TIDMEST

RNS Number : 8472X

East Star Resources PLC

10 January 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

10 January 2022

East Star Resources Plc

("East Star" or the "Company")

Re-Admission to the London Stock Exchange

East Star, the Kazakhstan-focused gold and copper explorer, is

pleased to announce that it has raised gross proceeds of GBP3.1

million by way of an oversubscribed placing and subscription of

62,000,000 new shares at a price of 5p, and has today been

readmitted to the Official List of the Financial Conduct Authority

by way of a Standard Listing following its acquisition of 100% of

the share capital of Discovery Ventures Kazakhstan Limited ("DVK")

(the "Acquisition"). As a result of the Acquisition, East Star now

owns 100% of DVK.

Trading in the Company's shares will recommence trading at 8.00

a.m. today on London Stock Exchange's Main Market for listed

securities under the ticker 'EST' (ISIN: GB00BN92HZ16).

With effect from today, Mr Charles Wood resigns as a Director of

the Company and Mr Alex Walker and Mr David Minchin join the Board

of Directors of the Company.

Highlights

-- Oversubscribed placing and subscription raising gross proceeds of GBP3.1 million

-- Re-admission to London Stock Exchange following acquisition of DVK

-- DVK holds initial package of four licences in two producing

but underexplored mineral belts in Kazakhstan.

o Chu-Ili belt - high grade historic samples, prospective for

gold and copper

o Rudny Altai belt - copper-zinc potential, in heart of

high-grade volcanic massive sulphide belt

-- Results from initial 3,127m of drilling and 739 km(2) of magnetic survey due in Q1

-- New mineral law (2018) modelled on Western Australia

-- Licences will be held in 80/20 Joint Venture established together with state mining company

-- CEO based full time in Kazakhstan, supported by experienced local team

-- Established logistics

-- Access to historic data and local technical expertise

Alex Walker, Chief Executive Officer, commented:

"Kazakhstan today is like having all of Western Australia

available to peg but in the 1970s. The size is almost the same, the

mineral law is modelled on Western Australia's, and the deposits

discovered are high grade and highly profitable.

Our first mover advantage has enabled us to secure exceptional

tenements where there is already evidence of mineralisation close

to surface but where the potential for discoveries under cover

using modern geophysics is incredibly exciting.

We believe all our projects have large mineral potential without

large mine requirements, and Kazakhstan's existing infrastructure

and operating costs mean a low economic threshold for development.

I have based myself full time in Kazakhstan to drive forward what I

believe represents a once in a generation opportunity in the mining

sector.

I am delighted to bring the Company to the Main Market of London

Stock Exchange today following an oversubscribed fundraising which

will enable us to pursue an intensive exploration programme over

the coming months and years. We will waste no time, with the first

set of drilling results due this quarter, and an expectation that

we will be operational in the field throughout the year."

For further information visit the Company's newly launched

website at www.eaststarplc.com , or contact:

East Star Resources Plc

Alex Walker, Chief Executive Officer

Tel: +44 (0)20 7390 0234 (via Vigo Consulting)

Peterhouse Capital Limited (Corporate Broker and Placing

Agent)

Duncan Vasey / Lucy Williams

Tel: +44 (0) 20 7469 0930

Vigo Consulting (Investor Relations)

Ben Simons / Oliver Clark

Tel: +44 (0)20 7390 0234

About East Star Resources Plc

East Star Resources is focused on the discovery and development

of gold, copper, and base metals in Kazakhstan. With an initial

four licences covering 1,432 km(2) in two mineral rich belts, East

Star is undertaking an intensive exploration programme, applying

modern geophysics to discover gold, copper, and base metals in

levels that were not explored in the Soviet era. The Company also

intends to expand its licence portfolio in Kazakhstan. East Star's

management are based permanently on the ground, supported by local

expertise, and a joint venture with the state mining company.

Follow us on social media:

LinkedIn:

https://www.linkedin.com/company/east-star-resources/

Twitter: https://twitter.com/EastStar_PLC

Kazakhstan - Current Events

On 5 January 2022, the Kazakhstan Government declared a two-week

state of emergency, as a result of political unrest and

anti-government protests.

