TIDMEMR

RNS Number : 1272N

Empresaria Group PLC

28 January 2021

28 January 2021

Empresaria Group plc

("Empresaria" or the "Group")

Trading Update and Notice of Results

Profitability, operational resilience and financial strength

Empresaria (AIM: EMR), the global specialist staffing group,

today provides a trading update for the financial year ended 31

December 2020 ahead of announcing its full year results on 18 March

2021.

Trading update

-- Adjusted profit before tax expected to be approximately 5%

above the top end of market guidance

-- Net fee income of GBP54.0m, towards the higher end of market

guidance, down 28% compared to 2019, (27% in constant currency)

-- Profitable* in every quarter despite impact of COVID-19,

demonstrating the benefits of the Group's diversity by sector and

geography

-- Maintained a strong balance sheet - adjusted net debt at 31

December 2020 of GBP13.6m, a reduction of GBP5.5m compared to 31

December 2019 and an increase of GBP4.7m from 30 June 2020

reflecting working capital outflows as trading started to

recover

-- Operational investments and initiatives continue to position the Group for long-term growth

-- Good momentum in Q4 2020, but cautious start to 2021 with

increased lockdown and other restrictions across several

markets

* adjusted profit before tax

The Group had a strong start to 2020 delivering year on year

growth in operating profit in every month of the first quarter as

operational initiatives, launched in 2019 and aimed at improving

collaboration and delivering synergies and efficiency across the

Group, started to have a positive impact. COVID-19 started to

impact the Group in March, resulting in net fee income for the

first quarter being down 5% on 2019.

The second and third quarters saw the most significant impact

from the COVID-19 pandemic on the Group with May, June and July

being hit hardest as clients reacted to the impact of lockdowns on

their own businesses and the wider economy. Overall, second quarter

net fee income was down 39% against 2019 while the third quarter

was down 38%. As markets and clients started adjusting to a new

normal, we were pleased to see some positive momentum going into

the final months of the year, with net fee income for the fourth

quarter down 27% on prior year.

The swift and decisive actions taken on costs at the start of

the pandemic translated into ongoing strong cost controls, while

operating model efficiencies put in place both before and during

the pandemic delivered benefits. As a result, profits started to

recover more quickly than net fee income in the second half of 2020

and the Group's adjusted operating profit for the second half of

2020 was greater than the first half.

The Group has continued to benefit from its diverse nature by

both sector and geography. In our Commercial sector our German

logistics business performed strongly while our Healthcare

operation in the US saw some good momentum starting to build

towards the end of the year with increased COVID-19 testing and the

commencement of vaccinations. These have helped partially offset

the more significant impacts we have seen elsewhere, particularly

in our Professional sector where, for example, our business

supporting the aviation industry saw very significant falls in net

fee income.

We have taken the opportunity to accelerate and drive forward

key operational investments and initiatives, particularly in

technology where we are investing in the implementation of a common

platform across the Group to help drive sales and improve operating

efficiency. These initiatives will help the Group to exit the

pandemic more strongly than we entered it and to deliver a return

to growth.

Financial position

Adjusted net debt at 31 December 2020 was GBP13.6m, a GBP5.5m

reduction from 31 December 2019, and an increase of GBP4.7m against

30 June 2020. The significant working capital inflows seen in the

first half of the year began to unwind as trading levels started to

recover. Headroom, excluding invoice financing, remains strong at

GBP17.6m and the Group is in the final stages of refinancing its

revolving credit facility and expects to have a new facility in

place in time for the full year results announcement.

Performance by sector

Net fee income by sector for the year ended 31 December:

% change

(constant

GBPm 2020 2019 % change currency)*

-------------------------------------- ------ ------ --------- ------------

Professional 15.4 27.3 -44% -43%

IT 12.7 14.4 -12% -12%

Healthcare 2.5 2.8 -11% -11%

Property, Construction & Engineering 0.7 3.8 -82% -82%

Commercial 17.2 19.7 -13% -12%

Offshore Recruitment Services 6.1 7.0 -13% -8%

Intragroup (0.6) (0.5) +20% +20%

-------------------------------------- ------ ------ --------- ------------

Total 54.0 74.5 -28% -27%

-------------------------------------- ------ ------ --------- ------------

* The constant currency movement is calculated by translating

the 2019 results at the 2020 exchange rates.

The Group's Professional sector has seen the greatest impact

from COVID-19 with a 44% fall in net fee income compared with 2019.

Adverse impacts were seen across the sector but the most

significant fall was in our aviation recruitment business which has

experienced very substantial and sustained reductions in demand. We

do not expect to see a recovery to pre-COVID-19 levels in the short

term, but believe that this business continues to have good growth

potential in the medium and long term and the aviation industry has

a strong track record of rebounding after significant adverse

events. A substantial restructuring has been undertaken in this

business to right size its cost base and ensure it is well placed

to rebuild when the market returns. Elsewhere in Professional we

saw some signs of recovery in the second half of 2020, particularly

in our domestic services and digital businesses, but remain

cautious on outlook as we move into 2021.

