TIDMESC

RNS Number : 9110Y

Escape Hunt PLC

18 May 2021

18 May 2021

Escape Hunt plc (AIM: ESC)

("Escape Hunt", the "Company" or the "Group")

Final results for the year ended 31 December 2020

Escape Hunt is pleased to announce its audited final results for

the year ended 31 December 2020.

FINANCIAL HIGHLIGHTS

-- Group Adjusted EBITDA loss reduced to GBP1.4m (2019: loss

GBP1.7m) despite COVID-19 restrictions

-- > 25% like-for-like sales growth on a 12 week rolling

basis in the two months prior to lockdown

-- Group revenue of GBP2.7m (2019: GBP4.9m) was 46% lower than FY19, driven by COVID-19

-- Revenue from digital and other play at home products was GBP230k (2019: nil)

-- GBP0.4m positive site level Adjusted EBITDA from

owner-operated sites (2019: GBP1.0m) was driven by a strong

performance pre-lockdown and encouraging trading when allowed to

open under COVID-19 restrictions

-- Franchise EBITDA of GBP0.3m (2019: GBP0.4m)

-- Group operating loss of GBP6.4m (2019: loss of GBP5.9m)

-- GBP4.0m net of expenses successfully raised through an equity

placing and open offer, share subscription, and a convertible loan

note in July 2020

-- Cash at year end GBP2.7m (2019: GBP2.2m) and GBP3.3m on 31 March 2021

OPERATIONAL HIGHLIGHTS

-- Owner-operated estate expanded by 56% to 14 sites (2019: 9

sites) including Watford (which was scheduled to open on December

27(th) ) and the acquisition of Dubai

-- Record opening performances at each of Norwich and Basingstoke sites

-- All eight sites open for more than 12 months were named by

TripAdvisor(TM) as a Travellers' Choice Winner in August 2020 and

continued five star TripAdvisor(TM) ratings across the UK

estate

-- Transition to new, lower cost games supplier and installation

of first fully modular games in Watford

-- COVID-19 closures of all UK sites resulted in 45% of

available days lost and restrictions impacted a further 36% of

available trading days

-- Estimated 40% of trading days lost by franchise estate due to

COVID-19 closures and a further 42% of days operating under

COVID-19 restrictions

-- Successful launch of digital and remote play propositions

-- Acquisition of Middle East master franchise, including owner-operated site in Dubai

POST YEAR

-- Full UK lockdown enforced shortly after Christmas 2020 with UK sites re-opened on 17 May 2021

-- Acquisition of French and Belgian master franchise including

owner-operated sites in Paris and Brussels

-- Placing to raise GBP1.3m (after expenses) in January 2021 to

fund French and Belgian acquisition and provide further working

capital

-- Majority of French franchise agreements extended for further six years

-- Kingston opened on May 17, taking the owned and operated estate to 17 sites

-- Heads of terms agreed on site in Milton Keynes; legals close to completion

-- Work commencing shortly at new site in Lakeside

-- Inclusive of Milton Keynes and Lakeside, owner operated

estate will have grown 111% compared to 31 Dec 2019

-- Digital and downloadable sales continuing to perform,

generating GBP92k revenue in the 3 months to 31 March 2021.

-- GBP1.0m convertible loan note facility put in place to

provide further flexibility to continue UK roll-out in the event of

further lockdown restrictions or continued adverse impact on

trading from COVID-19

Richard Harpham, Chief Executive of Escape Hunt, commented :

"We are delighted that our UK sites have finally been able to

re-open and are excited to be building on the substantial strategic

progress we have been able to make in the last year,

notwithstanding the extremely tough conditions brought about by

Covid-19. Escape Hunt is in a much stronger position today than it

was twelve months ago, and subject to reasonable assumptions on

demand returning, we are confident that we now have a platform

established capable of supporting a profitable business. We have

significantly grown our owner-operated estate, launched our digital

and remote-play propositions, made progress with our franchisees,

and re-capitalised the business. We are hopeful that consumer and

corporate demand will return strongly in the coming months and look

forward with cautious optimism."

This announcement is available on the Company's website,

https://escapehunt.com/investors/

Enquiries

Escape Hunt plc

Richard Harpham (Chief Executive Officer)

Graham Bird (Chief Financial Officer) +44 (0) 20 7846

Kam Bansil (Investor Relations) 3322

Shore Capital - NOMAD and Joint Broker

Tom Griffiths, David Coaten (Corporate Advisory) +44 (0) 20 7408

Fiona Conroy (Corporate Broking) 4050

Zeus Capital - Joint Broker

John Goold +44 (0) 20 3829

Daniel Harris 5000

IFC Advisory - Financial PR

Graham Herring

Tim Metcalfe +44 (0) 20 3934

Florence Chandler 6630

About Escape Hunt plc

The Escape Hunt Group is a global leader in providing

escape-the-room experiences delivered through a network of

owner-operated sites in the UK, an international network of

franchised outlets in five continents, and through digitally

delivered games which can be played remotely. Its products enjoy

consistent premium customer ratings and cater for leisure or

teambuilding, in small groups or large, and are suitable for

consumers, businesses and other organisations. Having been

re-admitted to AIM in May 2017, the Company has a strategy of

creating high quality premium games and experiences delivered

through multiple formats and which can incorporate branded IP

content. (https://escapehunt.com/)

Facebook: EscapeHuntUK

Twitter: @EscapeHuntUK

Instagram: @escapehuntuk

Chairman's Statement

2020 was undoubtedly the most difficult year for the leisure

industry in recent history, with government enforced closures

impacting businesses in all parts of the world. Notwithstanding the

challenges, the Company has used the time productively, launching

new digital and play-at-home products, significantly expanding its

UK owner-operated estate, establishing improved games manufacturing

and installation processes, progressing the potential for the

business in North America, and acquiring the Middle East master

franchises along with negotiating the acquisition of the French and

Belgian master franchises. As a result, the Group finds itself

significantly better positioned for the future than was the case a

year ago.

The progress would not have been possible without the support of

stakeholders at all levels. Firstly from our shareholders who have

demonstrated their belief in the future of the business, supporting

a GBP4.3m fund raise in July 2020 to provide development and

working capital, and a further GBP1.4m fund raise after the year

end in January 2021 to support the acquisition of our French and

Belgian master franchisee and to provide further working capital.

The Group has also been able to benefit from a number of government

support schemes put in place to help businesses through the

COVID-19 pandemic. Cash has been preserved through effective use of

these schemes and careful management of costs, whilst investment in

new sites has continued. I would also like to extend my thanks to

all our employees who have had to endure through uncertain and

difficult circumstances. Many have spent large portions of the last

year on furlough, whilst all have had to cope with significant

changes to the working environment. Throughout the period they have

continued to work with passion and enthusiasm, helping deliver

innovative new games to support our strategy, implementing the

social distancing requirements at our sites, and accepting changes

to their working conditions. During the first lockdown, all our

head office staff agreed to a pay reduction whilst continuing to

work, a sacrifice which was enormously helpful and appreciated. A

number of our landlords agreed concessions on rent, allowing

deferred or reduced rents, whilst number of our suppliers reduced

or deferred costs. Their support was likewise both welcome and

valued.

