TIDMEPIC

RNS Number : 3309Z

Ediston Property Inv Comp PLC

21 May 2021

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

Ediston Property Investment Company plc

(the 'Company')

(LEI: 213800JRL87EGX9TUI28)

HALF YEAR RESULTS

MOVING FORWARD

Ediston Property Investment Company plc (LSE: EPIC) announces

its half-year results for the six months ended 31 March 2021.

Key points for the six months to 31 March 2021:

-- share price increased by 35.6% to 69.00 pence, narrowing the

discount to 18.1% at the period end;

-- net asset value decreased 2.0% to 84.26 pence (30 September 2020: 86.01 pence);

-- dividend cover of 133.7% at the period end (on an accounting

basis), based on a 4.00 pence annualised dividend;

-- dividend increased by 25.0% to 5.00 pence per share annualised, payable from May 2021;

---------------------------------------------------------------------------------------------------------------------------------

-- completed four lease restructures across the office and

retail warehouse portfolio securing GBP1.45m of income per

annum;

-- completed the development of a pre-let drive-thru pod at

Barnsley for Costa Coffee which provides GBP72,500 of new

contracted income per annum;

-- sold the Tesco Superstore at Prestatyn Shopping Park for

GBP26.5m, which was in line with valuation;

-- progressed the development of Haddington Retail Park. The

project remains on time and budget, with completion anticipated in

June 2021;

-- 95.7% of the rent due was collected for the period;

-- property portfolio increased in value, on a like-for like basis, by 0.2%; and

-- various pipeline projects, with income accretive opportunities, being considered.

Key Performance Indicators

Six months Six months Year ended

ended 31 ended 31 30 September

March March 2020

2021 2020 (audited)

EPRA NAV per share 84.26p 96.23p 86.01p

----------- ----------- --------------

NAV total return 0.3% (8.9)% (16.6)%

----------- ----------- --------------

Share price total return 39.8% (44.4)% (35.3)%

----------- ----------- --------------

Average premium/ (discount) of

share price to NAV (24.3)% (22.5)% (33.2)%

----------- ----------- --------------

EPRA vacancy rate 5.6% 5.7% 5.1%

----------- ----------- --------------

William Hill, Chairman, commented:

" The Company has come through the pandemic in a relatively

strong position and is well positioned to navigate recovery and to

respond to challenges that may lie ahead. The Board believes that

the case for share price growth is realistic given an attractive

yield of 7.2% on the current share price. The improving rental

income position should drive further dividend growth. A substantial

part of the portfolio is held in a sector of the market where

recovery has started to take shape which should benefit the NAV. In

summary, whilst still cautious, we are in a position to move

forward with some optimism."

---------------------------------------------------------------------------------------------------------------------------------

Enquiries

Will Barnett - Investec Bank plc 0207 597 5873

Calum Bruce - Ediston Properties Limited 0131 225 5599

Ruth Wright - JTC 0203 893 1011

Ben Robinson - Kaso Legg Communications 0203 995 6672

Stephanie

Ross - Kaso Legg Communications 0203 995 6676

Chairman's Statement

introduction

Twelve months on from writing an interim statement at a very

challenging time in the Company's history, it is with relief that I

am able to introduce this Interim Statement with some significant

positives to report:

-- the Board has been able to increase the dividend by 25.0%

from May 2021, following strong rental collection over recent

quarters;

-- tenant interest in vacant units has picked up and the Company

is on track to restore income to pre-pandemic levels over the next

six months giving, we hope, further scope for dividend

progress;

-- the market has at long last become more discerning in its

views on retail, and values are increasing within the retail

warehouse sector as its attributes and future potential have become

better understood. The Company is well-positioned to benefit given

its large exposure in the sector;

-- the value of the Company's investments showed an increase, on

a like for like basis, against the reported valuation six months

ago and may now be on an upward trend;

-- the recent sale of the Tesco Superstore at Prestatyn has

provided an opportunity to refresh the portfolio with new stock;

and

-- the share price has increased by 35.6% during the first half

of the financial year and, post the dividend increase, shows a

yield of 7.2% on the new dividend level and share price at the

period end.

In listing the positives above, I also want to make it very

clear on behalf of the Board and the management team that there is

no risk of any complacency creeping in. As we plan to take

advantage of the opportunities that lie ahead, ensuring resilience

of the portfolio against potential future shocks is central to our

approach. We also remain acutely aware of those that continue to

struggle with the impact of the pandemic in the UK and the

suffering it is causing around the world. The uncertainty is by no

means removed and the longer term financial and economic impact on

how we live, work and play will take some time to become fully

apparent.

NAV AND SHARE PRICE PERFORMANCE

The Company's investment portfolio was valued at GBP246.9m at 31

March 2021 (30 September 2020: GBP272.9m). Taking into account the

asset sold in the period, the property portfolio has increased in

value by 0.2%, on a like-for-like basis, over the six months.

Nevertheless, over the six months to 31 March 2021 the increase

in property valuations was not sufficient to offset the effect of

capital expenditure, and costs associated with the sale of the

Tesco Superstore at Prestatyn. The EPRA NAV per share therefore

fell from 86.01 pence to 84.26 pence, a decrease of 2.0%. Taking

into account dividends paid in the period, the NAV total return per

share based on NAV movement was 0.3% over the first six months of

the Company's financial year.

The Company's share price 12 months ago had fallen to 45.70

pence per share as the market took fright at the possible impact of

COVID-19 restrictions on the retail sector, and on property more

generally. However, the share price began to recover prior to the

start of the current financial year, and this has continued into

the first six months of the current year. As a result, the

Company's share price total return over the first half of the year

has been strong at 39.8%, with an average discount to NAV of 24.26%

compared to 40.8% at the start of the period. Closing the discount

further is a priority for the Board and we hope to see more

positive price progression to reflect the improved dividend pay-out

and cover, and also potentially improving NAV.

The Investment Manager's review includes an analysis of the

financial results of the last 12 months, since the onset of the

pandemic, and what the impact has been on the Company.

