Faron Pharmaceuticals Oy Holding(s) in Company (4814P)

February 17 2021 - 10:30AM

UK Regulatory

TIDMFARN

RNS Number : 4814P

Faron Pharmaceuticals Oy

17 February 2021

Faron Pharmaceuticals Oy

("Faron" or the "Company")

Holding(s) in the Company

Company announcement, 17 February 2021 at 4.30pm GMT / 6.30pm

EET

TURKU - FINLAND - Faron Pharmaceuticals Oy (First North: FARON,

AIM: FARN), the clinical stage biopharmaceutical company, has on 16

February 2021 received notifications from Mr. Timo Syrjälä and Mr.

Tom-Erik Lind of the decrease of their holdings due to issuance of

new shares.

Trading in the Placing Shares commenced on First North and AIM

on 16 February 2021.

The mentioned notifications are attached in this

announcement.

For more information please contact:

Faron Pharmaceuticals Oy

Dr Markku Jalkanen, Chief Executive Officer

investor.relations@faron.com

Cairn Financial Advisers LLP, Nomad

Sandy Jamieson, Jo Turner, Mark Rogers

Phone: + 44 207 213 0880

Sisu Partners Oy, Certified Adviser on Nasdaq First North

Juha Karttunen

Phone: +358 40 555 4727

Jukka Järvelä

Phone: +358 50 553 8990

Consilium Strategic Communications

Mary-Jane Elliott, David Daley, Lindsey Neville

Phone: +44 (0)20 3709 5700

E-mail: faron@consilium-comms.com

Stern Investor Relations

Julie Seidel, Naina Zaman

Phone: +1 (212) 362-1200

E-mail: julie.seidel@sternir.com

About Faron Pharmaceuticals Ltd

Faron (AIM: FARN, First North: FARON) is a clinical stage

biopharmaceutical company developing novel treatments for medical

conditions with significant unmet needs. The Company currently has

a pipeline based on the receptors involved in regulation of immune

response in oncology and organ damage. Bexmarilimab is its

investigative precision immunotherapy with the potential to provide

permanent immune stimulation for difficult-to-treat cancers through

targeting myeloid function. A novel anti-Clever-1 humanised

antibody, bexmarilimab targets Clever-1 positive (Common Lymphatic

Endothelial and Vascular Endothelial Receptor 1) tumour associated

macrophages (TAMs) in the tumour microenvironment, converting these

highly immunosuppressive M2 macrophages to immune stimulating M1

macrophages. With the ability to switch immune suppression to

immune activation in various conditions, bexmarilimab has potential

across oncology, infectious diseases and vaccine development.

Currently in phase I/II clinical development as a potential therapy

for patients with untreatable solid tumours, bexmarilimab has

potential as a single-agent therapy or in combination with other

standard treatments including immune checkpoint molecules.

Traumakine is an investigational intravenous (IV) interferon

beta-1a therapy for the treatment of acute respiratory distress

syndrome (ARDS) and other ischemic or hyperinflammatory conditions.

In addition to its profound antiviral effect, Traumakine

upregulates the cell surface protein Cluster of Differentiation 73

(CD73), an enzyme that suppresses pro-inflammatory responses in

endothelial cells. Using an IV administration of interferon beta-1a

provides optimal exposure to the lung vasculature, increasing

protection against serious lung complications and helping to

prevent vascular leakage by enhancing endothelial barrier function.

Traumakine is currently being evaluated in global trials as a

potential treatment for hospitalised patients with COVID-19. As

part of a working relationship established with Faron, the 59th

Medical Wing of the US Air Force and the US Department of Defense

are also evaluating Traumakine's role in preventing multiple organ

dysfunction syndrome (MODS) after ischemia-reperfusion injury

caused by a major trauma. Faron is based in Turku, Finland. Further

information is available at www.faron.com .

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible) (i)

1a. Identity of the issuer or the Faron Pharmaceuticals Ltd

underlying issuer of existing shares

to which voting rights are attached

(ii) :

-------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer X

-----

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights

-----

An acquisition or disposal of financial instruments

-----

An event changing the breakdown of voting rights

-----

Other (please specify)(iii) : (Decrease of holding due to issuance X

of new shares)

-----

3. Details of person subject to the notification obligation (iv)

Name

Timo Syrjälä

City and country of registered office

(if applicable)

4. Full name of shareholder(s) (if different from 3.) (v)

Name

-------------------------------------------

City and country of registered office

(if applicable)

-------------------------------------------

5. Date on which the threshold was 12.2.2021

crossed or reached (vi) :

-------------------------------------------

6. Date on which issuer notified (DD/MM/YYYY): 16.2.2021

-------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer (vii)

of 8. A) (total of 8.B

1 + 8.B 2)

------------------ --------------------- -------------- --------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 13.57 13.57 50,417,874

------------------ --------------------- -------------- --------------------

Position of

previous notification

(if

applicable) 14.08% 14.08%

------------------ --------------------- -------------- --------------------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached (viii)

A: Voting rights attached to shares

Class/type of Number of voting rights % of voting rights

shares (ix)

ISIN code (if

possible)

--------------------------------------------------

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive

2004/109/EC) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC)

(DTR5.1) (DTR5.2.1) (DTR5.2.1)

---------------------- -------------------------- ------------------------- ---------------------

FI4000153309 2,561,402 4,277,837 5.08% 8.48%

---------------------- -------------------------- ------------------------- ---------------------

SUBTOTAL 8.

