TIDMEML

RNS Number : 5393A

Emmerson PLC

26 September 2022

Emmerson PLC / Ticker: EML / Index: AIM / Sector: Mining

26 September 2022

Emmerson PLC ("Emmerson" or the "Company")

Renewal of Strategic Investment Commitment and US$6.0 million

Equity Placing & Retail Offering

Emmerson, the Moroccan focused potash development company, is

pleased to announce it has reached agreement with Global

Sustainable Minerals Pte Ltd ("GSM") and Gold Quay Capital Pte Ltd

("GQC") (together the "Strategic Investors") to extend the

commitment period for the previously announced US$40.0 million

convertible loan note subscription to 30 September 2023, providing

continued cornerstone financing support for the development of the

Khemisset Potash Project ("Khemisset" or the "Project").

In addition, the Company is pleased to announce that it has

entered into a subscription agreement (the "Subscription

Agreement") with GSM whereby GSM will make an immediate equity

investment of US$6.0 million at a price of 6.0 pence per new

ordinary share of nil par value in the capital of the Company

("Ordinary Shares") (the "GSM Subscription").

The Company is now funded to complete basic engineering work,

remaining permitting and project financing processes through to a

construction decision.

To enable the Company's existing shareholders to participate on

the same terms as the GSM Subscription, the Company intends to make

an offer of Ordinary Shares at a price of 6.0 pence per Ordinary

Share available on the REX platform (the "Retail Offer"). A

separate announcement will be made by the Company shortly regarding

the Retail Offer.

Highlights

-- US$40.0 million Convertible Loan Notes commitment from

strategic investors GSM and GQC extended by 12 months to 30

September 2023, reconfirming a key component of Khemisset's

construction financing plan

-- In consideration for the extension of the Convertible Loan

Notes commitment, the Company has issued 50,000,000 warrants to

GSM, exercisable at a price of 8.2 pence per share until 23

September 2023 (the "New Warrants")

-- Equity subscription for US$6.0 million (approximately GBP5.4

million) at a price of 6.0 pence per Ordinary Share, a discount of

8% to the 30-day VWAP and a premium of 9% to the share price at

market close on 23 September 2022

-- Retail Offer on the same terms as the GSM Subscription, open

to the Company's existing shareholders

-- Emmerson now funded for remaining technical and other

workstreams to deliver Khemisset through to construction decision

and finalisation of project financing, currently expected to be

during H2 2023

-- Khemisset represents a world class development project,

technically de-risked and with strong cornerstone investor support,

ready to deliver into strong global potash markets

-- Strong expressions of interest received from international

and Moroccan lending banks, as well as development financial

institutions and other financing counterparties, expected to

underpin attractive construction financing package

Graham Clarke, CEO of Emmerson commented: "I am very pleased

with the progress that the Emmerson team have made at Khemisset in

recent months, working with our Moroccan partners Reminex. I am

particularly delighted to be able to announce the continued support

from GSM and GQC. This further investment from our strategic

investors demonstrates their continued commitment to the Khemisset

project and their confidence in Morocco. Emmerson is funded for all

anticipated technical and working capital requirements. This is a

world-class potash project with huge potential and I look forward

to working with a range of Moroccan partners to take it to the next

stage. In view of the strong interest we have received from banks

and other investors keen to invest in this exciting Moroccan

venture, we expect to pull together the full financing package for

the construction phase rapidly, once the remaining environmental

approvals have been received."

Background

On 10 November 2021 the Company announced a strategic investment

of up to US$46.75 million by GSM and GQC for the development of

Khemisset, comprising an equity investment of US$6.75 million and a

subscription for up to US$40.0 million of convertible loan notes

with a conversion price of 8.2 pence per share and using a GBP: USD

exchange rate of 1.375 (the "Convertible Loan Notes"). The

subscription for the Convertible Loan Notes was subsequently

approved by shareholders at a general meeting held on 6 December

2021.

In conjunction with the subscription for the Convertible Loan

Notes, GSM and GQC were issued 82,391,714 warrants to subscribe for

new Ordinary Shares at a price of 8.2 pence per share, expiring 6

December 2022 (the "CLN Warrants").

Draw-down of funds under the Convertible Loan Notes is subject

to satisfaction of conditions precedent, to be satisfied by 30

September 2022 (the "Long Stop Date") including, inter alia:

(i) the Company obtaining all requisite Government licences and

approvals for the construction of the Project; and

(ii) the Company having signed definitive agreements and

satisfied all conditions precedent for the draw-down of all project

finance (debt, equity and other components) for the funding of the

Project.

As these conditions precedent and others (see 10 November 2021

announcement for full details) will not be satisfied by the Long

Stop Date, the Company has engaged with the Strategic Investors to

extend their financing commitment, which is seen as a key component

of the expected financing package for the Project's construction

financing.

Extension of Convertible Loan Note Financing Commitment

Pursuant to a deed of variation (the "Variation Deed"), the

Company, GSM and GQC have agreed to:

(a) extend the Long Stop Date for the Convertible Loan Notes

subscription by 12 months to 30 September 2023, maintaining the

cornerstone financing commitment through the remaining permitting

and project financing processes;

(b) extend the expiry date of the CLN Warrants by 12 months to 6 December 2023; and

(c) amend the GBP: USD rate for the Convertible Loan Notes

conversion price from 1.375 to 1.227, reflecting the significant

weakening of the GBP against the USD.

