TIDMESNT

RNS Number : 0946Q

Essentra plc

24 June 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

FOR IMMEDIATE RELEASE

ESSENTRA PLC

A leading global provider of essential components and

solutions

SALE OF PACKAGING BUSINESS TO MAYR-MELNHOF

In line with the previously announced strategic review, Essentra

plc ("Essentra" or the "Company") today announces the disposal of

ESNT Packaging & Securing Solutions Limited and Essentra

Packaging US Inc and their respective subsidiary companies

("Packaging") to Mayr-Melnhof Group ("MM"), a leading producer of

carton board and folding cartons based in Austria, for a cash

consideration of GBP312(1) million, on a cash-free, debt-free basis

and subject to customary adjustments.

The transaction is subject to various conditions which are set

out further below including a shareholder vote for Essentra. The

Class 1 circular and notice of General Meeting will be published in

due course with the transaction set to complete in Q4 2022.

The Board intends to use the proceeds to further strengthen

Essentra's balance sheet, and make a small contribution to

Essentra's defined benefit pension schemes.

The strategic review of Essentra's Filters division is

progressing in line with expectations and, following the conclusion

of this review, the Board will determine the best use of cash on

the Company's balance sheet, carefully taking into consideration

the imperative of maximising shareholder value after allowing for

sufficient flexibility of the Components business to pursue value

creating opportunities.

Commenting on today's announcement, Paul Forman, Chief Executive

said:

"The sale of Packaging marks a significant step on our journey

to become a pure play Components business. A substantial amount of

work has gone into improving the Packaging division over the last

few years and I would like to thank all colleagues for their

commitment and hard work whilst part of Essentra. I wish them all

the best for the future. I am sure that the business will continue

to make excellent progress under the ownership of Mayr-Melnhof.

Essentra has a bright future as a global leading manufacturer

and distributor of components with a clear strategy and significant

opportunities to accelerate growth and expand market share. This

transaction will enhance Essentra's balance sheet strength and

enable the Group to participate in further investment

activity."

Details of the transaction

On 24 June 2022, Essentra International Limited and US NewCo,

LLC (the "Sellers"), MM Packaging GmbH (the "Purchaser") and

Mayr-Melnhof Karton AG entered a Sale and Purchase Agreement,

pursuant to which the Sellers agreed, on the terms and subject to

the conditions of the Sale and Purchase Agreement, to sell

Packaging to the Purchaser.

The consideration payable by the Purchaser at Completion is

GBP312m, subject to adjustments after Completion by way of a

standard completion accounts mechanics to allow for changes in

cash, debt and working capital.

Prior to completion of the transaction, Essentra will undertake

a group reorganisation to achieve the separation of Packaging from

the remainder of the Essentra group by transferring certain assets

that are currently part of Packaging to the retained Essentra group

and transferring certain other assets currently part of the

Essentra group to Packaging.

Under the terms of the Sale and Purchase Agreement, the

Purchaser has irrevocably granted to the UK Seller an option (the

"Put Option") to require the Purchaser to purchase the UK Shares

from the UK Seller. The Put Option may be exercised within five

business days following the date on which the information and

consultation process with the works council of Essentra Packaging

S.a.r.l. is deemed to have completed in accordance with the laws of

France.

The Sellers have given certain warranties and indemnities to the

Purchaser that are customary for a transaction of this nature and

size. These include, among other things, warranties that the

Sellers own the shares in the Target Companies free and clear from

any encumbrances and that each Seller has the requisite power and

authority to enter into and perform the Sale and Purchase Agreement

and other Transaction Documents. The Sellers' warranties also

include statements regarding the UK Shares and the US Shares;

financial statements; material contracts; insolvency; licences;

litigation and compliance with laws; intellectual property,

information technology and business information; property;

environmental matters; employment and incentives; pensions; and tax

affairs.

The transaction is conditional upon various conditions,

including the satisfaction (or waiver, where applicable) of the

following:

-- Approval of a resolution approving the transaction by

shareholders at a General Meeting of Essentra

-- Exercise of the Put Option

-- Completion of the reorganisation

-- Satisfaction of certain regulatory conditions

The Purchaser has agreed to take any and all steps to fulfil the

regulatory conditions at the earliest date.

The Board expects that, subject to the satisfaction and/or

waiver (where applicable) of the conditions precedent to the

transaction, completion will occur in Q4 2022.

The transaction excludes Essentra Packaging's business in India.

Whilst not material to the Group (less than 1% of revenue), the

Company will be reviewing options for this business moving

forward.

For the year ended 31 December 2021, Packaging excluding India

delivered adjusted operating profit of GBP15.8m pre-standalone cost

adjustments, and the gross assets(2) were GBP519.1m.

Class 1 transaction

The transaction constitutes a Class 1 transaction under the

Listing Rules. Completion is therefore conditional upon the

approval of Essentra's shareholders and a Circular will be sent to

the Company's shareholders in due course. Completion is also

subject to customary closing conditions, including anti-trust

clearance in certain jurisdictions.

Credit Suisse International is acting as sole sponsor and

exclusive financial advisor to Essentra plc in regard to the sale

of the Packaging business. Lazard & Co., Limited is acting as

independent financial adviser to the Board of Essentra.

Notes

1. GBP312m implies a multiple of 12.4x based on LTM May EBITDA

of GBP25.2m which includes standalone costs of GBP6.1m

2. The value of gross assets excludes intercompany receivables

and cash which will be settled as part of the transaction

Market Abuse Regulation statement

This announcement contains inside information.

