TIDMFCRM

RNS Number : 3515H

Fulcrum Utility Services Ltd

03 December 2020

MAR: The information contained within the announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via Regulatory Information Service

("RIS"), this inside information is now considered to be in the

public domain.

3 December 2020

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum" or "the Group")

Unaudited interim results for the six months ended 30 September

2020

Fulcrum Utility Services Limited, a leading independent

multi-utility infrastructure and services provider focused on

delivering infrastructure for the UK's net-zero future, announces

its interim results for the six-month period ended 30 September

2020.

Financial highlights

The Group responded quickly to the COVID-19 pandemic and has

recovered strongly from its initial impact, with activity levels

returning to pre-COVID levels in Q2:

-- Revenue of GBP19.5 million (2019: GBP19.5 million)

-- Adjusted EBITDA(1) loss of GBP1.0 million (2019: GBP1.4

million profit), reflecting the impact of COVID-19 combined with

investment for strategic growth

-- Year on year order book growth of 9.4%, to GBP68.5 million,

as at 30 September 2020 (2019: GBP62.6 million)

-- Adjusted loss before tax(1) of GBP2.4 million (2019: GBP0.1 million profit)

-- Net cash inflow from operations before tax of GBP0.7 million (2019: GBP0.0 million)

-- Basic loss per share of 1.4p (2019: 0.4p)

-- Net cash at the period end of GBP1.8 million (31 March 2020:

net cash GBP6.0 million) reflecting capital investment of GBP4.2

million in acquiring utility assets

Financial strength:

During the period, the Group has maintained its focus on

retaining a strong balance sheet and healthy cash flow, balanced

with investing for strategic growth. The Group has continued to

build its financial strength following the period end:

-- The second asset transfer to E.S. Pipelines Limited ("ESP")

completed on 30 November 2020, generating cash of GBP4.7 million.

In addition, the Group received a further GBP0.4 million in cash

relating to the first tranche of the asset transfer, following the

achievement of the first enhanced payment milestone

-- There is approximately GBP27 million still to be received

from ESP, the majority of which will be received over the next two

to three years. Future biannual transfer dates have now been agreed

(November and May each year) giving the Group enhanced visibility

over the timing of future cashflow receipts

-- On 1 December 2020, the Group entered into a new two year

GBP10.0 million Revolving Credit Facility ("RCF") to fund the

acquisition of utility assets. The majority of which, once

completed, will ultimately be sold to ESP and the funds used to

repay the RCF

Operational highlights

The Group continued to operate effectively, choosing to maintain

its core operational capability and winning key contracts in

housing, industrial and commercial and smart metering, whilst also

selectively investing to further position itself to capitalise on

the opportunities presented by a green economy as it moves into a

growth phase:

-- Effective and rapid response to COVID-19 led to a strong

recovery, with activity levels returning to pre-COVID levels in

Q2

-- Expanded Electric Vehicle team to capitalise on the

Government's commitment to invest GBP1.3bn in the roll out of

charging infrastructure

-- Built relationships with hydrogen stakeholders, leveraging

our existing gas capabilities to offer infrastructure solutions for

hydrogen networks. The growth of low carbon hydrogen is a key part

of the development of a greener economy and the Group's existing

gas capabilities place it very strongly to support the delivery of

future hydrogen networks

-- Continued to make good progress in executing our strategy,

with selective investment in bolstering operational

capabilities

-- Renewed focus on our high-performance behaviour framework,

with a sustained emphasis on supporting and developing our people

and bringing in refreshed talent

-- Improved our ability to win larger contracts, securing a

variety of new and significant contracts that supported sustained

order book growth.

Significant contract wins

Housing:

-- A GBP1.6 million multi-utility contract to power and heat 550

homes as part of a major redevelopment scheme*

-- A GBP1.1 million contract to deliver a full multi-utility

solution to a major development of 500 new homes

-- A GBP0.8 million contract to deliver a full multi-utility

service to a new development of 276 new homes*

Industrial and Commercial:

-- A GBP4.2 million contract to provide 13.5km of new high

voltage electrical infrastructure for a major redevelopment

project*

-- A GBP1.5 million contract to install 3.8km of gas

infrastructure to feed Combined Heat & Power units that will

serve a large automotive manufacturing operation*

-- A GBP0.7 million project to design and install electricity

infrastructure as part of a substantial extension to a UK shopping

centre

-- A GBP0.7 million contract to deliver a full multi-utility

solution to a large new commercial development

-- A GBP0.6 million contract to deliver over 2km of gas

infrastructure for major new renewable energy project for a food

waste recycling specialist

EV:

-- Contracts with a major Charge Point Operator to design and

install electric vehicle charging infrastructure for two national

UK retailers

-- A contract to install fleet charging facilities for a logistics organisation

-- A contract to install charging infrastructure for major EV charging hub development

Smart Metering:

-- The Group secured six new agreements with energy suppliers.

*Contract secured post period end and therefore not included in

the order book at 30 September 2020.

Outlook

Strong market drivers support the Group's future aspirations and

present significant long-term growth opportunities. These drivers

are further reinforced by the Government's Ten Point Plan for a

Green Industrial Revolution and National Infrastructure Strategy,

both announced in November 2020, which set out measures and funding

to support the development of a greener economy and to accelerate

the UK's journey to net zero.

The Group has entered the second half of the financial year in a

strong position and expects full year revenue to be stable year on

year, despite the COVID affected first quarter, and to be

profitable on an adjusted

EBITDA(1) basis for the full year.