Outside of the obvious adverse impact of COVID-19, the Company

delivered on a number of important milestones, further details of

which are provided in the sections of the strategic report that

follow. Importantly costs were managed carefully and cash preserved

where possible, leaving the Company in a stronger position to take

advantage of a return of demand once Government restrictions are

lifted and sites are re-opened. A few highlights from the period in

question are worth mentioning:

-- Strong trading from 1 January 2020 to 29 February 2020 with

revenue and owner-operated site performance comfortably ahead of

the Board's expectations

-- Careful cash management and encouraging return of demand after lockdowns when sites were open

-- Adjusted Group EBITDA loss reduced by 15% to GBP1.45m from GBP1.71m despite Covid closures

-- Raised GBP4.0m net of expenses through an equity placing and

open offer, share subscription, and convertible loan note issue in

July 2020

-- Successful launch of digital and other play at home products

generating revenue of GBP230k (2019: nil)

-- In the year to 31 December 2020, the owner-operated estate

expanded by 56% to 14 sites (2019: 9 sites) including the

acquisition of Dubai

-- Constructive progress within our franchise estate, both in the US and the rest of the world

-- Post year end completion of a new site in Kingston,

acquisition of the France and Belgium master franchises together

with GBP1.4m fundraise by way of an equity placing

The year started positively, with both our owner-operated and

franchise estates entering January 2020 on the back of strong sales

performances over Christmas. Performance in the period before

Covid-19 restrictions came into effect was ahead of the Board's

expectations.

In March, the onset of COVID-19 forced immediate action which

saw significant cost cuts and a period in which the business was

effectively put into hibernation. The team worked proactively to

launch new products which could be played remotely, initially

launching a range of print-and-play games, followed by

'zoom-in-a-room' and other digital propositions. We have been

pleased with the success of these products and it is our

expectation that they will continue to be an important part of our

portfolio of games in future.

At the same time, significant effort was put into seeking

further investment to secure the future of the Company. In July we

were delighted to raise GBP4.3m (GBP4.0m net of expenses) through

an issue of new equity and convertible loan notes which was

supported by our major shareholders as well as a number of new

investors who joined the register. At the same time, the Board

announced a five-point plan as follows to build shareholder

value.

1. Roll-out of our owner-managed network through direct investment

2. Sustain and support growth in performance from our existing franchise network

3. Deliver the US franchise opportunity in partnership with PCH

4. Enhance returns and margins through broadening our product set and target audience

5. Investment in infrastructure and operations to improve efficiency and scalability

I am pleased to report good progress in all of these objectives,

details of which are given in the sections of the strategic report

that follow.

The Board saw a number of changes during the year. Graham Bird

joined as Chief Financial Officer on 3 January 2020 and has worked

extremely well with the existing team, playing an important role in

securing the support of our shareholders in the two fund-raises

whilst adding significant additional experience and capability to

our senior leadership team. Adrian Jones, who was one of the

original management team which established Escape Hunt prior to its

acquisition by Dorcaster and Admission to AIM in 2017, stepped down

from the Board as a Non-Executive Director at the end of May 2020.

At the end of September 2020, we welcomed John Story to the Board

in his place as a Non-Executive Director.

We took steps to ensure that our key employees are aligned with

shareholders, implementing a new executive share incentive scheme

in July 2020. Since the year end, we have implemented a wider

scheme available to all our employees in the UK which will enable

anyone working for the Company to acquire shares in a tax efficient

manner and to be rewarded with matching share awards after a three

year holding period.

The pace at which the vaccination programme is being rolled out

in the UK and the reduction in serious cases of the disease

together with the fact that our UK sites have been able to open on

17 May 2021 as was initially indicated by the Government sets a

positive outlook. Evidence on re-opening after the 2020

spring/summer lockdown was very encouraging and, as a result, the

Board is hopeful that both consumer and corporate demand will

return strongly when the restrictions currently in place are

lifted. At the same time, property market conditions in the UK are

increasingly favourable for those seeking to take on new space and

the Company has been able to capitalise upon that opportunity.

There is clearly a growing demand for experiential leisure and the

Board has been actively exploring ways to broaden our sphere of

activities.

In February 2020, the Company had 9 Escape Hunt branded

owner-operated sites, all in the UK. Post year end, the completion

of the acquisition of our French and Belgian master franchises and

the build-out at Kingston, has expanded the network to 17. Heads of

terms have been signed for a site in Milton Keynes and, in

addition, the Company has carved out a space at a unit at the

Lakeside shopping centre in Essex which was previously trading as

Market Halls. These two further sites will potentially become the

Company's 18(th) and 19(th) owner operated sites respectively.

Further sites are now also in contemplation. When we raised money

in July 2020 we set a target of 20 owner-managed sites within two

years. We expect to achieve this before the end of 2021, six months

ahead of our target. Importantly, with the footprint already

established, the Directors believe that once new site performance

has matured and conditions and demand have normalised post

COVID-19, the Escape Hunt network should be capable of supporting

positive EBITDA and positive cash generation, subject to reasonable

assumptions in other areas of the Group.

On the international front, the Board is excited about the

potential of bringing the French and Belgian master franchises

in-house alongside the Middle East business which was acquired in

September 2020, and the progress being made in the US with partners

Proprietors Capital Holdings, is encouraging. Whilst a small number

of the Company's existing international franchise network look like

they will not survive the challenges of the pandemic, the

opportunity for the other parts of the network to rejuvenate after

COVID-19 is now much closer to being a reality.

Finally, the significant progress made by the Company in

establishing digital and other play-at-home products has provided a

new, scalable revenue stream and growth opportunity, which the

Directors expect to remain an important part of the product suite

in the future.

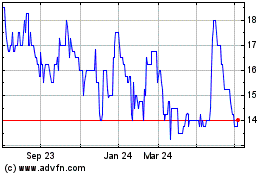

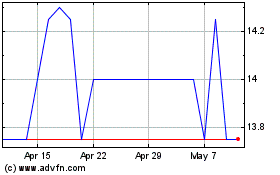

We are still at an early stage in delivery against the

objectives we set in July last year. However, it has been very

pleasing to see a positive response by the markets so far. Money

was raised at 7.5p per share in July 2020 whilst the placing

conducted in January 2021, partly to fund the French acquisition,

was completed at 17.5p per share.

We remain confident that we have a valuable business and that if

we deliver on our objectives, we have an opportunity to create

significant further value for our shareholders. As a result,

notwithstanding the continued uncertainty that the coming weeks and

possibly months hold for the whole leisure industry, the Board has

reason to look forward with cautious optimism.

Richard Rose

Chairman

17 May 2021

Chief Executive's Report

Notwithstanding the huge disruption caused by COVID-19, the

Group ended the year in a significantly stronger position than

before the onset of the crisis, and much better placed to benefit

from a return of demand. Throughout the year, the team continued

work on delivering the strategic plans across all five areas

identified. With the benefit of the COVID-19 related Government

support schemes, the outturn for the year was better than expected

given the pro-longed enforcement of restrictions.

