TIDMEPIC

RNS Number : 3717W

Ediston Property Inv Comp PLC

23 April 2021

Ediston Property Investment Company plc

(LEI: 213800JRL87EGX9TUI28)

Net Asset Value ('NAV') as at 31 March 2021

And Trading Update

Ediston Property Investment Company plc (LSE: EPIC) (the

'Company') announces its unaudited NAV at 31 March 2021, which will

form part of the unaudited interim accounts expected to be

published in May 2021.

Quarter Summary

-- Dividend increased by 25% to 5.00 pence per share annualised

from May 2021, as announced earlier in the month.

-- Monthly dividends maintained during the quarter at an

annualised rate of 4.00 pence per share and were fully covered.

-- 93% of rents due for quarter 1 collected, rising to 97% when rent deferments are factored in.

-- The Tesco Superstore in Prestatyn was sold for GBP26.5m, a

5.22% initial yield, in line with valuation and above the 2017

acquisition price.

-- Extended a lease with an office tenant in Newcastle for a

further 10 years (break in year five). Rent secured is 9% ahead of

passing rent.

-- The development of Haddington Retail Park remains on time and

budget, with completion anticipated in June 2021.

-------------------------------------------------------------------------------------

-- Like-for-like valuation increase of 0.45% for the retail

warehouse assets, which comprise 66.2% of the Company's

portfolio.

-- Fair value independent valuation of the property portfolio at

31 March 2021 of GBP246.9 million, a like-for-like increase of

0.34% compared to the valuation at 31 December 2020.

-- NAV per share at 31 March 2021 of 84.26 pence (31 December

2020: 84.63 pence), a decrease of 0.44% reflecting the impact of

capital expenditure and transaction costs for the Prestatyn

sale.

-- Share price total return for the quarter of 0.02%.

-- NAV total return (including dividends) for the quarter of 0.7%.

--------------------------------------------------------------------------------------

-- All types of retail warehouse tenant are now able to reopen

for trade. Occupational demand is picking up and investor sentiment

is improving towards the sector.

Net Asset Value

The unaudited NAV of the Company at 31 March 2021 was GBP178.04

million, or 84.26 pence per share, a decrease of 0.44% on the

Company's NAV per share as at 31 December 2020.

Pence Per Share GBP million

NAV at 31 December 2020 84.63 178.83

---------------- ------------

Valuation of property portfolio 0.39 0.82

---------------- ------------

Capital expenditure (1.04) (2.19)

---------------- ------------

Profit on sale of investment

properties 0.09 0.19

---------------- ------------

Income earned 2.04 4.31

---------------- ------------

Expenses & finance costs (0.85) (1.81)

---------------- ------------

Dividends paid (1.00) (2.11)

---------------- ------------

NAV at 31 March 2021 84.26 178.04

---------------- ------------

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards ('IFRS'); the

EPRA NAV is not reported separately in this update as it is the

same as the IFRS NAV.

The NAV incorporates the independent portfolio valuation as at

31 March 2021 and undistributed income for the quarter, but does

not include a provision for any accrued dividend.

Over the quarter, the valuation of the property portfolio

increased by 0.34% on a like-for-like basis. In the same period,

the Company's retail warehouse assets increased in value by 0.45%,

as sentiment for the sector improved.

The NAV decline is as a result of capital expenditure,

transaction costs for the sale of the Tesco Superstore at Prestatyn

and the impact of gearing.

Rent Collection update

As at 19 April 2021, 93% of the rent for quarter 1 2021 has been

collected. This will rise to 97% when rent deferments are factored

in. Similar levels of rent collection are anticipated for quarter

2. On a cash basis, the dividend cover for quarter 1 was 128%.

The Company's strong rent collection record during the pandemic

period has been assisted by the high quality of its office tenants,

and retail warehouse assets underpinned by tenants defined by the

UK Government as providing 'essential services', who have been

permitted to stay open for trade throughout the pandemic. Following

the easing of lockdown restrictions, 100% of the retail warehouse

portfolio (excluding vacant units) is open for trade.

For the 12 months to 31 March 2021, the Investment Manager has

collected 92% of the rent due, rising to 94% once rent deferment

and repayment plans are factored in. A more detailed analysis of

the Company's rental income will be included in the interim report

and accounts which are expected to be published in May 2021.

While this collection record is due in part to good

communication and a collaborative approach with tenants by the

Investment Manager, it is also because the retail warehouse sector

has shown greater resilience during the pandemic than other parts

of the retail market. Further, the sector's attributes have come to

the fore during this difficult trading period. It is anticipated

that the changes in retail patterns are likely to continue even

when lockdown restrictions are removed.

Dividends paid and 25% dividend increase from May 2021

Over the quarter, the Company continued to pay a monthly

dividend at a rate of 0.3333 pence per share, equating to an

annualised dividend of 4.00 pence per share. The dividend remains

fully covered.

The Company will increase its dividend by 25%, to 5.00 pence per

share annualised, with the first payment at the increased rate

being made in May 2021, for the month of April. This equates to 87%

of the dividend rate of 5.75 pence annualised that was paid up

until May 2020, when the dividend was reduced to 4.00 pence

annualised.

The 25% dividend increase takes into account the improving

outlook for income and rent collection and is not to the detriment

of the Company's investment and asset management activities.

Sale of Tesco Superstore at Prestatyn Shopping Park

During the period the Company disposed of the Tesco Superstore

which forms part of Prestatyn Shopping Park, for GBP26.5m (5.22%

initial yield). The sale price was in line with the property's

valuation as at 31 December 2020 and above the December 2017

acquisition price.

