TIDMEYE

RNS Number : 3317S

Eagle Eye Solutions Group PLC

16 March 2021

16 March 2021

Eagle Eye Solutions Group plc

("Eagle Eye", the "Group", or the "Company")

Interim Results for the six months ended 31 December 2020

Strong profit growth underpinned by new domestic and

international customer wins

Eagle Eye, a leading SaaS technology company that creates

digital connections enabling personalised, real-time marketing

through coupons, loyalty, apps, subscriptions and gift services, is

pleased to announce its results for the six months ended 31

December 2020 ("the Period").

Financial highlights

H1 2021 H1 2020 Change

------------------------------ --------- ---------- -------

Group revenue GBP10.8m GBP10.1m +8%

Recurring subscription and

transaction revenue GBP8.0m GBP7.3m +9%

Recurring revenue % of Group

revenue 73% 73% -

Adjusted EBITDA* GBP2.1m GBP1.3m +64%

Operating profit/ (loss) GBP0.2m GBP(0.5)m n/a

Net cash/ (debt)** at 31 GBP0.1m GBP(2.2)m n/a

December

Operational highlights:

-- Strong new business 'Win' performance in the UK and

Internationally, securing Woolworths Group in Australia, Pret a

Manger and Liberty Retail Limited in the UK and a leading

speciality office and home products & services retailer in the

US

-- New customers go live during the period including Virgin Red,

Virgin's game-changing reward club test launched in November

2020

-- Continued enhancements to the Eagle Eye AIR platform ("Eagle

Eye AIR"), including enhanced Promotions and Loyalty capabilities

together with the launch of Message at Till, opening up further

opportunities in the US market

-- Expansion of our partnership & collaboration network,

including integrations with Salesforce Commerce Cloud, Oracle

MICROS Simphony POS System, Outra, Chargebee and Peak

-- Continued low levels of customer churn at 0.2% (H1 2020: 0.3%)

Outlook

-- New business pipeline continues to grow at record levels

internationally including multiple enterprise level opportunities,

providing the Board with confidence in the ongoing success of the

business

-- COVID-19-related UK lockdown continues to negatively impact

the Group's Food & Beverage, Non-Grocery retail and Brand

customer revenue streams (c.10% of Group revenue pre-COVID-19)

-- Current funding position is comfortable and sufficient

headroom of GBP5.1m (Period-end net cash, together with Group's

GBP5m banking facility) to support the Group's existing growth

plans

-- Trading for the financial year ending 30 June 2021 remains in

line with the Board's expectations

Notes

* Adjusted EBITDA has been adjusted for the exclusion of

share-based payment charges along with depreciation, amortisation,

interest and tax from the measure of profit and is reconciled to

the GAAP measure of profit/(loss) before tax in note 5 to the

financial statements below.

** Net cash/(debt) is cash and cash equivalents less borrowings.

Tim Mason, Chief Executive of Eagle Eye , said: " With our

growing number of enterprise customers, around the world we are now

recognised as the business which can enable personalised marketing

in real-time. Eagle Eye has a proven technology platform that

connects a retailer's entire marketing eco-system and we sit at the

heart of the digital transformation of the retail sector.

"While COVID-19 has impacted an element of our customer base and

hence our growth rate in the short-term, it has highlighted the

need for retailers to digitally engage with their customers . We

are confident in our offering, excited by our increased opportunity

a nd believe there is considerable potential for expansion ."

For further information, please contact:

Eagle Eye Tel: 0844 824 3686

Tim Mason, Chief Executive Officer

Lucy Sharman-Munday, Chief Financial

Officer

Investec (Nominated Advisor and Joint Tel: 020 7597 5970

Broker)

Corporate Finance: David Anderson/ Sebastian

Lawrence

Corporate Broking: Sara Hale/ Toba Fatimilehin

Shore Capital (Joint Broker) Tel: 020 7408 4090

Corporate Finance: Hugh Morgan/ Daniel

Bush/ Sarah Mather

Corporate Broking: Henry Willcocks

Alma PR

Caroline Forde, Robyn Fisher, Molly Gretton Tel: 020 3405 0205

About Eagle Eye

Eagle Eye is a leading SaaS technology company transforming

marketing by creating digital connections that enable personalised

performance marketing in real time through coupons, loyalty, apps,

subscriptions and gift services.

Eagle Eye AIR enables the secure issuance and redemption of

digital offers and rewards at scale, across multiple channels,

enabling a single customer view. We create a network between

merchants, brands and audiences to enable customer acquisition,

interaction and retention at lower cost whilst driving marketing

innovation.

The Company's current customer base comprises leading names in

UK Grocery, Retail, Leisure and Food & Beverage sectors,

including Asda, Sainsbury's, Tesco, Waitrose and John Lewis &

Partners, Virgin Red, JD Sports, Pret a Manger, Greggs, Mitchells

& Butlers, Pizza Express; in North America, Loblaws, Shoppers

Drug Mart, Esso and Southeastern Grocers and in Australia & New

Zealand, Woolworths Group and The Warehouse Group.

For more information, please visit www.eagleeye.com

Chairman's Review

Against the ongoing backdrop of the COVID-19 pandemic, the Group

has delivered a strong performance, continuing to support and win

new enterprise customers, both at home and internationally, while

further expanding the capabilities of Eagle Eye AIR to increase its

attractiveness to the global retail market.

Once again, the strong management of the business is evident in

the excellent profit performance, delivering 64% growth in adjusted

EBITDA to GBP2.1m (H1 2020: GBP1.3m), on revenue growth of 8% to

GBP10.8m (H1 2020: GBP10.1m). The Group delivered another healthy

cash performance and closed the Period with net cash of GBP0.1m,

ahead of the Board's expectations.

Our growing number of enterprise customers provide further proof

of Eagle Eye AIR's capabilities and are opening doors to additional

customer discussions. While COVID-19 continues to impact sales

cycles, the business continues to secure new customers and the

number of opportunities in our pipeline is considerably higher than

at any other time in the business' history, providing the Board

with confidence in the Group's ability to deliver accelerated

growth rates in future periods.