Importantly, the expansion of the Group's owner-operated network

together with the launch of our digital and other remote-play

products has created a platform which we believe is capable of

supporting a profitable, cash-generative group, once COVID-19

restrictions are removed, trading normalises, new sites have

matured and subject to reasonable assumptions in other parts of the

business.

Owner-Operated site performance

Revenue from our owner-operated sites fell 46% to GBP2.1m (2019:

GBP3.8m), inclusive of digital and remote-play turnover of GBP230k

(2019: GBPnil). The fall in revenue reflects the significant impact

of both enforced closures and social distancing rules prohibiting

households mixing which were implemented by the UK Government in

response to the pandemic.

Prior to COVID, the first two months of 2020 were very strong

for the business and we saw continued growth across all Escape Hunt

branded UK sites, with target site economics for turnover and

EBITDA contribution being met. Moreover, the like-for-like sales

growth was particularly encouraging, with even the most mature

sites delivering 25% growth vs prior year on a 12 week rolling

basis.

Table 1: Like-for-Like Growth in first two months of 2020

Year-on-Year Growth

(Rolling average period)

Data as at 1 March 2020 4 weeks 12 weeks 24 weeks

------------------------- -------- --------- ---------

First 3 sites 18% 25% 30%

Next 5 sites 70% 99% N/A

All 8 mature sites 44% 59% N/A

-------------------------- -------- --------- ---------

The impact of COVID

Around the second week in March 2020, the impact of COVID-19

began to be felt, culminating in the implementation of the first UK

national lockdown on 23 March 2020.

In July 2020 we raised GBP4.0m (net of expenses) by way of a

placing, open offer, share subscription and convertible loan note

issue. This additional funding enabled the group to continue its

planned roll-out of sites and provided working capital to survive

the pandemic.

Whilst all UK sites were closed during the national lockdowns,

sites were also affected differently during periods when the UK

Government applied a tiered regional approach to restrictions. In

total, we estimate 45% of trading days in the year were completely

lost due to closures and a further 36% of trading days in the year

were impacted by varying levels of restrictions, such as the 'rule

of six', bans on household mixing or other social distancing

measures.

Notwithstanding the restrictions, we were encouraged by the

performance of our sites between July and October, after re-opening

at the end of the first national lockdown. In the first eight weeks

after re-opening, sales grew from an initial level of around 25% of

the equivalent week's sales in 2019 to over 90% of the equivalent

prior year sales in each of the last two weeks of the first

eight-week period. In September, the pace of recovery softened as

expected, notably as the UK Government began to implement

incrementally stringent social distancing and mixing rules.

Nevertheless, revenue inclusive of digital and remote sales over

the week beginning 26 October 2020, which coincided with schools'

half term week, was 25% ahead of the same period in 2019. During

that week, on a like-for-like basis, the Company's eight mature UK

sites traded at 96% of the 2019 level, despite four of the sites

being adversely affected by either the Government's tier 2, tier 3

or the Scottish COVID-related restrictions.

Throughout the year, when sites were open, we continued to

delight our customers. Before the onset of the pandemic, all nine

of our sites had five star ratings on TripAdvisor(TM) and in August

2020, all eight of our sites that had been opened for more than 12

months were named by TripAdvisor(TM) as a Travellers' Choice

Winner. The awards placed all our longer standing sites in the top

10% of attractions worldwide. We were equally delighted that our

then newest site at Birmingham Resorts World, which only opened in

December 2019, was ranked the top attraction in Birmingham and the

West Midlands, and #7 across the whole of the UK. We have continued

to receive positive customer feedback, and at the time of writing,

all our UK sites are five star rated by TripAdvisor(TM).

The strong performance prior to the onset of the pandemic,

coupled with encouraging trading performance after the first

lockdown and positive consumer feedback gave us confidence to

continue with the UK site roll-out strategy we outlined in July

2020. During the year and subsequently, we expanded our Escape Hunt

branded owner-operated estate by 89% from 9 to 17 sites, inclusive

of the acquisitions of our Middle East master franchisee ("EHE

LLC"), and French and Belgian master franchises ("BGP") which

brought sites in Dubai, Paris and Brussels into our owner-managed

estate respectively. All three of these were previously franchised

sites.

We opened a new site in Norwich on 23 September 2020. The site

had originally been planned to be opened in the spring, but had to

be delayed when all capital expenditure was put on hold and

construction work was halted in the first national lockdown. We

were delighted with the performance of the site in the few weeks

during which trading was permitted, as performance was in line with

a number of our mature sites.

Basingstoke was opened on 29 October 2020 only a few days before

the second national lockdown came into force on 3 November 2020.

Trading in its opening three days was the strongest of any of the

Company's new sites to date.

A new site in Cheltenham opened on 3 December 2020. Early

trading was encouraging, although the tiered restrictions and

subsequent closures in the run up to Christmas curtailed any

meaningful launch.

Two additional sites have been able to open in the week

beginning May 17 2021. Watford was completed and was due to open

before the year end, but was prevented from doing so by the

COVID-19 restrictions. Kingston too is now complete, and at both we

have newly recruited teams that are excited to begin welcoming

customers.

Work is soon to begin on a unit in Lakeside shopping centre in

Essex, where Escape Hunt has carved out 4,000 square feet in a

space that was previously trading as Market Halls. Lakeside is a

very high dense and popular retail and entertainment destination,

and the business will be well positioned amid some strong adjacent

operators. The site is expected to open in Q4 2021.

Additionally, we have also ordered games for a further site,

most likely Milton Keynes, where we have agreed heads of terms and

are in the final stages of legal agreements.

Government support through COVID

A total of 152 employees in the Group were registered on the UK

Government's Coronavirus Job Retention Scheme ("CJRS") at some

point during the year to 31 December 2020. Of these, 145 were

employed within the owner-operated segment. The total benefit

received from the CJRS during the year was GBP756k, of which

GBP699k is attributable to the owner-operated segment.

Importantly, the 'flexible furlough' version of the scheme was

critical in ensuring that sites were able to make a positive

contribution when they re-opened but remained subject to

restrictions. This flexibility led us to re-examine our service

contracts to ensure that the business will be able to manage

fluctuations in revenue better in future, when the scheme will no

longer be in place. In November we implemented changes which have

enabled us to convert over 80% of what were previously fixed costs

to variable costs. This change will result in lower break-even

points at all our UK sites and ultimately should lead to higher

operating margins as a result of the better flexibility the changes

afford.

The pandemic has been extraordinarily tough on all kinds of

businesses and people, and many of our owner-operated employees

have spent a large proportion of the year on furlough, facing

uncertainty about the future. However, I have been humbled by the

loyalty and dedication shown by our teams, and am delighted to

welcome everybody back to once again delight our customers as we

reopen.

