TIDMFCAP

RNS Number : 1845S

finnCap Group PLC

07 July 2020

finnCap Group plc ("finnCap" or "the Company")

Preliminary results for the year ended 31 March 2020

Financial Highlights(1) :

-- Turnover of GBP26.0m (FY19: GBP24.5m)

-- Equity Capital Markets division turnover of GBP18.7m (FY19: GBP21.3m)

-- M&A division turnover of GBP7.3m (FY19: GBP3.2m; 12 months to 31 March 2019: GBP14.9m)

-- Pre-tax profit GBP1.4m before non-recurring costs of GBP0.2m

(FY19: GBP4.3m before non-recurring costs of GBP1.1m)

-- Basic EPS: 0.49p (FY19: 1.85p). Adjusted EPS: (2) 0.80p (FY19: 2.86p)

-- Cash of GBP4.7m (31 Mar 2019: GBP4.7m)

Strategic Development (1) :

-- Completed 61 transactions with total deal and advisory fees of GBP16.0m (FY19: GBP15.2m)

-- Completed 13 private M&A transactions in Cavendish

-- Completed 3 debt mandates and signed up 9 new mandates for FY21

-- Hired new revenue generators to cover target sectors and services

-- Debt advisory and private growth capital practices launched,

further diversifying revenue

Current Trading (unaudited)(3)

-- Q1 2021 revenue GBP9.8m (Q120: GBP6.5m) including GBP6.5m of

advisory fees (Q120: GBP4.3m)

-- COVID-19: significantly reduced cost base and enhanced cash generation

-- Cash(4) at 30 June 2020 was GBP8.5m (excluding proceeds from

property loan and HMRC deferrals)

Commenting on the results, Sam Smith, Chief Executive Officer,

said:

"The financial year was dominated by the uncertain political and

economic backdrop which is reflected in our results. Equity

issuance levels reached a multi-year low and M&A deal cycles

lengthened considerably during the latter half of the year.

Nonetheless we have continued to concentrate on expanding services,

such as debt advisory and private growth capital, to enhance our

product line up, as well as investing in sector coverage from which

we expect to derive the benefit in future years.

At the end of March we anticipated a difficult trading

environment due to COVID-19 and took the right steps to prepare

quickly. In Q1 2021, we helped clients raise significant equity to

strengthen balance sheets and support investment cases from a range

of companies, many of which operate in areas such as life sciences

and tech and are at the forefront of the UK's efforts to recover

from the pandemic. This contributed to making the period the best

quarter we have ever recorded.

Our capital raising activity and market volatility also helped

drive higher trading revenues. While the global M&A business

slowed, our team still completed several mandates, both public and

private.

This strong performance in Q1 coupled with our actions to

significantly reduce costs has resulted in us having a much more

resilient balance sheet at 30 June 2020.

The overall outlook for the global economy and the effects of

COVID-19 remain uncertain and we must continue to be cautious about

the overall prospects for the current financial year. In the

shorter term, our pipeline of deals for the first half remains good

and we will continue to deliver on our strategy for growth."

Contacts

finnCap Group plc Tel: +44 (0) 20 7220 0500

Sam Smith, Chief Executive Officer

investor.relations@finncap.com

Richard Snow, Chief Financial Officer

Grant Thornton (Nominated Adviser) Tel: +44 (0) 20 7383 5100

Philip Secrett/Samantha Harrison/Seamus Fricker

finnCap Ltd (Broker) Tel: +44 (0) 20 7220 0500

Rhys Williams / Tim Redfern

Sapience Communications (PR adviser) Tel: +44 (0) 20 3195 3240

Richard Morgan Evans

Notes to Editors

About finnCap Group

finnCap Group plc provides financial services to growth

companies both public and private. We provide advisory, broking and

research services to 126 companies on AIM and on the London Stock

Exchange Main Market and also advises on M&A, with a specialism

in sell-side M&A through Cavendish Corporate Finance, corporate

debt and private company fundraisings. finnCap also provides

trading services to a broad range of institutional investors.