The Collective Security Treaty Organisation (CSTO) subsequently

announced that a group of peacekeeping forces, led by Russia, would

be dispatched to Kazakhstan to help the Kazakhstan Government

maintain peace and order in the region. On 7 January 2022, the

President of Kazakhstan declared that constitutional order had

mainly been restored in all regions of the country.

The Board is continuing to review and monitor the situation in

Kazakhstan. The Directors do not believe that the current situation

in Kazakhstan is likely to have any adverse impact upon the

Company's proposed operations or its intended strategy, but it will

issue further announcements should circumstances change.

Background to and reasons for the Acquisition and Strategy

East Star was admitted to the standard listing segment of the

Official List on 4 May 2021, having raised gross proceeds of

approximately GBP2 million to pursue its strategy. The Company was

formed to undertake one or more acquisitions of a majority interest

in a company, business, or asset with a focus upon opportunities in

the natural resources sector.

On 19 July 2021, the Company announced the proposed acquisition

of DVK, which has today been completed, following an oversubscribed

placing and subscription of 62,000,000 new shares at a price of 5p

raising gross proceeds of GBP3.1 million.

DVK was formed with the purpose of identifying and developing

gold and base metals projects in prospective regions of Kazakhstan.

Kazakhstan has a rich mining history for gold and base metals but

is relatively underexplored and has lacked modern exploration since

independence from the Soviet Union. The Board believes the

potential exploration and development opportunities offered by the

Company's projects has the potential to generate significant value

for shareholders.

The Company's strategy is built on three main pillars:

-- Identify highly prospective exploration ground and

brownfields projects by its technical team in known mineral

districts with demonstrated historical exploration success and

limited application of modern exploration techniques

-- Develop proven and out-of-the-box concepts for potential

mineral targets and efficiently conduct exploration by application

of state-of-the-art methods and equipment

-- Partner with existing companies via joint venture or farm-in

DVK's management combines a successful team of corporate,

technical, and commercial professionals with an excellent

international track record. DVK and the national mining company,

Tau-Ken Samruk ("TKS"), formed a joint venture which initially

covers four mineral exploration licences totalling 1,432 km(2) ,

across two mineral districts: the Chu-Ili Belt, with its endowment

of orogenic and intrusion-related gold deposits; and the Rudny

Altai Belt with world-class VMS deposits.

In the Chu-Ili Belt, historically gold mineralisation was

discovered either by soil sampling or quartz sampling from the

surface as grab/chip samples from float material, outcrops, or

weathered crust (eluvium). Some substantial and high-grade deposits

were uncovered using these methods including

the Akbakay mining complex containing more than six million

ounces. By targeting areas of existing known high-grade

mineralisation based on historical reports, and adding modern

exploration techniques including magnetics surveys, the Company

expects to realise the potential of these existing areas and

uncover additional data to target new areas in the region.

In the Rudny Altai VMS belt, the majority of VMS deposits in the

region were initially found during historical exploration due to

their surface appearance as outcrops of mineralised rocks and

geochemical soil anomalies related to shallow targets, covered by

thin overburden. The Company expects to use geophysical surveys

such as electromagnetic, gravity and IP to target anomalies without

a surface expression or from previous mines on the licence that

were discontinued as the ore body could not be followed at

depth.

With full time in-country management, East Star expects to grow

its portfolio by pegging additional ground and farming into

licences with credible historical data that show promise for

economic deposits.

Board and Key Management

Alexander ("Sandy") Barblett, Non-Executive Chairman

Sandy Barblett has over 20 years' experience working with

private and public listed international companies. He sits as a

director and advises companies both private and listed on AIM and

the ASX in

relation to raising private equity and general fund raising,

admission onto public markets, strategy and management selection.

Additionally, he has previously held senior leadership roles within

the technology sector, most notably with former FTSE 250 company

Pace Plc. Mr Barblett has a Bachelor of Business from Curtin

University of Technology in Perth, Australia and a Bachelor of Laws

from the University of Queensland; he previously worked for Minter

Ellison as a solicitor.

Alex Walker, Chief Executive Officer

Alex Walker is an investment banker and resources executive with

more than 14 years' experience in

natural resources investment with Norwegian Bank, Pareto

Securities, London-based investment bank, Brandon Hill Capital, and

Australian broking firm Patersons Securities. Mr Walker co-founded

and was the General Manager of ScandiVanadium Ltd. He was also

involved in the process of listing ScandiVanadium Ltd on the

Australian Securities Exchange. Mr Walker holds a MSc in Mineral

and Energy Economics from Curtin University of Technology, Graduate

Diploma of Applied Finance, BComm, BSocSci, and is a Graduate of

the Australian Institute of Company Directors.