COVID-19 lockdowns continue to impact on our Food &

Beverage, Non-Grocery retail and Brand customers. We stand ready to

support their recovery once lockdown ends and they are able to

re-connect with their customers.

Growing market opportunity

"Winning businesses" are those who can build deep, one-to-one

relationships with their customers, personalising every

interaction. To achieve this, such companies have to transform

their marketing for the always-on, omnichannel world, connecting

all aspects of the customer journey in real time. The two key

themes of omnichannel marketing and personalisation are

increasingly coming to the fore.

The potential upsides to personalisation are vast as McKinsey's

recent report, Personalising the Customer Experience, makes

abundantly clear. " Personalisation at scale often delivers a 1 to

2 percent lift in total sales for grocery companies and an even

higher lift for other retailers, typically by driving up loyalty

and share-of-wallet among already-loyal customers. These programs

can also reduce marketing and sales costs by around 10 to 20

percent. Not only that, successful personalisation programs yield

more engaged customers and drive up the top line."

In addition to personalisation, the COVID-19 pandemic has

highlighted just how crucial an omnichannel offering is in

providing retailers with the means to survive and thrive. Retailers

need the agility to switch between channels, and market to their

customers, no matter how they connect. In the UK, for example, data

from the IMRG Capgemini Sales Index in January 2021 revealed that

the rate of sales growth for multi-channel retailers exceeded

online only for the first time since 2017, up 57% year-on-year vs.

9%.

The relevance of Eagle Eye AIR to retailers is increasingly

clear. Through integration with Eagle Eye AIR, a retailer can

deliver a personalised marketing message to any customer, in real

time, at any point in the customer's journey with them, securely

and at scale. We are currently delivering this for leading

retailers across sectors and geographies. In this way, Eagle Eye

enables companies to unlock the capability to deliver

personalisation, to streamline marketing execution and to open up

new revenue streams by enabling FMCG brand partners to fund direct

marketing to their end customers.

Delivering on all elements of our growth strategy

I am pleased to report the following progress across all four

elements of our growth strategy.

1."Win, Transact and Deepen"

Our customer strategy is to:

-- 'Win': bring more customers on to the Eagle Eye AIR platform;

-- 'Transact': drive higher redemption and interaction volumes through the platform; and

-- 'Deepen': encourage our customers to adopt more of our

product portfolio as they become more adept at digital

marketing.

Win

During the Period we saw an increase in win rate, both in the UK

and internationally, resulting in an uplift in "Win" related

revenue. New customers secured in the Period included a five-year

contract with Woolworths Group in Australia & New Zealand; a

three-year contract with a leading speciality office and home

products & services retailer in North America, and in the UK, a

three-year contract with Liberty Retail Limited, the luxury

department store, to support their omnichannel gift programme.

We were pleased to recently confirm our role as a key technology

provider for Virgin Red, Virgin's new rewards club, which launched

on an invite-only basis in November 2020 before opening up to

everyone from 8 February 2021. The Eagle Eye platform was chosen

earlier in 2020 for its ability to process and manage the billions

of points flowing across the platform, being earnt and spent across

multiple organisations globally, bringing together the Virgin

companies and beyond, across multiple sectors.

We have been delighted by the success of Pret a Manger's

'YourPret Barista' programme, launched in September 2020. This is

the first in-shop, flat subscription service to be launched by a

hospitality operator in the UK. Subscribers are able to enjoy up to

five barista-prepared drinks per day for a fixed monthly price of

GBP20. The Service was built on the Eagle Eye AIR platform as part

of Pret's new digital infrastructure. This new in-shop digital

service capability will allow Pret to launch insight-led customer

propositions more quickly and at scale.

These new wins demonstrate the much needed capabilities of Eagle

Eye AIR. By deploying Eagle Eye AIR and utilising our Wallet

capability, Enterprise businesses can gain an omnichannel, single

view of the customer, the primary requirement to set the

foundations for personalisation. Through our deep integrations to

all points of sale and the rest of the marketing stack, we enable

businesses to act on their leading data science capabilities,

moving from manual and cumbersome promotions and loyalty management

across multiple systems to zero-touch personalisation, all

delivered via API. Not only does Eagle Eye AIR streamline

efficiency, moving businesses from batch to real-time marketing,

but it also unlocks the capability to create new and innovative

ways to engage customers through the ability to deploy any

promotional or marketing tactic required, from points to money off,

gamification, subscription services, charity donations and more.

The ways in which businesses are using Eagle Eye AIR is increasing

at pace, providing us with a strong base for future expected

growth.

Strategic Partnerships and Collaborations

Eagle Eye AIR has the ability to sit across the entire marketing

ecosystem, connecting all the elements required to deliver

personalised marketing at scale. As part of our growth strategy, we

will continue to create partnerships and collaborations with other

businesses in the industry, using their expertise to strengthen our

offering and leveraging their marketing reach.

Combining these relationships with our own, direct marketing

activities, we believe provides us with the right mix to capture

more of the promotions and loyalty markets and we are encouraged by

the increasing number of opportunities entering our sales

pipeline.

New partnerships include: Oracle MICROS Simphony POS System (to

deliver YourPret Barista); Outra, a predictive data science

business, to help retailers, hospitality operators and branded CPG

(Consumer Packaged Goods) to enhance the effectiveness of their

promotional marketing investments; revenue management platform,

Chargebee, to help retail and hospitality operators drive customer

engagement and recurring revenue through subscription services; and

Artificial Intelligence provider Peak to help retailers leverage

customer data for loyalty and promotional campaigns.

The Liberty omnichannel gift programme was enabled through our

integration with Salesforce Commerce Cloud. Salesforce Commerce

Cloud is a powerful ecommerce solution from the world's largest CRM

provider and as an accredited Salesforce partner we are able to

deploy our solutions quickly to the wider Salesforce customer

base.