Notes:

(1) The FY19 comparable figures throughout this announcement,

except for the M&A revenue comparative, are for the 11 month

period from 1 May 2018 to 31 March 2019 because of a change in

year-end and the approximately 4 months results of Cavendish

Corporate Finance following its acquisition on 5 December 2018. In

order to provide an appropriate 12 month comparative for the

performance of the M&A segment, the comparative revenue for the

M&A divisions is extracted from the audited accounts of

Cavendish Corporate Finance LLP for the 12 months ended 31 March

2019.

(2) Adjusted EPS is calculated excluding share-based payments,

amortisation of intangible assets from the acquisition of

Cavendish, non-recurring costs and includes an adjustment to

normalise tax. The weighted average number of shares in issue

during the period excludes shares held by the Group's Employee

Benefit Trust.

(3) The Q1 19 comparable period includes trading for three

months for both finnCap Ltd and Cavendish Corporate Finance

LLP.

(4) Cash at 30 June excludes GBP1.8m proceeds from the 5-year

loan announced on 26 May for fitting out the new premises at One

Bartholomew (which was drawn in June 2020 and which will be spent

over the next three months) and amounts due to HMRC under COVID-19

arrangements and repayable over the next 6-12 12 months of

c.GBP1.6m. Cash is stated before any deduction for market making

working capital.

Business review

During FY20, we made significant progress with business

integration, in consolidating our existing client offerings,

improving our infrastructure and investing in new services which

are central to delivering our strategy for growth and strengthening

the business.

However, the operating environment for UK financial services was

challenging and volatile. Business confidence was significantly

impacted by the protracted discussion on Brexit timing in the first

part of the financial year and then the resulting change in

Conservative Party leadership and general election. Completing

transactions in both Equity Capital Markets ("ECM") and Mergers and

Acquisitions ("M&A") was significantly harder than in the prior

year. This was particularly evident in the quantum of funds raised

on AIM during the period with the funds raised in the calendar year

2019 amounting to only GBP3.8bn, a reduction of 30% on prior year

and the lowest since 2012.

In this context, whilst the result for the year was

disappointing, with revenue per head declining markedly to GBP189k

(FY19: GBP230k), it was important to remain profitable and continue

the development of the business.

ECM

Our equity capital markets division of the Group delivered

GBP18.7m of turnover in the year (FY19: GBP21.3m). The principal

reason for the reduction in turnover was a significant reduction in

deal fees as a result of lower equity issuance by our corporate

clients consistent with the equity market activity as a whole. The

individual contributors to this performance are considered

below.

Retainers - Total fees from retainers in the year were GBP6.5m

(FY19: GBP5.9m). Retainers have remained stable on a pro rata basis

which does not reflect the significant change in the client base in

the year. Our focus on client service saw 24 new client wins which

was offset by client losses principally due to delistings and

takeovers.

Transactions - Total fees received from transactions in the year

were GBP8.7m (FY19: GBP12.0m).

Notable public market fundraisings and advisory mandates

included:

-- Xeros Technology Group plc - GBP5.7m Equity Fundraising

-- Trackwise Designs plc - GBP5.9m Equity Fundraising

-- Synairgen plc - GBP14.0m Equity Fundraising

-- The Barkby Group plc - Admission to AIM, GBP5.0m Equity

Fundraising; GBP30.6m reverse takeover

-- FFI Holdings plc - GBP39.5m recommended offer by Lumiere Acquisitions - Rule 3 Adviser

-- Nasstar plc - GBP79.4m recommended offer by GCI - Rule 3 Adviser, NOMAD and Broker

-- SCISYS Group plc - GBP78.9m recommended offer by CGI Inc -

Rule 3 Adviser, NOMAD and Broker

-- Kingswood Holdings plc - advice on GBP80.0m Convertible Preference Shares issue

Our debt advisory team - which works across Cavendish and

finnCap - closed three deals and signed up a further 9 mandates for

FY21 and our private capital team closed 4 fundraisings including

for Parsley Box and Bella & Duke. Together these generated

GBP0.4m revenue.

