TIDMEST

RNS Number : 9063L

East Star Resources PLC

18 May 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

18 May 2022

East Star Resources Plc

("East Star" or the "Company")

Farm-In to Ionic Adsorption Clay Heavy Rare Earths Project,

Kazakhstan

East Star Resources Plc (LSE:EST), the Kazakhstan-focused gold,

copper and now rare earths explorer is pleased to announce a

farm-in to the Talairyk Ionic Adsorption Clay (IAC) Heavy Rare

Earth Element (HREE) project in the Kostanay region of Kazakhstan

(the "Licence").

Highlights:

-- Low-cost entry to a geologically de-risked IAC hosted HREE deposit

-- 19,962 tonnes of contained Total Rare Earth Oxides (TREO)

including 4,300 tonnes of yttrium oxide at average of 7.5m from

surface (1994 resource model)

-- Average 786g/t TREO in IAC profile up to 58.6m thick - same

geochemical signature as the IACs of South China from where most of

the world's HREEs are currently supplied

-- Database includes 128 core holes and 61 auger holes for 3,755 samples

-- Exploration upside within the Licence across similar

weathering profiles over prospective basement lithologies and with

potential for regional expansion

-- IAC peers generally have lower CAPEX and lower OPEX than hard

rock rare earth projects and a higher average basket price of

>$80 kg REO*

-- Farm-in terms up to 90% ownership:

o No cash payments

o First tranche of US$250,000 in shares for 51% after

expenditure of US$500,000 including planned drilling and initial

metallurgical test work

o Second tranche of US$250,000 in shares for 75% after

expenditure of a further US$500,000 which will include scoping

study level feasibility assessment

o Additional expenditure secures up to 90% of the asset on a

contribute or dilute basis

-- The Company is fully funded from existing cash reserves to

complete this transaction along with the current exploration

programme across all its projects

*Argus Metals pricing at 30 April 2022

Alex Walker, East Star CEO, commented:

"The Talairyk project represents the exact reason East Star is

focussed on Kazakhstan. There are very few places in the world

where a company can find a project of this quality and potential

and with this amount of data that has not undergone any work since

1994. The deal structure presents very little risk to East Star

given no share-based payments are made until a significant amount

of work is done. This will include re-drilling much of the existing

deposit, extensional exploration and conducting initial leach test

work. We have already begun the process to get all approvals for

drilling and are very excited to start work to quickly advance this

asset in the critical mineral space. The market dynamics for rare

earths are extremely compelling, driven by the green energy

transition and a desire to reduce dependence on China for

supply.

We are also very excited to be working with Phoenix, our JV

partners, whose principal shareholders include a highly experienced

mining executive with existing gold production and several other

exploration licences in Kazakhstan, and the H ead of Natural

Resources for a global law firm who was rated by 'The Legal 500' as

the 'Leading Lawyer in Kazakhstan' in 2013 and 2014 ."

Farm-in Terms

Stage 1: Upon incurring cumulative expenditure in relation to

the Licence of US$500,000, East Star will be entitled to a total

shareholding of 51% of the Joint Venture company (the "JV")

Stage 2: Upon incurring cumulative expenditure in relation to

the Licence of a further US$500,000, East Star will be entitled to

a total shareholding of 75% of the JV

On completion of each stage, after East Star receives the

respective shares in the JV, East Star will transfer to Phoenix

US$250,000 of fully paid Ordinary shares in East Star. The shares

will be calculated in the equivalent amount of Pound Sterling based

on the 30-day volume weighted average price on the date that East

Star receives its shareholdings in the JV.

East Star will continue to sole-fund all expenditure in relation

to the Licence from the commencement of Phase 2 until the

completion of a definitive feasibility or bankable feasibility

study to earn up to 90% of the project, however, Phoenix may elect

to contribute expenditure proportionately after Stage 2 to maintain

its share.