In the US, our partnerships and collaborations with Neptune

Retail Solutions (previously News America Marketing) the premier

marketing services company in the US and Canada, E crebo, the

receipt marketing technology provider and dunnhumby, a global

leader in customer data analytics, are progressing well. These

represent powerful, relevant relationships to continue to optimise

our expansion into the US.

Transact

Chargeable AIR redemption and interaction volumes, a key measure

of usage of Eagle Eye AIR , fell by 5% to 452.2m (H1 2020: 476.8m),

primarily reflecting the impact of COVID-19, offset by an increased

number of loyalty transactions following the successful launch of

new customer programmes, including for Southeastern Grocers ("SEG")

and the full period effect of Sainsbury's.

The Period saw an increase in SMS volumes driven by the growth

of Click & Collect offerings at certain of our high-street

retail customers during the COVID-19 pandemic and also from

supporting clients following the UK Government's Test and Trace

guidelines.

Brands & Audiences

Eagle Eye AIR is also used by brands to run campaign activations

across our growing Retailer, Operator and Audience Network. This

was one of the key areas of the business impacted by the COVID-19

lockdown. Overall, t he revenue from branded drinks campaigns

decreased to GBP0.1m (H1 2020: GBP0.3m), which was effectively

delivered during the three heavily restricted summer months.

Affiliate revenue held steady at GBP0.2m (H1 2020: GBP0.2m),

bringing total brand and audience revenue to GBP0.3m (H1 2020:

GBP0.5m).

We now have over 7,000 hospitality venues on Eagle Eye AIR,

creating an attractive platform for Brands to exploit once lockdown

restrictions are lifted, as they seek the means to recapture lost

revenue and strengthen their businesses.

Deepen

We have seen continued deepening across our customer base, as

they grow their use of Eagle Eye AIR. While COVID-19 has caused

some contract expansion to be delayed, we continue to have a wide

range of discussions across our customer base as they consider how

to continue on their journey towards personalised multi-channel

loyalty, promotion and gift offerings. With several new customers

having commenced transacting in the Period, including Pret a Manger

and Virgin Red in the UK, and our international customers

continuing with their roll-outs, we anticipate our recurring,

transactional revenues to increase in future periods.

Pleasingly, our long-term contract customer churn rate by value

remains very low at 0.2% (H1 2020: 0.3%), with good levels of

renewals, including multi-year contracts with IMO, the world's

largest dedicated car wash company, leisure operator Azzurri Group

and the restaurant group, Giggling Squid.

Our high level of customer retention means that each new

customer win significantly adds to our growth prospects, with

revenue from our largest revenue-generating customers typically

increasing by a multiple of over three times by the end of their

third year on Eagle Eye AIR, through both use of the platform and

the addition of new services.

2. Innovation

Innovation continues to lie at the heart of our proposition,

investing in the capabilities of Eagle Eye AIR to ensure that our

technology continues to benefit our customers, and their consumers.

In the Period, we have invested in new core functionality

continuing to increase the attractiveness of the platform for

enterprise customers, providing them with new means of digitally

engaging with their customers.

In the Period we launched our new, personalised Message At Till

capability which we believe will soon have many innovative use

cases associated to it, based on the different ways in which

businesses will deploy the technology. AIR connects with the

retailer's till system to enable real-time, relevant and targeted

promotions, through physical coupons at the till or digital

coupons, SMS and in-app push notifications following a transaction,

based on their customers' basket content and buying behaviour.

Customers will feel valued as they are engaged by compelling timely

and tailored offers based on what they have just or not bought, or

profile or purchasing history, while enabling the retailer to

connect with previously anonymous customers, providing a means to

drive customer retention, increase redemption rates and increase

frequency and average spend.

This functionality is particularly important in the US, acting

as a digital replacement for the widely prevalent receipt-based

couponing market, adding further capability for our US enterprise

customers while opening-up a new segment of the US retail market. A

digital message at till enables retailers to connect with

previously anonymised customers, encouraging them to digitally

connect and form a digital identity with the retailer, through

which future marketing messages can flow.

In the Period, we also launched our Load to Card function

allowing retailers to leverage data analytics and artificial

intelligence ("AI") to recommend and issue personalised digital

rewards via digital channels such as a website or an app. A

consumer is able to select the offers they wish to redeem and load

them to their digital loyalty card. Both of these features are

already in use at Southeastern Grocers, driving customer engagement

through curated promotions and offers based on their shopping

patterns.

We have also taken advantage of the additional computing power

of the cloud to provide an enhanced version of our POS Connect

loyalty feature, to provide retailers with more flexibility in the

numbers, personalisation for types of offers, points and discounts

they can give to their customers. We have enabled this through the

launch of a powerful new application programming interface ("API")

that sets retailers free from the constraints of their existing POS

system, with AIR performing all of the complex calculations

relating to promotional offer adjudication and basket adjustments

such as discounts or point allocations. All of these calculations

take place in the cloud and in real time. Linking a consumer's

identity to the items in their shopping basket, gives the retailer

the capability to offer truly personalised promotions without being

restricted by how many the POS can handle.

The performance of Eagle Eye AIR continues to benefit from our

move to the Google Cloud, increasing our scalability and

flexibility, being able to grow compute power as we sign up new

customers and as our existing customers require it. As planned, we

have now introduced site reliability engineering in order to be

more scalable, automated, reliable, standardised and secure.

3. International Growth

We have continued to prosecute our international growth strategy

in the Period, winning new customers, and strengthening our

positions in our new territories. We are particularly pleased to

have added these customers during this COVID-disrupted period. Our

new agile methodologies have enabled us to supplement our local

teams by our global resource pool, enabling us to open up these

geographies in a cost-efficient and scalable manner.

North America

In December 2020, we were pleased to secure our second US

customer. A leading speciality office and home products and

services retailer in North America signed a three-year agreement to

use Eagle Eye AIR for its Digital Wallet and promotional

capabilities. This retailer has over 1,000 stores across the United

States. This win, coupled with Eagle Eye's first US win in December

2019 with SEG, further strengthens our position in North America

and demonstrates the applicability of AIR in sectors outside of

grocery.