Trading - trading revenues were GBP3.6m (FY19: GBP3.4m), an

improvement on the previous year, despite market conditions. This

reflects our core focus on providing liquidity to our corporate

client list.

M&A Advisory

Cavendish generated revenues of GBP7.3m in the year (FY19:

GBP3.2m being c.4 months since acquisition), closing 13 private

M&A transactions. Revenue was well down on the previous full

financial year (year to 31 March 2019: GBP14.9m) reflecting the

impact of political uncertainty in H2 on buyer and seller

confidence and the cancellation of a small number of high value

deals that would have made a material difference to the year's

outturn.

Activity improved in the final quarter and the team signed up a

significant number of new retainers which, we believe, demonstrates

the strength of the Cavendish brand and its engagement with clients

in the private sell-side market. This should benefit revenue when

buyer confidence returns to the market although COVID-19 is clearly

delaying many deal timetables.

Key transactions included:

-- Java Republic - sale to Spanish coffee group Cafento

-- Centaur Media - sale of three subsidiaries as part of its strategic refocus

-- The Farm Post Production - advised the founders and WPP plc

on the sale to Picture Head Group

-- Avicenna Holdings - sale to Juno Health

-- Lay & Wheeler - advised Naked Wines Plc on its sale Coterie Limited

-- Star Professional - sale to IRIS Software Group

-- Falcon Green - sale of a minority stake to two private business investors

-- AltoDigital Holdings - sale to Xerox.

Administrative expenses

Costs increased as a result of the longer duration of the

financial period, the cost base assumed from the acquisition of

Cavendish, and the additional costs of being a public company

throughout the period.

The average operating cost per employee reduced to GBP175k

(FY19: GBP191k) primarily as a result of lower bonus payments.

Average staff costs per employee reduced by 15% to GBP115k (FY19:

GBP136k). Staff costs to revenue were broadly stable at 62% (FY19:

59%). Non staff operating cost per employee increased by 10% to

GBP60k partly as the result of the transition to being a listed

company. However, cost action decisions taken during Q4 reduced our

quarterly cost run rate and we currently expect that operating

costs excluding variable compensation and non-recurring costs

(primarily redundancy and property move) in FY21 to be roughly 10%

below FY20.

Capital and liquidity

The Group's cash and cash equivalents, net of borrowings, did

not change over the period at GBP4.7m.

The Group has implemented IFRS 16 for the current period,

resulting in an increase in the carrying value of Property, Plant

and Equipment, and a corresponding creditor. As both of the Group's

office leases are into their last year, the impact on both the

Consolidated Statement of Financial Position and the Consolidated

Statement of Comprehensive Income is not material.

COVID-19 Response and Dividend

At the time of its admission, we set a dividend policy

reflecting the historic performance of each business, the

expectation of future cash flow generation and long-term earnings

potential of the Group. During FY19 the Group made dividend

payments of GBP1.2m.

The COVID-19 pandemic required a rapid response and, reflecting

the expectation of a severe economic impact, it appeared only

sensible to preserve cash resources as a buffer against future

developments.

To reduce cost, we implemented a 3-month voluntary and

Group-wide reduction in salaries and directors' remuneration,

deferred recruiting and reduced discretionary expenditure. In

addition, we have made limited redundancies and staff furloughs.

Alongside this, we also took the difficult decision to not pay any

further dividends relating to the year ended 31 March 2020.

The Board recognises the importance of income to its

shareholders, and is keen to reinstate the dividend, but will only

do so when the operating environment is more certain and the

visibility of revenue becomes clearer.

We will review our position again in November with our interim

results. We further recognise our employees' and directors'

contribution to the firm's financial resilience in these testing

times.

Current trading and outlook

In the 3 months to 30 June 2020, the Group recorded turnover

(unaudited) of GBP9.8m (Q119: GBP6.5m), up by 51% and the best

quarter on record.

Our ECM division has benefitted from a number of equity fund

raisings by clients to invest in COVID-19 related activities,

support balance sheets and to accelerate investment. Alongside this

we have completed a number of public M&A transactions,

experienced favourable market-making conditions and continued to

win clients.