Franchise network

Our franchise network has had a broadly similar experience of

2020 as our owner-operated segment. Whilst the impact of the

pandemic has differed regionally, turnover from our franchise

network fell 46% to GBP0.6m (2019: GBP1.1m), whilst EBITDA from the

segment fell 18% to GBP297k (2019: GBP361k).

In total, we estimate that our franchisee base lost 40% of their

potential trading days in 2020 to government mandated closures,

whilst a further 42% of trading days would have been impacted by

some form of COVID-19 restrictions.

The pandemic has put many of our franchisees under tremendous

financial strain. In some parts of the world there has been little

or no financial assistance. Sadly, as a result, a number of our

franchisees have closed permanently, including Amman and Jeddah,

and since the year end, two sites in Buenos Aires look certain to

close. Dubai became an owner-operated site, joined by Paris and

Brussels post year end. At the date of writing, we have 29

franchise sites in the estate.

Given the uncertainty from the pandemic, there was little we

could do by way of direct financial assistance to our franchise

network. However, we have provided support by way of relief against

fixed fees whilst franchisee sites have been closed and, in

addition, we have made our digital and remote play propositions

available to the network. Where taken on by the franchisees, these

remote-play products have contributed meaningfully to their

respective underlying performance.

In the USA, progress was slowed by the pandemic, but we have

nevertheless moved forward. We achieved an important milestone when

our first US franchise disclosure document was filed in December

2020. This enables our area representative, PCH through its

subsidiary GoXperia, to begin selling proactively. Since the year

end, we have held our first 'discovery day' for potential

franchisees and conversions in the US, and the pipeline of

potential franchisees is beginning to build. GoXperia has recruited

a senior brand director to augment its team and we remain

optimistic about the potential for the region.

During the year we have invested in our communications and user

journeys for franchisees, introduced new global communications

tools and forums, improved the user experience on our websites,

introduced country level homepages and made other enhancements to

the service provided to the network.

With the majority of our existing franchisee base now converted

to the catalogue approach and our improving level of interaction

and communication with the network, we are again beginning to look

at opportunities to expand our franchise estate, and plan to

leverage the capabilities and experience which have joined the

Group through our Middle Eastern, French and Belgian acquisitions.

Whilst the size of the network has reduced during the pandemic, it

has been pleasing to a number of sites recording strong recovery

performances in the early months of 2021. We have seen sites in

both the Middle East and Australia performing at record levels. We

believe that the changes made during the last year are a step

towards significantly improving the level of service we provide our

franchisees and will, in time, lead to a stronger, larger and more

profitable network.

Content strategy

A year ago we outlined our strategy to broaden our customer mix

and to create games which are not constrained by the size and

capacity of our physical sites.

During the year we introduced three new remote-play formats

including print-and-play, 'zoom-in-a-room' and digital games. In

total, our remote games generated GBP230k of revenue within our

owner-operated network. Of this print-and-play contributed GBP94k

and GBP21k came from 'zoom-in-a-room'. The balance of GBP115k was

almost all earned in December, shortly after launching our digital

products aimed predominantly at the corporate market as part of our

EH for Business proposition.

We currently have 20 remote play products in the portfolio which

we intend to expand further.

We have made progress in building our product set for EH Retail.

As mentioned above, the downloadable print-and-play games have

proved successful and are aimed predominantly at a retail audience.

Whilst we launched our first virtual reality rooms in December 2019

at our site in Birmingham Resorts World, the onset of the pandemic

has meant that it is still too early to judge the full potential of

this format. We have nevertheless established VR rooms at all our

new sites opened since then, bringing the total number of VR rooms

that will be open in May to 7 and eagerly await for the return of

customers. We have also invested in the outdoor formats, utilising

the software license signed in the Autumn, which enables us to

develop our own content for outdoor games.

The success of our digital products in particular, has advanced

our EH for Business proposition. In December we were delighted with

the response from corporates and now have a truly scalable

proposition. In the run up to Christmas performance surpassed our

expectations, as we received over 200 bookings, comprising over

1000 corporate teams and 6000 individuals. The largest single game

had 347 people playing, split between 57 teams playing from

multiple countries.

EH for Brands saw a major success in September when we secured

an agreement with Netflix(TM) to develop a game based on the

Netflix(TM) original film, Enola Holmes(c). The game, which was

free to download, led to c.19k downloads from individuals, many of

whom have since returned and purchased other Escape Hunt products.

We also launched a Doctor Who themed print-and-play game, "The

Hollow Planet" in conjunction with the BBC. This followed the

launch of our newest Doctor Who escape game, "A Dalek Awakens",

which was launched just before the pandemic struck in March 2020.

We plan to roll out further instances of "A Dalek Awakens" at a

number of our new sites.

We are in discussions with other IP owners about forming

partnerships which make sense for both parties, and believe that

there is a role for these types of opportunities. However, we have

also found that games built around IP that is out of copyright,

such as Aladdin and Alice in Wonderland, have proved hugely

successful and are much more cost-effectively deployed. We

therefore expect to continue with a product portfolio which has a

mix of genre, copyright-free IP and bigger brands.

Strategic progress and objectives

In June 2020, the Board set out a five point plan for value

creation which was implemented following our fundraising in July

2020. As set out above, significant progress has been made in all

aspects of the plan since then, placing the business in a

substantially stronger position to benefit from any recovery in

demand when COVID-19 restrictions are lifted.

The progress since July 2020 under each of the five components

of the strategic plan is summarised as follows:

1. Roll out of owner operated sites

-- 89% increase vs 2019 in the size of the Escape Hunt branded

owner-operated estate, including sites acquired and completed post

31 December 2020

o 5 sites completed in the UK

o Acquisition of the Escape Hunt Middle East master franchise,

including Dubai as owner-operated site

o Post year end acquisition of BGP Escape and the resulting

addition of the Paris and Brussels sites to the owner operated

estate

-- Heads of terms signed for Milton Keynes; games ordered

-- Lakeside due to open in Q4 2021; work commencing shortly

-- Expect to achieve target of 20 owner-operated sites by end of 2021, six months ahead of plan

2. US Franchise network progress

-- Franchise disclosure document filed in December 2020

-- Decision to use the Houston site as the 'master site' and education centre for North America

-- Two instances of the new generation games have been ordered

and are in transit to be installed in Houston. A pipeline of both

new and potential conversion franchisees is now in active

development

-- Two ,discovery days' held with potential franchisees

3. International Franchise network progress

-- Acquisition of Middle East master franchise

-- Acquisition of France and Belgium master franchises

-- Australian franchisees moved to catalogue approach with new terms

-- Majority of French franchisees extended to 2027 and moved to catalogue approach

4. New products and markets

-- Launch of first remote-play products, generating GBP230k revenue in 2020

-- Proof of concept for large scale, scalable products

-- Development of 'Escape Hunt for Business' concept

5. Investment in Infrastructure

-- Completion and implementation of software with allows games

masters to manage multiple games at the same time at new sites

Whilst a number of other projects to improve efficiency and

improve scalability have been identified, the Board intends to

delay further work on these until COVID-19 restrictions are

lifted.