Enquiries

Essentra plc Tulchan Communications LLP

Jack Clarke, Chief Financial Officer Olivia Peters

Claire Goodman, Group Investor Martin Robinson

Relations Manager Tel: +44 (0)20 7353 4200

Lucy Yank, Group Communications

Director

Tel: +44 (0)1908 359100

The person responsible for arranging the release of this

announcement on behalf of the Company is Jon Green, Company

Secretary of Essentra plc.

Cautionary forward-looking statement

This announcement contains forward-looking statements based on

current expectations and assumptions. Various known and unknown

risks, uncertainties and other factors may cause actual results to

differ from any future results or developments expressed or implied

by the forward-looking statement. Each forward-looking statement

speaks only as of the date of this announcement. The Company

accepts no obligation to revise or publicly update these

forward-looking statements or adjust them to future events or

developments, whether as a result of new information, future events

or otherwise, except to the extent legally required.

The release, publication or distribution of this announcement in

jurisdictions other than the United Kingdom may be restricted by

law and, therefore, any persons who are subject to the laws of any

jurisdiction other than the United Kingdom should inform themselves

about, and observe, any applicable requirements. Any failure to

comply with these requirements or restrictions may constitute a

violation of the securities laws or regulations of any such

jurisdiction. This announcement has been prepared for the purposes

of complying with English law and the UK Listing Rules and the

information disclosed may not be the same as that which would have

been disclosed if this announcement had been prepared in accordance

with the laws and regulations of any jurisdiction outside of

England.

No offer or solicitation

This announcement does not constitute or form part of any offer

or invitation to purchase, otherwise acquire, subscribe for, sell,

otherwise dispose of or issue, or any solicitation of any offer to

sell, otherwise dispose of, issue, purchase, otherwise acquire or

subscribe for, any security.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period.

Important information relating to financial advisers

Credit Suisse International ("Credit Suisse"), which is

authorised by the PRA and regulated by the FCA and the PRA in the

United Kingdom, is acting as financial adviser for Essentra plc and

no one else in connection with the transaction only and will not

regard any other person as its client in relation to the

transaction or any other matter referred to in this announcement

and will not be responsible to anyone other than Essentra plc for

providing the protections afforded to clients of Credit Suisse, nor

for providing advice to any other person in relation to the content

of this announcement or any other matter referenced herein.

Neither Credit Suisse nor any of its subsidiaries, branches or

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Credit Suisse in connection with this announcement, any

statement contained herein or otherwise

Lazard & Co., Limited ("Lazard"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively as financial adviser to the Board of Essentra

plc and no one else in connection with the transaction and will not

be responsible to anyone other than the Board of Essentra plc for

providing the protections afforded to clients of Lazard, nor for

providing advice to any other person in relation to the transaction

or any other matters referred to in this announcement. Neither

Lazard nor any of its affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Lazard in connection with this

announcement, any statement contained herein or otherwise.

Notes to Editors

About Essentra plc

Essentra plc is a FTSE 250 company and a leading global provider

of essential components and solutions. Organised into three global

divisions, Essentra focuses on the light manufacture and

distribution of high volume, enabling components which serve

customers in a wide variety of end-markets and geographies.

Headquartered in the United Kingdom, Essentra's global network

extends to 34 countries and includes 8,327 employees, 47 principal

manufacturing facilities, 28 sales & distribution operations

and two research & development centres. For further

information, please visit www.essentraplc.com.

Essentra Components

Essentra Components is a global market leading manufacturer and

distributor of plastic injection moulded, vinyl dip moulded and

metal items. Operating in 25 countries worldwide, 13 manufacturing

facilities and 23 sales & distribution centres serve more than

79,000 customers with a rapid supply of low cost but essential

products for a variety of applications in industries such as

equipment manufacturing, automotive, fabrication, electronics and

construction. The division also includes the Reid Supply business,

which provides a wide range of branded hardware supplies to a broad

base of industrial customers, largely located in the US

Mid-West.

Essentra Packaging

Essentra Packaging is one of only two multicontinental suppliers

of a full secondary packaging range to the health and personal care

sectors, with 23 facilities across three geographic regions. The

division's innovative products include cartons, leaflets,

self-adhesive labels and printed foils used in blister packs, which

help customers to meet the rapidly-changing requirements of these

end-markets and can also be combined with Essentra's authentication

solutions to help the fight against counterfeiting.

Essentra Filters

Essentra Filters is the only global independent cigarette filter

supplier. Currently headquartered in Singapore, the division has 12

sites across nine countries, including two innovation centres,

providing a flexible infrastructure strategically positioned to

serve the tobacco sector. The business supplies a wide range of

value-adding high-quality innovative filters, packaging solutions

to the roll your own segment and analytical laboratory services for

ingredient measurement to the industry: Essentra's offering also

includes Heat Not Burn and e-cigarette solutions to the rapidly

evolving market for Next Generation Products. The division also

includes the Tear Tapes business, which is globally recognised as

the leading manufacturer and supplier of pressure-sensitive tear

tapes, that are largely used in the tobacco, e-commerce, food and

beverage and specialist packaging sectors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISPPUQGQUPPUAC

(END) Dow Jones Newswires

June 24, 2022 02:00 ET (06:00 GMT)

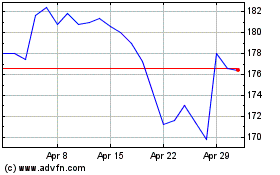

Essentra (LSE:ESNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Essentra (LSE:ESNT)

Historical Stock Chart

From Apr 2023 to Apr 2024