After launching the first phase of SEG's omni-channel strategy

in July 2020 to enable coupons-at-receipt, Eagle Eye has partnered

with Neptune Retail Solutions to create a personalised digital

coupon experience for SEG's customers. Neptune Retail Solutions

partners with leading CPG brands and uses 1st, 2nd and 3rd party

customer data to identify and target relevant offers &

promotions. For SEG, those offers will be further personalised

through Eagle Eye and automatically loaded-to-card directly into

customers' SEG Rewards loyalty accounts and are redeemable at

checkout.

Eagle Eye and dunnhumby are collaborating to enable the

personalisation of promotions for SEG, and to provide the retailer

with a deeper understanding of its customers' behaviours and

preferences. This collaboration will see accelerated execution on

SEG's retail vision and we are on track to deliver a complete

omni-channel strategy in record time.

In Canada, our relationship with Loblaw Companies Ltd ("Loblaw")

goes from strength to strength as we supported the launch of their

PC Health app which provides live chat to members with registered

nurses and dietitians, plus the opportunity to earn PC Optimum(TM)

rewards through custom digital health programs. We also supported

the re-launch of PC Insiders subscription service, now PC Optimum

Insiders(TM) subscription which provides members the opportunity to

earn more PC Optimum(TM) points and promotional rewards. Each year

we manage the load of promotional offers for their PC Optimum

Points Days which is Loblaws' biggest points-earning event of the

year, taking place in January and February.

Australasia

In November 2020, we secured a five-year agreement with

Woolworths Group where they will use Eagle Eye AIR to support their

personalised real-time digital marketing programme. Woolworths is

Australia's largest retailer; the group operates 3,000 stores in

Australia and New Zealand and serves more than 29 million customers

across its brands every week. Eagle Eye's services will allow

Woolworths Group to enable the end-to-end management of real-time

personalised digital promotions and support its transition to a

digitally led rewards program. Woolworths will deploy the

proposition across touchpoints including its app, its eCommerce

business and various other digital media. Eagle Eye AIR will also

be used to enable a real-time integration with a network of

partners. Implementation commenced on contract signature.

We continued our work with The Warehouse Group, one of the

largest retailing groups in New Zealand, supporting the pilot of

its digital customer engagement and community give back

programme.

With two of the largest retailers in the Australasia region now

as customers, we believe we have a strong position to use this

region as a base for further expansion. We have begun investment in

the Australia market in line with the Group's growing revenue

profile in the region and will continue to do so.

This growing range of international enterprise level customers

are opening up new conversations with other Tier 1 retailers and

our new business pipeline continues to grow at record levels

internationally.

4. "Better, Simpler, Cheaper"

While investing in innovation and growing the business, we

simultaneously look for inherent productivity

and efficiencies coming from the scale of what we do. The

relevance of this ethos came to the fore at the time of the

COVID-19 pandemic when the agility of the organisation enabled us

to swiftly implement home working and the change of working

practices required to ensure its successful execution. The proof of

this can be seen both in the continued successes with our Tier 1

customer implementations as well as the strong financials we have

reported throughout the COVID-19 affected period.

In August 2020 we were re-certified for the International

Standard ISO27001:2013 which provides the framework for an

effective Information Security Management System (ISMS). It sets

out the policies and procedures needed for robust IT security

management. We also completed our Soc Type 2 report after being

audited by an independent service auditor.

We are implementing automation tools across the Delivery and

Compliance teams to drive efficiencies in process and

reporting.

Our platform continued to operate and perform within all the

contracted SLAs across all our geographies 24/7 - through a busy

Black Friday and Christmas period.

Our People

We remain committed to our goal of being a great place to work

and to create an environment where our people can flourish.

Investment in our people to be the best they can be through

training and tools has never been as important, given the

unsettling nature of the COVID-19 crisis. This has been a period of

building on the successes of our past and adapting as appropriate.

We passionately believe that our values and the culture we have

created sets us apart.

We have been able to continue to deliver for all our clients

successfully, including international enterprise wins, by utilising

existing technologies for collaboration to deliver effective remote

working of the entire workforce. These technology platforms in

parallel with increased and frequent feedback loops will continue

to drive remote ways of working whilst enabling the business to

power through the recovery. We plan to continue with these improved

global operational mechanics when life returns to normal, to

continue to drive efficiencies in the business.

Early in the Period, we took a temperature gauge on the ability

of our people to deal with the stress that had been heightened due

to these unforeseen circumstances. These results were remarkable

and demonstrated our people's commitment to the business during

these challenging times. There were three clear actions that arose:

1. Continue the increased level of honest communication with all

staff, 2. Strengthen and empower the management team to give more

support to the employees, 3. Continue to measure employee

satisfaction.

Increased level of honest communication

Since the start of the pandemic, increased communication has

been vital. We have put in place our "Tea with Teams" weekly

company updates, daily Stand Ups at a department level, Sales &

Operations meetings to streamline the hand off between the two

functions and senior leadership meetings to align and empower the

senior team on the strategy of the business. We have moved the

whole business to a quarterly cadence where objectives are set at

the top of the business and rolled down to controllables and

deliverables for every employee so that we are all aligned. We have

moved from an annual company update to quarterly, so the business

understands the output of their contributions and can be proud of

working for Eagle Eye.

Developing the Senior Management Team

It was evident that we needed to strengthen the skills of our

Senior Management Team to better equip them to deliver on the

overall strategy and culture of the business but also for the

Executive and Senior Management Team to be better connected to

allow a quicker response to the evolving climate. We created a

'Weekly Club' for this group of people to self-educate, learn and

understand each other better, whilst staying abreast of topics

impacting the business. On top of quarterly business performance

reviews, we have so far studied 'Will it make the Boat Go Faster?',

'The Chimp Paradox' and Agile Methodology for application across

the broader business.

