TIDMEXPN

RNS Number : 8792M

Experian plc

17 January 2023

news release

Trading update, third quarter

17 January 2023 -- Experian plc, the global information services

company, today issues an update on trading for the three months

ended 31 December 2022.

Brian Cassin, Chief Executive Officer, commented:

"We delivered a good performance in Q3, in line with our

expectations, driven by new products, new business wins and

consumer expansion. At constant exchange rates, organic revenue

growth was 6% and total revenue growth was 7%. After the impact of

foreign exchange rates total revenue growth was 4%.

"While pressures in the global economy are likely to continue

for some time, we expect to remain resilient, supported by the

delivery of our growth strategy and growth in countercyclical

revenue streams. For the full year our expectations are unchanged,

for organic revenue growth of between 7-9%, total revenue growth of

between 8-10% and modest margin accretion, all at constant exchange

rates and on an ongoing basis ."

% change in revenue from ongoing activities year-on-year for the

three months ended

31 December 2022

Ongoing activities Total revenue Total revenue Organic revenue

only growth % growth % growth %

At actual At constant At constant

exchange rates(1) exchange rates exchange rates

-------------------- ------------------- ---------------- ----------------

North America 5 5 5

Latin America 21 17 16

UK and Ireland (7) 6 6

EMEA/Asia Pacific (10) 1 1

------------------- ---------------- ----------------

Total global 4 7 6

-------------------- ------------------- ---------------- ----------------

1 Experian reports in US dollars.

% change in organic revenue year-on-year for the three months

ended 31 December 2022

Organic revenue growth Data Decisioning B2B(3) Consumer Total

% (2) Services

North America 2 5 2 9 5

Latin America 10 14 11 40 16

UK and Ireland 7 15 10 (8) 6

EMEA/Asia Pacific (3) 16 1 n/a 1

----- ------------ ---------- ------

Total global 3 9 5 10 6

------------------------ ----- ------------ ------- ---------- ------

2 Ongoing activities only, at constant exchange rates.

3 B2B = Business-to-Business segment which consists of Data and

Decisioning business sub-divisions.

Business mix including % change in organic revenue year-on-year

for the three months ended 31 December 2022

Segment Business unit % of Group Q3 organic

revenue(4) revenue

growth %(5)

------------------------------ ------------ -------------

North America 68% 5%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 25% (2)%

--------------------

- CI / BI Bureaux, excluding

mortgage 22% 5%

- Mortgage 3% (42)%

Automotive 5% 7%

Targeting 3% 14%

--------------------------------------------------- ------------ -------------

Decisioning Health 8% 4%

--------------------

DA / Other 4% 7%

--------------------------------------------------- ------------ -------------

Consumer Services Consumer Services 23% 9%

-------------------- ------------------------------ ------------ -------------

Latin America 14% 16%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 9% 11%

--------------------

Other 0% (3)%

--------------------------------------------------- ------------ -------------

Decisioning DA / Other 3% 14%

-------------------- ------------------------------ ------------ -------------

Consumer Services Consumer Services 2% 40%

-------------------- ------------------------------ ------------ -------------

UK and Ireland 12% 6%

---------------------------------------------------- ------------ -------------

Data CI / BI Bureaux 5% 7%

--------------------

Targeting / Auto 1% 9%

--------------------------------------------------- ------------ -------------

Decisioning DA / Other 3% 15%

-------------------- ------------------------------ ------------ -------------

Consumer Services Consumer Services 3% (8)%

-------------------- ------------------------------ ------------ -------------

EMEA/Asia Pacific 6% 1%

---------------------------------------------------- ------------ -------------

Total global 100% 6%

---------------------------------------------------- ------------ -------------

4 Percentage of Group revenue from ongoing activities calculated

based on H1 FY23 revenue at actual exchange rates.

5 Ongoing activities only, at constant exchange rates.

CI = Consumer Information, BI = Business Information, DA =

Decision Analytics.

North America - 68% of Group revenue(4)

North America delivered organic and total revenue growth of

5%.

B2B organic revenue growth was 2% reflecting good progress on

new products, partially offset by mortgage decline and strong

prior-year comparables in short term lending and health. While some

clients have further tightened credit criteria, consumer and

business information contributed favourably, excluding mortgage,

and as we lapped last year's strong holiday season. Experian Ascend

contributed strongly, securing new client wins, and we continue to

make good progress across decisioning software, analytics and fraud

and identity management. Verification services also performed

strongly. Targeting and automotive performed well supported by new

product performance and new business wins, as did health, excluding

the prior-year COVID-19 related one-off item.