East Star will debt carry up to 10% of Phoenix's costs into

production with a priority distribution back to East Star from

revenue generated until the debt is repaid with interest.

Ionic Adsorption Clays (IACs)

Potentially economically extractible IACs are rarely found

outside of South China with only a few in South East Asia in

production today and exploration/development projects in Australia,

Brazil, Chile and Uganda. IAC deposits are comparatively rich in

HREEs and are a primary source of China's and therefore the world's

HREE production. IAC deposits offer several advantages to the more

commonly occurring hard rock REE deposits where the rare earths are

mostly hosted in complex mineral associations. These advantages

include:

Lower CAPEX: Deposits are shallow and free dig clays keeping the

footprint small, the pre-strip ratio low and with simple,

conventional machinery and material handling methods. Processing

generally requires no grinding or milling, removing these costly

and energy intensive mills from the processing circuit

Lower OPEX: Generally, the deposits are amenable to standard

leaching techniques with weak electrolyte solutions, such as

ammonium sulphate (widely used as a fertilizer for alkaline soils)

and sodium or magnesium chloride

Negligible radioactivity: Radioactive elements such as uranium

and thorium occur commonly in hard rock REE projects. In IACs, the

radioactive elements have been mostly removed by the weathering

process along with the lower value light rare earth elements

High-value basket of product: The heavy rare earth element

market is small and commercial production is restricted to very few

companies while the demand in the high-tech industry has

expanded

HREE Supply and Demand

Rare Earth Elements (REEs) are required for several high-tech

devices like high performance magnets for wind turbines or lighting

products for instance energy saving bulbs. Especially, the more

valuable Heavy Rare Earth Elements (HREEs) like Dysprosium and

Terbium are a critical resource. These HREEs are currently almost

exclusively supplied by ion adsorption clays (IACs) and almost

completely from southern China where the REEs are absorbed on clay

minerals and can be recovered with high extraction yields by

monovalent salt solutions using the concept of ion exchange.

The Talairyk Project

The Deposit

The thickness of the ore deposit varies along the historically

tested sections from 5.88m to 58.6m, averaging 19.46m. The average

overburden thickness is 7.38m and the average content of yttrium

oxide in the deposit is 169 g/t with other rare earth oxide

elements at 617 g/t for 786 g/t or 0.078% TREO. Using a cutoff

grade of 100 g/t, resources of yttrium oxide were calculated as

4,300 tons and TREO amounted to 15,662 tons.

Historical Exploration

Geological surveys of the site have been done since 1916,

however, it wasn't until 1972 when the first prospecting work was

carried out. In 1988-89, a magnetic survey on a scale of 1:5000 and

a gravity survey at a scale of 1:10000 were conducted over a 50x10m

and 200x50m network. From 1987-1991 prospecting work was carried

out resulting in discoveries of yttrium and REEs. From 1991-1994

prospecting and appraisal work was carried out to establish the

size of the ore zone in plan and in depth, the morphology and

conditions of occurrence of ore bodies, the qualitative

characteristics of ores, and the hydrogeological conditions. This

latest work was conducted by the State Holding Company "Marzhan"

and Joint Stock Company "Turgai Geological Exploration

Expedition".

The expedition drilled vertical core wells across the strike of

the ore zone on a 200x50m grid to an average depth up to 75m

including three hydro-geological wells. 128 holes were drilled by

core drilling for 6,022m and 61 holes by auger drilling for 903m.

3,755 samples were taken. On average, the core recovery in the

wells ranges from 68% to 76%.

Samples were subjected to the following types of analyses:

-- Semi-quantitative spectral analysis for 19 elements

-- XRF analysis for yttrium, zirconium, tin and niobium

-- Approximate quantitative analysis by a special method for the sum of rare earth oxides

-- Grain-size analysis of weathering crust

-- Lithological analysis of weathering rocks

Geology

The studied area is in the northern part of the Ulutau

meganticlinorium and is confined to the southern tip of the Sauktal

massif of the Arganty uplift. The uplift is composed of Proterozoic

metamorphic complex, gneissogranites and Paleozoic granitoids.