Strategic objectives for 2021

The Board plans to build on the success in progressing the

strategic objectives in 2020 and believes that the focus for

delivering growth by continuing to focus on the same objectives. At

the same time, property market conditions in the UK are

increasingly favourable for those seeking to take on new space and

we are therefore actively looking at ways in which we can

capitalise on the opportunity and build our platform to cater for

the growing demand for experiential leisure activities and

engagement. We believe there will be opportunities to expand the

range of products and markets we serve in the wider experiential

market.

We have taken steps to ensure that we can continue to pursue our

strategic objectives notwithstanding the continuing uncertainty

over the ongoing impact of COVID-19 on our trading, or the

possibility of a further temporary lockdown and have therefore

established a GBP1.0m convertible loan note facility with one of

the Company's non-executive directors, John Story. The availability

of this facility ensures we can continue to commit to capital

expenditure in new sites such as Lakeside and Milton Keynes without

the need to preserve cash in the event of further, unforeseen

adverse impacts from COVID-19. There is no obligation to draw any

of the facility. Details of the facility are given in note 35 of

the consolidated financial statements.

Our key performance indicators by which we monitor progress and

performance are set out in the Financial Review below.

Outlook

The pace at which the vaccination programme is being rolled out

in the UK and the reduction in cases attributable to COVID-19

together with the fact that our UK sites have been able to open on

17 May 2021 sets a positive outlook which we have planned for. Many

economic commentators are expecting a strong recovery in the UK

economy in the second half of the year, which would be positive for

Escape Hunt. As mentioned above, evidence on re-opening after the

2020 spring/summer lockdown was very encouraging and, as a result,

the Board is hopeful that both consumer and corporate demand will

return strongly when the restrictions are lifted. At the same time,

property market conditions in the UK are increasingly favourable

for those seeking to take on new space. We have already been able

to benefit from these favourable conditions in recent property

negotiations and the Board is actively looking at further ways in

which the Company can capitalise on the opportunity and build on

the platform to cater for the growing demand for experiential

leisure activities and engagement.

Within Escape Hunt, we are confident we can build on the

progress we have made in our owner-operated estate, and look

forward to working closely with our new colleagues in France and

Belgium and the UAE. We believe all these acquisitions will

contribute meaningfully in future. Progress in the US remains

encouraging, and our challenge now is to provide the level of

support to allow it to reach its true potential, which itself could

be transformational for the business as a whole.

Finally, the significant progress made by the Company in

establishing digital and other play-at-home products has provided a

new, scalable revenue stream and growth opportunity, which we

expect to remain an important part of our product suite in the

future.

As a result, notwithstanding the continued uncertainty that the

coming weeks and possibly months hold for the whole leisure

industry, the Board has reason to look forward with cautious

optimism.

Richard Harpham

Chief Executive Officer

17 May 2021

Financial Review

Group Results

Revenue

Group revenue fell by 46% to GBP2.7m from GBP4.9m as a result of

the impact of COVID-19 on both our owner-operated estate and the

franchise network.

Year Year Increase

ended ended / (decrease)

31 December 31 December

2020 2019

GBP'000 GBP'000

New site upfront location

exclusivity fees 122 138 (12%)

Support and administrative

fees 146 221 (34%)

Franchise revenues 309 717 (57%)

Owned branch revenues 2,070 3,832 (46%)

Other 11 7 57%

2,658 4,915 (46%)

------------ ------------ --------------

Owner-operated revenues included GBP230k from digital and remote

play propositions launched during the year and, in aggregate,

constituted 78% of revenue (2019: 78%).

Within the franchise business, recognition of upfront location

exclusivity fees fell modestly, largely as a result of the

termination of a small number of contracts in 2019 which led to the

accelerated recognition of upfront fees in 2019, but revenue

recognised from this source was in line with 2018. Fees linked to

franchise revenues were down 57% compared to the prior year,

reflecting the significant impact of COVID-19 on our network. We

estimate that our franchise network lost 40% of available days

during the year due to full closures, whilst a further 42% of

trading days in the year were impacted by COVID-19 related

restrictions imposed in different parts of the world between March

and December 2020.

Gross profit

Cost of sales includes the variable labour cost at sites and

other direct cost of sales, but not fixed salaries of site staff,

whose costs are included as administration costs. The Board

believes this categorisation best reflects the underlying

performance at sites and provides a more useful measure of the

business.

Gross margin rose from 67% in 2019 to 70% in 2020. The primary

driver of this improvement was the flexible furlough scheme which

was operating when sites were open, which afforded more flexibility

to manage labour costs than previously. As set out above, we have

since made changes to our labour contracts to maintain as much of

this flexibility as possible to safeguard the business against

future, unexpected revenue fluctuations and to lower the breakeven

levels at each site.

Adjusted EBITDA

Group Adjusted EBITDA loss reduced by 15% from GBP1.7m to

GBP1.4m and is a key performance measure for the Group. This

reduction was achieved notwithstanding the significant adverse

impact of COVID-19 on trading. The Adjusted EBITDA result is after

recognising the benefit of GBP135k property-related grant income,

GBP259k of Research and Development claims made under the SME

Scheme, and GBP756k from the Coronavirus Job Protection Scheme

("CJPS"). However, it also includes GBP187k of pre-opening losses

relating to new sites in Norwich, Basingstoke, Cheltenham and

Watford and bad debt provisions relating to historic franchise fees

of GBP105k. Whilst some of this pre-dates the onset of the

Coronavirus pandemic, the financial strain placed on the underlying

franchisees as a result of the pandemic has meant it has become

significantly less likely that we will be able to recover the full

amounts. A reconciliation between statutory operating loss and

Adjusted EBITDA is shown below.

2020 2019 Increase

/ (decrease)

GBP'000 GBP'000 GBP'000

------- ------- -------------

Owner-operated EBITDA - Site level 446 976 (530)

Centrally incurred overheads (69) (99) 30

Other income 186 - 186

------- ------- -------------

Owner-operated EBITDA after central

overheads 563 877 (314)

Franchise EBITDA after central overheads 297 361 (64)

Unallocated central costs (2,305) (2,945) 640

------- ------- -------------

Adjusted Group EBITDA (1,445) (1,707) 262

------- ------- -------------

Operating loss

Group operating loss increased by 7.5% to GBP6.4m (2019:

GBP5.9m). The extraordinary circumstances brought about by COVID-19

in 2020 means that there are several significant items in the 2020

result which might be considered one-off and it is therefore

difficult to draw a meaningful comparison from underlying

performance alone. COVID-related property grants of GBP135k and the

CJPS benefit of GBP756k were received and offset a proportion of

property and employment costs incurred whilst sites were closed. At

total of GBP259k of R&D claims made under the SME Scheme in

respect of 2018 have been recognised, whilst the result also

includes a GBP300k provision against a loan to a franchisee which

is doubtful as the franchisee is expecting to be evicted from its

most profitable site. Further provisions of GBP105k have been made

against other franchisee balances due to their impaired financial

position.