A 6,839,239 13.57%

-------------------------------------------------- ------------------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC

(DTR5.3.1.1 (a))

Type of Expiration Exercise/ Number of voting % of voting rights

financial date Conversion Period rights that may

instrument (x) (xi) be acquired if

the instrument

is

exercised/converted.

----------- ------------------------------ -------------------------------- ---------------------

SUBTOTAL 8. B 1

------------------------------ -------------------------------- ---------------------

B 2: Financial Instruments with similar economic effect according to Art.

13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of Expiration Exercise/ Physical or Number of % of voting rights

financial date (x) Conversion cash voting rights

instrument Period (xi) settlement

(xii)

---------------- -------------------- -------------------- --------------------

SUBTOTAL 8.B.2

-------------------- --------------------

9. Information in relation to the person subject to the notification

obligation (please mark the applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting rights X

and/or the financial instruments are effectively held starting with

the ultimate controlling natural person or legal entity(xiv) (please

add additional rows as necessary)

Name (xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is higher

is higher than the instruments if it than the notifiable

notifiable threshold equals or is higher threshold

than the notifiable

threshold

---------------------- --------------------- --------------------------

Timo Syrjälä

(Direct) 5.08% 5.08%

---------------------- --------------------- --------------------------

Acme Investments

SPF Sarl (Indirect) 8.48% 8.48%

---------------------- --------------------- --------------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

-------------------------------------------------

The number and % of voting rights

held

-------------------------------------------------

The date until which the voting rights

will be held

-------------------------------------------------

11. Additional information (xvi)

Decrease due to issuance of shares

Place of completion Luxembourg

Date of completion 16.02.2021

-----------

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible) (i)

1a. Identity of the issuer or the Faron Pharmaceuticals Ltd

underlying issuer of existing shares

to which voting rights are attached

(ii) :

-------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer X

-----

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights

-----

An acquisition or disposal of financial instruments

-----

An event changing the breakdown of voting rights

-----

Other (please specify)(iii) : (Decrease of holding due to issuance x

of new shares)

-----

3. Details of person subject to the notification obligation (iv)

Name

Tom-Erik Lind

City and country of registered office

(if applicable)

4. Full name of shareholder(s) (if different from 3.) (v)

Name

-------------------------------------------

City and country of registered office

(if applicable)

-------------------------------------------

5. Date on which the threshold was 12.2.2021

crossed or reached (vi) :

-------------------------------------------

6. Date on which issuer notified (DD/MM/YYYY): 16.2.2021

-------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer (vii)

of 8. A) (total of 8.B

1 + 8.B 2)

------------------ --------------------- -------------- --------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 7.55 7.55 50,417,874

------------------ --------------------- -------------- --------------------

Position of

previous notification

(if

applicable) 10.00% 10.00%

------------------ --------------------- -------------- --------------------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached (viii)

A: Voting rights attached to shares

Class/type of Number of voting rights % of voting rights

shares (ix)

ISIN code (if

possible)

--------------------------------------------------

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive

2004/109/EC) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC)

(DTR5.1) (DTR5.2.1) (DTR5.2.1)

---------------------- -------------------------- ------------------------- ---------------------

FI4000153309 3,806,611 7.55

---------------------- -------------------------- ------------------------- ---------------------

SUBTOTAL 8.

A 3,806,611 7.55%

-------------------------------------------------- ------------------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC

(DTR5.3.1.1 (a))

Type of Expiration Exercise/ Number of voting % of voting rights

financial date Conversion Period rights that may

instrument (x) (xi) be acquired if

the instrument

is

exercised/converted.

----------- ------------------------------ -------------------------------- ---------------------

SUBTOTAL 8. B 1

------------------------------ -------------------------------- ---------------------

B 2: Financial Instruments with similar economic effect according to Art.

13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of Expiration Exercise/ Physical or Number of % of voting rights

financial date (x) Conversion cash voting rights

instrument Period (xi) settlement

(xii)

---------------- -------------------- -------------------- --------------------

SUBTOTAL 8.B.2

-------------------- --------------------

9. Information in relation to the person subject to the notification

obligation (please mark the applicable box with an "X")

Person subject to the notification obligation is not controlled X

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting rights

and/or the financial instruments are effectively held starting with

the ultimate controlling natural person or legal entity(xiv) (please

add additional rows as necessary)

Name (xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is higher

is higher than the instruments if it than the notifiable

notifiable threshold equals or is higher threshold

than the notifiable

threshold

----------------------- --------------------- --------------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

-------------------------------------------------

The number and % of voting rights

held

-------------------------------------------------

The date until which the voting rights

will be held

-------------------------------------------------

11. Additional information (xvi)

Place of completion Malta

Date of completion 16.2.2021

----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

HOLZZGMZVNFGMZM

(END) Dow Jones Newswires

February 17, 2021 11:30 ET (16:30 GMT)

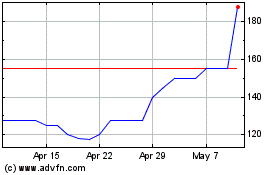

Faron Pharmaceuticals Oy (LSE:FARN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Faron Pharmaceuticals Oy (LSE:FARN)

Historical Stock Chart

From Apr 2023 to Apr 2024