In the M&A division transactions have continued to complete

and our team has continued to win new mandates, although several

transactions we expected to close in the first quarter have been

delayed as a result of COVID-19.

The trading performance, combined with the actions taken to

protect the business during the initial stage of the COVID-19

pandemic, led to an increase in cash at 30 June to GBP8.5m(4) .

This level of liquidity is substantially in excess of our capital

requirements and provides an excellent platform as we look to an

uncertain future.

In September, the Group will move into its new premises at 1

Bartholomew Close which will enable us to operate and leverage our

two brands from a single base and to share best practice, cross

sell and win new clients. The GBP1.8m fit out cost will be financed

by our 5-year loan announced in May. We expect to record c.GBP800k

as a non-recurring cost in H121 as a result of having overlapping

properties. Given the long rent-free period for 1 Bartholomew Close

the cash impact is very substantially lower.

Whilst we have experienced a good start to the year and have a

good pipeline of deals for the next few months, the fact remains

that the outlook is uncertain and we therefore remain cautious

about the prospects for the year and particularly the trading

period post September.

Regardless, we will continue to drive our strategy and, as the

result of our actions in March and a strong Q1 performance, we have

a more resilient balance sheet to capture the opportunities that

arise in the post COVID-19 period as we service the needs of

ambitious growing companies.

Sam Smith

Chief Executive Officer

7 July 2020

Consolidated Statement of Comprehensive Income

Year ended Period ended

31 March 2020 31 March 2019

Notes GBP'000 GBP'000

Revenue 2 26,006 24,516

Other operating income (115) 14

------------------------------------------ ------- ------------ ---------------

Total income 25,891 24,530

Administrative expenses 3 (24,522) (20,264)

------------------------------------------ ------- ------------ ---------------

Operating profit before non-recurring

items 1,369 4,266

Non-recurring items (188) (1,095)

Operating profit 1,181 3,171

Finance income 26 28

Finance charge (24) -

----------------------------------------- -------

Profit before taxation 1,183 3,199

Taxation (411) (875)

Profit attributable to equity

shareholders 772 2,324

-------------------------------------------- ------- ------------ ---------------

Total comprehensive income for

the year 772 2,324

-------------------------------------------- ------- ------------ ---------------

Earnings per share

(pence)

Basic 4 0.49 1.85

Diluted 4 0.46 1.65

There are no items of other comprehensive income.

All results derive from continuing operations.

Consolidated Statement of Financial Position

31 March 31 March

2020 2019

GBP'000 GBP'000

Non-current

assets

Property, plant and equipment 635 487

Intangible

assets 13,533 13,644

Financial assets held at

fair value 393 691

Deferred tax

asset 171 428

Total non-current

assets 14,732 15,250

---------------------------------- ---------- ----------

Current assets

Trade and other receivables 9,037 8,541

Current assets held at fair

value 431 1,111

Cash and cash equivalents 4,695 4,659

Total current

assets 14,163 14,311

--------------------------------- ---------- ----------

Total assets 28,895 29,561

--------------------------------- ---------- ----------

Non-Current liabilities

Provisions 40 63

--------------------------------- ---------- ----------

Current liabilities

Trade and other payables 8,469 8,065

Corporation taxation 64 498

Borrowings - -

Total current liabilities 8,533 8,563

---------------------------------- ---------- ----------

Equity

Share capital 1,697 1,688

Share premium 616 575

Capital redemption

reserve - -

Own shares

held (1,636) (1,636)

EBT reserve - -

Merger relief reserve 10,482 10,482

Share based payments reserve 388 292

Retained earnings 8,775 9,534

---------- ----------

Total equity 20,322 20,935

--------------------------------- ---------- ----------

Total equity and liabilities 28,895 29,561

---------------------------------- ---------- ----------

Consolidated Statement of Cashflows

Year ended Period ended

31 March 31 March

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 1,183 3,199

Adjustments for:

Depreciation 948 242

Amortisation of intangible assets 79 56

Finance income (26) (28)

Share based payments charge 110 100

Net fair value gains recognised

in profit or loss 115 (155)

Payments received of non-cash assets (275) (218)

2,134 3,196

Changes in working capital:

Decrease/increase in trade and

other receivables (495) 778

Increase in trade and other payables 173 109

Decrease in provisions (23) (10)

Cash generated from operations 1,789 4,073

Net cash receipts /payments for current

asset investments

held at fair value through profit

or loss 680 (465)

Tax paid (845) (796)

Net cash inflow from operating

activities 1,624 2,812

-------------------------------------------- ------------ --------------

Cash flows from investing activities

Acquisition of subsidiaries, net

of cash acquired - (3,592)

Purchase of property, plant and

equipment (262) (249)

Purchase of intangible assets (9) (30)

Proceeds on sale of investments 508 70

Interest received 26 28

Net cash (outflow)/inflow from

investing activities 263 (3,773)

-------------------------------------------- ------------ --------------

Cash flows from financing activities

Purchase of own shares by EBT - (1,260)

Sale of own share by EBT - 693

Equity dividends paid (1,218) (1,635)

Proceeds from the issue of new

shares net of costs - 3,665

Proceeds from exercise of options 50 375

Lease liability payments (683) -

Proceeds from borrowings - (739)

Net cash outflow from financing

activities (1,851) 1,099

-------------------------------------------- ------------ --------------

Net increase/(decrease) in cash and cash

equivalents 36 138

Cash and cash equivalents at beginning

of year 4,659 4,521

Cash and cash equivalents at end

of year 4,695 4,659

-------------------------------------------- ------------ --------------

Consolidated Statement of Changes in Equity

Capital Own Merger Share Based

Share Share Redemption Shares EBT Relief Payment Retained Total

Capital Premium Reserve Held Reserve Reserve Reserve Earnings Equity

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 April

2018 1,180 768 452 (676) (54) - 247 5,418 7,335

-------------------- -------- -------- ----------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income

for the period - - - - 54 - - 2,270 2,324

Transactions with

owners:

Transfer of own

shares - - - (960) - - - - (960)

Issue of share

capital 134 3,616 - - - - - - 3,750

Share issue costs - (85) - - - - - - (85)

Shares issued as

part of the

consideration in a

business

combination 334 - - - - 9,019 - - 9,353

Elimination in

share for share

acquisition - (1,011) (452) - - 1,463 - - -

Share premium

cancellation (3,048) - - - - - 3,048 -

Share based

payments charge - - - - - - 100 - 100

Deferred tax on

share based

payments - - - - - - - 378 378

Dividends - - - - - - - (1,635) (1,635)

Share options

exercised 40 335 - - - - (55) 55 375

508 (193) (452) (960) - 10,482 45 1,846 11,276

-------------------- -------- -------- ----------- -------- -------- -------- ------------ --------- --------

Balance at 31 March

2019 1,688 575 - (1,636) - 10,482 292 9,534 20,935

-------------------- -------- -------- ----------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income

for the period - - - - - - - 772 772

Transactions with

owners:

Share based

payments charge - - - - - - 110 - 110

Implementation of

IFRS16 (70) (70)

Deferred tax on

share based

payments - - - - - - - (257) (257)

Dividends - - - - - - - (1,218) (1,218)

Share options

exercised 9 41 - - - - (14) 14 50

9 41 - - - - 96 (1,531) (1,385)

-------------------- -------- -------- ----------- -------- -------- -------- ------------ --------- --------

Balance at 31 March

2020 1,697 616 - (1,636) - 10,482 388 8,775 20,322

-------------------- -------- -------- ----------- -------- -------- -------- ------------ --------- --------

Notes to the Financial Statements for the 12 months ended 31

March 2020

finnCap Group plc (the "Company") is a public limited company,

limited by shares, incorporated and domiciled in England and Wales.