Fulcrum is ideally placed to support the electrical revolution

that is needed to facilitate the global move away from fossil

fuels. It is a fundamentally robust business with strength in its

orderbook , its balance sheet and its operational capabilities and

it will be further strengthened by cash from the transfer of assets

to ESP. This will enable the Group to achieve its strategic growth

objectives and the Board remains confident that the business is

well placed to capitalise on the significant, long-term, growth

opportunities that a net-zero future presents:

-- The electrical revolution in the UK is underway. More

electrical infrastructure is needed to deliver low carbon and

emissions free green energy, and Ofgem has proposed a five-year

investment programme of GBP25 billion, with potential for an

additional GBP10 billion or more, to transform Britain's energy

networks

-- The ban on the sale of new petrol and diesel cars and vans

from 2030 creates additional impetus for new utility infrastructure

to power the nation's electric vehicles, with the Government

committing to invest an additional GBP1.3 billion to accelerate the

roll out of charging infrastructure

-- The growth of low carbon hydrogen is a key part of the

development of a greener economy and the Group's existing gas

capabilities place it very strongly to support the delivery of

future hydrogen networks

-- The UK Government has committed to build an average of

300,000 new homes each year by the mid-2020s, with each home

requiring new utility infrastructure

-- The smart energy revolution is a critical component of a

net-zero future, with energy suppliers required to exchange

approximately 30 million meters by mid-2025

Daren Harris, CEO, said:

We responded quickly to the initial impact of the COVID-19

pandemic, allowing a strong recovery in Q2, with activity levels

returning to pre-COVID levels. The Group and its people have

performed incredibly well, with agility and resilience and I am

proud of the recovery we have achieved, together.

At the same time, we made strong progress against our strategic

objectives, winning key new contracts in our core markets and

selectively investing in the business to support our future growth.

We also continued to secure a variety of significant new contracts,

achieving a year-on-year order book growth of 9.4%.

Whilst COVID-19 continues to create economic uncertainty in the

UK, the Group remains in a strong position. First, we have

financial strength, supported by a robust balance sheet, current

and future cash from the sale of our domestic gas assets and

associated meters to ESP. Second, we have a healthy and growing

order book and an improved ability to compete on and secure larger

schemes, and third we are supported by strong strategic tailwinds

driven by the need to decarbonise the UK's economy.

The Board is very pleased with the progress made in the period.

We are encouraged by the various and significant opportunities that

a net-zero future presents for long-term growth and are confident

the Group is well positioned to capitalise on this.

Footnote:

(1) Fulcrum discloses both statutory and alternative performance

measures. A full description and reconciliation of the alternative

performance measures is set out in note 3 to the condensed

consolidated interim financial information.

Enquiries:

+44 (0)114 280

4102

Fulcrum Utility Services Limited

Daren Harris, Chief Executive Officer

+44 (0)20 7397

Cenkos Securities plc (Nominated adviser and broker) 8900

Max Hartley (Nomad) / Michael Johnson (Sales)

N+1 Singer (Joint Corporate Broker) +44 (0)20 7496

Sandy Fraser / Rachel Hayes / Carlo Spingardi 3000

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield, UK

and its main business is the design, build, ownership and

maintenance of energy connections and their related utility

infrastructure. The Group's offering also extends to smart meter

ownership and exchange programmes, and the selective ownership and

maintenance of utility networks and infrastructure.

https://investors.fulcrum.co.uk/

Operational performance

We made strong progress in the execution of our strategy and in

each of our sectors in the period. Including:

-- Bolstering and improving capabilities, operations, processes,

management information and control systems to support future

strategic growth

-- Providing sustained and significant support and development

for our people, whilst bringing in new talent to strengthen our

operations

Sector highlights:

Sector Market assessment Business highlights

Housing

* The housing market is operating effectively during * Enquiry levels were strong as homebuilders seek to

the COVID-19 pandemic and the UK's home builders meet demand stimulated by the temporary relaxation of

remain optimistic about their ability to operate stamp duty

successfully moving forward

* Bolstered our business development function and

* Market drivers remain strong, with the Government's delivered targeted expansion into new geographies

commitment to build 300,000 homes each year by the

mid-2020s and 220,600 new build housing completions

in 2019/20 * Improved capabilities, resulting from our

relationship with ESP, has seen the group being able

to successfully compete on larger schemes

* Secured the Group's first 1,000+ connection

multi-utility housing project

* Achieved an enhanced milestone payment in the ESP

asset sale via securing a strong series of new

housing contract wins

----------------------------------------------------------------- ------------------------------------------------------------------

Industrial

and * There is a clear and significant requirement for more * Enquiry levels have remained strong and, during the

Commercial electrical and renewable energy generating period, the Group continued to secure a variety of

infrastructure to deliver low carbon and emissions substantial contracts

free green energy

* Established a Major Projects business development

* Additional opportunities presented by the UK's exit team to target and secure the most significant

from the EU as sectors, including domestic food schemes

growth and storage, grow

* Significantly bolstered our EV Business Development

* The recently announced ban on the sale of new petrol Team and operational delivery function

and diesel cars and vans from 2030 creates additional

impetus for new utility infrastructure to power the

nation's electric vehicles * Secured a variety of projects to design and install

electric vehicle charging infrastructure, including

contracts for two national UK retailers, fleet

* The Government has recently committed to invest charging facilities for a logistics organisation and

GBP1.3 billion to accelerate the roll out of EV infrastructure for a major EV charging hub

charging infrastructure development

----------------------------------------------------------------- ------------------------------------------------------------------

Smart

Metering * Binding obligations on energy suppliers to exchange * Our flexible and responsive service approach has

approximately 30 million meters to Smart by mid-2025, supported significant interest from gas and

remain electricity suppliers looking to fulfil their

regulatory obligations

* Bolstered our business development function

* Secured new agreements with a variety of energy

suppliers and are in advanced discussions with

additional energy suppliers

----------------------------------------------------------------- ------------------------------------------------------------------

Maintenance

and * The need for an electrical revolution and significant * Provided enhanced, responsive services to suppor

Ownership: requirement for more electrical and renewable t

generating infrastructure, to deliver low carbon and essential services and industries helping combat

emissions free green energy to achieve net zero, will COVID-19

require specialist maintenance

----------------------------------------------------------------- ------------------------------------------------------------------

Financial performance

In the first six months of the year, the Group reported an

adjusted EBITDA(1) loss of GBP1.0 million (2019: GBP1.4 million

profit). COVID-19 inevitably had a significant impact on the result

for the first quarter as revenue was delayed and fixed operational

costs continued, offset in part by the Coronavirus Job Retention

Scheme. However, the Group reacted responsibly, swiftly and

effectively to the global pandemic and as such activity levels in

the second quarter returned to pre-COVID levels. Investment in our

people, operations and processes has continued through the second

quarter as the Group lays the foundations for future growth.