Measuring Employee Satisfaction

Following the initial gauge, it was important to take a regular

measure of employee satisfaction and hence we introduced employee

NPS that we now measure quarterly. We use NPS to measure both our

employees' assessment of our product and whether they would

recommend Eagle Eye as a place to work. We have seen these scores

improve during the pandemic. The latest scores were over +50 which

is an encouraging achievement.

Employee Resource Groups

Eagle Eye has always prided itself on fostering a diverse and

inclusive workplace and culture in line with its strong and clearly

defined values. Last year we encouraged employees to create

Employee Resource Groups and established two, one for mental health

and another for racial diversity. This Period the Committee has

developed the concept further and each month take a topical subject

that showcases the lives and beliefs of our people.

Our people have demonstrated great resilience over the last 6

months, delivering for some of the biggest retailers in the world

whilst managing their own personal circumstances. I would like to

thank the team for their individual contributions.

Financial Review

Key performance indicators H1 2021 H1 2020

Financial GBP000 GBP000

----------- -----------

Revenue 10,829 10,072

----------- -----------

Recurring revenue 7,959 7,313

----------- -----------

Adjusted EBITDA(1) 2,095 1,280

----------- -----------

Operating profit/(loss) before interest

and tax 236 (473)

----------- -----------

Net cash/(debt)(2) 81 (2,161)

----------- -----------

Cash and cash equivalents 1,181 1,239

----------- -----------

Short term borrowings (1,100) (3,400)

----------- -----------

Non-financial

----------- -----------

Chargeable AIR redemption and interaction

volumes 452.2m 476.8m

----------- -----------

Recurring revenue:

----------- -----------

Percentage of licence revenue 3,799; 35% 3,850; 38%

----------- -----------

Percentage of AIR transaction revenue 3,037; 28% 2,999; 30%

----------- -----------

Percentage of SMS transaction revenue 1,123; 10% 464; 5%

----------- -----------

Total recurring revenue 73% 73%

----------- -----------

Long term contract customer churn by

value 0.2% 0.3%

----------- -----------

(1) Adjusted EBITDA excludes share-based payment charges along

with depreciation, amortisation, interest and tax from the measure

of profit

(2) Net cash/(debt) is cash and cash equivalents less

borrowings

Revenue and gross profit

During the Period, the Group delivered a revenue increase of 8%

to GBP10.8m (H1 2020: GBP10.1m). In addition, half-on-half growth

continued to be delivered with H1 2021 growing 5% over H2 2020.

These growth metrics have been achieved despite the impact of

lockdowns (most notably on our F&B and non-Grocery customer

segment) and other restrictions, which has been mitigated by

increased SMS messaging revenue. This is both from clients where

the Group is integrated, not only for their High Street stores, but

also for their e-commerce offering and also from supporting clients

following the UK Government's Test and Trace guidelines. This

change in product mix demonstrates the diversity and breadth of the

platform offering.

Revenue generated from recurring subscription fees and

transactions over the network represented 73% (H1 2020: 73%) of

total revenue for the Period. Reflecting the COVID-19 impact, AIR

recurring revenues were flat against the prior year at GBP6.8m (H1

2020: GBP6.8m) . However, international revenue grew 17% to GBP3.9m

(H1 2020: GBP3.4m) reflecting new wins in Australia and the US and

existing clients moving to the run time phase of their

contracts.

Chargeable AIR redemption and interaction volumes, a key measure

of usage of Eagle Eye AIR, fell by 5% to 452.2m (H1 2020: 476.8m),

primarily reflecting the impact of COVID-19, offset by an increased

number of loyalty transactions following the successful launch of

new customer programmes, including for SEG and the full period

effect of Sainsbury's. Gift transactional volumes over the Black

Friday and Christmas period were up 6% on the same period in H1

2020, driven by e-commerce sales.

Gross profit grew 4% to GBP9.8m (H1 2020: GBP9.4m) with gross

margin of 91% (H1 2020: 94%). The change in gross margin reflects

the impact of the growth in the lower margin SMS business. AIR

margin grew to 98% (H1 2020: 97%). Cost of sales includes the cost

of sending SMS messages, revenue share agreements and outsourced

bespoke development work. All internal resource costs are

recognised within operating costs, net of capitalised development

and contract costs.

Adjusted operating costs and EBITDA

Reflecting uncertainties in revenue created by COVID-19, the

cost base has been carefully managed whilst ensuring the necessary

investment in the business continues linked to new wins, which,

along with the full period benefits of moving our infrastructure to

Google Cloud, resulted in a reduction in adjusted operating costs

to GBP7.7m (H1 2020: GBP8.2m). Adjusted operating costs represents

sales and marketing, product development (net of capitalised

costs), project delivery (net of capitalised implementation costs),

operational IT, general and administration costs.

Net staff costs, which represent 62% of adjusted operating costs

(H1 2020: 59%), were held at GBP4.8m (H1 2020: GBP4.8m). Average

headcount for the Period was 140 (H1 2020: 140 ). Infrastructure

costs decreased 3% to GBP2.1m (H1 2020: GBP2.2m) reflecting the

full period impact of the transition to Google Cloud and certain

rent-free periods agreed with landlords, offset by increased costs

for higher transactional capacity. Other operating costs, which are

either discretionary or are not correlated to changes in revenue,

were 28% lower at GBP0.8m (H1 2020: GBP1.1m), primarily as a result

of minimal travel due to COVID-19.

We have continued to invest in our Product where total spend in

the Period was GBP2.2m (H1 2020: GBP2.2m). Capitalised product

development costs were GBP1.0m (H1 2020: GBP1.2m) whilst

amortisation of capitalised development costs was GBP1.1m (H1 2020:

GBP1.0m). Contract costs (including costs to obtain contracts and

contract fulfilment costs), recognised as assets under IFRS 15,

were GBP0.2m (H1 2020: GBP0.2m) and amortisation of contract costs

was GBP0.2m (H1 2020: GBP0.2m).

