TIDMEXPN

RNS Number : 4128Y

Experian plc

14 January 2022

news release

Trading update, third quarter

14 January 2022 -- Experian plc, the global information services

company, today issues an update on trading for the three months

ended 31 December 2021.

Brian Cassin, Chief Executive Officer, commented:

"Performance in Q3 was at the upper end of our expectations.

Total revenue growth was 14% at actual exchange rates and 15% at

constant exchange rates. Organic revenue growth was 11%.

"We now expect organic revenue growth for the full year to be in

the range of 12-13%, with total revenue growth now expected in the

range of 16-17%, at constant exchange rates. We continue to expect

strong EBIT margin accretion, also at constant exchange rates."

% change in revenue from ongoing activities year-on-year for the

three months ended

31 December 2021

Ongoing activities Total revenue Total revenue Organic revenue

only growth % growth % growth %

At actual At constant At constant

exchange rates(1) exchange rates exchange rates

-------------------- ------------------- ---------------- ----------------

North America 16 16 13

Latin America 16 21 11

UK and Ireland 10 8 8

EMEA/Asia Pacific 4 6 0

------------------- ---------------- ----------------

Total global 14 15 11

-------------------- ------------------- ---------------- ----------------

1 Experian reports in US dollars.

% change in organic revenue year-on-year for the three months

ended 31 December 2021

Organic revenue growth Data Decisioning B2B(3) Consumer Total

% (2) Services

North America 7 16 10 19 13

Latin America 10 9 10 19 11

UK and Ireland 6 7 6 13 8

EMEA/Asia Pacific 3 (6) 0 n/a 0

----- ------------ ---------- ------

Total global 7 11 8 19 11

------------------------ ----- ------------ ------- ---------- ------

2 Ongoing activities only, at constant exchange rates.

3 B2B = Business-to-Business segment consists of Data and

Decisioning business sub-divisions.

Business mix including % change in organic revenue year-on-year

for the three months ended 31 December 2021

Segment Business unit % of Group Q3 organic

revenue(4) revenue

growth %(5)

------------------------------ ------------ -------------

North America 67% 13%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 25% 8%

--------------------

- CI / BI Bureaux, excluding

mortgage 21% 15%

- Mortgage 4% (21)%

Automotive 4% 4%

Targeting 4% 7%

--------------------------------------------------- ------------ -------------

Decisioning Health 8% 17%

--------------------

DA / Other 5% 13%

--------------------------------------------------- ------------ -------------

Consumer Services Consumer Services 21% 19%

-------------------- ------------------------------ ------------ -------------

Latin America 12% 11%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 8% 10%

--------------------

Other 0% 14%

--------------------------------------------------- ------------ -------------

Decisioning DA / Other 2% 9%

-------------------- ------------------------------ ------------ -------------

Consumer Services Consumer Services 2% 19%

-------------------- ------------------------------ ------------ -------------

UK and Ireland 13% 8%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 5% 6%

--------------------

Targeting / Auto 1% 4%

--------------------------------------------------- ------------ -------------

Decisioning DA / Other 4% 7%

-------------------- ------------------------------ ------------ -------------

Consumer Services Consumer Services 3% 13%

-------------------- ------------------------------ ------------ -------------

EMEA/Asia Pacific 8% 0%

---------------------------------------------------- ------------ -------------

EMEA 5% (4)%

---------------------------------------------------- ------------ -------------

Asia Pacific 3% 10%

---------------------------------------------------- ------------ -------------

Total global 100% 11%

---------------------------------------------------- ------------ -------------

4 Percentage of group revenue from ongoing activities calculated

based on H1 FY22 revenue at actual exchange rates.

5 Ongoing activities only, at constant exchange rates.

CI = Consumer Information, BI = Business Information, DA =

Decision Analytics.

North America - 67% of Group revenue(4)

North America delivered organic revenue growth of 13%, driven by

further progress of our strategic initiatives, strength in bureau

volumes (excluding mortgage), vertical expansion, and strong

momentum in Consumer Services. Respectively, growth was 10% and 19%

across B2B and Consumer Services. Total revenue growth was 16%,

including acquisition contributions in targeting, verification

services and insurance marketplaces.

In B2B, we see good appetite by our financial services clients

for data and propositions which support new credit origination and

digitisation of their underwriting infrastructure. With the

exception of mortgage, bureau volumes have been strong, including a

step-up in short term lending linked to the holiday season, and

Ascend also had a particularly strong quarter. Decisioning

performed very well, with significant traction in fraud and

identity management, software and analytical services. Health

delivered a very strong quarter, with momentum in propositions

which drive digital patient interactions as well as in identity

management, which continues to include a contribution from COVID-19

related activity. There was further progress across verification

services, with new client wins for Experian Verify as well as for

employer services, and good progress in acquiring records. Auto and

Targeting also continued to perform well.