The Company will retain the remainder of the retail park, which

extends to c. 91,500 sq. ft. across 14 units. The retail park is

let to 13 tenants, with M&S as an anchor, and has various asset

management angles to exploit.

The sale of this asset is in line with the investment strategy

and provides the Company with the opportunity to recycle capital

from lower yielding assets into higher yielding properties which

are more suited to the Investment Manager's intensive style of

asset management. This will further improve the Company's income

stream.

Asset management and development update

At the office property in Newcastle, Citygate II, the Company

completed a lease restructure with N&D (London) Limited

('N&D'). N&D occupies c. 11,000 sq. ft. on the first floor

and has signed a ten-year reversionary lease, with a tenant break

option after five years. The lease will now expire in March 2032,

with the break option being in March 2027. The rent will increase

by c. 9.0%, which is 6.5% ahead of the independent valuer's

ERV.

The development of Haddington Retail Park continues on time and

budget and is expected to complete during June 2021. It is 97%

pre-let to Aldi, Home Bargains, Food Warehouse, Costa Coffee and

Euro Garages, with one unit of 1,500 sq. ft. available to let. Once

completed and fully occupied, the retail park will provide the

Company with new contracted rental income of GBP875,000 per

annum.

The Investment Manager is reporting improving occupational

demand from the Company's retail warehouse and office tenants and

is currently in discussions with tenants on new lettings and lease

regears. These will be reported on more fully in due course.

Cash and debt

As at 19 April 2021, the Company had approximately GBP16.7m of

cash for operational purposes. This includes GBP7.7m of the

Prestatyn sales proceeds. The Company also has GBP26.9m of cash

under its debt facility ring fenced specifically for investment.

GBP18.7m of this cash is from the sale of the Tesco Superstore at

Prestatyn.

At the date of the March valuation the average loan-to-value

across the Company's two debt facilities was 34.1%. The Company is

fully compliant with all debt covenants and has significant

headroom against income and asset cover covenants.

Summary

Full lockdown measures were put in place in various parts of the

country in December 2020 and remained in place for the entire first

quarter of 2021. These prevented certain businesses from being able

to open for trade and it was anticipated they might put pressure on

rent collection.

However, rent collection held up during the period and was ahead

of projections made at the start of the quarter. Throughout the

quarter c.73% (by income) of the Company's retail warehouse

portfolio was either open for trade or offered a click and collect

service which helped support rent collection.

Following the easing of lockdown restrictions in England and

Wales, 100% of the Company's retail warehouse portfolio (excluding

vacant units) is now open for trade.

As the economy re-opens, it is anticipated that rent collection

will improve and that any rent deferred over the past 12 months

will continue to be collected. There is ongoing asset management

activity in the portfolio which, on completion, will further

improve the income profile of the Company.

Occupational demand has improved, with several tenants in the

retail warehouse sector reactivating requirements for new stores

which had been put on hold during the pandemic. The Company is

benefiting from this and the Investment Manager is in discussions

with tenants looking to occupy units on the Company's retail

parks.

From an investment perspective, the sentiment towards retail

warehousing is improving and the sector is experiencing increased

investor demand. It is anticipated that this positive momentum will

continue as the year progresses and lockdown restrictions are eased

further.

The immediate focus is on delivering the ongoing asset

management initiatives which will help reduce the vacancy rate and

improve the Company's income stream. The Investment Manager is also

committed to reinvesting the Prestatyn sales proceeds in a higher

yielding asset suited to the Investment Manager's intensive style

of asset management.

William Hill, Chairman, commented:

"The continued high level of rent collection has enabled the

Company to increase the dividend by 25% from May 2021, which will

provide an attractive yield of 7.2%, based on the Company's last

published share price. If the economy continues to move in the

right direction the Board believes further dividend progression is

a realistic aspiration given the additional income expected from

the completion of its development at Haddington and other portfolio

activities in the pipeline."

Portfolio sector weightings and tenant and locational

exposure

Sector

Sector Exposure

(%)

Retail warehouse 66.2

---------

Office 28.6

---------

Development 3.2

---------

Other commercial/

Leisure 2.0

---------

Geography

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Wales 22.4

---------

North East 16.7

---------

Scotland 14.7

---------

West Midlands 14.0

---------

North West 12.9

---------

Yorkshire 12.2

---------

East Midlands 4.7

---------

South West 2.4

---------

Top five tenants

Tenant Exposure (%)

B&Q plc 10.2

-------------

B&M Retail Limited 7.1

-------------

AXA Insurance UK

plc 6.4

-------------

Marks & Spencer

plc 5.8

-------------

Ernst & Young LLP 5.8

-------------

Forthcoming events

The Company expects to produce its unaudited interim results for

the period to 31 March 2021 in May.

The next interim dividend announcement is expected to be made by

6 May 2021. The next scheduled independent quarterly valuation of

the property portfolio will be conducted by Knight Frank LLP as at

30 June 2021.

The Company intends to publish its next factsheet shortly which

will be made available on the Company's website at

www.ediston-reit.com.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries

Will Barnett - Investec Bank plc 0207 597 5873

Calum Bruce - Ediston Investment Services Limited 0131 225

5599

Ruth Wright - JTC 0203 893 1011

Ben Robinson - Kaso Legg Communications 0203 995 6672

Stephanie Ross - Kaso Legg Communications 0203 995 6676

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEAXLAASDFEFA

(END) Dow Jones Newswires

April 23, 2021 02:00 ET (06:00 GMT)

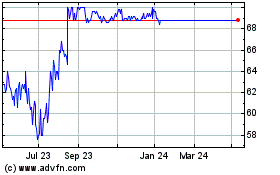

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Apr 2023 to Apr 2024