INVESTMENT STRATEGY

The Board is fully supportive of the Investment Manager's

strategy to retain and potentially increase the Company's exposure

to the retail warehouse sector. This confidence is underpinned by

the following:

-- the strong trading performance from some of the sector's

large space users, including B&Q and B&M;

-- affordability of rents in the type of assets owned by the Company;

-- provision of efficient and flexible space for modern forms of

retailing that is easily accessible;

-- low levels of vacancy and a number of acquisitive retailers taking space in the sector;

-- suitability of the space for socially distanced shopping that

is already driving footfall back towards pre-pandemic levels;

-- the format works well for 'click and collect', which combines

the physical world with the digital economy;

-- attractive yield on offer following the fall in all retail

values over the last 12 to 24 months; and

-- full pricing in other sectors of the real estate market,

particularly industrial and logistics.

PORTFOLIO ACTIVITY

During the period the Investment Manager has completed four new

asset management initiatives, progressed existing longer-term

projects and completed a sale. The EPRA vacancy in the portfolio

has remained low at 5.6% and is just below the level reported at

the same time last year. The outlook is encouraging with several

vacant units under offer.

The Board has continued to work closely with the Investment

Manager on achieving the Company's sustainability goals. This

progress will be reported on in detail in the next annual report

and is covered in the Investment Manager's review.

INCOME AND DIVID

Rent collection, a largely routine process until the onset of

the pandemic, became one of the industry's main KPIs from the March

2020 quarter day. The Company has provided regular updates to

shareholders on its ability to collect its due rent and further

analysis of the Company's strong collection statistics for the last

12 months can be found in the Investment Manager's review.

In May 2020 the Board announced a 30.4% cut in the annualised

dividend rate of 5.75p to 4.00p, bringing the dividend in line with

the expected rent collection levels at the time and for prudent

management of cash against a very uncertain economic backdrop.

The resilience of the Company's income and the ability of the

Investment Manager to work with tenants in collecting what was due

has enabled the Board to start the journey back towards reinstating

the former level of dividend. Over the last 12 months 92.0% of the

rent due has been collected and this is expected to rise to 94.0%

once rent deferment and repayment plans are factored in. The Board

was pleased to announce on 6 April that it would increase the May

dividend by 25.0% to an annualised rate of 5.00p per share. This

dividend level remains well-covered on current projections, but

prudence remains important in setting the dividend level as the

economic uncertainties are by no means over.

Rent collection statistics only provide part of the picture. It

is also important to understand the impact of the pandemic on the

overall rent roll of a company. Over the last 12 months the

Company's contracted rent has declined by 8.8% (ignoring the rent

foregone as a result of the sale of Tesco at Prestatyn, which will

be replaced) as it has not been immune from tenant failures, CVAs

and leases either not being renewed or agreed at lower rents.

However, without increasing the equity base or borrowings, the

Investment Manager projects that this missing rent will be made up

by the year end following completion of the Haddington development,

and the expected letting of vacant units. The Board believes

restoring rental income to pre-pandemic levels in this period would

be a highly positive outcome and commends the Investment Manager if

this is achieved.

CAPITAL STRUCTURE

The Company's total debt is unchanged at GBP111.1m at a blended

'all-in' fixed rate of 2.9%. Gearing at 31 March 2021 was 38.1% of

total assets. As at 31 March 2021, the Company had approximately

GBP16.2m of cash for operational purposes, and an additional

GBP27.0m of cash available for investment. The latter amount was

included within debtors at the period end. The Company works

closely with its debt provider, Aviva, to deploy cash as

efficiently as it can.

GOVERNANCE

The Board and Investment Manager continue to be very busy on

portfolio and operational resilience matters: to date both have

been relatively sound. We are also looking to the future in trying

to find means of 'moving forward' towards our strategic growth

objective. This remains an imperative for a relatively small

Company such as EPIC in order to diversify our portfolio further,

provide greater liquidity in our shares and reduce the impact of

operating costs.

At the Company's AGM all the resolutions put to the meeting were

passed by substantial margins. However, the remuneration policy was

opposed by certain voting agencies and attracted negative votes.

The Board stated its intention to engage with the voting agencies

and shareholders to ensure it understood their concerns and this

has now been done.

OUTLOOK

The progress made within the UK to re-open the economy is

encouraging, and it is certainly feasible for a strong bounce in

the rate of growth to take place. Real estate investment markets

are relatively buoyant and have the capacity to respond further

when travel restrictions are lifted, and more international capital

is unlocked. However, there is much to ponder for investors

including the fiscal response to repairing the nation's balance

sheet, the potential for inflation and its impact on interest

rates, the effect of the pandemic on how we live, work, shop and

play and regulatory interventions guiding our journey to net zero

carbon. The Board believes that the Company has come through the

pandemic in a relatively strong position and is well positioned to

navigate recovery and to respond to challenges that may lie ahead.

Returning to the positive note struck at the beginning of my

report, the Board believes that the case for share price growth is

realistic, given an attractive yield of 7.2% on the current share

price. The improving rental income position should drive further

dividend growth. A substantial part of the portfolio is held in a

sector of the market where recovery has started to take shape which

should benefit the NAV. In summary, whilst still cautious, we are

in a position to move forward with some optimism.

William Hill

Chairman

20 May 2021

Investment Manager's Review

Introduction and Market Commentary

The ongoing pandemic continued to impact on the activities of

the Company, particularly as various parts of the country were

under strict lockdown conditions for four of the six months of the

reporting period.

Despite the lockdown restrictions the investment market

continued to function, with investment levels improving in Q4 2020.

For the calendar year 2020 investment volumes reached c. GBP39bn, a

positive result given the low activity during quarters 2 and 3, but

the lowest year of investment volume since 2012. However, this was

hardly unexpected given the global effects of COVID-19.

Investment volumes slipped back during the first part of Q1

2021, but not by as much as some predicted. However, the total

number of deals increased as Q1 progressed. Encouragingly, investor

sentiment towards the retail warehouse sector improved in the

period which has driven increased investor demand. The yields on

offer in this sector look attractive. It is anticipated that this

positive momentum will continue as the year progresses and lockdown

restrictions are eased further. It could be argued that it has

taken a pandemic for the market to fully appreciate the qualities

of the retail warehouse sector given the prior indiscriminate

writing off of all things retail.

Over the reporting period occupational demand has also improved

for the Company's office and retail warehouse assets. In the retail

warehouse portfolio several tenants have reactivated requirements

for new stores, which had been put on hold during the pandemic. The

Investment Manager is in discussions with a number of tenants

looking to occupy units on the Company's retail parks. During the

period, the Investment Manager completed four asset management

initiatives across the office and retail warehouse portfolios,

which are more fully described in this report.