Continued control over costs along with revenue growth achieved

despite the impact of COVID-19 has seen adjusted EBITDA grow by 64%

to GBP2.1m (H1 2020: GBP1.3m). To provide a better guide to the

underlying business performance, adjusted EBITDA excludes

share-based payment charges along with depreciation, amortisation,

interest and tax from the measure of profit.

Maiden profit before tax

The GAAP measure of operating profit before interest and tax was

a maiden first half profit of GBP0.2m (H1 2020: loss of GBP0.5m),

reflecting the growth in EBITDA partially offset by higher

amortisation costs. The non-cash share-based payment charge

decreased to GBP0.3m (H1 2020: GBP0.4m), reflecting the impact of

COVID-19 on FY21 performance related vesting conditions.

Earnings per share

Net finance expenses reduced 75% to GBP0.04m (H1 2020: GBP0.16m)

reflecting the lower level of utilisation of the Group's revolving

credit facility.

The tax charge of GBP0.3m (H1 2020: GBP0.01m) reflects tax

payments for the Group's profitable operations in North America,

offset by the recognition of a deferred tax asset in the UK

reflecting the expected utilisation of a proportion of the historic

losses brought forward. Loss after taxation was GBP0.1m (H1 2020:

GBP0.6m) and reported basic and diluted loss per share improved by

86% to 0.36p (H1 2020: 2.51p) primarily reflecting the improvement

in adjusted EBITDA.

Cash and net debt

The Group ended the Period with net cash of GBP0.1m (H1 2020:

net debt of GBP2.2m) being better than the Board's expectations.

Cash consumption in the Period has followed the Group's usual

seasonal profile which sees higher cash consumption in the first

half of the year compared to the second half. In addition, in FY

2020 the Group made use of a number of COVID-19 linked schemes in

order to manage working capital, including the deferral of VAT and

PAYE in the UK. The outflow in H1 2021 of GBP1.4m (H1 2020:

GBP0.9m) included repayment of approximately GBP1.1m (H1 2020:

GBPnil) of these deferrals.

The Period end net cash, together with the unutilised portion of

the Group's GBP5m revolving credit facility with Barclays Bank plc,

means the Group has GBP5.1m available headroom (December 2019:

GBP2.8m) which the Directors are confident is sufficient to support

the Group's existing growth plans.

Statement of financial position

The Group had net assets of GBP4.4m at the end of the Period

(June 2020: GBP4.4m).

COVID-19

The impacts of COVID-19, and most recently the UK national

lockdown 3, continue to negatively impact the Group's UK Food &

Beverage and Non-Grocery customers, which accounted for

approximately 10% of Group revenue pre-COVID-19, while also

impacting the continued deepening of client accounts that we would

traditionally see and causing corporate decision-making to be

delayed.

Despite this, Eagle Eye has delivered targeted levels of revenue

growth, up 8% to GBP10.8m in the first half. Additionally, the cost

base has continued to be carefully managed whilst ensuring the

necessary investment in the business continues, as evidenced by the

strong growth in adjusted EBITDA.

Outlook

Against the ongoing challenging global outook, the careful

management of the business, successful new wins in the first half

of the year and continued growth of the existing customer base,

trading for the financial year ending 30 June 2021 remains in line

with the Board's expectations.

The growth of Eagle Eye's international customer base including

strengthened footholds in the US and Asia Pacific, alongside its

continued strong presence domestically in the UK, provide tangible

evidence of an expanding opportunity and these are expected to

drive accelerated growth in future periods. The Group will continue

to invest in its people, product development, sales and marketing,

and in new geographies in line with customer demand, whilst

carefully managing the business and cost-base, to capitalise on

this momentum.

Never has digital engagement with consumers been of more

relevance to the global retail sector. The Group's new business

pipeline continues to grow at record levels internationally,

including multiple enterprise level opportunities, providing the

Board with confidence in the ongoing success of the business.

Malcolm Wall, Non-Executive Chairman

Consolidated unaudited interim statement of total comprehensive

income for the six months ended 31 December 2020

Unaudited Unaudited Unaudited

6 months

to 6 months to Year to

31 December 31 December 30 June

2020 2019 2020

Note GBP000 GBP000 GBP000

Continuing operations

Revenue 3 10,829 10,072 20,421

Cost of sales (1,027) (636) (1,318)

------------------------------------ ---- ----------- ----------- ---------

Gross profit 9,802 9,436 19,103

Adjusted operating expenses(1) (7,707) (8,156) (15,825)

------------------------------------ ---- ----------- ----------- ---------

Profit before interest,

tax, depreciation, amortisation

and share-based payment

charge 2,095 1,280 3,278

Share-based payment

charge (252) (371) (464)

Depreciation and amortisation (1,607) (1,382) (2,856)

------------------------------------ ---- ----------- ----------- ---------

Operating profit/(loss) 236 (473) (42)

Finance income - 2 1

Finance expense (39) (161) (291)

------------------------------------ ---- ----------- ----------- ---------

Profit/(loss) before

taxation 197 (632) (332)

Taxation (290) (11) (122)

------------------------------------ ---- ----------- ----------- ---------

Loss after taxation for the

financial period (93) (643) (454)

Foreign exchange adjustments (199) (127) (98)

------------------------------------ ---- ----------- ----------- ---------

Total comprehensive loss attributable

to the owners of the parent

for the financial period (292) (770) (552)

------------------------------------------ ----------- ----------- ---------

(1) Adjusted operating expenses excludes share-based payment

charge, depreciation and amortisation

Loss per share

From continuing operations

Basic and diluted 4 (0.36)p (2.51)p (1.77)p

------------------------------------ ---- ----------- ----------- ---------

Consolidated unaudited interim statement of financial position

as at 31 December 2020

Unaudited Unaudited Unaudited

31 December 31 December 30 June

2020 2019 2020

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 6,264 6,413 6,494

Contract fulfilment

costs 270 237 209

Property, plant and

equipment 865 1,048 903

Deferred taxation 212 - 121

7,611 7,698 7,727

------------------------------ ----------- ----------- ---------

Current assets

Trade and other receivables 5,367 5,669 4,840

Current tax receivable - 407 -

Cash and cash equivalents 1,181 1,239 1,519

------------------------------- ----------- ----------- ---------

6,548 7,315 6,359

------------------------------ ----------- ----------- ---------

Total assets 14,159 15,013 14,086

------------------------------- ----------- ----------- ---------

Current liabilities

Trade and other payables (7,757) (6,749) (7,879)