The Company considers the overall investment by GSM and GQC to

be in the best interests of the Company and has therefore agreed to

seek the approval of the UK Panel on Takeovers and Mergers and

independent shareholders for a waiver of the requirement for GSM

and/or GQC to make a mandatory offer for the shares of the Company

as a result of GSM and/or GQC exercising their rights under the

Convertible Loan Notes, CLN Warrants and the New Warrants (with

such waiver limited to a maximum total combined shareholding of 40

per cent).

In consideration for the extension of the Convertible Loan Notes

commitment, the Company has issued the New Warrants to GSM,

exercisable at a price of 8.2 pence per share until 23 September

2023.

The GSM Subscription

Pursuant to the Subscription Agreement, GSM has agreed to

subscribe for 89,285,714 shares (the "Subscription Shares") at a

price of 6.0 pence per Ordinary share representing aggregate

proceeds of US$6.0 million before expenses (based on an agreed

exchange rate of 1.12).

Completion of the GSM Subscription is conditional upon the

admission of the Subscription Shares to trading on the AIM Market

of the London Stock Exchange ("AIM") and the Subscription Agreement

not having been terminated. For the avoidance of doubt, the GSM

Subscription is not conditional upon the completion of the Retail

Offer.

Retail Offer

In addition to the GSM Subscription, the Company intends to make

an offer of Ordinary Shares available on the REX platform at the

Subscription Price, in which retail investors will be invited to

participate. The Retail Offer is only being made available to

existing shareholders of the Company. A separate announcement will

be made by the Company shortly regarding the Retail Offer. The

maximum aggregate size of the Retail Offer will be capped at GBP1

million. The Retail Offer is conditional upon, amongst other

things, completion of the GSM Subscription and the admission to

trading on AIM of the Ordinary Shares issued pursuant to the GSM

Subscription and Retail Offer.

It is agreed that neither the Subscription Shares nor the Retail

Offer will trigger the price protection clause in respect of the

Convertible Loan Notes.

Admission of Shares

Application will be made for the Subscription Shares and those

shares to be issued pursuant to the Retail Offer (together the

"Fundraising Shares") to be admitted to trading on AIM

("Admission"). Admission is expected to occur at 8.00 a.m. on 10

October 2022 . The Fundraising Shares will, when issued, be

credited as fully paid and will rank pari passu in all respects

with the Company's existing issued Ordinary Shares.

The Company will provide an update as to Total Voting Rights

following the completion of the Retail Offer.

Use of proceeds

The net proceeds of the GSM Subscription and any proceeds from

the Retail Offer, together with the Company's existing cash

resources of approximately US$3.0 million as at 23 September 2022

will mean the Company is well funded to complete basic engineering

and geological studies for the development of Khemisset, and to

finalise the permitting and project financing processes.

The Company also announces its Interim Results for the six

months to 30 June 2022 today, which includes a full update on

project development, permitting and other corporate activities.

**S**

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson PLC +44 (0) 20 7236

Graham Clarke / Jim Wynn / Charles Vaughan 1177

Shore Capital (Nominated Adviser and Joint

Broker) +44 (0)20 7408

Toby Gibbs / John More 4090

Liberum Capital Limited (Joint Broker) +44 (0)20 3100

Scott Mathieson 2000

Shard Capital (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

St Brides Partners (Financial PR/IR) +44 (0)20 7236

Susie Geliher / Charlotte Page 1177

Notes to Editors

Emmerson is focused on advancing the Khemisset project in

Morocco into a low-cost, high-margin supplier of potash, and the

first primary producer on the African continent. With an initial

19-year life of mine, the development of Khemisset is expected to

deliver long-term investment and financial contributions to Morocco

including the creation of permanent employment, taxation income and

a plethora of ancillary benefits. As a UK-Moroccan partnership, the

Company is committed to bringing in significant international

investment over the life of the mine.

Morocco is widely recognised as one of the leading phosphate

producers globally, ranking third in the world in terms of tonnes

produced annually, and the development of this mine is set to

consolidate its position as the most important fertiliser producer

in Africa. The Project has a large JORC Resource Estimate (2012) of

537Mt @ 9.24% K(2) O, with significant exploration potential, and

is perfectly located to support the expected growth of African

fertiliser consumption whilst also being located on the doorstep of

European markets. The need to feed the world's rapidly increasing

population is driving demand for potash and Khemisset is well

placed to benefit from the opportunities this presents. The

Feasibility Study released in June 2020 indicated the Project has

the potential to be among the lowest capital cost development stage

potash projects in the world and also, as a result of its location,

one of the highest margin projects. This delivered outstanding

economics, including a post-tax NPV8 of approximately US$1.4

billion using industry expert Argus' price forecasts, and the spot

price for granular MOP fertiliser has since risen, further

enhancing the valuations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLAMLTMTITBLT

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

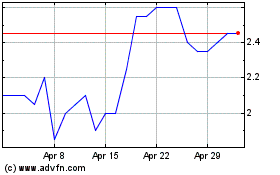

Emmerson (LSE:EML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emmerson (LSE:EML)

Historical Stock Chart

From Apr 2023 to Apr 2024