Portfolio Composition

We currently invest in office, retail warehouse and leisure

assets without the constraints of a specific market benchmark. As

at 31 March 2021 we owned 16 assets across the office, retail

warehouse and leisure sectors. The portfolio valuation was

GBP246.9m. The allocation is detailed in the table below.

Office Retail Warehouse Leisure

Number of properties 4 10 2

---------- ----------------- ----------

Value GBP70.4m GBP171.4m GBP5.1m

---------- ----------------- ----------

Sector weighted average 4.7 years 5.0 years 1.4 years

unexpired lease term

---------- ----------------- ----------

Total contracted rent GBP4.9m GBP12.5m GBP0.6m

per annum

---------- ----------------- ----------

The EPRA vacancy rate at 31 March 2021 was 5.6%, an increase

from 5.1% in September 2020, but marginally lower than at 31 March

2020 when it was 5.7%.

Sector weightings as at 31 March 2021

The Company's largest exposure is to convenience-led retail

warehousing which constitutes 66.2% of the property portfolio. The

retail warehouse assets are underpinned by tenants defined by the

UK Government as providing 'essential services', who have been

permitted to stay open for trade throughout the pandemic.

The remainder of the portfolio is made up of office and leisure

assets, and one retail warehouse development site which is 97%

pre-let. The latter is under construction with completion

anticipated in June 2021.

Sector Exposure

(%)

Retail warehouse 66.2

---------

Office 28.6

---------

Other commercial/

Leisure 3.2

---------

Development 2.0

---------

Geographical diversification as at 31 March 2021

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Wales 22.4

---------

North East 16.7

---------

Scotland 14.7

---------

West Midlands 14.0

---------

North West 12.9

---------

Yorkshire 12.2

---------

East Midlands 4.7

---------

South West 2.4

---------

Top five tenants as at 31 March 2021

The top five tenants comprise 35.3% of the Company's rent roll.

The remaining 64.7% is made up of tenants who individually do not

comprise more than 4.2% of the rent roll.

Tenant Exposure

(%)

B&Q plc* 10.2

---------

B&M Retail Limited* 7.1

---------

AXA Insurance UK

plc 6.4

---------

Marks & Spencer

plc* 5.8

---------

Ernst & Young LLP 5.8

---------

*Denotes a tenant providing 'essential services' which was able

to stay open for trade throughout periods of lockdown.

rent collection and rent analysis

The Company had a strong rent collection record throughout the

pandemic. For the 12 months to 31 March 2021, 92.0% of the rent due

has been collected, rising to 94.0% once rent deferment and

repayment plans are factored in. While this collection record is

due in part to good communication and a collaborative approach with

tenants, it is also because the retail warehouse sector has shown

greater resilience during the pandemic than other parts of the

retail market. The sector's attributes have also come to the fore

during this difficult trading period.

The rent collection since quarter 2 2020 is summarised in the

following table:

Quarter Q2 2020 (%) Q3 2020 (%) Q4 2020 (%) Q1 2021 (%)

Rent received 82.6 92.7 96.7 92.8

------------ ------------ ------------ ------------

Payment expected - 0.1 0.2 2.1

------------ ------------ ------------ ------------

Deferred 6.6 2.3 0.8 0.5

------------ ------------ ------------ ------------

Under discussion 2.3 1.6 0.9 1.7

------------ ------------ ------------ ------------

Outstanding 8.5 3.3 1.4 2.9

------------ ------------ ------------ ------------

Total 100 100 100 100

------------ ------------ ------------ ------------

In the main the Company's income stream has been resilient.

However, the property portfolio has not been totally immune from

tenants using insolvency procedures, such as Company Voluntary

Arrangements and administrations to reduce their liabilities and

rationalise property portfolios. This has resulted in a loss of

rent for the Company. When these insolvency processes are used

there is little a landlord can do to protect itself from them.

Tenants vacating at lease expiry and certain lease restructures

have all adversely impacted on the level of rent that the Company

receives.

Overall, the decline in the contracted rental income from the

portfolio since the outbreak of the pandemic over 12 months ago, on

a like-for-like basis (adjusting for the Tesco Superstore sale),

has been c. GBP1.8m (8.8%), a relatively modest amount for a

portfolio skewed to retail-based tenants. Over the same period, the

Company's ERV has reduced by 4.8%, with all the decline being in

the retail warehouse and leisure sectors. The ERV of the office

portfolio has been stable throughout the pandemic, with any letting

or lease restructuring activity in the office portfolio being in

line with or ahead of ERV.

During the 12 months ended 31 March 2021, the Company suffered

bad debts of c. GBP612,000 and has deferral plans in place for

GBP670,000 of the income, with approximately GBP160,000 already

recovered. With intensive efforts to manage rent collection, the

deterioration in income has been less than might have been

anticipated. Whilst there are still significant challenges ahead,

the good income cover and stabilisation of asset values has

returned some degree of confidence for the future.

It is anticipated that c. GBP1.5m of the lost contracted income

will be replaced in the next few months with the completion of the

Haddington development, and the completion of lettings that are

currently under offer. Assuming no further market setbacks and the

development of existing interest in vacant units, by the end of the

financial year at 30 September we are aiming to have restored

income to at least pre-pandemic levels without adding to the

existing capital base of the Company. Under the circumstances, we

believe this is a good result in preserving the Company's income

stream.

Portfolio Valuation AND NAV

The Company's property portfolio is valued by Knight Frank on a

quarterly basis throughout the year. As at 31 March 2021 it was

valued at GBP246.9m, a like-for-like increase of 0.2% compared to

the 30 September 2020 valuation.

The COVID-19 pandemic started to impact directly on the

portfolio during March 2020. To put the Company's circumstances in

some perspective, in the prior quarter end (31 December 2019) the

Company had 16 properties valued at GBP308.9m. By 31 March 2021,

the Company had 16 properties valued at GBP246.9m, a like-for-like

decrease of 12.6% from 31 December 2019. The number of properties

remain unchanged, despite the sale of the Tesco Superstore at

Prestatyn, as the Company retained the retail park element of the

asset.

