FirstGroup PLC Update On Train Operating Company Contracts

December 10 2020 - 1:00AM

UK Regulatory

TIDMFGP

FIRSTGROUP PLC

UPDATE ON TRAIN OPERATING COMPANY CONTRACTS

FirstGroup plc ('FirstGroup' or 'the Group') has reached agreement with the

Department for Transport ('DfT') on next steps for the South Western Railway

('SWR') and West Coast Partnership train operating companies, the latter of

which comprises Avanti West Coast and the shadow operator for HS2 (together,

'Avanti').

As announced on 20 September, these two companies are currently operating under

Emergency Recovery Measures Agreements ('ERMA') which were put in place by the

DfT to provide continuity for rail passengers and the industry during the

coronavirus pandemic. The ERMA for Avanti is in place to the end of March 2022

and the SWR ERMA is in place to the end of March 2021. Both can be extended by

a further half year at the DfT's discretion.

As previously stated, the ERMAs required the train operators and the DfT to

agree whether any payment is required to terminate the pre-existing franchise

agreements, and if so how much, based on a pre-coronavirus trajectory financial

model. The DfT and FirstGroup have agreed that no termination sum is required

for Avanti, which commenced operations in December 2019 and was performing well

prior to the pandemic. Agreement has also been reached for a termination sum

for SWR, which requires a further FirstGroup contribution of GBP33.2m. This

represents the Group's share of parent company support and additional funding

commitments under the franchise agreement, less amounts already paid into the

operating company, and which will be paid at the end of the ERMA term. The full

exposure to SWR performance bonds and parent company support has already been

provided in our accounts. The pre-existing franchise agreements will therefore

terminate at the end of the ERMA term for SWR and Avanti. Agreement of the

termination sums significantly reduces the overall financial risk within the

First Rail franchise portfolio.

Following agreement of the termination sums we are now negotiating new directly

awarded management contracts with the DfT, which will come into effect at the

end of the ERMAs, under which each incumbent train operator will deliver

passenger rail services. The DfT have indicated that these new National Rail

Contracts would last to 1 April 2023 for SWR, and to 1 April 2026 for Avanti,

each with extension periods of up to two further years at the DfT's discretion.

Our TransPennine Express ('TPE') rail franchise is also operating under an

ERMA, and the process to agree the franchise termination sum for TPE has been

extended to the end of January 2021 by the DfT. As also previously announced,

the existing Emergency Measures Agreement for Great Western Railway ('GWR') has

already been extended to June 2021.

Commenting on today's announcement, FirstGroup Chief Executive Matthew Gregory

said:

"We welcome this agreement, which marks a further evolution of the contractual

framework for our SWR and Avanti train operating companies, both in the context

of providing resilient services throughout the coronavirus pandemic and also a

more sustainable long-term approach. These new directly awarded management

contracts will focus on passengers and operational performance, with a more

appropriate balance of risk and reward. We look forward to working

constructively with the DfT to make this a reality, and to use our expertise

and understanding of the needs of our customers to deliver improvements that we

know passengers want."

"We have acted flexibly to ensure continuity of service while implementing

social distancing, as well as enhanced cleaning protocols and innovative

technology to improve the customer experience. Passengers and employees alike

can be confident that our trains are safe. We are now operating around 90% of

the rail services we were prior to the pandemic. We will continue to bring all

our experience to bear alongside Government and industry partners to deliver

the next phase of recovery of the rail network."

Notes

Termination assessments

As previously announced, the ERMAs require that each train operating company

agrees with the DfT appropriate terms to terminate the pre-existing franchise

agreements that were overlaid with the Emergency Measures Agreements in March.

The objective is to agree if and how much parent company support ('PCS') or

other sums would have been payable had the pandemic not occurred. The amounts

are based on the financial status of each franchise prior to the pandemic and

the DfT's assessment, acting reasonably, of their potential trajectory for the

remainder of the franchise term under those pre-existing agreements in the

absence of the pandemic. The assessments take into account the franchise

agreement change mechanisms and certain other input from the operating

companies.