The Company was incorporated on 28 August 2018. The registered

office of the Company is at 1 Bartholomew Close, London, EC1A 7BL,

United Kingdom. The registered company number is 11540126. The

Company is listed on the AIM market of the London Stock

Exchange.

1. Basis of Preparation and Relevant Accounting Policies

a. Basis of Preparation

The financial information set out in this announcement (the

"Preliminary Financial Statements") does not constitute the

Company's statutory accounts for the period ended 31 March 2020 (or

the period ended 31 March 2019) under the meaning of Section 434

the Companies Act 2006 but is derived from those accounts.

Statutory accounts for the period ended 31 March 2020 have been

reported on by the Company's independent auditors, BDO LLP (the

"Independent Auditors"). The Independent Auditors' Reports on the

Annual Report and Financial Statements for the period ended 31

March 2020 were unmodified, did not draw attention to any matters

by way of emphasis and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006. The statutory accounts will be

available at www.finncap.com and will be delivered to the Registrar

of Companies in due course.

The Preliminary Financial Statements comparatives for FY19

include the performance of finnCap Ltd for 11 months (due to the

alignment of year ends), and for Cavendish for just under four

months (since the date of its acquisition).

The statutory accounts have been prepared in accordance with

International Financial Reporting Standards and International

Accounting Standards as adopted by the European Union and the IFRS

Interpretation Committee interpretations (collectively IFRSs), and

in accordance with applicable law.

These consolidated Preliminary Financial Statements contain

information about the Group and have been prepared on a historical

cost basis except for certain financial instruments which are

carried at fair value. Amounts are rounded to the nearest thousand,

unless otherwise stated and are presented in pounds sterling, which

is the currency of the primary economic environment in which the

Group operates.

The preparation of these Preliminary Financial Statements

requires the use of certain critical accounting estimates. It also

requires Group management to exercise judgement in applying the

Group's accounting policies. Judgements and estimates used in these

Preliminary Financial Statements have been applied on a consistent

basis with those used in the statutory accounts for the year ended

31 March 2020.

b. Basis of Consolidation

The Group's consolidated financial statements include the

financial statements of the Company and all its subsidiaries.

Subsidiaries are entities over which the Group has control if all

three of the following elements are present: power over the

investee, exposure to variable returns from the investee and the

ability of the investor to use its power to affect those variable

returns. Subsidiaries are fully consolidated from the date on which

control is established and de-consolidated on the date that control

ceases.

The acquisition method of accounting is used for the acquisition

of subsidiaries. Transactions and balances between members of the

Group are eliminated on consolidation and consistent accounting

policies are used throughout the Group for the purposes of

consolidation.

The share for share acquisition of finnCap Ltd by finnCap Group

plc was a corporate reorganisation to facilitate the IPO on AIM and

the subsequent purchase of Cavendish. As this was not a business

combination, merger accounting principles have been applied.

The Directors believe that the company has adequate resources to

continue trading for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the

Preliminary Financial Statements.

IFRS16

The Group has applied the modified retrospective approach to the

two existing property leases. As such, an asset and liability were

created on the 1st April 2019 and the comparative figures have not

been restated. The right of use asset and lease liability have been

calculated as the net present value of the remaining lease payments

discounted at the incremental borrowing rate of 3.0%. As a result

of this change the group, has also derecognised a rent-free period

accrual and adjusted retained earnings brought forward upon

creation of the IFRS 16 assets and liabilities.

At 1 April 2019, a right-of-use asset of GBP850k was recognised

and lease liability of GBP1,074k. FY20 includes depreciation of

GBP600k that would have been recognised as an operating lease

expense in the prior period.

2. Segmental reporting

The Group is managed as an integrated full-service financial

services group and the different revenue streams are considered to

be subject to similar economic characteristics. Consequently, the

Group is managed as one business unit.

The trading operations of the Group comprise of Corporate

Advisory and Broking, M&A Advisory and Institutional

Stockbroking. The Group's revenues are derived from activities

conducted in the UK, although several of its corporate and

institutional investors and clients are situated overseas. All

assets of the Group reside in the UK.

