Ediston Property Inv Comp PLC Interim Dividend & Rent Collection Update (3040S)

July 08 2020 - 1:00AM

UK Regulatory

TIDMEPIC

RNS Number : 3040S

Ediston Property Inv Comp PLC

08 July 2020

08 July 2020

Ediston Property Investment Company plc

(LEI: 213800JRL87EGX9TUI28)

Announcement of Interim Dividend & Rent Collection

Update

Declaration of Interim Dividend

The Company declares its interim dividend (property income

distribution) payment in respect of the period from 1 June to 30

June 2020 of 0.3333 pence per share, as timetabled below:

Ex-Dividend 16 July

Date:

Record Date: 17 July

Pay Date: 31 July

This monthly dividend of 0.3333 pence per share equates to an

annualised dividend level of 4.00 pence per share and is unchanged

from the April and May dividend s, the latter of which was

announced on 3 June.

Th e monthly dividend s for April , May and June are fully

covered (109%) by the net rental income collected in the second

quarter of 2020.

Rent collection update

Quarter 2 rent collection

75% of the rent due for Q2 has been collected at the date of

this announcement. It is anticipated that a further 3% of rent will

be collected for this period from tenants who are currently paying

in arrears. The Investment Manager has agreed rent repayment plans

representing another 8% of the quarter's income from tenants who

have yet to pay rent. Receipt of these monies would lift the

collection to 86%, with a number of other tenant arrears still to

be resolved. To date, no outright rent-free period has been agreed

unless the Company has received something in return, for example, a

lease extension.

These collection statistics are significantly ahead of the 74%

reported in earlier trading updates, which is encouraging.

Quarter 3 rent collection

As at 6 July, 7 4% of the rent due by 1 July has been collected

across the portfolio. This compares to 69% paid at the same point

last quarter .

A number of tenants are now paying monthly instead of quarterly

in advance. The Company will have collected 88 % of rent due for

the quarter ending 30 September 2020 if the tenants who paid

monthly for July continue to make payments for August and

September. On this basis , the current dividend level would be 128%

covered by rent collected for Q3 and potentially as high as 135%,

after taking into account deferred rent covered by payment

plans.

One of the reasons for the anticipated improvement in rent

collection is the lifting of restrictions which have prevented

non-essential retailers trading. As at 6 July 2020, 96% (on a sq.

ft. basis) of the Company's retail warehouse accommodation has

reopened for trade, with many tenants reporting trading levels

ahead of their forecasts .

The Company will publish its net asset value as at 30 June 2020

later this month and expects to provide a full trading update at

that time. In the meantime, the Company will continue to pay

dividends out of net income received, absent unforeseen

circumstances, and to give guidance on a quarter by quarter basis

for future monthly dividends.

End

Enquiries

Will Barnett * Investec Bank plc 0207 597 5873

Calum Bruce * Ediston Investment Services Limited 0131 225 5599

Ruth Wright * JTC 0203 893 1011

Ben Robinson * Kaso Legg Communications 0203 995 6672

Stephanie

Ross * Kaso Legg Communications 0203 995 6676

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DIVMZGGNNNNGGZM

(END) Dow Jones Newswires

July 08, 2020 02:00 ET (06:00 GMT)

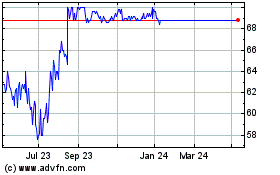

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

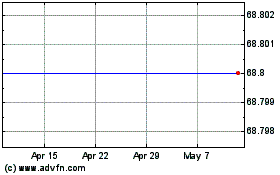

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Apr 2023 to Apr 2024