Notwithstanding the disruption from the COVID-19 pandemic, Group

revenue remained constant at GBP19.5 million, compared to the first

half of last year (2019: GBP19.5 million). Asset ownership revenue

also remained in line with the prior period at GBP1.8 million

(2019: GBP1.9 million), despite the transfer of the first tranche

of assets in the sale of the domestic gas asset portfolio on 31

March 2020 to ESP.

The order book increased by 9.4% since 30 September 2019 to

GBP68.5 million (2019: GBP62.6 million). This reflects the ongoing

and successful delivery of our sales growth strategy.

The adjusted loss before tax(1) was GBP2.4 million (2019: profit

of GBP0.1 million). This reduction was driven by the lower

EBITDA(1) performance.

At 30 September 2020, the Group had net cash of GBP1.8 million,

a decrease from 31 March 2020 of GBP4.2m (2019: net debt of

GBP(2.2) million). This decrease since year end is primarily due to

the investment in utility assets which will ultimately be

transferred to ESP.

The Group has a strong balance sheet with a net asset value

position of GBP43.4 million at 30 September 2020 (FY 2020:

GBP46.3m). It remains well capitalised and has benefited from the

transfer of the second tranche of assets to ESP on 30 November 2020

for a consideration of GBP4.8 million (GBP4.7 million of which has

been received in cash, with the remainder being a retention amount

which will be received on 31 May 2022). There is approximately

GBP27 million still to be received from ESP, the majority of which

will be received over the next two to three years. Future biannual

transfer dates have now been agreed with ESP (November and May each

year) giving the Group enhanced visibility over the timing of

future cashflow receipts . In addition, on 1 December 2020, the

Group entered into a new two year GBP10.0 million RCF to fund the

acquisition of utility assets, the majority of which, once

completed will ultimately be transferred to ESP.

The Board will not be recommending the payment of an interim

dividend, considering the loss for the period and continuing

near-term economic uncertainty.

Delivering contracts safely, efficiently and profitably

Maintaining the highest standards of health and safety remains

our highest priority, especially during the COVID-19 pandemic. A

safety-first strategy is in place to ensure zero harm and, although

this is well embedded into our culture and operations, we are never

complacent and are committed to continuous improvement in health

and safety performance.

In the period, we also introduced a COVID Safety Team and COVID

Safety Officer to ensure that the Group always complies fully with

Government guidelines on managing the risk of COVID-19. Throughout

the pandemic, our commitment to the safety and wellbeing of our

people, customers and the public has never faltered, and we

continue to ensure that there will be no disruption to the high

levels of service we offer.

Outlook

Strong market drivers support the Group's future aspirations and

present significant long-term growth opportunities. These drivers

are further reinforced by the Government's Ten Point Plan for a

Green Industrial Revolution and National Infrastructure Strategy,

both announced in November 2020, which set out measures and funding

to support the development of the greener economy and to accelerate

the UK's journey to net zero.

The Group has entered the second half of the financial year in a

strong position and expects full year revenue to be stable year on

year, despite the COVID affected first quarter, and to be

profitable on an adjusted EBITDA(1) basis for the full year.

Fulcrum is ideally placed to support the electrical revolution

that is needed to facilitate the global move away from fossil

fuels. It is a fundamentally robust business with strength in its

orderbook , its balance sheet and its operational capabilities and

it will be further strengthened by cash from the transfer of assets

to ESP. This will enable the Group to achieve its strategic growth

objectives and the Board remains confident that the business is

well placed to capitalise on the significant, long-term, growth

opportunities that a net-zero future presents.

Footnote:

(1 () Fulcrum discloses both statutory and alternative

performance measures. A full description and reconciliation of the

alternative performance measures is set out in note 3 to the

condensed consolidated interim financial information.

Consolidated Interim Statement of Comprehensive Income

For the six months ended 30 September 2020 (unaudited)

Unaudited Unaudited Audited

Six months ended 30 Six months ended 30 Year ended

September 2020 September 2019 31 March

2020

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ----------------------------- ----------------------------- -------------

Revenue 2 19,516 19,518 46,101

------------------------------ ----- ----------------------------- ----------------------------- -------------

Cost of sales - underlying (14,845) (13,421) (31,955)

Cost of sales - exceptional

items 4 (190) - (1,766)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total cost of sales (15,035) (13,421) (33,721)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Gross profit 4,481 6,097 12,380

Administrative expenses -

underlying (7,598) (6,521) (13,611)

Administrative expenses -

exceptional items 4 (456) (391) (870)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total administrative expenses (8,054) (6,912) (14,481)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Operating loss (3,573) (815) (2,101)

Profit on sale of subsidiary

- exceptional items 4 - - 3,886

Net finance expense (105) (126) (472)

(Loss)/profit before tax (3,678) (941) 1,313

Taxation 6 611 (1) 243

------------------------------ ----- ----------------------------- ----------------------------- -------------

(Loss)/profit for the

financial period/year (3,067) (942) 1,556

------------------------------ ----- ----------------------------- ----------------------------- -------------