2020 2019

GBP'000 GBP'000

Operating loss (6,367) (5,932)

Amortisation of intangibles 2,299 2,124

Depreciation 1,819 1,733

Rent concessions recognized (22)

Depreciation of right of use

assets 380 347

Loss on disposal of assets 30 -

Branch closure costs 52 -

Provision against loan to franchisee 300

Exceptional professional fees 35 7

Foreign currency losses 1

Share-based payment expense 29 12

Adjusted Group EBITDA (1,445) (1,707)

------- -------

Owner-Operated sites

Three new sites were opened during 2020, whilst a further site

had been scheduled to open before the year end, but was unable to

do so due to Coronavirus restrictions. These new sites contributed

GBP72k to revenue, whilst incurring a total of GBP186k costs before

they were open. In addition, an existing franchise site in Dubai

was acquired and has become an owner managed site and is included

in the owner-operated result for three months, contributing GBP57k

to revenue. Digital and other remote-play products are also

included in the owner-operated

site revenue and contributed GBP230k to the segment revenue. As mentioned above, revenue from our owner-operated sites fell to GBP2.1m from GBP3.8m in 2019.

Site level EBITDA fell 55% to GBP446k from GBP976k in 2019,

driven by the COVID-19 restrictions and closures, but also impacted

by a number of one-off items as described above. Total site labour

as a percentage of total sales is, under normal circumstances, a

key performance indicator. Although nominally the ratio was 41.7%

for the year, a further improvement on 2019, it is not considered

meaningful in the context of irregular sales and the operation of

the flexible operation of the CJRS. Whilst the costs were

controlled, the ratio is not meaningful in comparison to 2019.

Franchise estate

Revenue from our franchise estate fell 46% to GBP577k. We were

able to reduce the costs directly associated with managing our

franchise estate such that adjusted EBITDA from our franchise

estate fell only 18% to GBP297k from GBP361k in 2019. Following the

acquisition in the year and some further rationalisation of our

franchise estate, t he number of active franchisees at the end of

the year was 35 which compares to 40 at the end of 2019. Since the

year end, a further two sites have been acquired and will form part

or our owner-operated estate, and there have been further

rationalisations driven by the pandemic. The number of active

franchisees at the date of this report is 29.

Central overheads

In March 2020, the Company took immediate action to reduce

overheads and defer capital expenditure to preserve cash as the UK

went into its first national lockdown. We were able to maintain

many of the cost savings implemented during the first lockdown such

that the centrally incurred overhead costs, including costs

allocated to the owner-operated and franchise segments, reduced to

GBP2.8m from GBP3.9m in 2019. Whilst we expect to retain some of

the benefit of the cost savings on an ongoing basis, the savings

include GBP56k from CJRS grants which will not continue once the

scheme ends and other costs will also return as business activity

normalises.

Cashflow and capital expenditure

Cash and cash equivalents at the year-end was GBP2.7m (2019:

GBP2.2m).

In July 2020, the Company raised GBP4.0m (net of expenses)

through a placing, open offer, share subscription and convertible

loan note issue. Hence, total cash used during the year was

GBP3.5m. EBITDA losses absorbed approximately GBP1.5m whilst

working capital movements released GBP0.6m. We expect this to

reduce in future as the benefit of deferred rent and taxes is

caught up. Hence the net cash used in operations was restricted to

GBP0.9m.

The total deferred rentals and HMRC payments at the year end

which are expected to be caught up in the course of 2021 was

GBP299k.

GBP2.0m was utilised for capital investment, of which GBP1.8m

was on property plant and equipment, including new games and site

fit out, and GBP0.2m on intangibles, much of it capitalised staff

costs. The majority of this expenditure was for the new sites at

Norwich, Basingstoke, Cheltenham and Watford, but also including

the production of the new Doctor Who game, "A Dalek Awakens"

launched in Reading and Birmingham Resorts World in March 2020.

The balance (GBP0.5m) was property rental which under IFRS 16 s

accounted for as repayment of finance leases and interest, together

with other sundry items.

Return on capital is a key performance measure for the Company,

with each site being commissioned based on an anticipated cash

return on investment, payback and net present value generated.

Key Performance Indicators

The Directors and management have identified the following key

performance indicators ('KPIs') that the Company tracks. These will

be refined and augmented as the Group's business matures :

-- Numbers of owner-operated sites

-- Numbers of franchised sites

-- Site level revenue and like-for-like growth

-- Site level EBITDA

-- Adjusted EBITDA for the Group

-- Head office costs

The Company monitors performance of the owner operated sites on

a weekly basis. Investment is being made into data management

solutions which will provide faster and easier access to management

information across sites. The Board also receives monthly updates

on the progress on site selection, site openings and weekly as well

as monthly information on individual site revenue and site

operating costs. Monthly management accounts are also reviewed by

the Board which focuses on revenue, site profitability and adjusted

EBITDA as the key figures within the management accounts.

Both the number of franchised branches as well as their

financial performance are monitored by the management team and

assistance is provided to all branches that request it in terms of

marketing advice as well as the provision of additional games.

The Group changed its approach in 2018 to issuing new franchises

to focus on its Master Franchisees as well as larger, well

capitalised businesses which can open large numbers of owner

operated branches. The agreement signed with PCH in the US in

September 2019 is the first agreement signed since this new

approach. Since then, the Group has bought the master franchises in

the Middle East, France and Belgium in-house. The acquisitions have

brought these regions closer to the business' core, giving greater

control over the future strategic direction. In each of these

cases, the core management teams have been retained and provide

monthly performance updates to the Group senior leadership

team.

The key weekly KPIs by which the UK and owner-operated business

is operated are the site revenue, marketing spend and staff costs

and consequent ratio of staff costs to revenue. Total revenue is

tracked against budget, adjusted for seasonality, number of rooms

open and the stage in the site's maturity cycle. Staff costs are

measured against target percentages of revenue. The effectiveness

of marketing is assessed by observing revenue conversion rates and

the impact on web traffic, bookings and revenue from specific

marketing campaigns. With effect from January 2021, management of

digital marketing will be brought in-house with the requisite

skills being developed within the team.

The Company's systems track performance on both a weekly and a

monthly basis. These statistics provide an early and reliable

indicator of current performance. The pro tability of the business

is managed primarily via a review of revenue, adjusted EBITDA and

margins. Working capital is reviewed by measures of absolute

amounts.

Graham Bird

Chief Financial Officer

17 May 2021

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF ESCAPE HUNT PLC

Opinion

We have audited the financial statements of Escape Hunt PLC (the

"Parent Company") and its subsidiaries (the "Group") for the year

ended 31 December 2020, which comprise the:

-- Consolidated statement of comprehensive income;

-- Consolidated and Parent Company statement of financial position;

-- Consolidated and Parent Company statement of changes in equity;

-- Consolidated statement of Cash Flows;

-- the notes to the Consolidated and Parent Company financial

statements, including a summary of significant accounting

policies;

The financial reporting framework that has been applied in the

preparation of the Group financial statements is applicable law and

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. The financial reporting framework that has been

applied in the preparation of the Parent Company financial

statements is applicable law and United Kingdom Accounting

Standards, including Financial Reporting Standard 102 The Financial

Reporting Standard applicable in the UK and Republic of Ireland

(United Kingdom Generally Accepted Accounting Practice).