Consumer Services organic revenue growth was 9%, reflecting

growth in marketplace, premium services and partner solutions. We

are developing new propositions to help consumers build credit and

manage their finances and we are rolling out Experian Activate to

help our lender partners target credit offers more precisely. Paid

enrolments performed strongly, and we are adding free members to

take our free membership base to 59m.

Latin America - 14% of Group revenue (4)

Latin America delivered organic revenue growth of 16%. At

constant currency, total revenue growth was 17%, including

contributions from acquisitions in Consumer Services, and from our

new bureaux in Chile and Panama.

B2B organic revenue growth was 11%. In Brazil, we continue to

benefit from client adoption of positive data products. We have

also secured new implementations for Experian Ascend, and we have

strong traction with our cloud-enabled decisioning platforms. We

also see growing contributions from our small and medium enterprise

channel and our agribusiness vertical. Spanish Latin America

delivered a strong performance as we expand our presence across the

region.

Consumer Services delivered organic revenue growth of 40%. Free

consumer memberships in Brazil rose to 78m. We delivered a very

successful Limpa Nome credit fair, which helps consumers to resolve

and settle bills, and our credit comparison marketplace and premium

services also delivered good growth.

UK and Ireland - 12% of Group revenue (4)

Performance in the UK & Ireland was encouraging, delivering

organic and total constant currency revenue growth of 6%,

notwithstanding challenges in the economy and specific market

disruption during October.

B2B organic revenue growth was 10%. This reflects strong results

from new products and good execution across all major B2B business

units, including consumer credit information, business credit

information, analytics, fraud and identity management and

targeting, and helped by a strong new business win performance.

Most lenders continue to extend credit, having tightened criteria

and reduced supply in some categories, while consumer demand for

credit is generally elevated. Lender appetite is increasing for

analytics to monitor affordability and to derive cost-of living

insights, as well as for data and analytics to provide visibility

on small business economic exposure.

Organic revenue in Consumer Services declined 8%, as volumes

moderated in our credit marketplace, reflecting the lending market

disruption in October and tighter lending conditions, as well

reduced premium subscription revenue. Free memberships were

12m.

EMEA/Asia Pacific - 6% of Group revenue (4)

Organic revenue growth and total revenue growth at constant

exchange rates across EMEA/Asia Pacific was 1%, with growth across

the majority of our strategic markets. We are making good progress

on our plan to strengthen and focus our EMEA/Asia Pacific

operations.

Future events

Experian will release results for the full year ending 31 March

2023 on Wednesday, 17 May 2023.

Contact:

Experian

Nadia Ridout-Jamieson Investor queries +44 (0)20 3042 4200

Gerry Tschopp, Nick Jones Media queries

Tulchan

Graeme Wilson, Louise Male and Guy Bates +44 (0)20 7353 4200

This announcement is available on the Experian website at

www.experianplc.com . There will be a conference call today to

discuss this update at 9.00am (UK time), which will be broadcast

live on the website with a recording available later.

All financial information in this trading update is based on

unaudited management accounts. Certain statements made in this

trading update are forward-looking statements. Such statements are

based on current expectations and are subject to a number of risks

and uncertainties that could cause actual events or results to

differ materially from any expected future events or results

referred to in these forward-looking statements.

Neither the content of the Company's website, nor the content of

any website accessible from hyperlinks on the Company's website (or

any other website), is incorporated into, or forms part of, this

announcement.

About Experian

Experian is the world's leading global information services

company. During life's big moments - from buying a home or a car,

to sending a child to college, to growing a business by connecting

with new customers - we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organisations to prevent identity fraud and crime.

We have 21,700 people operating across 30 countries and every

day we're investing in new technologies, talented people, and

innovation to help all our clients maximise every opportunity. We

are listed on the London Stock Exchange (EXPN) and are a

constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content

hub at our global news blog for the latest news and insights from

the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFITLDIRLIV

(END) Dow Jones Newswires

January 17, 2023 02:00 ET (07:00 GMT)

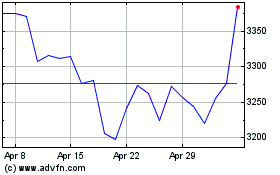

Experian (LSE:EXPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Apr 2023 to Apr 2024