Other comprehensive income

Items that will never be

reclassified to

(loss)/profit:

Revaluation of utility assets - - 3,036

Surplus arising on utility

assets internally adopted in

the period/year 145 649 951

Reversal of prior increase of

utility assets - (153) (1,086)

Deferred tax (28) - (321)

------------------------------ ----- ----------------------------- ----------------------------- -------------

Total comprehensive

(expense)/income for the

period/year (2,950) (446) 4,136

------------------------------ ----- ----------------------------- ----------------------------- -------------

(Loss)/profit per share attributable to the owners of the business

Basic 5 (1.4)p (0.4)p 0.7p

Diluted 5 (1.4)p (0.4)p 0.7p

------------------------------ ----- ----------------------------- ----------------------------- -------------

Adjusted EBITDA

Adjusted EBITDA from continuing operations is the basis that the

Board uses to measures and monitor the Group's financial

performance as it is a more accurate reflection of the commercial

reality of the Group's business. Further details of the Alternative

Performance Measures are included in note 3.

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 September 31 March

September 2019 2020

2020

GBP'000 GBP'000 GBP'000

------------------------------------ ------------ -------------------- ------------

Operating loss (3,573) (815) (2,101)

Equity-settled share-based payment

charge 23 31 (6)

Exceptional items within operating

loss 646 391 2,636

Depreciation and amortisation 1,937 1,834 4,019

------------------------------------- ------------ -------------------- ------------

Adjusted EBITDA from continuing

operations (967) 1,441 4,548

Surplus arising on sale of domestic

utility assets - - 3,886

------------------------------------- ------------ -------------------- ------------

Adjusted EBITDA including sale

of domestic utility assets (967) 1,441 8,434

Consolidated Interim Statement of Changes in Equity

For the six months ended 30 September 2020 (unaudited)

Share capital Share premium Revaluation Merger reserve Retained Total equity

reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Balance at 1

April 2020

(audited) 222 389 11,939 11,347 22,410 46,307

Loss for the

period - - - - (3,067) (3,067)

Surplus arising

on utility

assets

internally

adopted in the

year - - 145 - - 145

Depreciation on

previously

revalued

assets - - (116) - 116 -

Deferred tax

liability - - (28) - - (28)

Transactions

with equity

shareholders:

Equity settled

share-based

payments - - - - 23 23

Balance at 30

September 2020

(unaudited) 222 389 11,940 11,347 19,482 43,380

For the six months ended 30 September 2019

Restated

balance at 1

April 2019

(audited) 221 210 12,737 11,347 20,714 45,229

Loss for the

period - - - - (942) (942)

Surplus arising

on utility

assets

internally

adopted in the

year - - 649 - - 649

Disposal of

previously

revalued

assets - - (153) - 153 -

Deferred tax

liability - - (85) - - (85)

Transactions

with equity

shareholders:

Issues of new

shares 1 106 - - - 107

Equity settled

share-based

payments - - - - 31 31

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Balance at 30

September 2019

(unaudited) 222 316 13,148 11,347 19,956 44,989

---------------- -------------- -------------- ---------------- --------------- ---------------- -------------

Consolidated Interim Balance Sheet

At 30 September 2020

Unaudited Unaudited Audited

30 September 2020 30 September 2019 31 March 2020

Note GBP'000 GBP'000 GBP'000

-------------------------------- --------- ------------------- ------------------- ---------------

Non-current assets

Property, plant and equipment 42,626 44,348 38,820

Intangible assets 8 24,711 26,479 25,522

Right-of-use assets 2,334 2,152 2,720

Deferred tax assets 2,441 1,955 1,784

-------------------------------- --------- ------------------- ------------------- ---------------

72,112 74,934 68,846

-------------------------------- --------- ------------------- ------------------- ---------------

Current assets

Contract Assets 14,586 9,108 12,279

Inventories 422 629 446

Trade and other receivables 9 6,727 6,090 6,826

Cash and cash equivalents 11 1,753 3,782 15,973

-------------------------------- --------- ------------------- ------------------- ---------------

23,488 19,609 35,524

-------------------------------- --------- ------------------- ------------------- ---------------

Total assets 95,600 94,543 104,370

-------------------------------- --------- ------------------- ------------------- ---------------

Current liabilities

Trade and other payables 10 (13,629) (9,075) (11,909)

Contract liabilities (30,648) (26,460) (27,905)

Borrowings 11 - (6,000) (10,000)

Lease liabilities (816) (574) (772)

Provisions (58) (96) (58)

-------------------------------- --------- ------------------- ------------------- ---------------

(45,151) (42,205) (50,644)

-------------------------------- --------- ------------------- ------------------- ---------------

Non-current liabilities

Lease liabilities (1,796) (1,828) (2,226)

Deferred tax liabilities (5,273) (5,521) (5,193)

-------------------------------- --------- ------------------- ------------------- ---------------

(7,069) (7,349) (7,419)

-------------------------------- --------- ------------------- ------------------- ---------------

Total liabilities (52,220) (49,554) (58,063)

-------------------------------- --------- ------------------- ------------------- ---------------

Net assets 43,380 44,989 46,307

-------------------------------- --------- ------------------- ------------------- ---------------

Equity

Share capital 222 222 222

Share premium 389 316 389

Revaluation reserve 11,940 13,148 11,939

Merger reserve 11,347 11,347 11,347

Retained earnings 19,482 19,956 22,410

-------------------------------- -------------------------- ------------------- ---------------

Total equity 43,380 44,989 46,307

-------------------------------- -------------------------- ------------------- ---------------

Consolidated Interim Cash Flow Statement

For the six months ended 30

September 2020 Unaudited Unaudited Audited

Six months ended 30 Six months ended 30 Year ended 31 March 2020

September 2020 September 2019

GBP'000 GBP'000 GBP'000

----------------------------- --------------------------- --------------------------- ---------------------------