The PCS and additional funding commitments under each pre-existing franchise

agreement, plus the performance bonds, less any monies already paid by the

parent into the train operating company are the maximum remaining cash exposure

of the parent company under the termination sums process conducted by the DfT

in respect of SWR, TPE and Avanti. Following this announcement, the relevant

commitments to FirstGroup of the three train operating companies are shown

below, together with the total accounting provisions for losses on their

franchise agreements that have been provided for:

GBPm Avanti SWR TPE Total

(70% (70%

share) share)

Maximum remaining cash exposure as at 31 106.4 44.4 143.4 294.2

March 2020

PCS and additional funding commitments (92.4) - TBD (92.4)

not required

Performance bond (limited exposure risk) (14.0) (11.2) (17.1) (42.3)

Maximum remaining cash exposure following - 33.2 126.3 159.5

Avanti and SWR agreements; TPE to be

determined

Note: the operations also have season ticket bond commitments, but these are

covered by cash resources within each Train Operating Company. The TPE

termination sum agreement process has been extended to end of January 2021 by

the DfT, and any termination sum for TPE may be subject to discounting.

GBPm Avanti SWR (70% TPE

(70% share)

share)

Initial accounting provisions for losses - 102.1 106.3

(IAS 17 basis)

Ring-fenced cash

For the duration of the ERMAs, the train operating companies will continue to

maintain ring-fenced cash balances. As at 19 September 2020, GWR had GBP258.4m of

ring-fenced cash, SWR had GBP164.9m, TPE had GBP47.9m and West Coast Partnership

had GBP75.5m.

GWR

As announced on 1 September 2020, the Emergency Measures Agreement in respect

of Great Western Railway (GWR) was extended under its previous terms until at

least 26 June 2021. The PCS and performance bond commitments associated with

GWR are each GBP10m, and cash ring-fenced within the train operating company was

GBP266m as at 31 March 2020. GWR's original Emergency Measures Agreement was

signed on the same day as the new franchise agreement in March, and the DfT's

option to extend it formed part of that contract. This process and timing is

different from our other three rail franchised operations which were already on

established franchise agreements before adopting Emergency Measures Agreements

as a result of the pandemic.

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

corporate.comms@firstgroup.com

Tel: +44 (0) 20 7725 3354

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 3.1.

Figures presented in this announcement are not audited. Certain statements

included or incorporated by reference within this announcement may constitute

'forward-looking statements' with respect to the business, strategy and plans

of the Group and our current goals, assumptions and expectations relating to

our future financial condition, performance and results. By their nature,

forward-looking statements involve known and unknown risks, assumptions,

uncertainties and other factors that cause actual results, performance or

achievements of the Group to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. Shareholders are cautioned not to place undue reliance on the

forward-looking statements. Except as required by the UK Listing Rules and

applicable law, the Group does not undertake any obligation to update or change

any forward-looking statements to reflect events occurring after the date of

this announcement.

About FirstGroup

FirstGroup plc (LSE: FGP.L) is a leading provider of transport services in the

UK and North America. With GBP7.8 billion in revenue in the year to 31 March 2020

and around 100,000 employees, we transported 2.1 billion passengers. Whether

for business, education, health, social or recreation - we get our customers

where they want to be, when they want to be there. We create solutions that

reduce complexity, making travel smoother and life easier. We provide easy and

convenient mobility, improving quality of life by connecting people and

communities. Each of our five divisions is a leader in its field: In North

America, First Student is the largest provider of home-to-school student

transportation with a fleet of 43,000 yellow school buses, First Transit is one

of the largest providers of outsourced transit management and contracting

services, while Greyhound is the only nationwide operator of scheduled

intercity coaches. In the UK, First Bus is one of Britain's largest bus

companies with 1.4 million passengers a day in 2020, and First Rail is one of

the country's most experienced rail operators, carrying 340 million passengers

in the year.

Visit our website at www.firstgroupplc.com and follow us @firstgroupplc on

Twitter.

About First Rail

FirstGroup is one of the most experienced rail operators in the UK and the only

one to run every type of railway - long distance, regional, commuter and

sleeper operations. We carried more than 340m passengers almost 10bn miles last

year. We operate four passenger franchises - Avanti West Coast, Great Western

Railway, South Western Railway and TransPennine Express - and one open access

service, Hull Trains. We also operate the London Trams network on behalf of

Transport for London, carrying around 27 million passengers a year. As well as

Avanti services, the West Coast Partnership also includes the 'shadow operator'

for future high speed rail services which will design, develop and mobilise

operations for the new line working with HS2 Ltd and the Department for

Transport.

END

(END) Dow Jones Newswires

December 10, 2020 02:00 ET (07:00 GMT)

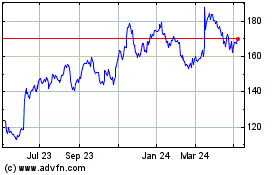

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

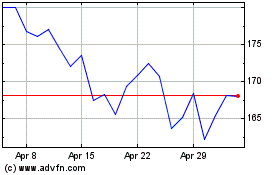

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024