In our opinion:

-- the financial statements give a true and fair view of the

state of the Group's and of the Parent Company's affairs as at 31

December 2020 and of the Group's loss for the period then

ended;

-- the Group financial statements have been properly prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union;

-- the Parent Company financial statements have been properly

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

'Auditor's responsibilities for the audit of the financial

statements' section of our report. We are independent of the Group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

We obtained management's assessment of the impact of Covid-19 to

the business of the Group and the forecast financial

projections.

Management prepared three main scenarios for the future business

following the planned re-opening of sites in the UK. As part of

their assessment, the following scenarios were presented:

-- a central case where sales levels recover by the end of

August 2021, where there is no impact on the capacity or occupancy

levels, no further lockdowns or major restrictions and the UK site

roll-out continues in accordance with plans previously

announced;

-- a central conservative case where the scenario assumes no

debt facility, no further opening of sites in 2021 other than those

already contracted, the remaining assumptions remain the same as

the central case presented above;

-- a downside where franchise revenues take longer to return to

pre-lockdown levels, planned UK site expansion is reduced, US

Franchise expansion is delayed, sites in the UK do not reopen until

mid-June, sales in the UK do not recover until the end of October

2021 and there is a permanent 5% reduction in capacity enforced on

the business until the end of 2023.

In all scenarios the group has surplus working capital following

the share issue in the year to meet its working capital

requirements for the foreseeable future.

We performed audit procedures, including challenge regarding

reasonableness on the inputs into the model as follows:

-- reviewed the revised forecast revenues and resulting cash

flows within the assessment period;

-- compared the forecast to available management information for the business post year end;

-- considered the overall impact on the forecast of those parts

of the business, such as franchises, were these are likely to be

significantly impacted by slower vaccination rollouts and the

restart of business due to health and safety requirements enforced

on the business;

-- considered the timing and financial impact of reduced support

mechanisms instigated by government, including the Coronavirus Job

Retention Scheme and business rates relief; and

-- reviewed and challenged the financial impact of the steps

taken by the directors to protect and manage the business during

the coming period, including the expected initial reduction across

the business following re-opening, reduced government support and

the impact of delay to planned capital investment projects.

We considered management's sensitivity analysis and also

performed an additional range of sensitivities to assess whether a

reasonably likely change to a key input would result in an erosion

of the revised headroom on working capital availability in the

downside model used by management.

We tested to ensure the mathematical accuracy of the model

presented.

We reviewed the appropriateness of the disclosures made and its

consistency with our knowledge of the business as well as the

impact of Covid-19 on the business as part of management's

assessment.

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

Group's and the Parent Company's ability to continue as a going

concern for a period of at least twelve months from when the

financial statements are authorised for issue.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Overview of our audit approach

Materiality

In planning and performing our audit we applied the concept of

materiality. An item is considered material if it could reasonably

be expected to change the economic decisions of a user of the

financial statements. We used the concept of materiality to both

focus our testing and to evaluate the impact of misstatements

identified.

Based on our professional judgement, we determined overall

materiality for the Group financial statements as a whole to be

GBP115,000 (2019: GBP100,000), based on approximately 5% (2019: 5%)

of EBITDA. As the group is in an early stage of trading this is

used as a key figure of investors to demonstrate the underlying

trading performance.

We use a different level of materiality ('performance

materiality') to determine the extent of our testing for the audit

of the financial statements. Performance materiality is set based

on the audit materiality as adjusted for the judgements made as to

the entity risk and our evaluation of the specific risk of each

audit area having regard to the internal control environment.

Where considered appropriate performance materiality may be

reduced to a lower level, such as, for related party transactions

and directors' remuneration.

We agreed with the Audit Committee to report to it all

identified errors in excess of GBP5,500 (2019: GBP2,500). Errors

below that threshold would also be reported to it if, in our

opinion as auditor, disclosure was required on qualitative

grounds.

Parent Company materiality was assessed as GBP55,000 based on

approximately 5% of its EBITDA.

Overview of the scope of our audit

There are seven components of the Group located and operating in

the United Kingdom, the audits of Escape Hunt PLC and its UK

subsidiary undertakings were conducted from the UK by the

engagement team. Financial information from other components not

considered to be individually significant individually was subject

to limited review procedures carried out by the audit team.

Key Audit Matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) that we identified. These matters included those which had

the greatest effect on: the overall audit strategy, the allocation

of resources in the audit; and directing the efforts of the

engagement team. These matters were addressed in the context of our

audit of the financial statements as a whole, and in forming our

opinion thereon, and we do not provide a separate opinion on these

matters.

We identified going concern as a key audit matter and have

detailed our response in the conclusions relating to going concern

section above.

This is not a complete list of all risks identified by our

audit.

Key audit matter How the scope of our audit addressed

the key audit matter

Revenue recognition Our audit procedures included the

Note 4 of the Group financial statements following:

The group has various streams of revenue. We carried out procedures to test

The main source of revenue relates each different revenue stream and

to game revenue where revenue is recognised to consider whether the revenue recognition

at the point of sale. Other streams policy applied to the revenue stream

such as franchise income where there was appropriate, having regard to

is an ongoing contractual term and the contractual terms and obligations.

obligation and recognised over the We agreed the performance obligations

contractual term as the obligations identified by management to a sample

are satisfied. Errors in revenue recognition of contracts to ensure the adopted

could materially influence, the view accounting policy was appropriate.

of a user of the financial statements. For a sample of transactions, we obtained

contracts with the franchisee and

As a key reporting metric, revenue reviewed their terms and conditions.

is also subject to the risk of fraudulent Based on this understanding, we considered

misrepresentation to achieve a certain if the underlying income was recognised

accounting presentation. in accordance with the stated accounting

policy and IFRS 15.

During the year, to gain assurance

of completeness of income recognised.

Members of the audit team played two

games remotely putting transactions

into the system which we followed

up during our testing.

-------------------------------------------------------------

Impairment of intangible assets (including We obtained management's assessment

goodwill) of impairment and discussed the key

Note 12 of the Group financial statements inputs into the assessment with management.

The Group's intangible assets comprise We performed audit procedures, including

of intellectual property, trademarks, challenge regarding reasonableness

franchise agreements, goodwill and on the inputs into the model as follows:

the portal. * the forecast cash flows within the assessment period;

The total carrying value of the intangible

assets was GBP0.9m at 31 December

2020 (31 December 2019: GBP2.9m). * the expected growth rate; and

The continued losses and the impact

of Covid-19 indicate there could be

an impairment in the carrying value * the discount rate applied to the forecast.

of the intangible assets and as such

we considered this to be a key audit

matter. We reviewed management's assessment

to ensure that expected reductions

in trading levels for the continued

Covid-19 restrictions have been taken

account.