Cash flows from operating

activities

(Loss)/profit for the

period/year after tax (3,067) (942) 1,556

Tax (credit)/charge (611) 1 (243)

----------------------------- --------------------------- --------------------------- ---------------------------

(Loss)/profit before tax for

the period/year (3,678) (941) 1,313

Adjustments for:

Depreciation 994 1,002 2,228

Amortisation of intangible

assets 943 832 1,791

Exceptional items - fixed

asset impairment - - 1,766

Net finance expense 105 147 472

Equity settled share-based

payment charges 23 31 (6)

Profit on disposal of

utility assets - - (3,886)

Loss on disposal of assets -

other - - 3

(Increase)/decrease in c

ontract assets (2,307) 23 (3,147)

Decrease in trade and other

receivables 99 154 916

Decrease/(increase) in

inventories 24 (22) 162

Increase/(decrease) in trade

and other payables 1,765 (1,374) (1,072)

Increase in contract

liabilities 2,743 118 1,562

Decrease in provisions - - (38)

Cash inflow/(outflow) from

operating activities 711 (30) 2,064

Tax paid (39) (345) (410)

Net cash inflow/(outflow)

from operating activities 672 (375) 1,654

----------------------------- --------------------------- --------------------------- ---------------------------

Cash (outflow)/inflow from

investing activities

Acquisition of external

utility assets (1,919) (2,346) (5,030)

Utility assets internally

adopted (gross construction

cost less impairment) (2,304) (2,707) (6,475)

Acquisition of property,

plant and equipment (46) (23) (98)

Acquisition of intangible

assets (132) (243) (326)

Proceeds on disposal of

utility assets - - 16,756

Proceeds on disposal of

assets - other - - 5

Finance income received - - 3

Net cash (outflow)/inflow

from investing activities (4,401) (5,319) 4,835

----------------------------- --------------------------- --------------------------- ---------------------------

Cash flows from financing

activities

Dividends paid - - (3,331)

Borrowings (10,000) 3,000 7,000

Interest paid and banking

charges (non-IFRS 16) (58) (105) (273)

IFRS 16 - principal payments (386) (306) (797)

IFRS 16 - interest payments (47) (43) (119)

Proceeds from issue of share

capital - 106 180

Net cash (outflow)/inflow

from financing activities (10,491) 2,652 2,660

----------------------------- --------------------------- --------------------------- ---------------------------

Net (decrease)/increase in

cash and cash equivalents (14,220) (3,042) 9,149

Cash and cash equivalents at

beginning of period/year 15,973 6,824 6,824

----------------------------- --------------------------- --------------------------- ---------------------------

Cash and cash equivalents at

end of period/year 1,753 3,782 15,973

----------------------------- --------------------------- --------------------------- ---------------------------

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

1. Basis of preparation of the condensed consolidated interim financial information

General information

Fulcrum Utility Services Limited (the "Company") is a limited

company incorporated in the Cayman Islands and domiciled in the UK.

The ordinary shares are traded on AIM on the London Stock Exchange.

The address of its registered office is PO Box 309, Ugland House,

Grand Cayman, KY1-1104, Cayman Islands.

The condensed consolidated interim financial information for the

six months ended 30 September 2020 comprise the Company and its

subsidiaries (together referred to as the "Group").

The condensed consolidated interim financial information,

including the financial information for the year ended 31 March

2020 set out in this interim financial information, does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. The information for the year ended 31 March

2020 is derived from the non-statutory accounts for that financial

year. The non-statutory accounts for the year ended 31 March 2020

were approved on 6 August 2020. The Auditor's report on those

accounts was unqualified. Attention was drawn to the accounting

policy in note 1 of the Annual Report and Accounts 2020, which

refers to the global Coronavirus pandemic however the audit opinion

was not modified in respect of this matter.

These condensed consolidated interim financial statements have

not been audited or reviewed. They were approved by the Board on 2

December 2020.

Basis of preparation

The condensed consolidated interim financial information for the

six month period ended 30 September 2020 has been prepared in

accordance with IAS 34, 'Interim Financial Reporting' as adopted by

the European Union. The condensed consolidated interim financial

information should be read in conjunction with the Annual Report

and Accounts for the year ended 31 March 2020, which have been

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union.

Going-concern basis

The condensed consolidated interim financial information is

prepared on the basis that the Group is a going concern. In

assessing going concern and determining whether there are material

uncertainties, the Directors consider the Group`s business

activities, together with factors that are likely to affect its

future development and position.

A review of the Group`s cashflows, solvency, liquidity position

and borrowing facilities has taken place. At 30 September 2020 the

Group had net assets of GBP43.4 million (31 March 2020: GBP46.3

million) including cash of GBP1.8 million (31 March 2020: GBP6.0

million) and had no borrowings. The RCF of GBP10.0 million was

fully repaid on 1 April 2020. In the six months to 30 September

2020 the Group generated a net cash inflow from operations before

tax of GBP0.7 million (2019: GBP0.0 million).

The Group`s forecasts and projections, after taking account of

sensitivity analysis of changes in trading performance and

corresponding mitigating actions show that the Group has adequate

cash resources for the foreseeable future.

On 30 November 2020 the second tranche of assets were

transferred to ESP for a total consideration of GBP4.8 million of

which GBP4.7 million was received in cash on that day and GBP0.1

million is withheld as retention and is due on 31 May 2022. In

addition, on 1 December 2020, the Group entered into a new 2 year

GBP10.0 million RCF to fund the acquisition of utility assets, of

which the vast majority will ultimately be sold to ESP.

Accounting policies

The same accounting policies are followed in this condensed

consolidated interim financial information as were applied in the

Group`s latest audited financial statements to 30 March 2020.