Anthony Eastman, Non-Executive Director

Anthony Eastman is a member of the CAANZ and ICAEW and a Partner

at Orana Corporate LLP. Mr Eastman has a number of years'

experience in financial management and corporate advisory services,

primarily in the natural resources sector, along with extensive

experience in the public company environment, having been a

director and company secretary of a number of ASX and AIM junior

mining and oil and gas focused companies. He has previously worked

with Ernst & Young and CalEnergy Gas Ltd, a subsidiary of the

Berkshire Hathaway Group of Companies in both Australia and the

United Kingdom.

David Minchin, Non-Executive Director

David Minchin is a geologist with over 15 years' experience in

production, exploration, and resource

investment. Mr Minchin has worked for Rio Tinto and the British

Geological Survey, as well working as Senior Exploration Geologist

for ICL-Boulby where he was closely involved in the discovery of

the 3.2 billion tonne polyhalite deposit that was subsequently put

into production and extended operating mine life by over 30 years.

Mr Minchin has worked as Director of Geology for AMED Funds, a

London based private equity group that focuses on exploration

projects in Africa. In this role, Mr Minchin was part of the team

responsible for investing and monitoring approximately USD 450

million in projects from exploration through to feasibility and

across a range of commodities. Mr Minchin is currently CEO of

Helium One Global Limited, an AIM quoted company developing a

significant primary helium project in Tanzania and was formerly

Managing Director of ASX-listed ScandiVanadium.

Key Management

Azamat Bizhanov, Geologist

Azamat Bizhanov is an exploration and resource geologist with

more than ten years' experience. Previously he served as the

Kazakhstan Exploration Manager for Freeport-McMoran where he was

involved in identifying and evaluating porphyry copper

opportunities in Kazakhstan and Mongolia. Azamat has a successful

background in the execution of both greenfield and brownfield

exploration programmes in Kazakhstan - in particular he was

involved in the implementation of geological and resource modelling

at the largest uranium project in South Kazakhstan. Azamat is a

Registered Professional Geoscientist and a Member of the Australian

Institute of Geoscientists.

Concert Party

The Concert Party comprises the Sellers of DVK set out in the

table below, who are presumed to be acting in concert under the

City Code. The maximum potential interest of the Concert Party in

the voting rights of the Company is as follows:

Member No. of Total Admission No. No. Maximum number Total Shares

of Concert Consideration Shares held Performance Management of Ordinary as a

Party Shares by the Sellers Shares Options Shares (assuming Percentage

and Placing as a the issue of the

Shares percentage of the Company's

subscribed of the Performance share

for as part Enlarged Shares capital following

of Ordinary and the exercise such issue

Fundraise Share Capital of the Management and

("Admission on Admission Options by exercise

Shares") Mr. Walker) (assuming

("Total Shares") that no other

Shares are

issued)

Alexander

Casey Walker 20,024,522 11.0 31,874,202 8,000,000 59,898,724 23.6

-------------- --------------- ------------ ----------- ------------------ ------------------

Reedbuck

Nominees

Pty 9,762,261 5.4 15,937,102 - 25,699,363 10.1

-------------- --------------- ------------ ----------- ------------------ ------------------

Rainer

Heinz Ellmies 9,762,261 5.4 15,937,102 - 25,699,363 10.1

-------------- --------------- ------------ ----------- ------------------ ------------------

Reedbuck Nominees Pty Ltd is a private company registered in

Australia as trustee for the Eilistraee No. 2 Trust, of which

Melvin Yeo is sole director and a beneficiary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RENUKAURUNUARAR

(END) Dow Jones Newswires

January 10, 2022 02:00 ET (07:00 GMT)

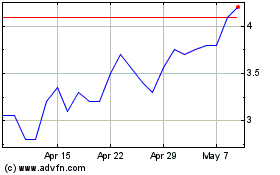

East Star Resources (LSE:EST)

Historical Stock Chart

From Mar 2024 to Apr 2024

East Star Resources (LSE:EST)

Historical Stock Chart

From Apr 2023 to Apr 2024