Prove Identity and Experian Partner to Advance Global Financial Inclusion Through Next-Generation Identity Verification Technology

October 25 2022 - 9:30AM

Business Wire

The digital identity leaders are joining forces

to enable more consumers across the globe, including underbanked

populations, to access safer, faster, and easier customer

experiences while also mitigating fraud

Experian, the leading global information services company, and

Prove Identity, Inc. (“Prove”), the leader in digital identity,

today announced a global partnership to further financial inclusion

across the globe through advanced identity verification technology.

The partnership, which is now live, has two goals:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221025005357/en/

- To enable companies to extend their financial services to more

consumers, including traditionally underbanked populations such as

consumers who might not already have a credit file or substantive

data history, while also mitigating digital fraud such as synthetic

identity fraud.

- To create wider access to faster, easier and more secure

experiences for more consumers. Traditionally, underbanked

populations have had to default to “slow lane” digital experiences.

Prove and Experian’s new partnership will extend “fast lane”

digital experiences to more consumers.

“At Prove, we believe that all consumers should have access to

the digital economy, regardless of whether you already have a

credit file or not,” said Rodger Desai, Co-Founder and Chief

Executive Officer at Prove. “We’re proud to be partnering with

Experian, which shares our vision for a more financially inclusive

digital world. Together, we are giving more companies across the

globe access to advanced identity technology, such as cryptographic

authentication, that they can use to verify more consumers in a

quick and secure manner.”

Prove is able to verify the identities of traditionally

underbanked populations such as those with “thin” or no credit

files. Prove’s identity verification and authentication solutions

leverage something nearly every adult consumer has – a mobile phone

– which helps businesses give more consumers access to services

regardless of whether or not they have an existing financial

history, further reducing consumer friction and bias.

As part of the partnership, Prove will integrate the following

solutions (can vary by region) into Experian CrossCore, a digital

identity and fraud risk mitigation platform that enables clients to

connect, access, and orchestrate customer decisions and actions

that leverage multiple data sources, verification and

authentication capabilities, and advanced analytics.

- Prove Pre-Fill®: Enables companies to onboard consumers in as

few as 10 seconds by auto-filling application forms with verified

data from authoritative sources, and authenticating consumer

identities to thwart account opening fraud. Global sanctions, PEPs,

adverse media, and monitoring included at no cost. Users will

benefit from a faster, easier, and more secure sign-up process,

where information is only auto-filled with their consent.

(Availability: U.S.)

- Prove Identity™: Validates consumer-provided personal identity

information and confirms phone number ownership using authoritative

data, including device and phone number data, while maintaining

privacy for all customers.

- Trust Score™: A real-time measure of phone number reputation

that can be leveraged for identity verification and authentication

purposes. Trust Score analyzes behavioral and cryptographic

authentication signals from authoritative sources at the time of a

potential transaction to mitigate fraud such as SIM swap and other

account takeover schemes.

- Mobile Auth™: Provides a real-time authentication of the status

of a consumer on a mobile network by silently authenticating that

consumer while requiring no action on their part.

The partnership will give Experian CrossCore customers access to

these solutions, which may be integrated with Experian’s regional

fraud and identity offerings.

“The rapid surge in demand for digital services and the growth

of online accounts has accelerated the need for robust, real-time

identity verification solutions with the broadest coverage and

greatest inclusion,” said Marika Vilen, SVP of Global Identity

& Fraud at Experian. “Integrating Prove’s industry-leading

identity solutions with CrossCore and offering them as part of the

CrossCore partner program strengthens our state-of-the-art cloud

platform, identity verification, and fraud defense while also

enabling our customers to verify more consumers.”

About Prove Identity, Inc. (“Prove”)

As the world moves to a mobile-first economy, businesses need to

modernize how they acquire, engage with and enable consumers.

Prove’s phone-centric identity tokenization and passive

cryptographic authentication solutions reduce friction, enhance

security and privacy across all digital channels, and accelerate

revenues while reducing operating expenses and fraud losses. Over

1,000 enterprise customers use Prove’s platform to process 20

billion customer requests annually across industries, including

banking, lending, healthcare, gaming, crypto, e-commerce,

marketplaces, and payments. For the latest updates from Prove,

follow us on LinkedIn.

About Experian

Experian is the world’s leading global information services

company. During life’s big moments – from buying a home or a car,

to sending a child to college, to growing a business by connecting

with new customers – we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organizations to prevent identity fraud and crime.

We have 20,600 people operating across 43 countries and every

day we’re investing in new technologies, talented people, and

innovation to help all our clients maximize every opportunity. We

are listed on the London Stock Exchange (EXPN) and are a

constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content

hub at our global news blog for the latest news and insights from

the Group.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221025005357/en/

Prove PR Contact: pr@prove.com

Experian PR Contact: Scott Anderson

Scott.n.anderson@experian.com

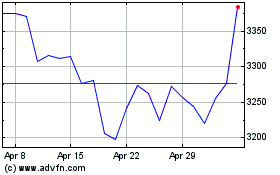

Experian (LSE:EXPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Apr 2023 to Apr 2024