The rocks of the Talairyk suite compose the dome of the Ulutau

anticlinorium, and in the area of work it is divided by the

Sabasaldy-Turgai granitoid massif into two bands: western and

eastern. The Talairyk Formation includes three subformations:

lower, middle, and upper. The lower subformation is represented by

mica gneisses, two-mica-plagioclase gneissic schists, thick (100-

300m) units of amphibolites, garnet amphibolites, and

plagioclase-amphibolite schists. The thickness of the subformation

is 600-800m.

In the geological structure of the region, bodies of igneous

rocks of different composition and age make up about 75% of the

work area. According to geological data, three complexes are

distinguished:

1. Middle Proterozoic complex of granites (granite-gneisses)

2. Ulutau Complex of basic and ultrabasic rocks of Late Upper

Proterozoic to Early Cambrian age

3. Late Ordovician - Early Silurian complex of granodiorites -

granites

The Middle Proterozoic complex of granites is represented by the

Souktal granite-gneiss massif, a Precambrian complex located in the

Ulutau structural-facies zone and is also host to the Talairyk

deposit in the weathering crust.

In the weathering crust the main carriers of yttrium and rare

earths are kaolinite, hydromuscovite and to a lesser degree,

plagioclase. The average content of minerals in the weathering

crust are quartz (40%), kaolinite (42%) and sericite (18%).

The average thickness of the weathering crusts is 25m. In some

zones, the depth to basement is up to 100m.

For further information visit the Company's website at

www.eaststarplc.com , or contact:

East Star Resources Plc

Alex Walker, Chief Executive Officer

Tel: +44 (0)20 7390 0234 (via Vigo Consulting)

Peterhouse Capital Limited (Corporate Broker and Placing

Agent)

Duncan Vasey / Lucy Williams

Tel: +44 (0) 20 7469 0930

Vigo Consulting (Investor Relations)

Ben Simons / Oliver Clark

Tel: +44 (0)20 7390 0234

About East Star Resources Plc

East Star Resources is focused on the discovery and development

of gold, copper, and rare earth deposits in Kazakhstan. With an

initial five licences covering 1,442 km(2) in three mineral rich

districts, East Star is undertaking an intensive exploration

programme, applying modern geophysics to discover minerals in

levels that were not previously explored. The Company also intends

to further expand its licence portfolio in Kazakhstan. East Star's

management are based permanently on the ground, supported by local

expertise, and a joint venture with the state mining company.

Follow us on social media:

LinkedIn:

https://www.linkedin.com/company/east-star-resources/

Twitter: https://twitter.com/EastStar_PLC

The person who arranged for the release of this announcement was

Alex Walker, CEO of the Company.

Competent Persons Statement

Information and data presented within this announcement has been

compiled by Mr Azamat Bizhanov, a Member of the Australian

Institute of Geoscientists ("MAIG"). Mr Bizhanov is the Exploration

Manager for East Star Resources Plc and has sufficient experience,

which is relevant to the style of mineralisation, deposit type and

to the activity which he is undertaking to qualify as a Competent

Person defined by the 2012 Edition of the Australasian Code for

Reporting Exploration Results, Mineral Resources and Ore Reserves

(the "JORC" Code). This includes 10 years of Mining, Resource

Estimation and Exploration relevant to the style of

mineralisation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDAPMATMTJBMIT

(END) Dow Jones Newswires

May 18, 2022 10:07 ET (14:07 GMT)

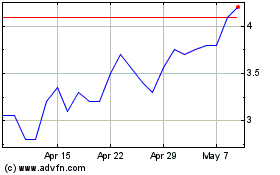

East Star Resources (LSE:EST)

Historical Stock Chart

From Mar 2024 to Apr 2024

East Star Resources (LSE:EST)

Historical Stock Chart

From Apr 2023 to Apr 2024