This valuation decline was the main reason for the Company

suffering a net asset value deterioration of 18.7% during the

15-month period 31 December 2019 to 31 March 2021, with, the

negative impact of gearing exacerbating the fall. The net asset

value of 96.23p at 31 March last year had already been impacted by

changes in retail trends, coming down from a high of 112.21p the

previous year. It is encouraging that the most severe impacts on

valuation now appear to have passed, but the challenge remains to

restore the net asset value, as well as the Company's net

income.

Asset Management Activity

During the period we have completed four asset management

initiatives in the property portfolio, across both office and

retail warehouse assets, securing GBP1.45m of rental income per

annum.

In the office portfolio, we completed two lease restructures

with existing tenants which secured c. GBP973,000 of income per

annum. At St Philips Point in Birmingham, AXA Insurance UK plc

committed to 27,990 sq. ft. of space across three floors, reducing

the amount of floorspace it leases by 5,005 sq. ft. One floor has a

break option in June 2022, one has a break option in December 2023,

and the largest floor is leased for a term certain of five years.

The rent secured was in line with the passing rents and the

independent valuer's ERV.

At Citygate II in Newcastle we completed a lease restructure

with N&D (London) Limited ('N&D'). N&D occupies c.

11,000 sq. ft. on the first floor and has signed a ten-year

reversionary lease, with a tenant break option after five years.

The lease will now expire in March 2032, with the break option

being in March 2027. The rent will increase by c. 9.0%, which is

6.5% ahead of the independent valuer's ERV.

In the retail warehouse portfolio, we secured GBP485,000 of

income per annum from two tenants. The new rent is 12.6% above the

previous passing rent across the units. At Clwyd Retail Park in

Rhyl, we agreed a five-year lease extension with Halfords, who

occupy c. 7,500 sq. ft. Securing Halfords on the retail park for

another five years is good news for the Company as the retailer has

performed well during the pandemic and has paid its rent

throughout.

At Pallion Retail Park in Sunderland, we upsized B&M from a

unit of 20,000 sq. ft. into a vacant unit of 30,000 sq. ft. B&M

will pay an annual rent of GBP400,000, and the lease expires in

2032. This is the third time we have been able to accommodate

B&M's expansion on our retail parks having completed similar

deals at Barnsley and Hull in previous years.

The development programme has continued to deliver successfully.

During the period, at Barnsley East Retail Park, we completed a

1,800 sq. ft. drive-thru unit for Costa Coffee. Costa now occupies

the unit on a 15-year lease (without break) and pays an annual rent

of GBP72,500.

The development of Haddington Retail Park, which commenced in

August 2020, is progressing on time and budget. It is expected to

complete in June 2021. The development is 97.0% pre-let to Aldi,

The Food Warehouse, Costa Coffee, Home Bargains and Euro Garages.

One unit of 1,500 sq. ft. remains available to let. Once fully let

and constructed, the asset will have a WAULT in excess of 15 years

and will generate an annual rent of GBP875,000.

We are seeing improving occupational demand from both our retail

warehouse and office tenants. We are currently in discussions with

tenants on new lettings and lease regears, which will be reported

on more fully in due course.

ASSET SALE

In March, we sold the Tesco Superstore which forms part of

Prestatyn Shopping Park, for GBP26.5m. The sale price was in line

with the property's valuation as at 31 December 2020 and above the

December 2017 acquisition price.

We have retained the remainder of the retail park, which extends

to c. 91,500 sq. ft. across 14 units. The retail park is let to 13

tenants, with M&S as an anchor, and has various asset

management angles to exploit.

The sale is in line with the investment strategy and provides

the opportunity to recycle capital from lower yielding assets into

higher yielding properties which are more suited to our intensive

style of asset management. This will further improve the Company's

income stream. A number of acquisition opportunities are currently

being reviewed.

ESG UPDATE

During the reporting period the Company has continued to make

good progress with its ESG objectives, which were put in place

during FY2020. The Company has targeted the following areas in

order to make further improvements in its ESG credentials:

-- Health, Safety and Wellbeing;

-- ESG Disclosure and Transparency;

-- Managing Environmental Impacts; and

-- Sustainable Building Design.

To help reach these targets, during the period the Company has

introduced Asset Sustainability Plans. These plans outline specific

asset targets and initiatives for all operationally managed assets,

aimed at improving environmental efficiency, health and wellbeing,

and tenant and community engagement on ESG issues. Progress is also

well underway on developing the Company's pathway towards net zero

carbon in operation.

Having achieved 'Green Star' status from GRESB in 2020, the

Company is again participating in the GRESB Real Estate

Sustainability Benchmark, with its submission due by the end of

June 2021. It is anticipated that the work completed to date will

help to improve the Company's rankings across a number of ESG

aspects under both Management and Performance components. In

addition, work is ongoing to ensure that the Company reports in

line with the EPRA Best Practices Recommendations for

Sustainability Reporting (sBPR) and improves its alignment with the

Task Force on Climate-related Financial Disclosures (TCFD)

recommendations.

A full update on the Company's ESG progress will be provided in

the annual report and accounts which are due to be published later

this year.

Outlook

The success of the vaccination programme and the easing of

lockdown restrictions across the UK are reasons to be optimistic.

The pathway out of the COVID-19 pandemic is now clearer, but there

will still be obstacles to navigate. There is nervousness around

new strains of the virus emerging, and until the economy is fully

open and restrictions are eased further, a degree of caution should

be exercised.

That said, demand for UK real estate remains robust and there is

an increased appetite for retail warehouse assets, which constitute

66.2% of the Company's portfolio. Retail warehousing has proved to

be more resilient than other parts of the retail market, and its

attributes, which the Company has been championing for some time,

are now being more widely understood.

Identifying and executing asset management initiatives remains a

priority and it is encouraging that there are several underway in

the portfolio. On completion these transactions will improve the

Company's income stream, reduce the vacancy rate and support and

improve the capital value of the property portfolio.

Calum Bruce

Investment Manager

20 May 2021

Directors' Responsibilities

Statement of Principal Risks and Uncertainties

The risks, and the way in which they are managed, are described

in more detail under the heading 'Principal and emerging risks'

within the Strategic Report in the Group's Annual Report and

Accounts for the year ended 30 September 2020. The Group's

principal and emerging risks have not changed materially since the

date of that report. The COVID-19 pandemic continues to have a

significant impact on capital values and income from the portfolio.