2. Segmental analysis

The Board has been identified as the Chief Operating Decision

Maker (CODM) as defined under IFRS 8: Operating Segments. The

Directors consider there to be two operating segments,

Infrastructure: Design and Build and Utility assets: Own and

Operate. Fulcrum's Infrastructure: Design and Build segment

provides utility infrastructure and connections services. Utility

assets: Own and Operate comprises both the ownership of gas,

electrical and meter assets and the safe and efficient conveyance

of gas and electricity through its transportation networks. Gas

transportation services are provided under the iGT licence granted

from Ofgem in June 2007 and electricity services are provided under

the iDNO licence granted from Ofgem in November 2017.

The information provided to the Board includes management

accounts comprising operating profit before exceptional items for

each segment and other financial and non-financial information used

to manage the business on a consolidated basis.

Six months to 30 September 2020 Six months to 30 September 2019

(unaudited) (unaudited)

Infrastructure:

Design and Utility assets: Infrastructure: Utility assets:

Build Own and Operate Total Group Design and Build Own and Operate Total Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ---------------- ---------------- ----------- ----------------- ---------------- -----------

Reportable

segment revenue 17,748 1,768 19,516 17,624 1,894 19,518

Adjusted EBITDA

from continuing

operations * (1,383) 416 (967) 660 781 1,441

Share based

payments (23) - (23) (31) - (31)

Depreciation and

amortisation (1,462) (475) (1,937) (1,300) (534) (1,834)

----------------- ---------------- ---------------- ----------- ----------------- ---------------- -----------

Reportable

segment

operating

(loss)/profit

before

exceptional

items (2,868) (59) (2,927) (671) 247 (424)

Cost of sales

-exceptional

items - (190) (190) - - -

Administrative

expenses

-exceptional

items (437) (19) (456) (391) - (391)

----------------- ---------------- ---------------- ----------- ----------------- ---------------- -----------

Reporting segment

operating

(loss)/profit (3,305) (268) (3,573) (1,062) 247 (815)

Net finance

expense (102) (3) (105) (40) (86) (126)

----------------- ---------------- ---------------- ----------- ----------------- ---------------- -----------

(Loss)/profit

before tax (3,407) (271) (3,678) (1,102) 161 (941)

----------------- ---------------- ---------------- ----------- ----------------- ---------------- -----------

Year ended 31 March 2020 (audited)

Utility assets: Total Group

Infrastructure: Own and Operate GBP'000

Design and Build GBP'000

GBP'000

------------------------------------------------------------------- ------------------ ---------------- -----------

Reportable segment revenue 41,848 4,253 46,101

Adjusted EBITDA from continuing operations* 2,341 2,207 4,548

Share based payment 6 - 6

Depreciation and amortisation (2,887) (1,132) (4,019)

------------------------------------------------------------------- ------------------ ---------------- -----------

Reportable segment operating (loss)/profit before exceptional items (540) 1,075 535

------------------------------------------------------------------- ------------------ ---------------- -----------

Cost of sales -exceptional items - (1,766) (1,766)

Administrative expenses - exceptional items (832) (38) (870)

------------------------------------------------------------------- ------------------ ---------------- -----------

Reporting segment operating loss (1,372) (729) (2,101)

Profit on sale of subsidiary - exceptional items - 3,886 3,886

Net finance expense (219) (253) (472)

------------------------------------------------------------------- ------------------ ---------------- -----------

(Loss)/profit before tax (1,591) 2,904 1,313

------------------------------------------------------------------- ------------------ ---------------- -----------

*Adjusted EBITDA from continuing operations is operating

(loss)/profit excluding the impact of exceptional items,

depreciation, amortisation and equity-settled share based payment

charges. A full reconciliation of Alternative Performance Measures

is provided in note 3.

The Group derives all of its revenue from the UK and all of the

Group's customers are based in the UK. The Group`s revenue is

derived from contracts with customers.

3. Alternative Performance Measures ("APMs")

The Group uses APMs, as listed below, to present users of the

accounts with a clear view of what the Group considers to be the

results of its underlying, sustainable business operations, thereby

enabling consistent period-on-period comparisons and making it

easier for users of the accounts to identify trends. APMs are not

defined by IFRS and therefore may not be directly comparable with

other companies` APMs. APMs should be considered in addition to,

and are not intended to be a substitute for, or superior to, IFRS

measurements.

Alternative Performance

Measure Definition

------------------------------- ---------------------------------------------

Adjusted EBITDA from continuing Operating (loss)/profit excluding exceptional

operations items, amortisation, depreciation and

equity-settled share-based payments

Adjusted (loss)/profit (Loss)/profit before taxation excluding

before taxation amortisation of acquired intangibles

and exceptional items included within

cost of sales and administrative expenses

Net assets per share Net assets divided by the number of shares

in issue at the financial reporting date

------------------------------- ---------------------------------------------

A reconciliation of APMs to statutory measures is disclosed in

the tables below:

(a) Reconciliation of operating loss to "adjusted EBITDA from

continuing operations"

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 September ended 30 31 March

2020 September 2020

2019

GBP'000 GBP'000 GBP'000

--------------------------------------------- ------------ ------------

Operating loss (3,573) (815) (2,101)

Adjusted for:

Exceptional items within operating

loss (note 4) 646 391 2,636

Amortisation and depreciation 1,937 1,834 4,019

Equity-settled share-based payments 23 31 (6)

------------------------------------- ------- ------------ ------------

Adjusted EBITDA from continuing

operations (967) 1,441 4,548

------------------------------------- ------- ------------ ------------

(b) Reconciliation of (loss)/profit before tax to "adjusted

(loss)/profit before tax"

Unaudited Unaudited Audited

Six months ended Six months Year ended

30 September ended 30 31 March

2020 September 2020

2019

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ------------ ------------

(Loss)/profit before tax (3,678) (941) 1,313

Adjusted for:

Exceptional items included

in cost of sales 190 - 1,766

Exceptional items included

in administrative expenses 456 391 870

Amortisation of acquired intangibles 678 678 1,356

------------------------------------- ------------------ ------------ ------------

Adjusted (loss)/profit before

tax (2,354) 128 5,305

------------------------------------- ------------------ ------------ ------------

(c) Net assets per share

Unaudited Unaudited Audited

30 September 30 September 31 March

2020 2019 2020

------------------------------------ -------------- -------------- ----------

Net assets at end of period/year

(GBP`000) 43,380 44,989 46,307

Issued shares at end of period/year

(000`s) 222,118 221,106 222,118

Net assets per share (p) 19.5p 20.3p 20.8p

------------------------------------ -------------- -------------- ----------

4. Exceptional items

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Exceptional items included in cost

of sales 190 - 1,766

Exceptional items included in

administrative expenses 456 391 870

Profit on sale of subsidiary - - (3,886)

------------------------------------- ------------------------------- ------------------------------- -------------

646 391 (1,250)

------------------------------------- ------------------------------- ------------------------------- -------------

(a) Exceptional items included in cost of sales

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------------------- ------------------------------- -------------

Fixed asset impairment - - 1,766

Exceptional remedial works to 190 - -

utility assets

------------------------------------- ------------------------------- ------------------------------- -------------

190 - 1,766

------------------------------------- ------------------------------- ------------------------------- -------------

Fixed asset impairment relates to the impairment of utility

assets not previously revalued upwards.

(b) Exceptional items included in administrative expenses

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

--------------------------------- -------------------------------- -------------------------------- -------------

Restructuring costs 33 276 641

One-off legal and advisor costs 323 40 229

Other one-off costs 100 75 -

--------------------------------- -------------------------------- -------------------------------- -------------

456 391 870

--------------------------------- -------------------------------- -------------------------------- -------------

Restructuring costs relate to employee exit and severance costs.

One off legal and advisor costs include costs incurred in the

Group`s response to the Proposed Tender Offer from Harwood Capital

LLP. Other one off costs include non-recurring Group

re-organisational costs.

(c) Profit on sale of subsidiary

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

------------------------------ --------------------------------- --------------------------------- -------------

Profit on sale of subsidiary - - (3,886)

------------------------------ --------------------------------- --------------------------------- -------------

- - (3,886)

--------------------------------- ---------------------------------------------------------------- -------------

On 27 January 2020, utility assets belonging to one of the

Group's subsidiaries, Fulcrum Pipelines Limited, were transferred

to a fellow Group subsidiary, Gas Newco 1 Limited. On 31 March

2020, the Group disposed of its 100% equity interest in Gas Newco 1

Limited. The transaction gave rise to the following profit on

disposal:

Year ended

31 March 2020

GBP'000

----------------------------------------- ---------------

Consideration - proceeds received (16,756)

Consideration - retention (receivable

in September 2021) (500)

Consideration - deferred (received

30 June 2020) (670)

----------------------------------------- ---------------

Total consideration (17,926)

Net book value of assets acquired 9,724

Revaluation in prior periods 3,071

Legal costs relating to the transaction 1,245

----------------------------------------- ---------------

(3,886)

----------------------------------------- ---------------

Some of the disposed utility assets had previously been revalued

in accordance with the Group policy. Upon disposal, this gave rise

to a transfer between the revaluation reserve and retained earnings

of GBP3,071,000.

5. Earnings per share (EPS)

The calculation of the adjusted basic and diluted earnings per

share is based upon the following (loss)/profit attributable to

ordinary shareholders and the weighted average number of ordinary

shares outstanding:

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

----------------------------------- -------------------------------- -------------------------------- -------------

(Loss)/profit for the period/year

used for the calculation of basic

EPS (3,067) (942) 1,556

Exceptional items included in cost

of sales 190 - 1,766

Exceptional items included in

administrative expenses 456 391 870

Remove tax relief on exceptional

items (123) (74) (501)

Add amortisation of intangibles* 678 832 1,356

----------------------------------- -------------------------------- -------------------------------- -------------

( Loss)/profit for the period/year

used for the calculation of

adjusted EPS (1,866) 207 5,047

----------------------------------- -------------------------------- -------------------------------- -------------

*Excludes amortisation of software and developments costs

Number of shares ('000):

30 September 30 September 31 March 2020

2020 Number 2019 Number Number of

of Shares of Shares Shares

-------------------------------- ------------- ------------- --------------

Weighted average number

of ordinary shares for the

purpose of basic EPS 222,118 221,651 221,907

Effect of potentially dilutive

ordinary shares 4,901 9,490 4,901

-------------------------------- ------------- ------------- --------------

Weighted average number

of ordinary shares for the

purpose of diluted EPS 227,019 231,141 226,808

-------------------------------- ------------- ------------- --------------

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 March

EPS September September 2020

2020 2019

-------------------------------- ------------- ------------- ----------------

Basic (1.4)p (0.4)p 0.7p

Diluted basic (1.4)p (0.4)p 0.7p

Adjusted basic (0.8)p 0.1p 2.3p

Adjusted diluted (0.8)p 0.1p 2.2p

-------------------------------- ------------- ------------- ----------------

6. Taxation

Unaudited Unaudited Audited

Six months ended 30 September Six months ended 30 September Year ended

2020 2019 31 March

2020

GBP'000 GBP'000 GBP'000

--------------------------- ------------------------------- ------------------------------- ------------

Current tax (7) - 128

Deferred tax (604) 1 (371)

--------------------------- ------------------------------- ------------------------------- ------------

Total tax (credit)/charge (611) 1 (243)

--------------------------- ------------------------------- ------------------------------- ------------

A change to the main UK corporation tax rate, announced in the

Budget on 11 March 2020, was substantively enacted on 17 March

2020. The rate applicable from 1 April 2020 now remains at 19.0%.

Deferred tax balances have been adjusted accordingly and are

calculated on the basis that they will unwind at 19.0%.