The Group's IT sector has proven to be one of our more resilient

sectors in the face of COVID-19 with net fee income falling by 12%

against 2019. Our US and Japan businesses have been the most

resilient with single digit falls in net fee income although in the

US, where the majority of our business is permanent recruitment,

demand fell significantly after a very strong start to the year.

The UK, where the majority of sales are into Europe, was more

heavily affected and demand remained muted in the second half of

the year. The UK business has been restructured to increase the

focus on driving sales and creating a more efficient operating

model.

The Group's Healthcare sector was adversely impacted by

COVID-19, particularly during the first lockdowns, with patients

unable or unwilling to engage with healthcare services unless

absolutely necessary resulting in lower demand for temporary staff.

However, demand started to recover in the second half and the end

of the year saw strong momentum in the US driven by the testing and

vaccination programmes.

The Group's Property, Construction & Engineering sector,

which is based in the UK, has been significantly impacted, with

lockdown restrictions closing new home sales sites and

significantly reducing demand. Prior year net fee income includes

the UK engineering business, a substantial part of which was closed

in late 2019.

The Group's Commercial sector saw a 13% fall in net fee income

compared with 2019. In Germany, our logistics business has had a

positive impact from COVID-19, particularly during lockdown

restrictions where demand from supermarkets increased. This was

offset by adverse impacts in our businesses with major clients in

the automotive sector which faced significant challenges in the

first half of the year, although we started to see some increase in

demand in the second half of the year. COVID-19 also had a negative

impact on our businesses in Peru and Chile, however, our business

in Chile has received some protection as supermarkets form a large

part of its client base.

The Group's Offshore Recruitment Services business in India,

which supports the staffing sector in the US and UK, experienced a

significant drop in demand during the second quarter, particularly

from its US clients, when staffing services started to see the

initial impact of COVID-19 on their own businesses. As a result,

net fee income for the year was down 13%. However, the business

recovered strongly through the second half of 2020 and is now back

at the levels seen at the beginning of the year. We have continued

investment in this business with the launch of a managed talent

community solution supporting direct sourcing and recruitment

process outsourcing (RPO) which we anticipate will further

accelerate the growth and diversification of this business.

Rhona Driggs, CEO of Empresaria, commented:

"I would like to acknowledge the incredible efforts of our teams

around the world as we continue to navigate the uncertainty of

COVID-19. We have come together with purpose as a group, delivering

resilient results under difficult trading conditions, and have

remained committed to our strategy.

We took swift and decisive actions at the start of the pandemic

which have translated into improved ongoing cost controls, while

operating model efficiencies put in place both before and during

the pandemic have delivered cost benefits and, along with our

ongoing investment in technology initiatives, strengthen our

position to capitalise on market recovery. As a result of our

actions we have delivered greater adjusted operating profit in the

second half of 2020 than in the first.

The Group experienced positive momentum through the second half

of 2020, particularly through the fourth quarter, delivering

profits ahead of the guidance we issued at the start of December.

We have made good progress, although we are cautious on the

immediate outlook given the increase in national lockdowns and

local restrictions across our markets at the start of 2021.

We have proven we can deliver under adverse conditions and I

believe the operational investments and initiatives we have

continued to implement leave us well positioned to exit the

pandemic stronger than we entered it."

- Ends -

Enquiries:

Empresaria Group plc via Alma PR

Rhona Driggs, Chief Executive Officer

Tim Anderson, Chief Financial Officer

N+1 Singer (Nominated Adviser and

Broker)

Shaun Dobson / James Moat 020 7614 3000

Alma PR (Financial PR) 020 3405 0205

Sam Modlin empresaria@almapr.com

David Ison

Notes for editors:

-- Empresaria Group plc is a global specialist staffing group

offering temporary and contract recruitment, permanent recruitment

and offshore recruitment services across 6 sectors: Professional,

IT, Healthcare, Property, Construction and Engineering, Commercial

and Offshore Recruitment Services.

-- Empresaria operates from locations across the world including

the 4 largest staffing markets of the US, Japan, UK and Germany

along with a strong presence elsewhere in Asia Pacific and Latin

America.

-- Empresaria is listed on AIM under ticker EMR. For more

information visit empresaria.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGZGZMLNGGMZM

(END) Dow Jones Newswires

January 28, 2021 02:00 ET (07:00 GMT)

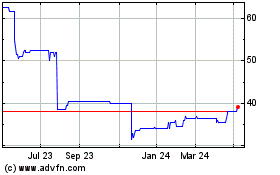

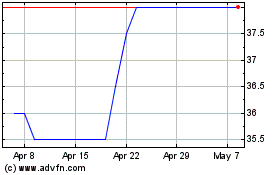

Empresaria (LSE:EMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Empresaria (LSE:EMR)

Historical Stock Chart

From Apr 2023 to Apr 2024