The operational risks of the Company and resilience of the

portfolio are being examined on an ongoing basis but have been

sound to date, both in the management of the portfolio and in the

Company's operations.

As a direct result of the COVID-19 pandemic and the attendant

economic, social, financial and market crises, the Group's

principal and emerging risks have been heightened for a

considerable period However, these are expected to be moderated in

light of the government's COVID-19 strategy and the easing of

lockdown restrictions.

Statement of Directors' Responsibilities in Respect of the

Interim Report

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as adopted

by the European Union and gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the

Group;

-- the Chairman's Statement and Investment Manager's Review

(together constituting the Interim Management Report) include a

fair review of the information required by the Disclosure and

Transparency Rules (DTR) 4.2.7R, being an indication of important

events that have occurred during the first six months of the

financial year and their impact on the condensed set of

consolidated financial statements;

-- the Statement of Principal Risks and Uncertainties above is a

fair review of the information required by DTR 4.2.7R; and

-- the Chairman's Statement and Investment Manager's Review,

together with the condensed set of consolidated financial

statements, include a fair review of the information required by

DTR 4.2.8R, being related party transactions that have taken place

in the first six months of the current financial year and that have

materially affected the financial position or performance of the

Company during the period, and any changes in the related party

transactions described in the last Annual Report that could do so

are included in Note 10.

These interim statements are unaudited and have not been subject

to review by the audit firm.

On behalf of the Board

William Hill

Chairman

20 May 2021

Financial Statements

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2021

Notes Six months ended 31 March 2021 (unaudited)

===== ============================================== ================= ===============

Six months ended Year ended

31 March 30 September

2020 (unaudited) 2020 (audited)

Revenue Capital Total Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=========================== ===== ============== ============== ============== ================= ===============

Revenue

Rental income 9,107 - 9,107 10,328 19,857

=========================== ===== ============== ============== ============== ================= ===============

Total revenue 9,107 - 9,107 10,328 19,857

Unrealised loss on

revaluation of investment

properties 5 - (5,324) (5,324) (27,290) (49,991)

Gain on sale of investment

properties realised 5 - 192 192 - -

=========================== ===== ============== ============== ============== ================= ===============

Total income 9,107 (5,132) 3,975 (16,962) (30,134)

=========================== ===== ============== ============== ============== ================= ===============

Expenditure

Investment management fee 2 (824) - (824) (999) (1,882))

Other expenses (1,043) - (1,043) (495) (1,648)

=========================== ===== ============== ============== ============== ================= ===============

Total expenditure (1,867) - (1,867) (1,764) (4,042)

=========================== ===== ============== ============== ============== ================= ===============

Profit/(loss) before

finance costs and taxation 7,240 (5,132) 2,108 (18,726) (34,176)

Net finance costs

Interest receivable - - - 36 58

Interest payable (1,588) - (1,588) (1,630) (3,258)

=========================== ===== ============== ============== ============== ================= ===============

Profit/(loss) before

taxation 5,652 (5,132) 520 (20,320) (37,376)

Taxation - - - - -

=========================== ===== ============== ============== ============== ================= ===============

Profit/(loss) and total

comprehensive income for

the period 5,652 (5,132) 520 (20,320) (37,376)

=========================== ===== ============== ============== ============== ================= ===============

Basic and diluted earnings

per share 3 2.68p (2.43)p 0.25p (9.61)p (17.69)p

=========================== ===== ============== ============== ============== ================= ===============

The total column of this statement represents the Group's

Condensed Consolidated Statement of Comprehensive Income, prepared

in accordance with IFRS.

The supplementary revenue return and capital return columns are

prepared under guidance published by the Association of Investment

Companies.

All revenue and capital items in the above statement are derived

from continuing operations.

No operations were acquired or discontinued in the period.

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Statement of Financial Position

As at 31 March 2021

Notes As at As at As at

31 March 2021 31 March 2020 30 September 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

=================================== ===== =============== =============== ===================

Non-current assets

Investment properties 5 242,008 289,098 268,246

=================================== ===== =============== =============== ===================

242,008 289,098 268,246

=================================== ===== =============== =============== ===================

Current assets

Trade and other receivables 33,194 15,959 14,164

Cash and cash equivalents 16,186 12,511 12,308

=================================== ===== =============== =============== ===================

49,380 28,470 26,472

=================================== ===== =============== =============== ===================

Total assets 291,388 317,568 294,718

=================================== ===== =============== =============== ===================

Non-current liabilities

Loans 6 (110,195) (110,029) (110,112)

=================================== ===== =============== =============== ===================

(110,195) (110,029) (110,112)

Current liabilities

Trade and other payables (3,126) (4,175) (2,833)

=================================== ===== =============== =============== ===================

Total liabilities (113,321) (114,204) (112,945)

=================================== ===== =============== =============== ===================

Net assets 178,067 203,364 181,773

=================================== ===== =============== =============== ===================

Equity and reserves

Called-up equity share capital 7 2,113 2,113 2,113

Share premium 125,559 125,559 125,559

Capital reserve - investments held (52,689) (24,664) (47,365)

Capital reserve - investments sold 2,574 2,382 2,382

Special distributable reserve 82,893 83,388 83,162

Revenue reserve 17,617 14,586 15,922

=================================== ===== =============== =============== ===================

Equity shareholders' funds 178,067 203,364 181,773

=================================== ===== =============== =============== ===================

Net asset value per Ordinary Share 8 84.26p 96.23p 86.01p

=================================== ===== =============== =============== ===================

The accompanying notes are an integral part of these condensed

consolidated financial statements.