Year ended Period ended

31 March 2020 31 March 2019

GBP'000 GBP'000

Revenues

Retainers 6,471 5,922

Transactions 8,642 11,950

Corporate advisory and broking 15,113 17,872

M&A advisory 7,326 3,229

Institutional Stockbroking 3,567 3,415

Total Revenue 26,006 24,516

---------------------------------- -------------- --------------

3. Expenses by Nature

12 months 11 months

ended ended

31 March 2020 31 March 2019

Audited

GBP'000 GBP'000

Employee benefit

expense 16,095 14,451

Non-employee

costs 8,427 5,813

Total administrative

expenses 24,522 20,264

------------------------ --- -------------- --------------

Average number of

employees 140 106

------------------------ --- -------------- --------------

4. Earnings per share

Year ended Period ended

31 March 2020 31 March 2019

GBP'000 GBP'000

Earnings (GBP'000)

Earnings for the purposes of basic

and diluted earnings

per share being profit for the

year attributable to

equity shareholders 772 2,324

Number of shares

Weighted average number of shares

for the purposes

of basic earnings per share 157,093,604 125,845,121

-------------- --------------

Weighted average dilutive effect

of conditional share

awards 9,553,641 14,927,048

-------------- --------------

Weighted average number of shares

for the purposes

of diluted earnings per share 166,647,245 140,772,169

------------------------------------- -------------- --------------

Profit per ordinary share (pence)

Basic profit per ordinary share 0.49 1.85

Diluted profit per ordinary

share 0.46 1.65

------------------------------------- -------------- --------------

The shares held by the Group's Employee Benefit Trust have been

excluded from the calculation of earnings per share.

The earnings per share for the year ended 31 March 2020 is

reported after charging the non-recurring costs from restructuring

costs, which equate to 0.12p per share.

The earnings per share for the 11 months ended 31 March 2019 is

reported after charging the non-recurring costs from the IPO and

acquisition of Cavendish, which equate to 0.87p per share.

5. Dividends

Year ended Period ended

31 March 2020 31 March 2019

GBP'000 GBP'000

Dividends proposed and paid

during the year 1,218 1,635

------------------------------- -------------- --------------

Dividends per share 0.78p 1.38p

6. Balance Sheet items

i) Plant, property and equipment

See IFRS16 disclosure above

ii) Intangible assets

Intangible assets include goodwill of GBP13,335,000 recognised

on the acquisition of all the share capital of Cavendish Corporate

Finance (UK) Limited and all the partnership rights of Cavendish

Corporate Finance LLP on the 5(th) December 2018.

iii) Deferred tax asset

Deferred taxation for the Group relates to timing differences on

the taxation relief on the exercise of options. The amount of the

asset is determined using tax rates that have been enacted or

substantively enacted when the deferred tax assets are expected to

be recovered.

iv) Trade and other receivables

Trade and other receivables principally consist of amounts due

from client, brokers and other counterparties.

v) Own shares held

The value of own shares held is the cost of shares purchased the

Group's Employee Benefit Trust. The Trust was established with the

authority to acquire shares in finnCap Group plc and is funded by

the Group.

vi) Merger relief reserve

The merger relief reserve represents:

-- the difference between net book value of finnCap Ltd and the

nominal value of the shares issued due to the share for share

exchange on the acquisition of finnCap Ltd. Upon consolidation,

part of the merger reserve was eliminated to recognise the

pre-acquisition share premium and capital redemption reserve of

finnCap Ltd; and

-- the difference between the fair value and nominal value of

shares issued for the acquisition of Cavendish Corporate Finance

(UK) Limited and Cavendish Corporate Finance LLP.

This reserve is not distributable.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FLFLADLIRIII

(END) Dow Jones Newswires

July 07, 2020 02:00 ET (06:00 GMT)

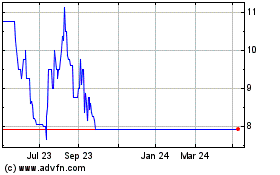

Finncap (LSE:FCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Finncap (LSE:FCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024