Fulcrum Utility Services Ltd Trading Update (3627L)

May 13 2022 - 1:01AM

UK Regulatory

TIDMFCRM

RNS Number : 3627L

Fulcrum Utility Services Ltd

13 May 2022

13 May 2022

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum" or "the Group")

Trading Update

Fulcrum Utility Services Limited, a leading independent provider

of essential utility services including multi-utility connections,

electric vehicle charging infrastructure, renewable energy

infrastructure and smart metering solutions, provides a trading

update today for its financial year ended 31 March 2022.

Since the Group's fundraise in December 2021, the UK energy

market has continued to experience considerable turbulence and

whilst the Group's core multi-utility contracting business has

remained relatively unaffected by this, the Group's meter exchange

operations have not been immune to the fallout from the energy

market crisis. In particular, the performance and profitability of

the Group's smart meter exchange and management contract with

energy supplier, E (Gas and Electricity) Limited ("E") ("the

Contract"), was acutely impacted in the final quarter of the year,

primarily as a result of the insolvency of several of the Group's

other energy supplier customers and one of the Group's labour-only

subcontractors. These events resulted in Fulcrum being unable to

service the Contract in a manner to maintain the Contract's

profitability for the Group and, as a result, the Board has

mutually agreed with E to terminate the Contract.

At the same time, wider market issues of supply chain pressure

and cost inflation in materials and labour are weighing on the

profitability of the Group's core multi-utility contracting

business. These pressures are particularly prevalent in the Group's

major multi-utility and complex electrical infrastructure projects,

which are inherently specialist and longer term in nature. As such,

whilst the Group expects to report adjusted Revenue(1) for the year

ended 31 March 2022 of GBP57.4 million, representing year on year

growth of 21.8%, adjusted EBITDA(2) is now expected to be

approximately GBP0.5 million. Furthermore, the Board expects that

whilst the crisis in the energy market, and the difficult market

conditions prevail, the Group's order book will soften and this is

reflected in the order book value of approximately GBP48 million(3)

as at 31 March 2022.

Whilst the Board is mindful of the ongoing volatility in the UK

energy market, its priority is to refocus the Group's operations on

executing its core utility infrastructure and asset ownership

growth strategies whilst protecting and improving margins. Antony

Collins was appointed as interim CEO in January this year. Antony

has a strong background in business turnaround and brings extensive

experience of leading underperforming businesses and, since joining

Fulcrum, has worked to put in place a strong and experienced

executive team to lead the Group. Jonathan Jager joined the Group

as CFO in February and is a highly experienced CFO with over 20

years' experience of developing high performing finance functions

within the energy sector. Stuart Crossman joined the Group in

January as COO and is a Chartered Engineer with over 40 years in

utilities and experience in asset management and delivering

excellence in operational performance and health and safety.

The Group's network of utility assets, valued in excess of GBP36

million as at 31 March 2022, continue to generate recurring income

and provide attractive and predictable long-term returns. The Board

continues to believe that additional asset ownership presents a

significant growth opportunity for the Group. The Board is

cognisant that, whilst presenting risks, the current instability in

the energy market also produces opportunities for the Group to

acquire asset portfolios at attractive valuations. As such, the

Board continues to identify and review asset acquisition

opportunities and is at varying stages of discussion and due

diligence with several opportunities.

Antony Collins, CEO, said:

Despite the challenges presented by both the UK's energy crisis

and wider difficult trading conditions, I believe that Fulcrum has

the essential capabilities needed to be successful in what are

exciting and growing markets. The new executive team is actively

reviewing the Group's activities to ensure optimal performance and

to identify opportunities to improve profitability and to deliver

long term, sustainable growth for the benefit of all

shareholders.

The Board is confident that the Group remains well positioned to

support the expansion of the UK's energy infrastructure, by

providing services that are essential to the UK as it transitions

to a net-zero future.

(1) Adjusted Revenue from continuing operations excluding Smart

Metering's onerous contracts

(2) Adjusted EBITDA from continuing operations is operating

profit excluding the impact of exceptional items (inclusive of

Smart Metering's onerous contracts) other gains, depreciation,

amortisation, and equity-settled share-based payment charges

(3) Orderbook value excluding Smart Metering's onerous

contracts

This announcement contains inside information.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Antony Collins, Chief Executive Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns, and maintains utility infrastructure

and offers smart meter exchange programmes.

https://investors.fulcrum.co.uk/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFVTELIFLIF

(END) Dow Jones Newswires

May 13, 2022 02:01 ET (06:01 GMT)

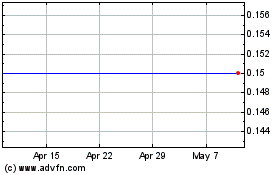

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Jan 2025 to Feb 2025

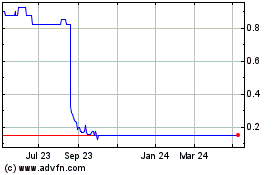

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Feb 2024 to Feb 2025