The condensed financial statements on pages 8 to 14 were

approved by the Board of Directors and authorised for issue on 20

May 2021 and were signed on its behalf by:

William Hill

Chairman

Registered number: 09090446

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 March 2021 (unaudited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2020 2,113 125,559 (47,365) 2,382 83,162 15,922 181,773

Profit and

total

comprehensive

income for

the period - - (5,324) 192 - 5,652 520

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (4,226) (4,226)

Transfer from

special

reserve - - - - (269) 269 -

As at 31 March

2021 2,113 125,559 (52,689) 2,574 82,893 17,617 178,067

============== ============= ============= ============= ============= ============= ============= ============

For the six months ended 31 March 2020 (unaudited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2019 2,113 125,559 2,626 2,382 83,639 13,441 229,760

(Loss)/Profit

and total

comprehensive

income for

the period - - (27,290) - - 6,970 (20,320)

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (6,076) (6,076)

Transfer from

special

reserve - - - - (251) 251 -

============== ============= ============= ============= ============= ============= ============= ============

As at 31 March

2020 2,113 125,559 (24,664) 2,382 83,388 14,586 203,364

============== ============= ============= ============= ============= ============= ============= ============

For the year ended 30 September 2020 (audited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2019 2,113 125,559 2,626 2,382 83,639 13,441 229,760

Loss and total

comprehensive

income for

the year - - (49,991) - - 12,615 (37,376)

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (10,611) (10,611)

Transfer from

special

reserve - - - - (477) 477 -

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2020 2,113 125,559 (47,365) 2,382 83,162 15,922 181,773

============== ============= ============= ============= ============= ============= ============= ============

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Cash Flow Statement

For the six months ended 31 March 2021

Six months ended Six months ended Year ended

31 March 2020 31 March 2019 30 September 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

==================================================== === ================ ================ ===================

Cash flows from operating activities

Profit/(loss) before tax 520 (20,320) (37,376)

Adjustments for:

Interest receivable - (36) (58)

Interest payable 1,588 1,630 3,258

Unrealised revaluation loss on property portfolio 5,324 27,290 49,991

Gain on sale of investment property realised (192) - -

========================================================= ================ ================ ===================

Operating cash flows before working capital changes 7,240 8,564 15,815

(Increase)/decrease in trade and other receivables (18,078) (370) 620

(Decrease)/increase in trade and other payables (538) 1,299 1,169

========================================================= ================ ================ ===================

Net cash (outflow)/inflow from operating activities (11,376) 9,493 17,604

========================================================= ================ ================ ===================

Cash flows from investing activities

Capital expenditure (5,512) (1,330) (3,355)

Sale of investment properties 26,466 - -

========================================================= ================ ================ ===================

Net cash inflow/(outflow) from investing activities 20,954 (1,330) (3,355)

========================================================= ================ ================ ===================

Cash flows from financing activities

Dividends paid (4,090) (6,078) (10,803)

Interest received - 36 58

Interest paid (1,610) (1,586) (3,172)

========================================================= ================ ================ ===================

Net cash outflow from financing activities (5,700) (7,628) (13,917)

========================================================= ================ ================ ===================

Net increase in cash 3,878 535 332

Opening cash and cash equivalents 12,308 11,976 11,976

========================================================= ================ ================ ===================

Closing cash and cash equivalents 16,186 12,511 12,308

========================================================= ================ ================ ===================

The accompanying notes are an integral part of these condensed

financial statements.

Notes to the Condensed Consolidated Financial Statements

1. Interim results

The condensed consolidated financial statements have been

prepared in accordance with International Financial Reporting

Standards (IFRS) and IAS 34 'Interim Financial Reporting' adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union and the accounting policies set out in the statutory

accounts of the Group for the year ended 30 September 2020. The

condensed consolidated financial statements do not include all of

the information required for a complete set of IFRS financial

statements and should be read in conjunction with the financial

statements of the Group for the year ended 30 September 2020, which

were prepared under IFRS adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union. The accounting

policies adopted in this report are consistent with those applied

in the Group's audited financial statements for the year ended 30

September 2020, apart from the amendment to IFRS 16 "Leases"

related to COVID-19 related rent concessions. The amendment to IFRS

16 specifies how rent concessions granted to lessees are

recognised, measured, presented and disclosed. This has not had a

material impact on the Group as a lessor and accordingly there have

been no restatements to the Group's previously reported financial

information as a result of the amendment to IFRS 16. The accounting

policies applied in the preparation of this financial information

are expected to be consistently applied in the financial statements

for the year to 30 September 2021 Based on the current operations

of the Group, no other new or revised accounting standards have

been issued that are expected to have a material effect on the

Group's financial statements in the future. There have been no

significant changes to management judgements and estimates since 30

September 2020.

The condensed consolidated financial statements have been

prepared on the going concern basis. In assessing the going concern

basis of accounting the Directors have had regard to the guidance

issued by the Financial Reporting Council. Whilst the timing of the

recovery from the impact of COVID-19 is unknown, after making

enquiries, and bearing in mind the nature of the Group's business

and assets, the Directors consider that the Group has adequate

resources to continue in operational existence over the medium

term. For these reasons, the Board continues to adopt the going

concern basis in preparing these financial statements.

2. Investment Management Fee

Six months ended Six months ended Year ended

31 March 2021 31 March 2020 30 September 2020

GBP'000 GBP'000 GBP'000

========================== ================ ================ ==================

Investment management fee 824 999 1,882

========================== ================ ================ ==================

Total 824 999 1,882

========================== ================ ================ ==================

Ediston Investment Services Limited has been appointed as the

Company's Alternative Investment Manager (AIFM) and investment

manager, with the property management services for the Group being

delegated to Ediston Properties Limited. Ediston Investment

Services Limited is entitled to a fee calculated as 0.95% per annum

of the net assets of the Group up to GBP250m, 0.75% per annum of

the net assets of the Group over GBP250m and up to GBP500m and

0.65% per annum of the net assets of the Group over GBP500m. The

management fee on any cash available for investment (being all cash

held by the Group except cash required for working capital and

capital expenditure) is reduced to 0.475% per annum while such cash

remains uninvested. The Management fee is reduced by a quarterly

contribution of GBP10,000 (GBP40,000 per annum) towards the overall

management costs of the Company.

Ediston Investment Services Limited has committed to investing

20.0% of the quarterly management fee in the Company's shares each

quarter for a period of three years commencing 1 October 2020.

Refer to note 10 for further information.

3. Earnings per Share

Six months ended Six months ended Year ended

31 March 2021 31 March 2020 30 September 2020

================================== ======================== ========================= =========================

GBP'000 Pence per share GBP'000 Pence per share GBP'000 Pence per share

================================== ======= =============== ======== =============== ======== ===============

Revenue earnings 5,652 2.68 6,970 3.30 12,615 5.97

Capital earnings (5,132) (2.43) (27,290) (12.91) (49,991) (23.66)

Total earnings 520 0.25 (20,320) (9.61) (37,376) (17.69)

================================== ======= =============== ======== =============== ======== ===============

Average number of shares in issue 211,333,737 211,333,737 211,333,737

================================== ======================== ========================= =========================

Earnings for the period to 31 March 2021 should not be taken as

a guide to the results for the year to 30 September 2021.