The Group has GBP12.8 million (31 March 2020: GBP9.3 million) of

tax losses for which deferred tax assets of GBP2.4 million (31

March 2020: GBP1.8 million) have been recognised. The deferred tax

asset increased by GBP0.6 million as a result of the newly

recognised losses in the period (31 March 2020: GBP0.1 million

utilised). The deferred tax asset is expected to be recovered over

12 years (31 March 2020: 12 years). The Group also has unrecognised

tax losses of GBP1.8 million (31 March 2020: GBP1.8 million), for

which no deferred tax asset is recognised as there is insufficient

certainty over whether the losses will reverse.

7. Capital commitments

At the 30 September 2020 the Group had entered into contracts to

purchase property, plant and equipment in the form of utility

assets for the amount of GBP12.1 million. The capital commitment at

31 March 2020 was GBP14.0 million and at 30 September 2019 was

GBP16.4 million .

8. Intangible assets

Goodwill Brand & customer relationships Software Total

GBP`000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- ------------------------------ --------- ---------

At 1 April 2019 (audited) 14,251 11,045 1,773 27,069

Additions - - 242 242

Amortisation for the period - (678) (154) (832)

--------------------------------- --------- ------------------------------ --------- ---------

At 30 September 2019 (unaudited) 14,251 10,367 1,861 26,479

--------------------------------- --------- ------------------------------ --------- ---------

Additions - - 84 84

Disposals - - (91) (91)

Amortisation for the period - (678) (272) (950)

--------------------------------- --------- ------------------------------ --------- ---------

At 31 March 2020 (audited) 14,251 9,689 1,582 25,522

--------------------------------- --------- ------------------------------ --------- ---------

Additions - - 132 132

Amortisation for the period - (678) (265) (943)

--------------------------------- --------- ------------------------------ --------- ---------

At 30 September 2020 (unaudited) 14,251 9,011 1,449 24,711

--------------------------------- --------- ------------------------------ --------- ---------

9. Trade and other receivables

Unaudited Unaudited Audited

30 September 2020 30 September 2019 31 March 2020

GBP'000 GBP'000 GBP'000

----------------------------------- ------------------- ------------------- ---------------

Trade receivables 4,051 3,448 3,744

Other receivables and prepayments 2 ,676 2,642 3,082

----------------------------------- ------------------- ------------------- ---------------

6,727 6,090 6,826

----------------------------------- ------------------- ------------------- ---------------

10. Trade and other payables

Unaudited Unaudited Audited

30 September 2020 30 September 2019 31 March 2020

GBP'000 GBP'000 GBP'000

---------------- ------------------- ------------------- ---------------

Trade payables 6,532 3,961 5,593

Other payables 7,097 5,114 6,316

---------------- ------------------- ------------------- ---------------

13,629 9,075 11,909

---------------- ------------------- ------------------- ---------------

11. Reconciliation to net funds/(debt)

Unaudited Unaudited Audited

30 September 2020 30 September 2019 31 March 2020

GBP'000 GBP'000 GBP'000

-------------------------- ------------------ ------------------ --------------

Cash and cash equivalents 1,753 3,782 15,973

Borrowings - (6,000) (10,000)

-------------------------- ------------------ ------------------ --------------

Net funds/(debt) 1,753 (2,218) 5,973

-------------------------- ------------------ ------------------ --------------

12. Related parties

The Group has a related party relationship with its subsidiaries

and with its key management personnel. Details of the remuneration,

share options and pension entitlement of the Directors are included

in the Remuneration Report on page 44 of the Annual Report and

Accounts 2020, which are available on Fulcrum Utility Services

Limited's website at https://investors.fulcrum.co.uk/

13. Principal risks

The Board has assessed the Principal Risks, as disclosed on

pages 24 to 28 of the Annual Report and Accounts 2020, which are

available on Fulcrum Utility Services Limited's website at

https://investors.fulcrum.co.uk/ , and have determined that there

has been no change in risks faced or the risk rating to most of the

risks detailed.

It has been determined that two risks have been reduced as set

out below:

Description Mitigating actions Change

in risk

----------------------------------------------------------------- -----------------------------------------------------------------

COVID-19

------------------------------------------------------------------------------------------------------------------------------------ -------

There is a risk that: Reduced

* The recent outbreak and global spread of COVID-19 has * The Group has proven that it can continue to operate

a significant and prolonged impact on the UK economy effectively in a UK lockdown due to the essential

and may disrupt our supply chain and our customers' nature of the services it provides and the markets it

projects and adversely impact our operations. serves

* The temporary emergency public safety measures which

the UK Government introduced, continue for an

extended period of time, increasing pressure on our

operations due to an economic downturn.

----------------------------------------------------------------- -----------------------------------------------------------------

Working capital management and funding

------------------------------------------------------------------------------------------------------------------------------------ -------

There is a risk that: Reduced

* The Group does not have the working capital * The Group has maintained its focus on retaining a

management and funding required to deliver on its strong balance sheet and healthy cash flow as

strategy and future growth plans described within the Financial Strength overview.

----------------------------------------------------------------- ----------------------------------------------------------------- -------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KLLFBBLLBFBK

(END) Dow Jones Newswires

December 03, 2020 02:00 ET (07:00 GMT)

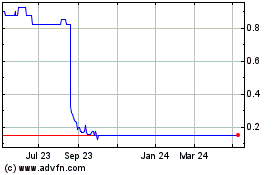

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

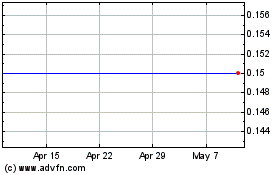

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Apr 2023 to Apr 2024