Consumer Services, our fastest growing segment in North America,

now has a free membership base of 49m. Our performance reflects

free membership growth and a very strong performance in cards and

loans across our marketplace. Volumes on our lending panel were

particularly strong in the quarter as consumers shop for credit and

access a wide range of lending offers on our platform. We are also

progressing the development of our insurance marketplace, which is

in the early stages of scaling as we integrate the Gabi

acquisition.

Latin America - 12% of Group revenue (4)

Latin America delivered organic revenue growth of 11%. At

constant currency, total revenue growth was 21%, including

contributions from acquisitions in fraud and identity management,

our new bureau in Chile and in Consumer Services.

B2B organic revenue was up 10%. Our B2B business has maintained

a strong trajectory reflecting successful execution of our

strategic initiatives, including strong demand for positive data

propositions. Drivers of performance in the quarter were higher

bureau volumes, including adoption of positive data scores and

attributes in Brazil. We also secured new wins for our global

platforms, including Experian Ascend, with good demand for our

advanced analytics and decisioning platforms.

Consumer Services delivered organic revenue growth of 19%. Free

consumer memberships rose to 68m. We are making good progress on

our strategy to expand the ecosystem of offers we make available to

our membership base. Our credit comparison marketplace contributed

strongly in the quarter and there was good uptake too of our

premium identity management offer. This adds to our collections

marketplace, Limpa Nome, which helps consumers to resolve and

settle bills, both online and through our leading annual credit

fair which took place in November and December and was very well

attended.

UK and Ireland - 13% of Group revenue (4)

We continue to see good execution on our strategic plan in the

UK and Ireland where organic and total constant currency revenue

growth was 8%.

Organic growth in B2B revenues was 6%. Credit origination and

pre-qualification volumes have been robust, stimulated by market

recovery and new business wins. We are making good progress in new

client segments, such as buy now pay later. Uptake of B2B platforms

and other new products is also encouraging as clients upgrade their

core underwriting systems. This includes good demand for

affordability and eligibility assessment propositions, growing

momentum for Experian Ascend, significant client momentum in our

data quality business and strong demand for our advanced

analytics.

Organic revenue growth in Consumer Services was 13%. Transaction

volumes across our credit comparison marketplace were very strong,

reflecting growth in free memberships (now 10.8m) and buoyant

market conditions.

EMEA/Asia Pacific - 8% of Group revenue (4)

Organic revenue growth across EMEA/Asia Pacific was flat and

total revenue growth was 6% at constant exchange rates, including

the contribution from the bureau acquisition in Spain.

Bureau volumes have continued to slowly recover from the worst

effects of the COVID-19 restrictions. We continue to focus on

driving performance improvement across the region through measures

to focus on scale, simplify our operations and by enhancing

operating efficiency.

Future events

Experian will release results for the full year ending 31 March

2022 on Wednesday, 18 May 2022.

Contact:

Experian

Nadia Ridout-Jamieson Investor queries +44 (0)20 3042 4278

Gerry Tschopp Media queries

Tulchan

Graeme Wilson, Louise Male and Guy Bates +44 (0)20 7353 4200

This announcement is available on the Experian website at

www.experianplc.com . There will be a conference call today to

discuss this update at 9.00am (UK time), which will be broadcast

live on the website with a recording available later.

All financial information in this trading update is based on

unaudited management accounts. Certain statements made in this

trading update are forward-looking statements. Such statements are

based on current expectations and are subject to a number of risks

and uncertainties that could cause actual events or results to

differ materially from any expected future events or results

referred to in these forward-looking statements.

Neither the content of the Company's website, nor the content of

any website accessible from hyperlinks on the Company's website (or

any other website), is incorporated into, or forms part of, this

announcement.

About Experian

Experian is the world's leading global information services

company. During life's big moments - from buying a home or a car,

to sending a child to college, to growing a business by connecting

with new customers - we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organisations to prevent identity fraud and crime.

We have 20,000 people operating across 44 countries and every

day we're investing in new technologies, talented people, and

innovation to help all our clients maximise every opportunity. We

are listed on the London Stock Exchange (EXPN) and are a

constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content

hub at our global news blog for the latest news and insights from

the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFWESDEESEDF

(END) Dow Jones Newswires

January 14, 2022 02:00 ET (07:00 GMT)

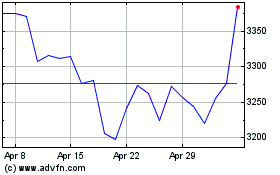

Experian (LSE:EXPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Apr 2023 to Apr 2024