4. Dividends

Six monthly dividends of 0.3333 pence per share, at a cost of

GBP4,224,000 (six monthly dividends at a rate of 0.472 pence per

share for the six months ended 31 March 2020, at a cost of

GBP6,078,000) were paid during the period. The rate was reduced

from 0.472 pence per share to 0.3333 pence per share in April

2020.

A seventh interim dividend for the year ending 30 September

2021, of 0.4167 pence per share, will be paid on 28 May 2021 to

shareholders on the register on 14 May 2021. This monthly dividend

of 0.4167 pence per share equates to an annualised dividend level

of 5.00 pence per share.

All of the distributions made by the Company have been Property

Income Distributions (PIDs).

5. Investment Properties

As at As at As at

31 March 31 March 30 September

2021 2020 2020

Freehold and leasehold properties GBP'000 GBP'000 GBP'000

============================================== ========= ========= =============

Opening book cost 315,611 312,517 312,517

Opening unrealised appreciation (47,365) 2,626 2,626

============================================== ========= ========= =============

Opening fair value 268,246 315,143 315,143

============================================== ========= ========= =============

Movement for the period

Sales

- net proceeds (26,466) - -

- gain on sales 192 - -

Capital expenditure 5,360 1,245 3,094

============================================== ========= ========= =============

Movement in book cost (20,914) 1,245 3,094

============================================== ========= ========= =============

Unrealised gain/loss realised during the year - - -

Unrealised gains on investment properties 598 - -

Unrealised losses on investment properties (5,922) (27,290) (49,991)

============================================== ========= ========= =============

Movement in fair value (26,238) (26,045) (46,897)

============================================== ========= ========= =============

Closing book cost 294,697 313,762 315,611

============================================== ========= ========= =============

Closing unrealised (depreciation) (52,689) (24,664) (47,365)

============================================== ========= ========= =============

Closing fair value 242,008 289,098 268,246

============================================== ========= ========= =============

During the period ended 31 March 2021 the Group sold the Tesco

Superstore, which forms part of Prestatyn Shopping Park, as well as

a strip of undeveloped land at Hull (which was acquired from us by

way of a compulsory purchase order). The Group received a net

amount of GBP26,466,000 (31 March 2020: GBP0) from investments sold

in the period. The book cost of the Prestatyn Tesco investment when

it was purchased was GBP26,274,000. This investment has been

revalued over time and, until it was sold, any unrealised

gains/losses were included in the fair value of the

investments.

The fair value of the investment properties reconciled to the appraised value as follows:

Six months ended Six months ended Year ended

31 March 2021 31 March 2020 30 September 2020

GBP'000 GBP'000 GBP'000

=================================================== ================ ================ ==================

Closing fair value 242,008 289,098 268,246

Lease incentives held as debtors 4,842 4,702 4,729

=================================================== ================ ================ ==================

Appraised market value per Knight Frank 246,850 293,800 272,975

=================================================== ================ ================ ==================

Changes in the valuation of investment properties

Six months ended Six months ended Year ended

31 March 2021 31 March 2020 30 September 2020

GBP'000 GBP'000 GBP'000

=================================================== ================ ================ ==================

Gain on sale of investment properties 192 - -

Gain on sale of investment properties realised* 192 - -

Unrealised gains on investment properties 598 - -

Unrealised losses on investment properties (5,922) (27,290) (49,991)

=================================================== ================ ================ ==================

Total loss on revaluation of investment properties (5,132) (27,290) (49,991)

=================================================== ================ ================ ==================

*Represents the difference between the sales proceeds, net of

costs, and the property valuation at the end of the prior year.

5. Investment Properties continued

The loss on revaluation of investment properties reconciles to the movement in appraised market

value as follows:

Six months ended Six months ended Year ended

31 March 2021 31 March 2020 30 September 2020

GBP'000 GBP'000 GBP'000

=================================================== ================ ================ ==================

Total loss on revaluation of investment properties (5,132) (27,290) (49,991)

Capital expenditure 5,360 1,245 3,094

Sales - net proceeds (26,466) - -

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in fair value (26,238) (26,045) (46,897)

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in lease incentives held as debtors 113 670 697

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in appraised market value (26,125) (25,375) (46,200)

--------------------------------------------------- ---------------- ---------------- ------------------

At 31 March 2021, the properties were valued at GBP246,850,000

(31 March 2020: GBP293,800,000 and 30 September 2020:

GBP272,975,000) by Knight Frank LLP (Knight Frank), in their

capacity as external valuers. The valuation was undertaken in

accordance with the current editions of RICS Valuation - Global

Standards, which incorporate the International Valuation Standards,

and the RICS UK National Supplement.

Fair value is based on an open market valuation (the price that

would be received to sell an asset, or paid to transfer a

liability, in an orderly transaction between market participants at

the measurement date), provided by Knight Frank on a quarterly

basis, using recognised valuation techniques as set out in the

accounting policies and Note 9 of the consolidated financial

statements of the Group for the year ended 30 September 2020.

There were no other significant changes to the valuation

process, assumptions or techniques used during the period.

6. Loans

As at As at As at

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

================================== ========= ========= =============

Principal amount outstanding 111,076 111,076 111,076

Set-up costs (1,612) (1,612) (1,612)

Amortisation of loan set-up costs 731 565 648

================================== ========= ========= =============

Total 110,195, 110,029 110,112

================================== ========= ========= =============

The Group's loan arrangements are with Aviva Commercial Finance

Limited.

The Group has loans totalling GBP56,920,000 which carry a fixed

interest rate of 2.99% and mature in May 2025. This rate is fixed

for the period of the loan as long as the loan-to-value is

maintained below 40%, increasing by ten basis points if the

loan-to-value is 40% or higher. These loans are secured over EPIC

(No.1) Limited's property portfolio. The Group also has loans

totalling GBP54,156,000 which carry a fixed interest rate of 2.73%

and mature in December 2027. This rate is fixed for the period of

the loan as long as the loan-to-value is maintained below 40%,

increasing by ten basis points if the loan-to-value is 40% or

higher. These loans are secured over EPIC (No.2) Limited's property

portfolio.

