year-end.

Consolidated financial statements are prepared using uniform

accounting policies for like transactions.

2.3 Functional and presentational currency

The financial information of the Group is presented in US

dollars. The functional currency of the Company Emmerson PLC

changed on 1 January 2022 from GBP to US$ reflecting the stage in

development of activities whereby the cost base of the Group

changed from GBP to US$. The effect of a change in functional

currency is accounted for prospectively. All items were translated

into the new functional currency using the exchange rate at the

date of the change .

The individual financial statements of each of the Company's

wholly-owned subsidiaries are prepared in the currency of the

primary economic environment in which they operate (functional

currency ).

2.4 Change in Functional and Presentation Currency

The Group presented its results in US dollars for the first time

for the year to 31 December 2021 having previously reported in GBP.

This change should help to provide a clearer understanding of the

Group's financial position as the future corporate development

activity is likely to be US focused.

In order to satisfy the requirements of IAS 21 with respect to a

change in presentation currency, the statutory financial

information as previously reported in the Group's Annual Reports

have been restated from UK Sterling into US Dollars using the

procedures outlined below:

-- Assets and liabilities were translated to US Dollars at the

closing rates of exchange at each respective balance sheet

date.

-- Share capital, share premium and other reserves were

translated at the historic rates prevailing at the dates of

transactions.

-- Income and expenses were translated to US Dollars at an

average rate at each of the respective reporting years. This has

been deemed to be a reasonable approximation.

-- Differences resulting from the retranslation were taken to reserves.

-- All exchange rates used were extracted from the Group's underlying financial records.

2.5 Going concern

The Directors have reviewed the Group's ongoing activities and

have a reasonable expectation that the Group has adequate resources

to continue operating for the foreseeable future. For this reason,

they have adopted the going concern basis in preparing the Interim

Financial Statements.

2.6 Future changes in accounting policies

The Directors have reviewed the IFRS standards in issue which

are effective for annual accounting periods ending on or after the

stated effective date. In their view, none of these standards would

have a material impact on the financial reporting of the Group.

2.7 Segment reporting and cyclicality

A business segment is a group of assets and operations engaged

in providing products or services that are subject to risks and

returns that are different from those of other business segments. A

geographical segment is engaged in providing products or services

within a particular economic environment that are subject to risks

and returns that are different from those of segments operating in

other economic environments.

The Directors consider the Group is engaged in a single segment

of business being the exploration activity of potash in one

geographical area, being the Khemisset Project in Morocco.

The interim results for the six months ended 30 June 2022 are

not necessarily indicative of the results to be expected for the

full year ending 31 December 2022. Due to the nature of the entity,

the operations are not affected by seasonal variations at this

stage.

3. Administrative fee and other expenses

6 months

6 months ended ended 12 months ended

30 Jun 2022 30 Jun 2021 31 Dec 2021

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Project costs - 7 7

Directors' fees 292 263 635

Travel and accommodation 61 9 59

Auditors' remuneration including associates:

Current year 22 15 25

Adjustment for prior year 12 - -

Employment costs 298 105 455

Professional and consultancy fees 559 498 1,168

Total 1,244 897 2,349

---------------------------------------------- --------------- ------------- ----------------

4. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

6 months

6 months ended ended 12 months ended

30 Jun 2022 30 Jun 2021 31 Dec 2021

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Earnings

Loss from continuing operations for the period attributable to the

equity holders of the Company (1,378) (1,145) (2,777)

Number of shares

Weighted average number of ordinary shares for the purpose of basic

and diluted earnings per

share 915,425,829 794,971,631 822,875,086

-------------------------------------------------------------------- --------------- ------------- ----------------

Basic and diluted loss per share 0.15 cents 0.14 cents 0.34 cents

-------------------------------------------------------------------- --------------- ------------- ----------------

5. Intangible assets

The intangible assets consist of capitalised exploration and

evaluation expenditure, including the cost of acquiring the mining

license and research permits held by the Company's

subsidiaries.

30 Jun 2022 30 Jun 2021 31 Dec 2021

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Cost:

At the beginning of the period 13,555 11,132 11,132

Additions 2,934 766 2,671

Effects of changes in foreign

exchange rates - 134 (248)

As at end of period 16,489 12,032 13,555

-------------------------------- ------------ ------------ ------------

6. Related party transactions

Directors' consultancy fees

Hayden Locke is a Director of the Company and is a director of

Benson Capital Limited, which provided consulting services to the

Company. During the period, Benson Capital Limited received total

fees of US$65k (year to 31 December 2021: US$244k). The amount

outstanding as at period end was US$nil (31 December 2021:

US$nil).

Robert Wrixon is a Director of the Company and also provided

consulting services to the Company. During the period, Robert

Wrixon received fees of US$ 55k (year to 31 December 2021:

US$116k). The amount outstanding as at period-end was US$ nil (31

December 2021: US$ nil).

Graham Clarke is a Director of the Company and is a director of

GCUK Consulting Limited, which provided consulting services to the

Company during 2021 for US$99k. No services were provided during

the period and no amounts were outstanding at 30 June 2022 or 31

December 2021.

The total Directors' fees during the period is shown in note

3.

7. Post-balance sheet events

On 26 September 2022, the Company announced it had entered into

an agreement with Global Sustainable Minerals Pte Ltd ("GSM") and

Gold Quay Capital Pte Ltd ("GQC") to extend the commitment period

for the previously announced US$40.0 million convertible loan note

subscription to 30 September 2023, providing continued cornerstone

financing support for the development of the Khemisset Potash

Project, as well as extending the expiry date for the 82.4 million

warrants at 8.2 pence due to expire on 6 December 2022 for a

further 12 months. GSM received a renewal fee of 50 million

warrants at 8.2 pence with an expiry date of 6 December 2023.