Financial liabilities (1,100) (3,400) -

------------------------------- ----------- ----------- ---------

(8,857) (10,149) (7,879)

------------------------------ ----------- ----------- ---------

Non-current liabilities

Other payables (858) (817) (1,783)

------------------------------- ----------- ----------- ---------

Total liabilities (9,715) (10,966) (9,662)

------------------------------- ----------- ----------- ---------

Net assets 4,444 4,047 4,424

------------------------------- ----------- ----------- ---------

Equity attributable to owners

of the parent

Share capital 258 257 257

Share premium 17,315 17,190 17,256

Merger reserve 3,278 3,278 3,278

Share option reserve 3,762 3,456 3,525

Retained losses (20,169) (20,134) (19,892)

------------------------------- ----------- ----------- ---------

Total equity 4,444 4,047 4,424

------------------------------- ----------- ----------- ---------

Consolidated unaudited interim statement of changes in equity

for the six months ended 31 December 2020

Share Merger Share option Retained

capital Share premium reserve reserve losses Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 July

2019 255 17,066 3,278 3,236 (19,515) 4,320

Loss for the period - - - - (643) (643)

Other comprehensive

income

Foreign exchange adjustments - - - - (127) (127)

------------------------------- -------- ------------- -------- ------------ -------- ------

- - - - (770) (770)

------------------------------- -------- ------------- -------- ------------ -------- ------

Transactions with

owners

Exercise of share

options 2 124 - - - 126

Fair value of share

options exercised - - - (151) 151 -

Share-based payment

charge - - - 371 - 371

------------------------------- -------- ------------- -------- ------------ -------- ------

2 124 - 220 151 497

Balance at 31 December

2019 257 17,190 3,278 3,456 (20,134) 4,047

------------------------------- -------- ------------- -------- ------------ -------- ------

Profit for the period - - - - 189 189

Other comprehensive

income

Foreign exchange adjustments - - - - 29 29

------------------------------- -------- ------------- -------- ------------ -------- ------

- - - - 218 218

------------------------------- -------- ------------- -------- ------------ -------- ------

Transactions with

owners

Exercise of share

options - 66 - - - 66

Fair value of share

options exercised - - - (24) 24 -

Share-based payment

charge - - - 93 - 93

------------------------------- -------- ------------- -------- ------------ -------- ------

- 66 - 69 24 159

------------------------------- -------- ------------- -------- ------------ -------- ------

Balance at 30 June

2020 257 17,256 3,278 3,525 (19,892) 4,424

Loss for the period - - - - (93) (93)

Other comprehensive

income

Foreign exchange adjustments - - - - (199) (199)

------------------------------- -------- ------------- -------- ------------ -------- ------

- - - - (292) (292)

------------------------------- -------- ------------- -------- ------------ -------- ------

Transactions with

owners

Exercise of share

options 1 59 - - - 60

Fair value of share

options exercised - - - (15) 15 -

Share-based payment

charge - - - 252 - 252

------------------------------- -------- ------------- -------- ------------ -------- ------

1 59 - 237 15 312

Balance at 31 December

2020 258 17,315 3,278 3,762 (20,169) 4,444

------------------------------- -------- ------------- -------- ------------ -------- ------

Included in "retained losses" is a cumulative foreign exchange

balance of GBP(168,000) (June 2020: GBP31,000).

Consolidated unaudited interim statement of cash flows for the

six months ended 31 December 2020

Unaudited Unaudited Unaudited

6 months

6 months to to Year to

31 December 31 December 30 June

2020 2019 2020

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit/(loss) before taxation 197 (632) (332)

Adjustments for:

Depreciation 149 205 370

Amortisation 1,458 1,178 2,487

Share-based payment charge 252 371 464

Finance income - (2) (1)

Finance expense 39 161 291

Increase in trade and other receivables (527) (2,052) (1,222)

(Decrease)/increase in trade and

other payables (1,072) 1,792 3,793

Income tax paid (344) (153) (180)

Income tax received - - 389

Net cash flows from operating activities 152 868 6,059

-------------------------------------------- ----------- ----------- ---------

Cash flows from investing activities

Payments to acquire property, plant

and equipment (111) (48) (68)

Payments to acquire intangible

assets (1,288) (1,452) (2,815)

Net cash flows used in investing

activities (1,399) (1,500) (2,883)

-------------------------------------------- ----------- ----------- ---------

Cash flows from financing activities

Net proceeds from issue of equity 60 126 192

Proceeds from borrowings 1,300 1,700 2,000

Repayment of borrowings (200) (900) (4,600)

Capital payments in respect of

leases (13) (133) (224)

Interest paid in respect of leases (20) (23) (44)

Interest paid (19) (137) (248)

Interest received - 2 2

-------------------------------------------- ----------- ----------- ---------

Net cash flows from financing activities 1,108 635 (2,922)

-------------------------------------------- ----------- ----------- ---------

Net (decrease)/increase in cash

and cash equivalents in the period (139) 3 254

Foreign exchange adjustments (199) (127) (98)

Cash and cash equivalents at beginning

of period 1,519 1,363 1,363

-------------------------------------------- ----------- ----------- ---------

Cash and cash equivalents at end

of period 1,181 1,239 1,519

-------------------------------------------- ----------- ----------- ---------

Notes to the consolidated unaudited interim financial

statements

1. Basis of preparation

The Group's half-yearly financial information, which is

unaudited, consolidates the results of Eagle Eye Solutions Group

plc and its subsidiary undertakings up to 31 December 2020. The

Group's accounting reference date is 30 June. Eagle Eye Solutions

Group plc's shares are listed on the Alternative Investment Market

of the London Stock Exchange (AIM).