We considered management's sensitivity

analysis and also performed an additional

range of sensitivities to assess whether

a reasonably likely change to a key

input would result in an impairment

charge;

We tested to ensure the mathematical

accuracy of the model presented; and

We reviewed the appropriateness of

the disclosure made and its consistency

with our knowledge of the impairment

assessment.

-------------------------------------------------------------

Our audit procedures in relation to these matters were designed

in the context of our audit opinion as a whole. They were not

designed to enable us to express an opinion on these matters

individually and we express no such opinion.

Other information

The directors are responsible for the other information

contained within the annual report. The other information comprises

the information included in the annual report, other than the

financial statements and our auditor's report thereon. Our opinion

on the financial statements does not cover the other information

and, except to the extent otherwise explicitly stated in our

report, we do not express any form of assurance conclusion

thereon.

Our responsibility is to read the other information and, in

doing so, consider whether the other information is materially

inconsistent with the financial statements or our knowledge

obtained in the audit or otherwise appears to be materially

misstated. If we identify such material inconsistencies or apparent

material misstatements, we are required to determine whether this

gives rise to a material misstatement in the financial statements

themselves. If, based on the work we have performed, we conclude

that there is a material misstatement of this other information, we

are required to report that fact.

We have nothing to report in this regard.

Opinion on other matter prescribed by the Companies Act 2006

In our opinion based on the work undertaken in the course of our

audit

-- the information given in the strategic report and the

directors' report for the financial year for which the financial

statements are prepared is consistent with the financial

statements; and

-- the strategic report and directors' report have been prepared

in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In light of the knowledge and understanding of the Group and the

Parent Company and their environment obtained in the course of the

audit, we have not identified material misstatements in the

strategic report or the directors' report.

We have nothing to report in respect of the following matters

where the Companies Act 2006 requires us to report to you if, in

our opinion:

-- adequate accounting records have not been kept by the Parent

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- the Parent company financial statements are not in agreement

with the accounting records and returns; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of the directors for the financial

statements

As explained more fully in the directors' responsibilities

statement set out on page 37 the directors are responsible for the

preparation of the financial statements and for being satisfied

that they give a true and fair view, and for such internal control

as the directors determine is necessary to enable the preparation

of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the Group's and Parent Company's ability

to continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

Group or the Parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below:

We gained an understanding of the legal and regulatory framework

applicable to the Company and Industry in which the company

operates, and considered the risk of acts by the Company which were

contrary to applicable laws and regulations, including fraud. These

included but were not limited to compliance with Companies Act

2006, Listing rules and Tax legislation.

Our procedures involved enquiries with management, review of the

reporting to the directors with respect to compliance with laws and

regulation, review of board meeting minutes and review of legal

correspondence.

We focused on laws and regulations that could give rise to a

material misstatement in the Company financial statements. Our

tested included by were not limited to:

-- agreement of the financial statement disclosures to underlying supporting documentation;

-- enquiries of management;

-- testing of journal postings made during the year to identify

potential management override of controls;

-- review of minutes of board meetings throughout the period; and

-- obtaining an understanding of the control environment in

monitoring compliance with laws and regulations.

Our audit procedures were designed to respond to risks of

material misstatement in the financial statements, recognising that

the risk of not detecting a material misstatement due to fraud is

higher than the risk of not detecting one resulting from error, as

fraud may involve deliberate concealment by, for example, forgery,

misrepresentations or through collusion. There are inherent

limitations in the audit procedures performed and the further

removed non-compliance with laws and regulations is from the events

and transactions reflected in the financial statements, the less

likely we are to become aware of it.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities. This

description forms part of our auditor's report.

Use of our report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Matthew Stallabrass (Senior Statutory Auditor)

for and on behalf of

Crowe U.K. LLP

Statutory Auditor

London

17 May 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the Year Ended 31 December 2020

All figures in GBP'000s Year ended Year ended

31 December 31 December

Continuing operations Note 2020 2019

Revenue 4 2,658 4,915

Cost of sales 6 (778) (1,279)

Gross profit 1,880 3,636

Other income 34 394 -

Administrative expenses 6 (8,641) (9,568)

Operating loss 6 (6,367) (5,932)

Adjusted EBITDA (1,445) (1,707)

Amortisation of intangibles 12 (2,299) (2,124)

Rent concessions recognised in the

year 11 22 -

Depreciation of property plant and

equipment 10 (1,819) (1,733)

Depreciation of right-of-use assets 11 (380) (347)

Loss on disposal of tangible assets 10 (23) -

Loss on disposal of intangible assets 12 (7) -

Branch closure costs (52) -

Provision against loan to franchisee 15 (300) -

Costs arising from subsidiary liquidation (35) (7)

Foreign currency gains / (losses) - (1)

Share-based payment expense 25 (29) (12)

----------- -----------

Operating loss (6,367) (5,932)

------------------------------------------ ---- ----------- -----------

Gain on disposal of subsidiary 13 - 30

Interest (charged)/received (17) 33

Lease finance charges 20 (180) (171)

Loss before taxation (6,564) (6,040)

Taxation 8 (15) (4)

Loss after taxation (6,579) (6,044)

Other comprehensive income:

Items that may or will be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations (62) (30)

Total comprehensive loss (6,641) (6,074)

Loss attributable to:

Equity holders of Escape Hunt plc (6,579) (5,993)

Non-controlling interests - (51)

----------- -----------

(6,579) (6,044)

Total comprehensive loss attributable

to:

Equity holders of Escape Hunt plc (6,641) (6,023)

Non-controlling interests - (51)

----------- -----------

(6,641) (6,074)

----------- -----------

Loss per share attributable to equity

holders:

Basic and diluted (Pence) 9 (12.36) (24.78)

----------- -----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2020

As at As at

31 December 31 December

Note 2020 2019

GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 10 3,885 3,935

Right-of-use assets 11 2,940 2,470

Intangible assets 12 913 2,906

Rent deposits 26 26

Loan to franchisee 15 2 300

7,766 9,637

Current assets

Inventories 17 16 12

Trade receivables 16 182 370

Other receivables and prepayments 16 691 473

Cash and cash equivalents 18 2,722 2,171

3,611 3,026

TOTAL ASSETS 11,377 12,663

LIABILITIES

Current liabilities

Trade payables 19 606 317

Contract liabilities 21 441 360

Lease liabilities 20 489 304

Other payables and accruals 19 815 948

2,351 1,929

Consolidated Statement of Financial Position

As at 31 December 2020 (continued)

As at As at

31 December 31 December

2020 2019

Note GBP'000 GBP'000

Non-current liabilities

Contract liabilities 21 152 262

Provisions 22 128 74

Convertible loan notes 25 289 -

Lease liabilities 20 3,253 2,298

3,822 2,634

TOTAL LIABILITIES 6,173 4,563

NET ASSETS 5,204 8,100

EQUITY