GSM also agreed to subscribe for 89.3 million shares at a price

of 6.0 pence per Ordinary share representing aggregate proceeds of

US$6.0 million before expenses.

8. Change in Functional and Presentation Currency

The Directors believe that US dollars are a more appropriate

currency in which to present the Group's consolidated results, on

the basis that, along with most international mining groups, the

majority of financing and pricing discussions and presentations are

undertaken in that currency.

Consequently, the Group opted for the financial results to be

presented in US dollars for the year ended 31 December 2021. The

change in presentation currency was applied retrospectively.

In re-presenting the Group Financial Statements for the year

ended 31 December 2021, the reported information was converted to

US dollars from GBP using the following procedures:

-- Assets and liabilities were translated to US dollars at the

closing rates of exchange at each respective balance sheet date (31

December 2021: GBP1: US$1:3532; 31 December 2020:

GBP1:US$1.367).

-- Share capital, share premium and other reserves were

translated at the historic rates prevailing at the dates of

transactions.

-- Income and expenses were translated to US dollars at an

average rate at each of the respective reporting periods. This has

been deemed to be a reasonable approximation (31 December 2021:

GBP1: US$1.377; 31 December 2020: GBP1: US$1.276).

-- Differences resulting from the retranslation were taken to reserves.

With effect from 1 January 2022 the Company changed the

functional currency to US dollars from GBP. This was deemed

appropriate as the Company moves from a prospecting stage to the

development of the mining asset. As a consequence, the expense base

for the Group has changed from GBP to US$.

In accordance with IAS 21, the change in functional currency is

applied prospectively with all balances being converted to US$ at

the rate of exchange on the appropriate date.

To assist shareholders during this change, the impact on the

prior period results, closing balance sheet and the numerator for

earnings per share as originally reported is set out below:

Condensed Consolidated Statement of Comprehensive Income for the

six months ended 30 June 2021 (represented)

As originally reported 6 months to Re-presented 6 months to 30 June

30 June 2021 2021

Note GBP'000 US$'000

Continuing Operations

Administrative expenses 3 (658) (897)

Share-based payment expense (158) (217)

Net foreign exchange loss (19) (26)

Operating loss (835) (1,140)

Finance cost (4) (5)

Loss before tax (839) (1,145)

Income tax - -

----------------------------------- ------------------------------------

Loss for the year attributable to

equity owners (839) (1,145)

----------------------------------- ------------------------------------

Other comprehensive income

Items that may be subsequently

reclassified to profit or loss:

Exchange gain on translating

foreign operations (176) (169)

Total comprehensive income

attributable to equity owners (1,015) (1,314)

----------------------------------- ------------------------------------

Loss per share - Basic and diluted 4 (0.11 pence) (0.14 cents)

Consolidated Statement of Financial Position at 30 June 2021

(represented)

As originally presented 30 June 2021 Re-presented 30 June 2021

Note GBP'000 US$'000

Non-current assets

Intangible assets 5 8,699 12,032

Property, plant and equipment 9 12

Total non-current assets 8,708 12,044

Current assets

Trade and other receivables 354 490

Cash and cash equivalents 4,600 6,362

------------------------------------- --------------------------

Total current assets 4,954 6,852

Total assets 13,662 18,896

------------------------------------- --------------------------

Current liabilities

Trade and other payables (150) (207)

Total current liabilities (150) (207)

Net assets 13,512 18,689

------------------------------------- --------------------------

Shareholders equity attributable to equity

owners

Share capital 17,388 23,223

Share-based payment reserve 1,216 1,572

Reverse acquisition reserve 1,651 2,198

Translation reserve (167) 346

Retained earnings (6,576) (8,650)

Total equity 13,512 18,689

------------------------------------- --------------------------

**ENDS**

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson PLC +44 (0) 20 7236

Graham Clarke / Jim Wynn / Charles Vaughan 1177

Shore Capital (Nominated Adviser and Joint

Broker) +44 (0)20 7408

Toby Gibbs / John More 4090

Liberum Capital Limited (Joint Broker) +44 (0)20 3100

Scott Mathieson 2000

Shard Capital (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

St Brides Partners (Financial PR/IR) +44 (0)20 7236

Susie Geliher / Charlotte Page 1177

Notes to Editors

Emmerson is focused on advancing the Khemisset project

("Khemisset" or the "Project") in Morocco into a low cost, high

margin supplier of potash, and the first primary producer on the

African continent. With an initial 19-year life of mine, the

development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one of the leading phosphate

producers globally, ranking third in the world in terms of tonnes

produced annually, and the development of this mine is set to

consolidate its position as the most important fertiliser producer

in Africa. The Project has a large JORC Resource Estimate (2012) of

537Mt @ 9.24% K(2) O, with significant exploration potential, and

is perfectly located to support the expected growth of African

fertiliser consumption whilst also being located on the doorstep of

European markets. The need to feed the world's rapidly increasing

population is driving demand for potash and Khemisset is well

placed to benefit from the opportunities this presents. The

Feasibility Study released in June 2020 indicated the Project has

the potential to be among the lowest capital cost development stage

potash projects in the world and also, as a result of its location,

one of the highest margin projects. This delivered outstanding

economics, including a post-tax NPV8 of approximately US$1.4

billion using industry expert Argus' price forecasts, and the spot

price for granular MOP fertiliser has since risen, further

enhancing the valuations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKPBQCBKDACB

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

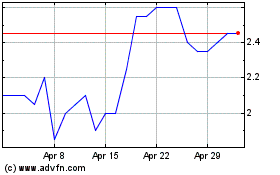

Emmerson (LSE:EML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emmerson (LSE:EML)

Historical Stock Chart

From Apr 2023 to Apr 2024