The Company is a public limited liability company incorporated

and domiciled in England & Wales. The presentational and

functional currency of the Group is Sterling. Results in this

consolidated financial information have been prepared to the

nearest GBP1,000.

Eagle Eye Solutions Group plc and its subsidiary undertakings

have not applied IAS 34, Interim Financial Reporting, which is not

mandatory for UK AIM listed groups, in the preparation of this

half-yearly financial report.

The accounting policies used in the preparation of the financial

information for the six months ended 31 December 2020 are in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards ('IFRS') as adopted by

the European Union and are consistent with those which will be

adopted in the annual financial statements for the year ending 30

June 2021.

The profit before interest, tax, depreciation, amortisation and

share-based payment charge is presented in the statement of total

comprehensive income as the Directors consider this performance

measure provides a more accurate indication of the underlying

performance of the Group and is commonly used by City analysts and

investors.

While the financial information included has been prepared in

accordance with the recognition and measurement criteria of IFRS,

as adopted by the European Union, these interim financial

statements do not contain sufficient information to comply with

IFRS.

The comparative financial information for the year ended 30 June

2020 has been extracted from the annual financial statements of

Eagle Eye Solutions Group plc. These interim results for the period

ended 31 December 2020, which are not audited, do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The financial information does not therefore

include all of the information and disclosures required in the

annual financial statements.

Full audited accounts of the Group in respect of the year ended

30 June 2020, which received an unqualified audit opinion and did

not contain a statement under section 498(2) or (3) of the

Companies Act 2006, have been delivered to the Registrar of

Companies.

2. Going concern basis

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled " Guidance on Risk Management and Internal Control

and Related Financial and Business Reporting" . The Directors have

prepared detailed financial forecasts and cash flows looking beyond

12 months from the date of this half-yearly financial information.

In developing these forecasts, the Directors have made assumptions

based upon their view of the current and future economic conditions

that will prevail over the forecast period.

On the basis of the above projections, the Directors are

confident that the Group has sufficient working capital to honour

all of its obligations to creditors as and when they fall due. In

reaching this conclusion, the Directors have considered the

forecast cash headroom, the resources available to the Group and

the potential impact of changes in forecast growth and other

assumptions, including the potential to avoid or defer certain

costs and to reduce discretionary spend as mitigating actions in

the event of such changes. Accordingly, the Directors continue to

adopt the going concern basis in preparing this half-yearly

financial information .

3. Segmental analysis

The Group is organised into one principal operating division for

management purposes. Revenue is analysed as follows:

Unaudited Unaudited Unaudited

6 months

to 6 months to Year to

31 December 31 December 30 June

2020 2019 2020

GBP000 GBP000 GBP000

Development and set

up fees 2,870 2,759 5,505

Subscription and transaction

fees 7,959 7,313 14,916

10,829 10,072 20,421

----------------------------- ----------- ----------- ---------

Unaudited Unaudited Unaudited

6 months

to 6 months to Year to

31 December 31 December 30 June

2020 2019 2020

GBP000 GBP000 GBP000

AIR revenue 9,659 9,564 19,165

Messaging revenue 1,170 508 1,256

10,829 10,072 20,421

------------------ ----------- ----------- ---------

The majority of the Group's revenue comes from services which

are transferred over time.

4. Loss per share

The calculation of basic and diluted loss per share is based on

the result attributable to ordinary shareholders divided by the

weighted average number of ordinary shares in issue during the

period. The weighted average number of shares for the purpose of

calculating the basic and diluted measures is the same. This is

because the outstanding share options would have the effect of

reducing the loss per ordinary share and therefore would not be

dilutive.

Unaudited Unaudited

H1 2021 H1 2020

Unaudited Weighted Unaudited Weighted

H1 2021 Unaudited average H1 2020 Unaudited average

Loss H1 2021 number Loss H1 2020 number

per share Loss of ordinary per share Loss of ordinary

pence GBP000 shares pence GBP000 shares

Basic and

diluted loss

per share (0.36) (93) 25,747,607 (2.51) (643) 25,593,503

-------------- ---------- --------- ------------ ---------- --------- ------------

5. Alternative performance measure

EBITDA is a key performance measure for the Group and is derived

as follows:

Unaudited Unaudited Unaudited

6 months to 6 months Year to

31 December to 31 December 30 June

2020 2019 2020

GBP000 GBP000 GBP000

Profit/(loss) before taxation

Add back: 197 (632) (332)

Finance income and expense 39 159 290

Share-based payments 252 371 464

Depreciation and amortisation 1,607 1,382 2,856

------------------------------------------ ----------------- ---------------- ----------

EBITDA 2,095 1,280 3,278

------------------------------------------ ----------------- ---------------- ----------

6. Net cash

Foreign

30 June exchange 31 December

2020 Cash flow adjustments 2020

GBP000 GBP000 GBP000 GBP000

Cash and cash equivalents 1,519 (139) (199) 1,181

Financial liabilities - (1,100) - (1,100)

Net cash 1,519 (1,239) (199) 81

---------------------------- -------- ---------- ------------- ------------

7. Availability of this Interim Announcement

Copies of this announcement are available on the Company's

website, www.eagleeye.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FELLFFXLFBBZ

(END) Dow Jones Newswires

March 16, 2021 03:00 ET (07:00 GMT)

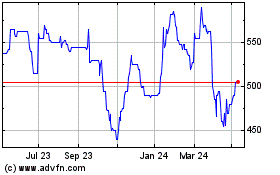

Eagle Eye Solutions (LSE:EYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

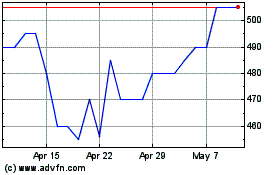

Eagle Eye Solutions (LSE:EYE)

Historical Stock Chart

From Apr 2023 to Apr 2024