Under the terms of early repayment relating to the loans, the

cost of repaying the loans on 31 March 2021, based on the yield on

the Treasury 5% 2025 and Treasury 4.25% 2027 plus a margin of 0.5%,

would have been approximately GBP122,222,000 (31 March 2020:

GBP126,019,000 and 30 September 2020: GBP126,362,000), Including

repayment of the principal GBP111,076,000 (31 March 2020:

GBP111,076,000 and 30 September 2020: GBP111,076,000).

The fair value of the loans based on a marked-to-market basis,

being the yield on the relevant Treasury plus the appropriate

margin, was GBP116,274,000 at 31 March 2021 (31 March 2020:

GBP118,841,000 and 30 September 2020: GBP119,668,000). This

includes the principal borrowed.

7. Called-up Equity Share Capital

The Company had 211,333,737 Ordinary Shares of 1 pence par value

in issue at 31 March 2021 (31 March 2020: 211,333,737 and 30

September 2020: 211,333,737).

During the period to 31 March 2021, the Company did not issue

any Ordinary Shares (six months ended 31 March 2020: issued none;

year ended 30 September 2020: issued none). The Company did not

buyback or resell from treasury any Ordinary Shares during the

period or during either comparative period.

The Company did not hold any shares in treasury at 31 March 2021

(31 March 2020: nil and 30 September 2020: nil).

8. Net Asset Value

The Group's net asset value per Ordinary Share of 84.26 pence

(31 March 2020: 96.23 pence and 30 September 2020: 86.01 pence) is

based on equity shareholders' funds of GBP178,087,000 (31 March

2020: GBP203,364,000 and 30 September 2020: GBP181,773,000) and on

211,333,737 (31 March 2020: 211,333,737 and 30 September 2020:

211,333,737) Ordinary Shares, being the number of shares in issue

at the period end.

The net asset value calculated under IFRS is the same as the

EPRA net asset value as at 31 March 2021 and for both comparative

periods.

9. Investment in subsidiaries

The Group's results consolidate those of EPIC (No.1) Limited, a

wholly owned subsidiary of Ediston Property Investment Company plc,

incorporated in England & Wales on 27 June 2014 (Company

Number: 09106328) and EPIC (No.2) Limited, a wholly owned

subsidiary of Ediston Property Investment Company plc, incorporated

in England & Wales on 23 September 2017 (Company Number:

10978359). The subsidiaries hold all the investment properties

owned by the Group and are also the parties which hold the Group's

borrowings (see Note 6).

10. Related Parties

There have been no material transactions between the Company and

its directors during the period other than amounts paid to them in

respect of expenses and remuneration for which there were no

outstanding amounts payable at the period end.

Ediston Investment Services Limited has received investment

management fees of GBP824,000 in relation to the six months ended

31 March 2021 (six months ended 31 March 2020: GBP999,000 and year

ended 30 September 2020: GBP1,882,000) of which GBP411,213 (31

March 2020: GBP481,000 and 30 September 2020: GBP430,000) remained

payable at the period end. Ediston Investment Services Limited

received development management fees of GBP177,000 in relation to

the six months ended 31 March 2021 (six months ended 31 March 2020:

GBPnil and year ended 30 September 2020: GBPnil) of which GBPnil

(31 March 2020: GBPnil and 30 September 2020: GBPnil) remained

payable at the period end.

Ediston Investment Services Limited acquired 121,944 shares in

the Company during the period ended 31 March 2021 as part of its

commitment to reinvest 20 per cent of its quarterly management

fee.

The aggregate shareholding of the manager and its senior

personnel as at 31 March 2021 is 1,721,377 shares, 0.8% of the

issued share capital as at that date.

11. Commitments

As at 31 March 2021 the Group had contractual commitments

totalling GBP1,738,000 (31 March 2020: GBP1,500,000 and 30

September 2020: GBP4,666,000). This is in relation to retentions

for the capital works on the Coatbridge Pods, the Barnsley Costa

Coffee and the JD Gyms fit out at Widnes as well as the development

of Haddington Retail Park and ongoing works at Kingston Retail Park

in Hull.

The Group did not have any other contractual commitments to

refurbish, construct or develop any investment property, or for

repair, maintenance or enhancements, as at 31 March 2021.

12. Fair Value Measurements

The fair value measurements for assets and liabilities are

categorised into different levels in the fair value hierarchy based

on the inputs to valuation techniques used. These different levels

have been defined as follows:

-- Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities that the Group can access at the

measurement date.

-- Level 2 - inputs, other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly or indirectly.

-- Level 3 - unobservable inputs for the asset or liability.

Value is the Directors' best estimate, based on advice from

relevant knowledgeable experts, use of recognised valuation

techniques and on assumptions as to what inputs other market

participants would apply in pricing the same or similar instrument.

All investment properties are included in Level 3.

There were no transfers between levels of the fair value

hierarchy during the six months ended 31 March 2021.

13. Interim Report Statement

The Company's auditor, Grant Thornton UK LLP, has not audited or

reviewed the Interim Report to 31 March 2021 pursuant to the

Auditing Practices Board guidance on 'Review of Interim Financial

Information'. These are not full statutory accounts in terms of

Section 434 of the Companies Act 2006 and are unaudited. Statutory

accounts for the year ended 30 September 2020, which received an

unqualified audit report and which did not contain a statement

under Section 498 of the Companies Act 2006, have been lodged with

the Registrar of Companies. No full statutory accounts in respect

of any period after 30 September 2020 have been reported on by the

Company's auditor or delivered to the Registrar of Companies.

---------------------------------------------------------------------------------------------------------------------------------

This interim report and accounts will only be produced in an

electronic form. It will be available on the Company's website at

www.epic-reit.com. In accordance with Listing Rule 9.6.1, copies of

these documents will also be submitted to the UK Listing Authority

via the National Storage Mechanism and will be available for

viewing shortly at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SELFLSEFSEEI

(END) Dow Jones Newswires

May 21, 2021 02:00 ET (06:00 GMT)

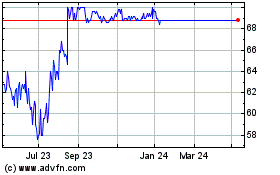

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Apr 2023 to Apr 2024